Nitheesh NH

What’s the Story?

Starting with Hudson’s Bay in 1670, the department store is the oldest store format. However, in today’s world of niche, specialized products and services, the department store format is costly and it is challenging to support a merchandise assortment for the changing wants and needs of multiple consumers. In this Market Outlook, we explore how the US department store sector has been impacted by the Covid-19 pandemic and provide an outlook for the sector moving forward. We discuss trends in physical and online sales and highlight key themes that we are watching in the sector.Market Performance and Outlook

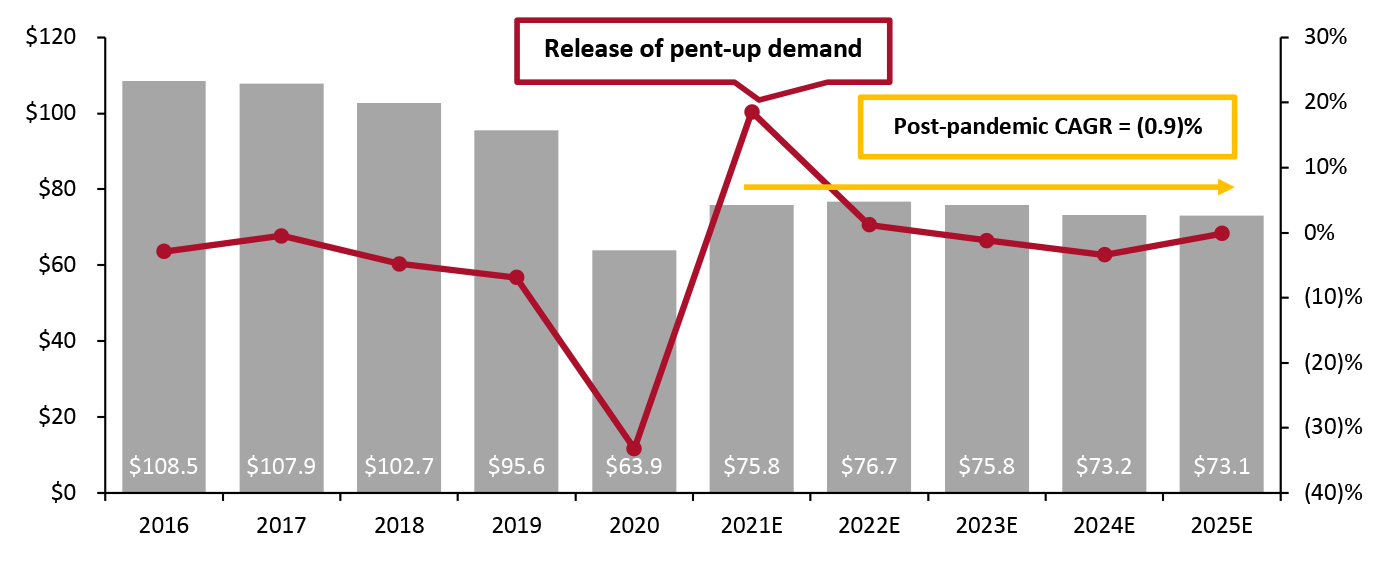

The Impact of Covid-19 The department store sector was severely impacted by pandemic-enforced closures of nonessential retailers. Coresight Research estimates that total sector revenue declined by 33.2% year over year in 2020, to total $63.9 billion—with a 49.1% decline in revenues from physical stores compared to 2019. With stores closed, the department store retailers lost revenue for several months; even as department stores reopened, traffic recovery has been gradual due to consumers’ reluctance to return to in-store shopping and their continued prioritization of essential categories. We discuss online versus in-store sales further in the next section of this report. Even before the impacts of the pandemic, the department store sector had already been experiencing revenue declines: In 2019, total department store sector revenue declined by 6.9% year over year, according to Coresight Research estimates. From 2015 to 2019, the sector declined from $111.8 billion to $95.6 billion, representing a (3.8)% CAGR. Within a two-week period in May 2020—during the Covid-19 pandemic—three major US department-store retailers filed for Chapter 11 bankruptcy: Neiman Marcus on May 5, Stage Stores on May 11 and JCPenney on May 15. Combined, the three chains hold 1,862 stores and $17.3 billion in revenue as of their last reporting period—totaling 18.1% of the 2019 US department store sector revenue from selected major retailers. Two of the companies have since reemerged from bankruptcy protection—Neiman Marcus and JCPenney. There are two overall trends in the department store sector: It is becoming smaller due to bankruptcies and a lack of new entrants; and major department stores are gaining share in the sector. Recovery Prospects in 2021 and Beyond We estimate that department store sector revenues will increase by 18.6% year over year in 2021 but will remain 20.7% below 2019 levels. Although we expect the department store sector to be buoyed this year—driven by a release of pent-up demand following pandemic-led lockdowns, as we discuss later—we anticipate that post 2021, spending levels will normalize to pre-pandemic patterns. Coresight Research therefore estimates that overall sector revenues will decline to $73.1 billion in 2025—a CAGR of (0.9)% from 2021. Figure 1. US Department Store Sector Size (Left Axis; USD Bil.) and YoY Change (Right Axis; %) [caption id="attachment_128092" align="aligncenter" width="725"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Market Driver: Vaccinations Lead a Return to Work and Recreation, Boosting Apparel Spending

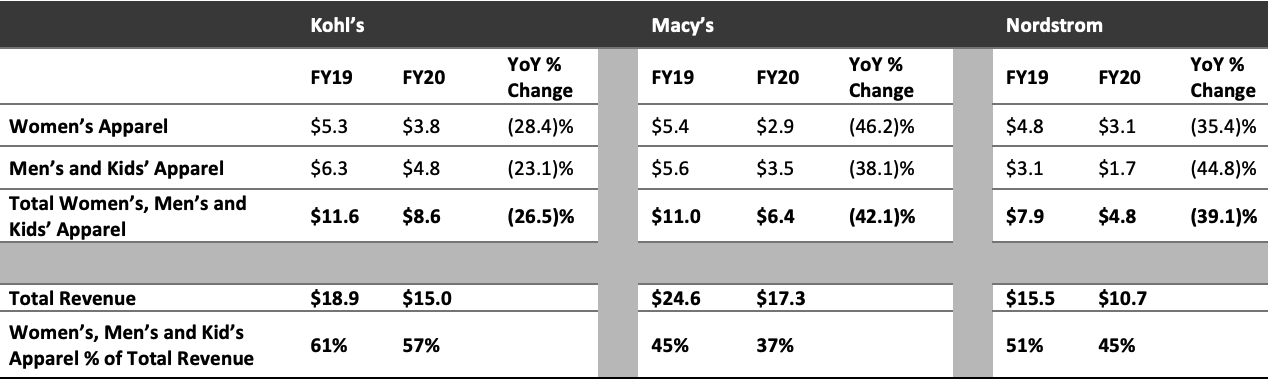

As of May 17, 2021, 48.0% of Americans had received one Covid-19 vaccination, and 37.6% of Americans were fully vaccinated, according to the Centers for Disease Control and Prevention. We expect US consumers to return to more normalized ways of living and spending as an increased proportion of the population receives Covid-19 vaccines—releasing pent-up demand following stay-at-home measures and temporary store closures last year. This will provide gains for sectors that were particularly impacted by the pandemic last year, such as apparel retail, travel and food services. At the three major US department stores—Kohl’s, Macy’s and Nordstrom—combined revenue from the women’s, men’s and kids’ apparel categories declined by 35.1% from fiscal 2019 to fiscal 2020. However, with 2021 bringing new opportunities for consumers to socialize, go to parties and attend events—activities they missed out on amid Covid-19 lockdowns last year—we expect that department stores will see a boost in apparel sales. This is in line with our estimate that US consumer spending on apparel and footwear overall will increase by around 7.0% year over year in 2021, with growth weighted toward the second half of the year. Workplaces are gradually beginning to open, which will give rise to consumers’ need to refresh their closets with workwear items. Additionally, the last time that many consumers traveled or were on beaches, at pools, eating at restaurants, meeting friends and attending concerts may have been over a year ago. Consumers will be looking to update their spring and summer wardrobes; even if they have items in their closet already, many will probably want new items to signify the new post-pandemic beginning. Department store retailers have been reporting seeing this trend in their latest quarter. In May 2021, Macy’s reported on its earnings call for the first quarter of fiscal 2021 (1Q21) that consumers are shopping apparel and travel-related items, including sandals, swimwear, dresses and luggage. Kohl’s also reported on its 1Q21 earnings call in May that its best-performing areas in the recent period were those most impacted by the pandemic last year, namely men’s and women’s apparel.Online Sales vs. Physical Store Sales

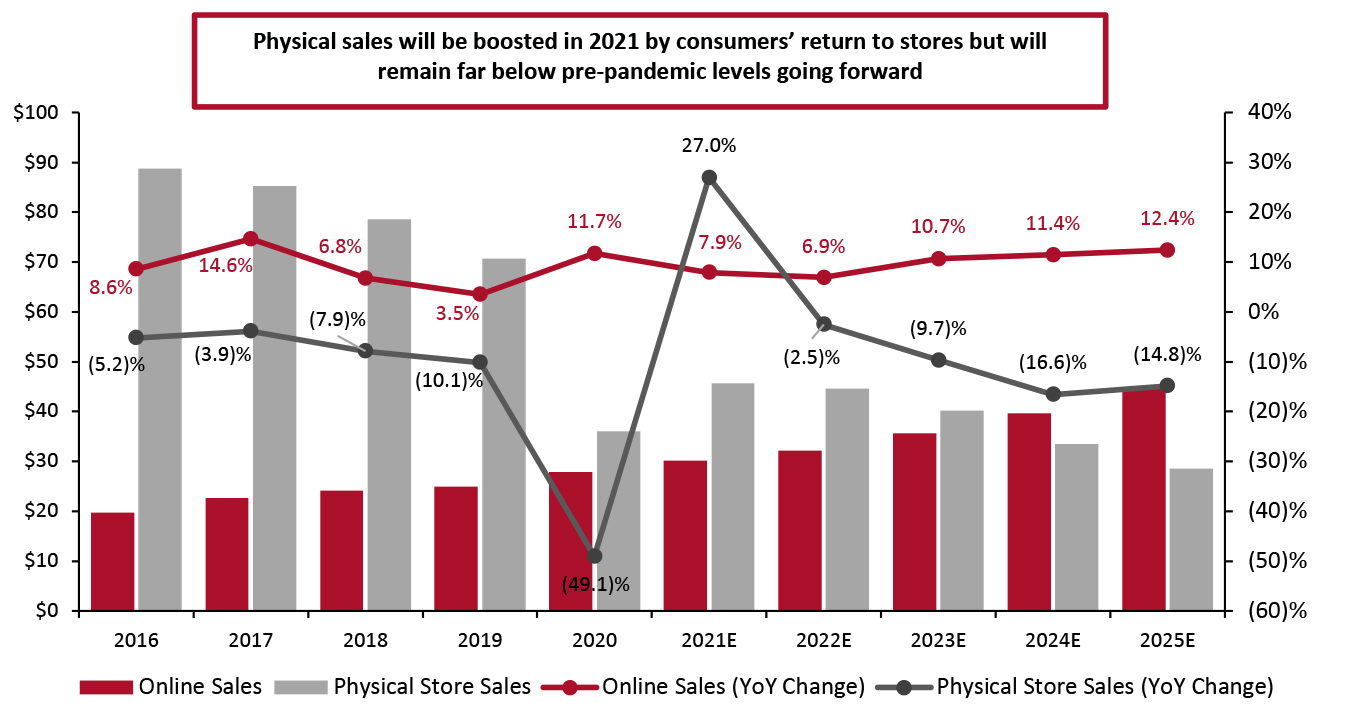

The department store sector saw e-commerce sales grow 11.7% year over year in 2020, to $27.9 billion, according to Coresight Research estimates based on Euromonitor International data. As was seen in other US retail sectors, consumers shifted their spending to the online channel amid the pandemic, due to physical store closures. Additionally, as stores reopened, department stores encouraged consumers to use store-based fulfillment services for online orders, such as BOPIS (buy online, pick up in-store) and curbside pickup. This year, we expect e-commerce growth to moderate slightly but remain high in 2021, at 7.9%, with online sales totaling approximately $30.1 billion. Against weak comparatives due to the huge decline in physical store sales last year, we estimate that physical store sales will grow by 27.0% year over year in 2021 as consumers return to in-store shopping. However, we do not expect physical store sales to reach pre-pandemic levels, with the estimated total of $45.7 billion representing a 35.3% decline on a two-year basis, down from $70.5 billion in 2019. Looking forward, we anticipate that e-commerce sales will remain roughly steady in 2022, before growth accelerates again in 2023. We assume that consumers will be shopping more online than in-store in the coming years, continuing the pandemic-led shift to e-commerce. As a result, in-store sales are likely to decline between 2021 and 2025—we estimate at a CAGR of (11.1)%—as online sales grow at a CAGR of 10.1%. Figure 2. US Department Store Sector: Online Sales vs. Physical Store Sales (Left Axis; USD Bil.) and YoY Change (Right Axis; %) [caption id="attachment_128094" align="aligncenter" width="725"] Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

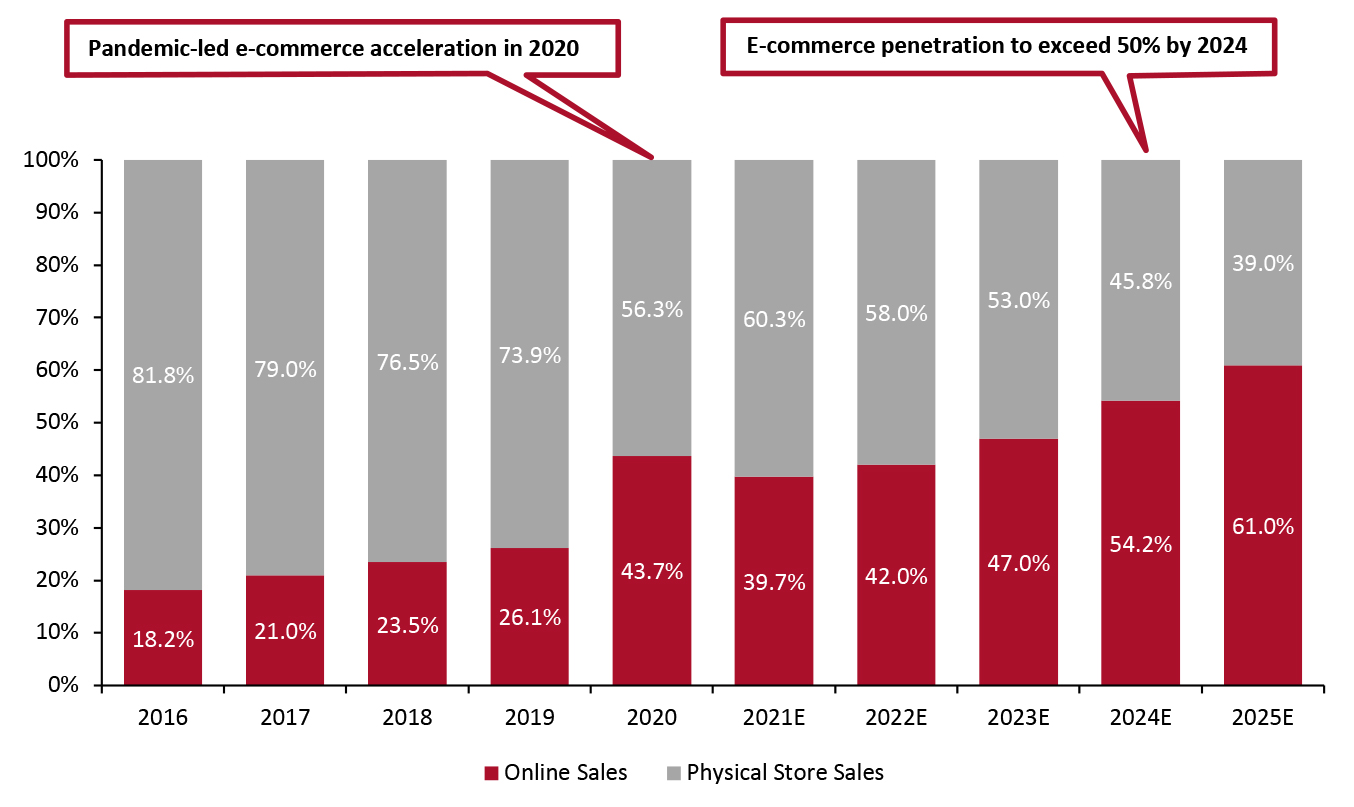

The acceleration of e-commerce in 2020 saw online sales represent 43.7% of all department store sector sales—almost double the penetration from 2019, according to Coresight Research estimates based on Euromonitor International data (see Figure 3).

The three major US department stores—Kohl’s, Macy’s and Nordstrom—reported steep acceleration of online sales in fiscal 2020:

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

The acceleration of e-commerce in 2020 saw online sales represent 43.7% of all department store sector sales—almost double the penetration from 2019, according to Coresight Research estimates based on Euromonitor International data (see Figure 3).

The three major US department stores—Kohl’s, Macy’s and Nordstrom—reported steep acceleration of online sales in fiscal 2020:

- Kohl’s fiscal 2020 online sales accounted for 40% of total sales, increasing from 24% in fiscal 2019.

- Macy’s fiscal 2020 online sales comprised 44% of total sales, increasing from 26% in fiscal 2019.

- Nordstrom’s fiscal 2020 online sales contributed 55% of total sales, increasing from 33% in fiscal 2019.

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Competitive Landscape

In Figure 4, we present an industry landscape of the major US department store retailers with operations in the US—namely, Dillard’s JCPenney, Kohl’s, Macy’s, Neiman Marcus, Nordstrom and Saks Fifth Avenue. Figure 4. Industry Landscape: A Comparison of Selected Department Store Retailers with US Operations [wpdatatable id=1002]*Macy’s includes 572 Macy’s, 55 Bloomingdale’s and 162 Bluemercury stores; Neiman Marcus includes 37 Neiman Marcus, two Bergdorf Goodman and five Last Call stores; Nordstrom includes 94 full-price Nordstrom and 242 off-price Nordstrom Rack stores; Hudson’s Bay Company store total is estimated but includes 111 Saks Off Fifth stores and 39 Saks Fifth Avenue stores—the company closed and liquidated its Lord & Taylor stores due to Chapter 11 bankruptcy Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research

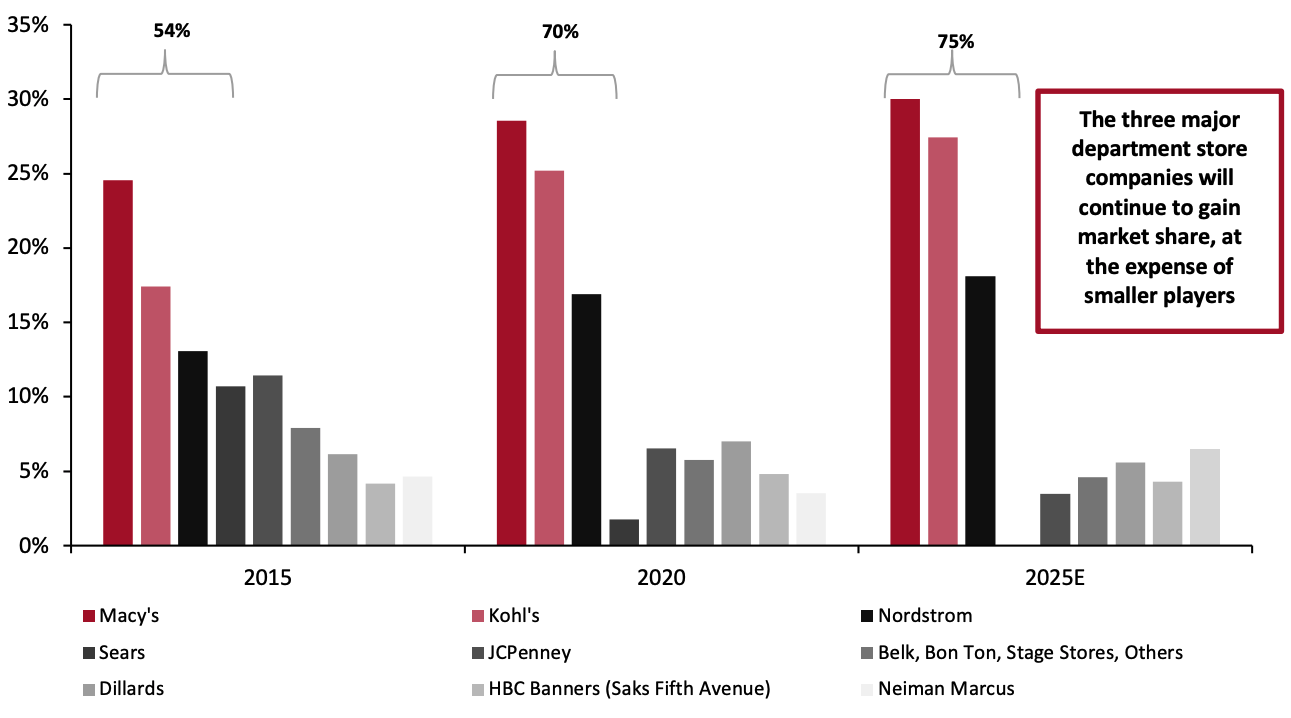

The Department Store Sector Is Becoming Dominated by Fewer Major Players The department store sector is becoming dominated by fewer department stores, with Kohl’s, Macy’s and Nordstrom increasing their market share. As shown in Figure 5, the three major department stores have grown their combined market share from 54% in 2015 to 70% in 2020. We estimate that by 2025, the three retailers will hold 75% of the market. There are four primary factors behind this trend:- Over the past five years, two of the department store sector’s major players have filed for Chapter 11 bankruptcy—JCPenney and Sears. The retailers held a combined 21.8% market share in 2015, with combined revenues totaling $24.4 billion. While JCPenney emerged from bankruptcy protection this year, the company announced on May 19, 2020, that it would not reopen 246 stores (22.6% of its fleet) between fiscal 2020 and 2021, with expectations to close 192 stores in fiscal 2020 and 50 more in fiscal 2021—taking its store count down from 846 to 604. We estimate that the department store’s revenues declined by approximately 61.3% year over year in fiscal 2020 from $10.7 billion to $4.1 billion. Sears, however, has been closing the majority of its stores; at the end of fiscal 2020, the company reportedly had approximately 160 stores and $1.1 billion in revenue. In fiscal 2021, Sears plans to operate only 28 stores.

- Hudson’s Bay Company’s Lord & Taylor department stores filed for bankruptcy protection on August 20, 2020, resulting in 38 store closures under the banner.

- Stage Stores declared bankruptcy on May 11, 2020. The company had 769 total stores, including 158 Gordmans stores. The company closed all of its stores in 2020.

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Revenue Growth and Expectations of Kohl’s, Macy’s and Nordstrom

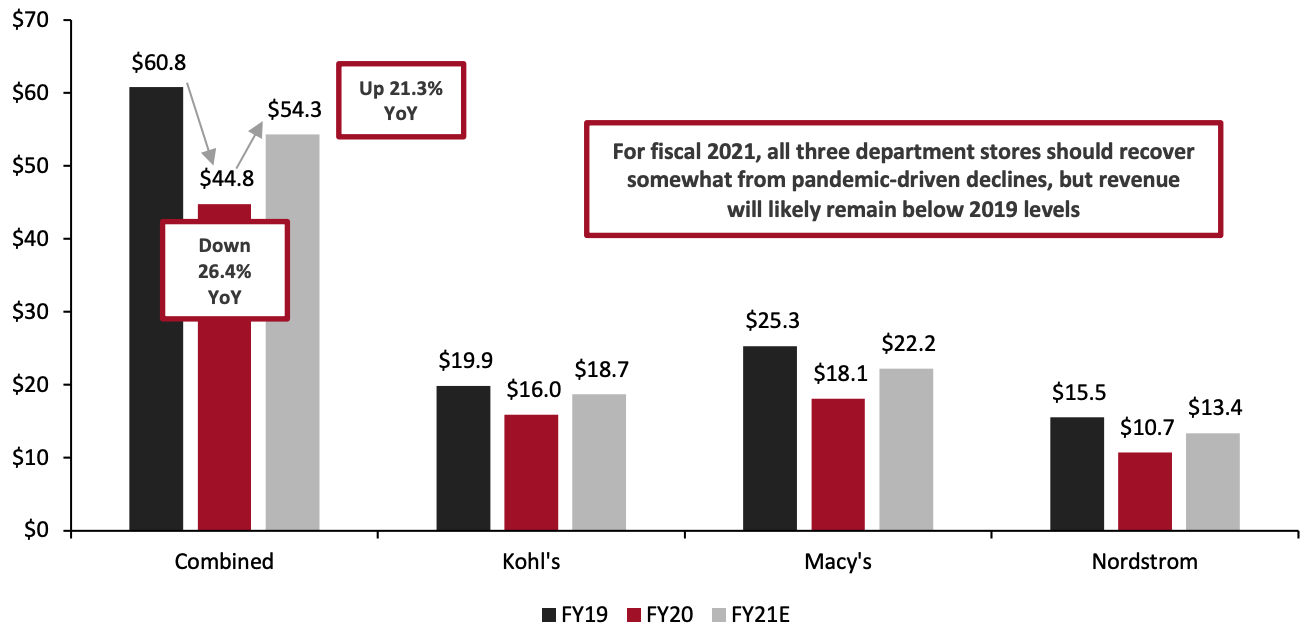

The Covid-19 pandemic hit the department store sector after a particularly difficult fiscal 2019 in which each of the three major department stores moved into negative territory. The onset of Covid-19 exacerbated revenue declines as physical stores were forced to close temporarily; the department stores were most affected in 1Q20. For fiscal 2020, combined revenues of the three major department stores declined by 26.4% year over year, from $60.8 billion to $44.76 billion.- Kohl’s experienced a revenue decline of 20.1% in fiscal 2020, down $4.0 billion from fiscal 2019.

- In dollar terms, Macy’s saw the largest revenue decline in fiscal 2020 of the three department stores, with the 28.6% decline being $7.2 billion lower than fiscal 2019 revenues.

- In percentage terms, Nordstrom had the largest revenue decline of 31.0% from fiscal 2019 to fiscal 2020, with the decline totaling $4.8 billion.

Source: Company reports[/caption]

Source: Company reports[/caption]

Three Themes We Are Watching

1. More Efficient Supply Chains The pandemic highlighted the need for efficient supply chains and brought to light the importance of using stores to fulfill orders—reducing store inventory while more efficiently getting products to consumers. Additionally, offering BOPIS, curbside-pickup and pickup-in-store services helps retailers to defray shipping costs, which have been heightened due to the attractiveness of same-day delivery to consumers. As digital sales have risen, having an efficient and integrated supply chain is essential. Managing the required inventories at the store level and at distribution centers requires advanced analytics, planning and forecasting, as well as the effective alignment of digital to physical channels. We expect department stores to continue to focus on building more efficient supply chains and owning last-mile delivery, including leveraging physical stores as fulfillment centers (ship from store, BOPIS and curbside pickup).- Kohl’s fulfilled 45% of its digital sales from its stores in 4Q20.

- Macy’s fulfilled approximately 25% of its orders from stores during 4Q20.

- In October 2020, Nordstrom expanded its fulfillment capabilities to its Nordstrom Rack stores. The company reported that 30% of its digital orders were fulfilled by stores in 4Q20, and approximately 10% of online orders were picked up at stores.

Source: Company reports

3. Category Expansion and Intense Apparel Competition In 2020, we saw an expansion into categories away from traditional dress apparel, such as home, beauty and casualwear. We expect to see consumers return to apparel shopping (as we discussed earlier), leading to increased apparel competition in fiscal 2021.- Macy’s was most affected by the apparel downturn in 2020 of the three major department stores, most notably in its women’s department. This year, we expect to see competition between Macy’s and Kohl’s in the men’s department, as Kohl’s has been expanding its men’s offerings rapidly over the past year and most recently signed an agreement with Tommy Hilfiger, which was one of Macy’s largest national brands. Additionally, Kohl’s is seeking to expand its active and casual offerings, including in the men’s and kids’ apparel categories. Therefore, we expect to see Macy’s aggressively pursue its men’s offerings, in addition to focusing on its women’s portfolio.

- We expect Nordstrom to invest in its men’s and kids’ businesses; its men’s business declined by 48.2% in 2020 and kids’ apparel by 31.0%. The department store will likely add more casual and smart casual assortments to its mix.

Source: Company reports[/caption]

However, we also expect that department stores will expand further into other categories moving forward, with beauty being a big category to watch:

Source: Company reports[/caption]

However, we also expect that department stores will expand further into other categories moving forward, with beauty being a big category to watch:

- Kohl’s is growing its beauty category through Sephora shop-in-shop locations. We expect this to be a game changer in terms of competition, as Kohl’s currently does not report beauty as a line-item category.

- At Macy’s, cosmetic sales are summarized within its largest revenue-generating category, “women's accessories, intimate apparel, shoes, cosmetics and fragrances,” which accounted for $7.2 billion in sales in fiscal 2020. Macy’s reported on its 1Q21 earnings call in May 2021 that it plans to “double down” on beauty. The company is building out experiences that will enhance its makeup, skincare and fragrance businesses, including virtual try-on. The company is providing consumers access through its social media channels, including Instagram.

- Nordstrom’s beauty sales represented 12% of its total sales in fiscal 2020, totaling $1.3 billion.

- Macy’s reported on 1Q21 earnings call that it is expanding into “emerging categories”—including toys, pet, food and wine, health and fitness—either through its Vendor Direct Program or through its owned inventory. The company has added hundreds of new brands and categories in apparel, home and beauty over the past year, allowing it to capture additional spend with new and existing customers.

- Nordstrom reported that it sees opportunities to grow its home business by 5X within the next three to five years, tripling its selections in bedding, office and even pet products.

Retail Innovators

Below, we present three US-based innovators whose solutions can benefit the department store sector. LogicSource According to a February 2021 Coresight Research survey of retail and CPG executives in the US, non-merchandise spending—including on information technology, marketing, corporate services, packaging and distribution logistics—typically accounts for 11%–20% of a retailer’s costs, with many companies overspending in these areas for reasons that amount to “business as usual.” LogicSource, a provider of sourcing and procurement services and technology, has helped major brands such as Big Lots!, Gap and Rite Aid optimize their supply chains and find deep cost savings in indirect business functions and not-for-resale spending. LogicSource emphasizes that, after a turbulent year that has reshaped retail, possibly forever, leaders have a mandate to respond in ways that can alleviate increasing pressure on their margins, launch cost-reduction procedures and ultimately drive savings to their bottom line. However, a lack of data and resources can present challenges in enacting these initiatives. LogicSource offers options for varying levels of client procurement maturity, often building the function from the ground up and deploying teams on-site to ensure that sourcing activities are conducted in accordance with agreed pricing and policies or providing its fully integrated OneMarket technology platform to empower the source-to-pay process. The company drives value across a broad range of not-for-resale categories and initiatives, from optimizing a retailer’s small-parcel delivery services by working on rate or usage adjustments with FedEx and UPS, to supporting the implementation of a new contingent labor management platform across hundreds of retail locations and supporting distribution centers. It will be increasingly important for department stores to have a holistic strategy for procurement as they seek to drive cost efficiencies through the supply chain, in order to improve the accuracy of demand forecasting, reducing excess inventory and synchronize cross-functional business processes. 3DLOOK 3DLOOK is helping reduce returns and improve retail sustainability in the apparel category by accurately sizing individuals with its mobile body-scanning technologies. The 3DLOOK app measures the customer’s shape and size with just two photos. The technology then provides sizing recommendations, specific to different brands, for each product category. Using artificial intelligence and machine learning, 3DLOOK’s body-scanning lab captures over 100 data points from the human body to create lifelike 3D models. In the post-coronavirus environment, consumers are seeking out contactless alternatives for a number of stages in the shopping journey, including trying on apparel. Company Co-Founder Whitney Cathcart said that retailers are actively seeking safe consumer solutions as stores reopen due to changing demand post pandemic. In addition to helping customers feel safe in stores, contactless sizing te chnology offers two advantages to retailers by using actual measurements: better control of inventory challenges, as returns are likely to be reduced; and an understanding of their customers’ body shapes and sizes through increased data.- Read our separate report, Retail Innovators: Apparel Technologies

- Read more Coresight Research coverage of sustainability in retail.