DIpil Das

What’s the Story?

In this report, part of our Market Outlook series, we examine the size and trajectory of the US grocery market and key factors impacting growth. We also cover the performance and outlook for online grocery in the US, as well as the overall market’s competitive landscape, retail innovators and three themes we are watching in 2021 and beyond.Total US Grocery Market Performance and Outlook

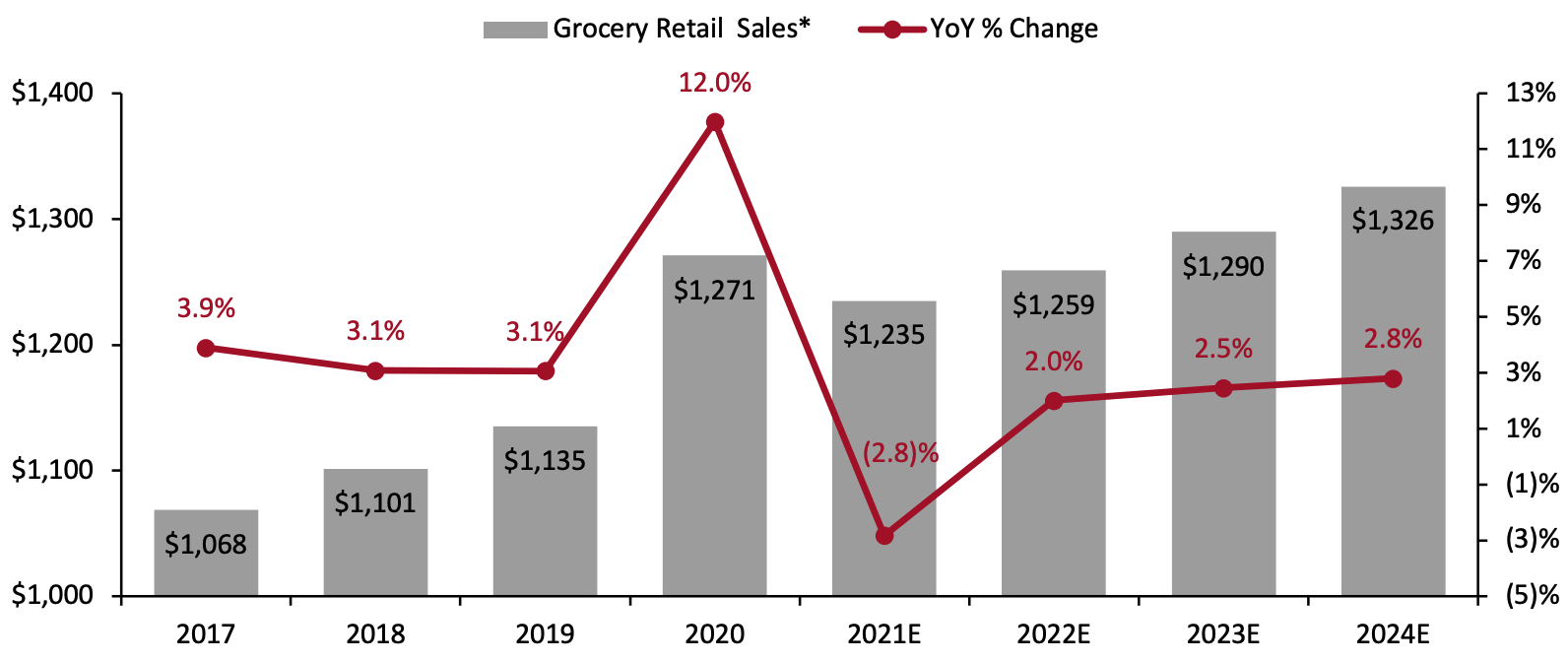

Coresight Research estimates that the US grocery market reached $1.27 trillion in 2020, hitting record growth of 12% year over year. The growth was fueled by panic buying and stockpiling as the pandemic hit and the more sustained shift of food dollars from service spending to grocery retailers as the pandemic stretched on through the year. We expect the US grocery market to decline by 2.8% in 2021, assuming that foodservice demand moves closer to normalcy in the second half of the year and as we cycle tough comparisons from 2020. Covid-19 cases in the US have edged downward since the beginning of January 2021 and we expect consumers to become increasingly confident in returning to more normal ways of living, working and spending. Many grocery retailers have highlighted a sales slowdown from the year-ago period.- Grocery Outlet reported an 8.2% decline in comparable sales in its first quarter, ended April 3, 2021.

- In its earnings call for the quarter ended May 22, 2021, Kroger stated that it expects comparable store sales to decline by 2.5–4% in its fiscal 2022.

- Sprouts Farmer’s Market announced guidance of decline in the low to mid-single digits in comparable sales for its fiscal 2022.

Figure 1. US Grocery Market: Total Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_129407" align="aligncenter" width="700"]

*Includes sales of all products by food retailers and grocery sales of selected major retailers in the mass merchandiser, warehouse club and discount-store sectors

*Includes sales of all products by food retailers and grocery sales of selected major retailers in the mass merchandiser, warehouse club and discount-store sectorsSource: US Census Bureau/Company reports/Coresight Research[/caption]

Market Driver: Pandemic-Induced Stickiness Will Continue To Fuel Food-at-Home Demand

The Covid-19 pandemic shifted foodservice dollars toward grocery retail, reversing food consumption trends and likely driving long-term implications. Many grocery retailers have indicated that behavior changes resulting from the pandemic will create tailwinds in the years ahead for food-at-home demand.- In its fiscal-year earnings call on February 17, 2021, Ahold Delhaize highlighted that many consumers have found a new love for eating at home and found new ways to engage with its brands, through online and in-store channels and these behaviors will have a lot of stickiness.

- In its third-quarter earnings call on January 12, 2021, Albertsons noted that the shift to more flexible workweeks and work-from-home routines should lead to consumers eating more breakfasts and lunches at home. The company added that many consumers “rediscovered their passion for cooking” during the prolonged pandemic and are prioritizing healthy and fresh product purchases.

- In its second-quarter earnings call on September 12, 2020, Kroger noted that consumers have grown accustomed to eating and cooking more meals at home due to the pandemic and that it expects this behavior to continue for the foreseeable future.

Market Challenge: A Return to On-Premise Consumption

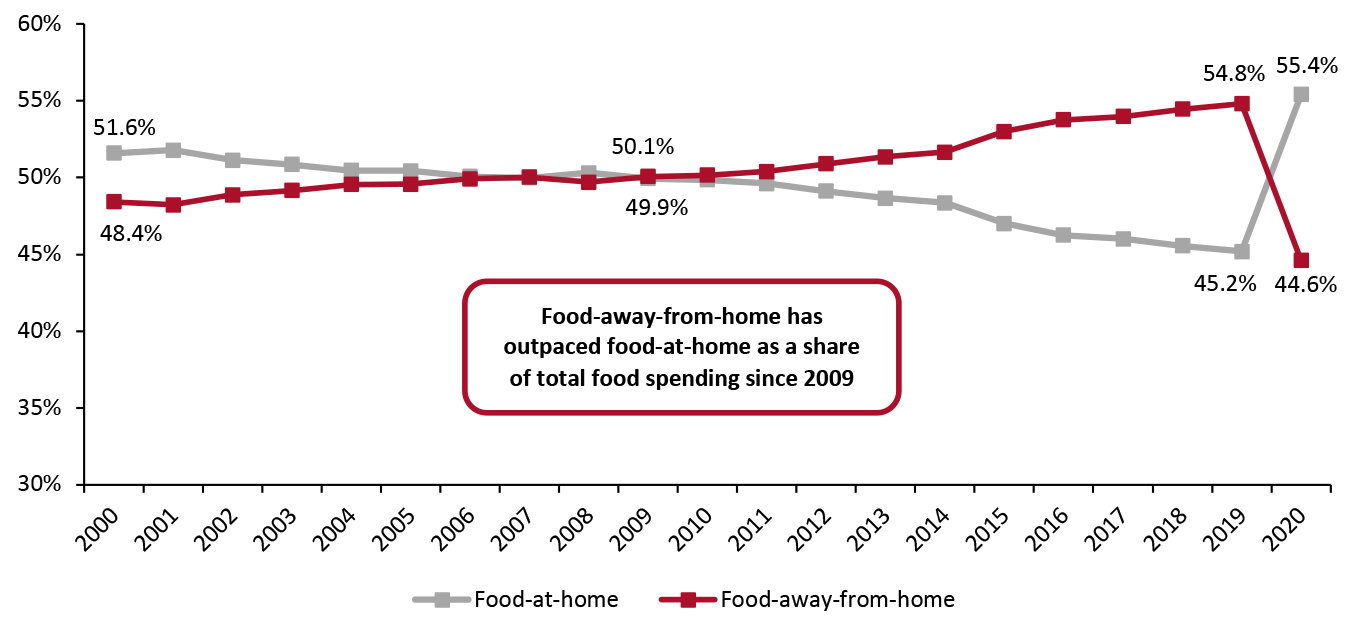

The pandemic has had a huge impact on food consumption behavior, swinging the pendulum from foodservice spending—which has outpaced food-at-home spending since 2009—back to food retail. In 2020, the food-at-home share of total food spending increased to 55.4% from 45.2% in 2019. Figure 2 shows the bifurcation in food-at-home and foodservice spending since 2000, showing that food-away-from-home purchases have increased as a share of total food spending from 48.4% in 2000 to 54.8% in pre-pandemic 2019.Figure 2. Total US Food Expenditure: Food-at-Home Spending Versus Food-Away-from-Home Spending [caption id="attachment_129273" align="aligncenter" width="725"]

Source: USDA ERS[/caption]

In 2021, we expect demand in the foodservice sector to stabilize, particularly in the latter half of the year, as more consumers obtain vaccines and shift back to eating and socializing outside of their homes. This will peel away share from food retail sales, presenting a significant headwind for grocers in 2021 and beyond.

Source: USDA ERS[/caption]

In 2021, we expect demand in the foodservice sector to stabilize, particularly in the latter half of the year, as more consumers obtain vaccines and shift back to eating and socializing outside of their homes. This will peel away share from food retail sales, presenting a significant headwind for grocers in 2021 and beyond.

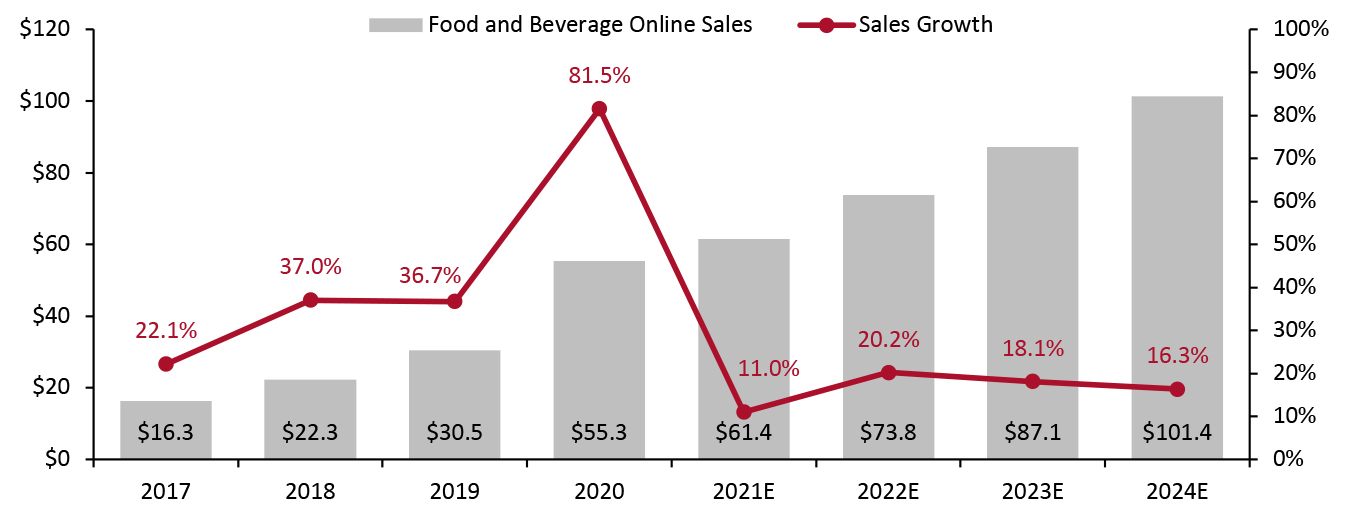

US Online Food and Beverage Market Performance and Outlook

The Covid-19 pandemic was a significant catalyst in rapidly accelerating online grocery adoption and transformation. We estimate that total US food and beverage e-commerce sales grew to $55.3 billion in 2020, up 81.5% year over year—a vastly greater increase than any recent year. We estimate that e-commerce sales will outperform the total grocery market in 2021 despite growth slowing to 11.0% year over year—given the impact of the previously discussed return to dining out on grocery retail and the hit from increasing consumer willingness to shop in stores. Nevertheless, we expect the slowdown to be temporary and that the pandemic-induced channel stickiness will likely support solid online growth in 2022 and beyond. As such, retailers have a unique opportunity to capitalize on shifting trends and the still-evolving e-commerce experience.Figure 3. US Online Food and Beverage Market: Total Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_129274" align="aligncenter" width="725"]

Online sales of alcoholic beverages are not included.

Online sales of alcoholic beverages are not included. Source: IRI E-Market Insights™/Coresight Research [/caption]

Competitive Landscape

The US grocery market is highly fragmented and regionalized, with Walmart and Kroger leading grocery sales, followed by Costco, Albertsons and Ahold Delhaize. These top five retailers accounted for approximately 42% of total grocery sales in 2020, with Walmart holding almost 20% of the market. We believe that grocery discounters, such as Aldi and Lidl, will continue their solid run—despite the channel being smaller than other US grocery retail channels, it continues to attract cost-conscious consumers supported by a rapid brick-and-mortar expansion strategy. Meanwhile, we expect Amazon to also cause market disruption as it streamlines its online grocery offerings, such as shutting down its standalone Prime Now app and integrating the two-hour delivery option into the primary Amazon website to better service big-basket grocery shopping. The company is also developing a multichannel grocery model—for instance, with the expansion of its Amazon Fresh store format.Figure 4. Top US Grocery Retailers, by Revenue (Most Recent Fiscal Year) [wpdatatable id=1064 table_view=regular]

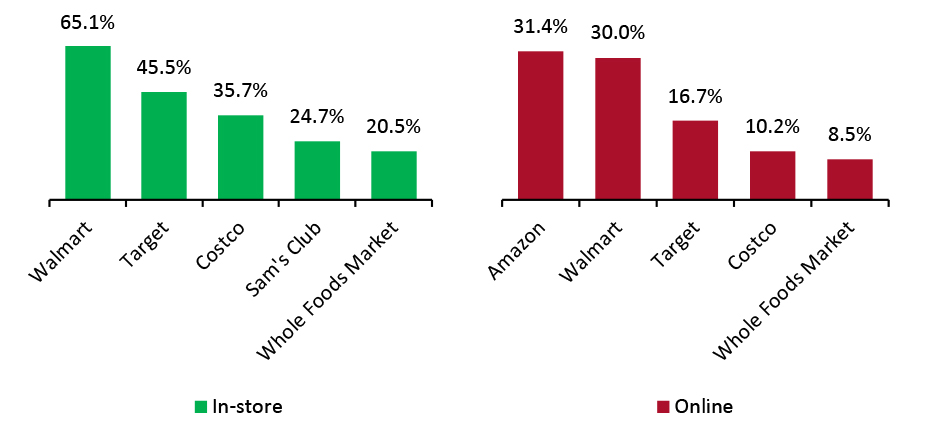

Source: Company reports/Coresight Research Coresight Research’s US online grocery survey conducted in April 2021 (and which also covered in-store shopping) confirmed that Walmart is the most-shopped physical retailer with 65.1% of respondents reporting that they bought groceries in its stores the last 12 months. In comparison, 31.4% of respondents said that they made online grocery purchases at Amazon.

Figure 5 shows the top retailers by share of in-store and online grocery shoppers for the period April 2020 to April 2021.

Figure 5. Top Five Retailers by Share of Grocery Shoppers: In-Store and Online (% of Respondents) [caption id="attachment_129275" align="aligncenter" width="726"]

Base: 1,652 Internet users aged 18+

Base: 1,652 Internet users aged 18+ Source: Coresight Research [/caption] We expect to see some consolidation in the US grocery market in the long term. Looking beyond the pandemic-accelerated shift to online shopping, we anticipate that grocery players will look to build scale to achieve profitability in their online operations, which will drive mergers and acquisitions in the industry. With more consumers shifting to e-commerce, smaller players that are unable to compete will ultimately drop out of the market or get acquired by more prominent players.

Retail Innovators

We expect solutions developed by retail innovators to play a significant role in catering to operational development that will drive growth in the grocery industry. We discuss three key innovators and their impact on the US grocery market.- Fabric

- A platform model where Fabric builds a private network of sites for partners that retailers can operate and run independently

- A service model where Fabric builds and operates its own MFCs and sells the space inside the facility to retailers, requiring minimal capex investment from the retailers.

- Position Imaging

- Precima

Themes We Are Watching

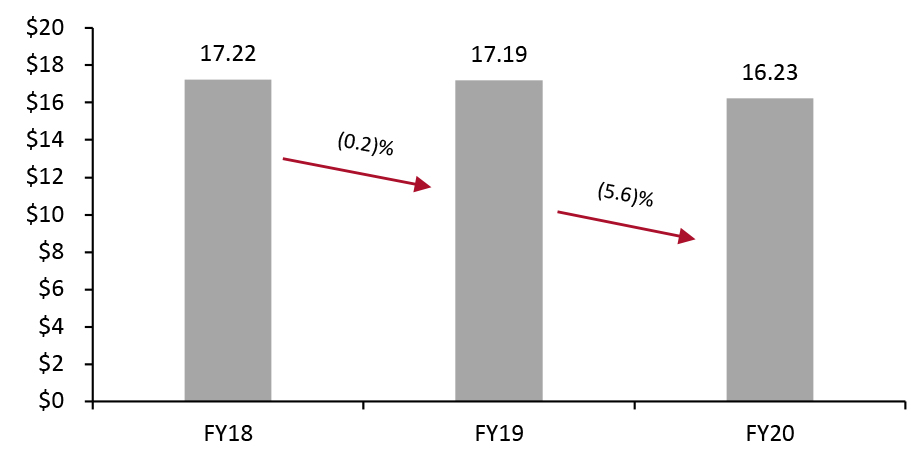

1. Amazon Is Ramping Up Its Offline Grocery Footprint Amazon is establishing a presence in the mainstream US grocery market that is not currently served by Whole Foods. The retailer opened its twelfth Amazon Fresh store in March 2021, just over six months after the launch of the grocery format, with more locations in the pipeline. In May 2021, Amazon announced that it will rebrand Amazon Go Grocery in Capitol Hill, Seattle as Amazon Fresh and close down its other Go Grocery store in Redmond, Washington. Amazon Fresh offers a broader, wider assortment of mainstream brands at lower price points than other Amazon physical store formats and the stores are built primarily with omnichannel demand and efficiency in mind. For instance, Amazon Fresh shoppers can use Dash Carts to locate items, track purchases and skip the checkout line. The stores also offer same-day grocery delivery and pickup options for grocery orders as well as Amazon.com purchases. The introduction of Amazon Fresh may pose a more serious threat for traditional retailers than Amazon’s existing offerings—Amazon has previously focused on its Amazon Go stores, of which it has 26, and its network of 502 Whole Food stores. Amazon Go is primarily positioned to cater to young shoppers’ demand for convenience while Whole Foods is positioned to serve demand for healthy choices at a higher price point: These two formats hold limited relevance for mid-market, big-basket grocery shoppers. However, Amazon Fresh is positioned at value—with the potential for the format to accelerate a margin-destructive price war and become a regular destination for large-basket shopping trips among middle-income consumers. This would enable Amazon to capture a meaningful share of full-basket grocery shops from its mass-market grocery rivals. That said, Amazon is yet to make any significant dent in offline retailing. Its brick-and-mortar portfolio saw sales dip by 5.6% in fiscal 2020. Amazon’s offline portfolio formats include 540 grocery stores, 24 Amazon Books stores, 29 Amazon 4-star outlets and seven Presented By Amazon locations. The company does not provide a sales breakdown for its brick-and-mortar retail segments.Figure 6. Amazon’s Physical Store Sales (USD Bil.) and YoY Growth Rate [caption id="attachment_129278" align="aligncenter" width="726"]

Note: Total excludes online orders picked up at physical stores. Fiscal year ends December 31

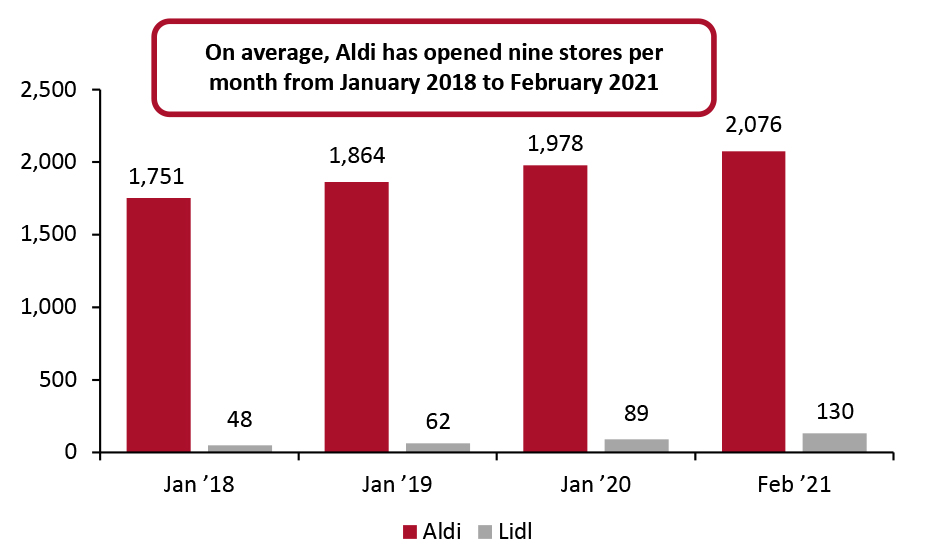

Note: Total excludes online orders picked up at physical stores. Fiscal year ends December 31Source: Company reports[/caption] 2. Momentum in Grocery Discounters’ Real Estate Expansion With the onset of the crisis in the US, many consumers looked to value-conscious retailers to stretch their budgets, to the benefit of discount retailers such as Aldi and Lidl. We have also identified that Aldi and Lidl were also successful in attracting higher-income shoppers who perceive their private-label products to be an often healthier alternative to name brands. Both Aldi and Lidl have pursued their brick-and-mortar expansion plans amid the pandemic.

- Aldi reached the 2,000-store mark in July 2020 and operates 2,076 locations as of February 2021. In the same month, Aldi announced that it would open approximately 100 new US locations by the end of 2021. The company also stated that it would implement curbside grocery pickup at around 500 additional stores, bringing the service to more than 1,200 of its locations. Aldi will also continue to offer grocery delivery via Instacart in almost all its US locations.

- Meanwhile, Lidl’s expansion has been relatively moderate, with the retailer running a total of 130 US locations as of February 2021, with plans to open 50 new stores by the end of the year. However, we expect the retailer to ramp up its footprint, based on its April 2020 announcement of a new network of distribution centers along the Eastern Coast that will service supply chain needs for around 1,500 stores.

Figure 7. Total US Store Count: Aldi and Lidl [caption id="attachment_129277" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

- Grocery Outlet, another key player in the discount channel, has also made store expansion an important part of its growth strategy, with plans to open 36 to 38 stores in fiscal 2022. Primarily dotted across the West Coast, the retailer stated that it plans to expand its Mid-Atlantic presence by opening three to five new stores in the region. Grocery Outlet focuses heavily on product assortment, offering a more comprehensive range of SKUs than its competitors.

Figure 8. Total US Store Count: Grocery Outlet [wpdatatable id=1065 table_view=regular]

Source: Company reports 3. Dark Stores: Accommodating Growth in Online Grocery Shopping Dark stores gained significant traction in the US in 2020, as e-commerce volumes grew beyond the efficient fulfillment capacity of an operational store. Dark stores are repurposed brick-and-mortar locations that are specifically geared toward fulfilling online grocery orders and do not serve walk-in customers. Dark stores can be manual or combined with some form of automation; they often support delivery and pickup services. Coresight Research has identified that around 25 to 30 grocery-related dark stores are currently operational in the US. Whole Foods, which leads the pack, has rolled out nine dark stores since the onset of the pandemic. Other retailers, including Giant Eagle, Kroger and Stop and Shop have also repurposed brick-and-mortar locations into dark stores. Many retailers are seeing long-term benefits from having one or more dark store locations as they can take the fulfillment burden away from a regular store, plus speed up fulfillment times and expand inventory space. Dark stores also enable retailers to launch operations in new markets at a lower cost as they can occupy a more functional space rather than prime real estate. However, the success of a dark store depends on sufficient online order volume. Retailers exploring the idea of opening a dark store must have adequate online demand from the localities surrounding the store before making such an investment. Dark stores work well in urban locations with high population density. We believe that dark stores have the potential to play a key role for retail, well beyond the pandemic. Heightened demand for online grocery shopping has pushed retailers to accelerate the development of automation and fulfillment infrastructure. With those systems already in place, dark stores will likely turn into permanent fixtures post crisis, to relieve the strain on existing stores that are serving both in-store and online shoppers. Additionally, a dark-store strategy can allow retailers to keep some of their stores running as dark stores in any future lockdown situation, working as a local distribution point, rather than shutting down all operations entirely.

What We Think

Grocers have a breathing space to re-equip themselves for the strategic challenges ahead before consumers return to normal ways of living and spending and on-premise consumption regains its full strength. Grocery retailers should use this time gap to capitalize on pandemic-induced behavior stickiness and sustain the market’s momentum in the coming months. Implications for Retailers- The pandemic delivered a sales windfall for grocery retailers in 2020. However, in 2021, as people are increasingly vaccinated and return to more normal ways of living, we expect part of the share of food-away-from-home dollars captured by grocery retailers in 2020 to flow back to foodservice. Retailers must seek to retain as much of that portion as possible, such as through revamping loyalty programs, incorporating adding fresh meal offerings and boosting healthy in their product mix. Retailers must also invest in innovative merchandise to maintain consumer interest in cooking at home.

- Although Covid-19 accelerated the shift to online shopping, Amazon’s bold move to roll out its Fresh store format amid the pandemic underscores its belief that physical stores will remain a key component of how consumers shop. Retailers must prioritize investing in technologies such as smart checkout systems to keep up with competition and improve brick-and-mortar shopping experiences.

- Meanwhile, retailers should also look to improving online shopping experiences, including making apps and websites easier to use, improving e-commerce supply chain efficiency, and providing friction-free last-mile services.

- In 2021, grocery retailers will focus on strategically managing their gains for long-term growth. Retailers will look to leverage innovation and technology to keep up with the pandemic-induced industry trends, improve their margins and retain customer loyalty. Technology vendors must capitalize on the environment and pitch in the importance of their solutions for grocery retailers’ pain points.