DIpil Das

Introduction

Each report in our Market Overview series provides an analysis of a particular retail sector or consumer market. In this report, we cover the US grocery sector, with a focus on supermarket retailers, although we include some discussions of other grocery channels. This report includes:- Total grocery and online grocery market size and growth

- Key technology innovators in the grocery market

- Review of major themes across the market

- The outlook for US grocery retail

Market Size and Growth

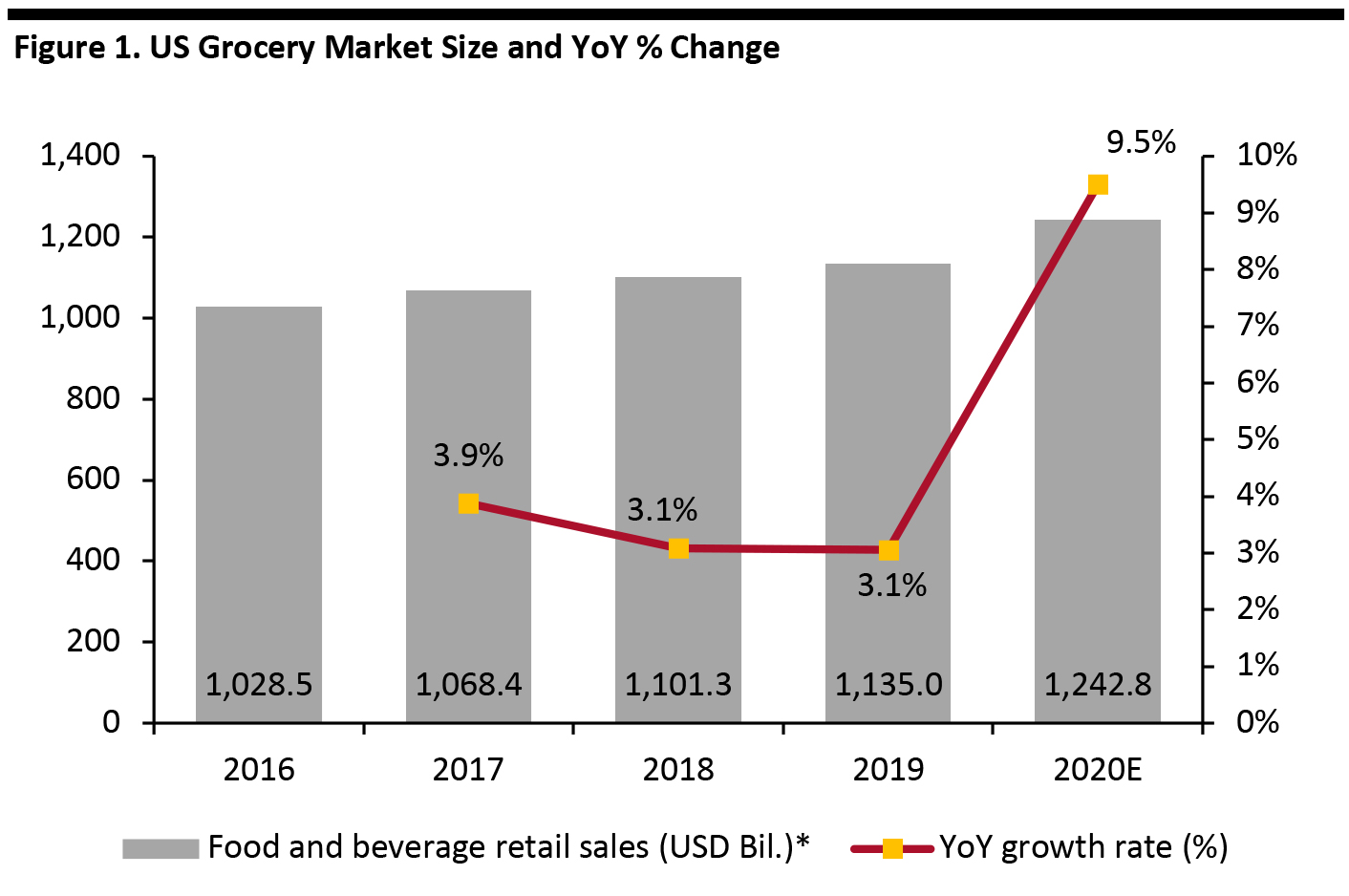

Grocery Market Coresight Research estimates that the US grocery market size will total $1.24 trillion in 2020, up 9.5% year over year. This growth will have been fueled by panic buying and stockpiling of food in the first half of the year amid the Covid-19 pandemic and the more sustained shift of food spending from food-service outlets to grocery retailers (which we detail later in this report). Assuming food-service demand moves closer to normalcy in the second half of 2020, we expect growth to moderate but remain at elevated levels versus last year.- Our market size includes total sales (of all categories) by food retailers as defined by the US Census Bureau and grocery-only sales at selected major retailers of food in other sectors; this includes mass merchandisers (Target and Walmart), warehouse clubs (BJ’s, Costco and Sam’s Club) and discount stores (Big Lots, Dollar General, Dollar Tree and Five Below). The market size excludes grocery sales by other retailers not included in the food retail sector.

Includes sales of all products by food retailers and grocery sales by selected major retailers in the mass-merchandiser, warehouse-club and discount-store sectors.

Includes sales of all products by food retailers and grocery sales by selected major retailers in the mass-merchandiser, warehouse-club and discount-store sectors. Source: US Census Bureau/Coresight Research [/caption]

Online Grocery Market

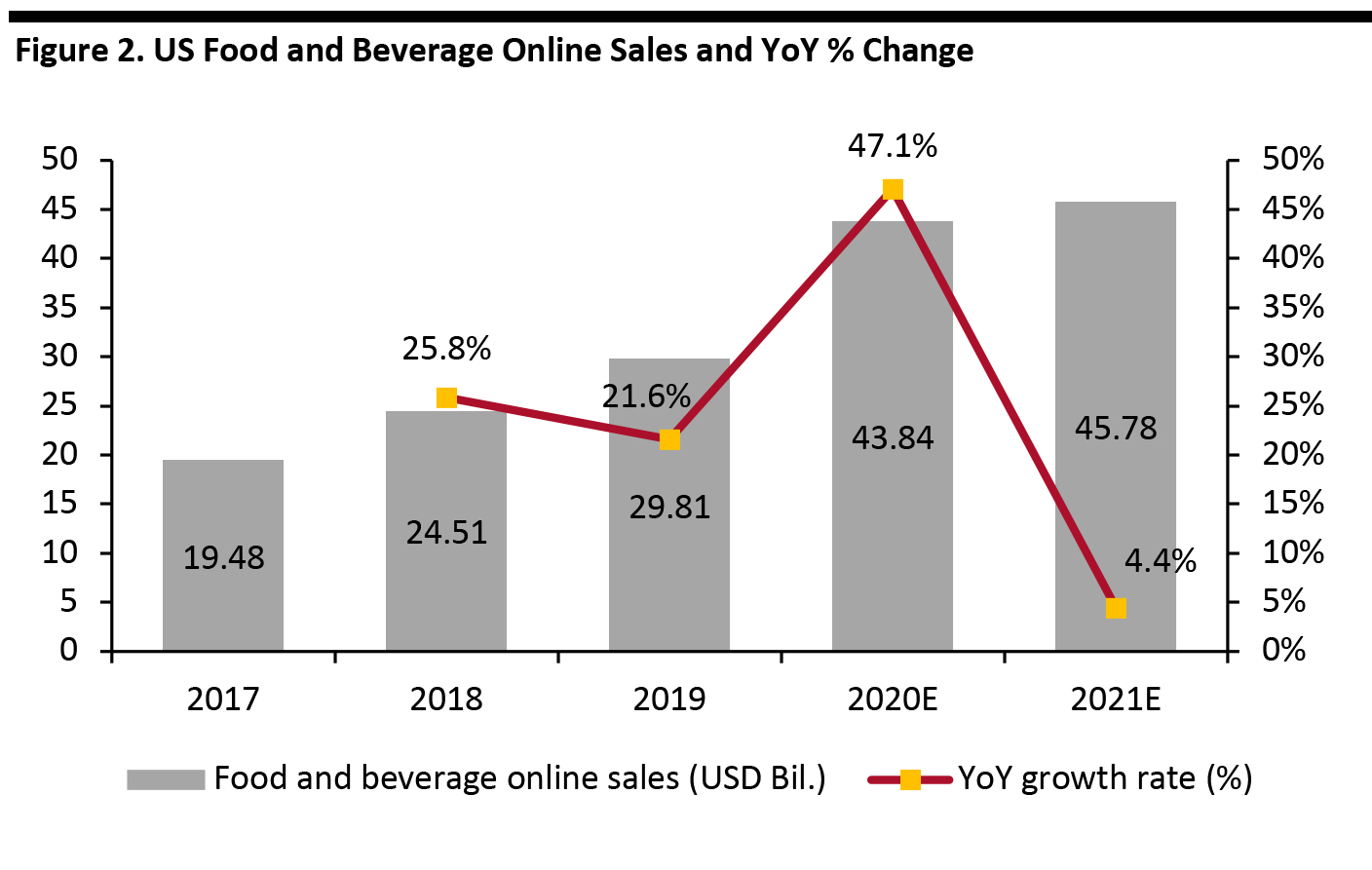

The Covid-19 pandemic has caused an unprecedented surge in demand for online grocery in the US. The new necessity of social distancing and self-quarantine has spurred homebound consumers to turn to online grocery shopping in greater numbers and more frequently. Market Size and Growth Rate: US consumers spent just under $30 billion on food and beverages online in 2019, we calculate from IRI data. We estimate that online retail sales of food and beverages will surge by 45–50% in 2020, fueled by substantial growth during lockdown in the first half of the year. This will take the market close to $44 billion. Given the recent surge, we expect the growth rate to be volatile, month by month, into 2021. Assuming consumer demand will stabilize in the overall grocery market, retailers are likely to see a year-over-year decline in online demand in those months of 2021 when they lap the 2020 crisis peak. We estimate that online grocery growth will taper off to the low, single digits in 2021, given that 2020 will have seen approximately two years of growth compressed into a single year.- Our online market size excludes nonfood grocery products.

Online food and beverage figures are benchmarked to consumer spending on food and beverages in retail, as defined by the US Bureau of Economic Analysis

Online food and beverage figures are benchmarked to consumer spending on food and beverages in retail, as defined by the US Bureau of Economic AnalysisNote: The information contained herein is based in part on data reported by IRI through its Market Advantage service and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight. Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information

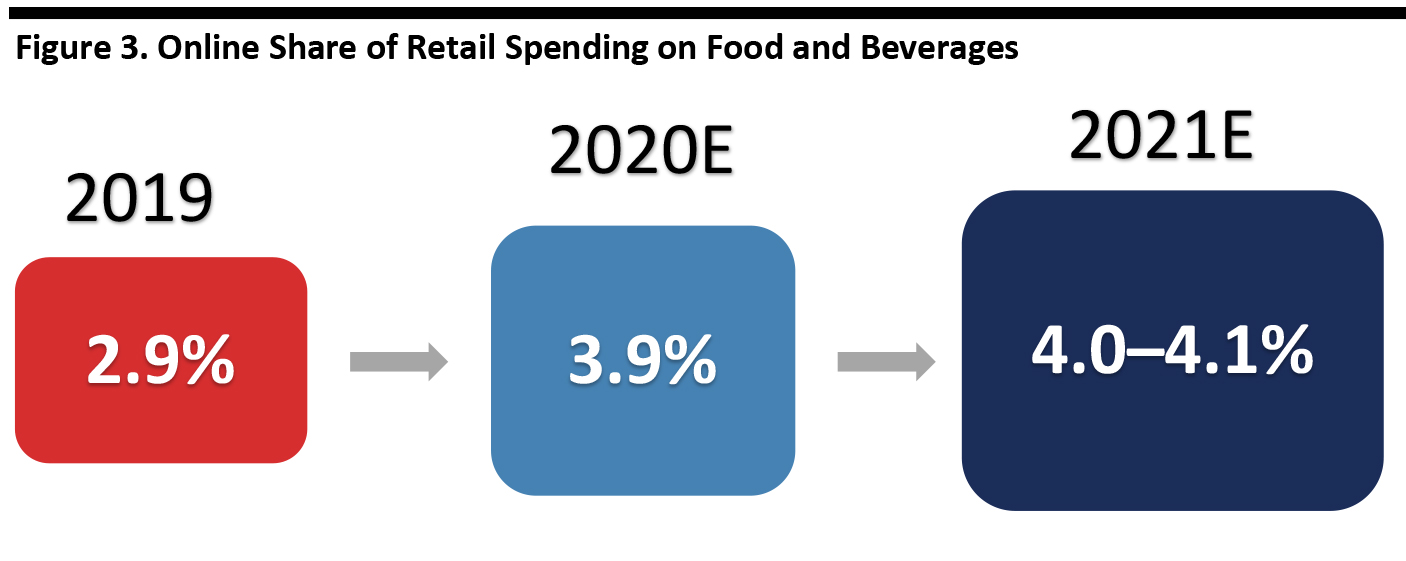

Source: IRI/US Bureau of Economic Analysis/Coresight Research [/caption] E-Commerce Sales Penetration: In 2019, we estimate that the online share of retail spending on food and beverages in the US was close to 2.9%—when compared to the approximate $1 billion spent on food and beverages in retail. Our projected increase in online grocery activity will raise that figure to an estimated 3.9% in 2020. We estimate that any increase in share in 2021 will be minimal, assuming that demand moderates in both grocery e-commerce and total food retail. [caption id="attachment_113612" align="aligncenter" width="700"]

Online food and beverage figures are benchmarked to consumer spending on food and beverages in retail, as defined by the US Bureau of Economic Analysis

Online food and beverage figures are benchmarked to consumer spending on food and beverages in retail, as defined by the US Bureau of Economic Analysis Note: The information contained herein is based in part on data reported by IRI through its Market Advantage service and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight. Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information

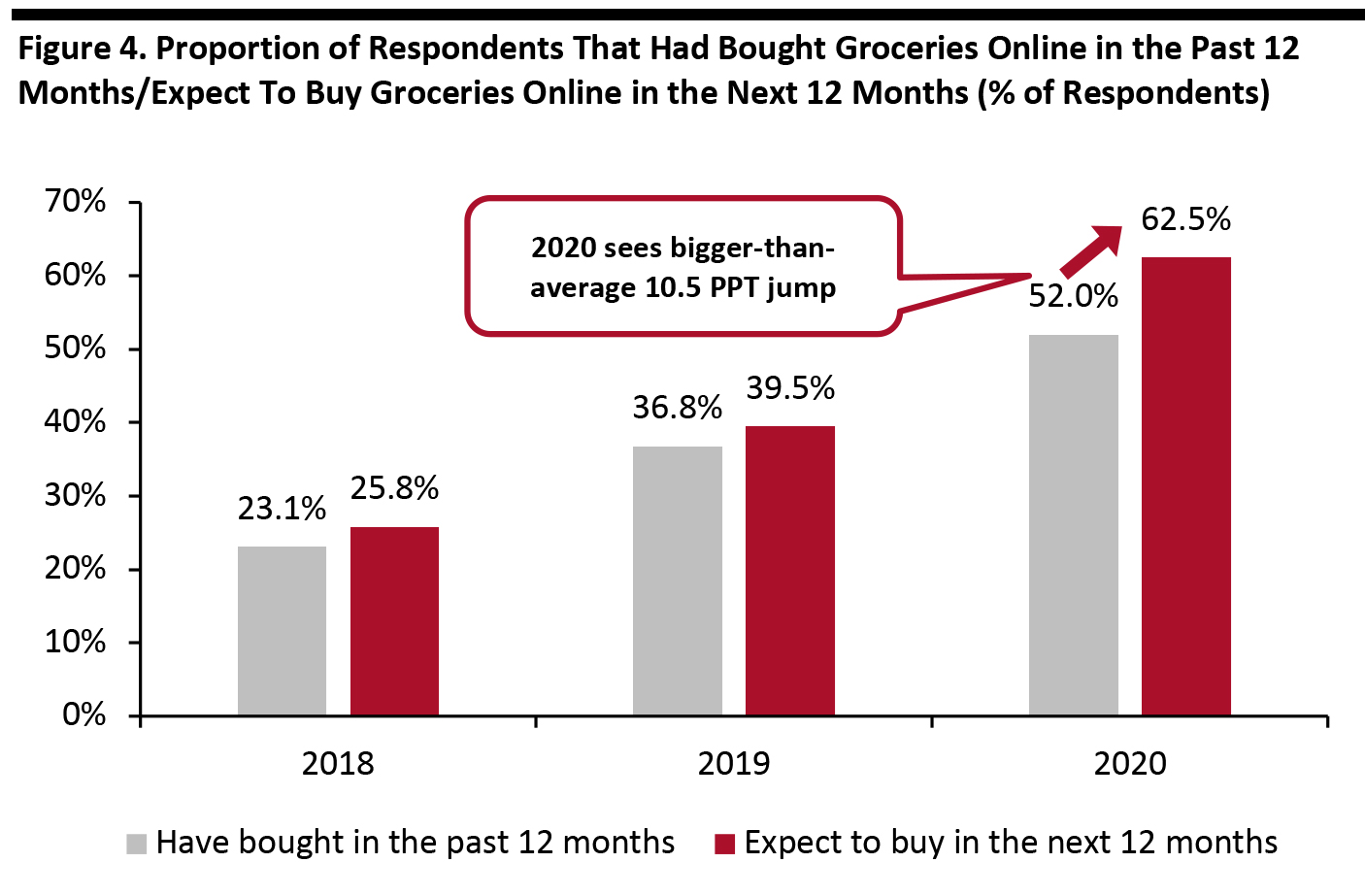

Source: IRI/US Bureau of Economic Analysis/Coresight Research [/caption] Shoppers’ Expectation To Purchase Groceries Online, Past 12 Months and Next 12 Months: The data below are taken from our annual US online grocery survey. Our 2020 survey (conducted in mid-March) found that, for the first time, 52.0% of US consumers had bought groceries online in the past 12 months—more than double the proportion of respondents from two years ago. Expectations to buy groceries online in the next 12 months were even higher at 62.5%—reflecting the impact of the coronavirus crisis. We expect this to have a potential long-lasting impact on online sales penetration in the grocery market. [caption id="attachment_113613" align="aligncenter" width="700"]

Surveys conducted in mid-March 2020, April 2019 and March 2018

Surveys conducted in mid-March 2020, April 2019 and March 2018 Base: US Internet users aged 18+

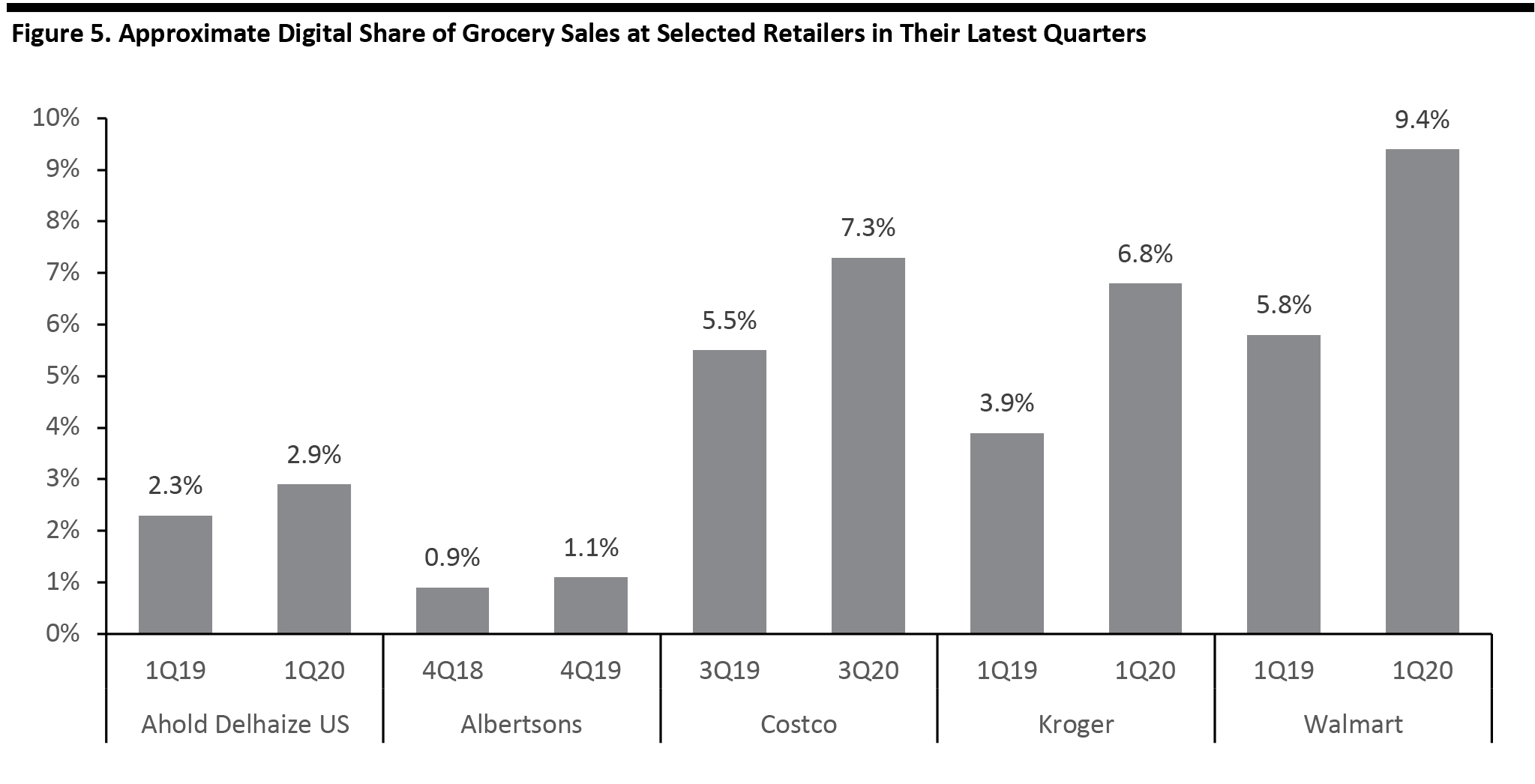

Source: Coresight Research [/caption] Online Growth, Comparison by Retailer: In response to the crisis, retailers accommodated the grocery surge swiftly by ramping up their e-commerce and omnichannel fulfillment capabilities. As a result, many retailers reported exceptional growth in online sales in their quarterly earnings:

- Kroger stated that its digital sales grew 92% in the first quarter of fiscal year 2020, which ended May 23, 2020. Digital revenues included online sale of products delivered to customers’ locations and revenue from all curbside-pickup locations.

- Albertsons reported that e-commerce sales for the eight weeks ended April 25 grew by 243% versus the same period last year. In March, the year-over-year increase in online sales was 109%; in April, the gain was 374%.

- Ahold Delhaize noted that its US online sales growth accelerated to 42.3% in the first quarter ended March 29, and e-commerce represented 2.9% of US revenues. The company said that it is upping its 2020 online-growth-rate target from 30% to more than 50%. Ahold Delhaize owns the established Peapod grocery delivery banner.

- Target’s digital sales soared by 141% in the first quarter ended May 2, driven by sharp growth in online food and beverage pickup and delivery as well as a bigger shopping basket. Target noted that stores fulfilled nearly 80% of digital sales in the quarter, with same-day BOPIS (buy online, pick up in store) service surging by278%.

- Walmart US reported 74% growth in e-commerce sales in the first quarter ended April 30, driven by strong demand for grocery pickup and delivery.

- Costco reported that online sales growth surged by 64.5% in its third quarter of fiscal year 2020 ended May 10, driven by “an incredible growth rate” in online grocery sales. Management noted that the increase in online grocery sales excludes same-day grocery delivery via delivery partner Instacart. If the company included the Instacart sales in its online growth, the increase in overall online sales would be over 100% for the same period, according to CFO Richard Galanti.

- Sprouts Farmer Market, which reported 160% e-commerce growth in the first quarter, noted that the majority of its online growth came directly through the Instacart platform.

Ahold Delhaize’s 1Q20 ended on March 29, 2020; Albertsons’ 4Q19 ended on February 29, 2020; Costco’s 3Q20 ended on May 10, 2020; Kroger’s 1Q20 ended on May 23, 2020; Walmart’s 1Q20 ended on April 30, 2020

Ahold Delhaize’s 1Q20 ended on March 29, 2020; Albertsons’ 4Q19 ended on February 29, 2020; Costco’s 3Q20 ended on May 10, 2020; Kroger’s 1Q20 ended on May 23, 2020; Walmart’s 1Q20 ended on April 30, 2020 Source: Company reports/Coresight Research [/caption]

Competitive Landscape

The US grocery market remains highly fragmented and regionalized, with Walmart and Kroger leading, followed by Albertsons and Ahold Delhaize. We believe that discounters such as Aldi will continue to maintain pressure on the grocery leaders this year, buoyed by possible post-crisis trading down by consumers. Meanwhile, Amazon is also expected to cause disruption—from both the crisis-driven shift to online and the company’s development of a multichannel grocery model.Figure 6. Top Grocery Retailers’ Revenues for the Last Fiscal Year [wpdatatable id=352 table_view=regular]

Walmart’s fiscal year ended on January 31, 2020; Kroger's on February 1, 2020; Albertsons’ on February 31, 2020; and Ahold Delhaize's on December 29, 2019. Costco’s year ends on the Sunday closest to August 31, and the data above are for its four fiscal quarters ended 2Q20, to provide a fair comparison. Source: Company reports/Coresight Research

Innovators in the Grocery Market

The dramatic surge in online orders has galvanized many grocers to move faster into the automated e-commerce fulfillment space to increase supply-chain efficiency and speed up delivery. Many technology innovators are emerging as a significant enabler to drive grocery retailers’ push into e-commerce expansion. Takeoff Technologies: Boston-based Takeoff Technologies provides automated grocery micro-fulfillment centers that have an average size of around 10,000 square feet and can be housed in the rear of an existing store or in a standalone building where the inventory is stored. These centers can fill online orders faster than the traditional store-pickup model while taking up limited space. The company is currently operating two micro-fulfillment facilities in the San Francisco Bay Area in partnership with Alberstons. It also operates one center each for Ahold Delhaize’s Stop and Shop, Sedano’s and Wakefern.

Ocado Technology: UK-based centralized fulfillment solutions provider Ocado Technology continues to make progress with partners worldwide. In April 2020, the company announced the launch of its first North American fulfillment center in Ontario, Canada. The new facility will service online grocery delivery of supermarket chain Sobeys, Ocado’s exclusive Canadian partner. In the US, Ocado has announced plans to open nine centralized fulfillment centers in partnership with Kroger, with the first one slated to open in Ohio in early 2021.

Figure 7. Grocery Retailers’ Covid-19 Investments [wpdatatable id=353 table_view=regular]

*Ahold Delhaize management noted that it will commit additional coronavirus-related investment for 2Q20 at a later date Source: Company reports Amazon Moves Further into Brick-and-Mortar Grocery Retail Amazon is getting more serious about its offline grocery ambitions by opening an expanded version of its cashierless “Go” model. The Amazon Go Grocery store, which opened in February 2020, is the company’s first full-size grocery store. It measures 10,400 square feet and stocks roughly 5,000 items, including fresh produce, dairy, packaged seafood, meats, household goods (such as paper towels) and alcoholic beverages. This marks a significant step up from the company’s original Amazon Go stores, which are typically much smaller—between 1,500 and 3,000 square feet—and stock fewer products (500 to 700 stock-keeping units) with the main focus being a mix of grab-and-go breakfast and lunch food as well as snacks. There are currently 26 such locations across Chicago, San Francisco, Seattle and New York. The technology in the new grocery format is similar to Amazon Go locations. Customers can walk in, scan a QR code from their Amazon mobile app, pick off items from shelves, and walk out when finished. The users’ authorized Amazon account will be automatically billed for the items they picked from the store. Although no human interaction is required, staff are present in stores to help stock shelves and answer shoppers’ queries. The company has advertised that it is opening a second Amazon Go Grocery store at Redmond, Washington, and is hiring managers for a third store in Washington, D.C. [caption id="attachment_113599" align="aligncenter" width="700"] Source: Amazon[/caption]

Amazon is also reportedly advancing on another front: opening grocery stores with a conventional checkout. These stores are expected to be separate from the Whole Foods banner and will offer a broader, more typical assortment at lower price points, including items containing artificial ingredients and other additives, as compared to the healthier assortment at a typical Whole Foods store. With this move, the company is preparing to tap customers beyond the affluent Whole Foods demographic. In recent months, Amazon has been advertising positions for these stores in Chicago, Los Angeles, Seattle and Washington, D.C.

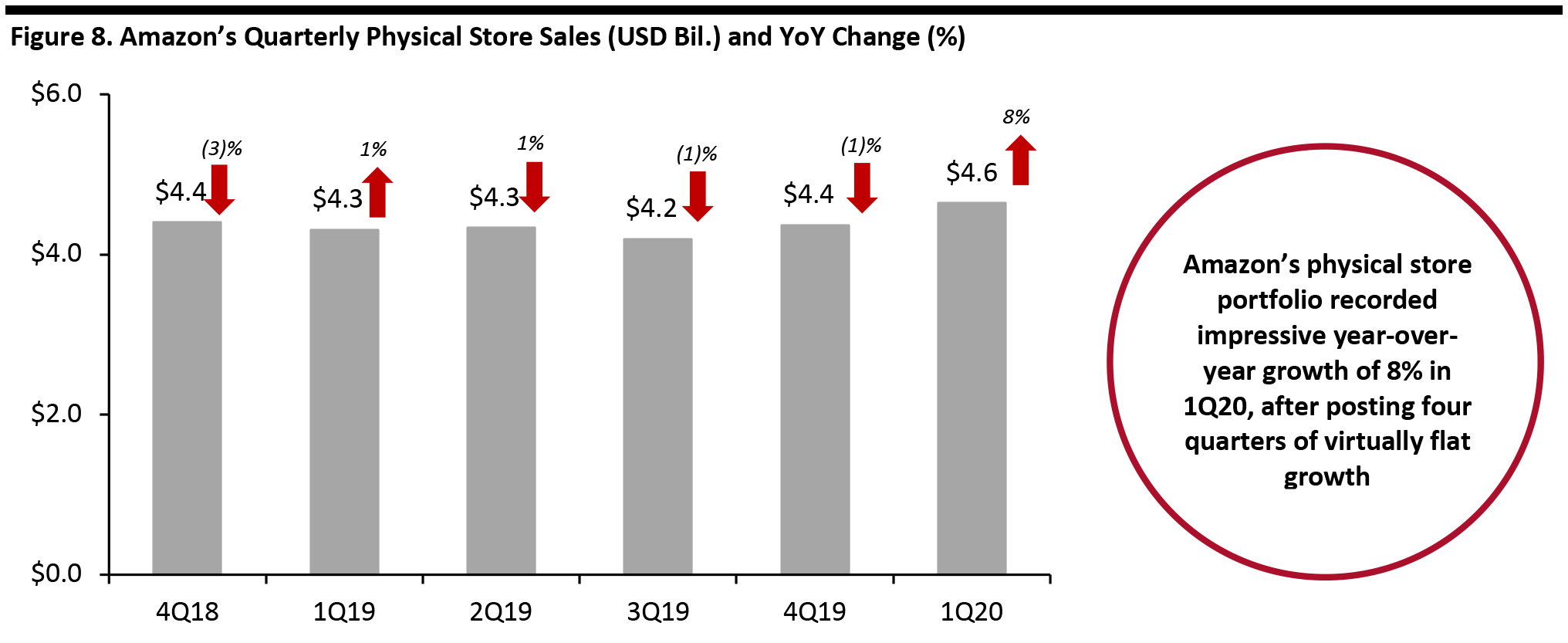

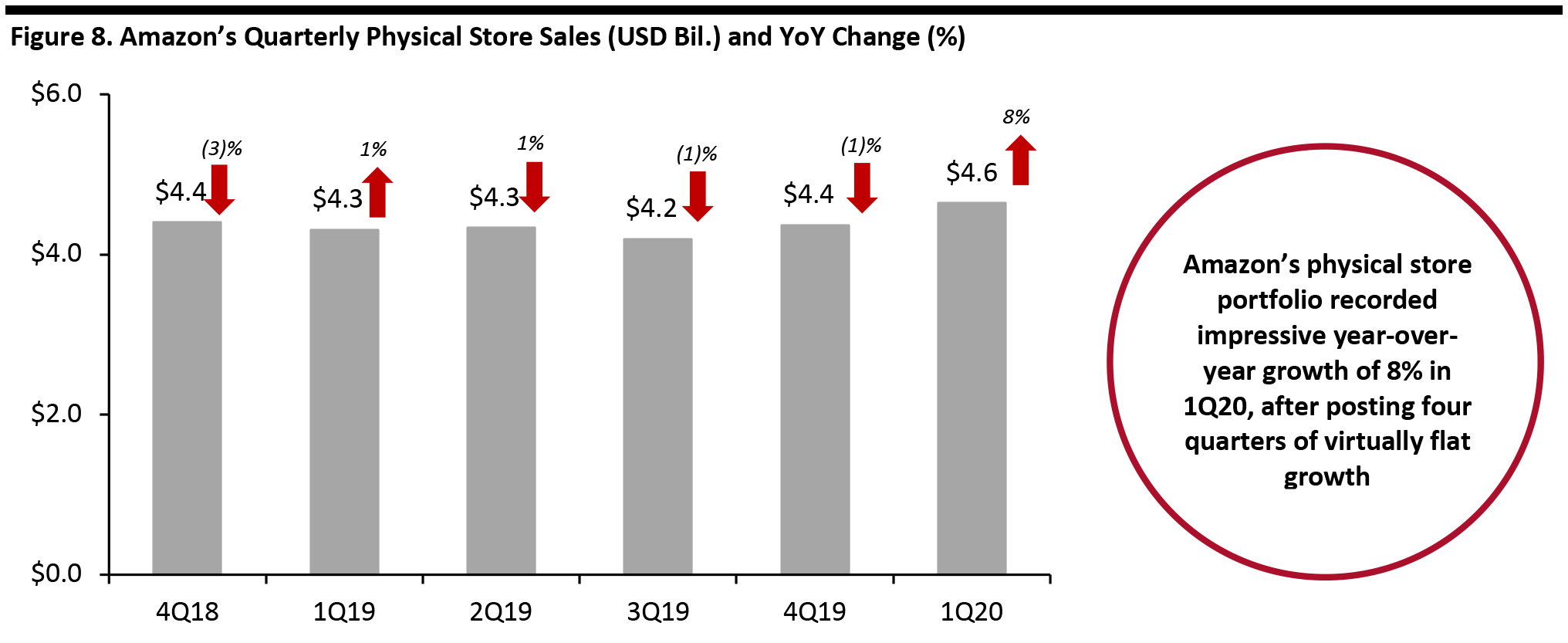

Amazon’s brick-and-mortar store portfolio saw robust sales growth for the first quarter of fiscal year 2020 after recording four quarters of virtually flat year-over-year growth. Amazon’s physical stores include 487 Whole Foods Markets, 25 Amazon Go cashierless convenience stores, one Amazon Go Grocery store, 21 Amazon Books stores, 12 Amazon 4-star outlets and six Presented by Amazon locations. The company does not break out sales for its brick-and-mortar retail segments.

[caption id="attachment_113614" align="aligncenter" width="700"]

Source: Amazon[/caption]

Amazon is also reportedly advancing on another front: opening grocery stores with a conventional checkout. These stores are expected to be separate from the Whole Foods banner and will offer a broader, more typical assortment at lower price points, including items containing artificial ingredients and other additives, as compared to the healthier assortment at a typical Whole Foods store. With this move, the company is preparing to tap customers beyond the affluent Whole Foods demographic. In recent months, Amazon has been advertising positions for these stores in Chicago, Los Angeles, Seattle and Washington, D.C.

Amazon’s brick-and-mortar store portfolio saw robust sales growth for the first quarter of fiscal year 2020 after recording four quarters of virtually flat year-over-year growth. Amazon’s physical stores include 487 Whole Foods Markets, 25 Amazon Go cashierless convenience stores, one Amazon Go Grocery store, 21 Amazon Books stores, 12 Amazon 4-star outlets and six Presented by Amazon locations. The company does not break out sales for its brick-and-mortar retail segments.

[caption id="attachment_113614" align="aligncenter" width="700"] Excludes online orders picked up at physical stores

Excludes online orders picked up at physical stores

Source: Company reports [/caption] The Pendulum Swings from Food Service to Food Retail Covid-19 lockdowns and social distancing protocols have dramatically reversed the trends of consumer spending on food. With consumers foregoing food-service venues, the crisis diverted food-away-from-home (restaurants, cafés, canteens, etc.) dollars back into grocery retail, a pattern that is expected to have potential long-term implications. With states easing lockdown restrictions, food-service establishments are still struggling to cope due to social distancing requirements and lower footfall. Food-service sector sales were down 38.7% in May than a year earlier, according to US Census Bureau. Additionally, according to a Coresight Research survey conducted on June 24, more than half of US consumers (57.2%) indicated that they are currently avoiding coffee shops, bars and restaurants. With the food-service industry still recovering, we believe that the grocery industry will continue to see their toplines grow over the coming months, although not nearly at the same levels that we saw in March–May. Also, some portion of food-away-from-home dollars will likely stay at home for the long term as consumers have developed a renewed appreciation for making meals at home. A survey conducted by marketing and PR firm Hunter in April 2020 revealed that among the US consumers cooking more at home, more than half (51%) would continue to do so even after the pandemic. Home cooking is also proving to be more attractive to consumers looking to save, as it presents a more affordable option than eating out. According to personal finance company Investment Zen, the average cost of a meal per person is $4 at home versus $13 at a restaurant, meaning it is 325% more expensive to dine out than cook at home. Centralized fulfillment vs Micro-Fulfillment Battle Expected To Heat Up With the existing supply chain strained to meet elevated demand and the logistics of online fulfillment due to the pandemic, major food retailers are looking to fast-track their e-commerce automated fulfillment plans. As a result, the innovation battle is expected to heat up in coming years between the centralized fulfillment centers and the store-based micro-fulfillment centers. Centralized fulfillment centers are standalone, large-format, automated facilities that serve many stores as well as providing online fulfillment to customers across a given region within variable delivery windows. On the other hand, automated micro-fulfillment centers are small-scale facilities, typically co-located within a grocery store, often in an adjacent building or in the back of the brick-and-mortar store. These centers require less space, can be installed in urban locations and are closer to end-consumers. A third variation also exists—smaller fulfillment centers that are more localized than centralized, but these typically have a larger footprint than micro-fulfillment centers, of roughly 100,000 square feet. In June 2020, Kroger announced plans to build three more centralized fulfillment centers in the Great Lakes, Pacific Northwest and West regions in partnership with Ocado. So far, the retailer has announced plans to open nine centralized fulfillment centers in the US, with the first one slated to open in Ohio in early 2021. When announcing their partnership in May 2018, Kroger and Ocado said that their goal is to open 20 such centers in the US over the next three years. In 2019, micro-fulfillment took center stage, and many retailers saw it as a competing strategy to centralized fulfillment. Supermarket chain Albertsons, in partnership with Takeoff Technologies, launched two automated micro-fulfillment centers at two supermarkets in the San Francisco Bay Area in December 2019. The retailer said that it plans to open 10 new micro-fulfillment centers in next two years. Similarly, Walmart unveiled its scaled-down automated warehouse system, Alphabot, in January 2020 in partnership with Alert Innovation—at the back of a Walmart supercenter in Salem, New Hampshire. Walmart plans to construct two additional Alphabot micro-fulfillment centers at stores in Burbank, California and Mustang, Oklahoma, which are slated to open later this year.

Figure 9. Centralized Fulfillment Centers Versus Micro-Fulfillment Centers [wpdatatable id=354 table_view=regular]

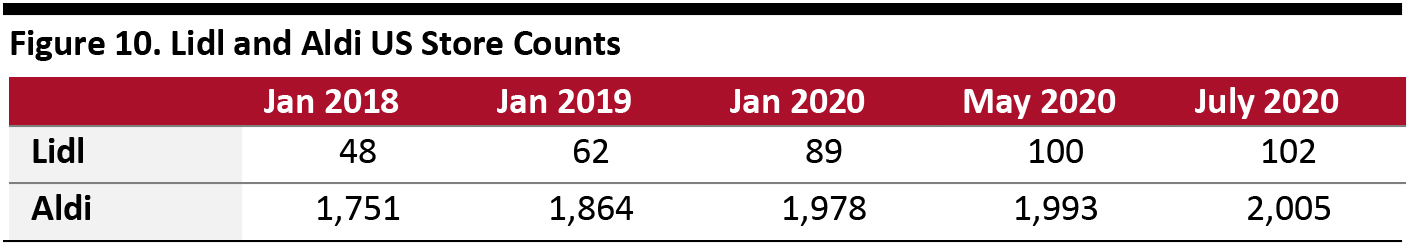

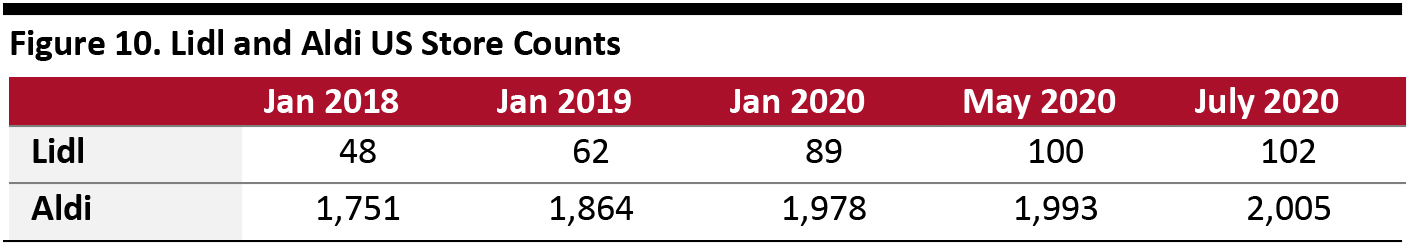

Source: Company reports/Coresight Research Dark Stores Advance amid Online Surge As online grocery sales soared amid the pandemic, several retailers—including Kroger, Stop and Shop and Whole Foods—have repurposed some brick-and-mortar locations into dark stores, driven by the lack of available pickup slots for online orders, reduction in store-operating hours and capacity restrictions inside stores. Although the pivot to dark stores began pre-Covid, with many supermarket chains experimenting with the concept at their stores nationwide, the pandemic has acted as a shot in the arm, bringing on quick acceleration in the adoption of this concept. Whole Foods converted six of its locations into dark stores as of May 19, 2020, located at Austin, Texas; Castle Rock, Colorado; Chicago, Illinois; San Francisco, California; and Baltimore and Bryant Park in New York City. In March, Kroger repurposed one of its Cincinnati, Ohio stores to a dark store fulfillment center. Additionally, supermarket chains Giant Eagle and Stop and Shop switched over several grocery stores to pickup-and-delivery-only locations as the pandemic set in. We believe that dark stores will play a key role in retail well beyond the pandemic. The heightened demand for groceries pushed chains to develop the infrastructure for automation and fulfillment quickly. With those systems already in place, dark stores will likely turn into permanent fixtures post crisis, to serve customers whose shopping behavior has shifted toward online channels. At the same time, the expected reduction in demand for retail space by nonfood retailers will create excess capacity that can be repurposed as dark stores: As we have previously noted, we may see mall owners turn to distribution formats, including dark stores, as they feel the impacts of widespread store closures. Discounters Maintain Their Winning Streak With the ongoing crisis, US consumers have attempted to further stretch their spending dollars by shifting to retail channels that emphasize value—and we see this benefitting the discounters, which offer a more limited assortment of products and sell items at lower prices. This trading down is also going to introduce more new customers to discounters, leading to potential stickiness. Lidl US: on more solid ground after facing initial hiccups: Two years behind schedule, Lidl US reached its 100-store milestone in May 2020. Back in 2017, Lidl opened its first stores in the US to much fanfare, but, by mid-2018, the retailer’s nascent US strategy failed to deliver the expected result: The retailer had only opened just over half of the 100 stores it had earlier announced it would open across the country by that time, and sales at existing stores were slower than had been anticipated. After a spell of recalibrations, Lidl increased its store fleet partly by converting some Best Market stores to the Lidl banner; Lidl acquired Best Market and its 27 stores in New York and New Jersey in November 2018. Additionally, the retailer purchased 13 Shoppers Food outlets from United Natural Foods in December 2019 and converted them to Lidl outlets. Although Lidl got off to a shaky start in the country, it quickly refined its US strategy and is rebounding well under the leadership of CEO Johannes Feiber. The company has accelerated the pace of openings and reached its 100th-store milestone comfortably ahead of the revised forecast, which indicated that the company would reach that figure by the end of 2020. Lidl also opened its third distribution center in the country in Maryland in April and has announced plans to build a fourth one in Covington, Georgia. Aldi US: Aldi US, meanwhile, is maintaining its phenomenal run in the country and reached the 2,000-store mark in July. The budget retailer is on track to become America’s third-largest supermarket chain by store count, behind Walmart and Kroger, by 2022. In June 2017, Aldi US announced a $3.4 billion plan to open 900 stores, taking its store count from 1,600 at that time to 2,500 by 2022. [caption id="attachment_113602" align="aligncenter" width="700"] Source: Company websites/Coresight Research[/caption]

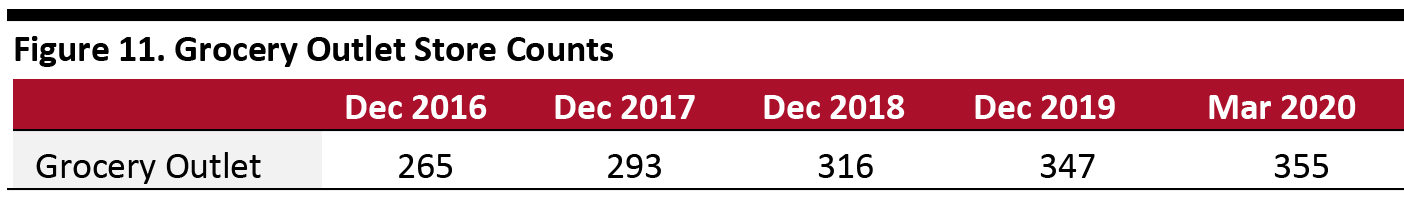

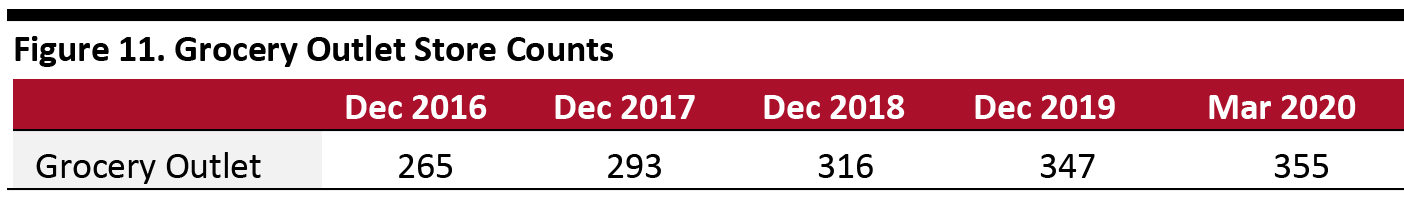

Although Aldi dominates the US discounter channel to a remarkable degree, its US-based rival discounter Grocery Outlet is also thriving. Grocery Outlet sells branded goods, in contrast to Aldi and Lidl, which focus strongly on private-label products. Despite this, Grocery Outlet can keep prices low by being opportunistic: buying canceled orders, factory overruns, packaging changes and products approaching “sell-by” dates—and passing the savings along to its customers. These opportunistic buys have allowed the grocery chain to offer consumers value while also recording higher-than-standard gross margins.

Another important characteristic of Grocery Outlet’s business model is its store operations. The stores are operated by independent operators (IOs) that are responsible for local marketing, labor recruitment and product-assortment decisions. On average, almost 75% of the assortment in each grocery outlet is selected by IOs based on local preference and shopping history.

For the first quarter of 2020, ended March 18, Grocery Outlet surged past its earnings projection and recorded a double-digit year-over-year sales growth of 25.4% to $760.3 million, fueled by heightened consumer demand from the crisis. Comparable store sales increased by 17.4% versus 4.2% last year. The company opened 10 new stores in the first quarter, and despite Covid-19 delays, still expects to open 28–30 stores this year.

[caption id="attachment_113603" align="aligncenter" width="700"]

Source: Company websites/Coresight Research[/caption]

Although Aldi dominates the US discounter channel to a remarkable degree, its US-based rival discounter Grocery Outlet is also thriving. Grocery Outlet sells branded goods, in contrast to Aldi and Lidl, which focus strongly on private-label products. Despite this, Grocery Outlet can keep prices low by being opportunistic: buying canceled orders, factory overruns, packaging changes and products approaching “sell-by” dates—and passing the savings along to its customers. These opportunistic buys have allowed the grocery chain to offer consumers value while also recording higher-than-standard gross margins.

Another important characteristic of Grocery Outlet’s business model is its store operations. The stores are operated by independent operators (IOs) that are responsible for local marketing, labor recruitment and product-assortment decisions. On average, almost 75% of the assortment in each grocery outlet is selected by IOs based on local preference and shopping history.

For the first quarter of 2020, ended March 18, Grocery Outlet surged past its earnings projection and recorded a double-digit year-over-year sales growth of 25.4% to $760.3 million, fueled by heightened consumer demand from the crisis. Comparable store sales increased by 17.4% versus 4.2% last year. The company opened 10 new stores in the first quarter, and despite Covid-19 delays, still expects to open 28–30 stores this year.

[caption id="attachment_113603" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Themes We Are Watching

Grocery Retailers Report High Covid-19 Costs in Their Quarterly Results Retailers witnessed a high demand for groceries amid the pandemic, but the costs of meeting that demand were also high. Several retailers reported making significant investments in coronavirus-related measures in their quarterly earnings—including extra sanitation and cleaning expenses, buying personal protective equipment, hiring extra personnel and offering enhanced pay and benefits.- Kroger reported that it has invested more than $830 million in its first quarter of 2020 to make operational changes and implement safety measures for shoppers and employees, which includes enhanced cleaning procedures and deep disinfection processes at all stores, as well as offering special premium pay and bonuses for associates.

- Walmart said that it incurred $900 million in incremental costs related to expanded cleaning practices, outfitting employees with personal protective equipment, expanded sick and emergency leave pay and special bonuses to store associates. On the company’s earnings call, CFO Brett Biggs said that it is a “reasonable assumption” that Walmart will spend a similar amount in the upcoming second quarter.

- Target reported a 64% plunge in quarterly profit, which the company attributed to high coronavirus-related expenses and a decline in sales in higher-margin categories such as apparel. The retailer spent almost $500 million in the first quarter to maintain safety measures at stores and pay a premium to employees working through the pandemic.

Figure 7. Grocery Retailers’ Covid-19 Investments [wpdatatable id=353 table_view=regular]

*Ahold Delhaize management noted that it will commit additional coronavirus-related investment for 2Q20 at a later date Source: Company reports Amazon Moves Further into Brick-and-Mortar Grocery Retail Amazon is getting more serious about its offline grocery ambitions by opening an expanded version of its cashierless “Go” model. The Amazon Go Grocery store, which opened in February 2020, is the company’s first full-size grocery store. It measures 10,400 square feet and stocks roughly 5,000 items, including fresh produce, dairy, packaged seafood, meats, household goods (such as paper towels) and alcoholic beverages. This marks a significant step up from the company’s original Amazon Go stores, which are typically much smaller—between 1,500 and 3,000 square feet—and stock fewer products (500 to 700 stock-keeping units) with the main focus being a mix of grab-and-go breakfast and lunch food as well as snacks. There are currently 26 such locations across Chicago, San Francisco, Seattle and New York. The technology in the new grocery format is similar to Amazon Go locations. Customers can walk in, scan a QR code from their Amazon mobile app, pick off items from shelves, and walk out when finished. The users’ authorized Amazon account will be automatically billed for the items they picked from the store. Although no human interaction is required, staff are present in stores to help stock shelves and answer shoppers’ queries. The company has advertised that it is opening a second Amazon Go Grocery store at Redmond, Washington, and is hiring managers for a third store in Washington, D.C. [caption id="attachment_113599" align="aligncenter" width="700"]

Source: Amazon[/caption]

Amazon is also reportedly advancing on another front: opening grocery stores with a conventional checkout. These stores are expected to be separate from the Whole Foods banner and will offer a broader, more typical assortment at lower price points, including items containing artificial ingredients and other additives, as compared to the healthier assortment at a typical Whole Foods store. With this move, the company is preparing to tap customers beyond the affluent Whole Foods demographic. In recent months, Amazon has been advertising positions for these stores in Chicago, Los Angeles, Seattle and Washington, D.C.

Amazon’s brick-and-mortar store portfolio saw robust sales growth for the first quarter of fiscal year 2020 after recording four quarters of virtually flat year-over-year growth. Amazon’s physical stores include 487 Whole Foods Markets, 25 Amazon Go cashierless convenience stores, one Amazon Go Grocery store, 21 Amazon Books stores, 12 Amazon 4-star outlets and six Presented by Amazon locations. The company does not break out sales for its brick-and-mortar retail segments.

[caption id="attachment_113614" align="aligncenter" width="700"]

Source: Amazon[/caption]

Amazon is also reportedly advancing on another front: opening grocery stores with a conventional checkout. These stores are expected to be separate from the Whole Foods banner and will offer a broader, more typical assortment at lower price points, including items containing artificial ingredients and other additives, as compared to the healthier assortment at a typical Whole Foods store. With this move, the company is preparing to tap customers beyond the affluent Whole Foods demographic. In recent months, Amazon has been advertising positions for these stores in Chicago, Los Angeles, Seattle and Washington, D.C.

Amazon’s brick-and-mortar store portfolio saw robust sales growth for the first quarter of fiscal year 2020 after recording four quarters of virtually flat year-over-year growth. Amazon’s physical stores include 487 Whole Foods Markets, 25 Amazon Go cashierless convenience stores, one Amazon Go Grocery store, 21 Amazon Books stores, 12 Amazon 4-star outlets and six Presented by Amazon locations. The company does not break out sales for its brick-and-mortar retail segments.

[caption id="attachment_113614" align="aligncenter" width="700"] Excludes online orders picked up at physical stores

Excludes online orders picked up at physical stores Source: Company reports [/caption] The Pendulum Swings from Food Service to Food Retail Covid-19 lockdowns and social distancing protocols have dramatically reversed the trends of consumer spending on food. With consumers foregoing food-service venues, the crisis diverted food-away-from-home (restaurants, cafés, canteens, etc.) dollars back into grocery retail, a pattern that is expected to have potential long-term implications. With states easing lockdown restrictions, food-service establishments are still struggling to cope due to social distancing requirements and lower footfall. Food-service sector sales were down 38.7% in May than a year earlier, according to US Census Bureau. Additionally, according to a Coresight Research survey conducted on June 24, more than half of US consumers (57.2%) indicated that they are currently avoiding coffee shops, bars and restaurants. With the food-service industry still recovering, we believe that the grocery industry will continue to see their toplines grow over the coming months, although not nearly at the same levels that we saw in March–May. Also, some portion of food-away-from-home dollars will likely stay at home for the long term as consumers have developed a renewed appreciation for making meals at home. A survey conducted by marketing and PR firm Hunter in April 2020 revealed that among the US consumers cooking more at home, more than half (51%) would continue to do so even after the pandemic. Home cooking is also proving to be more attractive to consumers looking to save, as it presents a more affordable option than eating out. According to personal finance company Investment Zen, the average cost of a meal per person is $4 at home versus $13 at a restaurant, meaning it is 325% more expensive to dine out than cook at home. Centralized fulfillment vs Micro-Fulfillment Battle Expected To Heat Up With the existing supply chain strained to meet elevated demand and the logistics of online fulfillment due to the pandemic, major food retailers are looking to fast-track their e-commerce automated fulfillment plans. As a result, the innovation battle is expected to heat up in coming years between the centralized fulfillment centers and the store-based micro-fulfillment centers. Centralized fulfillment centers are standalone, large-format, automated facilities that serve many stores as well as providing online fulfillment to customers across a given region within variable delivery windows. On the other hand, automated micro-fulfillment centers are small-scale facilities, typically co-located within a grocery store, often in an adjacent building or in the back of the brick-and-mortar store. These centers require less space, can be installed in urban locations and are closer to end-consumers. A third variation also exists—smaller fulfillment centers that are more localized than centralized, but these typically have a larger footprint than micro-fulfillment centers, of roughly 100,000 square feet. In June 2020, Kroger announced plans to build three more centralized fulfillment centers in the Great Lakes, Pacific Northwest and West regions in partnership with Ocado. So far, the retailer has announced plans to open nine centralized fulfillment centers in the US, with the first one slated to open in Ohio in early 2021. When announcing their partnership in May 2018, Kroger and Ocado said that their goal is to open 20 such centers in the US over the next three years. In 2019, micro-fulfillment took center stage, and many retailers saw it as a competing strategy to centralized fulfillment. Supermarket chain Albertsons, in partnership with Takeoff Technologies, launched two automated micro-fulfillment centers at two supermarkets in the San Francisco Bay Area in December 2019. The retailer said that it plans to open 10 new micro-fulfillment centers in next two years. Similarly, Walmart unveiled its scaled-down automated warehouse system, Alphabot, in January 2020 in partnership with Alert Innovation—at the back of a Walmart supercenter in Salem, New Hampshire. Walmart plans to construct two additional Alphabot micro-fulfillment centers at stores in Burbank, California and Mustang, Oklahoma, which are slated to open later this year.

Figure 9. Centralized Fulfillment Centers Versus Micro-Fulfillment Centers [wpdatatable id=354 table_view=regular]

Source: Company reports/Coresight Research Dark Stores Advance amid Online Surge As online grocery sales soared amid the pandemic, several retailers—including Kroger, Stop and Shop and Whole Foods—have repurposed some brick-and-mortar locations into dark stores, driven by the lack of available pickup slots for online orders, reduction in store-operating hours and capacity restrictions inside stores. Although the pivot to dark stores began pre-Covid, with many supermarket chains experimenting with the concept at their stores nationwide, the pandemic has acted as a shot in the arm, bringing on quick acceleration in the adoption of this concept. Whole Foods converted six of its locations into dark stores as of May 19, 2020, located at Austin, Texas; Castle Rock, Colorado; Chicago, Illinois; San Francisco, California; and Baltimore and Bryant Park in New York City. In March, Kroger repurposed one of its Cincinnati, Ohio stores to a dark store fulfillment center. Additionally, supermarket chains Giant Eagle and Stop and Shop switched over several grocery stores to pickup-and-delivery-only locations as the pandemic set in. We believe that dark stores will play a key role in retail well beyond the pandemic. The heightened demand for groceries pushed chains to develop the infrastructure for automation and fulfillment quickly. With those systems already in place, dark stores will likely turn into permanent fixtures post crisis, to serve customers whose shopping behavior has shifted toward online channels. At the same time, the expected reduction in demand for retail space by nonfood retailers will create excess capacity that can be repurposed as dark stores: As we have previously noted, we may see mall owners turn to distribution formats, including dark stores, as they feel the impacts of widespread store closures. Discounters Maintain Their Winning Streak With the ongoing crisis, US consumers have attempted to further stretch their spending dollars by shifting to retail channels that emphasize value—and we see this benefitting the discounters, which offer a more limited assortment of products and sell items at lower prices. This trading down is also going to introduce more new customers to discounters, leading to potential stickiness. Lidl US: on more solid ground after facing initial hiccups: Two years behind schedule, Lidl US reached its 100-store milestone in May 2020. Back in 2017, Lidl opened its first stores in the US to much fanfare, but, by mid-2018, the retailer’s nascent US strategy failed to deliver the expected result: The retailer had only opened just over half of the 100 stores it had earlier announced it would open across the country by that time, and sales at existing stores were slower than had been anticipated. After a spell of recalibrations, Lidl increased its store fleet partly by converting some Best Market stores to the Lidl banner; Lidl acquired Best Market and its 27 stores in New York and New Jersey in November 2018. Additionally, the retailer purchased 13 Shoppers Food outlets from United Natural Foods in December 2019 and converted them to Lidl outlets. Although Lidl got off to a shaky start in the country, it quickly refined its US strategy and is rebounding well under the leadership of CEO Johannes Feiber. The company has accelerated the pace of openings and reached its 100th-store milestone comfortably ahead of the revised forecast, which indicated that the company would reach that figure by the end of 2020. Lidl also opened its third distribution center in the country in Maryland in April and has announced plans to build a fourth one in Covington, Georgia. Aldi US: Aldi US, meanwhile, is maintaining its phenomenal run in the country and reached the 2,000-store mark in July. The budget retailer is on track to become America’s third-largest supermarket chain by store count, behind Walmart and Kroger, by 2022. In June 2017, Aldi US announced a $3.4 billion plan to open 900 stores, taking its store count from 1,600 at that time to 2,500 by 2022. [caption id="attachment_113602" align="aligncenter" width="700"]

Source: Company websites/Coresight Research[/caption]

Although Aldi dominates the US discounter channel to a remarkable degree, its US-based rival discounter Grocery Outlet is also thriving. Grocery Outlet sells branded goods, in contrast to Aldi and Lidl, which focus strongly on private-label products. Despite this, Grocery Outlet can keep prices low by being opportunistic: buying canceled orders, factory overruns, packaging changes and products approaching “sell-by” dates—and passing the savings along to its customers. These opportunistic buys have allowed the grocery chain to offer consumers value while also recording higher-than-standard gross margins.

Another important characteristic of Grocery Outlet’s business model is its store operations. The stores are operated by independent operators (IOs) that are responsible for local marketing, labor recruitment and product-assortment decisions. On average, almost 75% of the assortment in each grocery outlet is selected by IOs based on local preference and shopping history.

For the first quarter of 2020, ended March 18, Grocery Outlet surged past its earnings projection and recorded a double-digit year-over-year sales growth of 25.4% to $760.3 million, fueled by heightened consumer demand from the crisis. Comparable store sales increased by 17.4% versus 4.2% last year. The company opened 10 new stores in the first quarter, and despite Covid-19 delays, still expects to open 28–30 stores this year.

[caption id="attachment_113603" align="aligncenter" width="700"]

Source: Company websites/Coresight Research[/caption]

Although Aldi dominates the US discounter channel to a remarkable degree, its US-based rival discounter Grocery Outlet is also thriving. Grocery Outlet sells branded goods, in contrast to Aldi and Lidl, which focus strongly on private-label products. Despite this, Grocery Outlet can keep prices low by being opportunistic: buying canceled orders, factory overruns, packaging changes and products approaching “sell-by” dates—and passing the savings along to its customers. These opportunistic buys have allowed the grocery chain to offer consumers value while also recording higher-than-standard gross margins.

Another important characteristic of Grocery Outlet’s business model is its store operations. The stores are operated by independent operators (IOs) that are responsible for local marketing, labor recruitment and product-assortment decisions. On average, almost 75% of the assortment in each grocery outlet is selected by IOs based on local preference and shopping history.

For the first quarter of 2020, ended March 18, Grocery Outlet surged past its earnings projection and recorded a double-digit year-over-year sales growth of 25.4% to $760.3 million, fueled by heightened consumer demand from the crisis. Comparable store sales increased by 17.4% versus 4.2% last year. The company opened 10 new stores in the first quarter, and despite Covid-19 delays, still expects to open 28–30 stores this year.

[caption id="attachment_113603" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]