DIpil Das

Introduction

Evolving consumer preferences, shifting business models and improved digital capabilities are driving changes in the global apparel industry. We have been watching some of these driving forces, such as the rise of social media, sustainability and omnichannel business, for some time. While they are not new, what is new is that they have reached new stages of maturity: We see 2020 as a potential turning point for some of these medium-term or slow-burning forces. In 2020, we expect urban consumers to enjoy access to apparel retailers and brands offering a huge choice of product and add-ons such as customization and personalization. We’ll also see greater collaboration between retailers, as well as more private labels. This market overview covers:- Sector landscape.

- Top industry participants.

- Key themes in the sector.

- Sector outlook.

Apparel Market Overview

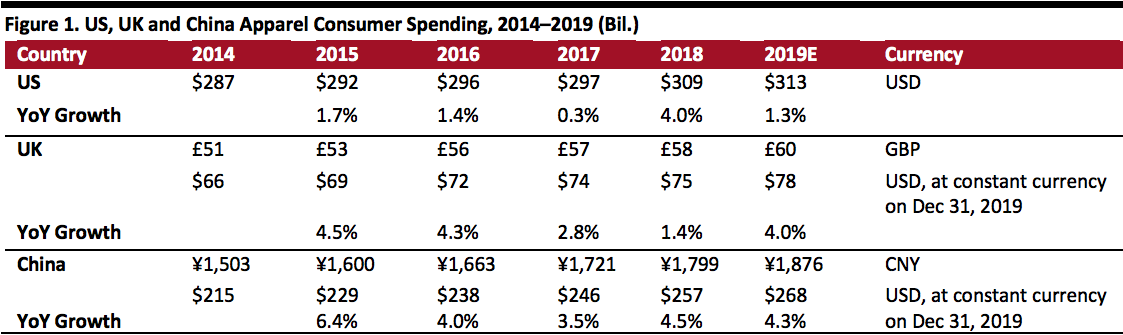

The US apparel market was worth $313 billion in 2019, up 1.3% year over year, according to the Bureau of Economic Analysis. At constant exchange rates, the five-year CAGR for the US apparel market was 1.7% for the 2014-2019 period. Apparel retail sales in China are estimated to have grown 4.3% in 2019, reaching approximately $270 billion, still below the value of the US apparel market but catching up. The UK apparel retail market has been stable in recent years, and is estimated to have been worth $78 billion in 2019. Based on the growth rates of China’s apparel retail market and the current economic turmoil caused by coronavirus, apparel retail sales in China are unlikely to surpass the US in this year. [caption id="attachment_104763" align="aligncenter" width="700"] Notes: China’s consumer spending data was derived from the multiple of average consumer spending on apparel and population

Notes: China’s consumer spending data was derived from the multiple of average consumer spending on apparel and populationSource: Bureau of Economic Analysis/National Bureau of Statistics of China/Office for National

Statistics/Coresight Research[/caption]

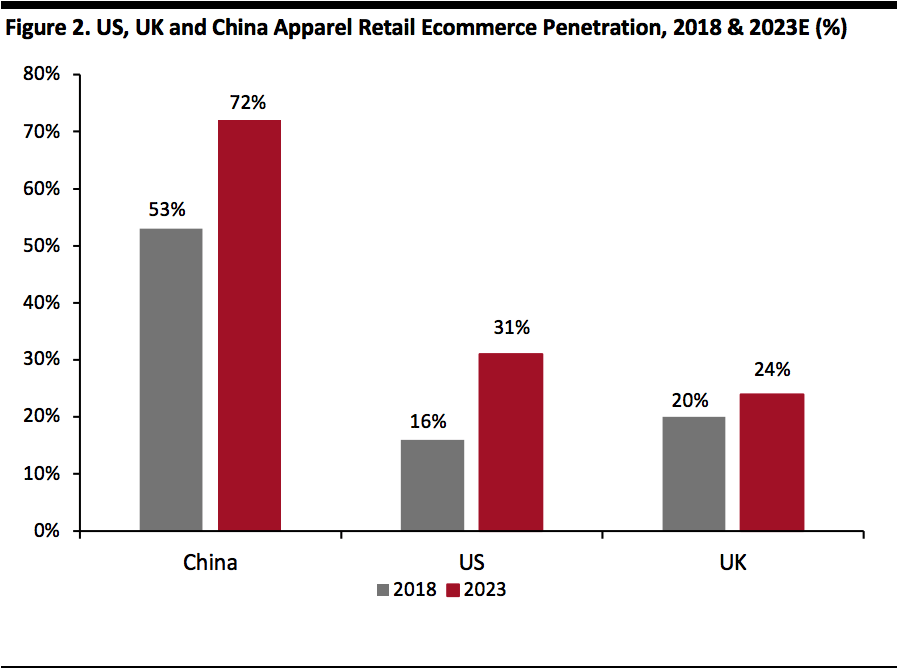

Some 31% of the US Apparel Market Expected to be Online by 2023

The US apparel retail market had an e-commerce penetration rate of 16% in 2018, the UK 20%. But that is expected to grow rapidly to 31% in the US and 24% in the UK by 2023, according to Statista. Online accounted for 53% of China’s total apparel retail sales in 2018, and that is expected that to grow to 72% in 2023, according to Statista. China leapfrogged the West in e-commerce, the adoption of smartphones and mobile payments. Online giants such as Alibaba and JD.com lead the charge in developing China’s online apparel market, especially after 2010. Now, Chinese consumers rely on influencers for product tips and information, and find online apparel shopping more convenient and interesting than shopping offline. [caption id="attachment_104764" align="aligncenter" width="700"] Source: Statista[/caption]

Source: Statista[/caption]

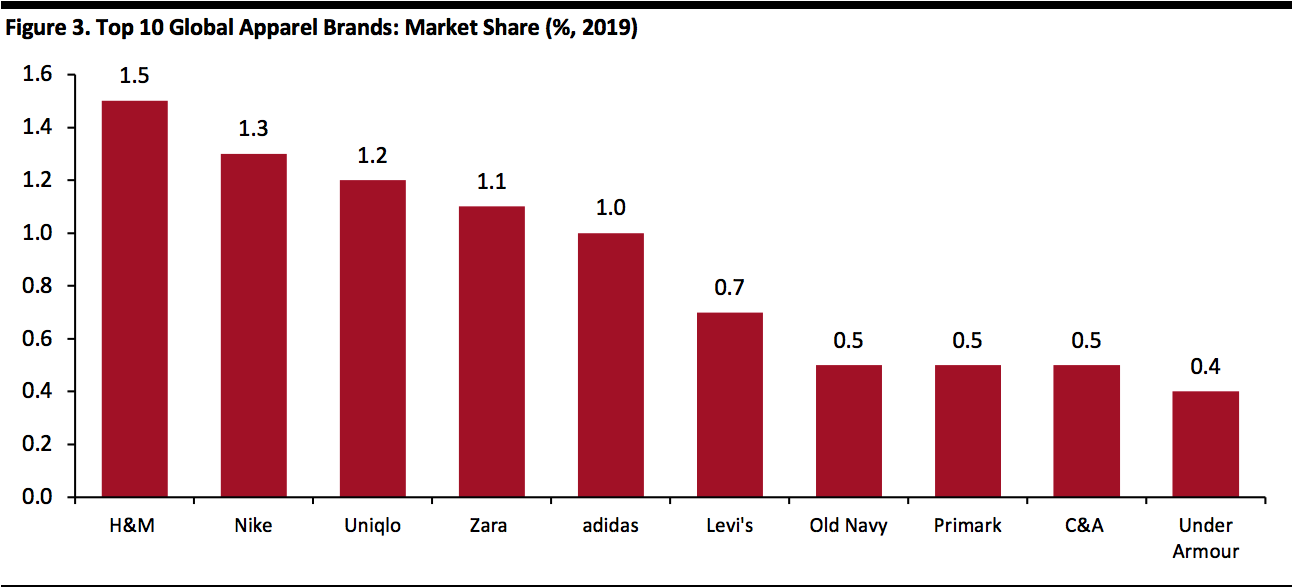

Competitive Landscape

The global apparel industry is fragmented, with the top 10 apparel brands accounting for 8.7% of global apparel sales in 2019. Even the number one global fashion and design brand, H&M, with 51 online markets and stores in 74 markets, holds just 1.5% of the global apparel market. Nike has just 1.3%, followed by Uniqlo (with 1.2%), Zara (1.1%) and Adidas (1.0%). [caption id="attachment_104765" align="aligncenter" width="700"] Notes: Data excludes multi-brand retailers as Euromonitor counts the sales of individual brands (private labels) only

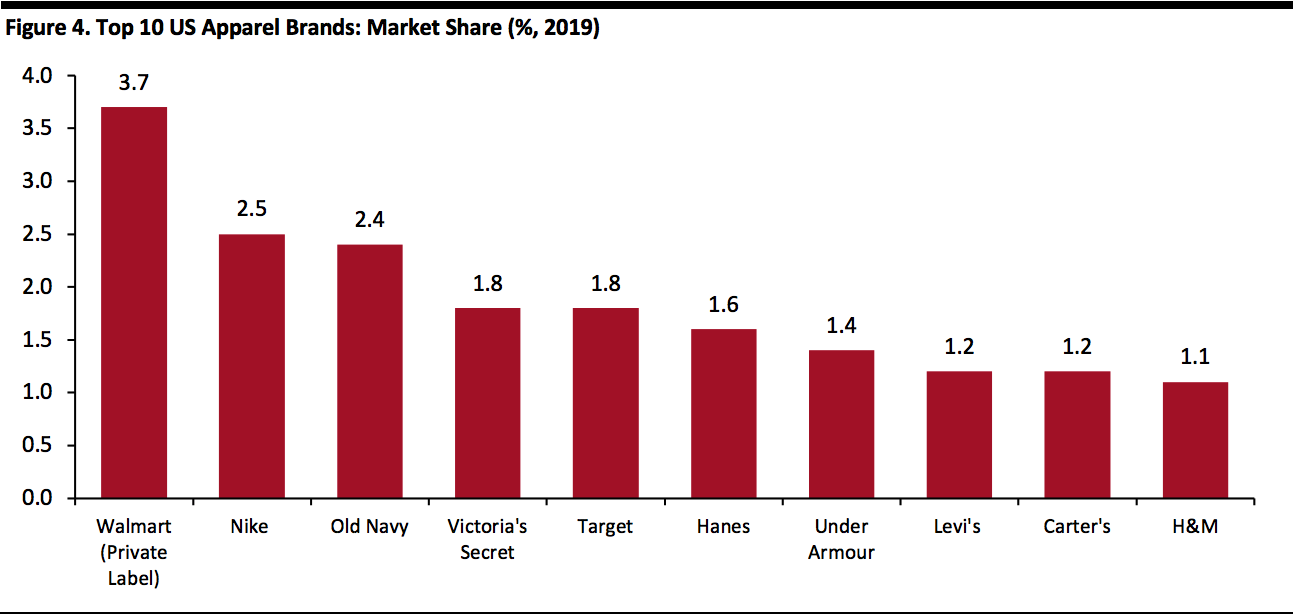

Notes: Data excludes multi-brand retailers as Euromonitor counts the sales of individual brands (private labels) onlySource: Euromonitor International Limited 2020 © All rights reserved[/caption] The US apparel industry is also fragmented, with the top 10 apparel brands accounting for just 18.7% of US apparel sales in 2019. Walmart (private label only) holds 3.7% of the US apparel market, reflecting its leading position in the industry, followed by Nike (with 2.5%) and Old Navy (2.4%). Walmart has continually strengthened its position in apparel and footwear through new offerings, acquisitions and strategic campaigns. [caption id="attachment_104766" align="aligncenter" width="700"]

Notes: Data excludes multi-brand retailers as Euromonitor counts the sales of individual brands (private labels) only

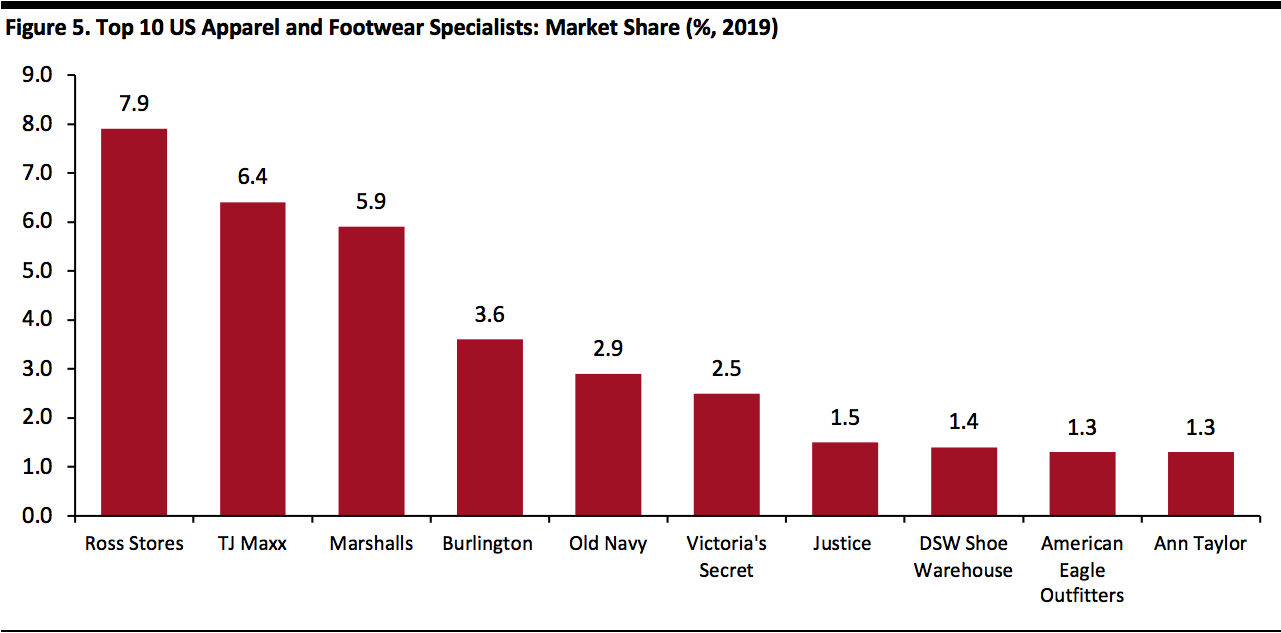

Notes: Data excludes multi-brand retailers as Euromonitor counts the sales of individual brands (private labels) onlySource: Euromonitor International Limited 2020 © All rights reserved[/caption] The US apparel and footwear specialist industry, on the other hand, is relatively concentrated, with the top 10 brands accounting for 34.7% of total apparel and footwear specialist sales in 2019. According to Euromonitor International. the top three specialty retailers in 2019 were Ross Stores, TJ Maxx and Marshalls. Combined, these three specialty retailers held 20.2% of the market, all of them off-price specialty brands. We believe leading US off-price retailers enjoy such healthy market shares because consumers are looking for greater value and more unique products. [caption id="attachment_104767" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

The US: Where They Shop

Coresight Research’s February 2020 consumer survey found Amazon widened its lead as the most-shopped retailer in the US for clothing or footwear, as measured by the number of consumers who had bought on the platform in the past 12 months.

Amazon, Walmart and Target lead this ranking, with major department stores, off-pricers and specialty retailers comprising a second tier.

[caption id="attachment_104768" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

The US: Where They Shop

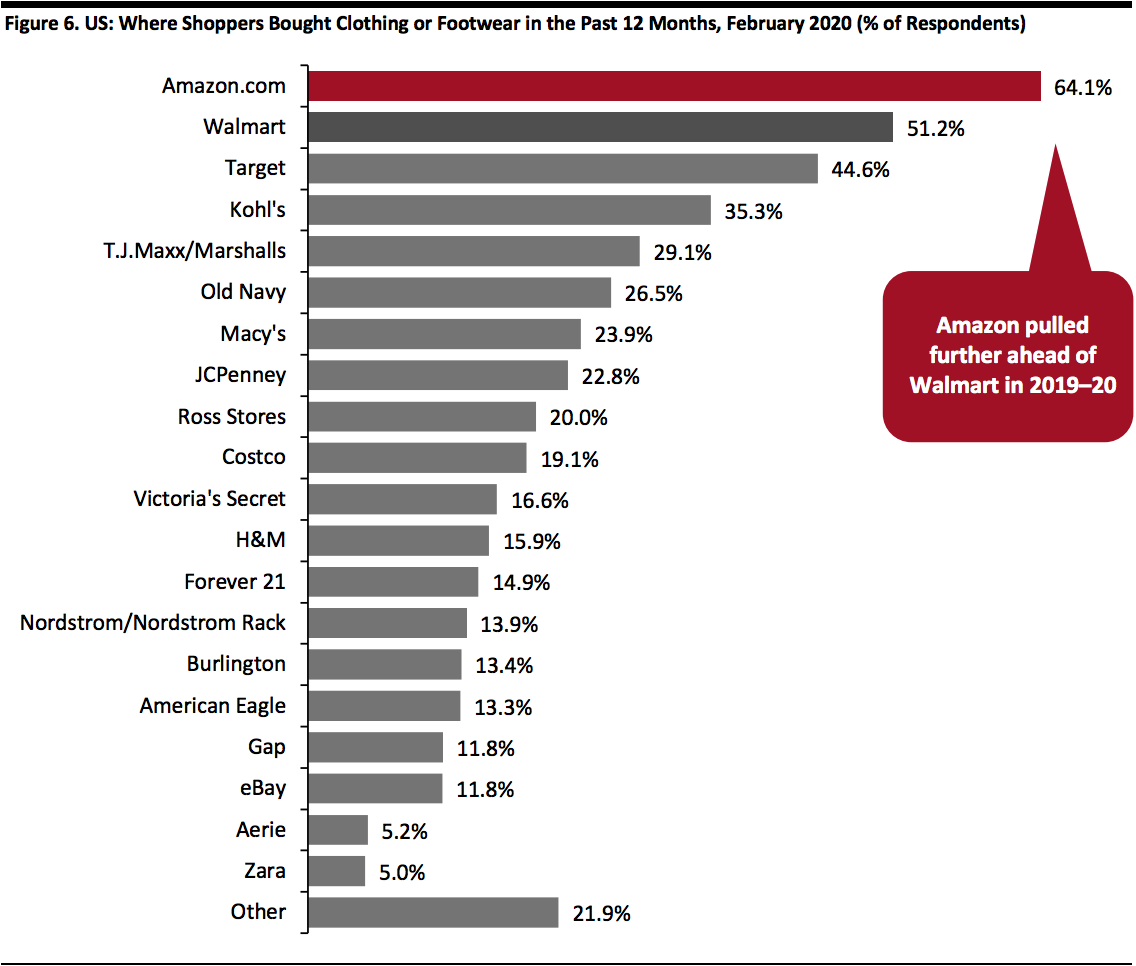

Coresight Research’s February 2020 consumer survey found Amazon widened its lead as the most-shopped retailer in the US for clothing or footwear, as measured by the number of consumers who had bought on the platform in the past 12 months.

Amazon, Walmart and Target lead this ranking, with major department stores, off-pricers and specialty retailers comprising a second tier.

[caption id="attachment_104768" align="aligncenter" width="700"] Base: 1,855 US Internet users aged 18 and above who bought clothing or footwear in the prior 12 months

Base: 1,855 US Internet users aged 18 and above who bought clothing or footwear in the prior 12 monthsSource: Coresight Research[/caption]

Values That Matter—and That Impact the Apparel Sector

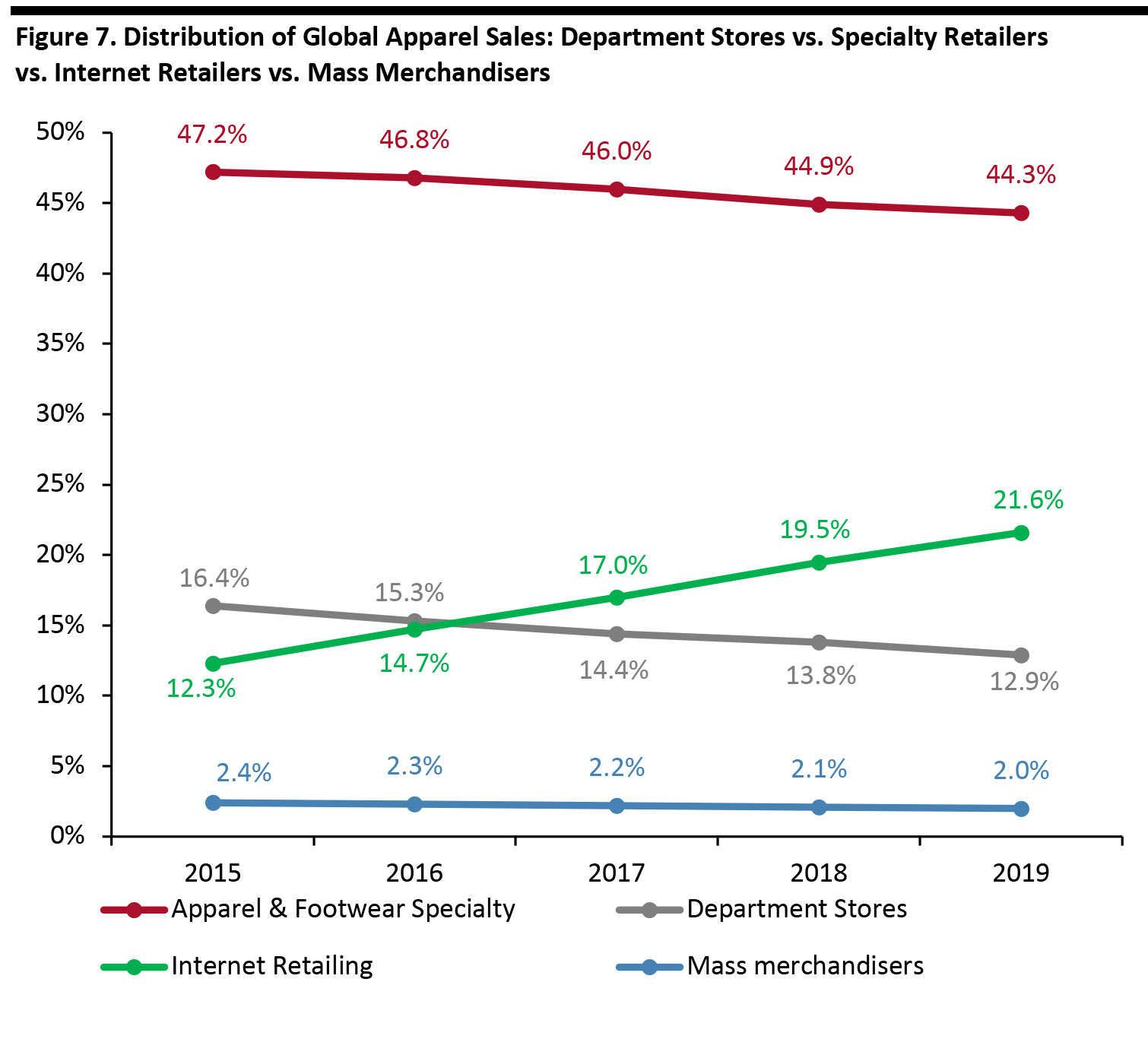

Inclusivity Inclusivity now means greater accessibility, gender equality, size inclusion and design diversity. Inclusivity is no longer about just marketing: we’ll see it manifest in 2020 product offerings. With 41.1% of US women considered obese, there is significant potential for brands and retailers to enter into or expand their inclusive apparel offering. Coresight Research estimates the US market for women’s inclusive clothing was worth approximately $30.7 billion in 2019. That said, women who wear extended sizes tend to spend less per capita on apparel and live in lower income households than the overall female population. Apparel brands and retailers have expanded extended size offerings to better serve this growing market segment and take advantage of the opportunity it presents. Sportswear, intimates and bridal dresses are popular segments for plus-size business expansion. Please see the Coresight Research report New Consumer Attitudes Drive US Plus-Size Apparel Demand for more information. Pricing and Perceived Value Consumers respond to lower prices in apparel now more than ever before. A February 2020 Coresight Research US consumer survey found 53.5% of shoppers try to save money with coupons or special offers when shopping for clothing or footwear. And, based on our oberservation, apparel companies cut prices around holidays to boost perceived value. However, 78% of companies say their pricing decisions could be improved, and acknowledge they are leaving money on the table in many areas of pricing, according to Bain & Company. Pricing still remains a challenge. Sustainability Sustainability is no longer a simple buzzword. It has become a new norm, especially for retailers moving through the supply chain and for consumers trying to decide what to buy and understand what the various sustainability claims mean. Although the apparel industry does not have one standard definition of sustainability, one thing is clear: Consumers want more environmentally friendly choices. Our 2020 survey found 22.7% of US consumers say they try to buy from brands and retailers they think have a good record on environmental issues. This growing consumer consciousness requires brands and retailers to change Companies are looking for less-damaging products and communicating their commitment to sustainability to consumers, investors and employees. Everlane launched a sustainable down coat, while Wrangler launched a menswear denim line using sustainably grown cotton. Amazon agreed to purchase 100,000 electric delivery vans and committed $10 billion to address climate change. The company expects 80% of its energy use to be supplied by renewable sources by 2024, and Inditex has pledged that the cotton, linen, and polyester it uses will be more sustainable, organic or recycled by 2025. Omnichannel E-commerce has been the main disruptor for the apparel industry during the past decade, altering the retail landscape as brick and mortar retailers close stores to rationalize fleets to be more in line with falling store traffic. Global apparel e-commerce saw its market share more than double from 12.3% to 21.6% between 2015 and 2019, according to Euromonitor. Specialty apparel retailers and department stores have ceded market share to online retailers and mass merchandisers. Department store market share fell from 16.4% in 2015 to 12.9% in 2019, and specialty apparel and footwear retailers slipped from 47.2% in 2015 to 44.3% in 2019. The growing popularity of online retail platforms such as Net-A-Porter, Farfetch, Yoox, MatchesFashion, Rent the Runway and Moda Operandi is shaping the future of the apparel industry. [caption id="attachment_104775" align="aligncenter" width="700"] Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

Themes We’re Watching

More Digitally Connected Consumers Consumers have become highly digitally connected and more active in product discovery. Social media use will continue to grow. There were 3.80 billion social media users worldwide as of January 2020, up 9% compared to the same period last year. More than 5.19 billion people now use mobile phones globally, up 2.4% over the past year, according to data from Digital 2020. The use of mobile phones and social media have democratized the retail market, especially the apparel sector as it is one of the biggest. Apparel retailers and brands that once would have been out of reach for most consumers are now readily available to anyone with an Internet connection through digital channels. And, consumers follow the social media accounts of brands they like or brands from which they are considering a purchase. In fact, 61.3% of US consumers use social media platforms as part of the shopping process, based on a Coresight Research consumer survey conducted in November 2019. New Retail Models Technology has supported the rapid development and adoption of new retail service models that are capturing consumer desire for luxury, value, easy access, differentiation and low commitment. Rental, resale/consignment and subscription models make apparel a leasable product with a just-in-time element. Shoppers need not commit to a purchase: they can rent, rent to buy and resell products. And, renting or even the ability to resell changes the value/price equation based on number of wearings relative to cost. Rent the Runway, The RealReal, and Stitch Fix have disrupted traditional models and changed the service offerings at many mall-based specialty apparel retailers and department stores. Macy’s and Nordstrom have in-store thrift offerings via ThredUP; clothing rental firm Le Tote recently acquired Lord & Taylor; Bloomingdale’s launched its own rental service called My List; specialty apparel brands as varied as American Eagle, Ann Taylor, Banana Republic and Express have also launched rental subscription offerings. Even Nike has a footwear subscription service for kids, Nike Adventure Club. According to a February 2020 Coresight Research survey of US consumers:- Some 29.8% of US apparel shoppers used resale websites to buy clothing/footwear/accessories in the prior 12 months. eBay, Poshmark and ThredUP were the most-shopped such apparel resale platforms, according to our survey.

- Just under 11% of clothing and footwear shoppers had used apparel rental websites in the past year, while just under 17% had used apparel subscription services in the same period. Stitch Fix, American Eagle Style Drop and Kidbox were the most used rental or subscription services among respondents.

Source: Coresight Research[/caption]

Private Label

Today’s shoppers want special, unique and different products. Private-label and exclusive products are one way to meet that desire.

Department stores leverage the power of private-label brands for a number of reasons: superior profit margins; exclusive product that drives traffic and return visits; to differentiate and distinguish themselves from competitors; and, in some cases, for quicker speed to market (and the customer).

Macy's has ambitious plans to grow four of its private brands to be worth $1 billion each, specifically, International Concepts, Alfani, Style & Co. and Charter Club. Macy’s management announced this plan during its investor meeting, adding it is on track for private brands to make up 25% of sales by 2025. See our sector overview on US department stores for further analysis on private labels.

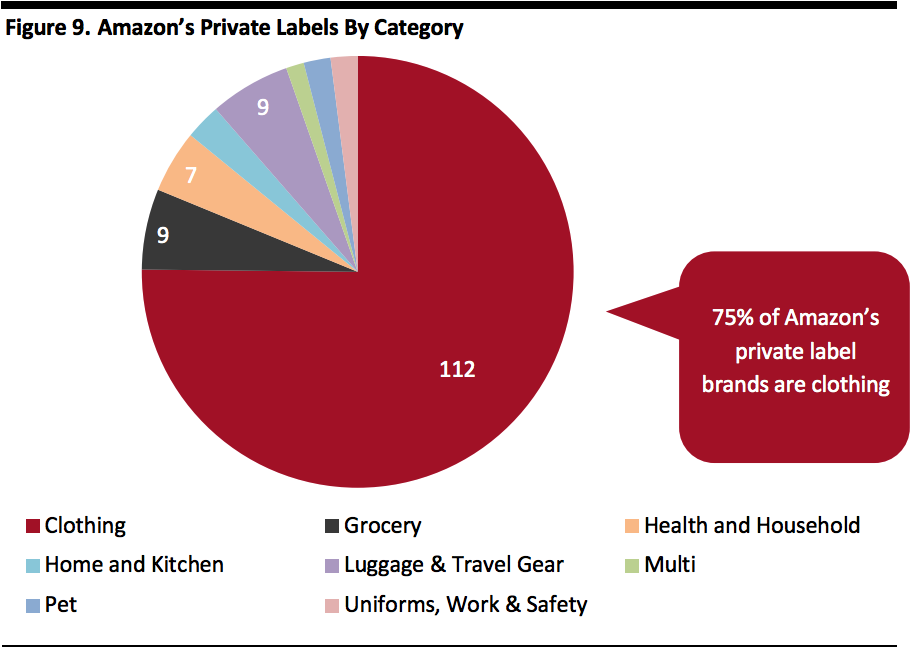

Our research shows that as of February 2020, Amazon had more than doubled the number of private-label brands in 20 months from 74 to 149.

Our exclusive analysis found that 75% of Amazon’s private-label brands are clothing products, compared to 89% as of June 2018—distantly trailed by grocery with 6%, travel gear also at 6% and health and household at just 5%.

[caption id="attachment_104771" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Private Label

Today’s shoppers want special, unique and different products. Private-label and exclusive products are one way to meet that desire.

Department stores leverage the power of private-label brands for a number of reasons: superior profit margins; exclusive product that drives traffic and return visits; to differentiate and distinguish themselves from competitors; and, in some cases, for quicker speed to market (and the customer).

Macy's has ambitious plans to grow four of its private brands to be worth $1 billion each, specifically, International Concepts, Alfani, Style & Co. and Charter Club. Macy’s management announced this plan during its investor meeting, adding it is on track for private brands to make up 25% of sales by 2025. See our sector overview on US department stores for further analysis on private labels.

Our research shows that as of February 2020, Amazon had more than doubled the number of private-label brands in 20 months from 74 to 149.

Our exclusive analysis found that 75% of Amazon’s private-label brands are clothing products, compared to 89% as of June 2018—distantly trailed by grocery with 6%, travel gear also at 6% and health and household at just 5%.

[caption id="attachment_104771" align="aligncenter" width="700"] Source: Coresight Research[/caption]

By comparison, Walmart had 319 private-label brands in 20 categories, according to ScrapeHero, while Target had 41 private labels, 17 of which are apparel, according to the company website.

Brand Collaborations

Strategic alliances and limited-run joint products are one possible apparel brand response to an increasingly competitive global market. When looking at a collaboration, apparel brands should consider their crossover partners, objectives and time needed to bring the partnership to fruition. Limited numbers, buzz of crossover, uniqueness and innovation of design are the main reasons consumers buy.

Out-of-the box collaborations such as Supreme and The North Face, Uniqlo and KAWS, North Face and Champion are just a few examples of successful collaborations that created new, exclusive products to drive excitement and buzz while attracting new shoppers to both brands.

Cult brands such as Supreme have used products drops to mark the arrival of new products—in limited run—and fans often wait for hours (even overnight) for the sought-after product, which sometimes sell online for three times (or more) the original purchase price in what has become a thriving resale market.

Source: Coresight Research[/caption]

By comparison, Walmart had 319 private-label brands in 20 categories, according to ScrapeHero, while Target had 41 private labels, 17 of which are apparel, according to the company website.

Brand Collaborations

Strategic alliances and limited-run joint products are one possible apparel brand response to an increasingly competitive global market. When looking at a collaboration, apparel brands should consider their crossover partners, objectives and time needed to bring the partnership to fruition. Limited numbers, buzz of crossover, uniqueness and innovation of design are the main reasons consumers buy.

Out-of-the box collaborations such as Supreme and The North Face, Uniqlo and KAWS, North Face and Champion are just a few examples of successful collaborations that created new, exclusive products to drive excitement and buzz while attracting new shoppers to both brands.

Cult brands such as Supreme have used products drops to mark the arrival of new products—in limited run—and fans often wait for hours (even overnight) for the sought-after product, which sometimes sell online for three times (or more) the original purchase price in what has become a thriving resale market.

Sector Outlook

- The cumulative effects of the trade dispute between the US and China, compounded by the coronavirus outbreak that remains ongoing, have put downward pressure on both countries’ economies and on the apparel industry. On top of price pressure from tariffs, apparel brands now face outbreak-related production delays.

- Consumers are becoming increasingly environmentally aware and expect the companies they buy from to reflect these values. Apparel companies need to take meaningful action on sustainability issues, such as using sustainably grown organic cotton, ensuring suppliers don’t pollute, examining supply chains to increase efficiency and making domestic operations more environmentally friendly.

- In 2020, we expect apparel retailers and brands to enter into more collaborations with a variety of partners and to offer products as exclusive, via more channels and in different event spaces to create hype on social media. We believe collaborations will become more outrageous in 2020.

- Apparel brands need to go digital to learn more about their customers as consumers become even more digitally connected.

- 2020 will be the year of inclusivity: Retailers will launch and embrace fashion that offers greater accessibility, gender equality, size inclusion and design diversity.

- Specialty retailers will continue to test new retail service models that include rental and subscription services. This will include more collaborations with innovators, disruptors and retailers.

Source for Euromonitor International data: Euromonitor International Limited 2020 © All rights reserved