DIpil Das

Introduction

E-commerce behemoths Alibaba and Amazon continue to lead the way in the online markets of the world’s two largest economies, China and the US, opening up opportunities for companies and providing consumers with a convenient and easy shopping experience. These e-commerce giants are staying innovative in their business models and offerings, solidifying their positions in the market. The black swan event of 2020—the coronavirus pandemic—has made the online channel the preferred option for consumers to shop as people avoid public places in fear of contracting the virus. Potentially, changes in consumer shopping behavior during the crisis could be sustained in the long term. While brick-and-mortar stores have been forced to close, significantly affecting in-store sales, there has been a jump in online sales. With lockdowns and stay-at-home orders in place around the globe, the rise in e-commerce is likely to continue, providing a tailwind to those that are already dominant in the channel. In this report, we explore the e-commerce market, with a focus on multicategory platforms in China and the US. We consider the market landscape, competitive landscape, key themes to watch and the market outlook. We also take a look at how e-commerce platforms are responding to the coronavirus crisis.Market Landscape

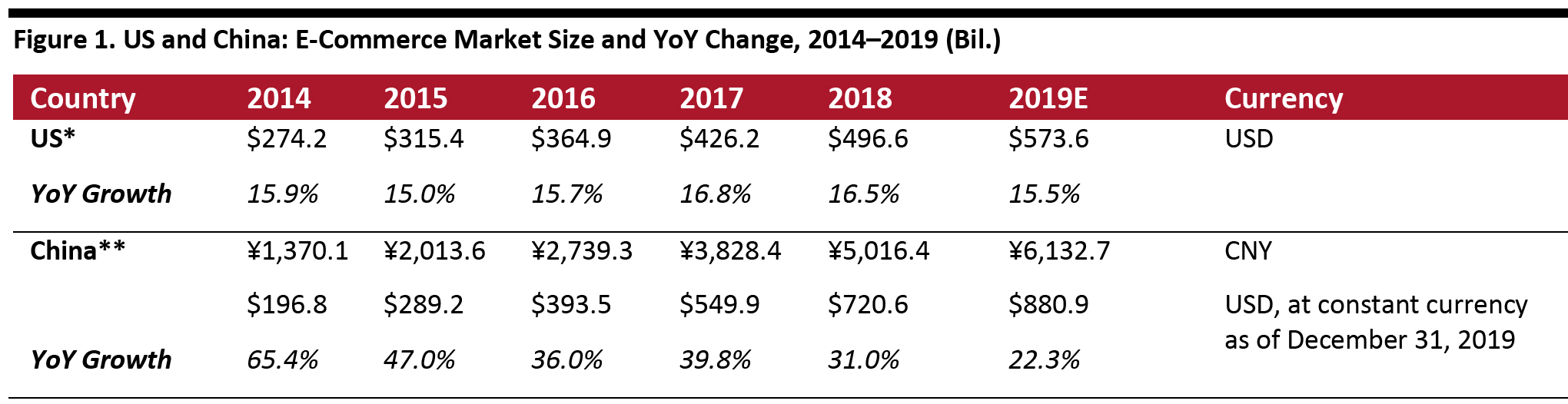

Retail e-commerce continues to grow at a healthy pace in the US. Using Census Bureau data, we estimate that the US e-commerce market was worth $573.6 billion in 2019—growing 15.5% over 2018 and at a CAGR of 15.9% from 2014 to 2019. Since 2010, China’s e-commerce industry has experienced tremendous growth. The market has grown at a steady and slower pace in recent years but remains the world’s largest e-commerce market. China’s business-to-consumer (B2C) e-commerce sales grew 22.3% year over year in 2019, reaching ¥6132.7 ($880.9 billion), according to Chinese data provider Analysys. We expect that China will retain its leading position in e-commerce in 2020, driven by the high penetration of Internet and mobile users, as well as ongoing innovation in the market. [caption id="attachment_108514" align="aligncenter" width="700"] *US online retail sales ex auto

*US online retail sales ex auto **B2C e-commerce sales

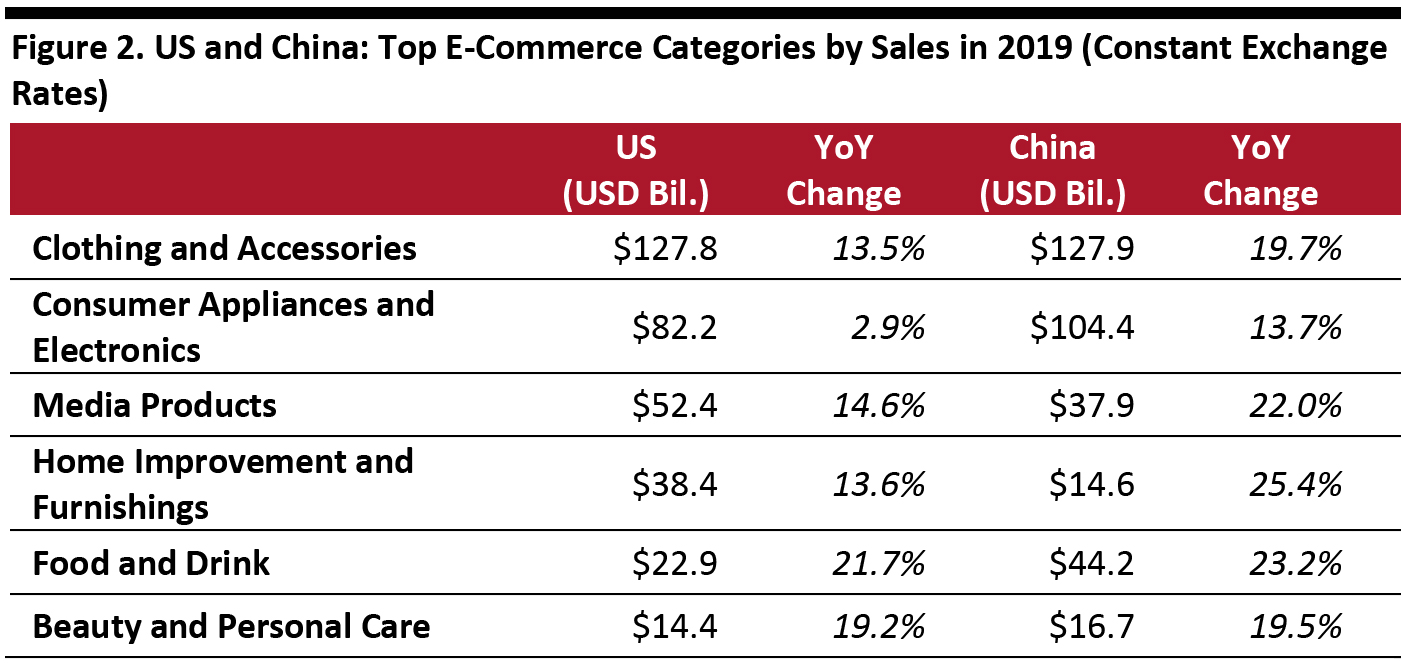

Source: US Census Bureau/Analysys/Coresight Research [/caption] By category, e-commerce sales of clothing and accessories took the lead in 2019 for both China and the US, followed by consumer appliances and electronics. However, this latter category experienced the slowest growth in 2019, of only 2.9% in the US—and this is partly a reflection that it is a relatively mature category online. Food and drink comprised the fastest-growing category online in the US—reflecting that e-commerce remains a nascent channel for groceries (with online capturing less than 3% of food sales in 2019, we estimate) and the rapid expansion of collection and delivery services by major food retailers.China saw the highest growth in home improvement and furnishings (see Figure 2). [caption id="attachment_108515" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

In 2020, we expect that e-commerce sales from food and drink will have the highest growth in both China and the US, as people switch to the online channel to shop for grocery products during the coronavirus crisis. In the US, we estimate that online grocery sales will grow by approximately 36% in 2020 overall, driven by an approximate doubling of sales during the lockdown period for retail (which we believe may last three months, to mid-June).

We also have spotted early signs of consumption recovery in China, with pent-up demand being released in the beauty and personal care category, which already had high online penetration prior to the coronavirus pandemic. In the US, consumers have been purchasing nesting items for the prolonged stay-at-home period, although spending on big-ticket home or electronics items is most likely to diminish over the remainder of the year. We expect other discretionary categories (such as apparel) to see negative sales growth, but overall e-commerce penetration may go up in 2020.

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

In 2020, we expect that e-commerce sales from food and drink will have the highest growth in both China and the US, as people switch to the online channel to shop for grocery products during the coronavirus crisis. In the US, we estimate that online grocery sales will grow by approximately 36% in 2020 overall, driven by an approximate doubling of sales during the lockdown period for retail (which we believe may last three months, to mid-June).

We also have spotted early signs of consumption recovery in China, with pent-up demand being released in the beauty and personal care category, which already had high online penetration prior to the coronavirus pandemic. In the US, consumers have been purchasing nesting items for the prolonged stay-at-home period, although spending on big-ticket home or electronics items is most likely to diminish over the remainder of the year. We expect other discretionary categories (such as apparel) to see negative sales growth, but overall e-commerce penetration may go up in 2020.

Competitive Landscape

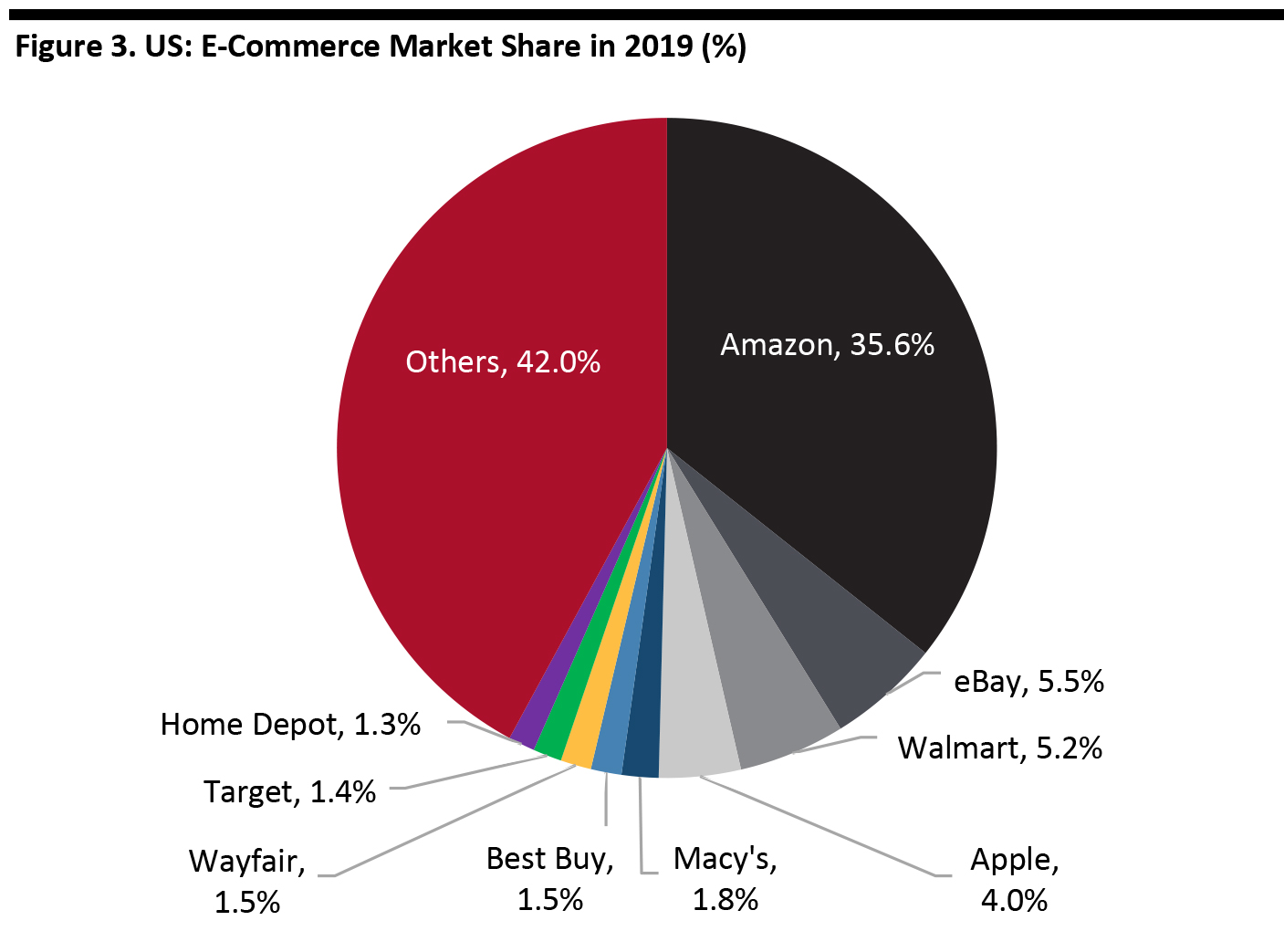

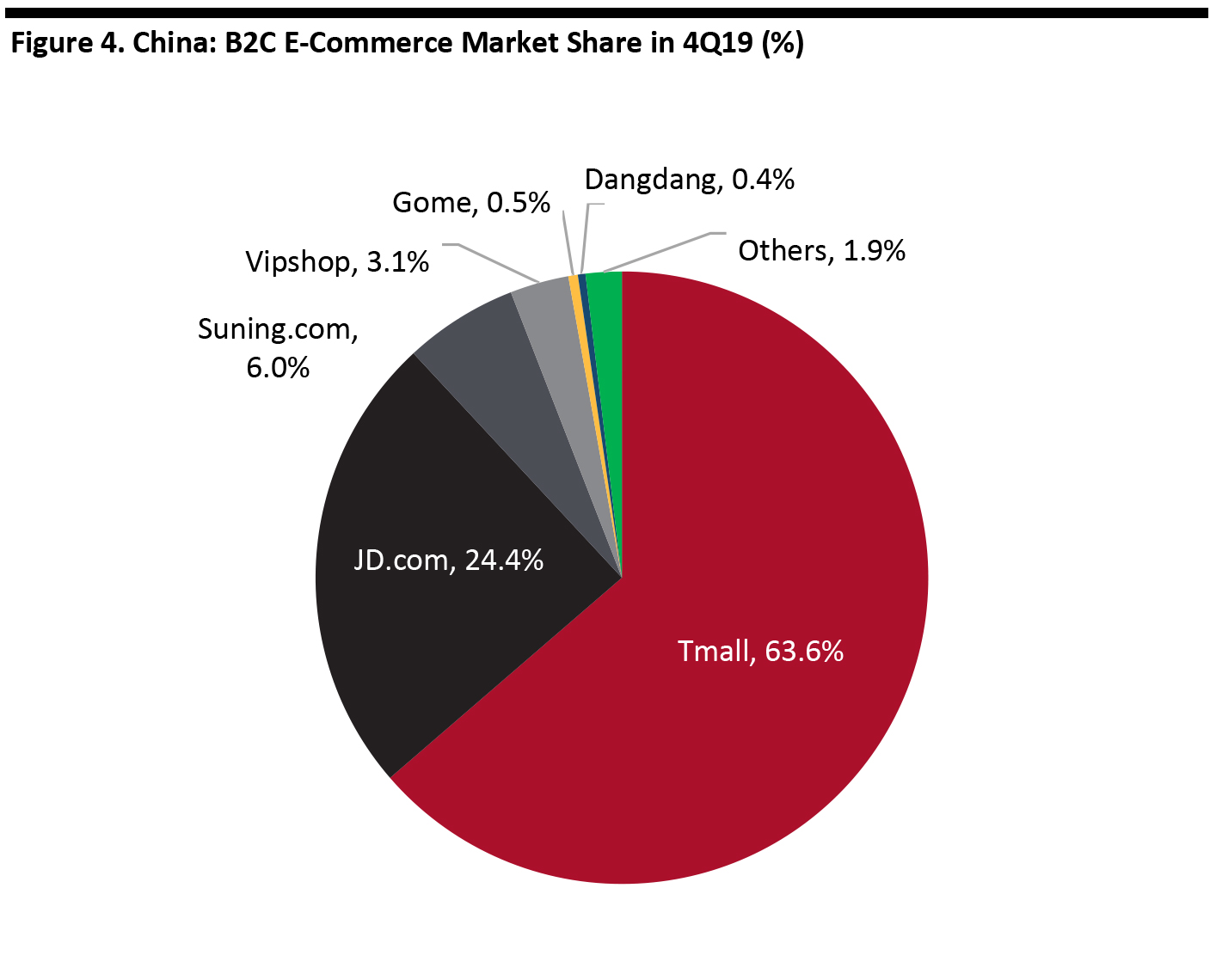

The e-commerce market continues to consolidate in the US and China, as larger players are gaining shares from smaller ones. In the US, Amazon leads the market, increasing its share to an estimated 35.6% in 2019 from 33.9% in 2018. In China, Alibaba’s Tmall accounted for more than 60% of the market in the fourth quarter of 2019, growing to an estimated 63.6% from 61.5% in the same quarter of 2018. Tmall and JD.com comprised a combined 88% of market share. [caption id="attachment_108516" align="aligncenter" width="700"] Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

[caption id="attachment_108517" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

[caption id="attachment_108517" align="aligncenter" width="700"] Source: Analysys[/caption]

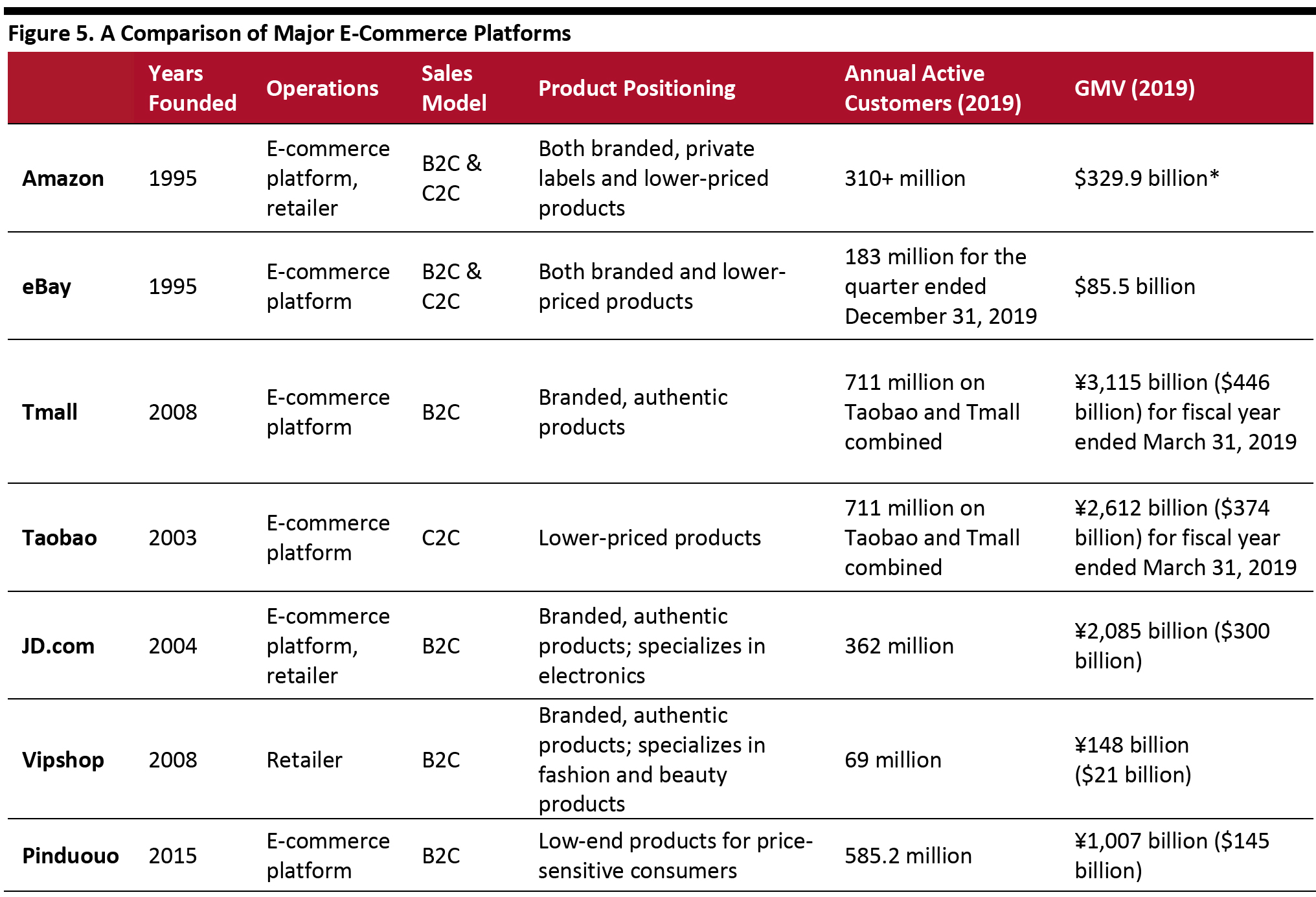

The following table compares the profile of major e-commerce platforms in the US and China.

[caption id="attachment_108518" align="aligncenter" width="700"]

Source: Analysys[/caption]

The following table compares the profile of major e-commerce platforms in the US and China.

[caption id="attachment_108518" align="aligncenter" width="700"] *Estimated figure excluding sales through physical stores

*Estimated figure excluding sales through physical stores Source: Company reports/Coresight Research [/caption]

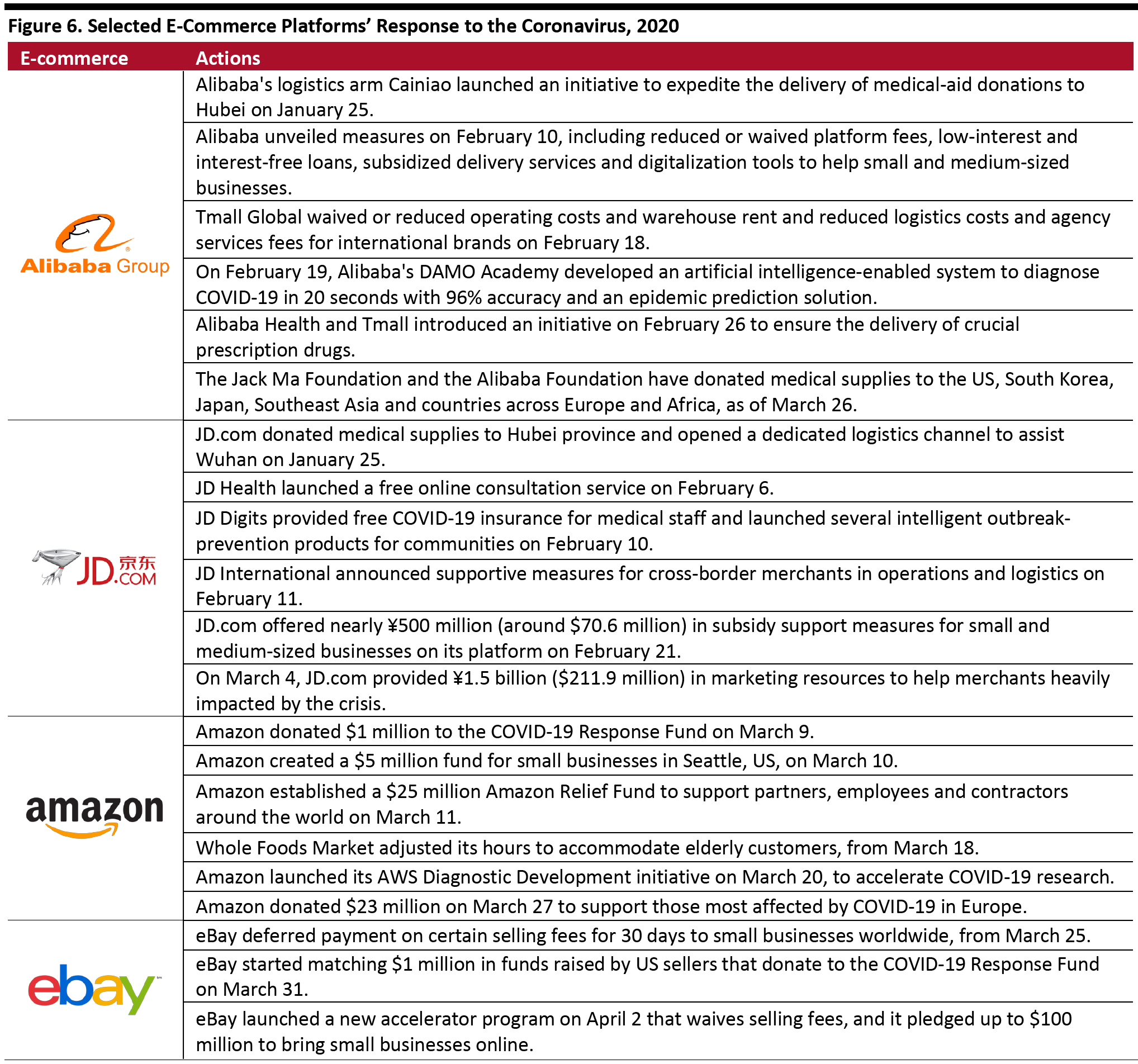

E-Commerce Platforms Play a More Critical Role during Coronavirus Pandemic

Back in 2003, the SARS epidemic led to the rise of Chinese e-commerce giants Alibaba and JD.com. Today, online retail platforms in China and the US have become more established and innovative, and e-commerce is therefore playing a more critical role during the outbreak. As such, the coronavirus pandemic could trigger expanded digitalization worldwide. Impact of the Crisis on E-Commerce Platforms The coronavirus has had a mixed impact on e-commerce platforms, which have seen sales increase mainly in essentials and food but declining demand for discretionary products. Temporary supply-chain disruption also negatively affected online business. During its earnings call for the third quarter of fiscal year 2020, Alibaba noted that its Freshippo grocery business experienced a significant surge in average basket size as consumers migrated to online purchasing of fresh food for the first two weeks after the Chinese New Year (in mid-February). The company also adopted a co-employment initiative, which saw the temporary hiring of workers from the food-service industry to combat a labor shortage problem. Alibaba’s enterprise communication application Ding Talk also witnessed explosive growth in user numbers, as people worked remotely and educational classes were held online. However, the company’s core commerce business was negatively impacted by delayed logistics and supply-chain disruption in early February. With China having brought the outbreak under control, business operations have resumed. Alibaba’s logistics company, Cainiao, returned to pre-coronavirus levels of staffing and output in March. In addition, during International Women’s Day on March 8, more than 20,000 brands doubled their sales year over year on Tmall, according to Alibaba—in particular, beauty brands Estée Lauder, Lancôme and Shiseido saw a 200% sales spike. These soaring online sales demonstrate that consumers may be releasing pent-up demand following the coronavirus, indicating reviving consumption in the coming months. JD.com showed more resilience amid the outbreak thanks to its self-operated logistics network. The company saw an uptick in online demand for consumer staples and household products in February, and JD Logistics was able to resume full operations quickly after the Chinese New Year to ensure the timely delivery of orders. The e-commerce platform saw its total numbers of daily active customers and fulfilled orders grow at a faster pace than in 2019. JD.com expects its revenue to continue to increase by double digits in the next quarter. In the US, where the impact of the coronavirus began to be felt in earnest in March, consumers are now relying more on e-commerce than before the outbreak: Coresight Research’s US consumer surveyon April 8, 2020 revealed that around six in 10 respondents are now making more purchases online than pre-coronavirus. For Amazon, the largest e-commerce platform in the US, order volumes amid the coronavirus are matching those during the holiday season. According to data firm Comscore, traffic to Amazon.com for the week of March 9, 2020 surged 32% compared to the same period in 2019. Demand rose across a broad variety of products: Sales of over-the-counter cold and flu drugs increased nine-fold from February 20 to March 15, and dog food sales jumped thirteen-fold, according to data from software company CommerceIQ. To tackle the overwhelming demand, Amazon hired 100,000 warehouse and delivery workers in March and announced on April 13 that it intends to hire an additional 75,000 staff. As of March 17, the company suspended third-party fulfillment of all products except medical supplies, essentials and other high-demand products, in response to the coronavirus crisis in the US. How E-Commerce Platforms Are Responding to the Coronavirus Crisis In addition to fulfilling consumer demand during this challenging time, e-commerce platforms have implemented relief programs for their merchants and other supportive measures for the community in response to the coronavirus crisis (see Figure 6). [caption id="attachment_108519" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Themes We Are Watching in the E-Commerce Market

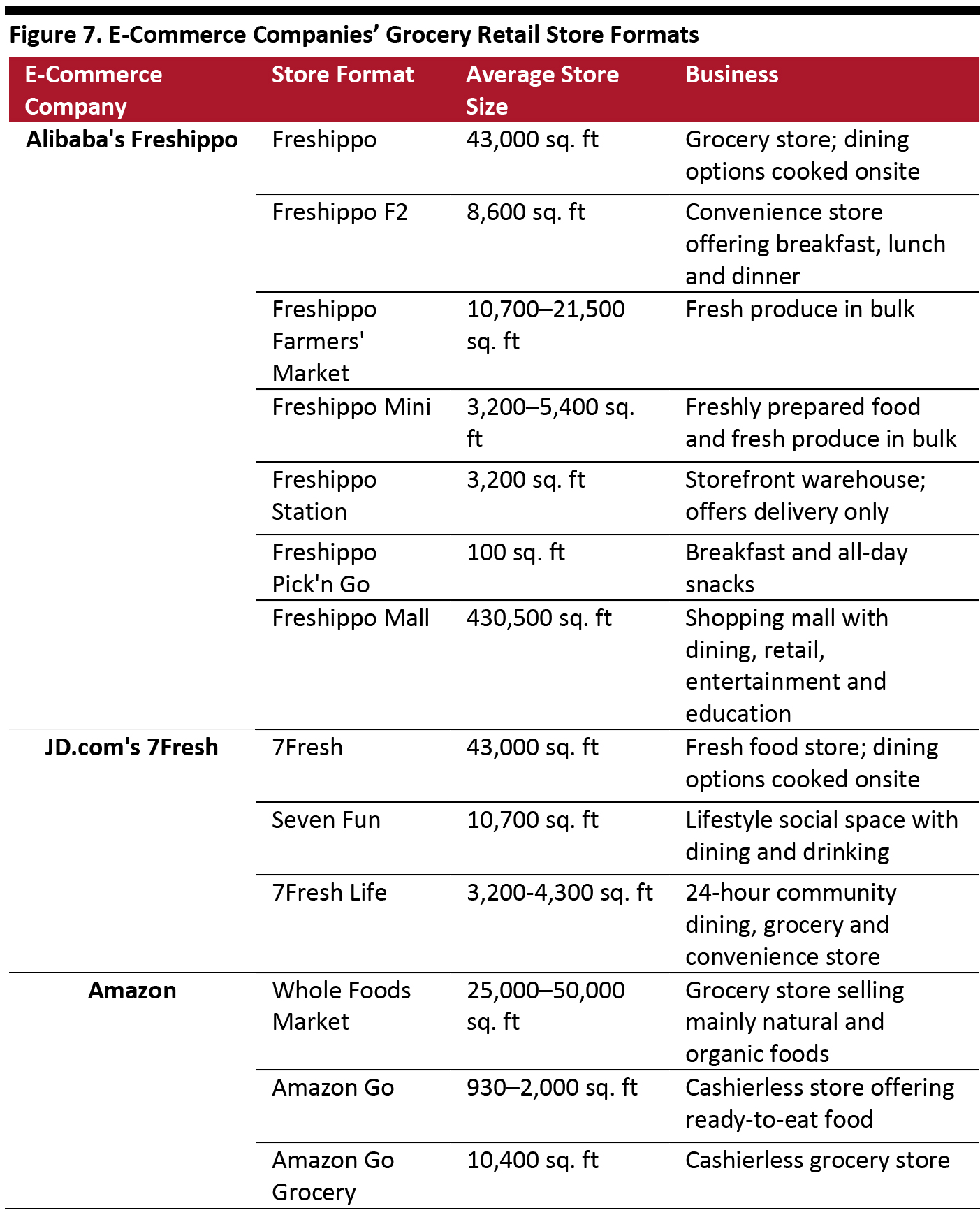

New Physical Store Formats E-commerce platforms first stepped into physical grocery retail in 2016, when Alibaba launched the Freshippo supermarket chain as part of its New Retail concept. Amazon acquired Whole Foods Market the following year, and then JD.com introduced its 7Fresh grocery shop in 2019. Today, these e-commerce giants are expanding their offline footprints through a multiformat approach to fulfill various consumer needs, with the goal of acquiring new customers and migrating them to the online business. Figure 7 shows the different format stores that these three market players have opened to date, including Amazon Go Grocery, Freshippo Mall and Seven Fun. [caption id="attachment_108520" align="aligncenter" width="700"] Source: Company reports[/caption]

Social Commerce

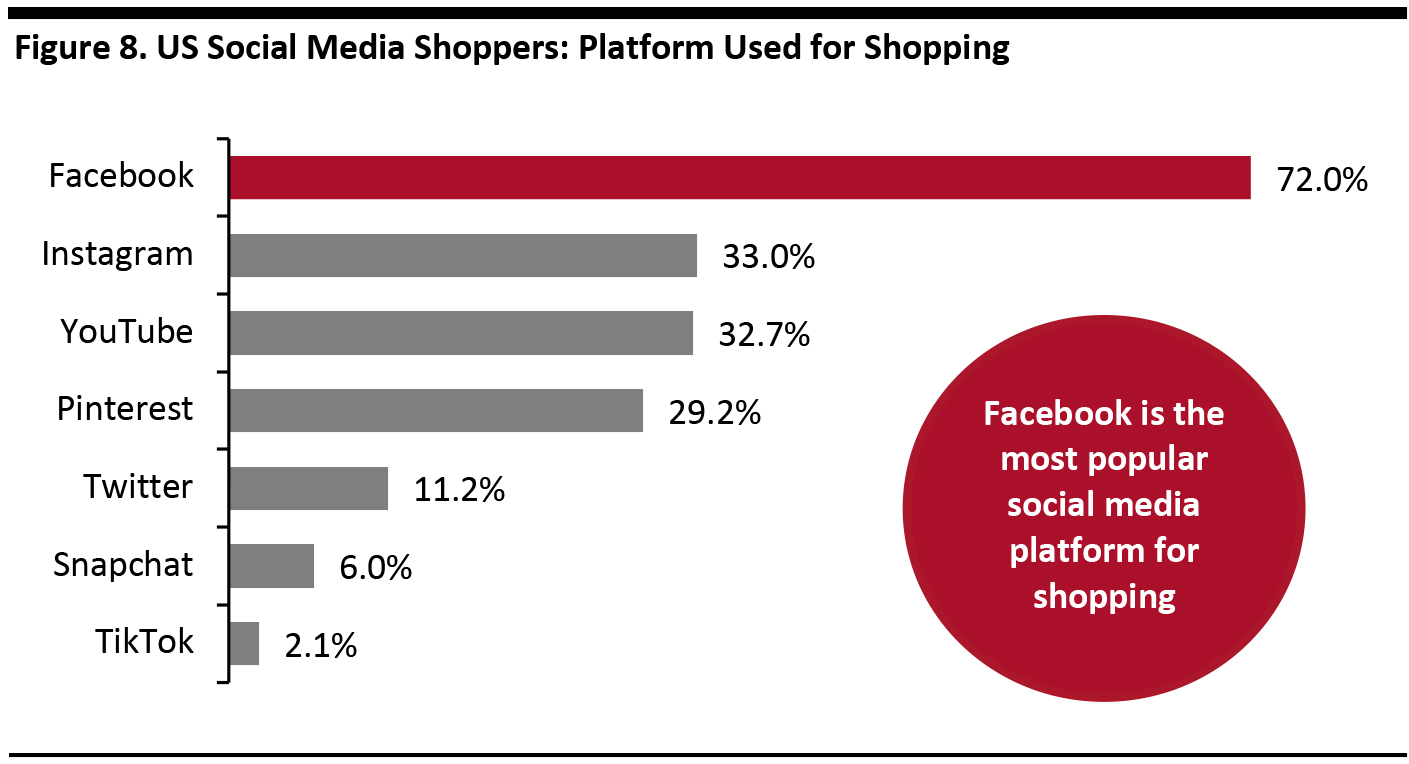

The growing number of Internet users and the sheer amount of time users spend on social media have prompted these platforms to integrate e-commerce functionality, enabling consumers to discover and purchase products. This channel is particularly popular among Gen-Z consumers, based on our Coresight Research's proprietary survey on US social commerce, which found that 57% of respondents used social media as part of the shopping process.

We also observed that Facebook is the most widely used platform for shopping, but Instagram is the most popular among respondents aged 18–24. With 2.5 billion monthly active users combined, both platforms have been working to eliminate friction in the shopping process and provide a seamless discover-to-purchase solution. Instagram launched its “Checkout on Instagram” function in March 2020, which allows users to buy products without leaving the social media app. The platform also added livestreaming functionality for influencers to engage with users.

[caption id="attachment_108521" align="aligncenter" width="700"]

Source: Company reports[/caption]

Social Commerce

The growing number of Internet users and the sheer amount of time users spend on social media have prompted these platforms to integrate e-commerce functionality, enabling consumers to discover and purchase products. This channel is particularly popular among Gen-Z consumers, based on our Coresight Research's proprietary survey on US social commerce, which found that 57% of respondents used social media as part of the shopping process.

We also observed that Facebook is the most widely used platform for shopping, but Instagram is the most popular among respondents aged 18–24. With 2.5 billion monthly active users combined, both platforms have been working to eliminate friction in the shopping process and provide a seamless discover-to-purchase solution. Instagram launched its “Checkout on Instagram” function in March 2020, which allows users to buy products without leaving the social media app. The platform also added livestreaming functionality for influencers to engage with users.

[caption id="attachment_108521" align="aligncenter" width="700"] Using social media for shopping is defined as “discovering products, researching purchases or buying products on social media”

Using social media for shopping is defined as “discovering products, researching purchases or buying products on social media” Base: 854 US internet respondents aged 18+ who use social media as part of the shopping process, surveyed in November 2019

Source: Coresight Research [/caption] The social commerce market is even more mature in China than in the US, and it has become the driving force of the nation’s e-commerce sector. Digital media China Internet Watch expects the social commerce market to grow 57% in 2020 and account for more than 20% of the overall e-commerce market in China. Social commerce penetration is also high, with 80% of Chinese consumers’ shopping occurring through this channel. The Chinese social media landscape is dynamic, with platforms such as Douyin (TikTok), Kuaishou and Xiaohongshu (RED) emerging in recent years. These platforms have incorporated access to e-commerce sites such as JD.com and Tmall, as well as adding livestreaming functionality to facilitate customer engagement. Furthermore, e-commerce platform Pinduoduo has pioneered the group-buying model, which relies heavily on users’ social networks. To keep up with the trend, traditional e-commerce platforms—including Taobao—have embraced social elements by launching peer-to-peer dropshipping functions. Innovative Delivery Services Following the launch of same-day or one-day shipping services, which have now widely become standard, e-commerce platforms have been innovating to provide more convenient and easy delivery options. To minimize the risk of package theft, Amazon Key Service—which relies on Amazon’s Cloud Cam technology with compatible smart lock—allows its Prime users to give access to their garages, gates, doors and car trunks for deliveries, in order to receive packages securely. Similarly, mass merchant Walmart introduced its InHome delivery service in June 2019, through which staff deliver groceries right to a consumer’s refrigerator. Amazon is likely to implement the same practice in the near term as its Key Service customers already possess the technology needed. Amid the coronavirus pandemic, Chinese e-commerce platforms deployed contactless delivery services in an effort to reduce the spread of infection. For example, Alibaba’s food-delivery platform Ele.me rolled out such an option on its app, with consumers determining the delivery drop-off location. Furthermore, the pandemic accelerated the e-commerce market’s adoption of drone and robot delivery. JD.com used autonomous vehicles to deliver groceries to communities in Wuhan during the lockdown. Drones were also utilized instead of human labor to spray disinfectant in public spaces. [caption id="attachment_108522" align="aligncenter" width="700"]

JD.com’s autonomous vehicle

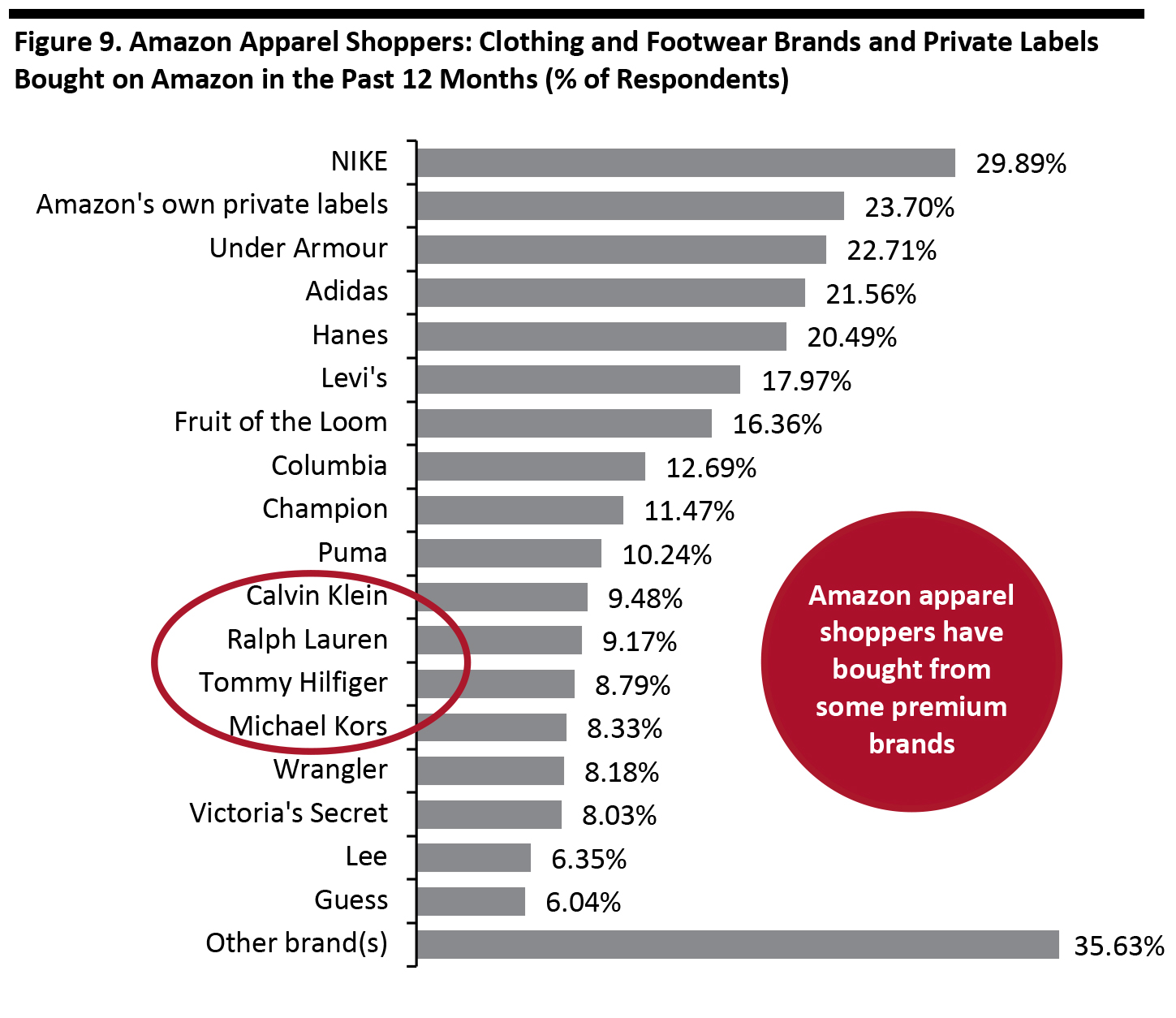

JD.com’s autonomous vehicle Source: JD corporate blog [/caption] Amazon’s Move into Luxury Amazon is reportedly planning to tap into the luxury market in 2020, Women’s Wear Dailyreported in January. The article stated that the e-commerce giant planned to launch a digital luxury platform via a concession model in the US in the first half of the year, although this timeline may be delayed due to the subsequent coronavirus outbreak. The article also noted that Amazon has signed 12 brands to the new platform and designated $100 million to marketing and warehouse operations in Arizona, US. Amazon has attempted to portray itself as a style destination for years, with its wide offerings of private labels on Amazon.com. However, our annual survey of US apparel shoppers, conducted in late February 2020, found that Amazon is typically perceived as a borderline off-pricer, with 43% of respondents stating that they always expect to pay less than full price on the platform. This perception is in stark contrast to the typical expectations of exclusivity, personalization and superior customer experience in the luxury sector. For instance, Alibaba’s Tmall Luxury Pavilion has been providing luxury brands with entire creative control on their storefronts, in addition to logistics, digital and marketing tools; the aim is to deliver the same kind of shopping experience that consumers would expect at a brick-and-mortar store. The platform currently hosts over 150 brands. While it is not clear which 12 brands would be first launched on Amazon’s luxury platform, we believe that mid-priced premium US brands such as Coach, Kate Spade, Michael Kors, Ralph Lauren and Tommy Hilfiger are more likely to be featured on Amazon than European heritage brands. Some of these brands were also the ones that Amazon apparel shoppers have bought in the past 12 months, according to our survey. The survey also shows that one-fifth of Amazon apparel shoppers would like to see more premium or luxury brands on the platform. Luxury brands have been reluctant to come onto Amazon due to its utilitarian website presentation and massive grey-market product portfolio. French luxury conglomerate LVMH reportedly refused to participate, as it already operates its own e-commerce site, 24S. Amazon’s approach is to employ a concession model. With the company’s data analytics and logistics capabilities and sizable Prime membership base, this could prove to be an appealing channel for luxury brands to generate more online traffic. [caption id="attachment_108523" align="aligncenter" width="700"]

Base: 1,308 US Internet users aged 18+ who had bought clothing or footwear on Amazon.com in the past 12 months, surveyed in February 2020

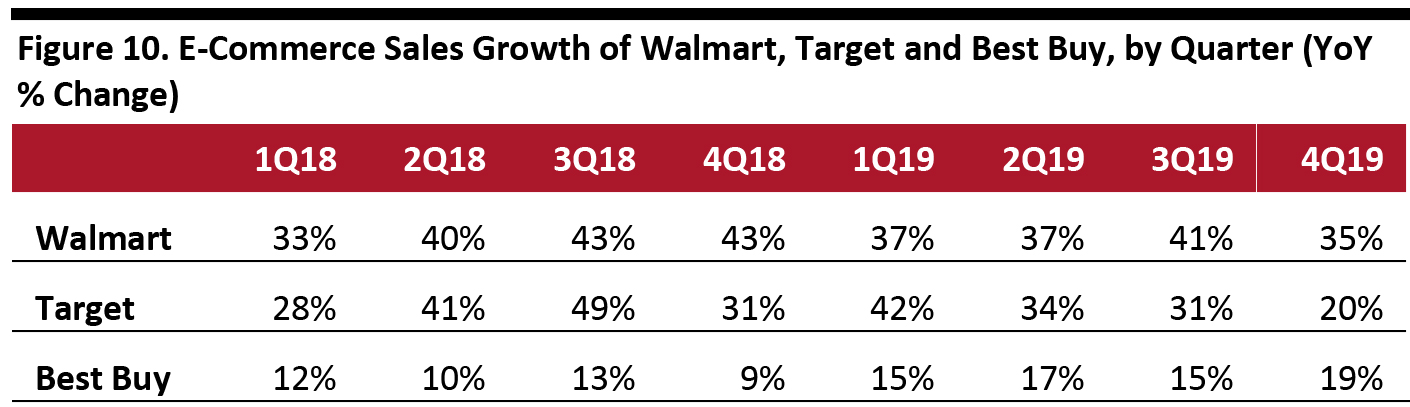

Base: 1,308 US Internet users aged 18+ who had bought clothing or footwear on Amazon.com in the past 12 months, surveyed in February 2020 Source: Coresight Research [/caption] Amazon Faces Stiffer Competition As Mass Merchants Go Online The emergence of Amazon has transformed how people shop with convenience these years and continue to dominate the US e-commerce market. The site is one of the top destinations consumers shop for electronics, clothing and accessories, and home products. Amazon’s total sales increased 20% in 2019. The encroachment of e-commerce fueled by Amazon has pushed big-box retailers such as Walmart, Target and Best Buy to plow money into online businesses. These retailers are turning stores into fulfillment centers and offering next-day or even same-day in-store pickup up and delivery option. As a result, they have been reporting strong online sales growth. Walmart’s quarterly online sales growth remained above 30% from 2018–2019, while Target enjoyed an explosive growth of 49% in 3Q18 and slowed down to 20% growth in 4Q19. Best Buy’s digital sales have surged 19% in 4Q19, the highest quarterly sales growth from 2018–2019. [caption id="attachment_108524" align="aligncenter" width="700"]

Source: Company reports[/caption]

During the outbreak, Walmart, Target and Best Buy are all offering contactless pickup and delivery services. Target commented on March 25, 2020 that it has been experiencing strong traffic and sales particularly in its stores and same-day pickup and delivery services beginning in mid-March. The strength was seen in categories including essentials, food and beverage, and hardlines to support in-home activities. Best Buy also mentioned on March 21, 2020 that demand for refrigerators to store food and work-related products spiked.

Private Labels and Customized Products

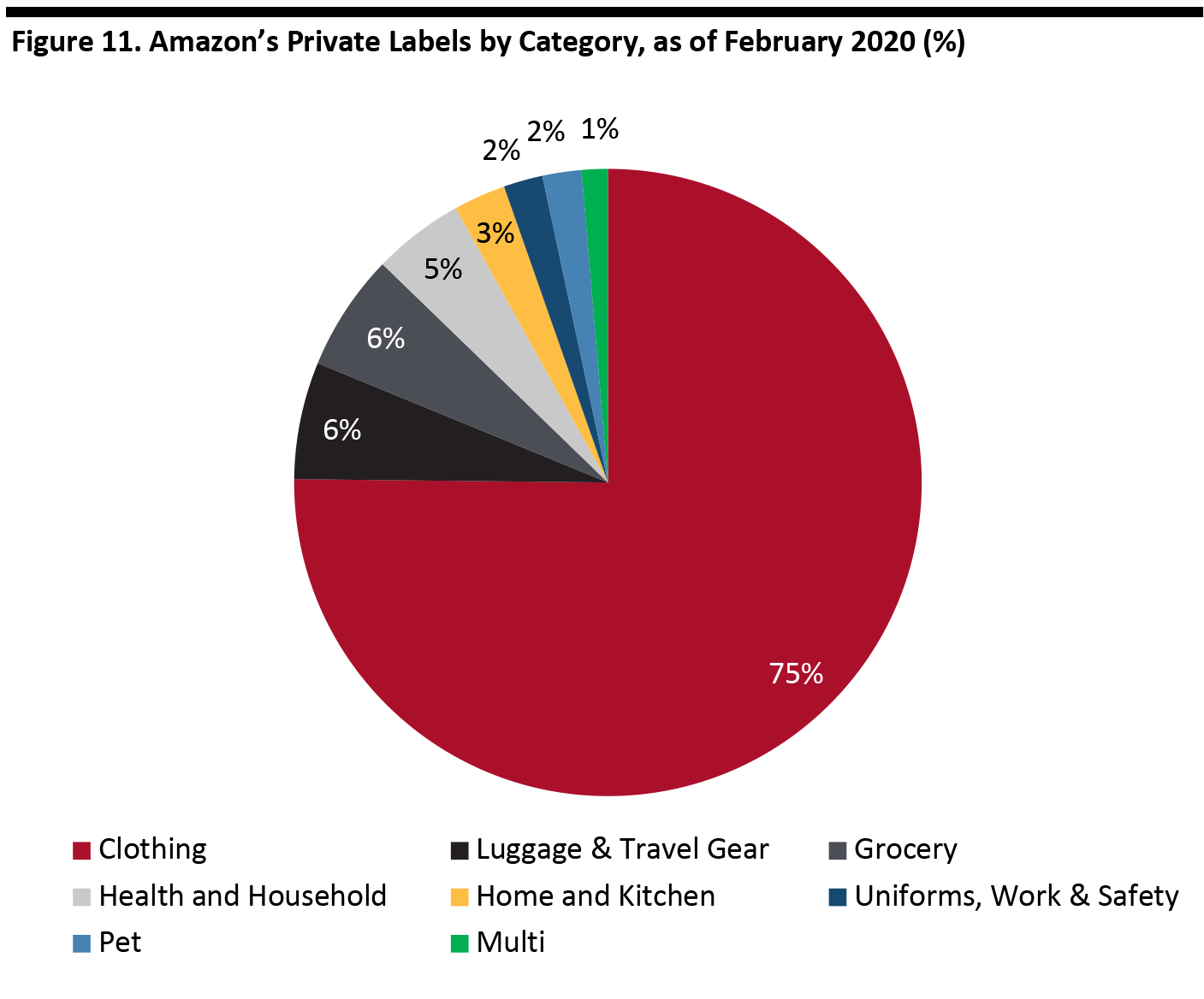

Amazon has been ramping up efforts to provide a wide range of private-label products, which helps the platform to reach more value-conscious consumers. Shoppers could turn to private labels instead of branded products following the coronavirus crisis, due to a weakened economic backdrop and concerns around reduced wealth.

Our research revealed that as of February 2020, Amazon had doubled the number of private-label brands on its platform in 20 months—from 74 to 149. Three-quarters of those fall under the apparel category and together comprise the second most-bought “brand” by Amazon apparel shoppers, according to our survey. By comparison, Walmart has 319 private-label brands across 20 categories, according to data company ScrapeHero,and Target has 42 private labels, according to the company’s website.

Amazon’s private labels comprise a small proportion of its overall business—just 1% of sales, according to a company statement on Twitter in April 2019.

[caption id="attachment_108525" align="aligncenter" width="700"]

Source: Company reports[/caption]

During the outbreak, Walmart, Target and Best Buy are all offering contactless pickup and delivery services. Target commented on March 25, 2020 that it has been experiencing strong traffic and sales particularly in its stores and same-day pickup and delivery services beginning in mid-March. The strength was seen in categories including essentials, food and beverage, and hardlines to support in-home activities. Best Buy also mentioned on March 21, 2020 that demand for refrigerators to store food and work-related products spiked.

Private Labels and Customized Products

Amazon has been ramping up efforts to provide a wide range of private-label products, which helps the platform to reach more value-conscious consumers. Shoppers could turn to private labels instead of branded products following the coronavirus crisis, due to a weakened economic backdrop and concerns around reduced wealth.

Our research revealed that as of February 2020, Amazon had doubled the number of private-label brands on its platform in 20 months—from 74 to 149. Three-quarters of those fall under the apparel category and together comprise the second most-bought “brand” by Amazon apparel shoppers, according to our survey. By comparison, Walmart has 319 private-label brands across 20 categories, according to data company ScrapeHero,and Target has 42 private labels, according to the company’s website.

Amazon’s private labels comprise a small proportion of its overall business—just 1% of sales, according to a company statement on Twitter in April 2019.

[caption id="attachment_108525" align="aligncenter" width="700"] Source: Coresight Research[/caption]

E-commerce platforms in China have been focusing on customized product offerings via the consumer-to-manufacturer (C2M) model, which leverages consumer data to produce tailored products at a low price point. Alibaba recently launched a new platform to aid traditional factories in managing raw materials and product inventories based on consumer data. Made-to-order products are gaining momentum in China, and Alibaba disclosed that C2M orders placed during Singles’ Day 2019 reached 170 million.

Voice Commerce

Smart speakers are emerging as a new shopping medium, catalyzed by advanced artificial intelligence technology. Global unit sales of smart speakers jumped 45% year over year to 55.7 million in the fourth quarter of 2019, according to Strategy Analytics. The top vendor of these products was Amazon, with a market share of 28%, followed by Google (25%), Baidu (11%) and Alibaba (10%).

While consumers are embracing smart speakers in their daily lives, they are not necessarily using them to shop. A survey released by Prosper Insights & Analytics showed that 31.5% of US respondents use a smart home assistant, but only 7.8% and 5.4% of those use it to purchase food and non-food items, respectively. The adoption rate is higher in China, with more than 40% of Tmall Genie users having tried its voice-shopping feature, according to Alibaba. However, these users may be curious first-timers, and it is uncertain if they will continue to use the device for this purpose on a regular basis.

Voice has been heralded as a new channel for digital shopping for a few years, but we remain skeptical that it can become a sizeable channel, in terms of share of sales, without adapting. One of the biggest challenges for voice commerce is the lack of visual interface during the shopping process. Also, the absence of features that enable consumers to browse and compare products mean that they might use voice to buy specific brands or just to make repeated purchases, preventing them from discovering new brands.

Source: Coresight Research[/caption]

E-commerce platforms in China have been focusing on customized product offerings via the consumer-to-manufacturer (C2M) model, which leverages consumer data to produce tailored products at a low price point. Alibaba recently launched a new platform to aid traditional factories in managing raw materials and product inventories based on consumer data. Made-to-order products are gaining momentum in China, and Alibaba disclosed that C2M orders placed during Singles’ Day 2019 reached 170 million.

Voice Commerce

Smart speakers are emerging as a new shopping medium, catalyzed by advanced artificial intelligence technology. Global unit sales of smart speakers jumped 45% year over year to 55.7 million in the fourth quarter of 2019, according to Strategy Analytics. The top vendor of these products was Amazon, with a market share of 28%, followed by Google (25%), Baidu (11%) and Alibaba (10%).

While consumers are embracing smart speakers in their daily lives, they are not necessarily using them to shop. A survey released by Prosper Insights & Analytics showed that 31.5% of US respondents use a smart home assistant, but only 7.8% and 5.4% of those use it to purchase food and non-food items, respectively. The adoption rate is higher in China, with more than 40% of Tmall Genie users having tried its voice-shopping feature, according to Alibaba. However, these users may be curious first-timers, and it is uncertain if they will continue to use the device for this purpose on a regular basis.

Voice has been heralded as a new channel for digital shopping for a few years, but we remain skeptical that it can become a sizeable channel, in terms of share of sales, without adapting. One of the biggest challenges for voice commerce is the lack of visual interface during the shopping process. Also, the absence of features that enable consumers to browse and compare products mean that they might use voice to buy specific brands or just to make repeated purchases, preventing them from discovering new brands.

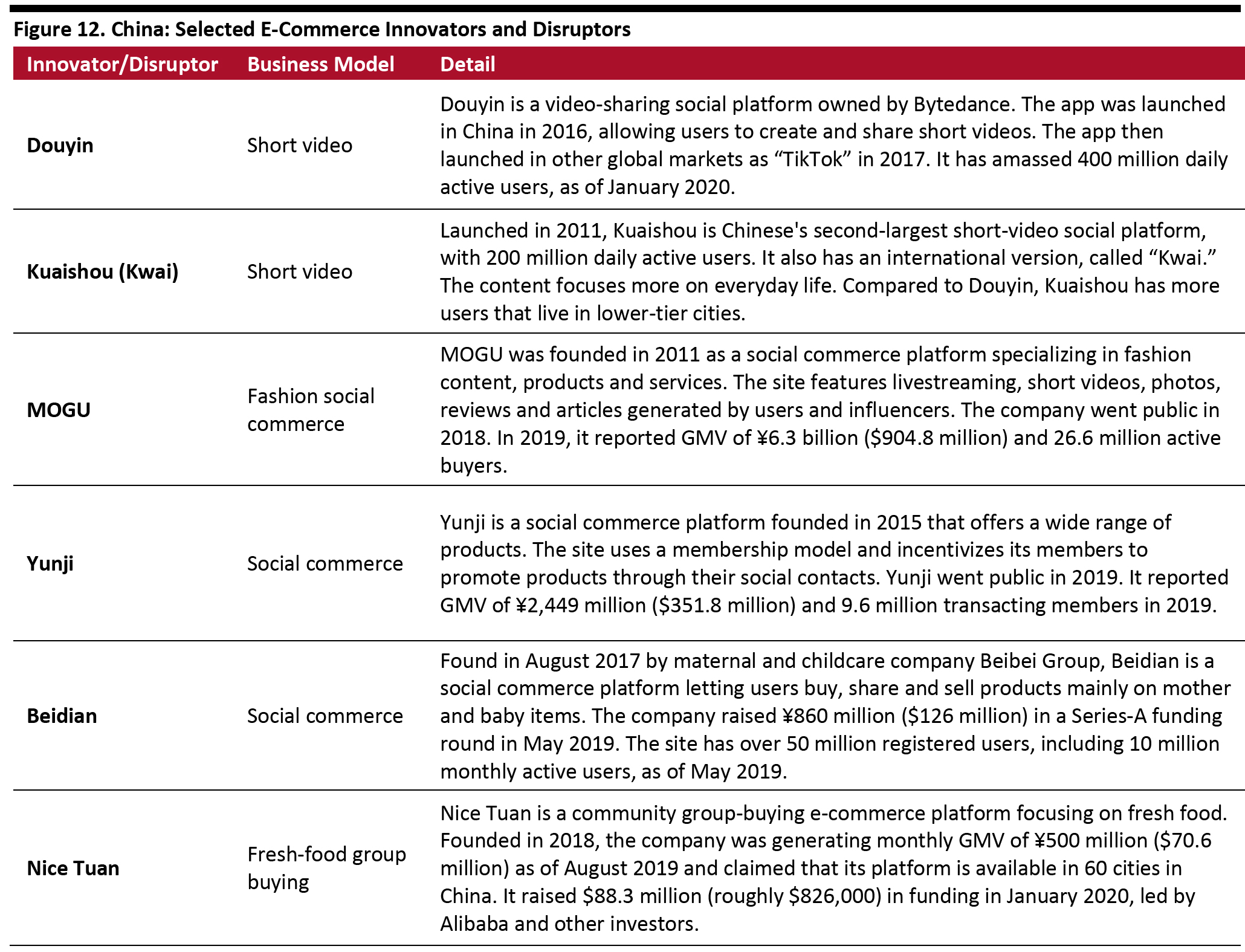

Innovators and Disruptors

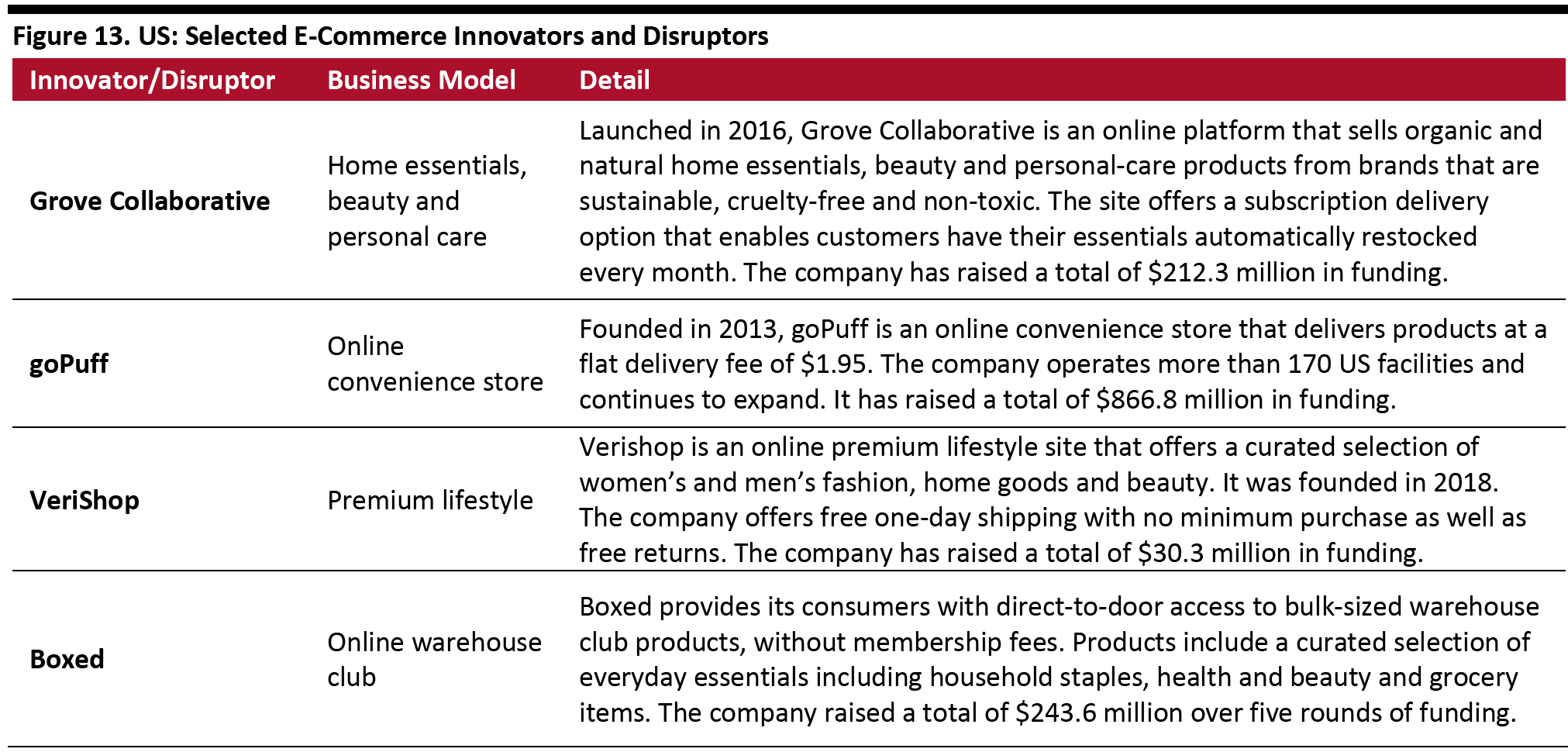

The e-commerce market has recently seen a number of innovative newcomers aiming to challenge the status quo in China and the US (see Figures 12 and 13, respectively). [caption id="attachment_108526" align="aligncenter" width="700"] Source: Company reports[/caption]

[caption id="attachment_108527" align="aligncenter" width="700"]

Source: Company reports[/caption]

[caption id="attachment_108527" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]