albert Chan

Marks and Spencer

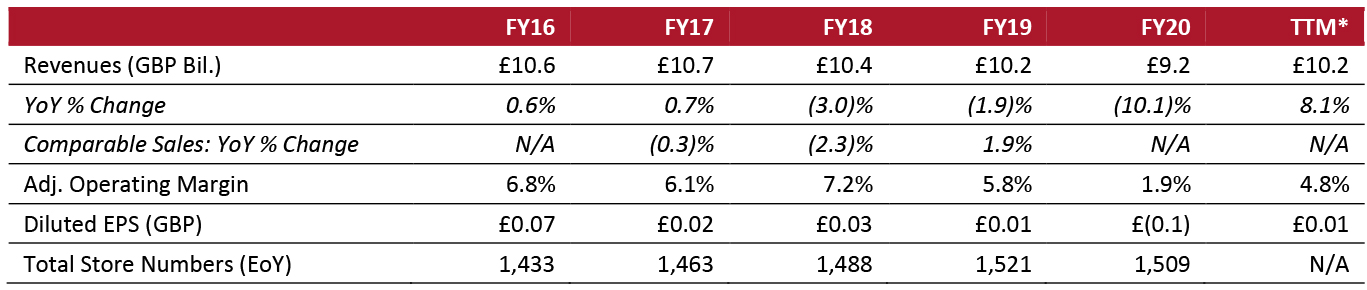

Sector: Department store Countries of operation: The UK and 99 other countries Key product categories: Apparel, food and home products Annual Metrics [caption id="attachment_146464" align="aligncenter" width="700"] Fiscal year ends at the end of March or early April of the following calendar year. FY20 ended April 3, 2021.

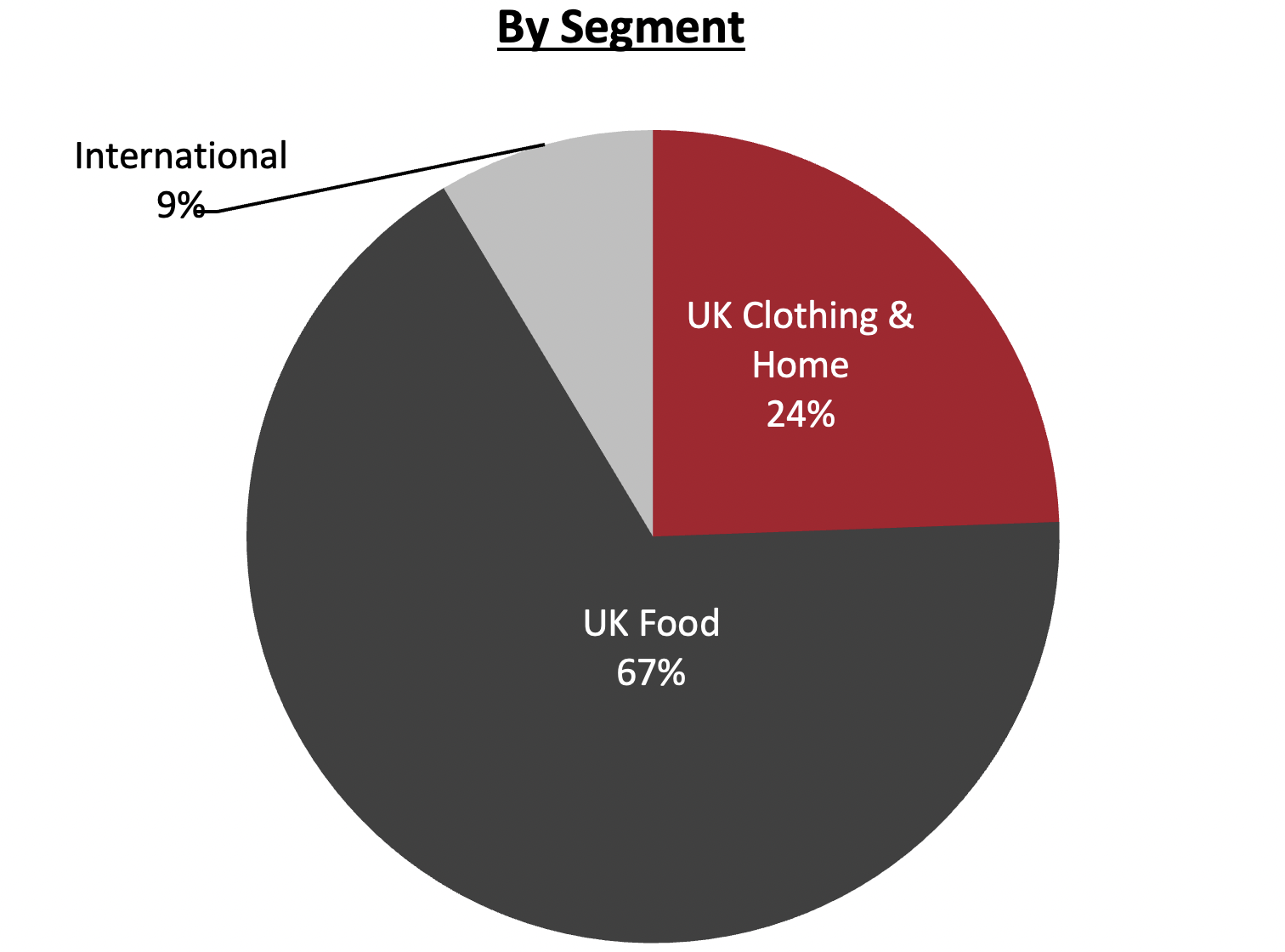

Fiscal year ends at the end of March or early April of the following calendar year. FY20 ended April 3, 2021. *Trailing 12 months ended October 2, 2021 [/caption] Summary Marks and Spencer (M&S) is a UK-based retailer that sells predominantly private-label products, including apparel, food and home products, in the UK and internationally. The company was founded in 1884 and is headquartered in London, UK. As of October 2, 2021, M&S operates 1,500 stores and 100 websites globally. The company operates under three reportable business segments: UK Food, UK Clothing & Home, and International—the International segment consists of owned and franchised businesses. As of April 3, 2021, M&S employs approximately 70,000 associates. The company holds a 50% investment in Ocado Retail—consumers can purchase M&S food and selected clothing products via the Ocado online platform. Company Analysis Coresight Research insight: M&S’s “Never the Same Again” program was unveiled in response to Covid-19—building on and accelerating a turnaround strategy introduced in November 2017, which focused on increasing digital and lowering store count, costs and clothing prices. Four years on, M&S is seeing gains from the program—as reflected in its solid sales performance in clothing and the jump in profit reported in its first half of 2021. The decision to trim store numbers and push digital (including in grocery, where it has undertaken a joint venture with Ocado) looked sensible in 2017—and it looks essential after the pandemic, with online demand permanently elevated in both clothing and food. In clothing, the company’s initiatives to reduce the number of product lines, sharpen prices (especially at the entry level) and focus on full-price sales are welcome actions—simplifying the customer proposition and supporting profit growth. In the long term, the fundamental challenge facing M&S clothing is that it is a centerground, broad-range, private-label retailer in an age of unlimited choice—and the splintering of spending to rivals has resulted in an ageing of its customer base. We view its decision to bring in third-party brands favorably as one means of driving consumer reconsideration, establishing greater resonance and consumer appeal—including through acquisitions, such as of casual lifestyle brand Jaeger in January 2021. Further supporting this strategy, Debenhams’s demise opens up opportunities for M&S to capture share with a multibrand clothing offer. Over the long term, its food segment has performed more positively, albeit with a period of considerably weaker performance centered around fiscal 2019. In its half year ended October 2, 2021, the company reported that M&S Food was up 10.4% compared to 2019, driven by price sharpening, the slowing of food store openings and a marketing overhaul to broaden the appeal of its Food range. Pandemic-driven demand for at-home groceries has been a substantial support. However, we remain cautious about M&S’s intention for its food halls to compete for regular, full-basket grocery shops, given its longstanding premium convenience position. Most notable in food is the company’s Ocado joint venture, which began in September 2020. This helped to bring M&S Food online and immediately provided an online discovery, purchase and distribution channel—as consumers have turned to e-commerce in huge numbers.

| Tailwinds | Headwinds |

|

|

- Broaden the food business’s appeal, focusing on families and improving perception of its value, to position it for growth.

- Grow capacity on Ocado by 50% by December 2022 and further realize the joint venture’s potential.

- Partner with a curated range of guest brands.

- Prioritize online growth and leverage store estate more effectively.

- Increase the speed of rotation to create a group of well-invested full-line stores.

- Invest in localized fulfillment.

- Improve digital trading, store modernization and supply chain development.

- Expand presence on marketplaces including Zalando and Launch websites in a further 46 markets

- Transform organizational design to drive commerciality, pace and ownership.

- Become a data-enabled and digitally focused business.

- Create empowered, responsive and commercial leaders who are close to the front line.

- Put the voice of the stores back at the core of the business.

- Create a culture of plain speaking, driven by data and focused on performance.

- Move away from hierarchy to create an involving, engaging culture where everyone has a voice.

- Move to net zero.

- Increase food redistribution and source responsible materials.

- Lead on human rights, including sourcing ethically and reporting transparently on supply chain practices.

- Establish an ESG committee to provide oversight and focus to Plan A goals.

Source: Company reports[/caption]

Company Developments

Source: Company reports[/caption]

Company Developments

| Date | Development |

| April 12, 2022 | M&S launches spring clothing rental collaboration with Hirestreet. The spring launch is the second drop of M&S products on the site, with 98% of Hirestreet customers who rented from the M&S autumn/winter collection saying they would rent a M&S product again from the online platform. |

| April 10, 2022 | M&S announces it will lower prices in its Remarksable food range, with a focus on everyday staples. |

| April 8, 2022 | M&S launches a bi-monthly food magazine featuring exclusive recipes available in all M&S owned stores across the UK. Sparks members will be able to obtain the magazine free by scanning their loyalty card at checkout. |

| April 5, 2022 | M&S announces that M&S Kidswear will trial with Dotte, a kidswear peer-to-peer marketplace where parents can buy, sell, donate, and recycle outgrown kidswear. |

| March 25, 2022 | M&S announces the Jaeger brand will expand into 14 stores across the UK and Ireland throughout April and May 2022 with a spring 2022 collection. |

| March 14, 2022 | M&S announces the Early Learning Centre to open in ten M&S stores after successful online partnership. The dedicated areas will stock Early Learning Centre's bestselling toys designed to support children’s learning and development. They will also have interactive play tables with Happyland products and free activity sheets for children. |

| March 10, 2022 | M&S announces leadership changes. Stuart Machin will become Chief Executive and will take on responsibility for day-to-day leadership of the business and the Executive Committee. Katie Bickerstaffe will become Co-Chief Executive with a particular focus on driving the global omnichannel, digital & data future for the business. Eoin Tonge becomes Chief Strategy & Finance Officer. In addition to his current responsibilities, he will play an enhanced role in leading the future development of the business. |

| March 10, 2022 | Steve Rowe will stand down as Chief Executive Officer of M&S at the company’s preliminary results on 25 May as part of a planned succession program. |

| March 8, 2022 | M&S invests in the Sports Edit, an e-commerce platform in the activewear market. |

| February 28, 2022 | M&S expands Sparks Loyalty Programme into the M&S Café with the launch of coffee rewards. |

| February 25, 2022 | M&S unveils first denim collection as part of the Ellen Macarthur Foundation Jeans Redesign Project. The M&S Jeans Redesign capsule collection includes five styles for the whole family, with jeans available across womenswear, menswear and kidswear, exclusively on M&S.com. |

| February 22, 2022 | M&S announces a new online and in-store partnership with skincare and make-up brand, Clinique. |

| February 16, 2022 | M&S announces it is investing in its people and increases its hourly rate of pay, with every store colleague across the UK set to earn at least £10 an hour, as part of a broader reward package. |

| January 27, 2022 | The company launches M&S Live, live shopping series on M&S.com which allows consumers to join a live broadcast to hear more about a product range and pose live questions to an M&S expert. |

| January 2022 | M&S launches “Remarksable” marketing campaign in its home division. The marketing activity will put a spotlight on the value of M&S’s entry price point home product—with trusted value items from tea towels to tea mugs available from just £1. |

| January 2022 | M&S launches live shopping on M&S.com that allows customers browsing the website to join a live broadcast to hear more about a product range and pose live questions to an M&S expert. Each live episode is shoppable, meaning customers can buy the products as they watch. |

| January 2022 | M&S reports Christmas trading statement for the 13 weeks to January 1, 2022; total revenue increased by 8.6% compared to 2019. By category, food sales were up by 12.4%, clothing and home increased by 3.2%, and international by 5.1% |

| December 2021 | M&S encourages customers that are planning a wardrobe clear-out to donate clothes via Shwopping to be sold, reused or recycled. Each time consumers place pre-loved clothes in M&S Shwop boxes they’re resold, reused or recycled, so nothing goes to waste. Sparks customers receive a free treat every time they Shwop by scanning the QR code on the top of the box in any M&S clothing store and the treat appears in the Sparks hub. |

| November 2021 | M&S reports half-year results: revenue is up by 5.0% to £5.1 billion from £4.9 billion in the same period in 2019. By category, food sales were up 10.4%, clothing and home sales were down by 1%, and clothing and home online sales grew 60.8%, totalling 34.4% of total clothing and home sales. |

| November 2021 | M&S announces the rollout of M&S Opticians service across the UK. The service will launch in 55 stores over the next 18 months (by April 2023). The service is available in 12 stores. |

| October 2021 | M&S launches the Jaeger brand on M&S.com with an in-store trial to begin later in October. |

| July 2021 | M&S launches its back-to-school campaign highlighting that the company has switched to organic cotton across all jerseys, knitwear and sweats. All garments meet M&S’s Organic Materials Sourcing Policy, meaning items are certified to third-party standards. The company is also introducing both sustainably sourced viscose, sustainably sourced trims and more recycled polyester than previous years. |

| June 2021 | M&S announces that it will begin selling Clarks shoes on M&S.com and in eight UK destination stores. This latest brand partnership under “Brands at M&S” is part of continued momentum for the retailer in its strategic shift from “special occasion” clothing and footwear to everyday style and value. |

| April 2021 | M&S announces that its Bradford distribution center is to become a second online warehouse for M&S.com, as part of the retailer’s “Never the Same Again” strategy to reengineer M&S’s supply chain. |

| March 2021 | M&S launches an omnichannel service for its 1,200 expert bra fitters both in-store or through new virtual appointments trialed during lockdown. The retailer is also starting to introduce the option to “Pay With Me” in the lingerie fitting room—a digital on-the-spot payment solution—at its top 50 lingerie stores. |

| March 2021 | M&S announces the first wave of eleven guest brands to be marketed and sold under the banner “Brands at M&S.” The new offering is part of M&S’s “Never the Same Again” strategy to make its clothing business more relevant. |

| March 2021 | M&S expands its international business to over 100 countries with the launch of 46 flagship websites in new markets. |

| January 2021 | M&S formally signs the Call to Action on human rights abuses, making a brand commitment to exit the Uyghur Region, in line with its long-term focus on ensuring its supply chains are sustainable and ethical. |

| December 2020 | M&S expands activewear brand Goodmove to include menswear and kidswear. |

| December 2020 | M&S launches an on-the-spot payment solution to make shopping quicker, easier, and safer before the holidays. “Pay With Me” is available at 200 stores and the company has also installed 1,000 additional self-service tills and rolled out scan-and-shop. |

| November 2020 | M&S announces that M&S Food plans to launch an Innovation Hub in January 2021, a new specialist team that will focus on disruptive innovation, aiming to create industry-leading products and address some of the biggest sector-wide challenges. |

| November 2020 | M&S launches “Mobile Pay Go,” a payment service where customers can use their mobile phones to scan items and pay. |

| November 2020 | M&S completes the UK rollout of its “Sparks Book & Shop” service, which allows customers to plan shopping ahead with reserved shopping slots. |

| October 2020 | M&S increases capacity at its online distribution center at Castle Donington. The company increased the number of associates by 30% over 2019, to a team of 4,000 versus 3,000. The team will receive training on at least two of the four core tasks to create a more agile workforce. |

| September 2020 | M&S partners with Ocado.com—M&S products become exclusively available with Ocado.com. |

| August 2020 | M&S announces that it will open a new national food distribution center in Milton Keynes, a 365,000-square-foot facility to be operated by XPO Logistics, supplying ambient M&S Food products to the South of England. |

| July 2020 | M&S relaunches its Sparks loyalty program as a digital-first loyalty scheme, offering a more personalized experience with instant rewards, a wider selection of charities to support and more tailored personal offers. |

| July 2020 | As part of the company’s “Never the Same Again” strategy, M&S moves its flexible management structure into store operations. Proposed changes would affect 950 roles across central support functions in field and central operations and property and store management. The company has now started collective consultation with its employee representative group and has set out its intention to first offer voluntary redundancy to affected colleagues. |

| May 2020 | M&S confirms that Richard Price will start his role as Managing Director, Clothing & Home on July 6, 2020. |

| April 2020 | M&S announces strengthened liquidity the pandemic. It reaches a formal agreement with banks’ lending syndicate providing a £1.1 billion revolving credit facility to substantially relax or remove covenant conditions for tests arising in September 2020, March 2021 and September 2021. |

| April 2020 | M&S announces management changes. The company appoints Tamara Ingram and Sapna Sood as a Non-Executive Directors, effective May 21, 2020. Katie Bickerstaffe began her new role of Chief Strategy and Transformation Director on Monday April 27 and will step down from the Board at the AGM in July 2020. Eoin P. Tonge is confirmed to join the Board as Chief Financial Officer on June 8 and Alison Brittain stepped down from the Board, retiring as a Director in July 2020. |

| April 2020 | M&S donates food and clothing to support the National Health Service (NHS) response to Covid-19. |

| February 2020 | M&S expands its popular “Mobile Pay Go” technology to 50 stores. The service offers a checkout-free payment experience. |

| February 2020 | M&S announces that Eoin P. Tonge will be joining the Board as Chief Financial Officer in June 2020. |

| February 2020 | M&S announces that Katie Bickerstaffe, currently a Non-Executive Director, will be joining the executive team as Chief Strategy and Transformation Director on April 27, 2020. |

| January 2020 | M&S launches new womenswear activewear brand Goodmove. |

| December 2019 | M&S partners with six startups in the first year of Founders Factory Joint Venture (Founders Factory Retail), designed to identify and accelerate emerging businesses and put M&S at the forefront of industry change and trends. |

| November 2019 | M&S announces that Richard Price, currently CEO of Tesco’s F&F clothing brand, has been appointed to the role of Managing Director, Clothing & Home. |

| October 2019 | M&S confirms Harriet Hounsell has joined as HR Director. |

| September 2019 | M&S announces that Gordon Mowat, Supply Chain and Logistics Director for the Clothing & Home segment, will step down from the post after over one year in the role. |

| September 2019 | M&S announces that CFO Humphrey Singer will step down from the post and from the board effective December 31, 2019. |

| August 2019 | M&S completes its acquisition of a 50% stake in Ocado Retail for the sum of £750 million. A full range of M&S food products will be available to customers on Ocado’s online platform by September 2020. |

| July 2019 | M&S announces that Jill McDonald, Managing Director of its Clothing & Home segment, has quit after nearly two years in the role. M&S CEO Steve Rowe will be taking charge of the Clothing & Home business directly in the near term. |

- Archie Norman—Non-Executive Chairman

- Steve Rowe—CEO and Executive Director

- Eoin P. Tonge—CFO and Executive Director

- Fraser Ramzan—Head of Investor Relations

Source: Company reports