albert Chan

Introduction

As part of our Market Outlook series, we examine the size and trajectory of the US grocery market and key factors impacting its growth. We also cover the performance and outlook for online grocery in the US, as well as the overall market’s competitive landscape, retail innovators and three themes we are watching in 2022 and beyond.

Market Performance and Outlook

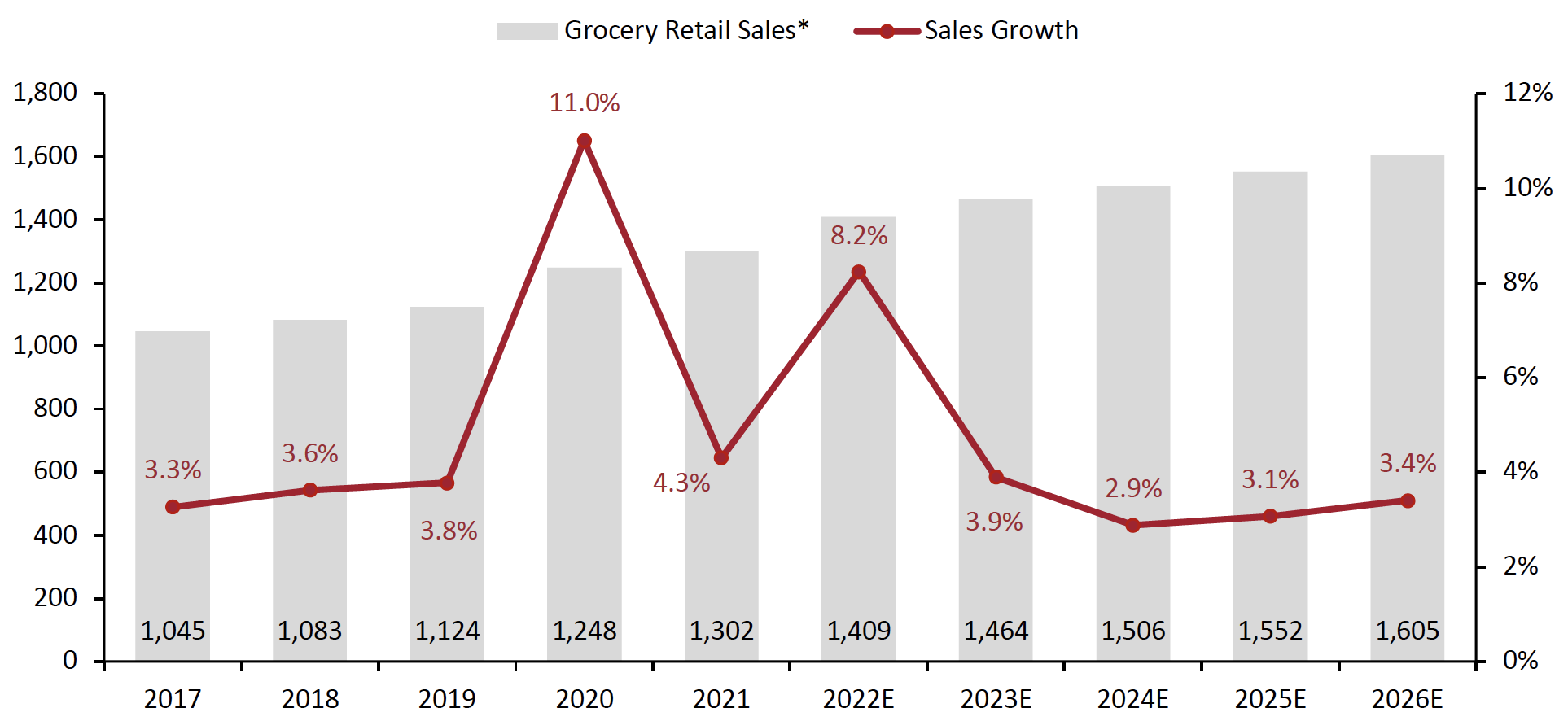

We expect the US grocery market growth to reach 8.2% in 2022, following moderation to 4.3% in 2021 after the pandemic-driven spike to 11.0% growth in 2020. Inflation, which soared by 12.2% year over year in June, will be a major driver of the sector’s growth in 2022. As such, we expect a slight real-term (or volume) retail sales decline in grocery in 2022. The US Department of Agriculture (USDA) has projected consumer price inflation rates for food categories in the range of 8.5% to 9.5% for the year. We expect the market to continue to see pressures from increased on-premise consumption as the price of dining out is rising less quickly than grocery prices—a trend that is making eating at restaurants more appealing. From 2023 to 2026, Coresight Research expects the market to grow at a moderate CAGR of 3.1%.Figure 1. US Grocery Market: Total Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_152576" align="aligncenter" width="700"]

*Includes sales of all products by food retailers and grocery sales of selected major retailers in the mass merchandiser, warehouse club and discount- store sectors

*Includes sales of all products by food retailers and grocery sales of selected major retailers in the mass merchandiser, warehouse club and discount- store sectorsSource: US Census Bureau/company reports/Coresight Research[/caption]

Market Factors

Increase in Private-Label Penetration

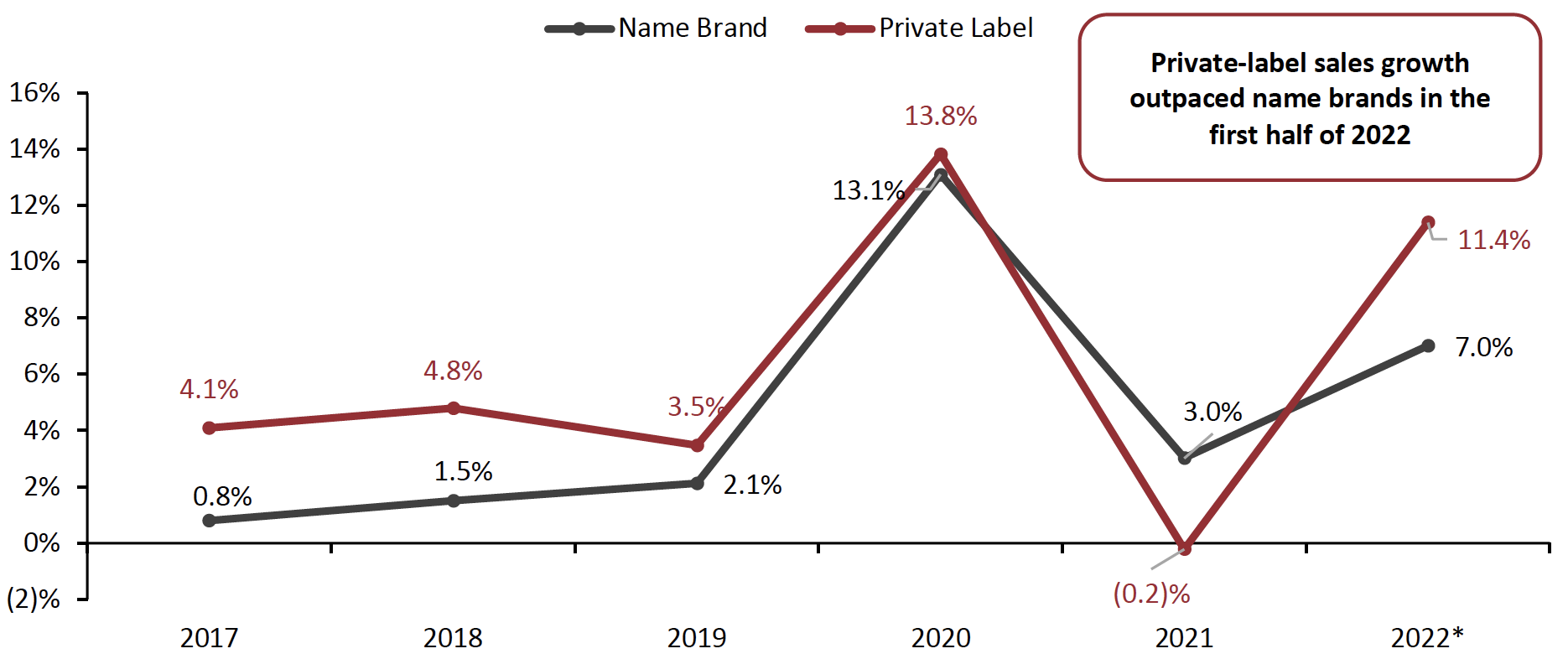

Private-label penetration in the food and beverages category rose steadily for five consecutive years to 2020—but ceded share to name brands in 2021, according to data analytics firm IRI, as shown in Figure 2.

Federal assistance programs and reallocation of household budgets due to reduced spending on vacations and dining out are factors that enabled shoppers to largely stick to trusted name brands amid pandemic uncertainty and steer away from private labels in 2021.

In 2022, the tide is turning again as consumers faced with inflated prices seek to stretch their budgets, making room for private labels to grow their market share. Private-label sales grew 11.4% year over year through July 10, 2022, versus 7.0% growth observed by name brands in the same period, as shown in Figure 2. Private labels accounted for 16.7% of total food and beverage sales through July 10, 2022—the highest penetration in the last five calendar years.

Figure 2. US: Market Breakdown, by Food and Beverage Name Brand and Private-Label Sales Value (% of Total Sales) [caption id="attachment_152577" align="aligncenter" width="700"]

Excludes online sales

Excludes online sales*YTD July 10, 2022

Source: IRI POS Data/Coresight Research[/caption]

Retailers on recent quarterly calls have also indicated that grocery shoppers are trading down to store brands:

- In its June 2022 earnings call, Kroger stated that its private-label sales saw identical (same-store) growth of 6.3% in the first quarter, outpacing name brands. The company added 239 new private-label products in the quarter.

- In its May 2022 earnings call, Target stated that its owned brand portfolio continues to grow at faster rate than total sales as consumers look for money-saving options for their meal solutions.

- In its first-quarter earnings call in May, Walmart said that customers are buying more private-label products as they feel inflation pressures.

As shoppers gravitate to private labels during uncertain economic times, we expect many to stick with those brands permanently if they find the quality comparable to or better than name brands. This may act as a boon for retailers with a strong roster of private-label products.

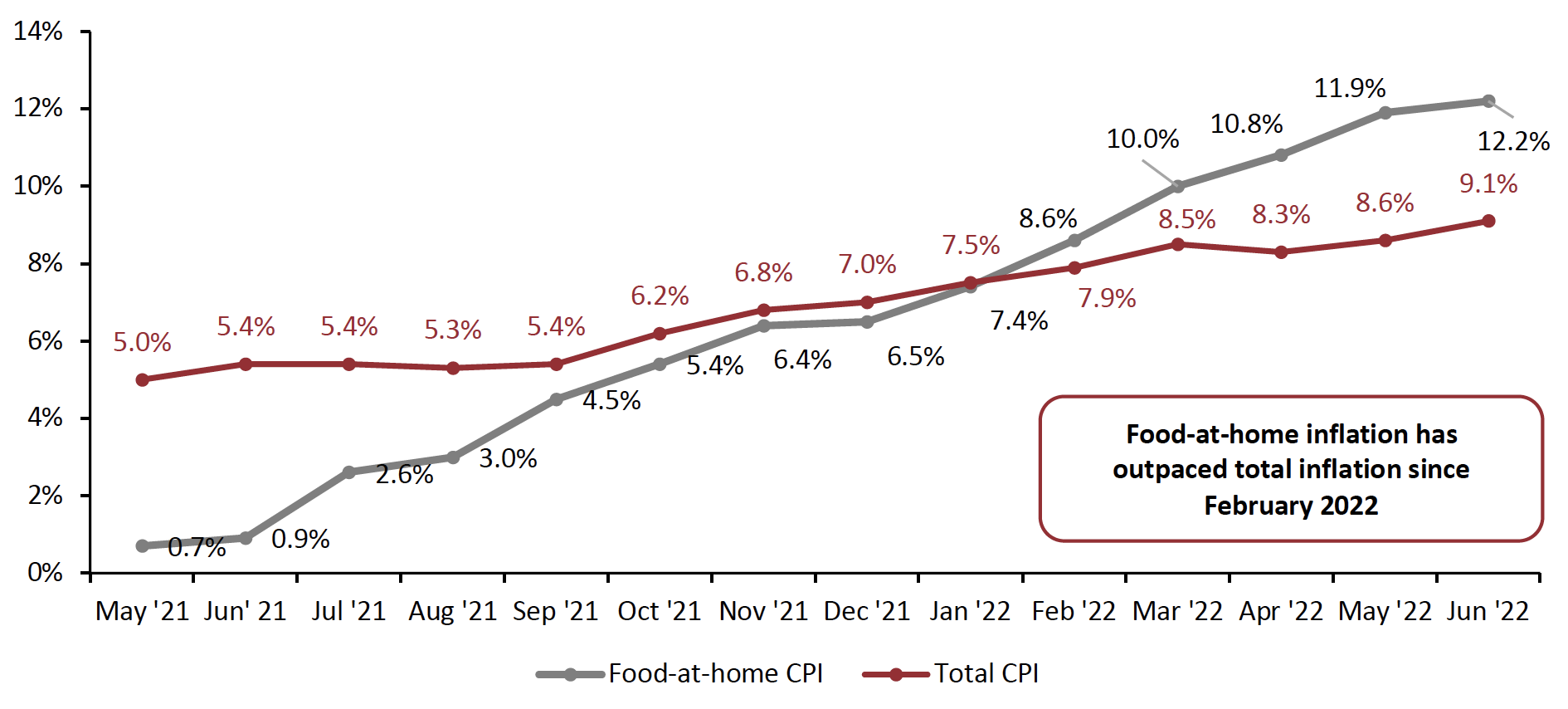

Inflation

US grocery inflation is running hotter than it has for many years. Food-at-home prices jumped further in June, increasing by 12.2%—the largest year over year hike since April 1979, according to the US Bureau of Labor Statistics (BLS). Categories experiencing the largest price hikes are typically meat and animal products. Prices for meat, fish, poultry and eggs surged by 11.7%, including an 18.6% jump for chicken products.

Increases in production prices of food commodities, elevated transportation and packaging costs, wage inflation and supply chain disruptions have all contributed to the rise in food prices. In its June update, the United States Department of Agriculture (USDA) updated its 2022 forecasts for food-at-home price inflation to a range of 8.5% to 9.5%, higher than the February forecast of 1.5% to 2.5%.

Figure 3. Food-at-Home and Total Inflation (YoY % Change) [caption id="attachment_152578" align="aligncenter" width="700"]

Source: BLS[/caption]

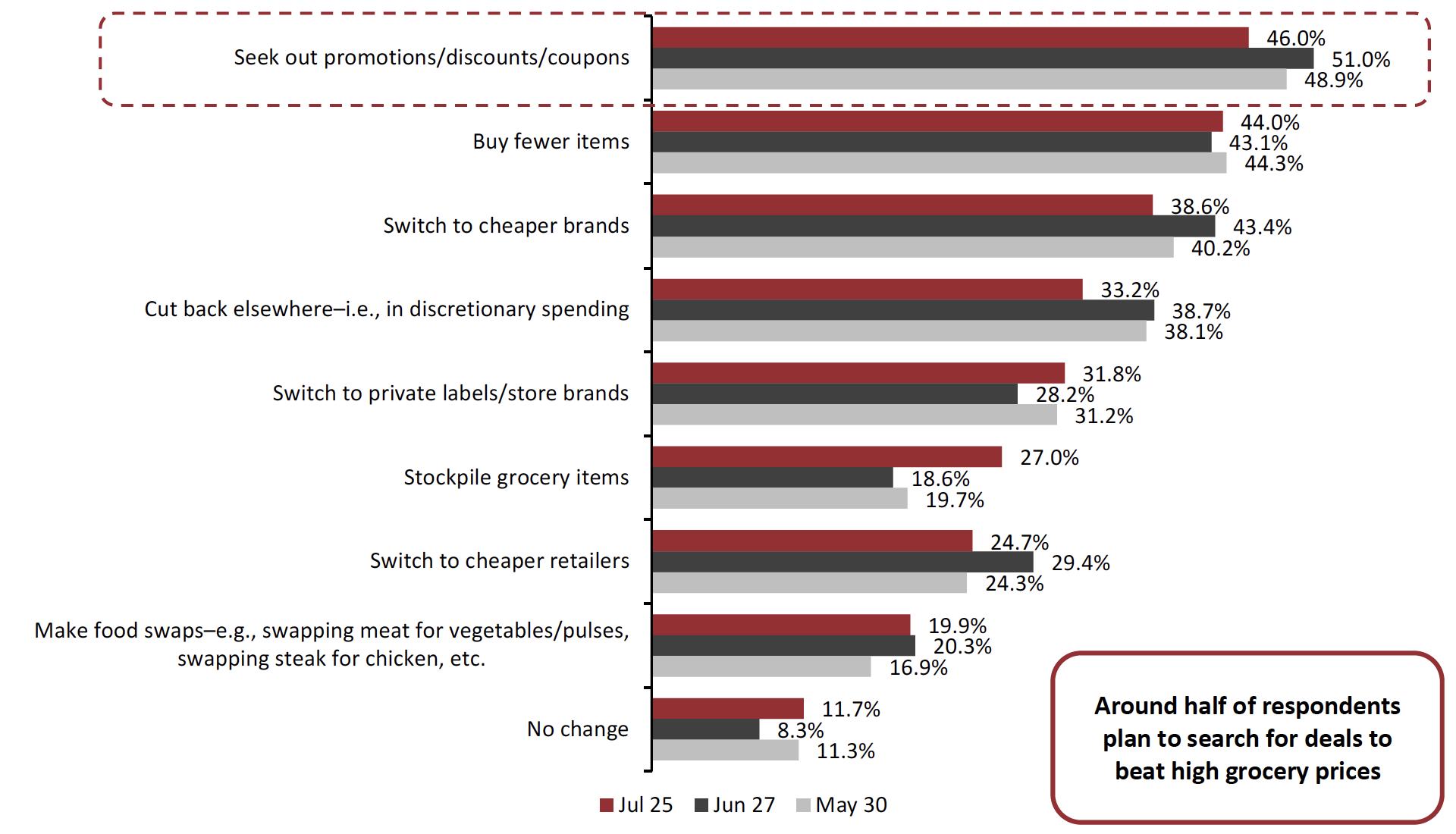

Although demand for groceries is inelastic, higher prices are driving consumers to change their grocery shopping habits. According to Coresight Research’s consumer surveys conducted on May 30, June 27 and July 25, around half of respondents who have noticed price rises indicated they are more actively seeking out promotions and discounts, while around four in 10 shoppers said they are opting for less expensive brands.

Source: BLS[/caption]

Although demand for groceries is inelastic, higher prices are driving consumers to change their grocery shopping habits. According to Coresight Research’s consumer surveys conducted on May 30, June 27 and July 25, around half of respondents who have noticed price rises indicated they are more actively seeking out promotions and discounts, while around four in 10 shoppers said they are opting for less expensive brands.

Figure 4. Respondents Who Have Observed Inflation: How They Have Changed, or Expect To Change, Their Shopping Habits in Grocery (% of Respondents) [caption id="attachment_152579" align="aligncenter" width="700"]

Base: US respondents aged 18+ who had observed recent price rises in retail

Base: US respondents aged 18+ who had observed recent price rises in retailSource: Coresight Research[/caption] Amid all-time highs in gas prices, consumers are likely consolidating their grocery trips and shopping. In its April earnings call this year, Albertsons stated that consumers are beginning to return to mission-driven shopping behavior of making fewer grocery trips while buying more in each basket—likely in an effort to cut down on driving. We expect this trend to provide a tailwind to grocery-heavy one-stop retailers such as Walmart and Costco in the short to medium term. Grocery retailers are navigating the challenging operating environment by selectively passing over costs to their customers—using data analytics and elasticity pricing models to inform decisions. These retailers are also capitalizing on their flexible procurement models and diversifying the supplier bases, including switching to lower-cost suppliers.

- In its June earnings call, Kroger stated that the company has increased its prices using an elasticity pricing model. Despite price increases, the company claims its price spread versus competitors has marginally widened. Kroger is also using personalization and promotional activities to target offers to its customers who are seeking value.

- In its May earnings call, Ahold Delhaize said that it is increasing prices by considering consumer elasticity via its shoot cost models, which deconstruct products down to component materials, such as raw materials, packaging, energy, transportation and labor. The company also said that negotiating with suppliers to mitigate price increases where possible.

- In its May earnings call, Sprouts Farmers Markets said that it has passed through inflationary costs to consumers and is testing promotional strategies to drive positive traffic without sacrificing overall gross margin.

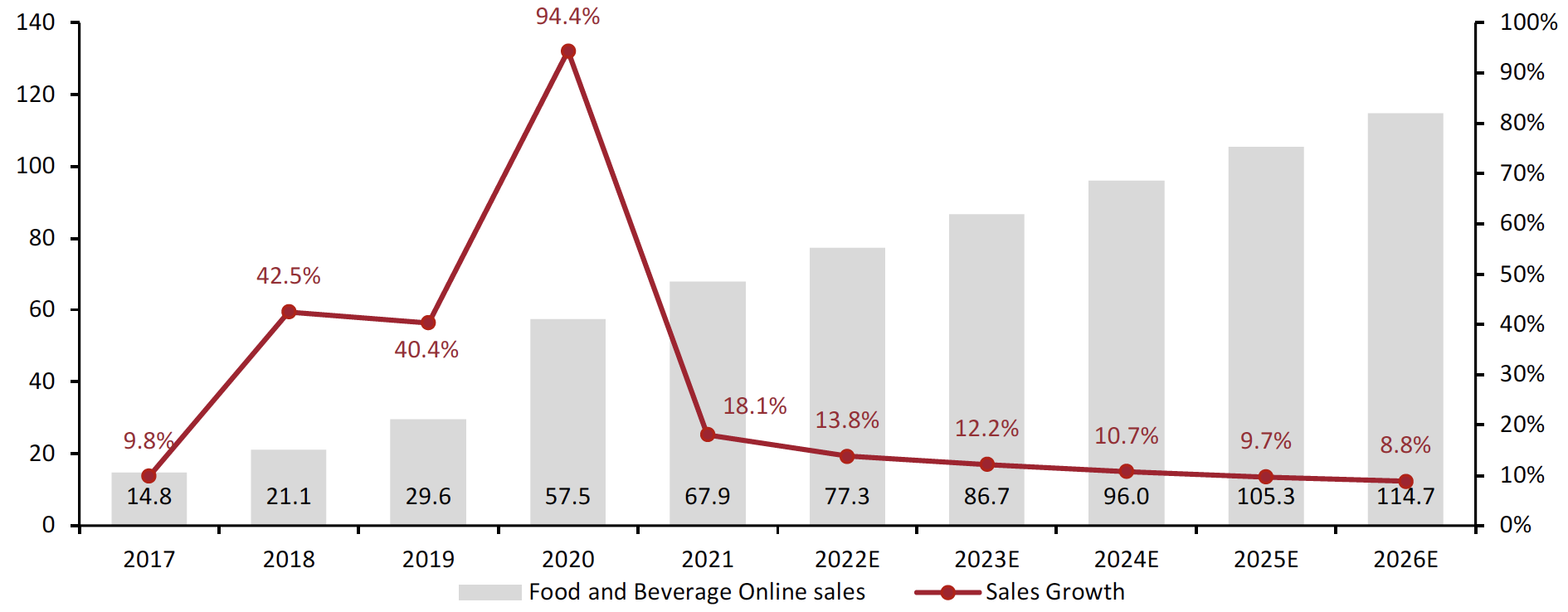

US Online Grocery Market Performance and Outlook

We expect online food and beverage sales growth to taper off further to 13.8% in 2022, given the slowdown in pandemic-driven online demand as consumers increasingly return to stores, partly offset by inflation and some channel stickiness. This is supported by Coresight Research’s annual grocery survey, conducted in March 2022, which found that the proportion of respondents that shopped online in the last 12 months has declined from the pandemic-driven highs of the previous survey.Figure 5. US Online Food and Beverage: Total Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_152580" align="aligncenter" width="700"]

Source: IRI E-Market InsightsTM/Coresight Research[/caption]

Source: IRI E-Market InsightsTM/Coresight Research[/caption]

Competitive Landscape

The US grocery market is highly fragmented and regionalized. Many notable retailers in the US grocery space are non-traditional grocers—four of the eight largest food retailers have sizeable general merchandise offerings (Walmart, Costco, Sam’s Club and Target). We estimate that the top four retailers accounted for 41.8% of total grocery sales in 2021, with Walmart accounting for around 20% of the market.

We believe that grocery discounters such as Aldi will continue to exert margin pressure on retailers, since they attract inflation-impacted, price-sensitive customers while rapidly expanding their brick-and-mortar store fleets. Meanwhile, we expect Amazon to also cause market disruption as it builds out its multichannel grocery model by stepping up its Amazon Fresh store footprint.

Figure 6. Top Eight US Grocery Retailers’ Revenue for Their Latest Reported Fiscal Year (USD Bil.) [wpdatatable id=2162] Year ends for fiscal 2021: January 31, 2022, at Walmart and Sam’s Club; January 29, 2022, at Kroger and Target; August 29, 2021, at Costco; February 26, 2022, at Albertsons; January 2, 2022, at Ahold Delhaize; December 25, 2021, at Publix Source: Company reports/Coresight Research

Where Consumers Are Shopping and What They Are Buying

Our weekly US consumer surveys show Walmart as the most-shopped grocery retailer, with around half of respondents indicating that they bought food products from the retailer in the prior two weeks. By number of respondents, the top five grocery retailers are non-specialists.

Figure 7. All Respondents: Which Retailers They Have Bought Food Products from in the Past Two Weeks (% of Respondents)

[wpdatatable id=2163] Base: US respondents aged 18+ *Kroger banners include City Market, Fred Meyer, Harris Teeter, King Soopers, Kroger, Ralphs and Smith’s Food & Drug **Ahold Delhaize banners include Food Lion, Giant, Hannaford and Stop & Shop Source: Coresight ResearchThemes We Are Watching

Positive Momentum Continues for Discounters Amid High Inflation

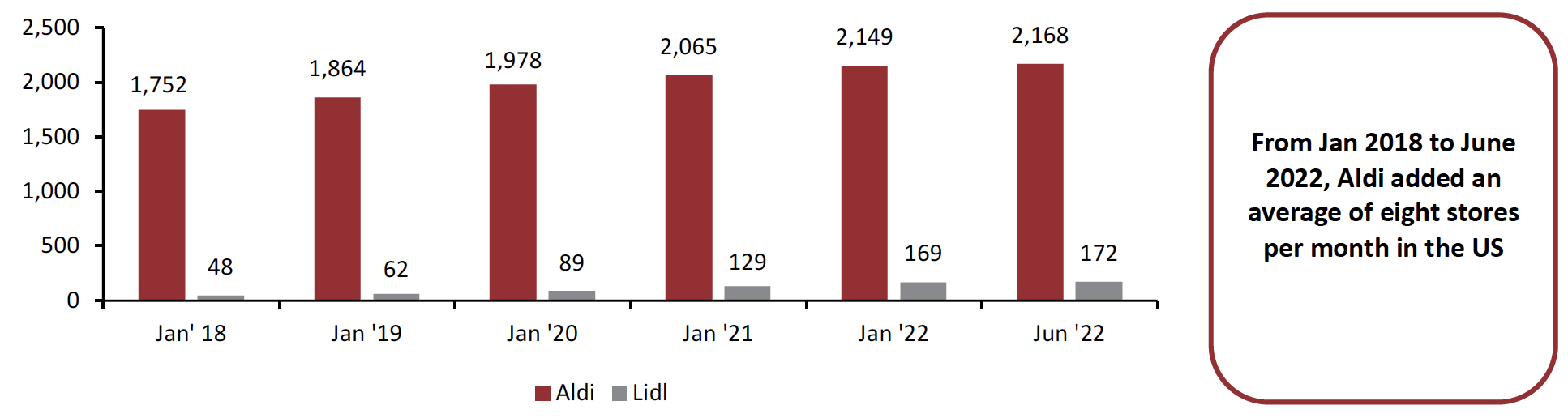

Grocery discounters have deepened their foothold in the US over the past few years by attracting a broad base of budget-conscious customers. They are set to be clear beneficiaries in the current inflationary environment as consumers attempt to stretch their spending dollars by shifting to retail channels that emphasize value. The two most prominent discounters, Aldi and Lidl, are well positioned to grow their US market share among an increasingly price-driven consumer base.

Aldi has established a strong presence in the US, with 2,168 stores as of June 2022. In keeping with its tradition of rapid growth, in February 2022, Aldi announced plans to open approximately 150 new stores in 2022. The grocer also entered its 38th state with the opening of a new store in Louisiana in February. The expansion plans follow on from Aldi’s 2017 announcement of its aim of becoming the third-largest grocery retailer by store count in the US by the end of 2022. According to a February 2022 press release by the retailer, it is “on track” to meet its goal this year.

Contrary to Aldi’s longstanding US presence, Lidl only entered the US market in June 2017 and operates 172 store locations as of June 2022. However, the retailer has made its intentions clear, announcing in April 2020 that it is building a network of distribution centers along the Eastern Coast that will service supply chain needs for around 1,500 stores.

Figure 8. US Store Count: Aldi and Lidl

[caption id="attachment_152581" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

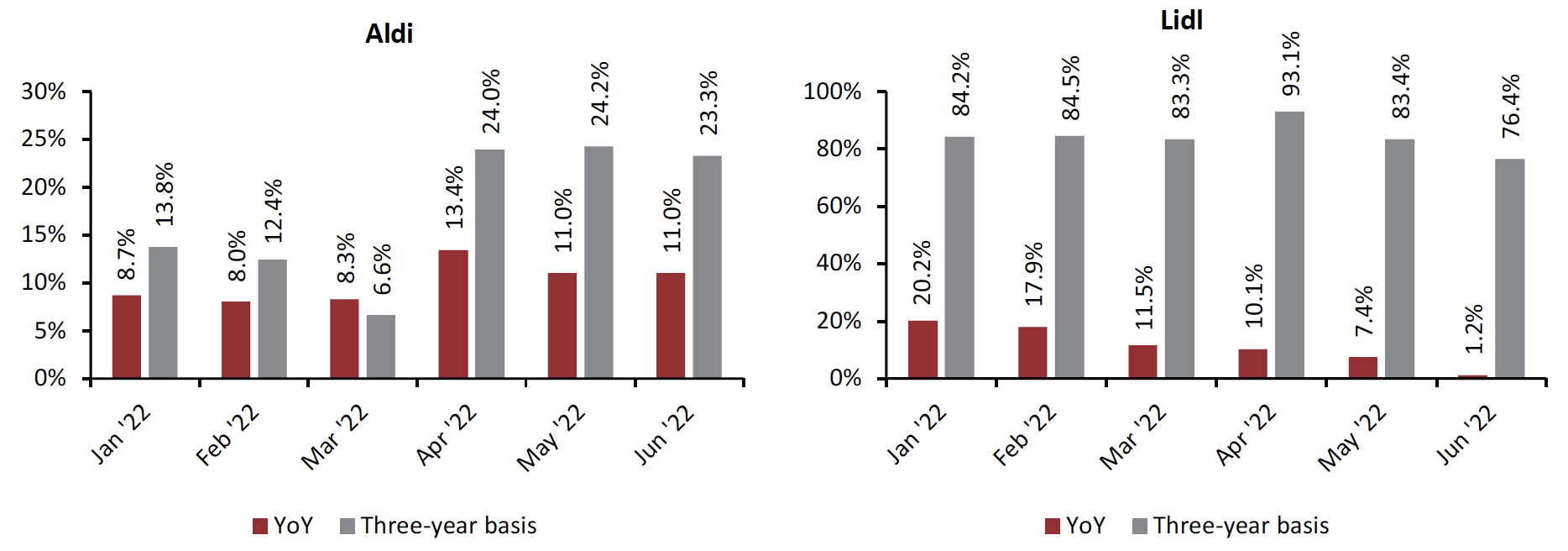

The growth in Aldi and Lidl’s foot traffic data suggests that consumers are shopping for cheaper alternatives. In June 2022, Aldi saw an 11.0% year-over-year increase in traffic and a 23.3% increase relative to June 2019. Although the Lidl brand is still comparatively new in the US, it is seeing strong growth compared to the same period three years ago. Much of the foot traffic growth is due to new store openings by Aldi and Lidl, but we believe low prices are also playing a role in attracting high visit volumes.

Source: Company reports/Coresight Research[/caption]

The growth in Aldi and Lidl’s foot traffic data suggests that consumers are shopping for cheaper alternatives. In June 2022, Aldi saw an 11.0% year-over-year increase in traffic and a 23.3% increase relative to June 2019. Although the Lidl brand is still comparatively new in the US, it is seeing strong growth compared to the same period three years ago. Much of the foot traffic growth is due to new store openings by Aldi and Lidl, but we believe low prices are also playing a role in attracting high visit volumes.

Figure 9. Aldi and Lidl Monthly Visit Growth (% Change) [caption id="attachment_152582" align="aligncenter" width="700"]

Source: Placer.ai/Coresight Research[/caption]

Source: Placer.ai/Coresight Research[/caption]

We believe that grocery discounters will remain a disruptive force and an increasingly competitive threat to traditional retailers in the coming years. Their growth will impact customer satisfaction among conventional retailers, likely pushing down reference prices among many shoppers. Rival retailers competing for price-sensitive customers must be prepared to fight even harder for share of shoppers, including through more intelligent and targeted promotions, which can be served by leveraging loyalty programs more effectively.

Read more in our Aldi vs. Lidl Head-to-Head report.

Quick Commerce Faces Adjustment Period After Pandemic Highs

The online grocery boom in 2020 supported the emergence of a micro-industry of vertically integrated players that promise to deliver grocery essentials in under 15 minutes, competing with more established operators that typically offer longer delivery windows. Investors bet big on the emerging quick-commerce market, with several delivery companies securing significant seed or sequential financing rounds in 2021.

However, the market has seen many of those vertically integrated startups drop out in the first half of 2022:

- 15-minute grocery delivery service JOKR announced its exit from the US market in June 2022 to focus on its core Latin American business.

- Buyk, a New York-based ultrafast grocery delivery startup filed for Chapter 11 bankruptcy in March after ending operations in New York City and Chicago.

- Fridge No More, a Brooklyn-based delivery provider operating in New York City and Boston, shut down its business in March “due to growing competition and other industry related issues,” as posted on the company’s Twitter account.

- Instant grocery delivery company 1520 shut down in December after less than one year of operation.

There are further signs that remaining quick-commerce players are under considerable pressure due to dwindling investor funding and a challenging economic environment:

- It was reported in July this year that Gopuff is laying off 10% of its staff and plans to close 76 warehouses “to accelerate its timeline to profitability.” Gopuff already laid off more than 400 employees in March, equating to 3% of its global workforce. The layoffs were part of an internal restructuring aimed at improving its financial performance, according to the company.

- In May 2022, Gorillas announced that it is shifting its focus from growth to profitability to strengthen its position in the long term. As such, the company will lay off 300 employees globally and tighten its focus on the five core markets that account for 90% of its revenue—Germany, France, the Netherlands, the UK and the US. The company added that it is looking at “all possible strategic options” in Spain, Denmark, Italy and Belgium, the four other markets that it currently operates in.

- It was reported in May that Getir will slash its global workforce by around 14%. In addition, the company stated that while it will cut back on marketing and expansion, it will not pull out of any markets.

While venture capitalists invested nearly $4 billion in the ultrafast global delivery market in 2021, up from $500 million the year before, according to financial data provider Pitchbook, the uncertainty in the current macro environment has caused investors’ enthusiasm to wane as companies fail to show a short-term path to profitability.

The abrupt failure of the startups due to the inability to secure capital quickly underscores a fundamental issue with their businesses. Vertically integrated delivery companies are capital-heavy startups. Labor costs are high, as delivery riders are more likely to be classified as employees than as gig workers. Intense competition forced many companies to offer large discounts to customers to capture market share. The infrastructure also requires fulfillment centers to be near customers’ homes in expensive urban spaces. As a result, most startups struggled to demonstrate a clear path to profitability in the current environment, amid growing fulfillment costs, expensive marketing, a slowdown in pandemic-driven online demand and other challenges affecting the world economy.

Existing players are seeking to diversify their operating models to trim losses. For example, Getir is seeking franchisees for its dark stores, Gopuff has expanded its delivery model to include higher-margin products including liquor and ready-to-eat pizza, and Gorillas has launched proprietary private-labels packaged products.

We believe that he current shakeout will ultimately benefit the existing operational players, including Gopuff and Getir, as they restructure their business operations to focus on profitability. Diminished competition will also enable them to increase their prices and delivery fees, which will help improve unit economics and grow margins.

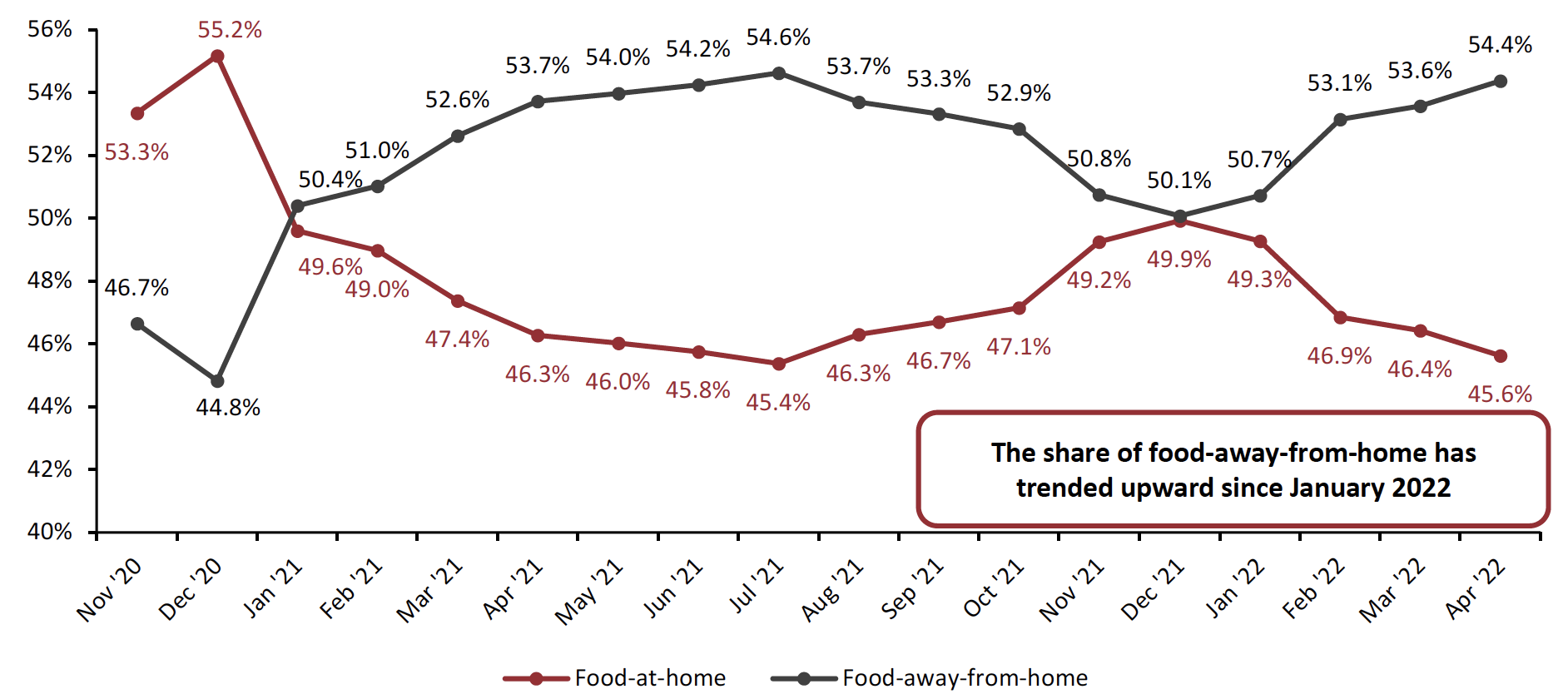

Return to On-Premise Consumption

While food-at-home (food purchased from supermarkets, convenience stores, warehouse club stores, supercenters and other retailers) dominated food spending throughout 2020, this trend reversed in January 2021 as consumer mobility and increased willingness to return to pre-pandemic activities boosted food-away-from-home sales (food purchased from restaurants, fast-food places and other away-from-home eating places). The gap narrowed in the final months of 2021, with increased Covid-19 cases in the US benefitting at-home consumption. The food-away-from-home share has risen since the beginning of 2022 and represented 54.4% of total monthly US food sales in April.

We believe that a continued increase in consumer mobility and a gradual return of workers to offices will pressure food-at-home sales in the coming months. Additionally, existing structural factors such as an acceleration in spending on services over goods will likely contribute to more sustained shifts of food spending from retail to foodservice outlets in 2022 and beyond.

Figure 10. Total US Food Expenditures: Food-At-Home Spending Versus Food-Away-From-Home Spending (% Share) [caption id="attachment_152583" align="aligncenter" width="700"]

Excludes food furnished, donated, home produced, and served at educational institutions

Excludes food furnished, donated, home produced, and served at educational institutionsSource: USDA/Coresight Research[/caption]

Retail Innovators

One Door

One Door is a developer of cloud-based merchandising software designed to optimize goods execution at each store for leading brands. The company's retail merchandising platform, Merchandising Cloud, leverages advanced technologies such as artificial intelligence (AI) and computer vision to help retailers better plan, communicate, execute and analyze their end-to-end merchandising efforts.

One Door’s Merchandising Cloud platform helps retailers consolidate key merchandising data into a single platform and provides automation capabilities that enable HQ teams to create and localize their merchandising plans around five to eight times faster than conventional methods, according to the company.

Nogin

Nogin offers a commerce-as-a-service (CaaS) full-stack e-commerce platform that includes research and development, sales optimization, machine learning, and AI-driven marketing and fulfillment. The company offers services such as onboarding and discovery, assessment of the critical business issue, roadmap development, project management, client support, product management, reporting and analytics, thereby helping global brands to drive profitability.

According to Nogin, its CaaS offerings can help brands and retailers achieve savings across various categories—specifically, 30%–40% savings on fulfillment and returns; 40% on free shipping; 10%–20% on discounting and promotions through data intelligence; and 20%–30% on marketing spend through algorithms, leading to increased sales, profits and conversion rates.

Trax

Trax offers a computer vision and analytics platform that enables grocery retailers and consumer packaged goods manufacturers to track stock on shelves and optimize their in-store execution and merchandising strategies. The company’s platform employs proprietary image-recognition technology, machine learning and the Internet of Things to turn everyday shelf images into actionable insights. From those insights, retailers and brands can take immediate action to improve on-shelf conditions using either their own teams or Trax’s on-demand retail workforce, resulting in positive shopper experiences and unlocked revenue opportunities at all points of sale.

What We Think

Grocery retailers should adapt to continued shifts in consumer spending as inflation impacts household budgets. Raising prices effectively without alienating shoppers will require retailers to monitor product price elasticity across channels and tailor revenue management strategies accordingly to maximize sales and margins. Retailers should use promotions strategically to drive growth where there is greater price elasticity.

Implications for Retailers

- In the current inflationary environment, private labels will come to the forefront because of their perceived economic value. Retailers can look to boost private brand adoption by increasing brand awareness among shoppers, such as by using social media to promote their brands. Retailers should also look to promote the message of wellbeing and sustainability around these products, for instance, by displaying product origin and sourcing details on packaging.

- We believe retailers with significant store overlap with Aldi or Lidl could be at serious risk of facing margin pressure in coming years. Additionally, the rapid expansion of these grocers—which remain predominantly offline retailers—could soften online grocery growth in those regions in the US where they establish a meaningful presence.

- US quick commerce space faced an adjustment period with many startups exiting and other players shifting their strategy from expansion to retrenchment. However, we believe the market for rapid grocery delivery is far from over. We expect the surviving players to emerge stronger as they diversify their operating models through category expansion and retail partnerships, improve their unit economics by optimizing fees and pricing and grow digital ads business to add incremental revenue.

Implications for Technology Vendors

- Technology vendors can provide tools that help retailers leverage data insights to better deal with inflationary challenges and more intelligently pass on costs to consumers. Through a data-driven approach, the tools can help retailers analyze various pricing scenarios to find a balance between satisfying customers, driving increased sales and optimizing profit margins.

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.