DIpil Das

Introduction

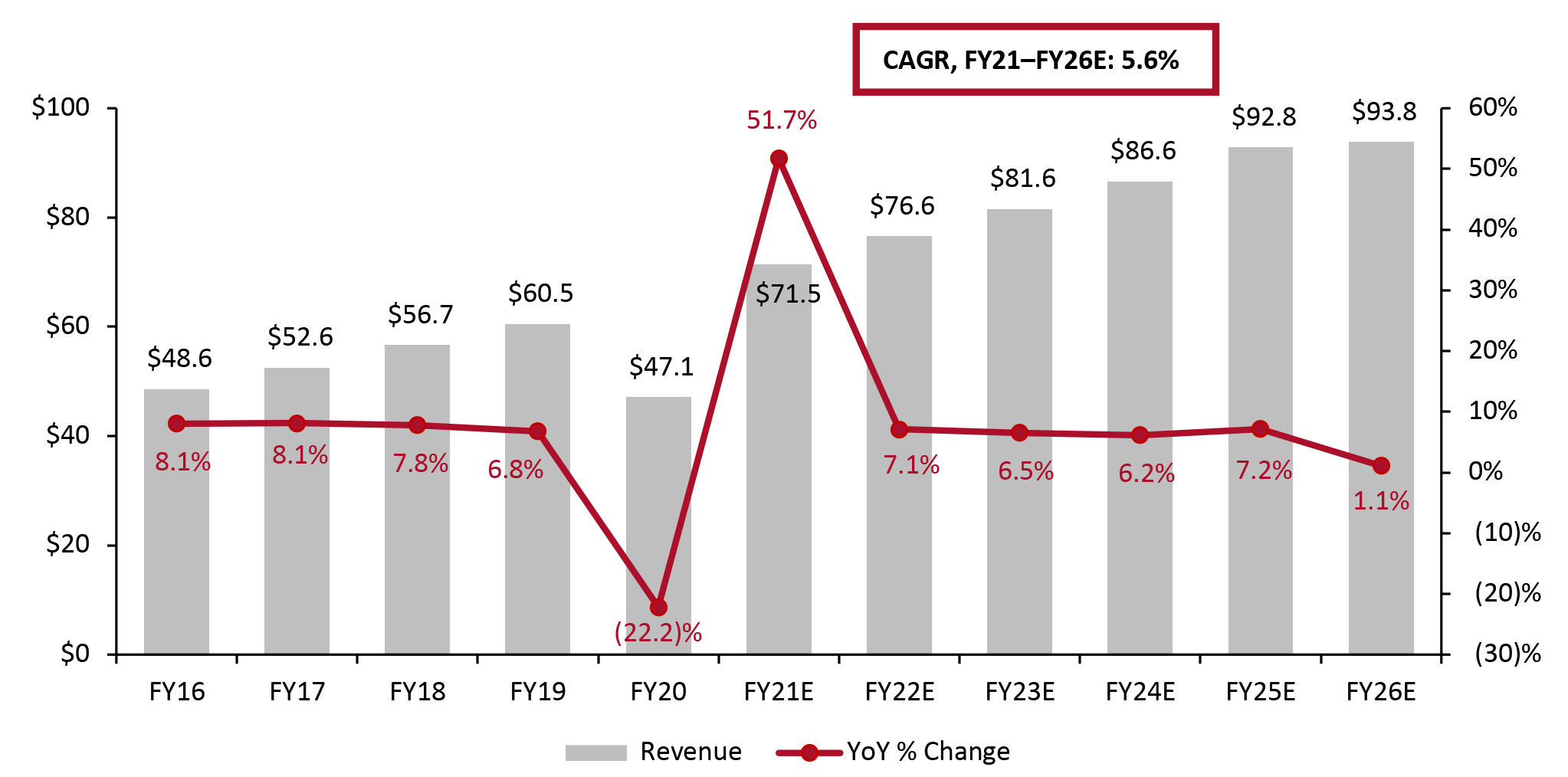

Off-price retail is focused on value pricing and off-mall physical locations, and the sector has grown steadily into a $71.5 billion industry. There are four major US off-price retailers that we focus on in this report: Burlington Stores, Nordstrom Rack, Ross Stores and The TJX Companies. In this Market Outlook, we discuss the US off-price sector, presenting our market sizing estimates for 2022 and beyond. We explore notable market factors, e-commerce penetration, the competitive landscape and retail innovators. We also identify three key themes that we are watching in the sector.Market Performance and Outlook

Continued Growth in 2022 and Beyond The off-price sector fared better than many other sectors during the pandemic, declining by 22.2%, year over year, in fiscal 2020, based on Coresight Research analysis of company data. This is remarkable as over 95% of sector revenues are derived from physical store sales. In fiscal 2021, the sector rebounded, with revenues up by 51.7% year over year.- In fiscal 2022, Coresight Research expects off-price sector revenues to be up 7.1% year over year. This growth is close to pre-pandemic levels; the off-price sector grew at a CAGR of 8.4% between fiscal 2010 and fiscal 2019.

- Through fiscal 2026, Coresight Research estimates that the sector will achieve a CAGR of 5.6% from fiscal 2021. We anticipate that consumers will continue to prioritize unique value offerings and that the off-price market will be a lucrative sector.

Figure 1. US Off-Price Sector Size (Left Axis; USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_145343" align="aligncenter" width="700"]

For the purposes of comparison in this report, we refer to FY21 (fiscal 2021) as the year ended January 30, 2022, although The TJX Companies refers to this year as FY22 in its reports

For the purposes of comparison in this report, we refer to FY21 (fiscal 2021) as the year ended January 30, 2022, although The TJX Companies refers to this year as FY22 in its reports Source: Company reports/Coresight Research [/caption]

Market Factors

Inflation The off-price retailers have all reported that in an inflationary economy, consumers seek off-price value, boosting sales in the sector.- Burlington’s management said on its fourth-quarter earnings call in March 2022 that the impact of inflation is both an opportunity and a risk for off-price. The risk is that consumers, particularly lower-income consumers, may be more affected as stimulus payments have ended and essential prices of food and gas are rising. The opportunity is that higher inflation affects all consumers, and management thinks the company will benefit from trade-down trends as customers seek value.

- Ross Stores reported in its fourth-quarter earnings results that with inflationary pressures, it can gain a trade-down customer. The company has experimented with higher levels of retail pricing to offset higher costs, with various levels of success. The company said it will continue to experiment and adjust prices and was cautionary in its guidance regarding the impact of inflation.

- The TJX Companies said on its fourth-quarter earnings call in March 2022 that it believes more customers will turn to the retailer as they seek value in an inflationary environment.

Online Market

The off-price market is a retail anomaly, with over 95% of its revenues driven by physical retail. It is only recently that the off-price sector has begun to launch e-commerce, as discussed further in our US Off-Price Retail: Strategies in the Physical and Digital Channels report.

In September 2021, The TJX Companies launched HomeGoods.com. Management believes that the retailer can capture a greater share of the home sector through an online presence. The TJX home banners, HomeGoods and Homesense, had the fastest-growing revenues of the off-price banners (which we discuss in a later section of this report); the addition of HomeGoods.com will advance the retailer’s position in the home category. The company reported that its comps and average unit retail (AUR) are very strong, with its Homesense business even stronger than its HomeGoods business. Management is confident about taking the business online amid current consumer product discovery and buying behaviors and delivery preferences. The TJX Companies launched tjmaxx.com in 2013, marshalls.com in 2019 and sierra.com in 1999 (The TJX Companies acquired Sierra Trading Post in 2012). The retailer reported that e-commerce sales were approximately 3% of TJX Marmaxx (comprising the Marshalls, T.J. Maxx and Sierra banners) net sales for fiscal 2020, totaling approximately $770 million.

Nordstrom Rack also launched an e-commerce presence and has been aggressively pursuing its digital capabilities for over two years. At its Investor Day presentation in February 2021, management reported that it is more cost-effective for the retailer when customers use its BOPIS (buy online, pick up in-store) services. BOPIS and ship-from-store help Nordstrom Rack to further the services it offers to customers while also increasing its supply chain capabilities. On its earnings call for the fourth quarter of fiscal 2021, Nordstrom reported that one-third of its next-day Nordstrom.com orders were picked up at Nordstrom Rack locations. Nordstrom is seeking to eventually put all its Nordstrom Rack assets online and create a “synergistic relationship” between its full-line stores and Nordstrom Rack stores, according to the company.

Competitive Landscape

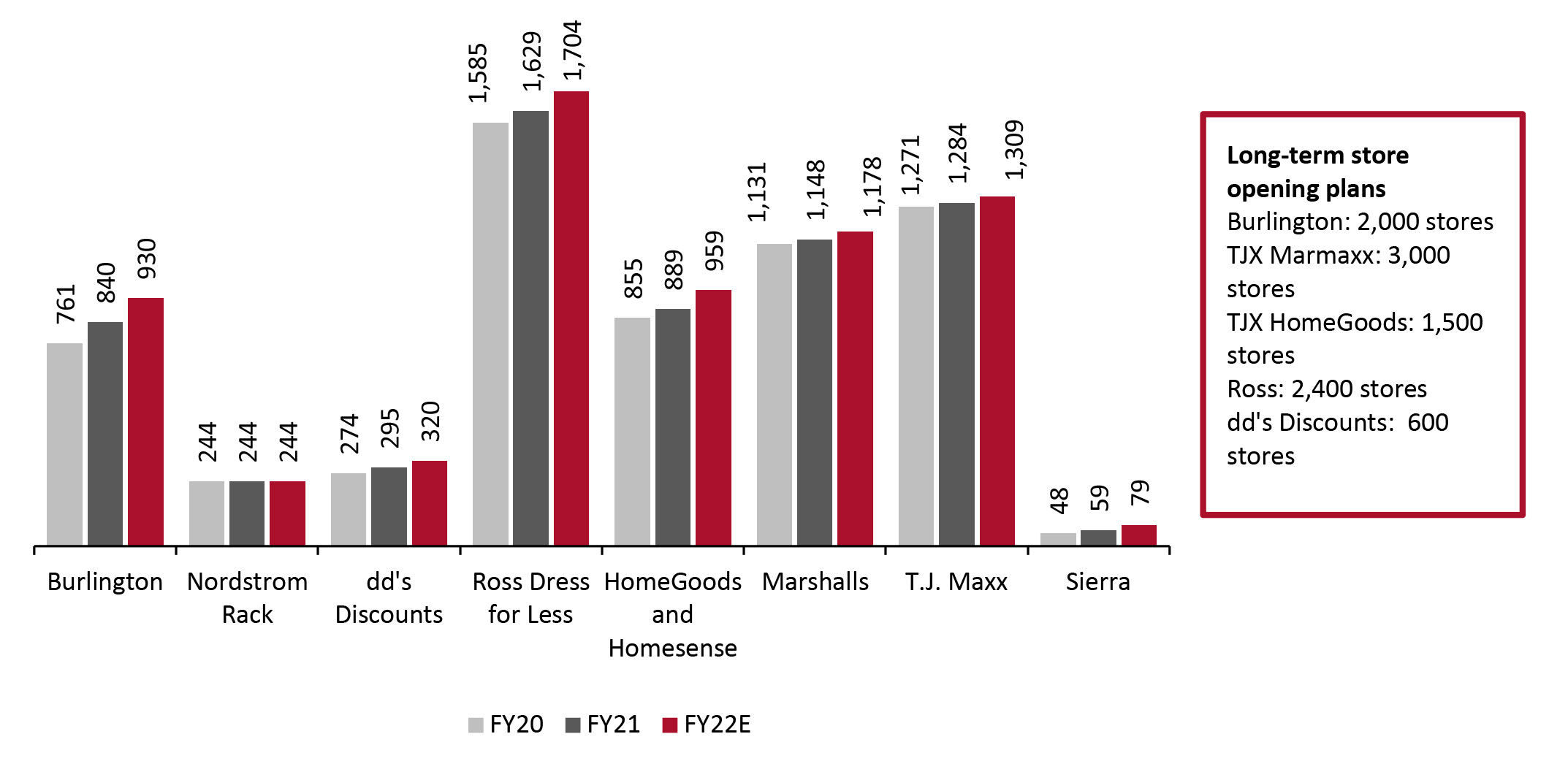

In Figure 2, we present selected metrics for the major off-price retailers. Ross Stores includes its Ross Dress for Less banner and dd’s Discount banners, and TJX Marmaxx includes Marshalls, TJ Maxx and Sierra banners.

Macy’s Backstage is also a major off-price retailer, with nearly all Backstage stores inside Macy’s locations. However, Macy’s does not report Backstage store revenues, nor does it regularly report on the number of Backstage stores, so Macy’s Backstage stores were not included as part of this competitive analysis.

Figure 2. US Off-Price Sector: Major Retailers’ Key Metrics [wpdatatable id=1884 table_view=regular]

Source: Company reports/Coresight Research In Figure 3, we provide an overview of the major off-price retailers’ revenues for the past five years and discuss each retailer’s performance below.

Figure 3. US Off-Price Sector: Major Retailers’ Revenues (USD Bil.) [wpdatatable id=1885 table_view=regular]

Companies listed largest to smallest by revenue Source: Company reports/Coresight Research

- The two largest off-price retailers by revenue, TJX Marmaxx and Ross Stores, hold 67.7% of the off-price market across the five banners. TJX Marmaxx is the largest off-price player, with a market share of 41.2% in fiscal 2021, followed by Ross Stores with a 26.5% market share. The retailers’ revenues have grown at a steady CAGR since fiscal 2017, as shown in Figure 3. Read our separate report, Head-to-Head in US Off-Price Retail: Ross Stores vs. TJX Marmaxx.

- TJX HomeGoods has emerged to become a dominant off-price player, with revenues expected to nearly double in fiscal year 2022 from fiscal year 2017. TJX HomeGoods and Homesense together hold the fourth-largest share of the off-price sector, but the revenues of these banners are growing the fastest, and the retailer is close on the heels of Burlington’s revenue—even overtaking the retailer for one year in fiscal 2020. We see this competition increasing as TJX continues to grow its home category presence, having launched HomeGoods online in September 2021 to offer consumers convenience in the shopping journey and last mile (through home delivery).

- Burlington has posted steady, strong growth over the past five years, with an 11.2% CAGR through fiscal 2021. Burlington is expanding its retail portfolio with smaller-format stores, which it expects will make its fleet more productive.

- Nordstrom Rack is the only off-price retailer with a negative CAGR over the past five years, (0.1)% from fiscal year 2017 to fiscal year 2021. The retailer was impacted the most by the Covid-19 pandemic, with revenues declining by 35.2% in fiscal 2020. We attribute this to the retailer’s heavy portfolio reliance on women’s fashion apparel; the other retailers are more diversified.

Figure 4. US Off-Price Sector: Physical Store Fleets, by Banner [caption id="attachment_145326" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

- Burlington has the most aggressive growth plan: At the end of fiscal 2022, the retailer plans to have 930 total stores, 10.7% more than in fiscal 2021. The company updated its long-term growth plan from 1,000 stores to 2,000 stores while reducing the size of its store format.

- Combined, The TJX Companies operates the most stores in the sector across its four banners, totaling an expected 3,525 stores in 2022. The company’s HomeGoods and Homesense banners are growing the fastest, at a 9.1% CAGR from fiscal 2010 to fiscal 2022, we calculate.

- Ross Stores is the second-largest off-price retailer in terms of store fleets; in 2021, the retailer had 1,924 stores across its two banners and has opened an average of 79 stores each year between fiscal 2010 and fiscal 2021. The company reported that its long-term store potential for Ross is 2,400 stores, and it has a target of 600 stores for dd’s Discounts.

- Nordstrom Rack’s store fleet expanded early, averaging 20 stores per year between fiscal 2010 and 2017. The retailer’s store-fleet growth has remained relatively flat, with only nine store openings since fiscal 2017.

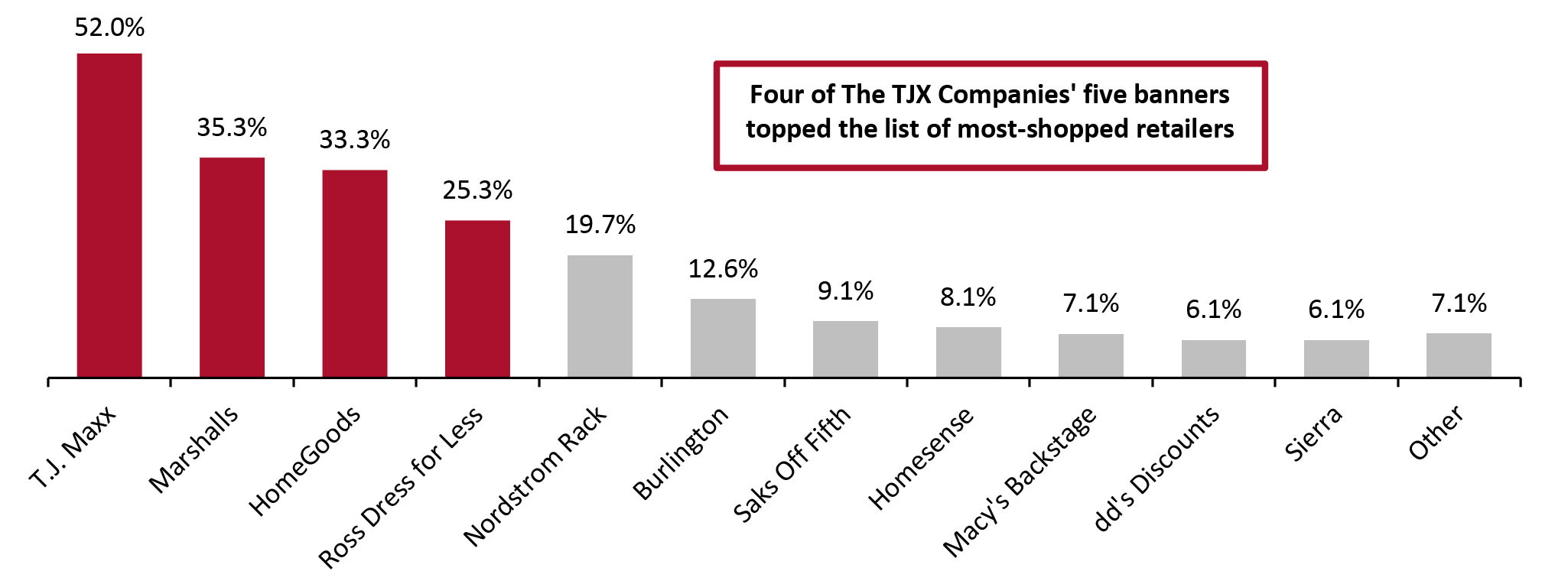

Figure 5. US Off-Price Shoppers: Retailers from Which They Made Purchases in the Past Three Months, as of January 31, 2022 (% of Respondents) [caption id="attachment_145327" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options 198 US respondents aged 18+ that had purchased from off-price retailers in the past three months

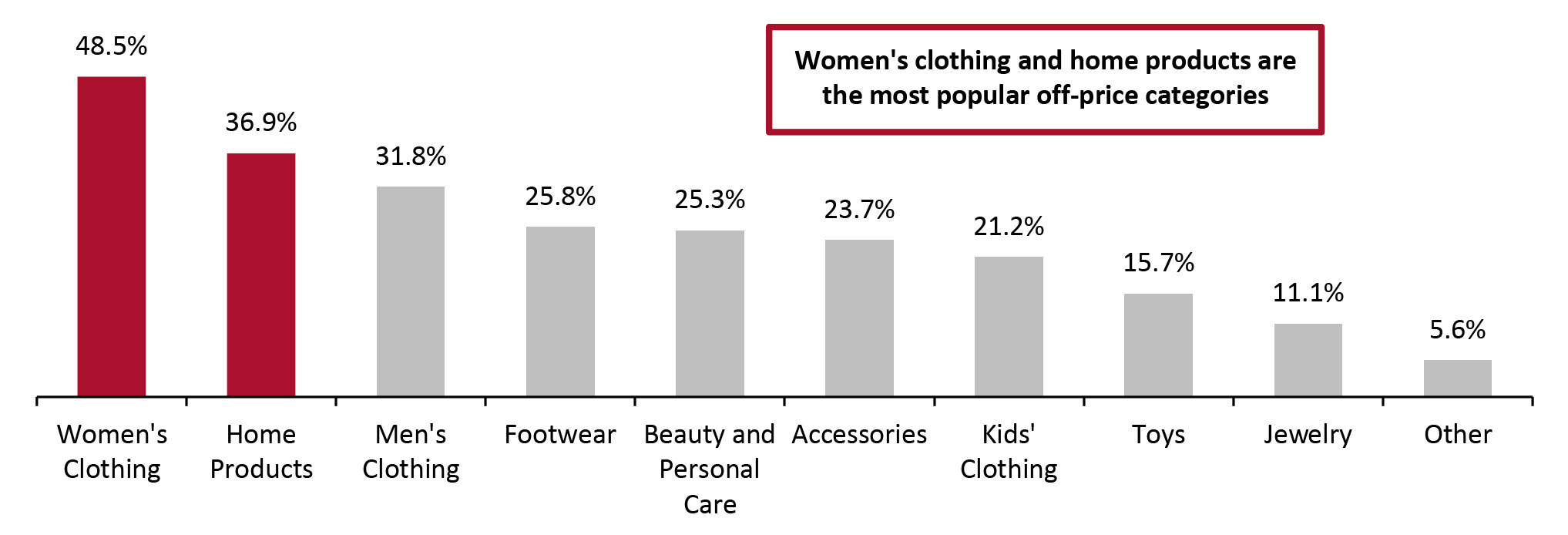

Source: Coresight Research [/caption] Among off-price shoppers, women’s clothing was the most popular category (bought by 48.5% of shoppers), followed by home (36.9%), as shown in Figure 6.

Figure 6. US Off-Price Shoppers: Categories They Purchased from Off-Price Retailers in the Past Three Months, as of January 31, 2022 (% of Respondents) [caption id="attachment_145328" align="aligncenter" width="701"]

Base: 198 US respondents aged 18+ that had purchased from off-price retailers in the past three months

Base: 198 US respondents aged 18+ that had purchased from off-price retailers in the past three months Source: Coresight Research [/caption]

Themes We Are Watching

Stores Are Becoming Smaller

The off-price sector is continuing to expand; however, store sizes are shrinking. This is a trend that we are seeing across the retail industry, and Burlington taking the lead in the off-price sector. As part of the “Burlington 2.0” improvement plan—announced by Burlington management during its earnings call for fiscal 2021 in March 2021—the company plans to double its store fleet in the long term from 1,000 stores to 2,000 stores in conjunction with the opening of smaller-footprint stores (approximately 25,000 square feet compared to the traditional store model of 40,000 square feet).

Michael O’Sullivan, CEO at Burlington, said that key benefits of the smaller format will be operating with leaner inventory levels, reduced resources, a heightened focus on trending products and opportunistic buys. Management said that over time, most of its new store openings will be in the smaller, 25,000-square-foot format, following one-third of new store openings being in this format in fiscal 2021.

On its earnings call for the second quarter of fiscal 2021 on August 26, 2021, management said that it was very pleased with the initial rollout of its small store format. The retailer had opened 16 new stores in the spring that measured 30,000 square feet or smaller with “very encouraging results.” Burlington said that the stores are running ahead of their targets. On its third-quarter earnings call on November 23, 2021, management reported that over the next five years, more than 75% of its new stores will be smaller than 30,000 square feet.

Digital Growth

The off-price sector has been slow to embrace online shopping for several reasons. First, the economics of off-price are not conducive for online shopping, where AUR is between $10 and $12, as reported by both Burlington and Ross management. Second, due to the multitude of SKUs (stock-keeping units), inventory management is challenging. Finally, recreating the customer experience of in-store shopping is challenging. The “treasure hunt” in-store shopping style in off-price involves consumers sifting through racks to discover items, but by limitation of the channel, a website condenses this experience to the items a consumer filters or searches and shows selected items on a webpage.

Only some off-price retailers are venturing into the digital channel. Coresight Research expects that the online presence of the TJX HomeGoods and Homesense banners will advance the retailer’s advantage in the home category and provide further competition to Burlington and Ross Stores. We expect that Nordstrom Rack’s e-commerce capabilities will provide competition for T.J. Maxx (TJX) in particular, as both banners are known for offering consumers unique and trending fashion apparel and accessories. Operating online will provide retailers with a data advantage to enable personalized offers, as well as supporting omnichannel services such as BOPIS, which could be a key differentiator in the crowded off-price space.

Increasing Competition

As we discussed earlier in this report, there is increasing competition in the off-price sector. The off-price sector has four defining characteristics:

- A variety of unique, different merchandise usually sourced from multiple suppliers—Off-price retailers often refer to their assortment as a “treasure hunt” for the consumer. Usually, there are very few items per style and varied styles dependent upon the selection that buyers find in the market.

- Deeply discounted prices, generally 20%–70% below full-price retailers’ prices—The AUR is $11–$12 at Burlington Stores, $10–$11 at Ross Stores and $14–$15 at The TJX Companies, according to the companies’ latest available data.

- Frequent inventory deliveries—Off-price retailers report that store inventories are replenished often, sometimes two to three times per week, which helps to drive traffic.

- Physical retail presence—Off-price retailers are invested heavily in physical locations with few having an online presence.

Retailers are challenging the off-price sector’s model of offering unique merchandise in two ways: Discount retailers are expanding product categories to include décor, home and beauty to target new consumers; and big-box retailers and Amazon are deepening categories with private labels and exclusive collaborations, most notably in the apparel, home and beauty categories. These players are also offering consumers convenience via the online channel, which is currently a white space opportunity in the off-price sector. Big-box retailers and Amazon are also offering consumers multi-destination shopping.

- Learn more about how off-price is differentiated from competitors and what trends the sector is experiencing.

Retail Innovators

Below, we present retail innovators that offer relevant solutions for the off-price sector. As the sector is heavily invested in physical stores and is in the infancy of growing its online presence, key solutions include those that can help to facilitate the move to e-commerce, provide customer data analytics and offer omnichannel strategies.

Persado: Using AI To Drive Customer Engagement and Conversion in Marketing Campaigns

Persado uses an AI (artificial intelligence)-based platform to improve customer communication. Persado’s solution enables businesses to understand how specific words and phrases impact the performance of marketing campaigns. The company’s platform breaks down marketing creatives into six critical elements: narrative, emotion, descriptions, calls-to-action, formatting and word positioning. The platform uses multiple combinations of these elements to come up with the best-performing message to speak to each customer.

Companies leverage Persado’s platform to improve brand engagement and conversion through promotional emails, web, mobile (text and in-app) and social media ads. For example, a Fortune 500 retailer achieved $50 million of revenue growth over a one-year period using Persado’s platform. The company used homepage messaging which led to a 19% website conversion lift; leveraged Persado’s trigger email campaign which reduced cart abandonment; and improved brand messaging across sales and communication channels, offering personalized deals to customers. For the off-price sector, Persado’s solution can help retailers to improve consumer engagement simply by changing some of the words retailers use on social media, in customer email and on websites. Using AI, the company tests and creates the best-performing messages that resonate with consumers. Persado’s AI-generated content produces an average of 41% uplift in engagement above a brand’s standard performance for every message delivered.- Read our separate report, AI-Powered Language: A New Era of Enhanced Customer Engagement.

Fillogic: Using the Store as a Micro-Fulfillment Center

Fillogic helps retailers with fulfillment capabilities, enabling faster delivery and returns. The New York-based retail and logistics company was founded in 2018. It aims to maximize efficiencies for retailers and freight delivery networks via mall-based micro-distribution hubs. Its leaders have extensive experience in the retail industry with specific experience in the off-price sector. Bill Thayer, Co-Founder of Fillogic, was the former CIO and COO of Loehmann’s off-price department store, chief logistics officer at Century 21 off-price department store, and advised Macy’s when they launched Backstage.

Fillogic provides retailers a variety of core services, including last-mile fulfillment, store-based fulfillment, last-mile sortation, returns/reverse logistics and B2B (business-to-business) distribution. Fillogic has hubs at eight major shopping centers where items that are ordered online and fulfilled through stores are picked up by Fillogic staff and delivered to its “Delivery Provider Network.” Fillogic then sorts the packages and for pickup and delivery.

As the off-price sector is moving online, Fillogic’s retail and logistics services can help retailers to efficiently streamline and optimize fulfillment services, particularly as online fulfillment services may be a newer process for off-price retailers. Filllogic has aggregated its logistics processes and is able to lower fulfillment costs for retailers.

- Read our three-part Not Your Regular Mall-Based Store series for more on mall-based fulfillment.

What We Think

We expect the off-price market to recover with robust 7.1% year-over-year growth in fiscal 2022, following an already strong fiscal 2021, when sales increased by 51.7%. The growth is nearly at levels consistent with pre-pandemic growth levels; sector revenues grew at a CAGR was 8.4% from fiscal 2010 to fiscal 2019. Implications for Brands and Retailers Off-price online expansion will drive competition in home and women’s apparel.- We expect off-price expansion online to be one of the biggest differentiators for TJX HomeGoods and Nordstrom Rack in the home and women’s apparel categories, providing more competition to Burlington in home and T.J. Maxx in women’s apparel.

- We expect that with TJX HomeGoods moving online, the retailer will surpass Burlington in revenue to become the third-largest off-price retailer in terms of revenue. The addition of its online site will propel its growth even further forward as consumers will be able to have their furniture and home goods delivered.

- We expect that Nordstrom Rack’s online presence will create more competition for T.J. Maxx; both offer a combination of designer brands and unique selections of women’s apparel. While T.J. Maxx has an online presence, Nordstrom Rack has scaled its website which is extensive in terms of category offerings, search functionality and designer offerings. Nordstrom Rack is also offering consumers expanded services including BOPIS.

- Due to increased external competition to the off-price market from mass retailers including Target and Walmart, discount retailers and Amazon, off-price retailers will need to continue to provide compelling reasons for consumers to shop, particularly as off-price retailers offer physical-only channels of distribution.

- Second, while some off-price retailers have noted that an inflationary environment will be a draw for consumers to shop in the off-price sector, retailers including Burlington and Ross, which have lower AUR prices, may have less leverage to raise prices (i.e. competing on value only) as it will affect their margins.

- Off-price retailers can work with technology providers to improve operations across customer analytics, marketing and omnichannel solutions, including fulfillment.

- Real estate companies can work with off-price retailers to identify store growth opportunities by geography, as the off-price sector is growing quickly. Real estate partners can identify vacancies and market trends.

- We expect the off-price sector to explore growing retail trends including the shop-in-shop format and retail collaborations. Real estate partners can capitalize on initiatives by retailers, such as experiential, pop-up and hyper-local stores.