DIpil Das

Introduction

Each report in our Market Overview series provides an analysis of a particular retail sector or consumer market. In this report, we cover US mass merchants, which includes warehouse clubs and mass merchandisers Target and Walmart, and discount stores. This report includes:- US sector sizes, growth and revenues for discounters Big Lots, Five Below, Dollar General and Dollar Tree; mass merchandisers Target and Walmart; and warehouse clubs BJ’s Wholesale Club, Costco and Sam’s Club

- The competitive landscape for these retailers

- Key innovators and disruptors across the market

- The outlook for US mass merchant and discount retailers

Sector Size and Growth

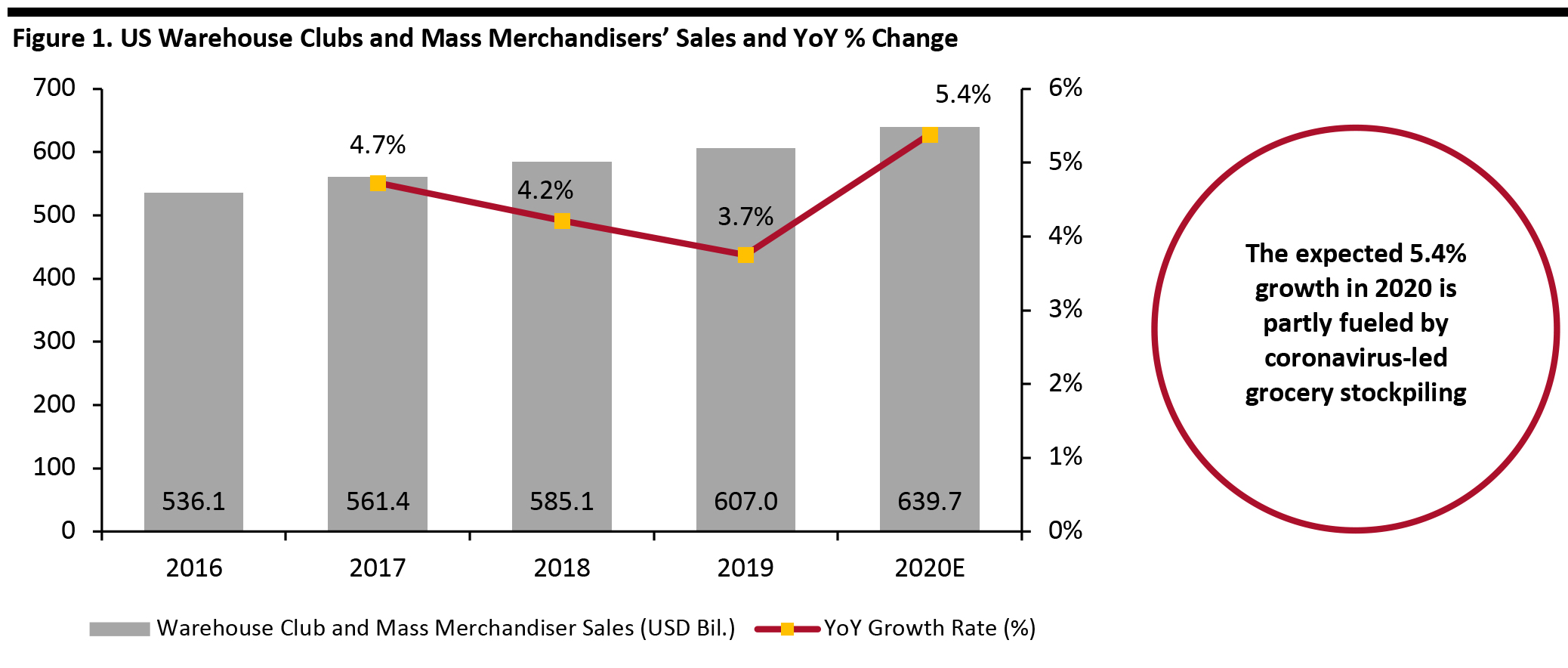

Warehouse Clubs and Mass Merchandisers Sector Size and Growth Coresight Research estimates that total sales by major US warehouse clubs and mass merchandisers will reach $639.7 billion in 2020, up 5.4% year over year. This total includes BJ’s Wholesale Club, Costco, Sam’s Club, Target and Walmart. In the first half of 2020, stockpiling trends and increased demand for grocery products drove the bulk of this increase, while general merchandise saw muted growth.- BJ’s Wholesale Club reported 32.6% growth in the grocery segment for the first fiscal quarter of 2021 (1Q21), ended May 2, 2020, while its general merchandise saw subdued growth of 2.5%.

- Sam’s Club reported 25% growth in its grocery and consumables division in 1Q21, ended April 30, 2020, while total sales of other segments declined by 13.2%.

- Target reported growth of 22.9% in its food and beverages division for 1Q21, ended May 2, 2020.

- Walmart US reported 14.5% growth in its grocery segment for 1Q21, ended April 30, 2020, while general merchandise saw growth of 4.4%.

Warehouse clubs are BJ’s, Costco and Sam’s Club; Mass merchandisers are Target and Walmart.

Warehouse clubs are BJ’s, Costco and Sam’s Club; Mass merchandisers are Target and Walmart. 2020E based on analyst consensus for fiscal-year revenue growth (including any non-US sales).

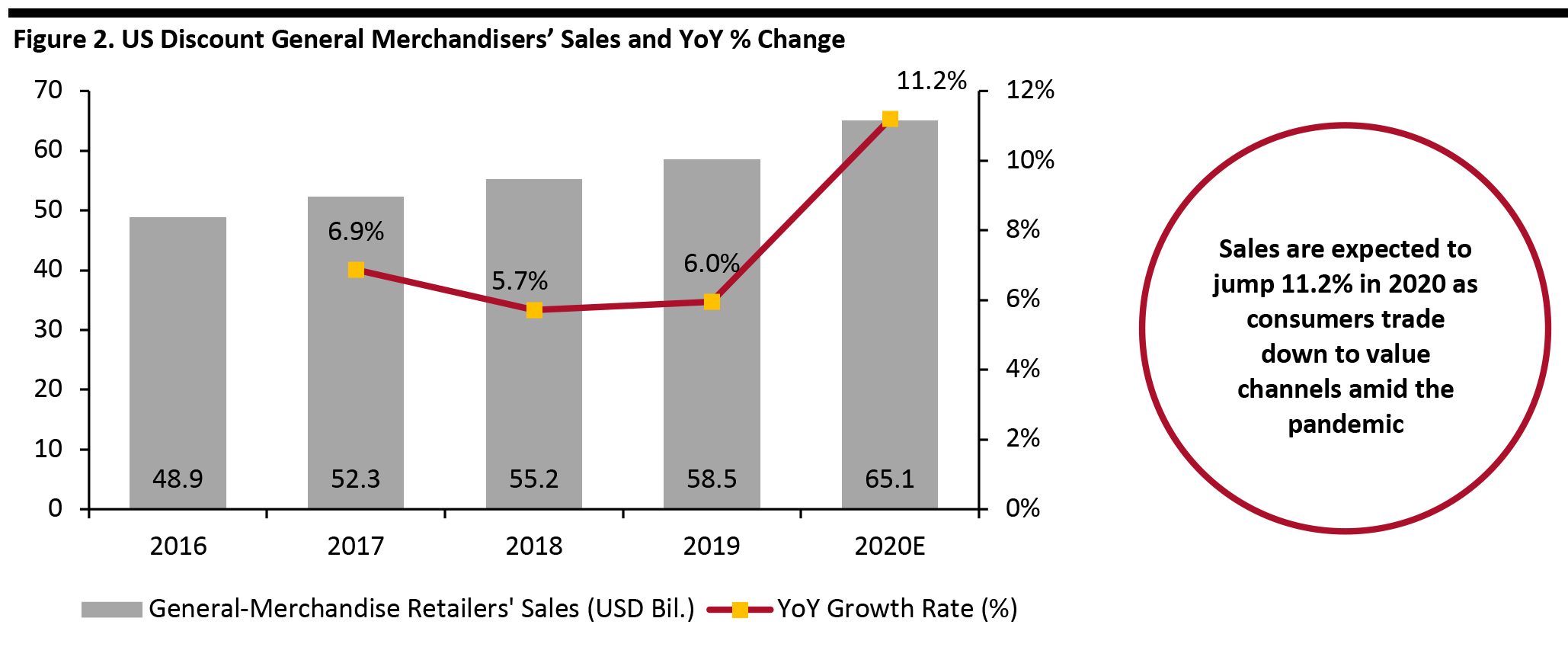

Source: Company reports/S&P Capital IQ/Coresight Research [/caption] Discount General Merchandisers: Sector Size and Growth With the ongoing crisis, US consumers have attempted to stretch their dollars as far as possible by shifting to retail channels that emphasize value—we see this benefiting discounter retailers, which typically offer a limited assortment of products and sell items at low prices. Coresight Research estimates that sales from discount general-merchandise retailers will reach $65.1 billion in 2020, up 11.2% year over year—driven by strong demand for consumables in the first half of the year. For example, Dollar General posted solid growth of 28.6% in the consumable category for 1Q21, ended May 1, 2020. The market total in Figure 2 comprises Big Lots, Dollar General, Dollar Tree (including Family Dollar) and Five Below. [caption id="attachment_115649" align="aligncenter" width="700"]

General-merchandise retailers are Big Lots, Dollar General, Dollar Tree (including Family Dollar) and Five Below.

General-merchandise retailers are Big Lots, Dollar General, Dollar Tree (including Family Dollar) and Five Below. 2020E based on analyst consensus for fiscal-year revenue growth.

Source: Company reports/S&P Capital IQ/Coresight Research [/caption]

Competitive Landscape

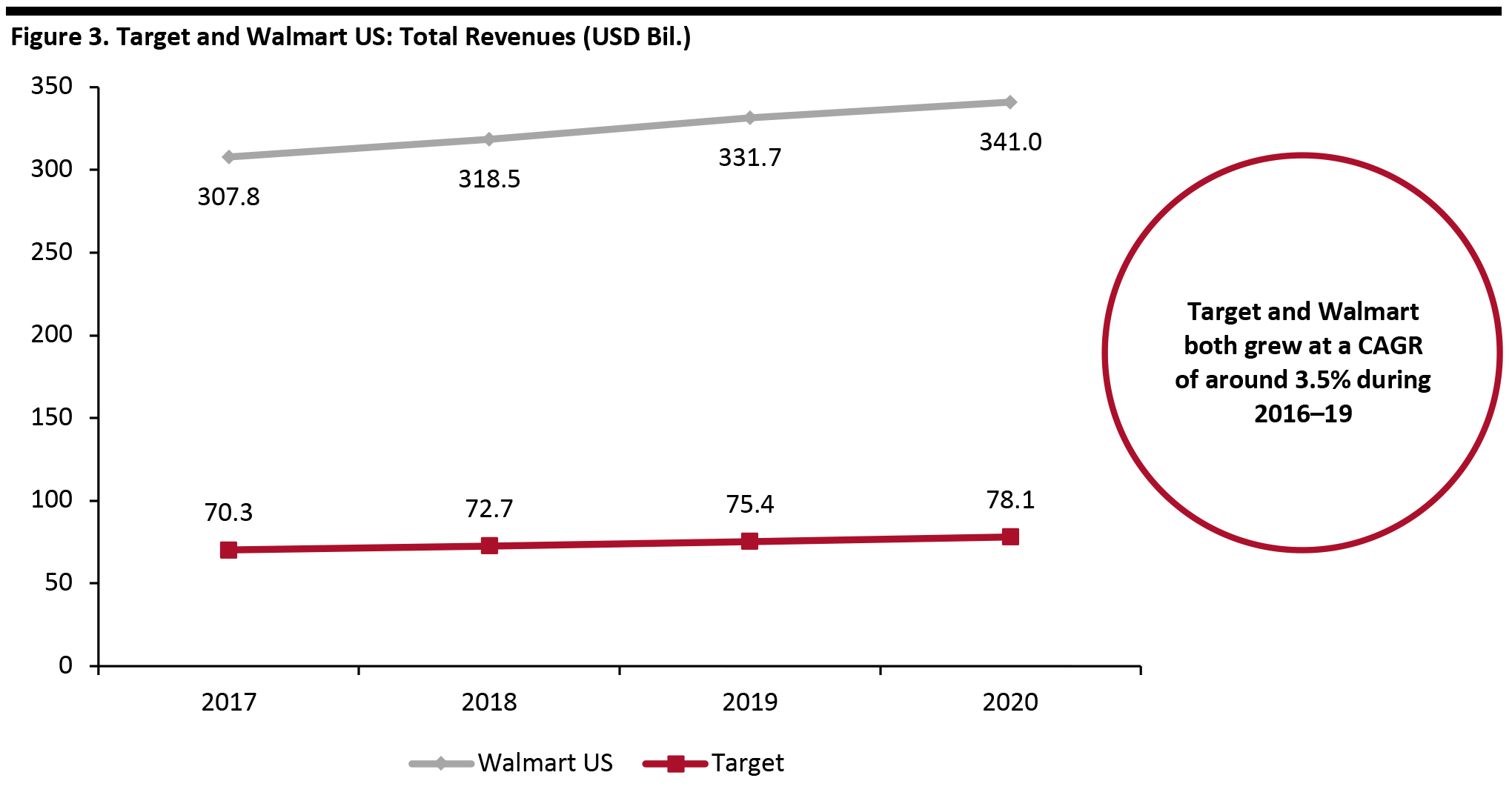

Retail giants Target and Walmart are both low-cost mass merchandisers with huge revenues. Walmart dominates the mixed retailers’ market with its sheer size. Its nearest competitor, Target, uses a similar low-pricing approach, but it focuses on slightly smaller stores and is more youth-oriented. The chart below shows the revenue trajectory of the two companies for the 2017 to 2020 fiscal years. In the financial year ending 2020, Walmart US reported revenue of $341 billion, more than four times that of Target’s $78.1 billion. [caption id="attachment_115650" align="aligncenter" width="700"] Source: Company reports[/caption]

Warehouse Clubs

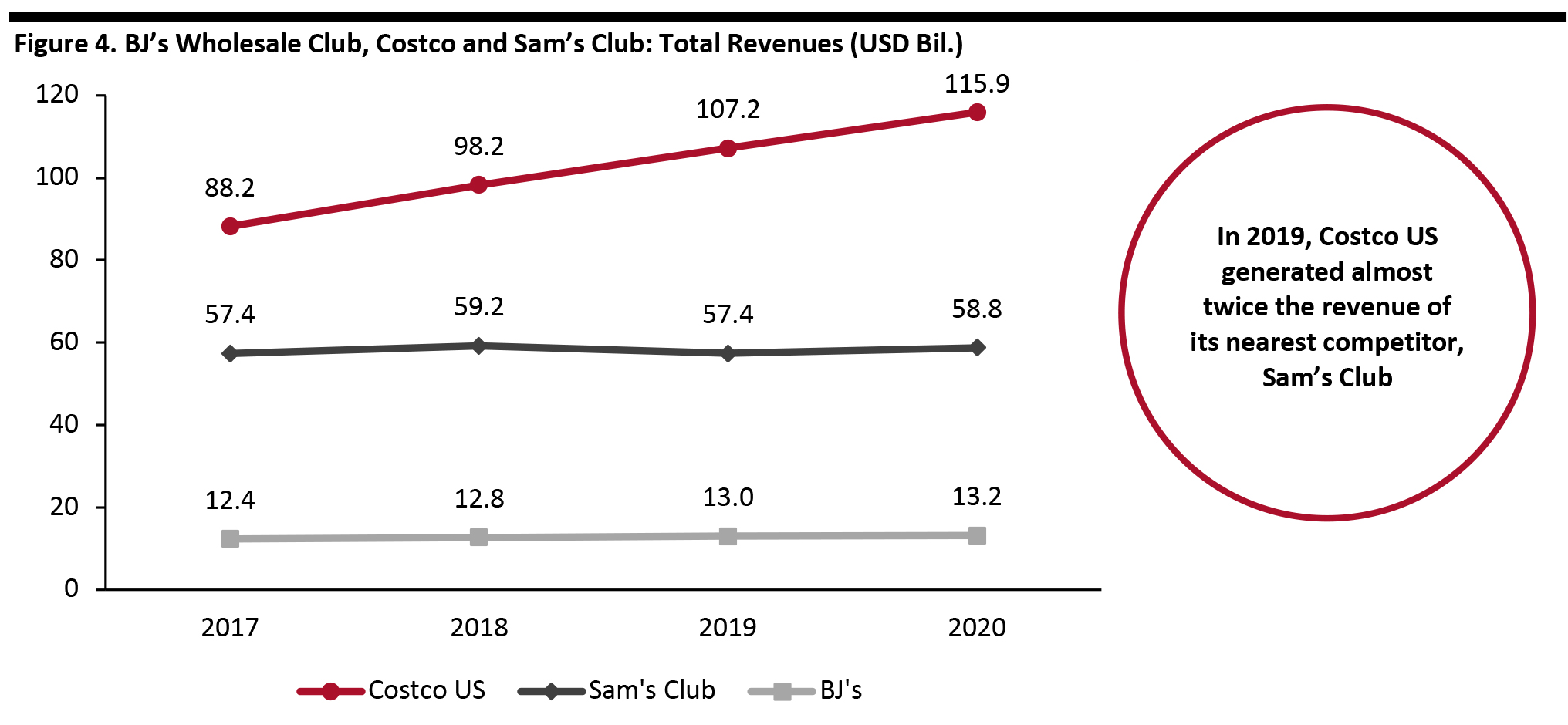

The warehouse club sector in the US is highly concentrated. There are only three big players, all of which are US-centric and headquartered in the US. The concentration is likely to remain high, given the substantial capital that would be required for new entrants or other rivals to be able to compete with these market leaders. Nonetheless, warehouse club chains face heavy competition from each other and from other retail verticals, including discount stores, drugstores, mass retailers, department stores and Internet retailers.

Costco remains the dominant wholesaler among the three major warehouse club chains. In 2020, Costco US generated almost twice the revenue of its nearest competitor, Sam’s Club.

[caption id="attachment_115651" align="aligncenter" width="700"]

Source: Company reports[/caption]

Warehouse Clubs

The warehouse club sector in the US is highly concentrated. There are only three big players, all of which are US-centric and headquartered in the US. The concentration is likely to remain high, given the substantial capital that would be required for new entrants or other rivals to be able to compete with these market leaders. Nonetheless, warehouse club chains face heavy competition from each other and from other retail verticals, including discount stores, drugstores, mass retailers, department stores and Internet retailers.

Costco remains the dominant wholesaler among the three major warehouse club chains. In 2020, Costco US generated almost twice the revenue of its nearest competitor, Sam’s Club.

[caption id="attachment_115651" align="aligncenter" width="700"] Source: Company reports[/caption]

Discount Stores

Source: Company reports[/caption]

Discount Stores

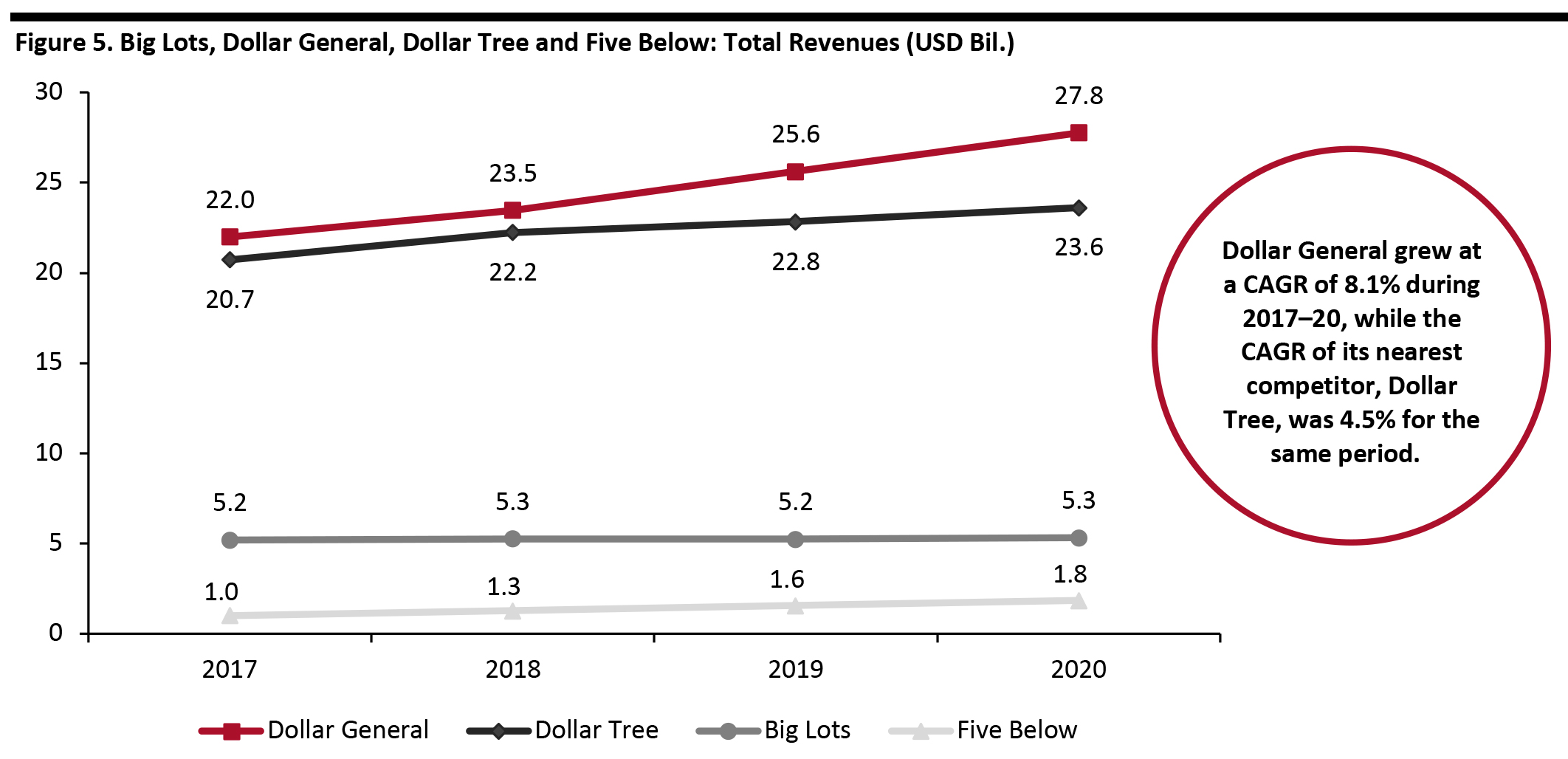

Discount chains are among the top performers in US store-based retail, with Dollar General and Dollar Tree dominating the market. Dollar General focuses on rural areas, while Dollar Tree primarily targets urban and suburban markets. In terms of absolute revenue growth, Dollar General grew at a CAGR of 8.1% during 2017–20, while the CAGR of its nearest competitor, Dollar Tree, was 4.5% for the same period. Although its revenues and store count are much smaller than dollar store chains, with its focus on a young demographic, Five Below grew at an impressive CAGR of 22.7% from 2017 to 2020.

[caption id="attachment_115652" align="aligncenter" width="700"] Dollar Tree includes the Family Dollar banner

Dollar Tree includes the Family Dollar banner Source: Company reports [/caption]

Innovators and Disruptors

There are numerous startups seeking to enter and disrupt the mass merchandise segment. We outline two notable examples below:- Boxed is a New York City-based membership-free online retailer that offers direct bulk delivery. Through technological innovations, Boxed is proving to be tough competition for established warehouse retailers such as BJ’s, Costco and Sam’s Club. The online retailer has introduced a platform that uses artificial intelligence to forecast customer orders, as well as adding a customer service chatbot, a group-ordering function and an augmented reality, pantry-storage planning tool. The company also offers individual and curated products for customers in multiple categories, including corporations, educational institutions, small businesses, healthcare facilities and hotels.

- Thrive Market is a membership-based online shopping club that offers organic and non-GMO groceries, as well as sustainable beauty and cleaning products, at prices 25–50% less than regular retail prices. Anecdotally described as “Whole Foods meets Costco,” Thrive Market boasts more than 600,000 members and carries over 6,000 products in food, home and beauty categories. The company claims to use 100% recycled packaging and ship its boxes from zero-waste warehouses. Like many other online grocers, Thrive Market has seen a surge in new customers and higher demand from existing ones amid the pandemic. According to The Wall Street Journal, the company experienced 110% growth in May this year compared to figures from last year, and it has had more than 100,000 new customer sign-ups during the pandemic.

Themes We Are Watching

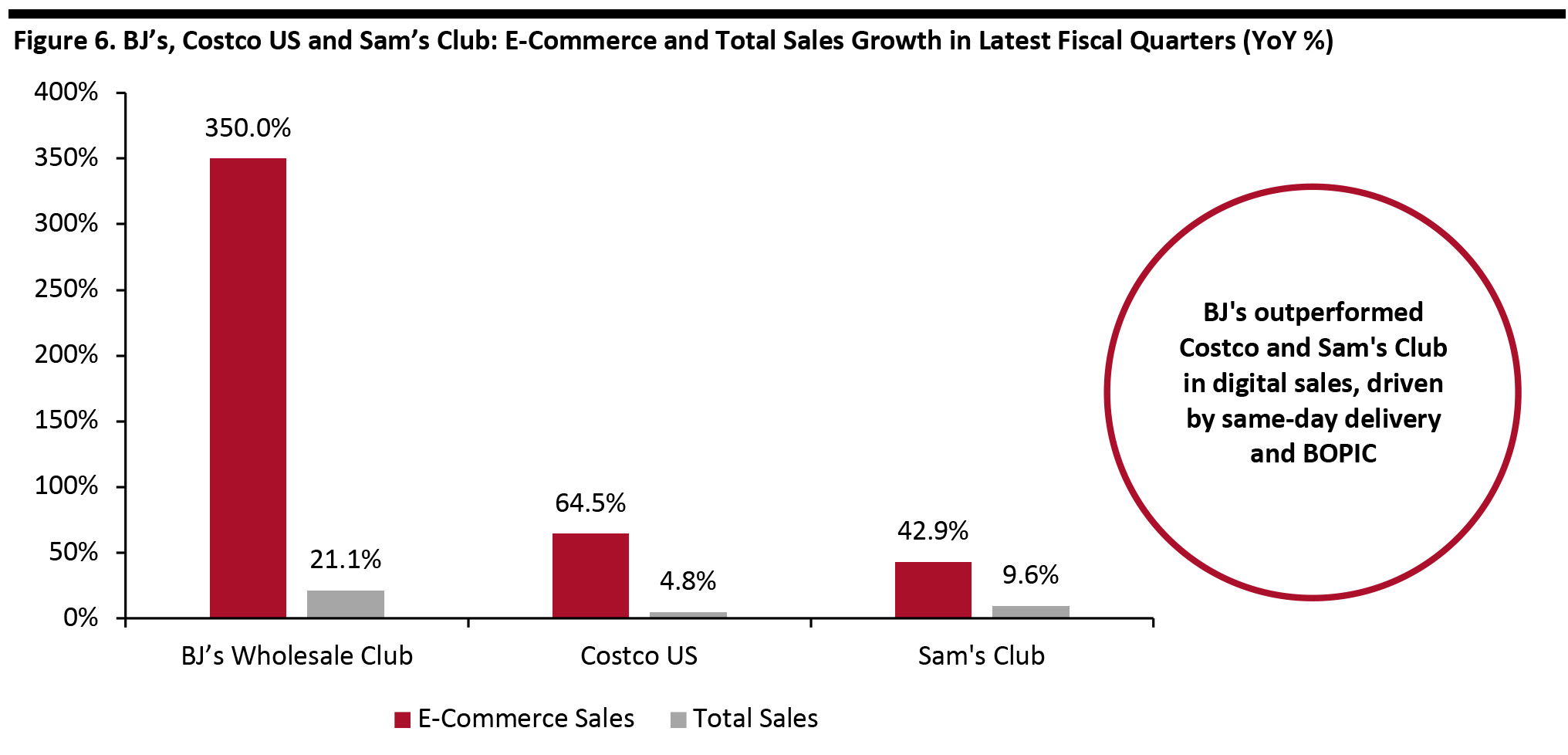

Digital Investments and E-Commerce While warehouse club retailers have been slower to embrace e-commerce than many other US retailers, the rapid growth in online demand in the country and growing competition from online pure plays has forced them to make concerted efforts to expand digital capabilities in recent years. The clubs have increasingly placed greater emphasis on e-commerce and omnichannel capabilities, which has involved developing same-day and two-day grocery delivery, rolling out BOPIC (buy online, pick up in club) services and opening e-commerce fulfillment centers. Investments into expanding digital shopping capabilities proved to be timely for these retailers as customer adoption of pickup and delivery services grew significantly with the onset of the pandemic, leading to a jump in digital sales in the clubs’ latest fiscal quarters.- BJ’s Wholesale Club reported unprecedented levels of demand for digital shopping in 1Q21, ended May 2020. The company reported that digital sales swelled 350% for the period, representing 5% of the company’s comp sales for the quarter—compared to 1.5% in 1Q19. Approximately three-quarters of its digital sales in the first quarter were driven by same-day delivery and BOPIC.

- Costco US reported e-commerce growth of 64.5% year over year for 3Q20, which ended May 10, 2020. Costco management noted that the increase in online grocery sales excludes third-party or same-day grocery program via Instacart. If the company included the Instacart sales in its online growth, the increase in overall online sales would be just above 100%, according to CFO Richard Galanti. The company said that e-commerce made up 8% of Costco’s sales—and if third-party apps were to be included, it would be 10% of total US sales.

- Sam’s Club reported e-commerce sales growth of 42.9%, positively contributing 1.7% to comp sales in 1Q21, ended April 30, 2020. This number is expected to grow following the company’s June rollout of curbside pickup across almost 600 stores, after a pilot program at 16 locations. Sam’s Club e-commerce penetration rate in 1Q21 increased to 6.6%, compared to 5.1% 1Q20.

Source: Company reports[/caption]

Mass merchandisers Target and Walmart, which are ahead of the curve in terms of digital transformation, have continued to thrive in a growing e-commerce landscape amid the pandemic. In the 2Q21 ended July 31, 2020, Walmart US posted strong growth of 97% in e-commerce sales, with robust results across all channels. As of July 31, the company offers grocery pickup at 3,450 locations and same-day delivery at 2,730 stores in the US.

For the fiscal quarter ended August 1, 2020, Target reported digital comparable sales growth of 195%. Its same-day services—Order Pick Up (buy online, pick up in store), Drive Up (curbside pickup) and Shipt (on-demand delivery)—grew by 273% over this period and accounted for around 6% of the overall comparable sales gains. Among these services, the company saw the fastest growth in Drive Up, which grew 734%, while orders fulfilled by Shipt were up more than 350% and in-store pickup sales increased more than 60% in the quarter.

Expanding Retail Footprints

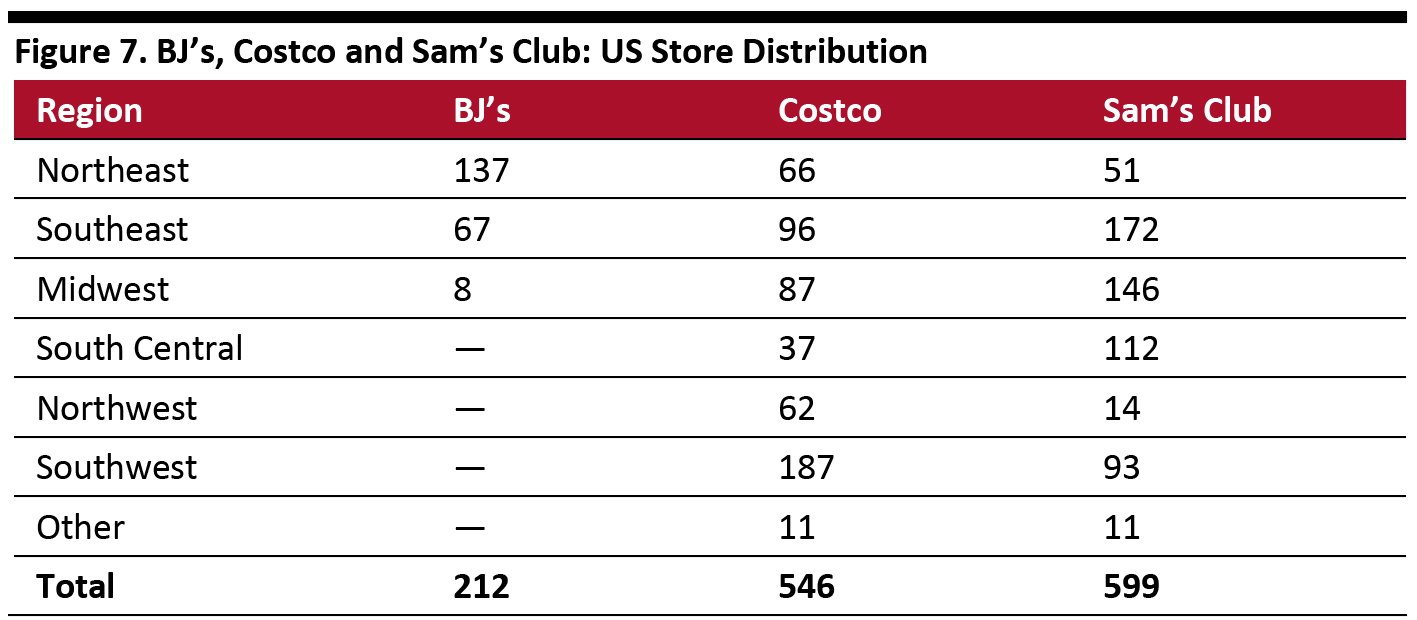

Unlike its larger rivals—Costco and Sam’s Club—BJ’s Wholesale Club does not have store presence throughout the US. It operates mostly along the East Coast, with additional outlets located in the state of Ohio. Since 2019, the wholesale retailer has expanded further into the Midwest by opening two new stores in Michigan in 2019 and a further store in the state in July 2020. BJ’s is expected to face strong competition in the region— the communities where BJ’s opened its two Michigan locations in November 2019 are already served by nearby Costco or Sam’s Club outlets.

US warehouse clubs have varying regional focuses. While BJ’s focuses primarily on the Northeast region of the country, the majority of Costco stores are located in the Southwest. Sam’s Club stores are primarily located in the Southeast, the Midwest and South-Central US (see Figure 7).

[caption id="attachment_115654" align="aligncenter" width="700"]

Source: Company reports[/caption]

Mass merchandisers Target and Walmart, which are ahead of the curve in terms of digital transformation, have continued to thrive in a growing e-commerce landscape amid the pandemic. In the 2Q21 ended July 31, 2020, Walmart US posted strong growth of 97% in e-commerce sales, with robust results across all channels. As of July 31, the company offers grocery pickup at 3,450 locations and same-day delivery at 2,730 stores in the US.

For the fiscal quarter ended August 1, 2020, Target reported digital comparable sales growth of 195%. Its same-day services—Order Pick Up (buy online, pick up in store), Drive Up (curbside pickup) and Shipt (on-demand delivery)—grew by 273% over this period and accounted for around 6% of the overall comparable sales gains. Among these services, the company saw the fastest growth in Drive Up, which grew 734%, while orders fulfilled by Shipt were up more than 350% and in-store pickup sales increased more than 60% in the quarter.

Expanding Retail Footprints

Unlike its larger rivals—Costco and Sam’s Club—BJ’s Wholesale Club does not have store presence throughout the US. It operates mostly along the East Coast, with additional outlets located in the state of Ohio. Since 2019, the wholesale retailer has expanded further into the Midwest by opening two new stores in Michigan in 2019 and a further store in the state in July 2020. BJ’s is expected to face strong competition in the region— the communities where BJ’s opened its two Michigan locations in November 2019 are already served by nearby Costco or Sam’s Club outlets.

US warehouse clubs have varying regional focuses. While BJ’s focuses primarily on the Northeast region of the country, the majority of Costco stores are located in the Southwest. Sam’s Club stores are primarily located in the Southeast, the Midwest and South-Central US (see Figure 7).

[caption id="attachment_115654" align="aligncenter" width="700"] As of February 2020

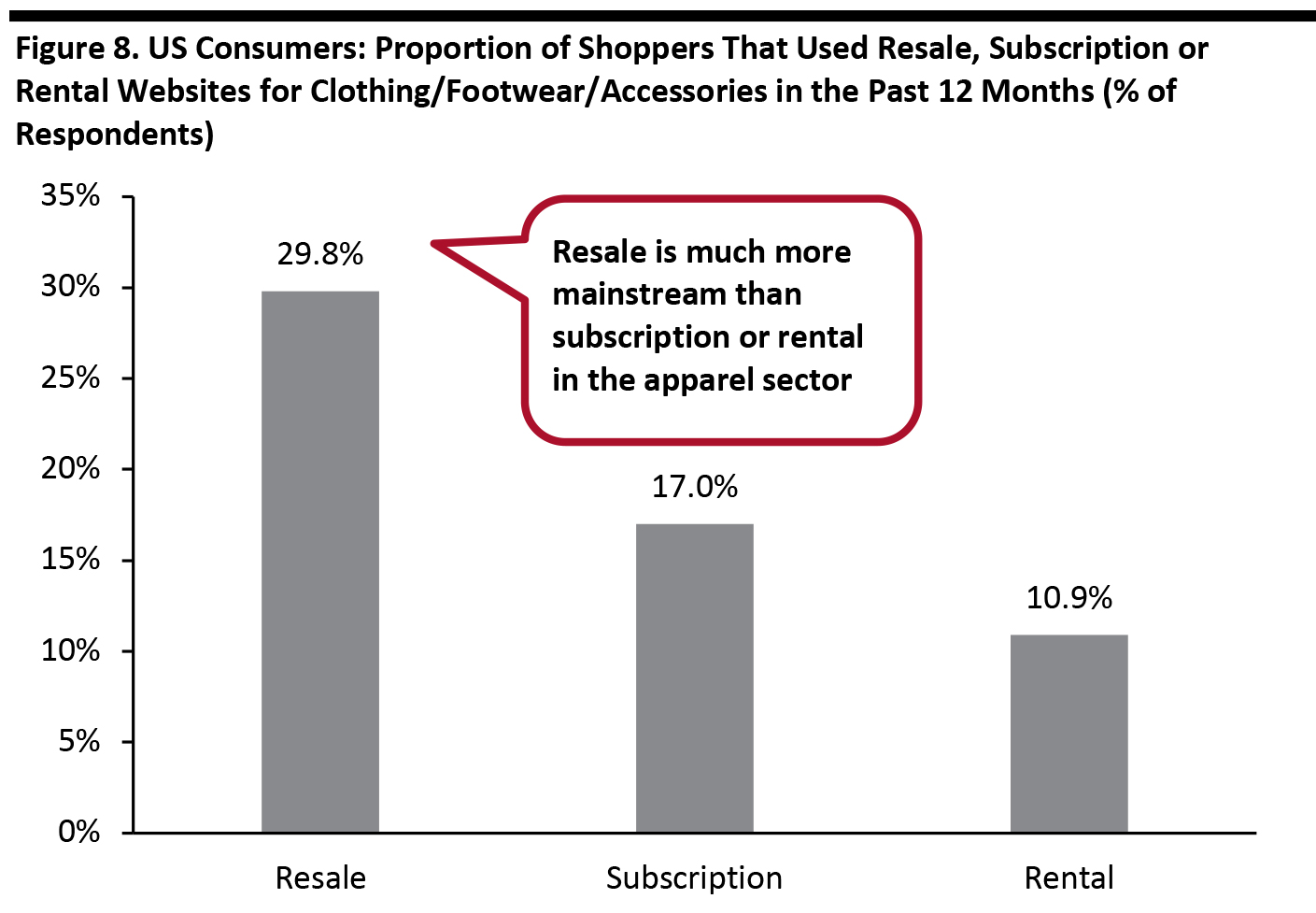

As of February 2020 Source: Company reports/Coresight Research [/caption] Walmart Dives into the Apparel Resale Market Walmart forayed into the clothing resale market with the announcement of a new strategic partnership with online fashion resale platform ThredUP in May 2020. With this partnership, ThredUP will offer a selection of nearly 750,000 pre-owned women’s and children’s clothing items and accessories from brands such as Calvin Klein, Carters, Michael Kors and NIKE, which will be available on walmart.com/thredup. We expect the partnership to be beneficial to both retailers, with Walmart gaining another well-known partner for its online marketplace of independent sellers, and ThredUP gaining exposure to Walmart’s growing online store space—Walmart noted that it has added almost 1,000 brands to its online assortment. Additionally, partnering with ThredUP could attract new customers who are looking for opportunities to save money with pre-owned purchases, as well as environmentally conscious shoppers. Several resellers have noted that consumer interest in online resale and consignment shot up amid the pandemic—with shoppers prioritizing value and accelerating the shift to thrift. According to the company, May 2020 was a record-breaking month for new ThredUP visits, and overall, shoppers spent 2.2 million hours on the site—up 31% compared to pre-Covid numbers. At the same time, the reseller has high inventory levels, due to what it calls a “quarantine clean-out frenzy.” Similarly, online sneaker resale platform StockX announced that May and June have been the most lucrative period in its history and that the average resale price for the top 500 sneakers increased by 6%. A Coresight Research survey conducted in February 2020 found that resale is more mainstream than subscription or rental in the US, with 29.8% of shoppers using resale websites to buy clothing, footwear or accessories in 2019—almost triple the proportion of respondents that used rental websites. [caption id="attachment_115655" align="aligncenter" width="700"]

Base: 1,855 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months, surveyed in February 2020

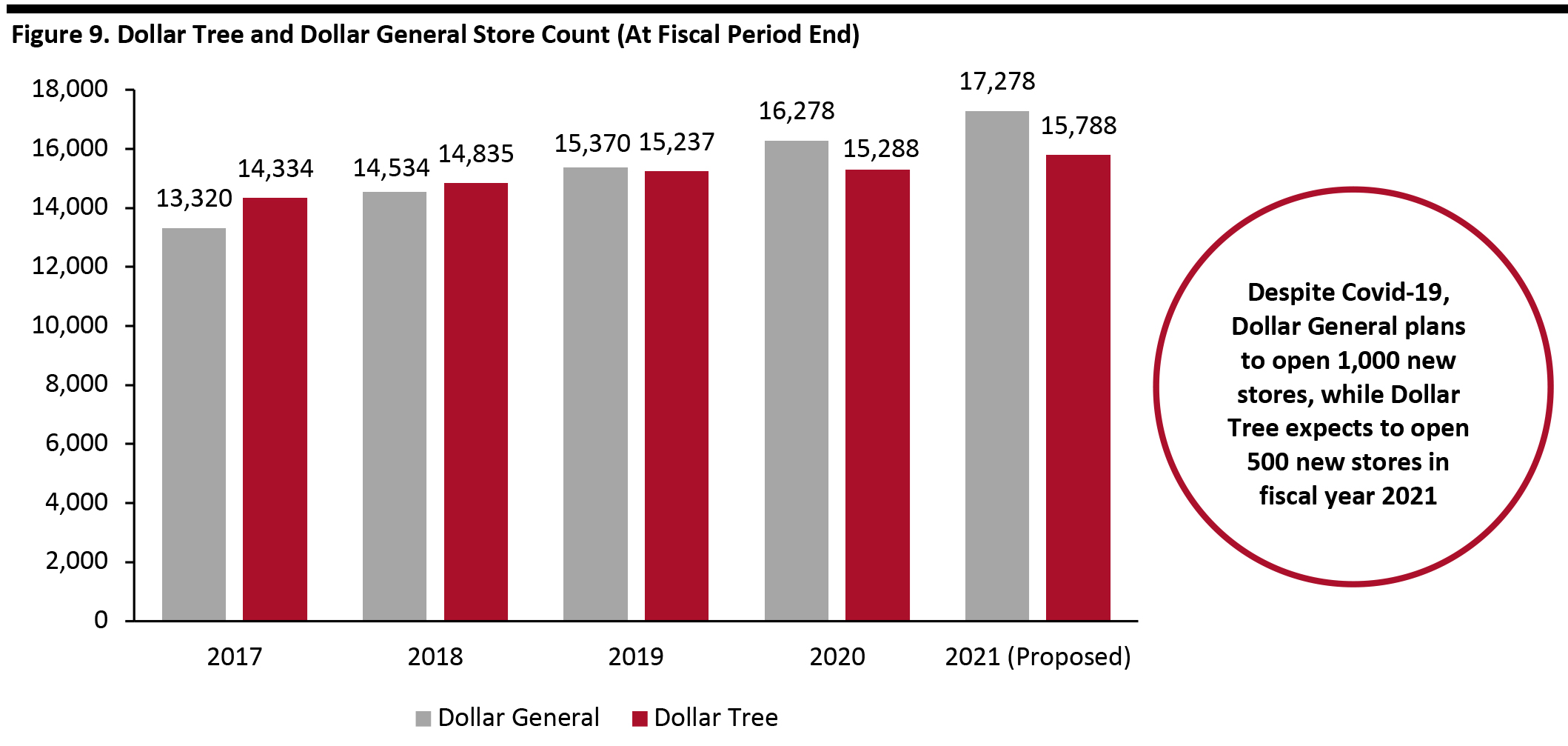

Base: 1,855 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months, surveyed in February 2020 Source: Coresight Research [/caption] Commitment to Store Expansion in 2020 Among Dollar Stores With the onset of the pandemic, many shoppers turned to discount retail formats as value became their key priority—benefiting the dollar stores that sell a limited assortment of products at low prices. The dollar chains posted strong sales and profit growth in their first fiscal quarter and are poised to gain as the economy struggles in the months ahead. Unlike most retailers that are shrinking their physical footprints, dollar companies’ real estate plans remain firmly in place, including new store expansion. Comp store sales for Dollar General swelled by 21.7% during 1Q21, reaffirming its commitment to pursue physical expansion in 2020. In 1Q21, the company reported opening 250 new stores and remodeling 481 stores. The company announced that the pandemic has not resulted in a delay in its real estate plans and it does not expect any significant delays for the rest of the fiscal year. By the end of the fiscal year, the retailer expects to open a total of 1,000 new stores, up from 975 in fiscal 2020. It also plans to remodel approximately 1,500 stores and relocate around 80 stores. Similarly, Dollar Tree opened 67 new Dollar Tree stores and 32 new Family Dollar stores in 1Q21, ended May 2, 2020. For the financial year 2021, the company expects its capital expenditure to reach approximately $1 billion, including the opening of 500 new stores (325 Dollar Tree stores and 175 Family Dollar stores) and renovation of around 750 stores. [caption id="attachment_115656" align="aligncenter" width="700"]

Source: Company reports[/caption]

Discounters and Omnichannel Initiatives

As limited-assortment retailers that prioritize value above anything else, the leading discount chains were, for a time, thought to be more insulated from the creeping threat of e-commerce than most other retailers. However, the shift in consumer shopping and behavioral patterns due to the pandemic made it clear that even discounters need to set out a clear digital shopping strategy to thrive in a post-crisis future. As a result, several discount chains are embracing omnichannel retail and building upon the tentative steps taken to develop e-commerce sales in recent years.

Dollar General launched a pilot for BOPIS (buy online, pick up in store) services for 30 stores in October 2019 and is the first dollar store chain to test the service. CEO Todd Vasos noted in the company’s 1Q21 earnings call that Dollar General is pleased with the initial results and plans to roll out BOPIS to most of its stores by the end of 2020.

On June 8, 2020, Big Lots took the first step in accelerating its e-commerce strategy by forging a partnership with Instacart. The partnership will see the discount retail chain launch same-day delivery nationwide from nearly 1,400 stores across 47 US states. In July, the company expanded this same-day delivery program by collaborating with on-demand logistics provider Pickup to allow customers to order assortment from their local Big Lots store. Big Lots added a curbside pickup service to all its stores in mid-March when the crisis began to unfold in the US.

With omnichannel retail gaining significance due to rapidly evolving consumer purchase patterns and the increasing number of customers across the income spectrum shopping at discount retailers, we expect the leading discounters to continue to refine their digital strategies to remain competitive in the near future.

Source: Company reports[/caption]

Discounters and Omnichannel Initiatives

As limited-assortment retailers that prioritize value above anything else, the leading discount chains were, for a time, thought to be more insulated from the creeping threat of e-commerce than most other retailers. However, the shift in consumer shopping and behavioral patterns due to the pandemic made it clear that even discounters need to set out a clear digital shopping strategy to thrive in a post-crisis future. As a result, several discount chains are embracing omnichannel retail and building upon the tentative steps taken to develop e-commerce sales in recent years.

Dollar General launched a pilot for BOPIS (buy online, pick up in store) services for 30 stores in October 2019 and is the first dollar store chain to test the service. CEO Todd Vasos noted in the company’s 1Q21 earnings call that Dollar General is pleased with the initial results and plans to roll out BOPIS to most of its stores by the end of 2020.

On June 8, 2020, Big Lots took the first step in accelerating its e-commerce strategy by forging a partnership with Instacart. The partnership will see the discount retail chain launch same-day delivery nationwide from nearly 1,400 stores across 47 US states. In July, the company expanded this same-day delivery program by collaborating with on-demand logistics provider Pickup to allow customers to order assortment from their local Big Lots store. Big Lots added a curbside pickup service to all its stores in mid-March when the crisis began to unfold in the US.

With omnichannel retail gaining significance due to rapidly evolving consumer purchase patterns and the increasing number of customers across the income spectrum shopping at discount retailers, we expect the leading discounters to continue to refine their digital strategies to remain competitive in the near future.

Sector Outlook

- The Covid-19 crisis has had a polarizing effect on mass merchandisers—with unprecedented surges in grocery product demand, while general-merchandise categories have seen subdued growth. We believe that mass retailers will see a rebound in general-merchandise categories, while grocery sales will ease over the rest of the year.

- In light of upward e-commerce trends amid the pandemic, warehouse club chains will look to accelerate digital transformation, including bolstering delivery services, boosting omnichannel capabilities and investing in technology to enhance mobile applications.

- The coronavirus upheaval has further strengthened the position of dollar store chains, owing to their small-format stores, close proximity to customers and value offerings. We believe that dollar stores are poised to emerge stronger as the pandemic subsides.