Nitheesh NH

Introduction

In this report, part of our Market Outlook series, we examine the size and trajectory of the US grocery market and key factors impacting growth. We also cover the performance and outlook for online grocery in the US, as well as the overall market’s competitive landscape, retail innovators and three themes we are watching in 2022 and beyond.Total US Grocery Market Performance and Outlook

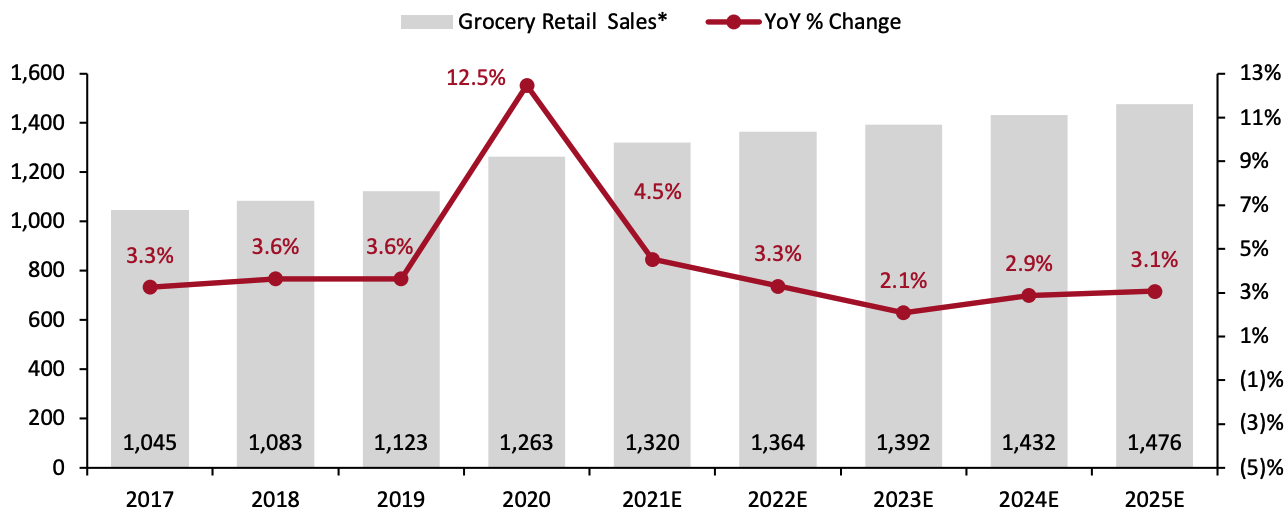

Coresight Research estimates that the US grocery market slowed to 4.5% year-over-year growth in 2021, reaching $1.32 trillion. This was partly due to demanding comparatives from 2020 and the partial recovery of the foodservice sector in the second half of the year. In 2022, we expect the market to taper off further to 3.3% growth, likely impacted by on-premise consumption regaining its full strength as more consumers shift back to eating and socializing outside of their homes, partly offset by some retention of food-at-home spending. Food-price inflation is expected to be in the range of 1.5–2.5% in 2022, per the US Department of Agriculture (USDA). However, if inflation, which has recently been at 6+% (see later), proves stronger over 2022, we see upside potential to our sector estimate. From 2022 to 2025, we expect the market to grow at a moderate CAGR of 2.7%.Figure 1. US Grocery Market: Total Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_141325" align="aligncenter" width="700"]

*Includes sales of all products by food retailers and grocery sales of selected major retailers in the mass merchandiser, warehouse club and discount-store sectors

*Includes sales of all products by food retailers and grocery sales of selected major retailers in the mass merchandiser, warehouse club and discount-store sectorsSource: US Census Bureau/company reports/Coresight Research[/caption]

Market Factors

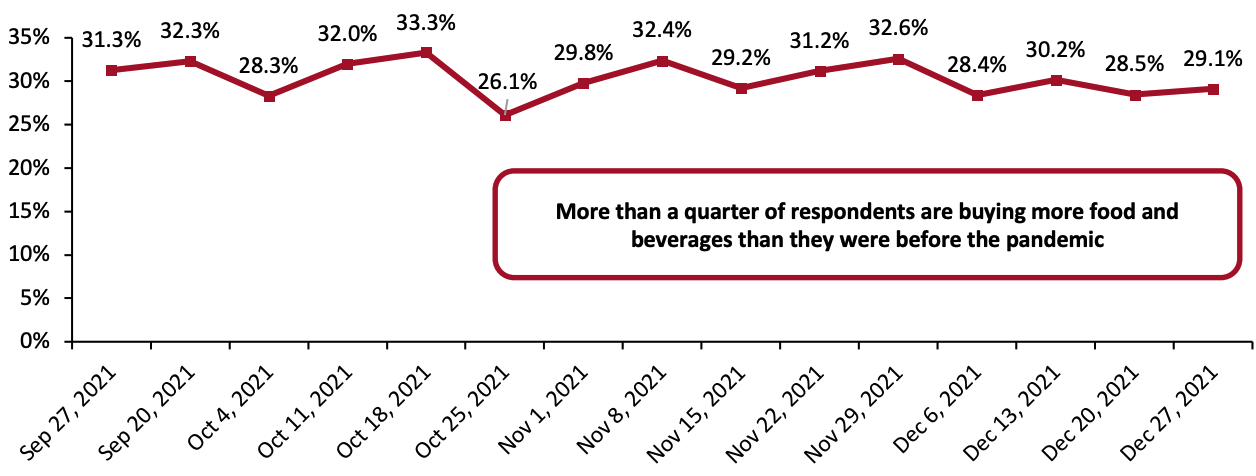

Retention of Food-At-Home Demand The pandemic shifted foodservice dollars toward grocery retail, reversing food consumption trends and likely driving long-term implications. Food-at-home spending will retain some portion of redirected food-away-from-home dollars in the long term, as many consumers have developed new cooking habits and a renewed appreciation for making meals at home. Moreover, the cost of eating out is rising much faster than retail inflation, which may encourage price-conscious shoppers to continue spending in food retail rather than switching back to foodservice in the near term. In the earnings call for the second quarter ended August 14, 2021, Kroger highlighted that food-at-home trends has been sticky, with consumers continuing to eat more food at home because they find it more budget-friendly, convenient and healthier. Additionally, in recent months Coresight Research’s US Consumer Tracker has consistently found that more than a quarter of respondents are buying more food and beverages than before the pandemic.Figure 2. US Consumers: Proportion Buying More Groceries Than Before the Covid-19 Pandemic (% of Respondents) [caption id="attachment_141326" align="aligncenter" width="700"]

Base: US respondents aged 18+

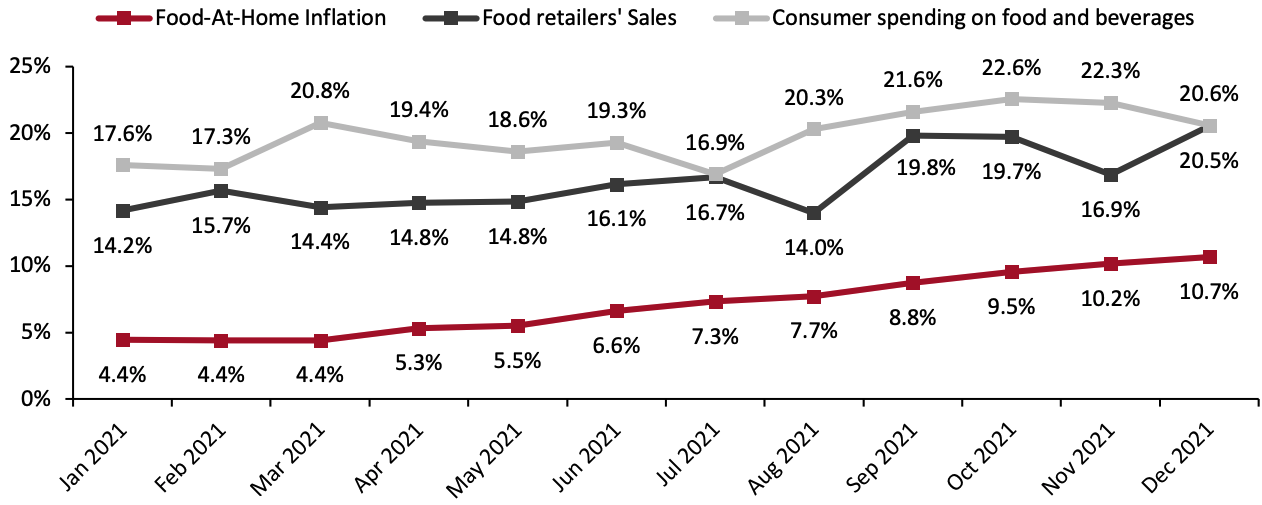

Base: US respondents aged 18+Source: Coresight Research[/caption] Inflation US food-at-home inflation was steady at 4.4% on a two-year basis at the start of 2021 and began to trend upward from March. This helped boost grocery retailers’ sales and consumer spending on food and beverages, with each tracking around 20% higher compared to the two-years-ago period in recent months (charted in Figure 3). The US Department of Agriculture expects food-at-home prices to increase by between 1.5% and 2.5% year over year in 2022, reflecting a moderation from recent stronger inflation at the time of writing. Grocery chains have strategically passed on price rises in categories and to shoppers best able to absorb them. In its first-quarter 2021 earnings call, Kroger CEO Rodney McMullen stated that the company performs best when inflation is 3%–4%. He added that Kroger can pass costs on to consumers when inflation hovers around that mark and “customers don’t overly react to that.” Albertsons CEO Vivek Sankaran also stated in the company’s first-quarter 2021 earnings call that the company had performed well in periods when inflation was at 3%–4%. However, higher food inflation may benefit discount stores at the expense of full-price supermarkets in the medium term, lifting sales at Walmart, Aldi and other discount chains that cater primarily to value-conscious shoppers.

Figure 3. US: Food Price Inflation, Food Retailers’ Sales and Consumer Spending on Food and Beverages (Two-Year % Change) [caption id="attachment_141327" align="aligncenter" width="700"]

Food retailers’ sales data are not seasonally adjusted; consumer spending data are seasonally adjusted

Food retailers’ sales data are not seasonally adjusted; consumer spending data are seasonally adjustedSource: US Bureau of Labor Statistics/US Census Bureau/US Bureau of Economic Analysis/Coresight Research[/caption]

US Online Grocery Market Performance and Outlook

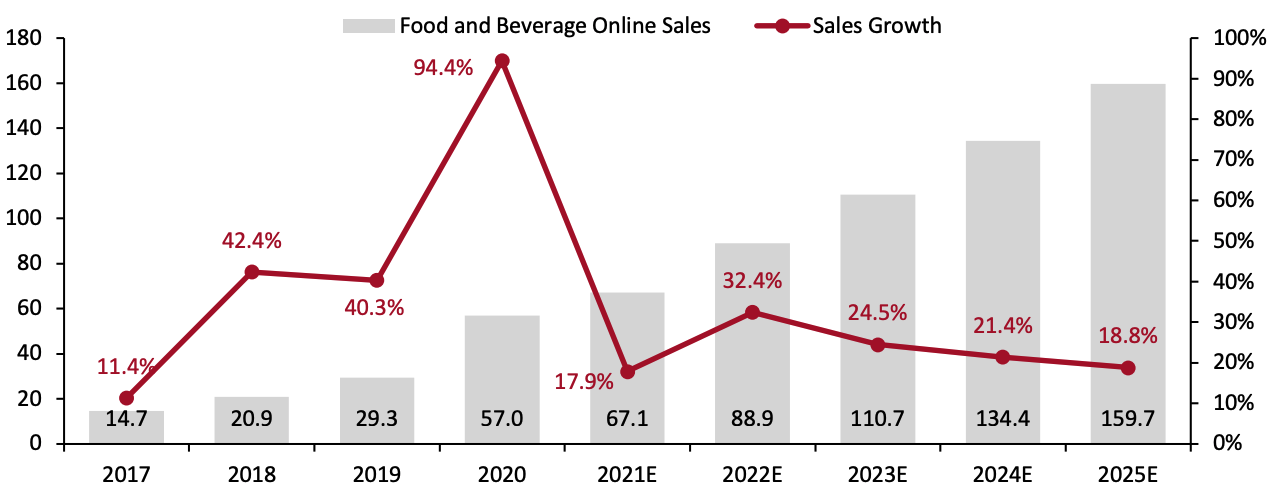

Coresight Research estimates that US online grocery sales grew 17.9% year over year in 2021, after 94.4% growth in 2020—given the impact of the previously discussed return to dining out on grocery retail and the hit from increasing consumer willingness to shop in stores. In 2022, we expect the market to expand by 32.4%, supported by pandemic-induced online shopping stickiness. Our US Consumer Tracker consistently found throughout 2021 that one-fifth of respondents bought food online, reflecting the retention of the pandemic-induced behaviors in the channel. Additionally, according to Coresight Research’s annual online grocery survey, conducted in April 2021, over one-quarter of shoppers plan to buy groceries online more frequently after the crisis subsides than they did during the crisis.Figure 4. US Online Grocery Market: Total Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis; %) [caption id="attachment_141328" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research[/caption]

Source: IRI E-Market Insights™/Coresight Research[/caption]

Competitive Landscape

The US grocery market is highly fragmented and regionalized, with Walmart and Kroger leading grocery sales, followed by Costco, and Albertsons. We estimate these top four retailers accounted for 41.8% of total grocery sales in 2021, with Walmart holding around 20% of the market. Major US mass merchandisers and warehouse clubs that sell a diverse mix of merchandise have capitalized on the sticky behaviors of pandemic-induced “one-stop” shopping, which partially sustained their growth momentum in 2021. We anticipate a reversal of this trend over the course of 2022 as consumers return to shopping from a range of stores, benefiting grocers with specialty and niche value propositions. We believe grocery discounters such as Aldi and Lidl will continue to exert margin pressure on retailers, since these retailers will attract inflation-impacted price-sensitive customers while rapidly expanding their brick-and-mortar store fleet. Meanwhile, we expect Amazon to also cause market disruption as it doubles down in the grocery market by expanding its private-label range, streamlining its online offerings and building out its multichannel grocery model by stepping up its Amazon Fresh store footprint.Figure 5. Top Five US Grocery Retailers’ Revenues For Their Latest Reported Fiscal Years (USD Bil.) [wpdatatable id=1706]

Source: Company reports

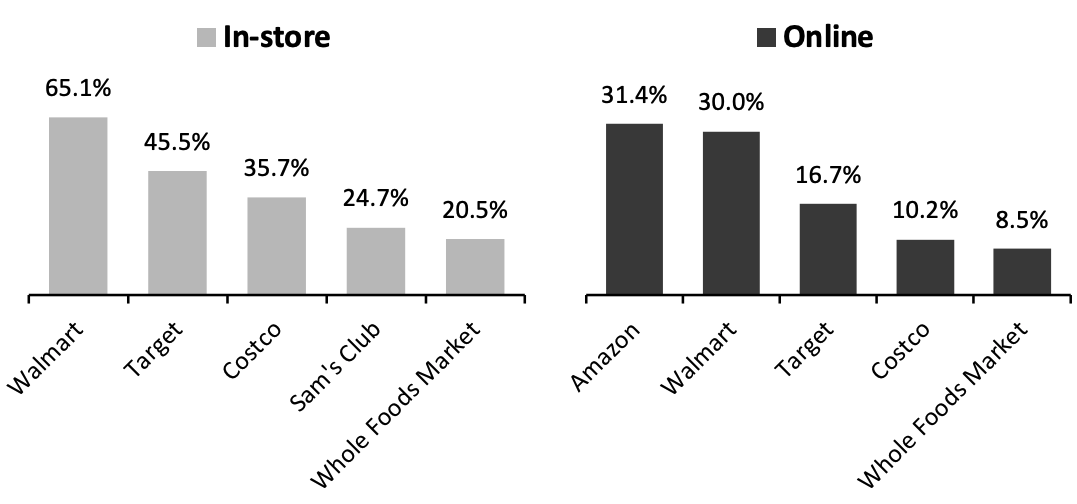

Coresight Research’s US online grocery survey, which also covers in-store shopping, confirmed that Walmart is the most-shopped physical retailer, with 65.1% of respondents reporting that they bought groceries in its stores the last 12 months. In comparison, 31.4% of respondents said that they made online grocery purchases at Amazon.Figure 6. Top Five Retailers by Share of Grocery Shoppers: In-Store and Online (% of Respondents) [caption id="attachment_141338" align="aligncenter" width="700"]

Base: 1,652 US respondents aged 18+

Base: 1,652 US respondents aged 18+Source: Coresight Research[/caption]

Themes We Are Watching

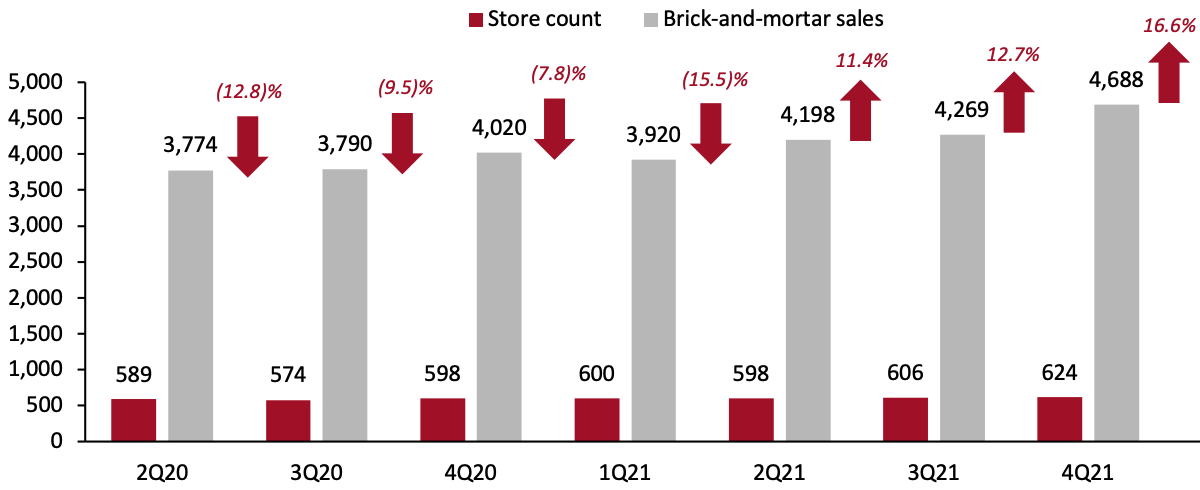

Amazon is Ramping Up its Offline Grocery Footprint Amazon is seeking to establish a presence in the mainstream US grocery market that is currently not served by Whole Foods, by stepping up its Fresh store footprint. The retailer has opened 23 Amazon Fresh stores in the US as of January 2022, just over a year after the launch of the grocery format, with more locations in the pipeline. Amazon’s previous offline grocery formats, Amazon Go and Whole Foods Market, hold limited relevance for mid-market, big-basket grocery shoppers as neither are positioned on value—even if Amazon expands the two chains, they will likely capture relatively few core big-shop customers from rival grocery retailers. The Amazon Fresh store format poses a more serious threat to traditional retailers, as it claims to offer “lower prices consistently” and stocks a wide assortment of mainstream brands. It is targeted at low- and middle-income shoppers who don’t frequent Whole Foods Market, as well as high-income customers looking for a bargain. The stores are built primarily with omnichannel demand and efficiency in mind. They have a particular focus on checkout-free shopping—offering smart shopping carts, referred to as Dash Carts, that scan and weigh items while keeping a running total of purchases. Recently, Amazon has been opening Fresh stores equipped with its ‘Just Walk Out’ technology. Amazon’s ability to implement this technology in a full-sized grocery store gives it an advantage, since third-party vendors that offer similar systems to retailers have struggled to overcome the technical challenges of implementing them in bigger stores. That said, Amazon is yet to make a significant impact in offline retail. Amazon’s brick-and-mortar store portfolio (which includes Whole Foods, Amazon 4-Star, Amazon Books, Amazon Fresh, Amazon Go and Amazon Pop Ups) saw sales grow only in the last three quarters, after four consecutive quarters of negative growth.Figure 7. Amazon US: Quarterly Store Count, Physical Store Sales (USD Bil.) and YoY % Change [caption id="attachment_141339" align="aligncenter" width="700"]

Excludes sales of online orders picked up at physical stores; Fiscal year ends December 31

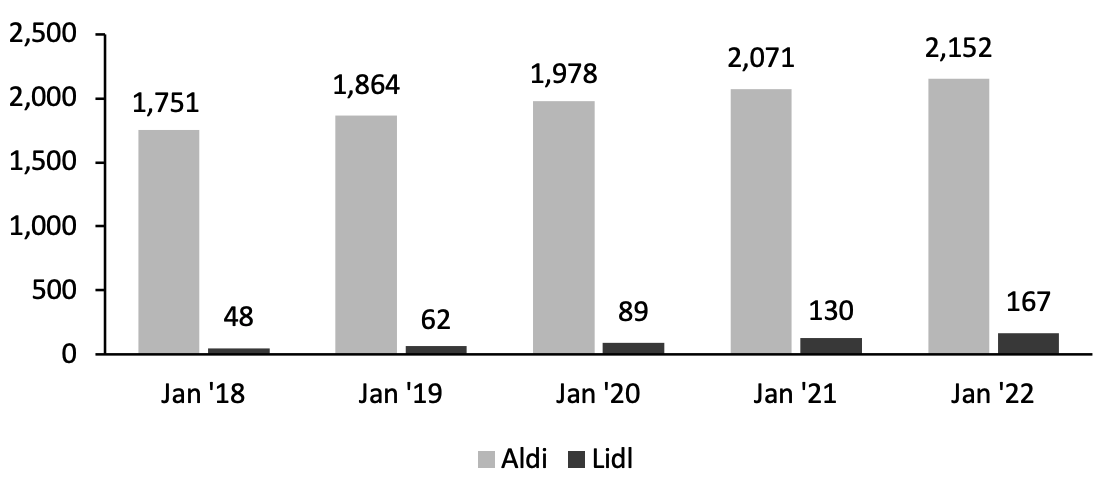

Excludes sales of online orders picked up at physical stores; Fiscal year ends December 31Source: Company reports[/caption] Momentum in Grocery Discounters’ Real Estate Expansion Discount retailers have seen strong growth over the last few years and were able to maintain that momentum amid the pandemic, with sales growth of 8.6% in the US in 2020, according to Euromonitor. We expect growth among discounters and their relentless real estate expansion to accentuate competition with traditional grocers and accelerate consolidation in the fragmented US grocery market—smaller and less differentiated players will likely struggle to cope with further margin pressure. Aldi has established a strong presence in the US, with a total of 2,098 stores as of July 2021, according to the company. In February 2021, Aldi announced that it would open approximately 100 new US locations by the end of the year, with a focus on Arizona, California, Florida and the Northeast, according to the company. The company added it aims to open up to 35 new stores in the Gulf Coast region by the end of 2022. Lidl’s US expansion plan has been modest compared to Aldi’s, and it has so far been a relatively niche player in the US grocery sector. However, the retailer made its intentions clear by announcing in April 2020 that it is building a network of distribution centers along the Eastern Coast that will service the supply chain needs for around 1,500 stores. We believe that retailers with significant store overlap with Aldi or Lidl could be at serious risk of profitability pressure in the coming years.

Figure 8. US Store Count: Aldi and Lidl [caption id="attachment_141341" align="aligncenter" width="700"]

Source: Company reports[/caption]

Dark Stores: Accommodating Growth in Online Grocery Shopping

Dark stores are brick-and-mortar stores that are dedicated to fulfilling online orders and so do not serve walk-in customers. Dark stores can be manual or combined with some form of automation; they often support delivery and pickup services.

Amid the pandemic, retailers turned to dark stores to meet increased volumes of e-commerce orders, which grew beyond what can be efficiently fulfilled from an operating store. Several retailers, including Giant Eagle, Kroger, Stop and Shop and Whole Foods Market, repurposed some brick-and-mortar locations as dark stores, driven by the lack of available pickup slots for online orders, a reduction in store-operating hours and the introduction of capacity restrictions inside stores.

Many retailers are seeing long-term benefits from having one or more dark store locations, as they can take the fulfillment burden away from a regular store, plus speed up fulfillment times and expand inventory space. Dark stores also enable retailers to launch operations in new markets at a lower cost, as with no need for customer footfall they can occupy cheaper locations.

More recently, dark stores have grown to include smaller warehouses built in dense urban locations, which are typically deployed by vertically integrated instant-commerce companies such as Buyk, Fridge No More, Gopuff, and JOKR. These companies offer delivery s in as little as 10–30 minutes.

Source: Company reports[/caption]

Dark Stores: Accommodating Growth in Online Grocery Shopping

Dark stores are brick-and-mortar stores that are dedicated to fulfilling online orders and so do not serve walk-in customers. Dark stores can be manual or combined with some form of automation; they often support delivery and pickup services.

Amid the pandemic, retailers turned to dark stores to meet increased volumes of e-commerce orders, which grew beyond what can be efficiently fulfilled from an operating store. Several retailers, including Giant Eagle, Kroger, Stop and Shop and Whole Foods Market, repurposed some brick-and-mortar locations as dark stores, driven by the lack of available pickup slots for online orders, a reduction in store-operating hours and the introduction of capacity restrictions inside stores.

Many retailers are seeing long-term benefits from having one or more dark store locations, as they can take the fulfillment burden away from a regular store, plus speed up fulfillment times and expand inventory space. Dark stores also enable retailers to launch operations in new markets at a lower cost, as with no need for customer footfall they can occupy cheaper locations.

More recently, dark stores have grown to include smaller warehouses built in dense urban locations, which are typically deployed by vertically integrated instant-commerce companies such as Buyk, Fridge No More, Gopuff, and JOKR. These companies offer delivery s in as little as 10–30 minutes.

- For more on vertically integrated companies versus delivery platforms, read our separate report.

Retail Innovators

Fabric Israel-based Fabric provides micro-fulfillment center (MFC) solutions that are designed to improve online fulfillment speed from a small footprint. By leveraging robotic automation, Fabric allows retailers to implement on-demand fulfillment solution and claims to offer one-hour delivery, 99.9% order accuracy and 70% savings in labor and rent to its retail partners. Fabric offers partners two deployment models:- A platform model, in which Fabric builds a private network of sites for partners to operate and run independently.

- A service model, in which Fabric builds and operates its own MFCs and leases space inside the facility to partners, requiring minimal capital expenditure from its partners.

What We Think

The pandemic delivered a sales windfall for grocery retailers in 2020. In 2021, as people returned to more normal ways of living, part of the share of food-away-from-home dollars captured by grocery retailers in 2020 flowed back to foodservice. Retailers should equip themselves for the strategic challenges ahead as on-premise consumption regains its full strength and look to capitalize on pandemic-induced behavior stickiness to sustain the market’s momentum in the years ahead. Implications for Brands/Retailers- We expect to see some mergers and acquisitions and organic consolidation in the US grocery market in the longer term. With pandemic-accelerated shift to online shopping, we anticipate that major grocery players will look to build scale to achieve profitability in their online operations, which will likely drive M&A in the industry. Smaller players with fewer resources to invest in e-commerce infrastructure and last-mile fulfillment will be unable to compete and ultimately drop out of the market or get acquired by more prominent players.

- As the US economy recovers from the effects of the pandemic, food prices will likely continue to stay high in the first half of the year. Discount formats are well-positioned to capture share among a price-conscious consumer base feeling the effects of inflation. Rival retailers competing for price-sensitive customer spend must be prepared to fight even harder for share of shoppers, including through more intelligent and targeted promotions which can be served by more aggressively leveraging loyalty programs.

- Although Covid-19 accelerated the shift to online shopping, Amazon’s bold move to roll out its Fresh store format amid the pandemic underscores its belief that physical stores will remain a key component of how consumers shop. Retailers must prioritize investing in technologies such as smart checkout systems to keep up with competition and improve in-store shopping experiences

- Grocery retailers will focus on strategically managing their gains for long-term growth. Retailers will look to leverage innovation and technology to keep up with pandemic-induced industry trends, improve their margins and retain customer loyalty. Technology vendors must capitalize on the environment and highlight the importance of their solutions for grocery retailers’ pain points.

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information. Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved