DIpil Das

Introduction

The US footwear specialty sector saw strong post-crisis recoveries in 2021, and we expect some momentum to continue in 2022, particularly in the first half. We provide an outlook for the sector in 2022 and beyond. We also explore the market’s key growth drivers, competitive landscape and opportunities arising from four key specialty footwear trends.- Our US footwear market report covers overall consumer spending on footwear and the competitive landscape of footwear brand owners.

US Specialty Footwear Sector: Performance and Outlook

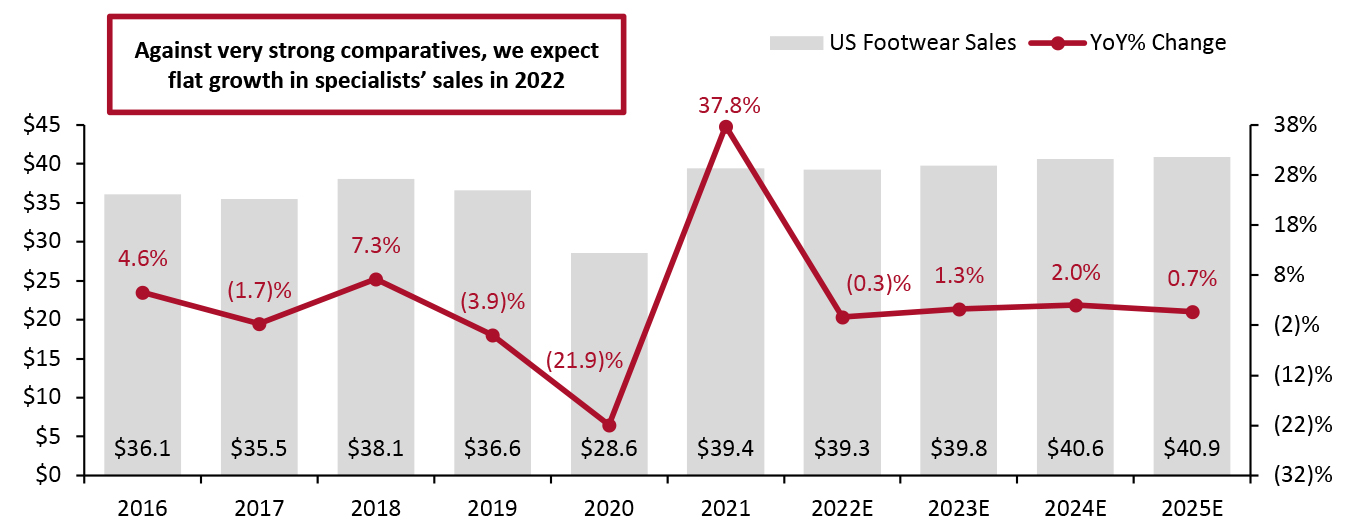

The US footwear specialty sector saw strong post-crisis recovery in 2021, and we expect some momentum to continue in 2022, particularly in the first half. In 2021, US footwear specialists’ sales increased by 37.8% year over year to approximately $39.4 billion (excluding sales taxes)—around 7.7% above 2019 levels. We believe this growth was driven by increased vaccinations, economic recovery, stimulus checks and consumers’ return to more normal ways of living and spending. In 2022, against very strong comparatives, Coresight Research estimates that US footwear specialists’ sales will be roughly flat, remaining at around $39.3 billion. From 2022 to 2025, we expect the US footwear specialty sector to witness a stabilized sales CAGR of 1.3%.Figure 1. US Footwear Specialists’ Sales (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_142516" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

Growth Analysis: Specialists’ Sales vs. Total Consumer Spending on Footwear

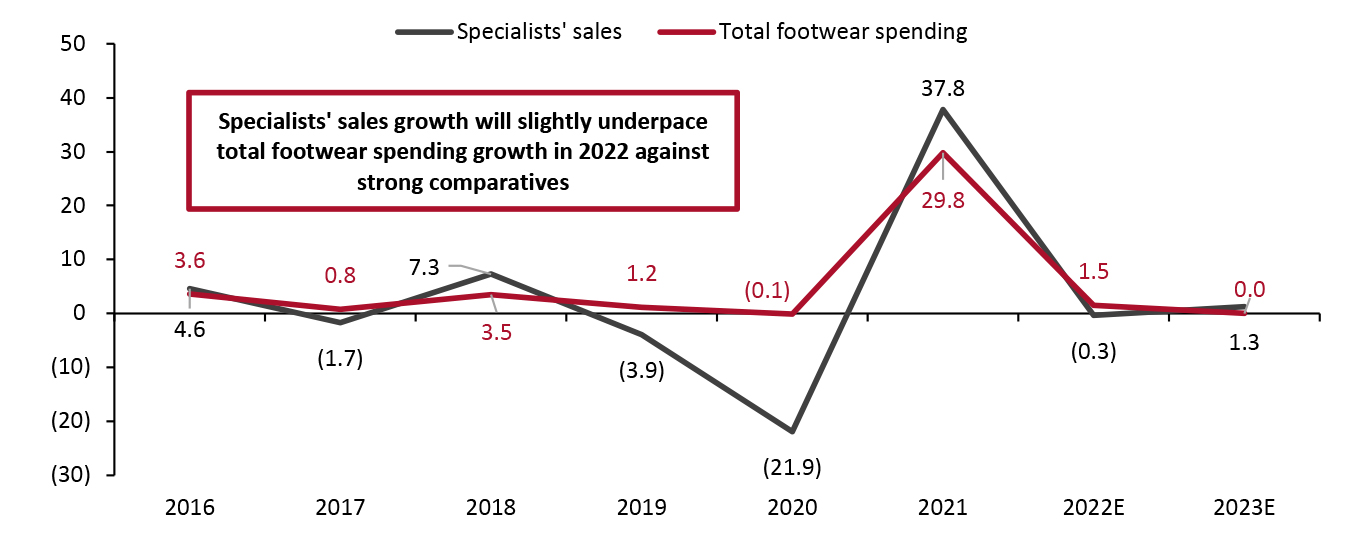

In 2021, footwear specialists saw substantially higher estimated growth than total footwear spending growth as specialty retailers recovered ground lost to rival channels amid forced store closures in 2020, such as online retailers and mass merchants.

In 2022, we expect footwear specialists to see almost flat growth, slightly underpacing total footwear spending growth. However, we expect growth to pick up in 2023, with specialists’ sales growth set to return to outpacing the growth of total footwear spending.

Source: US Census Bureau/Coresight Research[/caption]

Growth Analysis: Specialists’ Sales vs. Total Consumer Spending on Footwear

In 2021, footwear specialists saw substantially higher estimated growth than total footwear spending growth as specialty retailers recovered ground lost to rival channels amid forced store closures in 2020, such as online retailers and mass merchants.

In 2022, we expect footwear specialists to see almost flat growth, slightly underpacing total footwear spending growth. However, we expect growth to pick up in 2023, with specialists’ sales growth set to return to outpacing the growth of total footwear spending.

Figure 2. US: Footwear Specialists’ Sales Versus Total Footwear Consumer Spending (YoY % Change) [caption id="attachment_142517" align="aligncenter" width="700"]

Source: US Census Bureau/US Bureau of Economic Analysis/Coresight Research[/caption]

Source: US Census Bureau/US Bureau of Economic Analysis/Coresight Research[/caption]

Market Factors

Continued strong demand will drive sales in the footwear specialty sector in 2022, led by the three key factors presented in Figure 3. We also discuss the impact on ongoing inflation below. Furthermore, we discuss the ongoing inflation in the US footwear specialty sector in the section below the table.Figure 3. US: Key Factors Influencing Footwear Specialists’ Sales [wpdatatable id=1772 table_view=regular]

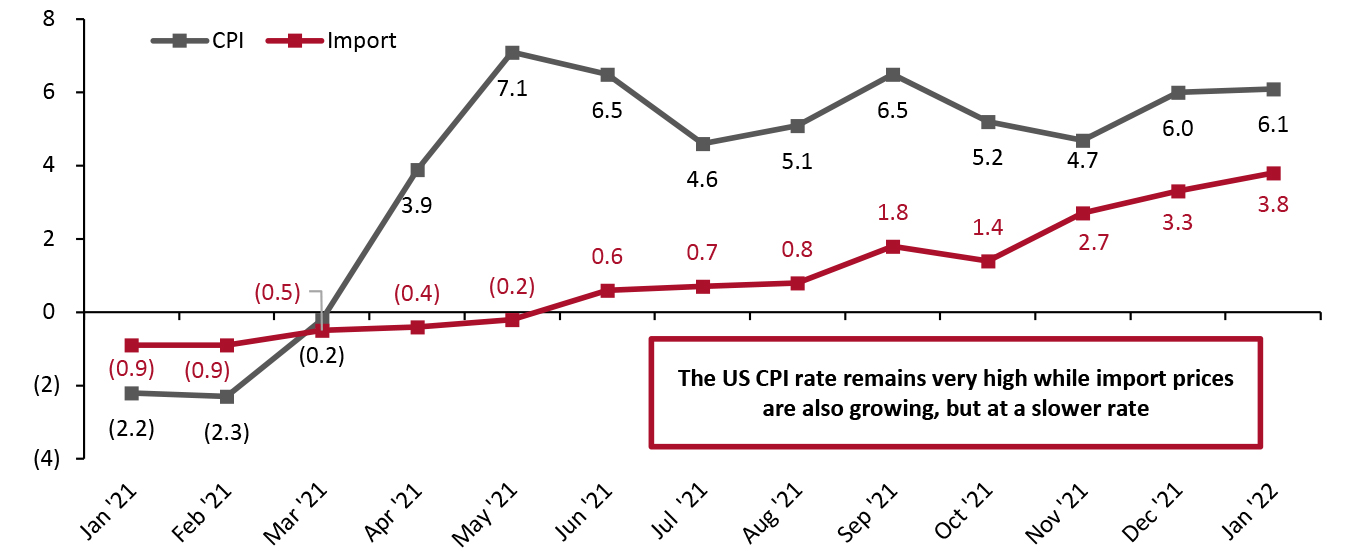

Source: Company reports/US Congressional Budget Office/US Bureau of Labor Statistics/Battleface/Coresight Research Inflation Since the May 2021 peak in consumer retail prices for footwear, year-over-year price inflation has been slowing but remains high. Strong footwear demand from consumers coincided with constrained supply as a result of supply chain challenges. Moreover, retailers had little incentive to offer discounts, equating to indirect inflation in consumer prices. Footwear retail prices continued to increase in January 2022, marking tenth consecutive months of year-over-year growth, according to the latest data from the Bureau of Labor Statistics. In 2022, we expect overall US inflation to slow, with the government set to raise key interest rates in three rounds this year. On December 18, 2021, the US Central Bank announced that the government could wind up the stimulus by the end of March 2022, after which it would raise the key interest rates. On February 21, 2022, US Federal Reserve Governor Michelle Bowman recommended a half percentage-point increase in interest rates in March. The slowing of overall inflation will likely lead to the easing of the footwear prices. Likewise, we expect footwear import prices to stabilize by the second half of 2022, with some easing in supply chain disruption allowing retailers, shippers and other supply chain stakeholders to clear their backlogs. As the majority of footwear products sold in the US are imported from China and Vietnam, import prices are a relevant metric for the US footwear specialty retail sector.

Figure 4. US Footwear: Import Prices vs. Consumer Price Index (YoY % Change) [caption id="attachment_142518" align="aligncenter" width="700"]

Data are not seasonally adjusted

Data are not seasonally adjusted Source: US Bureau of Labor Statistics [/caption]

Online Market

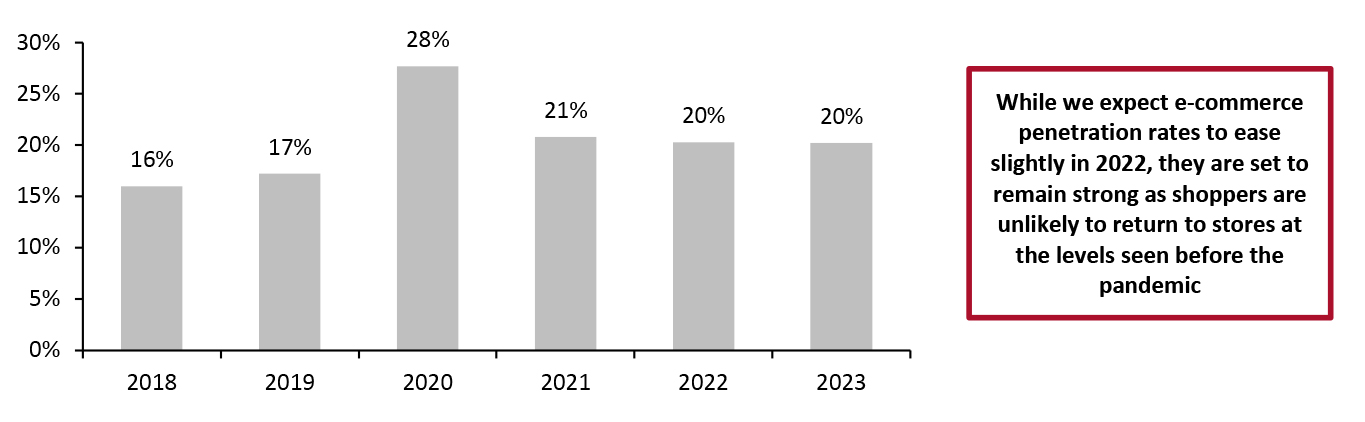

There has been an unprecedented online channel demand surge for footwear across the US since the pandemic began. While the 2020 shift to online slightly consolidated in 2021, we expect many footwear consumers to retain the habit of online shopping in 2022 and beyond. We estimate that the e-commerce penetration rate among US footwear specialists declined to 21% in 2021 from 28% in 2020, based on US Census Bureau data. We estimate that the penetration rate will ease further to a still-strong 20% in 2022 on the assumption that shoppers will not return to stores at the levels seen before the pandemic.Figure 5. US: Estimated E-Commerce Share of Footwear Specialists’ Sales (%) [caption id="attachment_142519" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

Competitive Landscape

America’s Biggest Footwear Retailers The US footwear retail market is relatively consolidated compared to the total apparel and footwear retail market. Foot Locker holds the most dominant position in the US footwear retail space in terms of revenue, followed by JD Sports USA (which owns well-known footwear retailers DTLR, Finish Line and Shoe Palace.) Figure 6 lists the top 10 footwear retailers, ranked by their latest US revenues. We expect to see different growth trajectories among footwear specialists by segment in 2022: retailers that focus on sports footwear, athleisure and casual wear—such as Foot Locker, JD Sports USA and Dick’s Sporting Goods—are showing stronger growth than retailers that focus on general footwear, such as Caleres and Designer Brands. Nevertheless, Caleres is witnessing strong growth in its casual wear and athletic footwear offerings/banners Famous Footwear and Ryka. Similarly, Designer Brands is witnessing strong demand in its sports footwear category and is looking to expand its athletic offerings.Figure 6. Top US Footwear Retailers, Ranked by Revenue (Latest Fiscal Year, USD Bil.) [wpdatatable id=1773 table_view=regular]

Source: Company reports/Rocketreach/Coresight Research Figure 7 presents recent key financial metrics and commentary from major specialists on footwear sales in the US market.

Figure 7. Selected US Specialists: Recent Financial Metrics and Key Commentary on US Footwear [wpdatatable id=1774 table_view=regular]

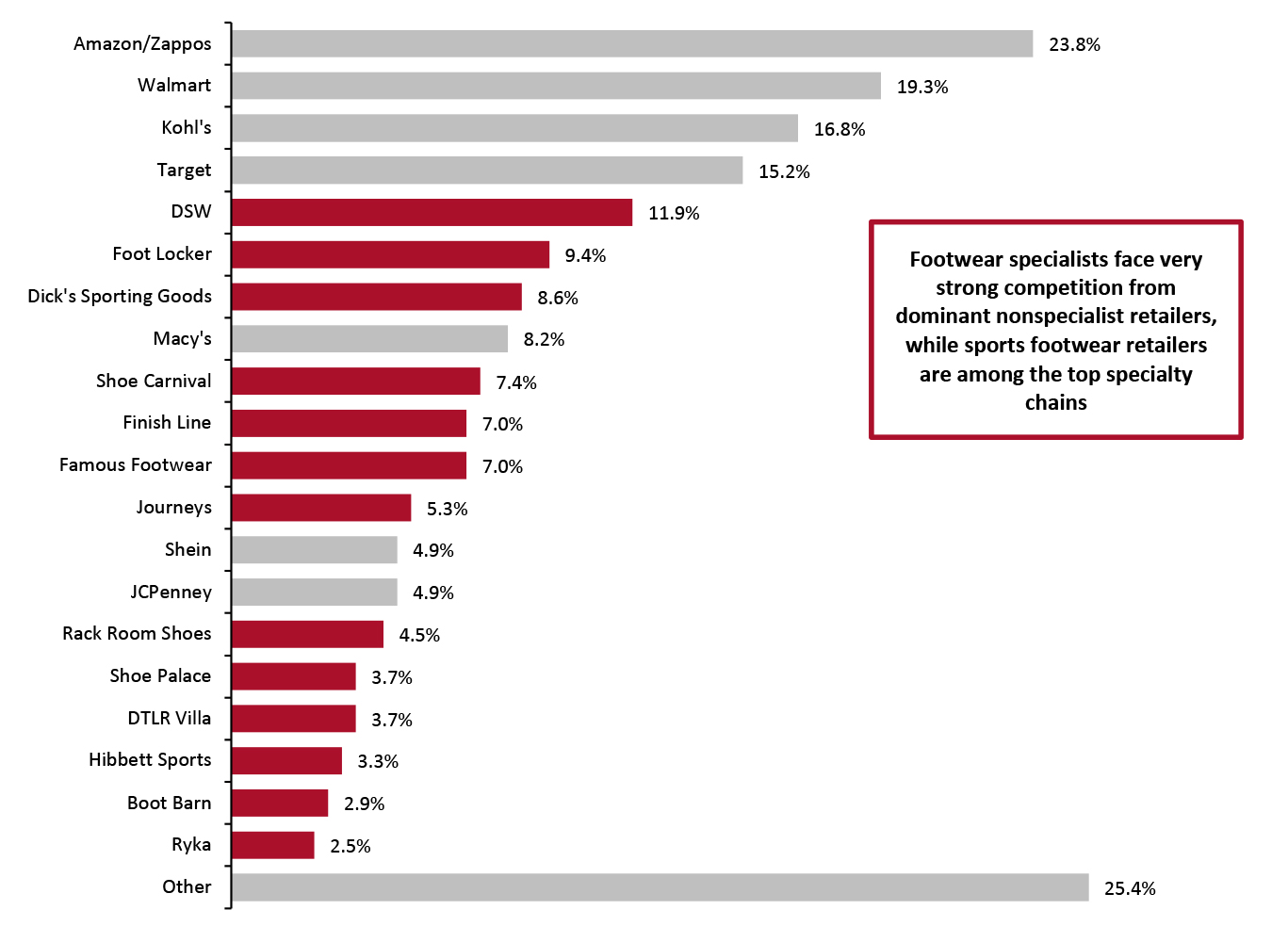

Source: Company reports/Coresight Research Where Footwear Consumers Are Shopping and What They Are Buying US footwear specialists face very strong competition from dominant non-specialist retailers, according to Coresight Research’s survey of US footwear shoppers conducted in February 2022. Some 55.7% of all respondents had bought footwear in the past three months. We asked those shoppers where they have bought footwear in the past three months, and we found the following.

- Amazon dominates the footwear space, with 23.8% of US consumers reporting that they had purchased footwear from the online retail giant. Amazon is a clear beneficiary of consumers switching more of their spending online across all categories.

- Mass merchandiser Walmart was the second-most shopped footwear retailer. Some 19.3% of the respondents reported shopping for footwear in Walmart. Walmart was followed by department store Kohl’s and another mass merchandiser Target—both capturing over 15.0% of footwear shoppers.

- Among the specialists, sports footwear retailers DSW (owned by Designer Brands), Foot Locker and Dick’s Sporting Goods were the most shopped, capturing 11.9%, 9.4% and 8.6% of footwear shoppers, respectively.

Figure 8. US Footwear Shoppers: Where They Have Purchased Footwear in the Past Three Months (% of Respondents) [caption id="attachment_142520" align="aligncenter" width="700"]

Base: 244 US respondents aged 18+ that had bought footwear in the past three months, surveyed on February 21, 2022

Base: 244 US respondents aged 18+ that had bought footwear in the past three months, surveyed on February 21, 2022 Red indicates specialists

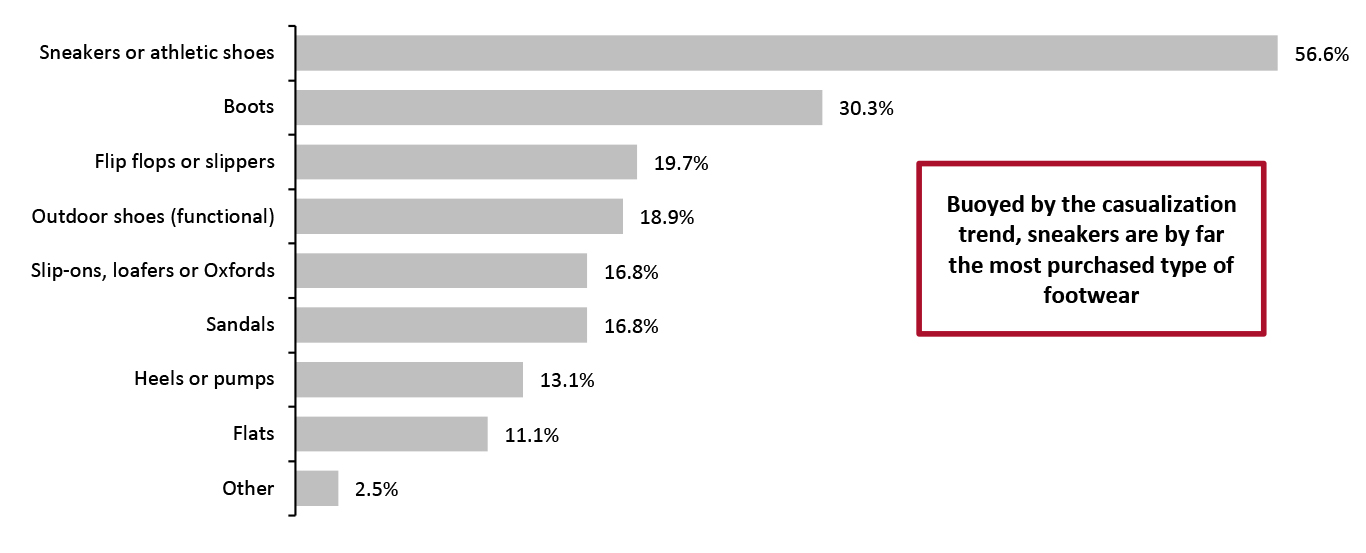

Source: Coresight Research [/caption] Furthermore, our survey found that sneakers or athletic shoes are by far the most shopped footwear category—followed by boots and flip flops or slippers—driven by the casualization trend. We asked shoppers what types of footwear they have shopped in the past three months, and we found the following:

- 56.6% of footwear shoppers said that they have purchased sneakers or athletic shoes, while 30.3% said they bought boots in the last three months. Some 19.7% of consumers said they purchased flip flops or slippers.

- Outdoor shoes were the next most shopped category, with 18.9% of respondents reporting that they have purchased outdoor shoes in the last three months. Some 16.8% of consumers said that they have bought sandals and the same percentage bought slip-ons, loafers or Oxfords.

Figure 9. US Footwear Shoppers: What Types of Footwear They Have Purchased in the Past Three Months (% of Respondents) [caption id="attachment_142521" align="aligncenter" width="700"]

Base: 244 US respondents aged 18+ that had bought footwear in the past three months, surveyed on February 21, 2022

Base: 244 US respondents aged 18+ that had bought footwear in the past three months, surveyed on February 21, 2022 Source: Coresight Research [/caption] In addition to outpacing leading specialists (as confirmed by our survey data above), we believe dominant non-specialists also captured the majority of share formerly held by bankrupt footwear giant Payless ShoeSource—which we discuss below. Non-Specialists Likely Captured the Majority of Bankrupt Footwear Giant Payless ShoeSource’s Shares US footwear retail giant Payless ShoeSource closed all of its operations in the US and Puerto Rico in 2019 after filing for bankruptcy for the second time within the span of two years. Several factors contributed to the demise of Payless ShoeSource, including fierce competition from online players, such as Amazon, and big-box discounters, such as Target and Walmart. Furthermore, the company was saddled with huge debt, which hindered its capabilities to expand its digital infrastructure. We believe that most of the shares lost by Payless ShoeSource in the US footwear industry have been captured by price-competitive non-specialists such as Walmart and Target—with some migrating to Amazon and Kohl’s too. On the other hand, Payless ShoeSource is trying to get its business off the ground again. In early 2021, the footwear retailer opened a flagship store in North Miami, nearly two years after closing over 2,000 stores in the US. The flagship launch marked the retailer’s re-entry into brick-and-mortar retail, a move that Payless ShoeSource has been discussing since the summer of 2020, when it launched its e-commerce website and announced plans to open 300–500 stores within a five-year span. The company is aiming to expand in the affordable footwear space, where it will face direct competition from specialists, such as Foot Locker and Designer Brands, and non-specialists, such as Amazon, Target and Walmart. With competition becoming fierce in the low-price arena, it will be interesting to see how Payless ShoeSource will manage to open and run hundreds of sustainably profitable stores.

Themes We Are Watching

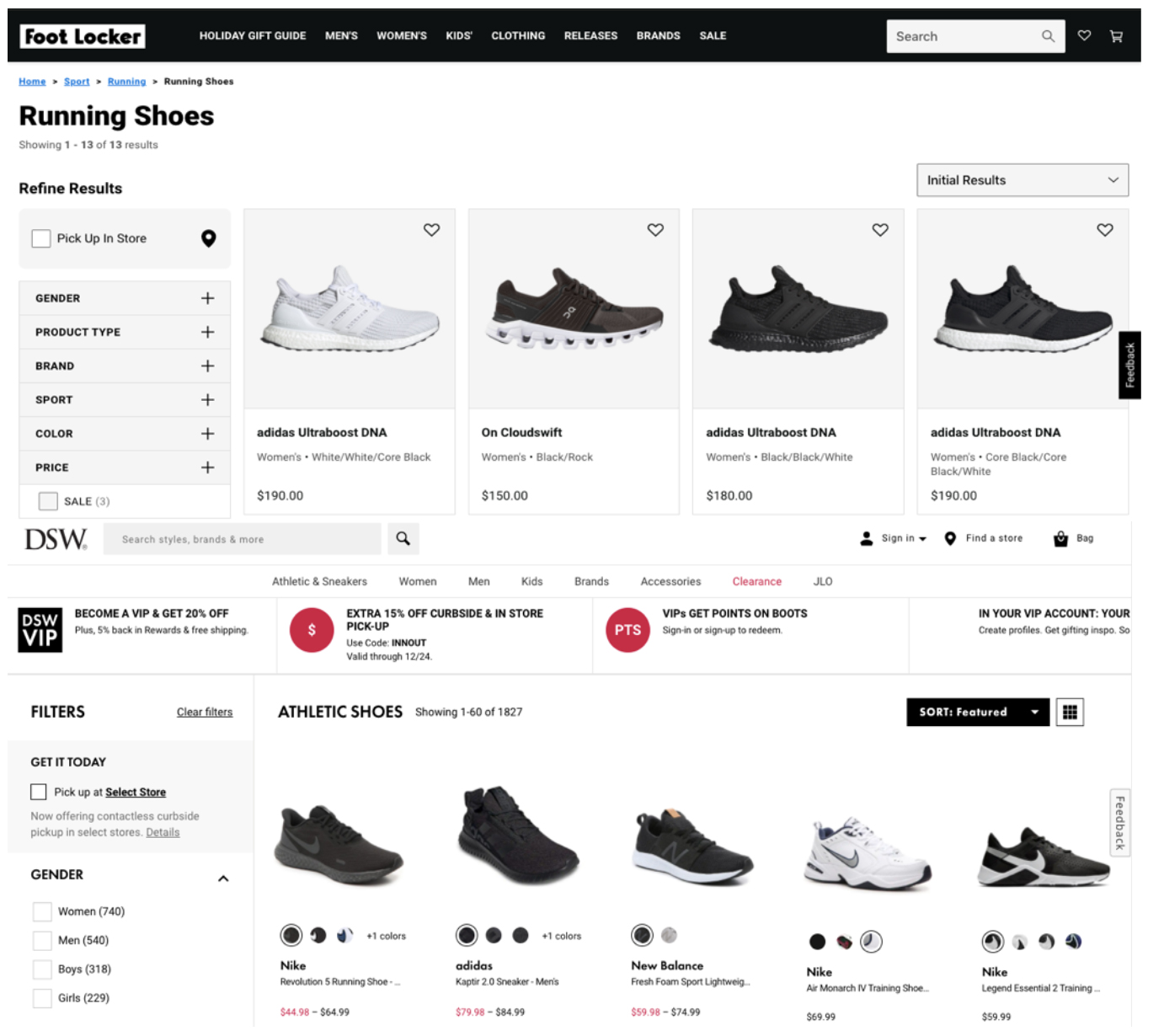

We discuss four key themes that we believe present opportunities in specialty footwear retail. 1. Growing Demand for Athleisure and Sports Footwear Athleisure and sports footwear have become the top categories in the US footwear market, as shown by our survey data in Figure 9 above. The reasons for the growth of these categories are rising demand for comfort-oriented styles, as well as increasing awareness and enthusiasm regarding the health benefits of sports and fitness activities. Retailers that focus on sports footwear and athleisure, such as Foot Locker, are showing strong growth. In the third quarter of the fiscal 2021 earnings call held in November 2021, Foot Locker’s CEO, Richard Johnson, said:There is the growing emphasis on fitness and self-care. Whether it's home fitness, running, training, hiking or any number of other sport fitness categories, we see consumers are turning to and returning to Foot Locker to meet their fitness needs. And we see this trend increasing.

Furthermore, the company noted that Foot Locker is benefitting from the overall athleisure trends, aided by the continued work-from-home environment and the new return-to-work hybrid model—where some employees work in the office, while others work from home. In past two years, Foot Locker has also doubled down on its standing as a sneaker-focused retailer by launching a series of “Power Stores.” Power Stores feature sporting areas, sneaker customization services, sneaker cleaning stations and spaces for sneakerhead-related lifestyle events. Similarly, retailers that mainly focus on general footwear, such as Designer Brands, are also ramping up their athletic and athleisure categories. In its third-quarter earnings call held in December 2021, Designer Brands’ management said that the company looks to expand its market share in the fast-growing athletic and athleisure categories through investments in its assortments and by enhancing consumer engagement. During the third quarter, the company’s athleisure comps were up 38% year over year and up 30% on a two-year basis. CFO Jared Poff said:We grew athleisure sales 26 percentage points faster than the rest of the market in July and August compared to the same period in 2019, resulting in an overall market share gain of 30 basis points. Athleisure penetration was 50% in the third quarter versus 38% in 2019.

However, one major concern among sports-focused footwear retailers is that a few leading sports brands are cutting some specialist stores from their distribution lists. For instance, in December 2021, NIKE announced that it will stop selling its footwear at Designer Brands starting from 2022 and shift to selling more of its products through its own stores, mobile apps, website and select retailers. NIKE is Designer Brands’ largest sports footwear supplier, accounting for about 7% of the retailer’s sports footwear sales in fiscal 2020 ending January 30, 2021. Likewise, footwear brand owners Adidas and Under Armour are also pulling back on retail partners and building their DTC channels. Nevertheless, despite losing big brands, Designer Brands can make up revenue by growing other small- and medium-sized athletic footwear brands. We believe strong collaborations between specialists and brand owners will be a win-win situation moving forward. Below, we discuss recent popular collaborations between footwear specialists and brand owners. [caption id="attachment_142522" align="aligncenter" width="700"] Sports footwear on Foot Locker’s and Designer Brands’ owned DSW websites

Sports footwear on Foot Locker’s and Designer Brands’ owned DSW websites Source: Foot Locker and Designer Brands [/caption] 2. Collaborations Among Footwear Specialists and Brand Owners We are seeing more footwear retailers and brand owners collaborate with each other to launch new products, capitalize on the unique strengths of each brand and take advantage of surprising partnerships to generate intrigue. In December 2021, Genesco (owner of Journeys, Journeys Kidz, Johnston & Murphy and Little Burgundy banners) entered into a three-year licensing agreement with US-based sports footwear brand Etonic to be the brand’s exclusive licensee in the US and Canada. The alliance also includes two three-year options for renewal, which would extend the partnership through January 31, 2030. Genesco’s licensed footwear includes leading brands Dockers, Levi’s and Starter. The addition of Etonic expands Genesco’s Licensed Brands Portfolio into the retro/heritage branded footwear space—featuring 1980s and 1990s style trends—which is a rising segment in the footwear industry. According to the terms of the alliance, Genesco will design and manufacture the footwear products for Etonic brand, and it will launch the new footwear line in specialty shoe stores by fall 2022 at retail prices ranging from $50 to $110. Similarly, in December 2021, JD Group entered into a strategic partnership with Authentic Brands Group to launch Reebok’s footwear collections in over 2,850 JD Group stores across North America and Europe. All stores under the JD Group banner, including Finish Line, JD, DTLR, Shoe Palace, Size, Sprinter and SportZone, will start selling Reebok products from fall 2022. In ABG’s press release on December 20, 2021, JD’s Executive Chairman Peter Cowgill said:

Reebok is an iconic global lifestyle brand with strong resonance across all JD channels and we are thrilled to partner with ABG to introduce new and exciting products to our legacy customers and JD’s growing Gen Z audience. Reebok fits squarely into our sports and active lifestyle verticals, and we look forward to maximizing Reebok’s potential by building on the brand’s incredible heritage.

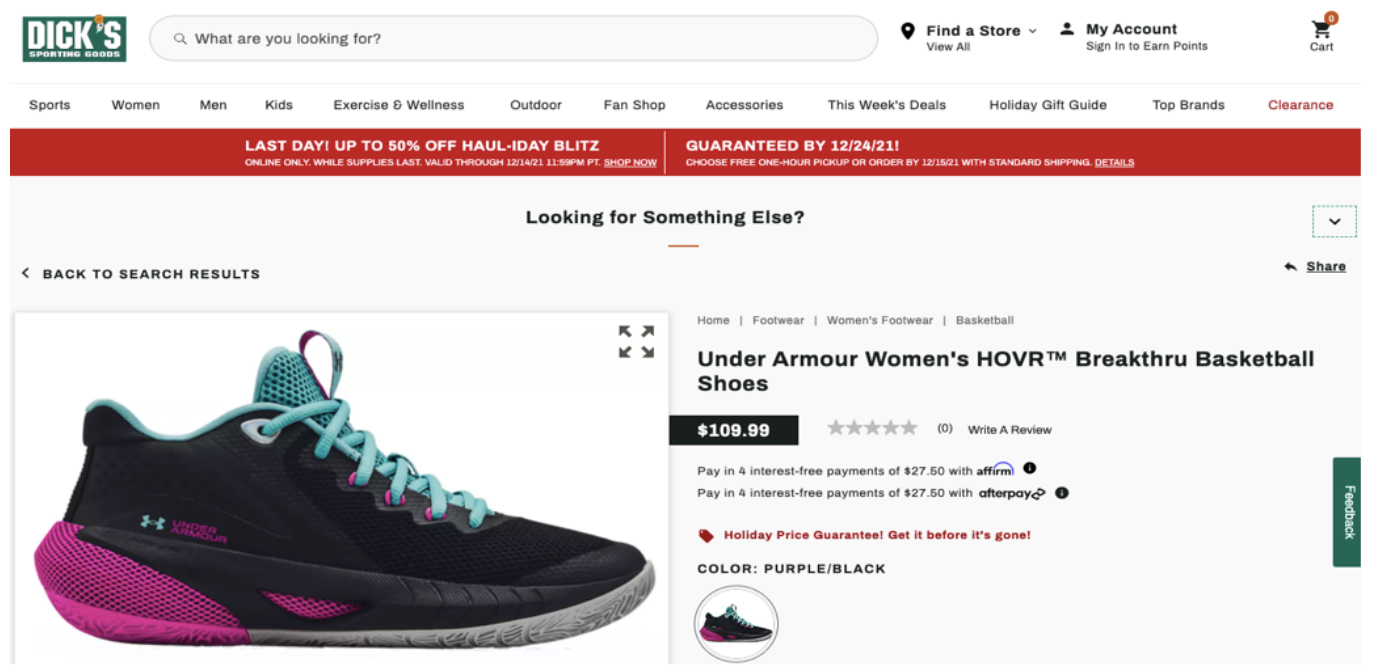

Likewise, in September 2020, Dick’s Sporting Goods collaborated with apparel and footwear brand owner Under Armour to launch UA HOVR Breakthru, a basketball shoe developed specifically for women. The UA HOVR Breakthru, available exclusively through Dick’s Sporting Goods and Under Armour, takes into account the physiological components unique to a woman’s foot—such as a narrower heel, the higher percentage of sensory receptors and the need for greater flexibility. Through this alliance, Dick’s Sporting Goods continues its push into the women’s footwear marketplace. In the company press release dated September 15, 2020, Dick’s CEO Lauren Hobart said:We saw a gap in the market for a basketball shoe developed specifically for women and wanted to be able to offer this to our female customers but needed the support from a major footwear brand to create this type of shoe. We're thrilled that Under Armour stepped up to collaborate with us and produce a shoe we're all proud of.

Going forward, we expect to see more footwear retailers and brand owners collaborate to meet consumers’ changing needs and drive excitement about footwear products. [caption id="attachment_142523" align="aligncenter" width="700"] The UA HOVR Breakthru basketball shoe for women available exclusively through Dick’s Sporting Goods and Under Armour

The UA HOVR Breakthru basketball shoe for women available exclusively through Dick’s Sporting Goods and Under Armour Source: Dick’s Sporting Goods [/caption] 3. Business Expansion Through M&A We expect the wave of footwear retail disruption and consolidation seen in 2021 to continue in 2022 and beyond among footwear companies. Below, we discuss footwear giants that have acquired rivals and added new technologies and consumer segments to gain market share.

- Caleres: In November 2021, Caleres completed the acquisition of US-based footwear brand Blowfish Malibu. The retailer noted that the acquisition feeds into Caleres’ overall expansion plans and also better positions the company to expand its strategically important sneaker and casual footwear segments. In its third-quarter earnings call held in November 2021, Caleres’ management said that the acquisition is accretive, offers additional growth potential, and fits extremely well into the company’s broader portfolio.

- Foot Locker: In September 2021, Foot Locker acquired Eurostar (WSS), a US-based athletic footwear retailer, for $750 million. Foot Locker’s CEO Richard Johnson said, “WSS brings an expanded and differentiated customer base rooted in the rapidly growing Hispanic community, diversifies and enhances our product mix, and strengthens our footprint with a 100% off-mall store fleet located in key markets.”

- Genesco: In January 2020, Genesco acquired Togast, a US-based company that specializes in sourcing and selling licensed footwear. Through this acquisition, the specialty retailer has expanded its footwear license portfolio to brands including Adio, Fubu and G.H. Bass & Co., among others.

- JD Sports: In March 2021, JD Sports acquired US-based athletic footwear retailer DTLR Villa for $495 million, of which $100 million will be used to repay DTLR’s existing debts. As of February 1, 2021, DTLR owns and operates 247 stores across 19 states, mainly in the eastern and northern US.

In December 2020, JD Sports acquired US-based footwear retailer Shoe Palace for $325 million, providing the British retailer with a robust geographical footprint in the western US through a network of 167 stores. JD Sports’ push into the US footwear retail market commenced in 2018 through the $558 million acquisition of athletic footwear retailer Finish Line.

[caption id="attachment_142524" align="aligncenter" width="700"] JD Sports successfully integrated US-based footwear retailer Shoe Palace in December 2020.

JD Sports successfully integrated US-based footwear retailer Shoe Palace in December 2020. Source: Company reports [/caption] 4. Environmental, Social and Governance Initiatives Footwear specialty retailers in the US have accelerated the pace of their activities promoting sustainability, diversity and inclusion. Below, we discuss two case examples of environmental, social and governance (ESG) initiatives by footwear specialists. In June 2021, Foot Locker entered into a partnership with footwear brand owner Adidas for the exclusive launch of the Adidas Originals Stan Smith Primegreen footwear line, which is made with 50% recycled materials. This initiative is the latest step in Foot Locker’s commitment to sustainability and ethics. Furthermore, Foot Locker is expanding its inclusive initiatives and plans to invest $200 million between fiscal 2020 and fiscal 2025 to support Foot Locker’s Black workforce and communities through the Leading in Education and Economic Development (LEED) initiative. Caleres owned Dr. Scholl’s Spring 2021 Original Shoe Collection, launched in March 2021, was its most sustainable footwear line to date, according to the company. The company stated that shoes were made using responsibly sourced materials, such as organic cotton, and sustainable techniques, including waterless dyeing. Furthermore, the linings and topcloths were made from recycled water bottles, diverting over 20 million bottles from landfills. Additionally, for every pair of shoes sold (over 135,000), Dr. Scholl’s donated a tree to Trees for the Future to mitigate carbon emissions. Furthermore, in April 2021, Caleres unveiled the following list of sustainable commitments in its ESG report:

- Use environmentally preferred materials in all Caleres products and shoeboxes by 2025

- Reduce energy consumption by 25% in the retail stores and distribution centers

- Recycle and refurbish 90,000 pairs of shoes annually

- Reduce waste by 50% in Caleres’ strategic-sourcing supplier base, with 100% of strategic-sourcing suppliers contributing to waste reduction

Adidas Originals Stan Smith Primegreen footwear line launched on Foot Locker in June 2021

Adidas Originals Stan Smith Primegreen footwear line launched on Foot Locker in June 2021 Source: Foot Locker [/caption]

Retail Innovators

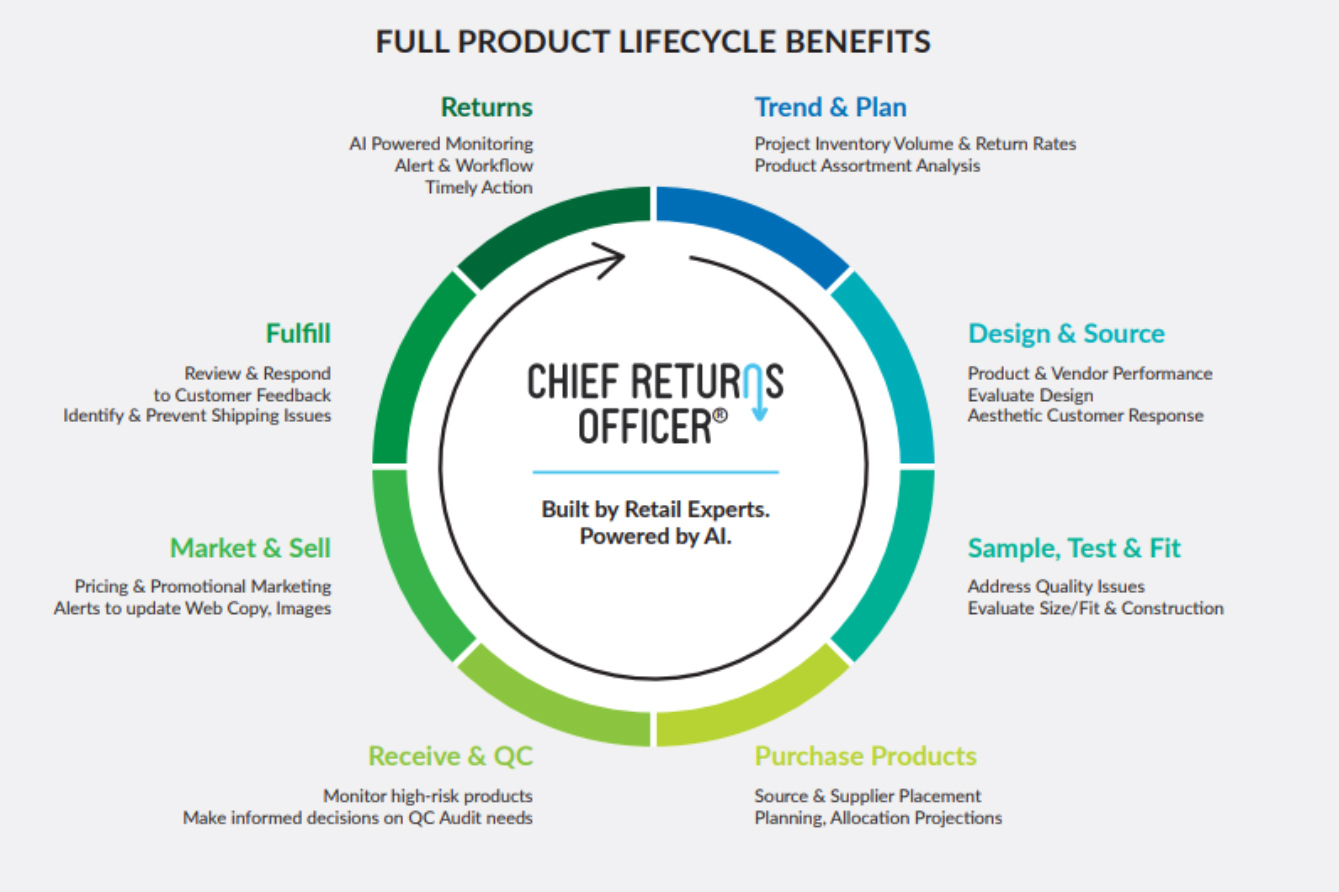

Technology innovators are emerging as a significant enabler of footwear retailers’ expansion into e-commerce. Through technological innovations, these startups are helping retailers to improve efficiency, agility and resilience across their supply chains. We discuss two innovators whose solutions can benefit the specialist footwear market. 1. FindMine Founded in 2016 and headquartered in New York, FindMine is an analytics company that uses artificial intelligence (AI) to automatically generate complete recommended outfits, both online and offline, when shoppers browse an individual item. FindMine’s platform integrates with a range of third-party tools, including SAP, Salesforce, Oracle, Facebook and Instagram, to automate data synchronization. FindMine’s “Complete the Look” platform utilizes shoppers’ trend data and mimics a company’s stylists through machine learning scale outfit guidance to understand which products sell best when paired together and to gain insight into how consumers interact with the retailer. The cloud-based platform automates and scales the creation of content about similar looks or recommended combinations for each individual footwear item, helping shoppers complete their fashion look and helping retailers save time. Furthermore, FindMine’s platform facilitates the retailer’s email and SMS campaigns to win back consumers or encourage them to buy related products; and offers businesses data on which merchandising strategies will lead to more conversions. Additionally, FindMine’s cloud platform adjusts for inventory levels and does not require custom feeds, product tagging or manual work. At present, FindMine works with several footwear brands, such as Adidas, Cole Haan and Reebok. We believe that FindMine’s “Complete the Look” platform can help footwear companies significantly increase their customer average order value (AOV). In early 2019, when Adidas partnered with Findmine, the footwear giant witnessed a 95% decline in the time spent for building complete recommended outfits on FindMine’s platform as compared to Adidas’s own complete the look feature and a 960% increase in the number of items included in outfits. 2. Newmine Founded in 2011 and based in Massachusetts, Newmine’s Chief Returns Officer, an AI-powered platform, enables retailers to holistically view returns data and provides analysis and prescriptive actions across the value chain. The Chief Returns Officer platform uses anomaly detection and natural language processing to identify the root cause of returns—generating corrective actions that retailers can take to reduce future returns and empower teams in different departments to collaborate seamlessly. This technology offering aims to improve retailers’ bottom lines by minimizing product returns, which are a significant cost driver across retail—particularly for footwear specialists. The company’s clients include footwear brands and retailers like Cavender’s Boot City, Express and Talbots. Furthermore, in July 2021, Spain-based footwear company Viscata joined Newmine’s client base of footwear brands and retailers. In the press release, Newmine’s CEO Navjit Bhasin said, “Footwear is known for having significant return rates, particularly in e-commerce. They [Viscata] are innovative and customer-driven, and Newmine welcomes the opportunity to support Viscata as they start their returns reduction journey.” Guillaume Benoit, Global Supply Chain Director at Viscata, said, “Newmine takes a visionary approach to the issue of returns. With Returns Intelligence, we'll reduce hassle, cut down on expenses, harness customer feedback, all while ensuring our supply chain remains resilient, efficient, and sustainable.” Earlier, in January 2021, Newmine launched KeepScore, a success benchmark that enables retailers to quickly identify their most profitable products, suppliers and customers by understanding which products customers chronically return and which they keep. [caption id="attachment_142526" align="aligncenter" width="700"] Newmine’s Chief Returns Officer, an AI-powered platform enabling retailers to holistically view returns data and provides prescriptive actions across the value chain

Newmine’s Chief Returns Officer, an AI-powered platform enabling retailers to holistically view returns data and provides prescriptive actions across the value chain Source: Newmine [/caption]

What We Think

Many footwear specialty retailers across the US saw a solid recovery in 2021—although with varying rates, depending on their key product segments. For 2022, against very strong comparatives, Coresight Research estimates that the US specialists will hold the resurgence, with the sector witnessing almost flat year-over-year sales growth. In the near future, we anticipate that Foot Locker will retain its status as the largest footwear retailer in the US, while JD Sports will continue to expand its operations in the US footwear space through organic and inorganic (M&A) means. We also expect Caleres and Dick’s Sporting Goods to gain market shares in the near future, mainly through expansions in the sports footwear and athleisure categories. Implications for Retailers- We see e-commerce as a significant opportunity for footwear retailers to drive sales as we expect many consumers to cement pandemic-driven online shopping habits in 2022 and beyond. We recommend that retailers enhance their digital capabilities across their supply chains.

- Footwear specialty retailers should continue to take proactive steps toward sustainability in order to win consumer trust and attract investors and employees in a dynamic retail landscape.

- We expect strong M&A activity in the US footwear retail industry to continue in 2022 and beyond. Acquisitions present opportunities for footwear giants to adopt new technologies and expand into new consumer segments to enhance their market shares. For struggling footwear retailers, M&A activity presents an opportunity to fix what is not working; for example, long-term strategies could address the core retail business missteps that led to the initial collapse.

- Innovators have strong opportunities to collaborate with footwear specialty retailers to drive the push into e-commerce expansion. Innovators can also support footwear retailers in improving efficiency, agility and resilience across their supply chains.