DIpil Das

Introduction

The outbreak of Covid-19 and related store closures has accelerated gradual declines for many struggling brick-and-mortar retailers. As property owners in this environment, retail REITs face significant challenges headwinds—the current move toward reopening stores is positive but the looming potential for second-round shutdowns puts pressure on REITs’ recovery. This report includes insights on the US retail REITs sector—including the distribution of shopping centers by state, performance and sector tailwinds and headwinds. We review major themes from across the sector, such as tenant-landlord relationships, consumer avoidance of public places and the impact of store closures. We also look ahead to the areas of opportunity in the retail REITs sector. Our coverage focuses on five REITs that each have a with strong presence in retail and that are each part of our Coresight 100 company coverage list: Brookfield, Macerich, Simon Property Group, Taubman Centers and Unibail-Rodamco-Westfield (URW). We also discuss other REITs where relevant.US Retail REITs: Sector Size

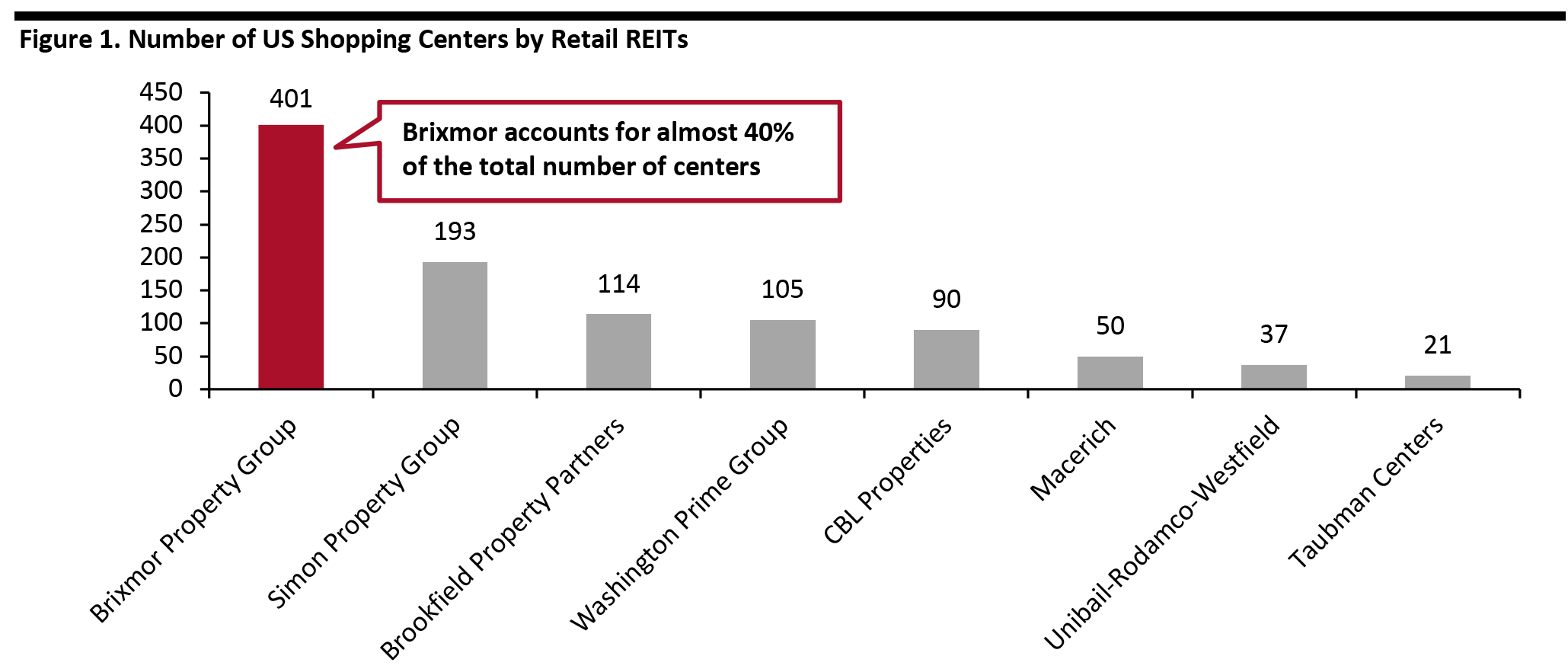

With 219 REITs in the US, the total market capitalization reaches more than $1 trillion. REITs own approximately $3 trillion in gross assets and public REITs account for $2 trillion, according to industry association Nareit. In 2019, REITs raised $109.4 billion in public market offerings. In this report, we focus on retail REITs. Retail REITs invest in, build and manage retail real estate. There is a total of 39 publicly listed retail REITs. Below, we chart the number of shopping centers owned by each of eight major players operating in the US: Brixmor, Brookfield Property Partners, CBL Properties, Macerich, Simon Property Group, Taubman Centers, Unibail-Rodamco-Westfield (URW) and Washington Prime Group (WPG). Based on company reports, Coresight Research calculates that eight retail REITs operate 1,011 shopping centers in the US. With the exception of URW, all are based in the US. [caption id="attachment_117107" align="aligncenter" width="700"] As of end of latest fiscal years

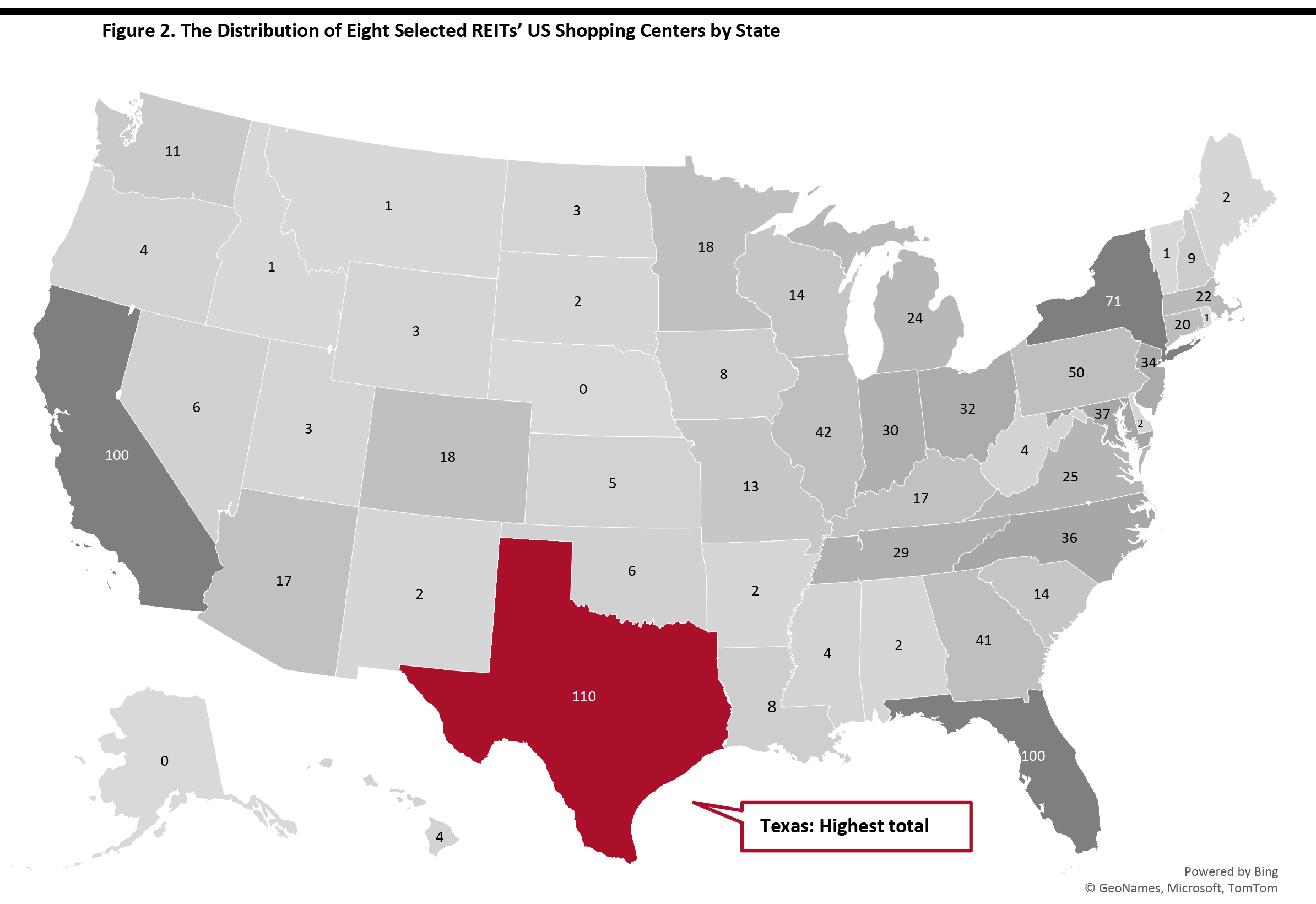

As of end of latest fiscal years Source: Company reports/Coresight Research [/caption] We mapped out the malls owned by the same eight REITs by state. Texas has the greatest total number (110 shopping centers), followed by California and Florida (100 each). [caption id="attachment_117108" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Covid-19 has exacerbated the struggles of US shopping centers, with several likely to close over the next few years. As such, the consolidation trend among US malls is set to accelerate—Coresight Research estimates that around 25% of malls will close over the next three to five years.

Funds from Operations

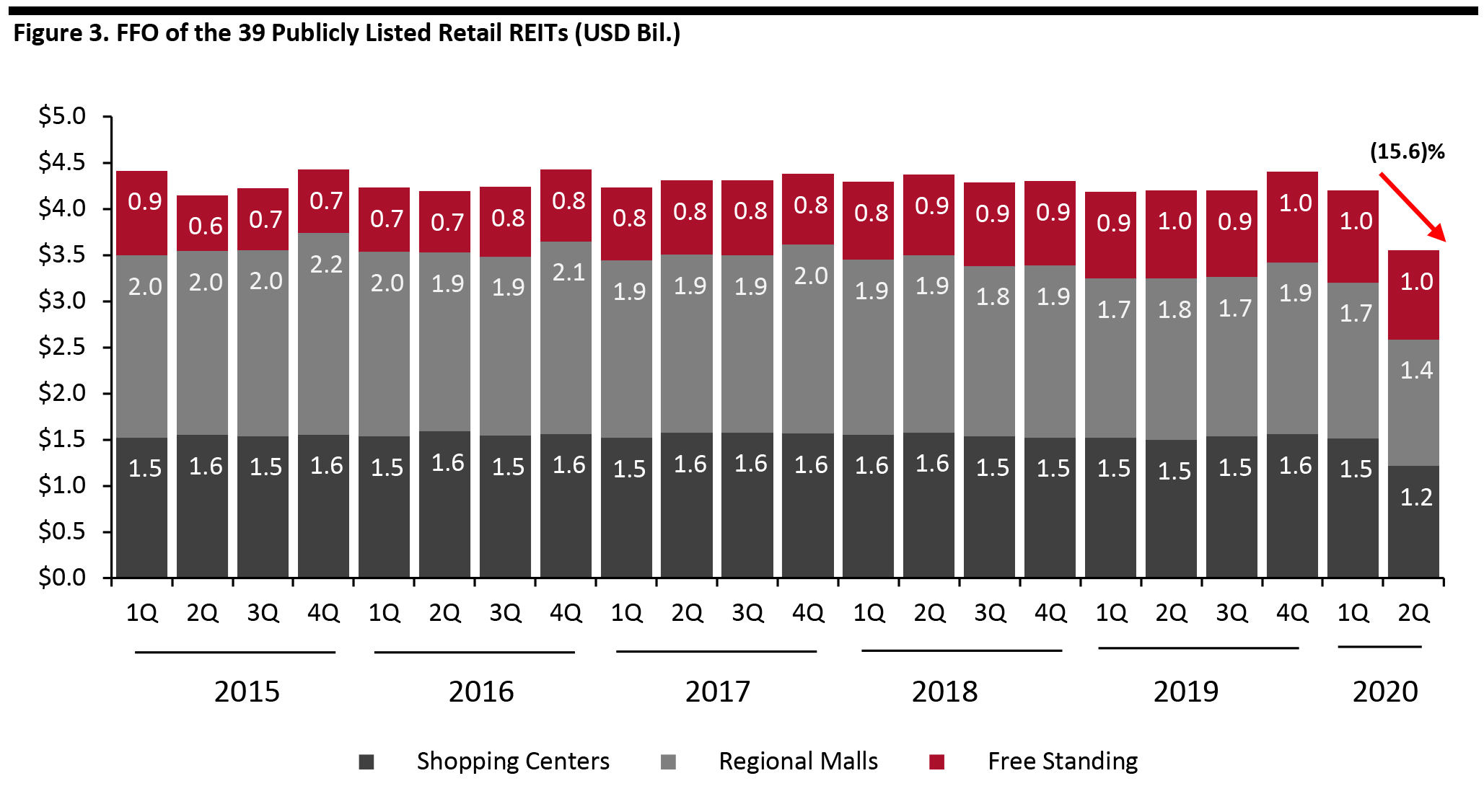

Funds from operations (FFO) is considered a better measure of REIT performance than net income because it discounts the influence of depreciation. FFO is calculated by adding depreciation expenses back into net income, along with a few other adjustments, to give investors a more accurate picture of a REIT’s cash flow.

The total FFO generated by US retail REITs has remained stable over the past five years. However, coronavirus-related shutdowns negatively impacted FFO in the second quarter, causing a year-over-year market decline of 15.6% to $3.5 billion.

We expect to see some degree of FFO improvement in the third quarter, as malls reopened.

[caption id="attachment_117109" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Covid-19 has exacerbated the struggles of US shopping centers, with several likely to close over the next few years. As such, the consolidation trend among US malls is set to accelerate—Coresight Research estimates that around 25% of malls will close over the next three to five years.

Funds from Operations

Funds from operations (FFO) is considered a better measure of REIT performance than net income because it discounts the influence of depreciation. FFO is calculated by adding depreciation expenses back into net income, along with a few other adjustments, to give investors a more accurate picture of a REIT’s cash flow.

The total FFO generated by US retail REITs has remained stable over the past five years. However, coronavirus-related shutdowns negatively impacted FFO in the second quarter, causing a year-over-year market decline of 15.6% to $3.5 billion.

We expect to see some degree of FFO improvement in the third quarter, as malls reopened.

[caption id="attachment_117109" align="aligncenter" width="700"] Source: Nareit T-Tracker[/caption]

Sector Headwinds

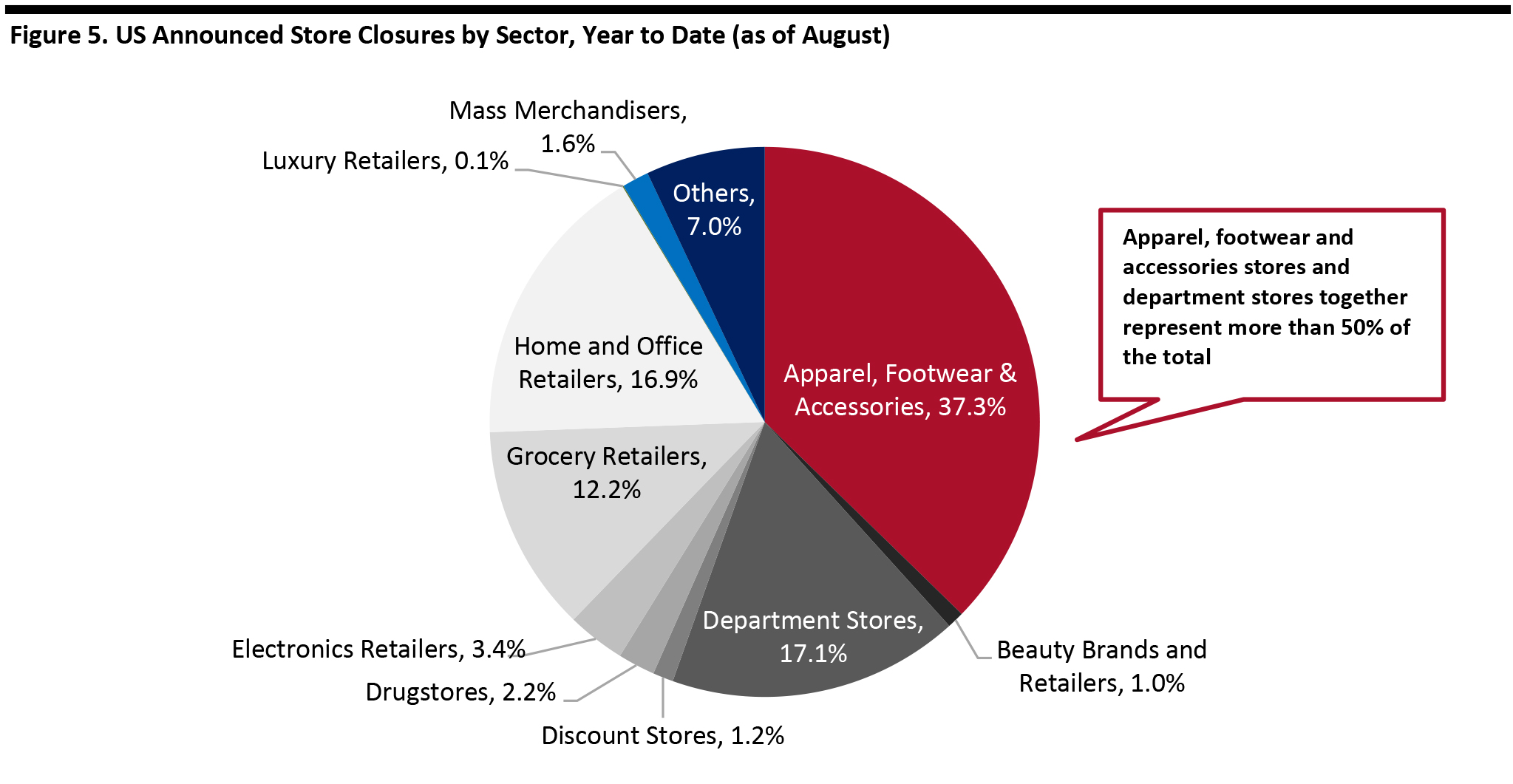

The ever-growing expansion of e-commerce continues to feature as a headwind for the retail industry—even more so during Covid-related lockdowns. While spectacular and experiential retail were major themes last year, the outbreak of the coronavirus shifted shopping online as consumers sought to avoid face-to-face contact and busy public spaces.

High unemployment rates, low consumer spending and low levels of business activity has resulted in reduced demand for commercial real estate, putting pressure on retail REITs.

As uncertainty related to the current health situation looks set to remain a little longer, the probability of additional lease cancellations in the upcoming months due to retailers’ bankruptcies and store closures is high. Retail rents likely face downward pressure as stores continue to close.

Sector Tailwinds

Near-zero low interest rates and stimulus packages can help the retail economy to recover. Pent-up demand in the post-coronavirus era may lead consumers to miss physical shopping experiences and increase outings to shopping centers.

Source: Nareit T-Tracker[/caption]

Sector Headwinds

The ever-growing expansion of e-commerce continues to feature as a headwind for the retail industry—even more so during Covid-related lockdowns. While spectacular and experiential retail were major themes last year, the outbreak of the coronavirus shifted shopping online as consumers sought to avoid face-to-face contact and busy public spaces.

High unemployment rates, low consumer spending and low levels of business activity has resulted in reduced demand for commercial real estate, putting pressure on retail REITs.

As uncertainty related to the current health situation looks set to remain a little longer, the probability of additional lease cancellations in the upcoming months due to retailers’ bankruptcies and store closures is high. Retail rents likely face downward pressure as stores continue to close.

Sector Tailwinds

Near-zero low interest rates and stimulus packages can help the retail economy to recover. Pent-up demand in the post-coronavirus era may lead consumers to miss physical shopping experiences and increase outings to shopping centers.

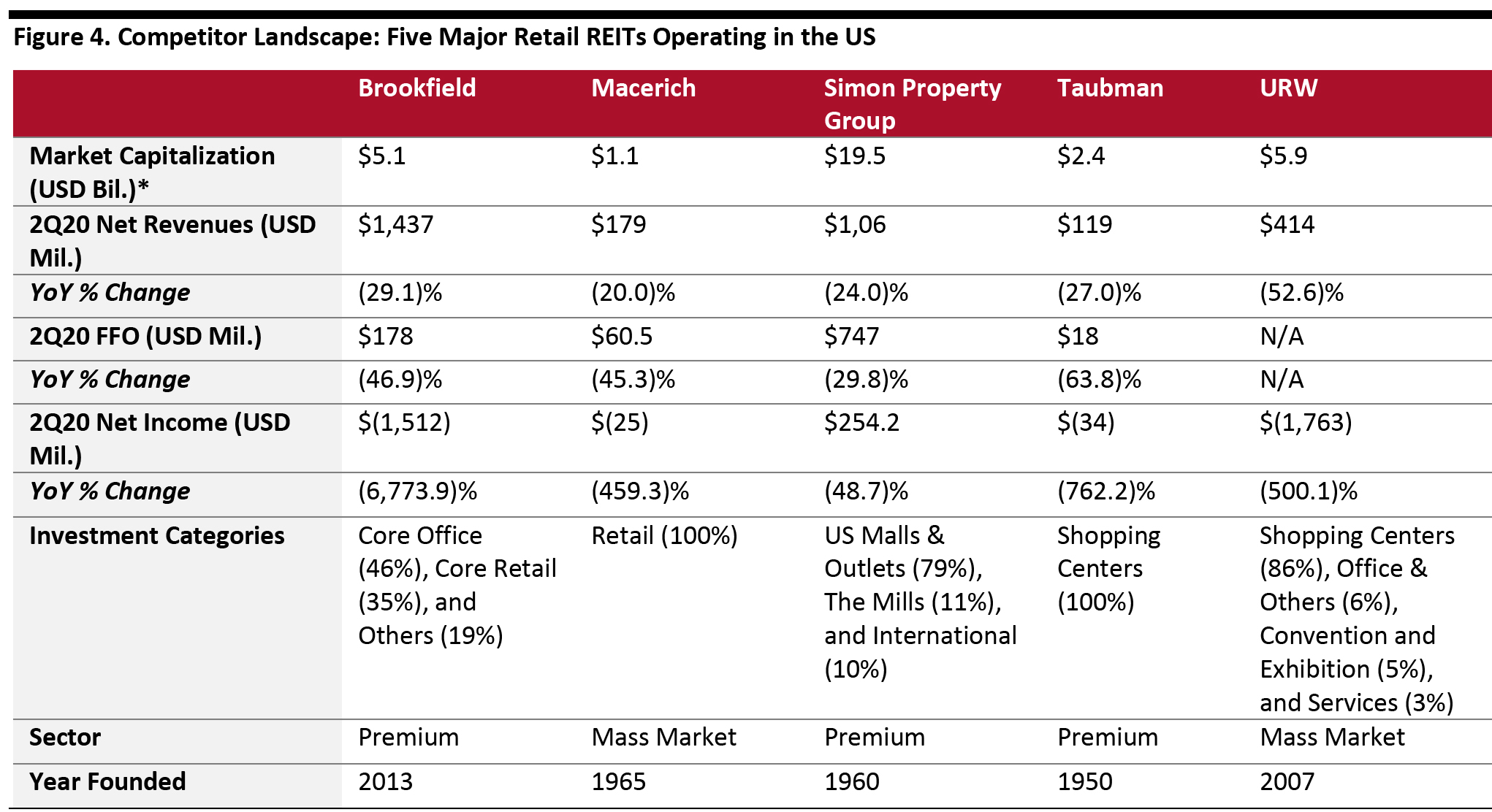

Competitive Landscape

The landscape remains highly competitive and diverse with a total of 39 publicly listed retail REITs. The table below summarizes market capitalization, net revenues, FFO, net income and investment categories for five of the eight major US retail REITs listed above. [caption id="attachment_117110" align="aligncenter" width="700"] *Market capitalization as of July 30, 2020

*Market capitalization as of July 30, 2020 Source: Company reports/Coresight Research [/caption]

Themes We Are Watching

Consumers Are Avoiding Public Places Many retailers are reopening as governments ease restrictions, bringing sales revenue and rental income to property owners. On average, the major US retail REITs have opened more than 90% of their portfolio shopping centers. Shopping centers are seeing a slow recovery. Our weekly US consumer survey undertaken on September 22suggests that 81.5% of respondents are currently avoiding public places. Specifically, 58.1% of respondents are avoiding shopping centers/malls, slightly up from 53.4% from the September 15 survey. Similarly, 51.7% of respondents reported avoiding restaurants, bars and coffee shops also—demonstrating consumers’ desire to stay away from public spaces. In addition, the proportion of consumers switching their spending to e-commerce channels remained high. In our survey of September 22 , 73.5% of consumers stated that they are buying more online than they were before the crisis. These data all point toward challenges for retail spaces and property owners. To counteract this, REITs should ensure that their stores environments are safe and promote their safety measures and in-store sales promotions to attract consumers. As coronavirus cases increase in certain areas of the US, some reopened stores are now closing for a second time. The absence of a clear recovery trajectory poses a continuing challenge for US discretionary retail. Rent Collection Rent is the main income source for retail REITs. As the shutdown begin, tenants were facing issues raising rent, and many delayed their payments.- For Brookfield, April rent collection on its retail portfolio reached approximately 20%, showing the immediate impact of closures on retailers. In the second quarter, the REIT collected approximately 34% of its retail portfolio’s rent and reported an improvement in July collections.

- Macerich reported that around 40% of its tenants paid rent for April and May. Rent collection then increased to 58% in June and 66% in July. The company noted for the first week of August, collections had already reached 51% —on pace to be a better result than July. Macerich has been negotiating with tenants that did not pay April and May rent. Terms were agreed with most of them—rent payment deferrals to 2021 were exchanged, in many cases, for landlord-favorable amendments to leases.

- Simon Property Group collected approximately 51% of its contractual rent for April and May combined, including some rent deferrals. The group collected 69% of rent due for June and 73% for July with minimal deferrals for its US retail portfolio.

- Taubman did not disclose the level of rent collection but it noted $32.6 million in uncollectible tenant revenues for the second quarter, due to elevated tenant bankruptcies and non-payments during shopping center closures.

- URW reported 38% rent collection in its second quarter, ended June 2020, for its shopping center division, which includes both American and European malls. The company also disclosed that 3% of the second quarter’s rents have been forgiven through rent relief, 20% has been deferred and 39% is overdue and to be recovered. As of July 24, it reported 50% rent collection for July and expected to see a further improvement after finishing negotiations with tenants.

Source: Company reports/Coresight Research[/caption]

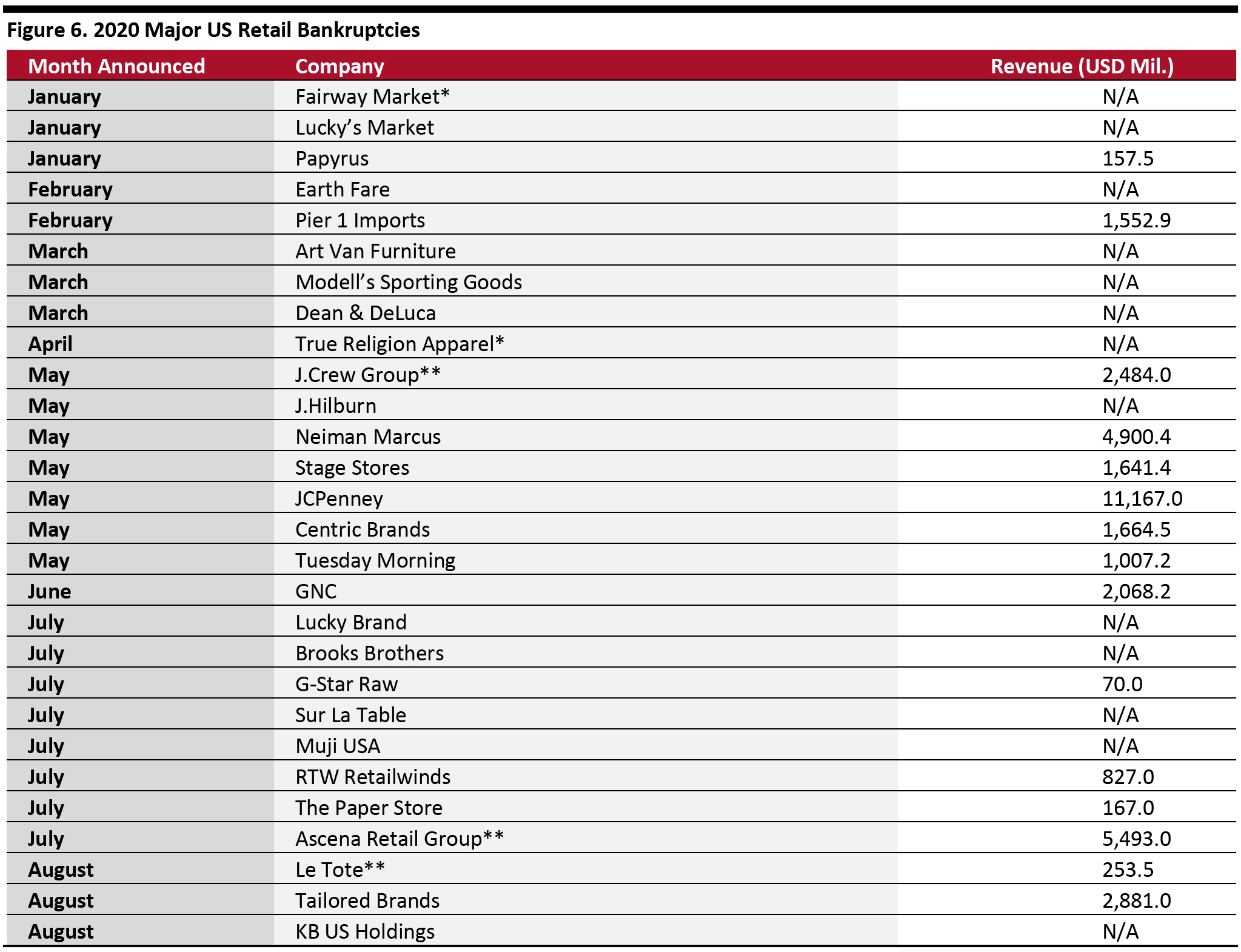

These store closures could have a significant negative impact on rent collection in the future. While landlords may still be able to collect partial rent from closed stores, rent from bankrupt retailers may be harder to recover.

Since emptying stores after closures and finding replacement tenants may be time consuming, the negative impact on rent collection is likely to manifest in the near future. As store closures accelerate and shutdowns reoccur, rent collection in the US is under pressure.

[caption id="attachment_117118" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

These store closures could have a significant negative impact on rent collection in the future. While landlords may still be able to collect partial rent from closed stores, rent from bankrupt retailers may be harder to recover.

Since emptying stores after closures and finding replacement tenants may be time consuming, the negative impact on rent collection is likely to manifest in the near future. As store closures accelerate and shutdowns reoccur, rent collection in the US is under pressure.

[caption id="attachment_117118" align="aligncenter" width="700"] Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019; Revenue figure depicted for Lord & Taylor is for fiscal 2018.

Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019; Revenue figure depicted for Lord & Taylor is for fiscal 2018. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017.

**J.Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant and Lou & Grey banners; Le Tote includes Lord & Taylor banner.

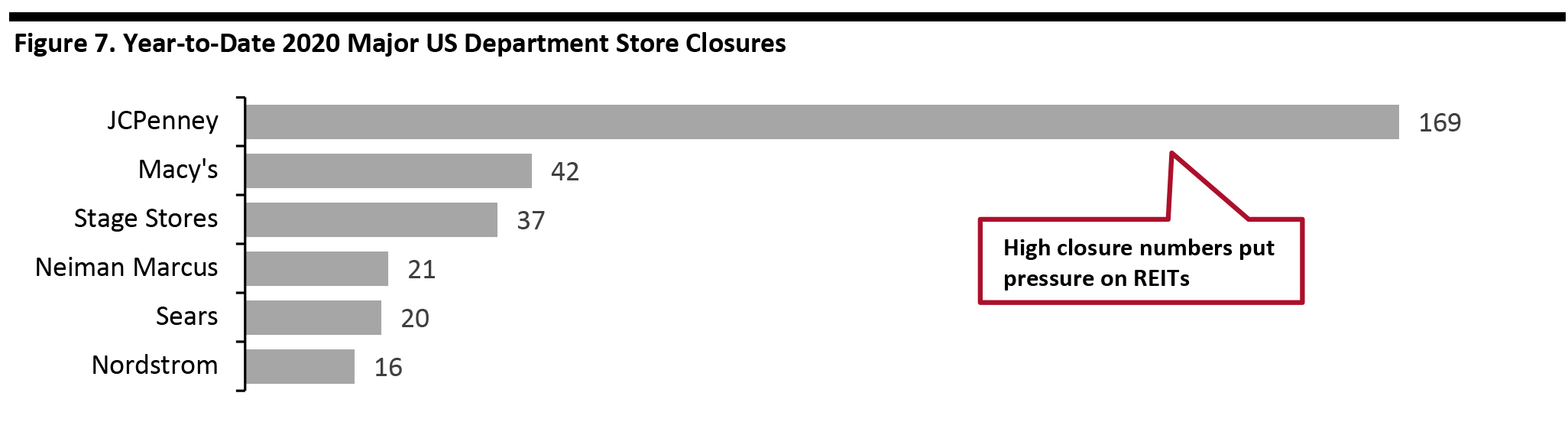

Source: Company reports/Coresight Research [/caption] Impact of Department Store Closures In total, there have been over 300 major US department store closures announced in 2020, including JCPenney, Macy’s, Neiman Marcus and Nordstrom. Retail Dive reported in February this year that Stage Stores plans to separately close around 200 Gordmans stores (off-price department stores), and we estimate that Sears will have closed at least 20 stores by the end of the year. [caption id="attachment_117113" align="aligncenter" width="700"]

Coresight Research attributes store closures to the year in which they occurred or are expected to occur. We estimate this information for JCPenney, Macy’s, Sears and Stage Stores.

Coresight Research attributes store closures to the year in which they occurred or are expected to occur. We estimate this information for JCPenney, Macy’s, Sears and Stage Stores. Neiman Marcus includes 17 Last Call Stores and four Neiman Marcus stores

Source: Company reports/Coresight Research [/caption] An average department store ranges from approximately 100,000 square feet to upwards of 160,000 square feet for a mall-based anchor store—considerably larger than other retail stores. Department store closures represent a significant challenge for mall owners in finding new tenants to occupy such vast retail spaces. Closures of mall-based department stores, such as JCPenney, and large-format retailers that operate as anchor tenants will also have a negative effect on overall foot traffic and may lead smaller retailers to follow suit. Such tenants often have co-tenancy clauses that enable them to pay lower rent or terminate their leases when an anchor tenant leaves. Department store closures in malls will therefore create a negative ripple effect throughout the mall environment. Consumers are likely to switch shopping locations if the stores they usually shop at are closed. Nevertheless, it will be harder to attract new customers with a significant number of vacant spaces. Overall, malls face potential losses of existing and new clients. REITs Buying Retailers With concerns abound regarding the ability of retail businesses to meet their rent obligations and utility expenses, many REITs have started to invest in or acquire retailers.

- Simon Property Group initiated this acquisition strategy in 2016 when the REIT bailed out Aéropostale in partnership with General Growth Properties (now owned by Brookfield Property Partners). Earlier in 2020, Simon Property Group acquired Forever 21 with Brookfield Property Partners and Authentic Brands Group. Most recently, Simon Property Group and Brookfield Property Group reached an agreement to buy JCPenney for $1.75 billion on September 9, 2020.

- SPARC Group, a joint entity of Simon Property Group and brand management company Authentic Brands (primarily known for acquiring brands with licensing potential), has been active in its acquisition strategy. For instance, on August 12, SPARC Group announced that it will acquire Brooks Brothers for $325 million and continue to operate at least 125 Brooks Brothers retail locations. This 200-year-old high-end clothing retailer filed for Chapter 11 bankruptcy protection on July 8, 2020.

Looking Forward

We expect retail REITs to see a sequential improvement in traffic and rent collection at their properties in the third quarter. However, with continued uncertainty related to Covid-19, it is likely to take a long time before traffic returns to prior-year levels. The Covid-19 crisis hurt retail revenues and many retailers delayed and are still delaying rent payments—with a knock-on effect for cash flows in the REIT sector. However, not all shopping center formats face the same challenges, so not all REITs will feel the impact of the crisis to the same degree.- The traditional, enclosed mall format was struggling pre-crisis. The Covid-19 pandemic has amplified difficulties through reduced rents, tenant bankruptcies and an apparently sustained reluctance among consumers to return to covered malls. In the wake of this crisis, Coresight Research estimates that around 25% of US malls could close in the next three to five years, roughly translating to around 300 of the country’s almost 1,200 malls.

- The malls that will be most affected by closures will be the Class B, C and D malls, which have higher vacancy rates and are struggling the most with waning consumer appeal. Higher-end Class A malls are less likely to be impacted as severely, given that they generate higher sales per square foot at superior locations and have a mixed-use value proposition.

- At the same time, non-mall formats such as open-air shopping centers are proving more resilient, supported by nondiscretionary anchor stores and an apparently greater consumer willingness to visit open-air shopping spaces.

- In the wake of the coronavirus crisis, REITs have the opportunity to improve tenant mix following store closures and bankruptcies from retailers that did not survive. In addition, the importance of technology prevails. We expect REITs to partner with technology vendors to further transform their properties and prepare for full reopening in the future.