albert Chan

Introduction

Each report in our Market Outlook series provides an analysis of a particular retail sector or consumer market. In this report, we cover the US drugstore sector, with a focus on major drugstore chains. We also discuss the scale of, and initiatives by, selected competitors in the health and drug space, such as Walmart and Kroger. This report includes:

- Total pharmacy and drugstore sector size and growth

- Online health and personal care market size and growth

- Competitive landscape and key disruptors in the drugstore market

- A review of major themes across the market

- The outlook for US drugstore retail

Market Size and Growth

Pharmacy and Drugstore Market Size and Growth

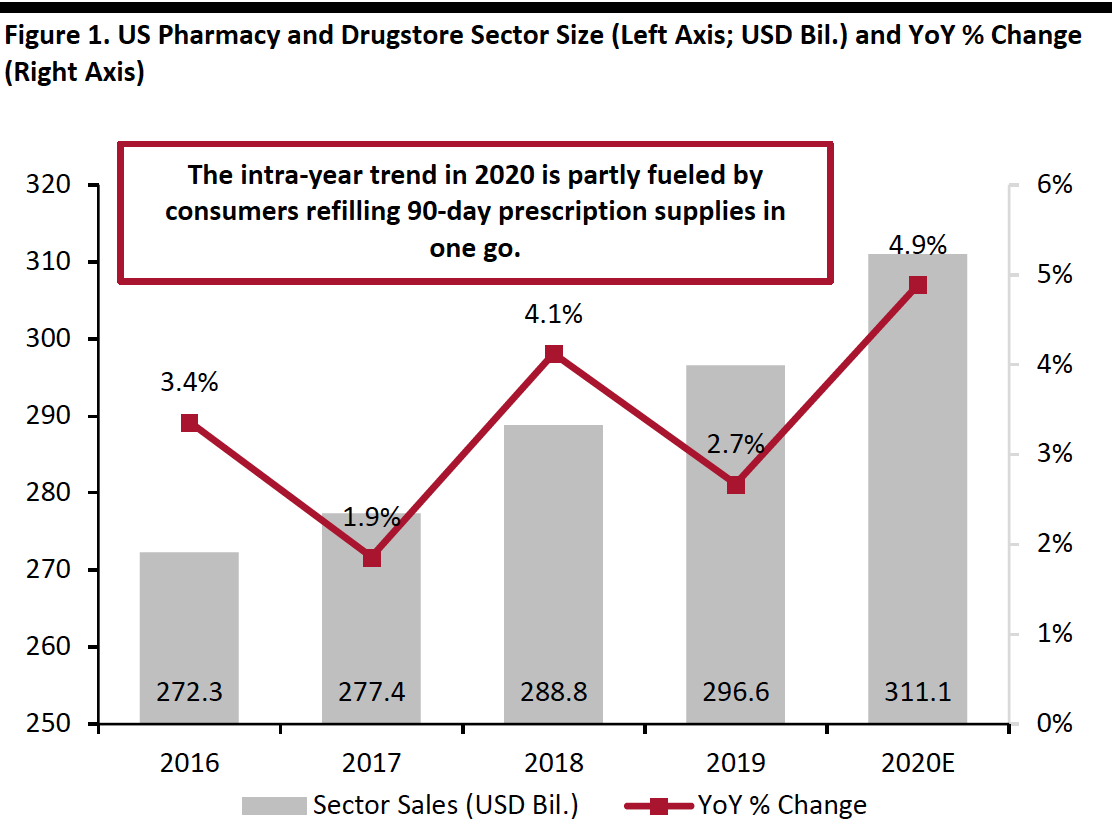

Coresight Research estimates that the US pharmacy and drugstore sector size will total around $311 billion in 2020, up 4.9% year over year. Growth has been supported by stockpiling in the months leading up to the unfolding of the pandemic. In March, demand saw a significant uptick as consumers stocked up on a 90-day supply of key prescriptions to ensure access to their medications and limit their trips to stores. After sluggish growth in April and May, sales rebounded in June and remained strong in July, as consumers returned to stores to replenish their 90-day prescription supplies.

For instance, CVS highlighted in its second-quarter earnings call that its prescription volumes accelerated in June as consumers refilled 90-day prescriptions from March.

As concerns about contracting coronavirus remain, we expect a similar pattern to play out in September and December as consumers continue to consolidate their trips to stores, albeit at a more moderate level.

Major drugstore chains, with their large number of outlets, have been expanding their grocery product offerings in recent years—so the strong food retail demand we have seen in 2020 is supporting drugstore sales. Additionally, continued demand for home-hygiene, personal-hygiene and wellness products will strengthen the drugstore sector this year.

[caption id="attachment_117557" align="aligncenter" width="550"] Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

Online Health and Personal Care Sector Size and Growth

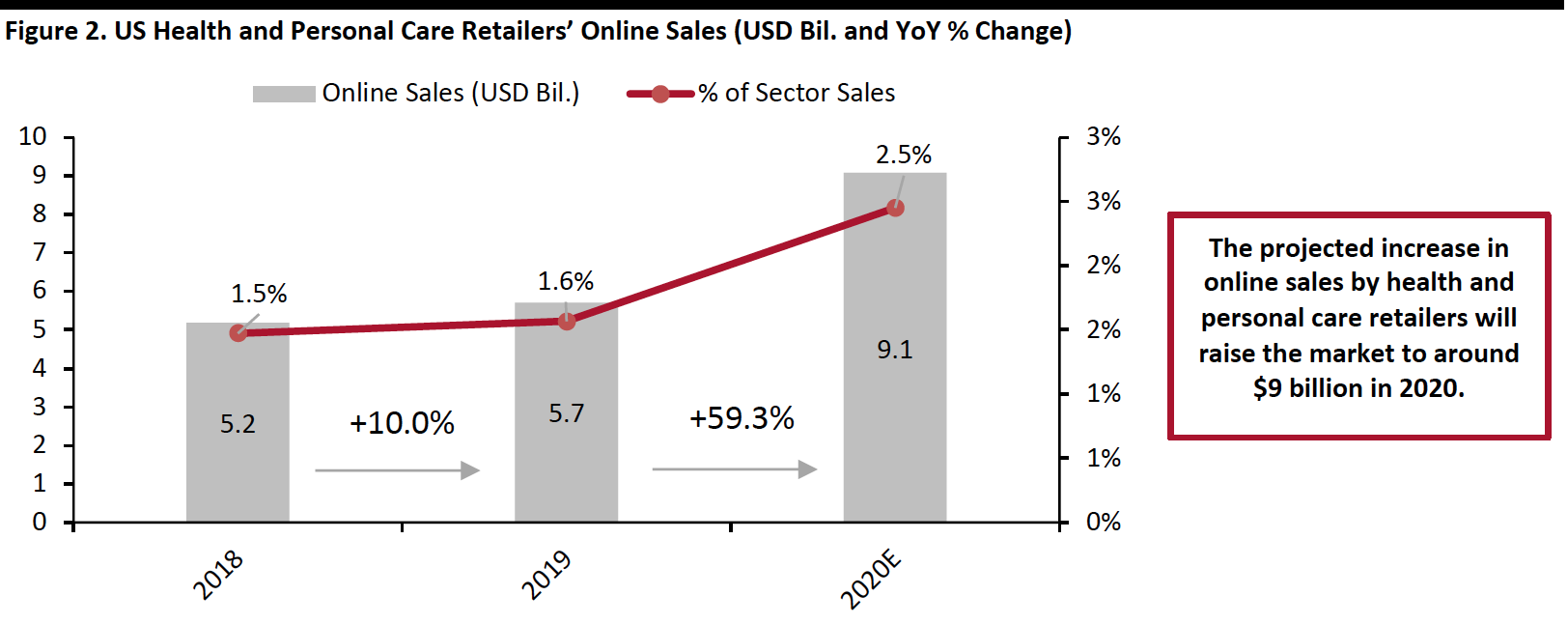

The pandemic has caused an unprecedented surge in demand for online refills of prescription drugs and front-end items that include over the counter (OTC) drugs, general merchandise items, and health and beauty products. The necessity of physical distancing and self-quarantine has spurred consumers to turn to online channels in greater numbers and more frequently.

Coresight Research estimates that online sales by health and personal care retailers (of which drugstores are a subsector) will surge 59.3% in 2020, fueled by substantial growth in the first half of the year. This will take the market to around $9 billion in 2020, equivalent to around 2.5% of total health and personal care retailers’ sector sales, versus 1.6% in 2019.

[caption id="attachment_117558" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

While e-commerce penetration remains low in the health and beauty specialist market, our analysis suggests that online sales in this sector are growing significantly faster than online sales for health and beauty products in general.

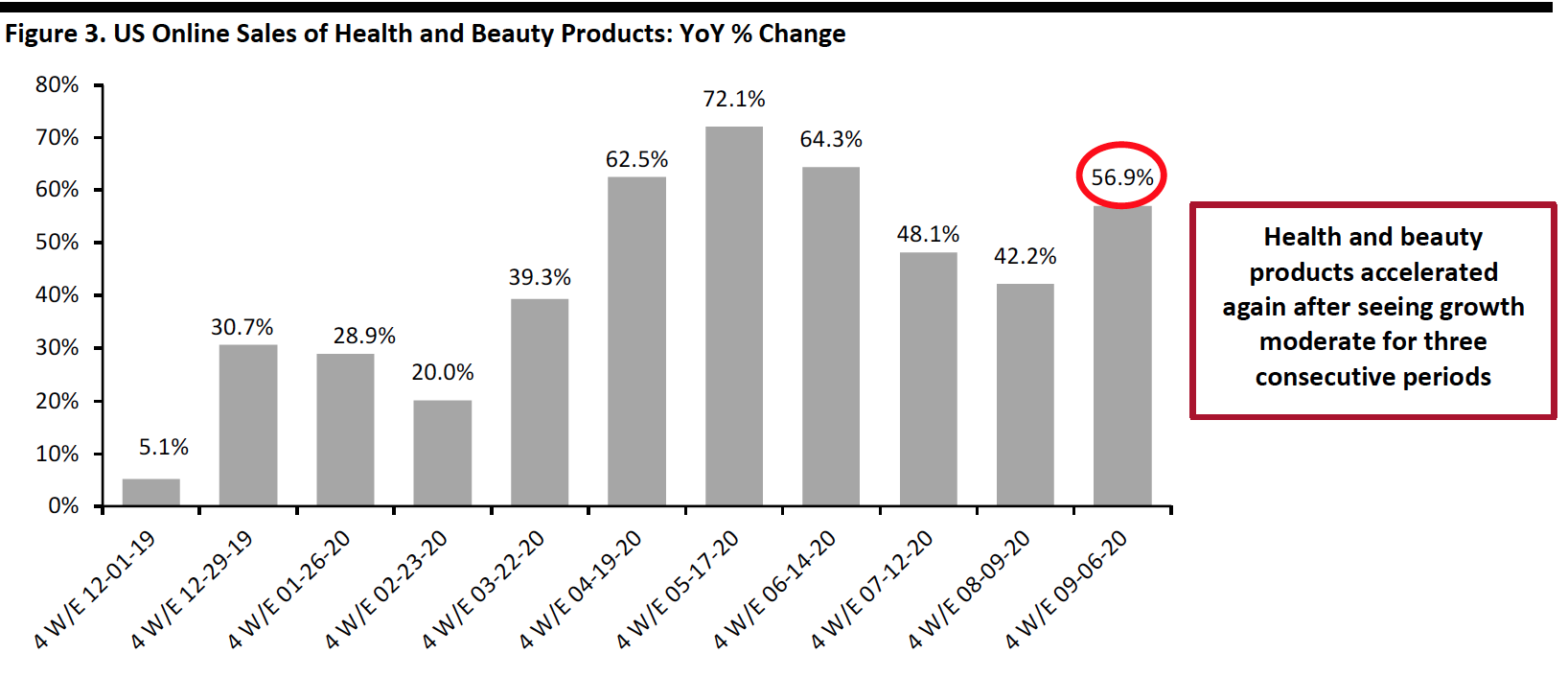

From IRI data, we calculate that total online sales of health and beauty products (excluding prescription drugs) grew by around two-thirds, year over year, in the second quarter of 2020. However, health and beauty specialist retailers’ online sales grew by 106% year over year in the second quarter, according to the US Census Bureau—representing a meaningful outperformance. As in other sectors, the pandemic has tended to support stronger online growth at multichannel retailers than at online-only retailers.

[caption id="attachment_117559" align="aligncenter" width="700"] Data exclude sales of prescription drugs

Data exclude sales of prescription drugsSource: IRI E-Market Insights™/Coresight Research[/caption]

Competitive Landscape

The US drugstore industry consists of large chains and small independent pharmacies that provide retail prescription drugs and front-end products that include OTC drugs, health and beauty products, and general merchandise items.

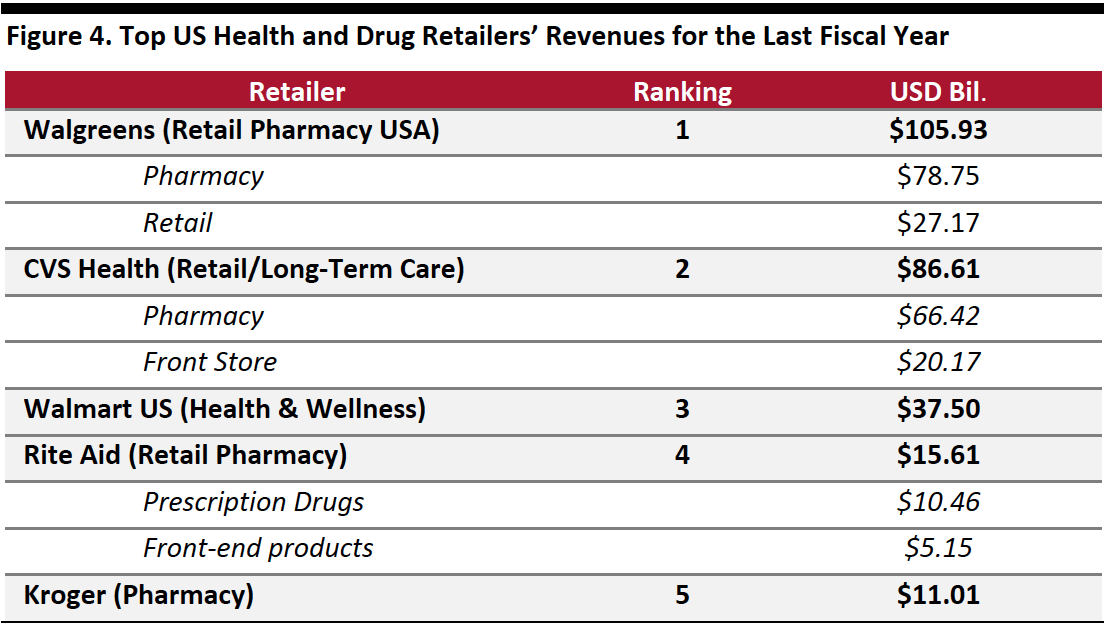

The US drugstore market is heavily concentrated with CVS, Rite Aid and Walgreens among the top drug retailers in the US. These drugstore companies face tough competition from grocery segment players such as Kroger and mass merchandisers such as Walmart—as well as wholesale clubs such as Costco. For example, Kroger operates nearly 2,200 pharmacies in 37 states, while Walmart operates over 5,000 pharmacies in 49 states. Additionally, e-pharmacy startups, which are on a coronavirus-fueled growth spurt, continue to maintain pressure on the industry leaders.

[caption id="attachment_117560" align="aligncenter" width="550"] CVS Health’s fiscal year ended on December 31, 2019; Walmart’s fiscal year ended on January 31, 2020; Rite Aid’s fiscal year ended on February 29, 2020; Kroger's on February 1, 2020; Walgreens’ year ends on August 31, and the data above are for its four fiscal quarters ended 2Q20, to provide a fair comparison.

CVS Health’s fiscal year ended on December 31, 2019; Walmart’s fiscal year ended on January 31, 2020; Rite Aid’s fiscal year ended on February 29, 2020; Kroger's on February 1, 2020; Walgreens’ year ends on August 31, and the data above are for its four fiscal quarters ended 2Q20, to provide a fair comparison.Totals may not sum due to rounding

Source: Company reports[/caption]

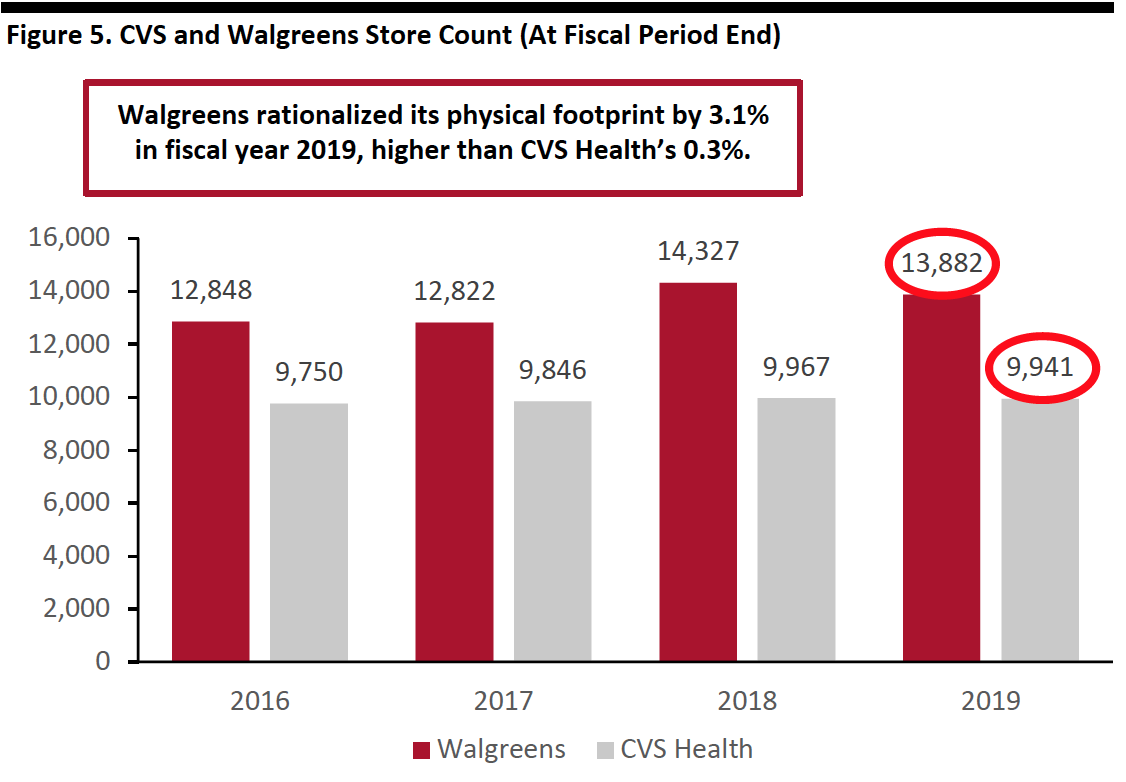

Store Closure Programs

- Walgreens leads the US drugstore market in number of locations. However, the retailer has been consolidating its retail footprint over the last few years. As part of the “transformational cost management program” launched by Walgreens in December 2018, the company announced in April 2019 that it would close 750 Rite Aid Stores out of 1,932 stores it purchased from Rite Aid in 2018. In August 2019, the company also disclosed plans to close 200 Walgreens stores in the US as well as 200 in the UK. In its recent earnings call, the company confirmed that its store closure program is broadly on track and that the transformational program will result in annual cost savings above $2 billion by fiscal year 2022.

- CVS Health reduced its net retail footprint by 26 stores in the fiscal year 2019. In November 2019, the company announced plans to close 75 retail stores in 2020, most of which are approaching the end of their lease term. The scheduled closures represent a small chunk of CVS Health’s footprint, at fewer than 1% of total stores. The company did not announce any further store closure plans.

Source: Company reports[/caption]

Source: Company reports[/caption]

Innovators and Disruptors

The pharmacy retail market has faced significant disruptions from online pharmacy startups for several years—with the newcomers often dispensing prescription medicines to patients at substantial discounts and offering the added benefit of free home delivery. The pandemic boosted e-pharmacy startups, as patients increasingly switched to prescription drug delivery services instead of in-person pharmacy visits. Buoyed by increasing demand, the startups are expanding their geographical reach and raising new rounds of capital from investors.

[caption id="attachment_117562" align="aligncenter" width="550"] Major e-pharmacy startups

Major e-pharmacy startupsSource: Company websites[/caption]

- Alto Pharmacy: A San Francisco-based digital pharmacy founded in 2015, offering patients free, same-day delivery of prescription medicine. Alto plans to grow its footprint nationally in 2020 after years of focus on the California market. In April 2020, the company launched its businesses in Denver, Las Vegas and Seattle. In January 2020, Alto raised $250 million in a Series D funding round led by Softbank’s Vision Fund 2 and other investors.

- Blink Health: An e-commerce platform for prescription drugs, founded in 2014. The company guarantees the lowest prices on generic drugs for its users and offers a “Price Match Guarantee” policy. Blink Health offers free home delivery or free local pick-up at Albertsons, Kroger, Safeway and Walmart pharmacies.

- Capsule: A New York City-based online pharmacy startup founded in 2015, offering a free, same-day delivery service. Capsule promises to provide the medication, hand-delivered by couriers within two hours of interaction for orders in New York City. At the beginning of 2020, the startup had one pharmacy facility based in Manhattan. Since the onset of the pandemic, Capsule has expanded its operations to Boston, Chicago, Minneapolis and parts of New Jersey. The company has also hired more than 400 people since March, almost doubling its workforce, according to New York Post.

- NowRx: An online pharmacy founded in 2015, specializing in same-day and same-hour prescription medication delivery services. The company attributes its rapid fulfillment capacity to its business model, which is based on micro fulfillment centers that operate a fully automated dispensing process driven by robotics and artificial intelligence. NowRx saw a surge in demand as the pandemic unfolded and it reportedly generated $1.1 million revenue in June. On July 15, the company announced raising $20 million in Series B funding through SeedInvest.com, a crowdfunding platform.

- PillPack by Amazon: A full-service e-pharmacy founded in 2013. It delivers medications in pre-sorted dose packaging, schedules refills and renewals, and offers emergency overnight deliveries for no delivery charge. In 2018, Amazon acquired PillPack for a reported $1 billion, enabling the e-commerce leader to enter the prescription drug industry for the first time. In August 2020, health insurer Horizon Healthcare Services partnered with PillPack to offer its members simplified sign up to PillPack, as well as an estimated out-of-pocket cost before selecting their prescription fill options.

Themes We Are Watching

Drug Retailers Go Head-to-Head in Health Care

As the health-care landscape continues to evolve amid the pandemic, drug retailers remain bullish in their push into the health-care services market and are embracing retail health care as a critical part of their growth strategies for a post-Covid future.

For the last two years, CVS and Walgreens have been redesigning their physical retail spaces to offer comprehensive primary-care services at a lower cost. Walgreens has forged a series of partnerships with medical-care providers and health insurance companies to provide in-store health services and primary care. On the other hand, CVS has relied on acquisitions, including the late-2018 takeover of health insurer Aetna, to make its push into health-care services.

- CVS: HealthHub Store Openings on Track

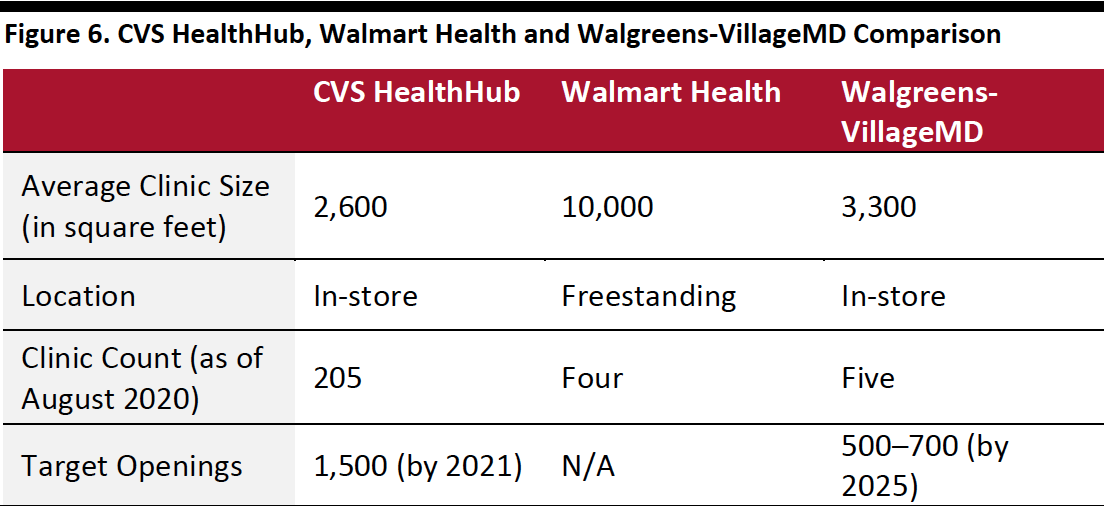

CVS noted in its earnings call for the second quarter, ended June 30, that its target to expand its new HealthHub concept to 1,500 stores across the US by the end of 2021 remains on track—despite the disruption caused by the pandemic. The drugstore retailer emphasized that it is seeing increased prescription sales and higher footfall in HealthHub concept stores compared to a control group of traditional CVS stores. CVS opened 50 HealthHub stores in the US last year, bringing the total number of stores with this concept to 205 locations across 22 states as of August 2020.

The HealthHub concept is based on remodeled CVS drugstores, with 20% of retail space newly dedicated to health-care services—including wellness products and personalized care. CVS already operates a network of approximately 1,100 MinuteClinic medical clinics inside stores to provide diagnosis and treatment of minor illnesses and injuries. The company notes that its HealthHub stores are better equipped to deal with patients with chronic conditions, such as diabetes and respiratory illnesses.

[caption id="attachment_117563" align="aligncenter" width="550"] Source: CVS[/caption]

Source: CVS[/caption]

- Walgreens: Aggressive Expansion of Primary-Care Services

Much like CVS, Walgreens is planning to expand its primary-care presence. The pharmacy chain is expanding its pilot with VillageMD nationwide as it seeks to establish its stores as health-care destinations.

On July 8, 2020, Walgreens announced that it would invest $1 billion in its primary health-care partner Village MD to open 500–700 physician-staffed clinics inside Walgreen drugstores in more than 30 US markets over the next five years—with more to follow after that. The roll-out follows positive customer response to the company’s in-store clinic pilot program, introduced in November 2019 at five stores in Houston, Texas.

Branded “Village Medical at Walgreens,” the 3,300-square-foot primary-care clinics offer annual preventive care, chronic care management, diagnostic testing, smoking cessation, some specialty care, vaccinations and women’s health services. The clinics will be staffed with nurses, pharmacists, primary-care physicians and social workers.

To diversify its business beyond traditional pharmacy sales, Walgreens has inked several agreements in recent years to provide retail clinical services at its stores. The company has teamed up with UnitedHealth Group to place MedExpress urgent care centers at 15 Walgreens locations in six states and also runs senior health clinics at five locations in collaboration with health insurer Humana.

[caption id="attachment_117564" align="aligncenter" width="550"] Source: Walgreens[/caption]

Source: Walgreens[/caption]

- Walmart: Further Push into the Health-Care Ecosystem

Walmart continues its push into the health-care market with the opening of a new Walmart Health Center in Newnan, Georgia, in September 2020. This follows the opening of two Walmart Health clinics in Georgia and one in Arkansas earlier this year. The company opened its first pilot health clinic last September in Dallas, Georgia. Walmart Health offers behavioral health, counseling, dental, hearing, laboratory tests, optometry, primary care, wellness education and X-rays. The company already operates Care Clinics in some of its stores, but according to the retailer they offer more limited services and do not address broader health-care needs.

[caption id="attachment_117565" align="aligncenter" width="550"] Source: Walmart[/caption]

Walmart Health are standalone centers, in contrast to the in-store clinics operated by CVS and Walgreens. The Walmart centers cover more than triple the clinic size of pharmacy chains.

[caption id="attachment_117566" align="aligncenter" width="550"]

Source: Walmart[/caption]

Walmart Health are standalone centers, in contrast to the in-store clinics operated by CVS and Walgreens. The Walmart centers cover more than triple the clinic size of pharmacy chains.

[caption id="attachment_117566" align="aligncenter" width="550"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

The drugstore chains are seeking to become the first port of call for patients by providing value-based primary-care services and positioning themselves as consumer health-care hubs. According to the J.D. Power 2020 Pharmacy survey results released on August 5, 2020, this strategy is working and is leading to significant increases in both customer satisfaction and consumer spending.

The study found that almost half (48%) of retail pharmacy customers have used at least one health-care service provided by their pharmacy this year—up five percentage points from 2019. Customer satisfaction with retail pharmacy is 26 points higher among consumers who use health-care services than those who do not used them. Furthermore, customers who use at least one pharmacy health-care service spend an average of $11 more than those who do not.

The expanding role of pharmacists in response to the current health emergency context is solidifying the drug retailers’ position as care providers. For example, on September 11, the US Department of Health and Human Services authorized state-licensed pharmacists nationwide to administer Covid-19 vaccines when they become available. In August, the department permitted pharmacists in all 50 states to administer routine childhood vaccines.

- Telehealth Adoption Shifts into Hyper-drive amid the Pandemic

The telehealth market is experiencing massive growth across the health-care industry due to patients staying at home and avoiding doctor surgeries and hospitals amid the pandemic. Many drugstore retailers had already introduced telehealth services in recent years as part of their larger digital transformation—with services mainly aimed at providing access to care in areas where physicians were not available. However, the crisis accelerated telehealth adoption and boosting nascent telehealth offerings.

CVS saw a growth spurt in telehealth usage during the pandemic. Virtual visits to the retailer’s MinuteClinic, which offers remote consultation for behavioral health, chronic conditions and common injuries, increased 750% in the second quarter ended June 30, 2020 and witnessed a 600% surge in its first fiscal quarter. The company launched its telehealth service in August 2018, in collaboration with virtual care provider Teladoc.

Similarly, Walgreens saw continued demand for telehealth in the third quarter ended May 31, 2020. Customer traffic on the retailer’s Find Care platform (launched in July 2018) was up 48%—amounting to over three million visits. Against the backdrop of growing demand, the company announced the expansion of its telehealth services in April 2020, including new features and additional health-care providers to help patients address their wide-ranging medical needs.

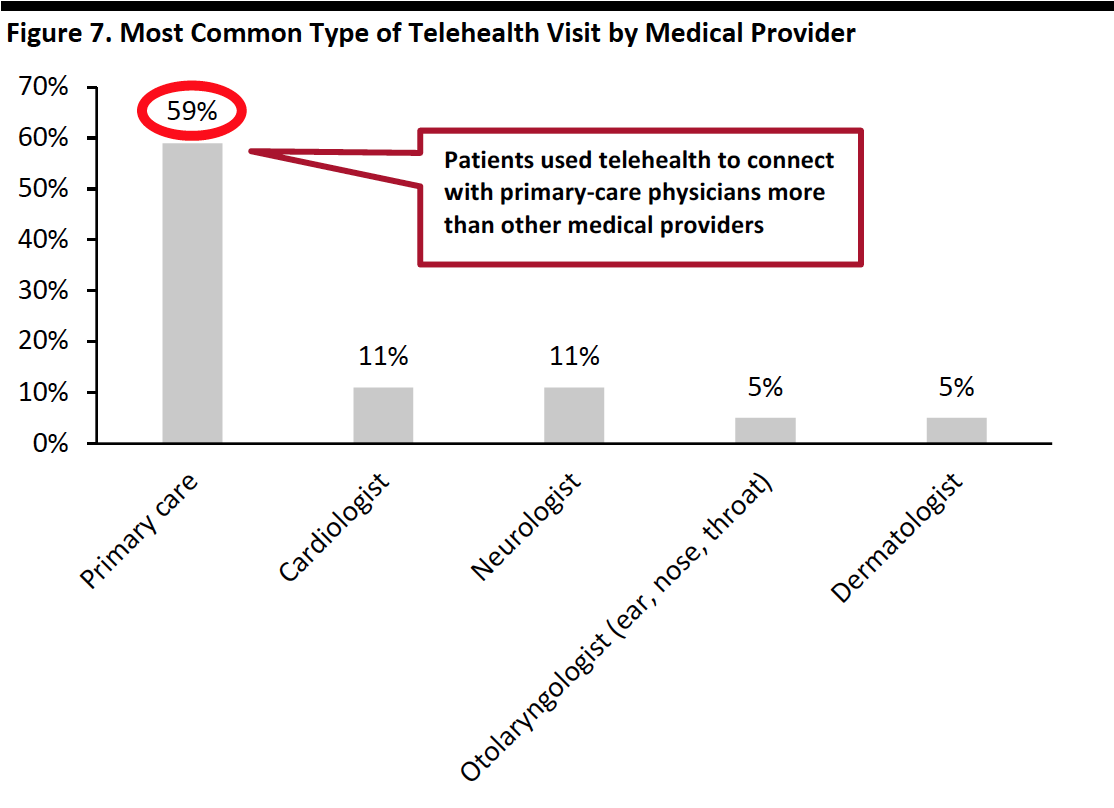

According to a survey of 2,042 American conducted by the health care data management firm Harmony Healthcare IT in July 2020, around two-thirds of respondents (67%) said that they had used telehealth services in some form since the onset of the pandemic. Additionally, around 60% of the respondents said that they plan to use telehealth services even when the pandemic subsides. The study added that respondents reported using telehealth services to consult a wide variety of providers, but virtual visits with primary-care physicians were the most common use case (59%).

[caption id="attachment_117567" align="aligncenter" width="550"] Source: Harmony Healthcare IT[/caption]

Source: Harmony Healthcare IT[/caption]

- Pandemic Sparks Surge in Drug Retailers’ Digital Sales

Amazon’s mid-2018 acquisition of PillPack galvanized major drugstore chains to place a greater emphasis on e-commerce. Walgreens went on to announce the launch of nationwide next-day prescription delivery services in December 2018. CVS followed by offering same-day prescription delivery services in 2019, in partnership with Shipt.

These pre-pandemic investments in online shopping and related digital initiatives are now paying off for drug retailers, as consumer adoption of pickup and delivery for online orders grew significantly with the onset of the pandemic, leading to a jump in their digital sales in the latest fiscal quarters.

CVS reported that its online retail prescription delivery volume was up 1,000% in 1Q20, ended March 31, 2020. The company witnessed a double-digit percentage increase in mobile app usage rates across CVS Pharmacy, Caremark and specialty. CVS recorded around 500% growth in retail prescription delivery volumes in 2Q20, ended June 30, 2020.

Similarly, Walgreens reported a 23% increase for total digitally initiated sales for the third quarter of fiscal 2020, and its mobile app traffic was up around 200%. The company has also introduced an “Order Ahead” drive-through service, which allows customers to shop for selected health and wellness products online and collect the items at more than 7,300 participating pharmacy drive-throughs nationwide.

Rite Aid reported an 86% surge in prescription home delivery in the first quarter ended May 30. In May 2020, Rite Aid expanded its partnership with Instacart to offer same-day delivery of OTC drugs and groceries in its 2,400 stores across 18 states.

Sector Outlook

Telehealth has helped to expand access to health care at a time when in=person doctor visits have been severely hindered. We believe that telehealth will continue to see rapid growth for at least the next 6 to 12 months, as concerns about contracting coronavirus remain. During this period, consumers’ channel preference for care access will continue to evolve and telehealth could become more ingrained into the health-care delivery system. We expect drug retailers to continue to leverage telehealth to drive customer engagement as the technology is likely to become more commonplace in a post-Covid future.

The coronavirus upheaval has further strengthened the prospects of the e-pharmacy sector. Online startups are seriously challenging the dominance of established drug retailers by attracting younger demographics with key value propositions, including better pricing, convenience and faster delivery. Pharmacy chains may see their market share dwindle if they fail to significantly increase their omnichannel capabilities and provide competitive e-commerce offerings.

In light of growing e-commerce trends, traditional drugstore chains with huge footprints have been forced to rethink the relevance of their stores. Revamping stores to add health services offerings is a step in the right direction as it provides a significant opportunity for drug retailers to differentiate themselves from online pure-plays and ensures steady traffic to its stores.