DIpil Das

Introduction

In this report, we examine the market size and trajectory of the US personal luxury goods market, major factors impacting the market, the competitive landscape, themes we are watching in 2022 and beyond and retail innovators in the space. This report only covers the personal luxury segment, which includes apparel, accessories, beauty, footwear, jewelry and watches, and excludes the secondhand luxury market and experiential luxury categories—such as art, hospitality, travel, vehicles and wines and spirits.Market Performance and Outlook

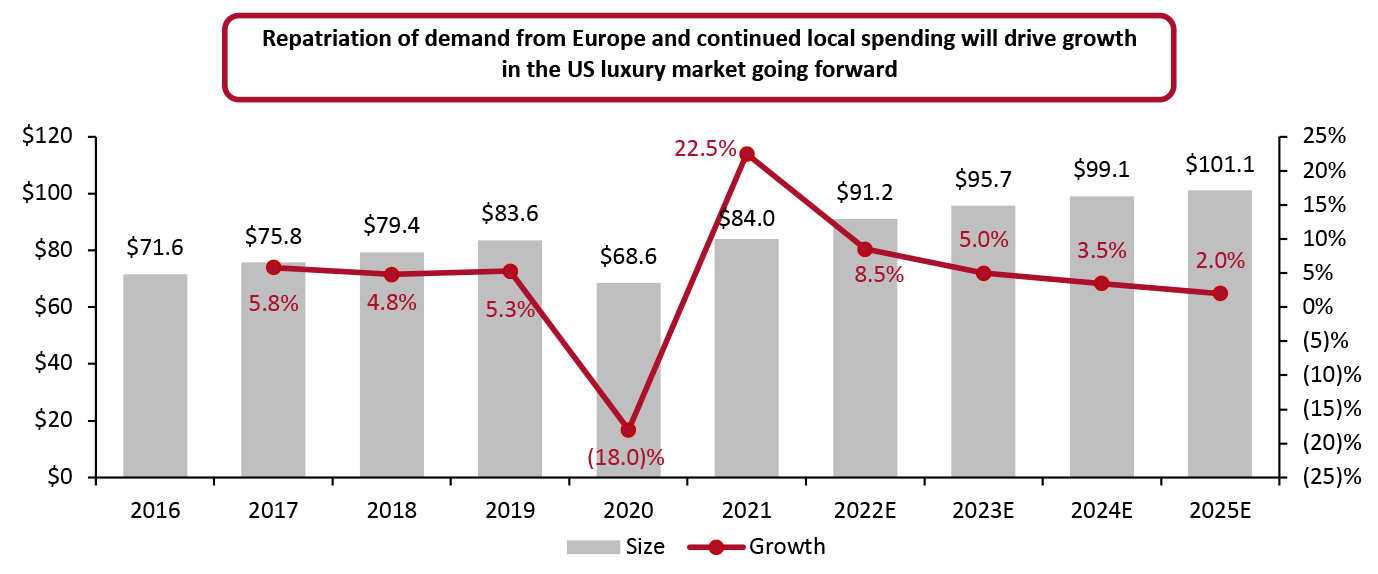

US Luxury Recovers Strongly, Continues Growth Toward $101.1 Billion in 2025 Coresight Research estimates that the US personal luxury goods market grew 22.5% year over year to $84.0 billion in 2021—surpassing pre-pandemic levels. US luxury is benefitting from an increase in local spending, following repatriation of demand amid pandemic restrictions.- We expect the US luxury market will increase by 8.5% to $91.2 billion by the end of 2022, driven by strong local consumption and a high share of affluent and young consumers.

- The Asian luxury market is a strong contender to the US but is currently reeling under an uncertain macroeconomic environment partly prompted by prolonged lockdowns in China. As Asia takes time to recover this year, we think the US and Europe will drive global luxury growth in 2022.

- Beyond 2022, we expect slow growth in the US as other markets with rising younger and middle-income populations—particularly Asia—draw luxury spending away from the US. While we expect China to become the world’s largest luxury market by 2025, the US will remain close behind.

Figure 1. US Personal Luxury Goods Market Size (Left Axis; USD Bil.) and YoY % Change (Right Axis; %) [caption id="attachment_150472" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Strong US Demand for European Luxury Goods

Source: Coresight Research[/caption]

Strong US Demand for European Luxury Goods

- In 2021, European luxury companies Hermès, Kering, LVMH, Moncler and Prada reported positive double-digit growth on a two-year basis for US sales. Meanwhile, US companies Capri Holdings and Tapestry reported sales levels lower than the same period in 2019.

- Most luxury companies on the Coresight 100 list reported a recovery in sales in 2021, led by China and the US, with a slower recovery in Europe due to extended lockdowns.

Market Factors

Localization of Demand and Affluent Consumers To Drive Growth Several factors are driving growth in the US luxury goods market:- Demand repatriation: Previously, many luxury shoppers from China and the US traveled to Europe, where several major brands are based, for their shopping. Over the last two years, however, with the limitations on travel, US shoppers began shopping domestically for luxury, repatriating demand to the country. We expect this behavior to continue in the coming years, with Hermès, Kering, LVMH and other European groups looking to expand within the US soon, per their recent earnings calls.

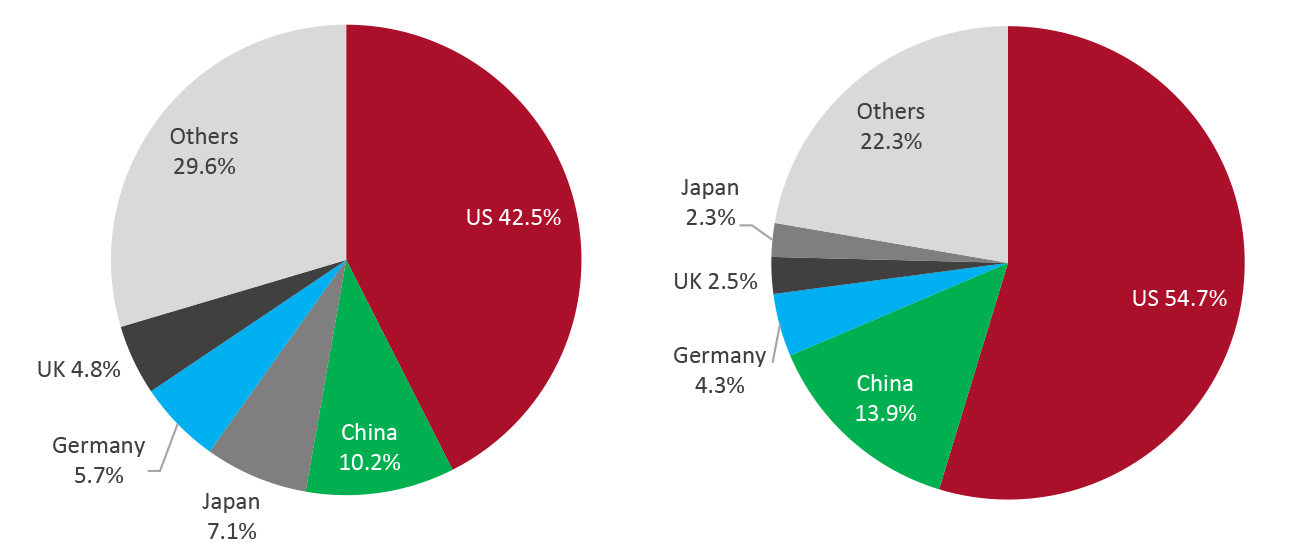

- High share of affluent consumers: The US is home to 22 million high-net-worth individuals (HNWIs)—those with a net worth over $1 million—as of 2020, accounting for 42.5% of the global total, according to data from Credit Suisse’s Global Wealth Databook 2021. Of this total, 110,850 individuals are ultra-high-net-worth individuals (UHNWIs) with assets exceeding $50 million. The US’s closest contender, China, had only about a quarter of that number of HNWIs and UHNWIs.

Figure 2. 2020: US Share of the World’s HNWIs (Left) and the World’s UHNWIs (Right) [caption id="attachment_150473" align="aligncenter" width="700"]

Source: Credit Suisse/Coresight Research[/caption]

Source: Credit Suisse/Coresight Research[/caption]

- Return to social events and gatherings: As the threat of Covid-19 recedes, socializing, working in physical office spaces, traveling and special events have started to become part of daily life once again. After wearing casual and loungewear for two years, consumers will seek to update their wardrobes with apparel and footwear suitable for these occasions, driving luxury sales.

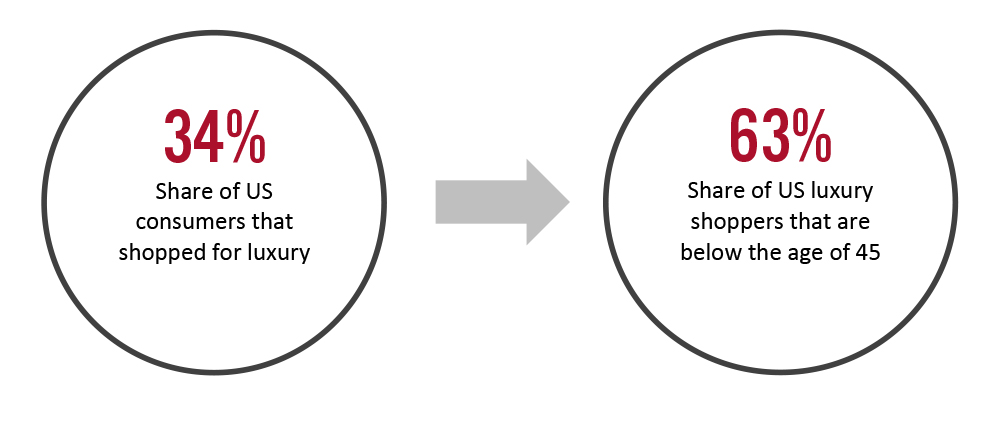

- Younger luxury consumers: In the US, luxury is being driven by a younger demographic. In our March 14, 2022, survey of US consumers, over one-third said they had shopped for luxury products in the last three months. Among those who had shopped for luxury, 63% were below the age of 45. While older luxury consumers may still have wealth and spending power, the younger demographic is growing and, as a result, becoming an essential segment for the sector.

Figure 3. US Consumers That Shopped for Luxury Goods in the Past Three Months [caption id="attachment_150474" align="aligncenter" width="700"]

Base: 448 US respondents aged 18+, surveyed March 14, 2022

Base: 448 US respondents aged 18+, surveyed March 14, 2022 Source: Coresight Research [/caption]

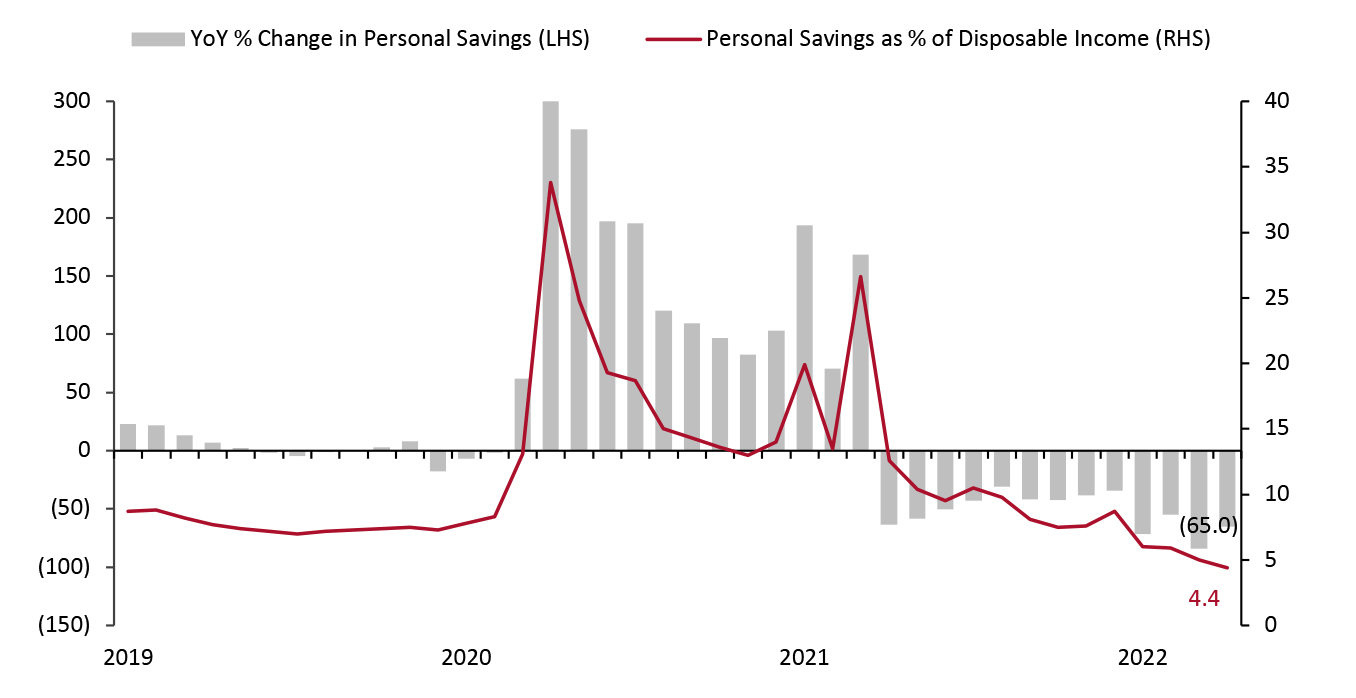

- Depleted savings: With rising inflation and economic uncertainty, US consumers are increasingly dipping into their savings, and this could be a potential headwind for luxury purchases by new earners and aspirational shoppers. As of April 2022, US consumers’ personal savings were down 65.0% year over year and personal savings as a share of disposable income was down to 4.4% from double-digit percentage shares at the same time last year and in 2020, based on data from the Bureau of Economic Analysis (BEA).

Figure 4. US Personal Savings: Year-Over-Year Change (Left) and As a Percentage of Disposable Income (Right) [caption id="attachment_150475" align="aligncenter" width="699"]

Through April 2022

Through April 2022 Source: BEA [/caption] Inflation

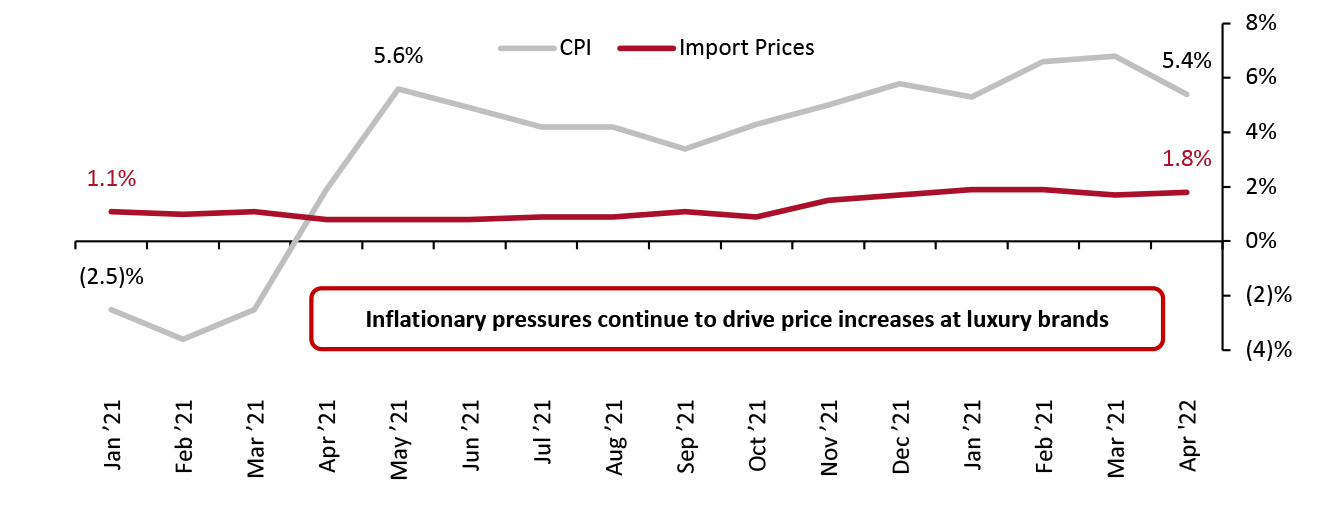

- Personal luxury goods cover several product categories. In this section, we discuss at inflation-related issues in the apparel and footwear segments specifically, as they comprise a significant portion of luxury sales.

- Apparel and footwear prices in the US rose steeply in May 2021—the US Consumer Price Index (CPI) rose by 5.0% overall, the most significant increase since the 2008 financial crisis—and have remained at high levels since. Meanwhile, import prices of textiles and textile products have also risen steadily, but at a lower rate than apparel and footwear CPI growth.

- Global supply chain disruptions continue, with brands and retailers across various sectors, including luxury brands, contending with increased raw material and shipping costs. While companies’ margins absorbed some costs early in the pandemic, it has become unfeasible to do so further. As a result, many luxury companies have turned to price increases.

- In its May 2022 earnings call, Tapestry stated that it has, so far, seen no negative impact from consumers on the price increases it has implemented. The company will continue to raise prices strategically through the year to handle inflationary headwinds.

- Likewise, Capri Holdings’ CEO John Idol remarked at a February 2022 conference held by Bank of America that the group has gradually increased prices at Jimmy Choo and Versace, and, compared to its peers in the industry, has room to raise prices further.

Figure 5. Apparel and Footwear Inflation in the US (% Change) [caption id="attachment_150476" align="aligncenter" width="699"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

Online Market

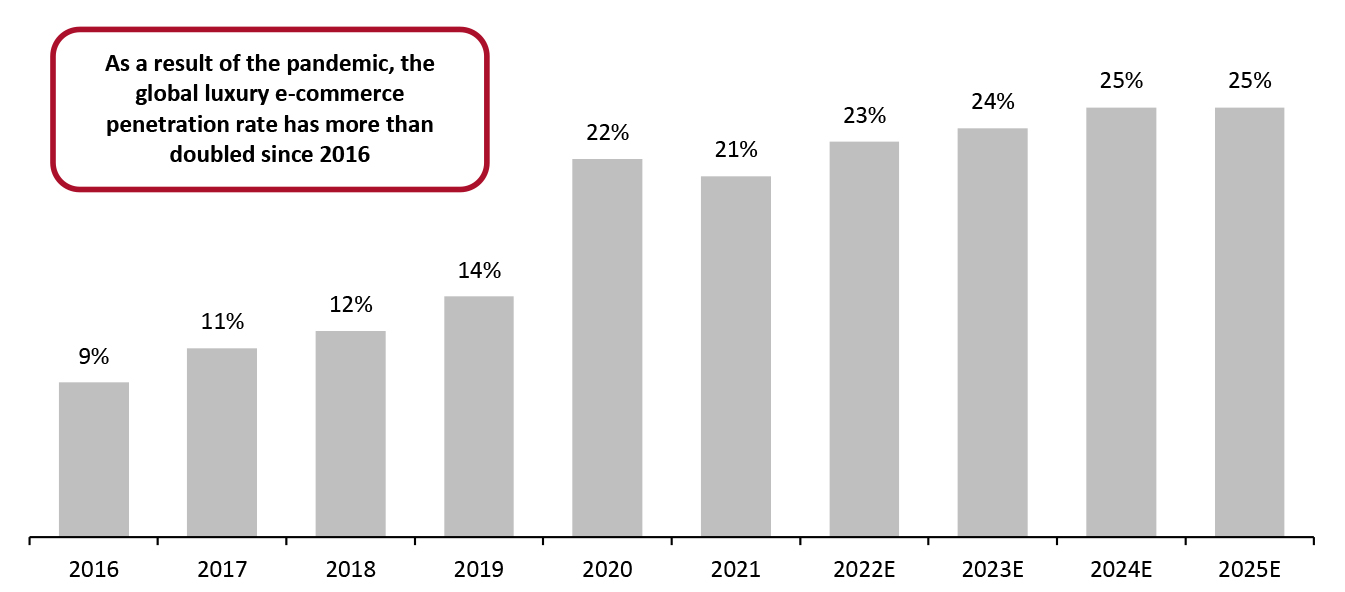

While luxury has been slow to adopt e-commerce, penetration rates in the US have typically been higher than in other mature retail markets. However, the pandemic forced luxury companies to confront the importance of e-commerce. Moving forward, we expect US e-commerce penetration rates to grow slowly considering their already high levels, as consumers return to shop in stores. Coresight Research estimates that online sales in the global personal luxury goods market totaled $71.7 billion in 2021—21.0% of the worldwide market—representing 19.9% growth. We expect luxury e-commerce sales to reach $83.7 billion in 2022, growing 16.6% from 2021 and accounting for 23.0% of the global market.Figure 6. Global: Luxury E-Commerce Penetration Rate (%) [caption id="attachment_150477" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Competitive Landscape

Global leader LVMH dominates the North American personal luxury goods market. This continued in fiscal 2021, when the company’s US sales doubled, up 69.7% on a two-year basis. It was also the first fiscal year that jewelry retailer Tiffany & Co. was integrated into the business. LVMH announced the acquisition of Tiffany & Co. in November 2019 and completed the purchase in January 2021. With travel still not at pre-pandemic levels last year, local consumer shopping drove US sales in 2021. CEO Bernard Arnault stated on LVMH’s January 27, 2022, earnings call that “selectivity and…great devotion by our sales forces and our ambassadors with local customers” helped create the company’s strong US growth. Kering, second in line after LVMH in North America, also witnessed a doubling in North American revenue, up 52.2% on a two-year basis. While the company does not provide its US revenue specifically, it is highly optimistic about the country, according to management comments during its full-year earnings call on February 17, 2022.The Group Managing Director at Kering, Jean-Francois Palus, remarked that the US is “young as a luxury market” and that the company has “had the opportunity to develop exclusive distribution strategies, in particular, rising online distribution but also in implementing new retail formats.” Palus also stated that Kering sees tremendous potential in second- and third-tier cities, such as Atlanta, Nashville and Austin. Gucci opened a new store in Austin in April 2022, shortly before Hermès opened a store in the same city.

Outside of Kering and LVMH, the US remains a strong market for other fashion-led European luxury brands, including Richemont, L’Oréal and Chanel, which all saw strong double-digit growth on both a year-over-year and two-year basis. However, while European luxury groups have performed well, accessory-focused American luxury groups Tapestry and Capri Holdings have been slow to recover in the region, posting negative growth and single-digit growth, respectively, on a two-year basis. Still, things are looking up for the American companies. In fiscal 2021, Tapestry increased its North American revenue by 18.5% year over year. Most recently, in its latest quarter (ended March 31, 2022), the company’s North American revenue was up 22.0% year over year, reflecting strong performances from all brands. Currently, the company forecasts robust growth in the region in fiscal 2022, as it plans to grow its customer base and reactive lapsed customers with a better assortment of products and more personalization in its digital engagement strategies. Capri Holdings’ fiscal 2021 Americas revenues were up 3.0% on a two-year basis and up 30% year over year—the company said the increase would have been greater if not for inventory constraints. The company’s CEO, John Idol, stated that it is confident about the strength of luxury consumption in the US, despite inflation headwinds.Figure 7. Major Luxury Companies’ Revenues (USD Bil.) [wpdatatable id=2086]

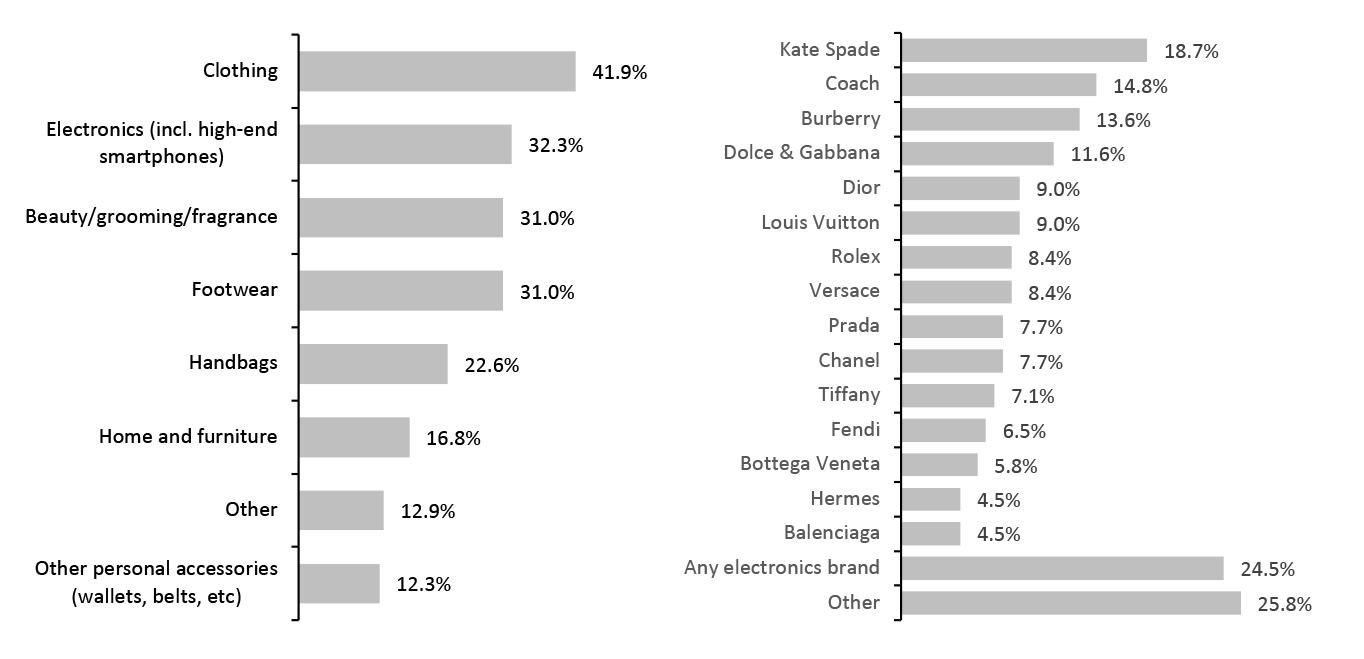

*Converted to USD at historical exchange rates Source: Company reports/S&P Capital IQ/Coresight Research Fashion-led brands and companies stand to do better in the US than those heavy on accessories, as a greater share of US consumers shop for clothing and footwear versus accessories, based on a Coresight Research survey conducted on March 14, 2022. However, despite clothing being a popular category, a greater share of Americans shopped for accessories-led brands Kate Spade and Coach—both owned by Tapestry—signaling greater interest in US-based luxury brands.

Figure 8. Luxury Goods Categories and Brands Shopped by US Consumers* [caption id="attachment_150478" align="aligncenter" width="700"]

*Respondents could select multiple responses

*Respondents could select multiple responses Base: 155 US Internet users aged 18+, surveyed March 14, 2022

Source: Coresight Research [/caption]

Themes We Are Watching

Cryptocurrency Payments Gucci has become a cryptocurrency leader in luxury, starting a pilot program in several US stores in May 2022. Tag Heuer and Balenciaga have made similar announcements and will soon begin accepting cryptocurrency payments online and in select US stores. We think more brands will follow suit and roll out cryptocurrency payment methods in the coming years. Expanding Store Networks Many working and affluent Americans moved from metro cities to smaller cities and suburbs during the pandemic; now, they have become more accustomed to shopping locally. Some luxury brands are meeting these consumers where they are and opening stores in smaller, suburban locations.- For more information on luxury companies opening stores in the United States, see our weekly US and UK Store Openings and Closures Tracker.

Retail Innovators

MarqVision is a platform that helps brands remove counterfeits from online marketplaces. Its platform uses artificial intelligence (AI)-powered image recognition and semantic analysis to identify and eradicate fake products. The startup’s reporting system automatically identifies and catalogs infringements across thousands of online marketplaces in 115 countries and automates takedown requests. Its machine-learning engine allows the company to acquire, assimilate and analyze large amounts of information, improving its ability to detect counterfeit products over time. MarqVision works with various luxury brands, including Bulgari, Ralph Lauren Korea and Tiffany & Co. In June 2022, the startup received a special mention at LVMH’s Innovation Awards in the Data and AI category. Obsess is a virtual store technology provider that enables brands and retailers to establish 3D stores, including virtual recreations of real-world locations, on their e-commerce platforms. The company also creates immersive AR/VR campaigns for marketing and brand engagement. Its clients include Coach, Christian Dior and Ralph Lauren, among others. In February 2020, Obsess opened Christian Dior’s “Dior Maison” virtual boutique, a digital recreation of the brand’s flagship store on the Champs-Elysées in Paris, France. Shoppers can “walk through” the store and discover products through imagery and sound that convey the notes of each perfume. Consumers can also view product details before purchasing through the platform. Seer is a software-as-a-service offering that helps luxury sales associates personalize sales content and showcase it to clients virtually through a range of channels, including email, messaging and video chat. Associates can also track various analytics, including real-time opens, clicks and views, and follow up with clients instantly.What We Think

The US is a bright spot for luxury companies. It follows closely behind China as one of the largest high-growth markets due to its high population of affluent consumers and familiarity with renowned luxury brands. The US, along with China, will drive global luxury sales growth in the years to come. Implications for Brands/Retailers- As consumers look to return to pre-pandemic levels of socialization, brands and retailers should provide opportunities for them to experience brands and mingle with other consumers in engaging retail experiences.

- Brands and retailers should leverage appropriate technologies and tools to remain relevant with increasingly digitally savvy consumers. Adopting cryptocurrency payment methods will help draw new consumers.

- As brands and retailers look to open stores in new areas where luxury consumers now reside, real estate firms can help them find locations for both stores and pop-up retail experiences.

- Technology vendors can help luxury brands and retailers to adopt new technology easily—such as integrating payment gateways that facilitate cryptocurrency payments or creating virtual stores—will benefit.