DIpil Das

Introduction

In this report, part of our Market Outlook series, we examine the size and trajectory of the US department store sector and key factors impacting growth. We also cover the performance and outlook for e-commerce in the US, as well as the overall sector’s competitive landscape and three themes we are watching in 2022 and beyond.Market Performance and Outlook

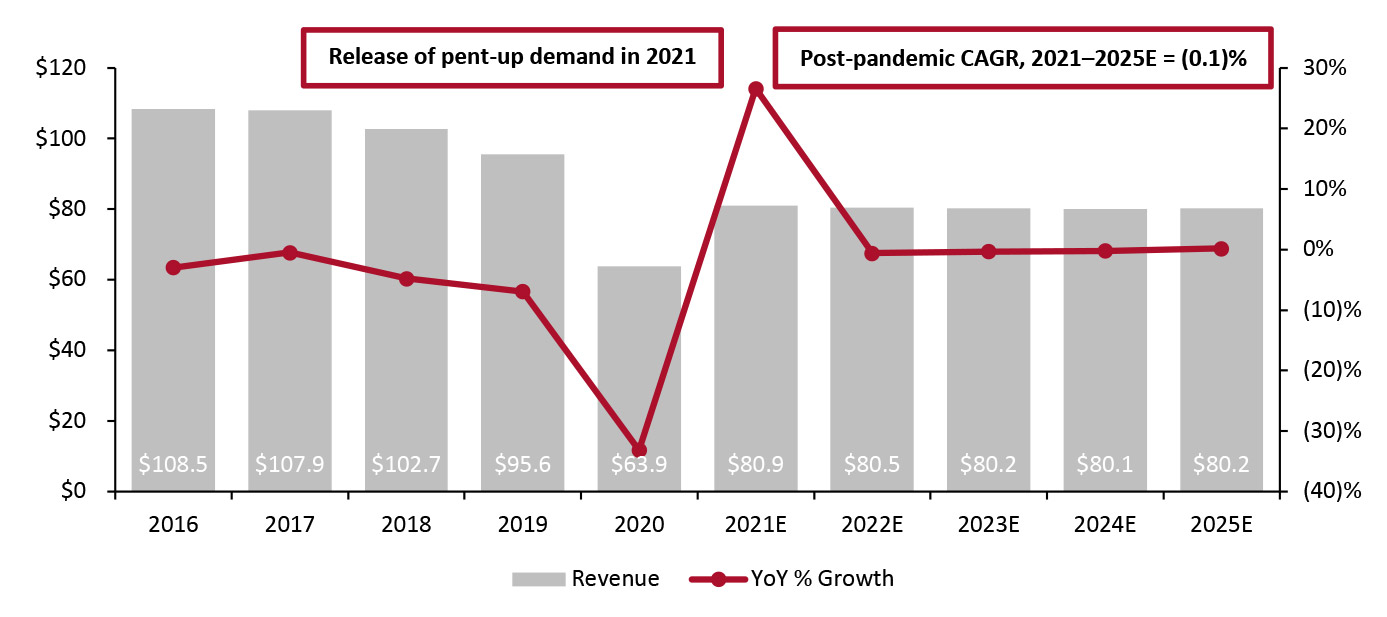

Recovery in 2022 and Beyond Coresight Research estimates that overall department store sector revenue in 2022 will decrease by 0.5%–1.5%, year over year, totaling $80.5 billion. Although this level would be 15.9% below pre-pandemic 2019 revenue of $95.6 billion, it follows a strong rebound in 2021 where revenues were $80.9 billion, 26.6% higher than in 2020 (see Figure 1). Department store sector sales were buoyed in 2021 due to several factors: the release of pent-up demand following pandemic-led lockdowns, government stimulus payments bolstering sales across the retail industry, and weak 2020 comparatives. The department store sector was severely impacted by the Covid-19 pandemic in 2020, which saw the enforced closures of nonessential retailers. Even before the impacts of the pandemic, the department store sector had already been experiencing revenue declines: In 2019, total department store sector revenue declined by 6.9% year over year, according to Coresight Research estimates. From 2015 to 2019, the sector declined from $111.8 billion to $95.6 billion, representing a (3.8)% CAGR. We anticipate that post 2022, sales levels will normalize and department store sector revenue will remain steady through 2025, at roughly 16% below pre-pandemic levels.Figure 1. US Department Store Sector: Total Revenue (Left Axis; USD Bil.) and Revenue Growth (Right Axis; YoY % Change) [caption id="attachment_141453" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Market Factors

Consumers Refresh Their Wardrobes- Vaccinations

- Consumers will gradually return to the workplace, even if on hybrid schedules (incorporating some working from home), leading to demand for workwear items.

- Consumers will resume social activities such as visiting restaurants, meeting friends and attending concerts, giving rise to the need for “going out” clothes.

- Consumers will seek occasion wear for events and ceremonies such as weddings, showers, bar mitzvahs and other special occasions that were previously postponed due to the pandemic.

- Pandemic-Led Size Fluctuations

Online vs. Physical Store Sales

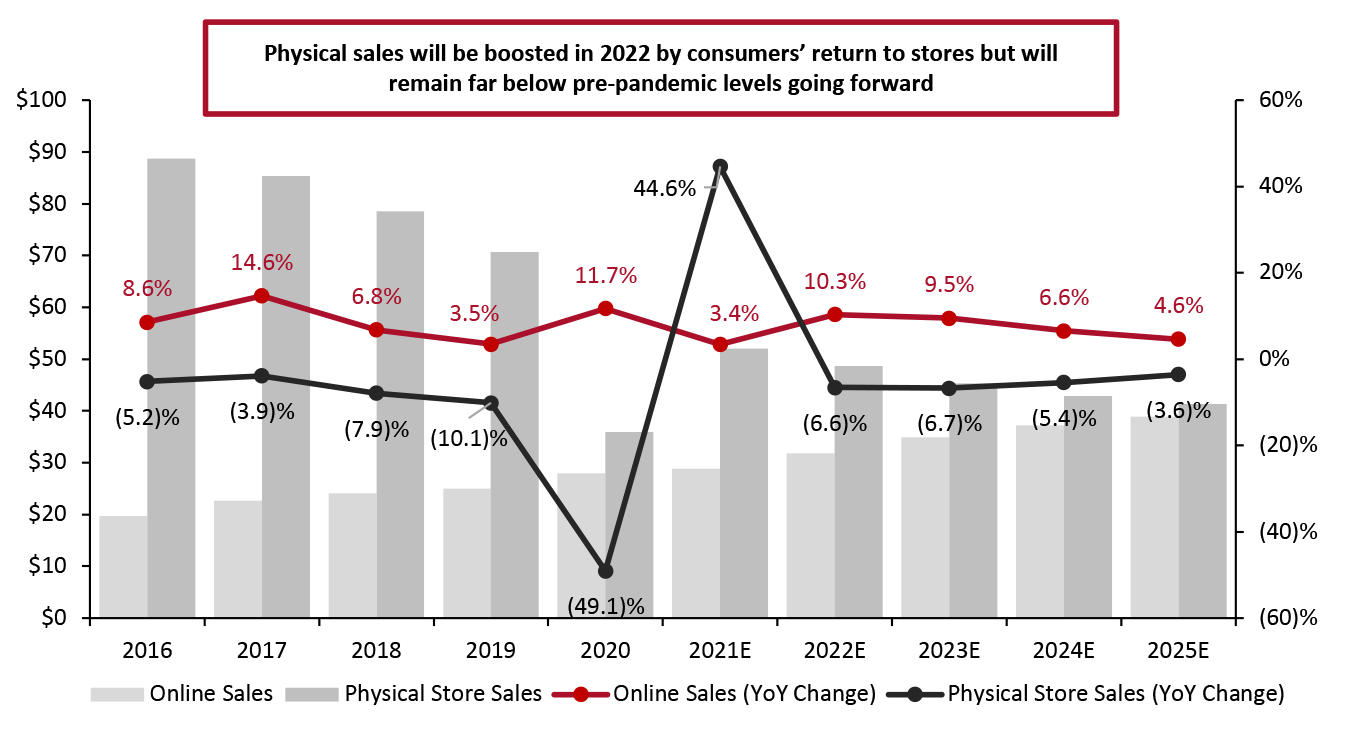

In 2022, e-commerce sales will see growth accelerate to double digits after moderating slightly last year, Coresight Research estimates based on Euromonitor International data (see Figure 2). As with other retail sectors, department stores saw the acceleration of e-commerce in 2020, amid pandemic-led store closures. Consumers began shopping in stores again in 2021: We estimate that physical store sales at department stores were up by 44.6% year over year. Against strong comparatives, we estimate that physical store sales will decrease by 6.6% in 2022.Figure 2. US Department Store Sector: Online Sales vs. Physical Store Sales (Left Axis; USD Bil.) and YoY Change (Right Axis; %) [caption id="attachment_141447" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

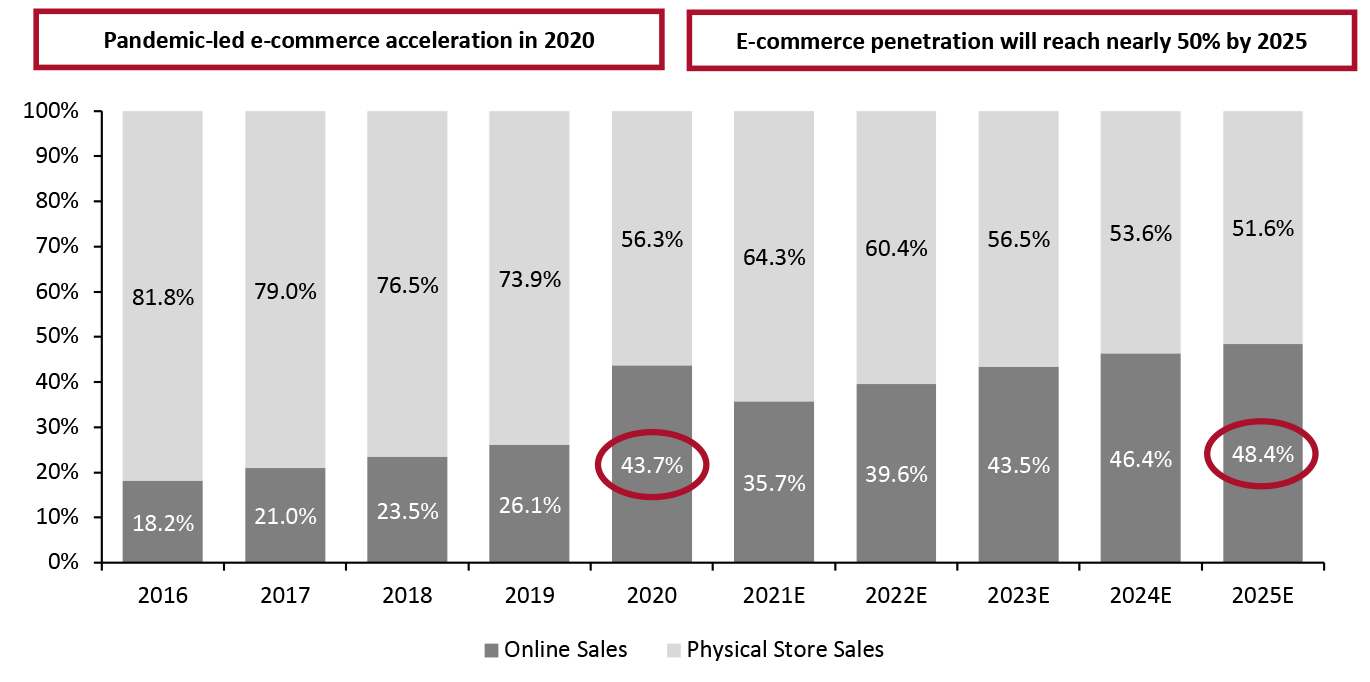

As shown in Figure 2, we expect physical store sales to trend downward in the coming years as online sales increase. This means that e-commerce will represent an increasingly greater share of total sales in the sector (see Figure 3).

E-commerce penetration moderated in 2021 as physical store traffic picked up, and the three major department stores (Kohl’s, Macy’s and Nordstrom) reduced their e-commerce penetration outlooks accordingly. However, each of the retailers are projecting that online sales will increase in the longer term.

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

As shown in Figure 2, we expect physical store sales to trend downward in the coming years as online sales increase. This means that e-commerce will represent an increasingly greater share of total sales in the sector (see Figure 3).

E-commerce penetration moderated in 2021 as physical store traffic picked up, and the three major department stores (Kohl’s, Macy’s and Nordstrom) reduced their e-commerce penetration outlooks accordingly. However, each of the retailers are projecting that online sales will increase in the longer term.

- Kohl’s: In fiscal 2020, online sales accounted for 40% of total sales, increasing from 24% in fiscal 2019, according to company reports. During the first three quarters of 2021 (to October 30, 2021), e-commerce sales averaged 28.3%. Kohl’s reduced its e-commerce penetration projection for fiscal 2021 to 30% of total sales but anticipates that e-commerce penetration will be 40% by fiscal 2023.

- Macy’s: In fiscal 2020, online sales comprised 44% of total sales, increasing from 26% in fiscal 2019, according to company reports. During the first three quarters of 2021 (to October 30, 2021), e-commerce sales averaged 34.0%. Macy’s expected e-commerce to account for 36% of total sales in fiscal 2021.

- Nordstrom: fiscal 2020 online sales contributed 55% of total sales, increasing from 33% in fiscal 2019. During the first three quarters of 2021 (to October 30, 2021), e-commerce sales averaged 42.0%. Nordstrom expected 50% e-commerce penetration in fiscal 2021.

Figure 3. US Department Store Sector: Online Sales vs. Physical Store Sales (% of Total Sales) [caption id="attachment_141448" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Competitive Landscape

In Figure 4, we present an industry landscape of the major US department store retailers with operations in the US—namely, Dillard’s JCPenney, Kohl’s, Macy’s, Neiman Marcus, Nordstrom and Saks Fifth Avenue.Figure 4. Industry Landscape: A Comparison of Selected Department Store Retailers with US Operations [wpdatatable id=1714 table_view=regular]

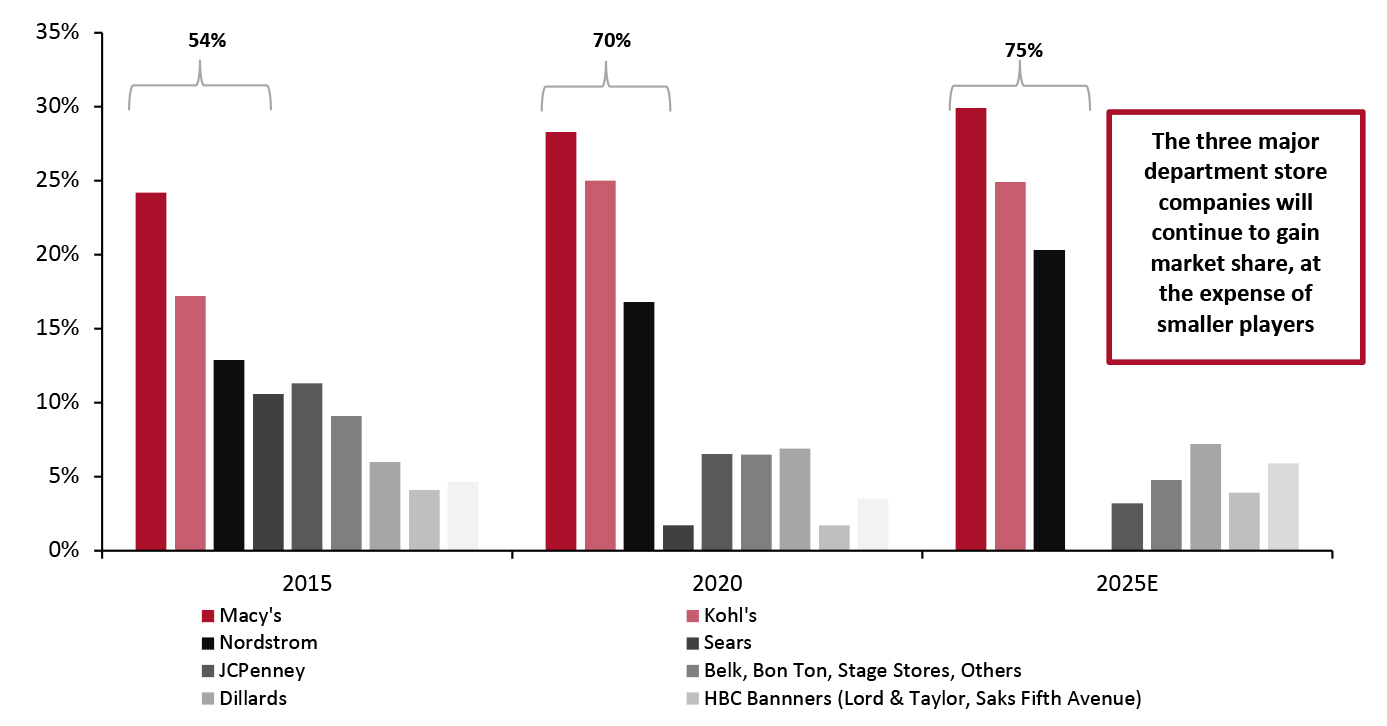

*Latest data available; fiscal 2020 ended January 30, 2021 **Macy’s includes 572 Macy’s, 55 Bloomingdale’s and 162 Bluemercury stores; Neiman Marcus includes 37 Neiman Marcus, two Bergdorf Goodman and five Last Call stores; Nordstrom includes 94 full-price Nordstrom and 242 off-price Nordstrom Rack stores; Hudson’s Bay Company store total is estimated but includes 111 Saks Off Fifth stores and 39 Saks Fifth Avenue stores—the company closed and liquidated its Lord & Taylor stores due to Chapter 11 bankruptcy Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research The Sector Is Becoming More Concentrated The department store sector is becoming dominated by fewer department stores, with Kohl’s, Macy’s and Nordstrom increasing their market share. As shown in Figure 5, the three major department stores have grown their combined market share from 54% in 2015 to 70% in 2020. We estimate that by 2025, the three retailers will hold 75% of the market. The primary factor contributing to sector consolidation has been bankruptcy filings and store closures by major players in the past five years:

- JCPenney and Sears have both filed for bankruptcy protection in the past five years. The retailers held a combined 21.8% market share in 2015, with combined revenues totaling $24.4 billion. JCPenney announced on May 19, 2020, that it would not reopen 246 stores (22.6% of its fleet) between fiscal 2020 and 2021, with expectations to close 192 stores in fiscal 2020 and 50 more in fiscal 2021—taking its store count down from 846 to 604. JCPenney emerged from bankruptcy protection in December 2020. Sears has been closing the majority of its stores; at the end of fiscal 2020, the company reportedly had approximately 160 stores, and it planned to operate only 28 stores in fiscal 2021.

- Hudson’s Bay Company’s Lord & Taylor filed for bankruptcy protection on August 20, 2020, resulting in 38 store closures under the banner.

- Stage Stores declared bankruptcy on May 11, 2020. The company had 769 total stores, including 158 Gordmans stores. The company closed all of its stores in 2020.

Figure 5. US Department Store Sector: Market Share by Company (%) [caption id="attachment_141449" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Kohl’s, Macy’s and Nordstrom: Revenue Growth and Expectations

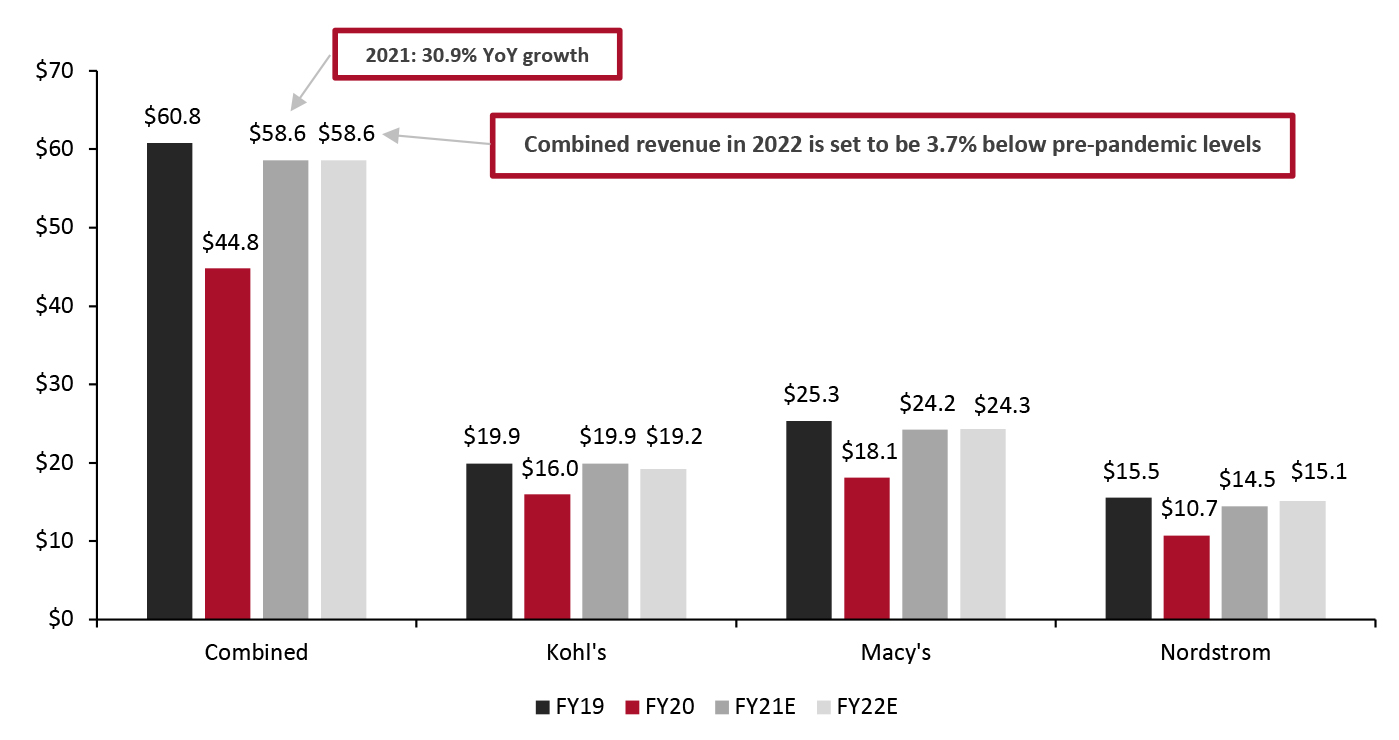

The three major department stores saw a strong recovery in 2021 compared to pandemic-impacted 2020, with revenues up 30.9% year over year, we estimate. Kohl’s and Macy’s raised their annual revenue guidance in every quarter of fiscal 2021, while Nordstrom maintained its guidance.

For fiscal 2022, combined revenue for Kohl’s, Macy’s and Nordstrom will total approximately $58.6 billion, according to company reports—matching 2021 levels at 3.7% below pre-pandemic 2019 (see Figure 6).

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Kohl’s, Macy’s and Nordstrom: Revenue Growth and Expectations

The three major department stores saw a strong recovery in 2021 compared to pandemic-impacted 2020, with revenues up 30.9% year over year, we estimate. Kohl’s and Macy’s raised their annual revenue guidance in every quarter of fiscal 2021, while Nordstrom maintained its guidance.

For fiscal 2022, combined revenue for Kohl’s, Macy’s and Nordstrom will total approximately $58.6 billion, according to company reports—matching 2021 levels at 3.7% below pre-pandemic 2019 (see Figure 6).

Figure 6. Kohl’s, Macy’s and Nordstrom: Annual Revenues (USD Bil.) [caption id="attachment_141450" align="aligncenter" width="700"]

Source: Company reports[/caption]

Source: Company reports[/caption]

Themes We Are Watching

Virtual Selling We expect US department stores to advance their virtual selling capabilities—including virtual chat, virtual consultations and livestreaming—as another channel to engage with consumers and increase e-commerce sales. Nordstrom introduced a virtual chat function during the Covid-19 pandemic, through which it can send consumers personalized product recommendations.- Macy’s: The company piloted livestreaming in 2021, partnering with Klarna and Cosmopolitanmagazine on a 48-hour “Hauliday” livestream targeted at millennials and Gen Zers that featured exclusive deals across fashion, apparel, footwear and beauty. According to company reports, Macy’s will continue to invest in livestreaming.

- Nordstrom: The company reported in August 2021 that it had hosted over 60 livestreams over the previous 12 months and had launched “Nordstrom Live,” a dedicated livestreaming platform, on its website. The sessions are available to watch and shop after the live recordings are over. The company also offers virtual consultations between consumers and Nordstrom styling associates. Nordstrom management expects virtual consultations to remain popular moving forward.

- Kohl’s is growing its beauty category through Sephora shop-in-shop locations. The company opened its first tranche of locations and the Sephora digital store in August 2021. Kohl’s planned to open 200 shop-in-shops by the end of 2021, 400 in 2022 and 350 in 2023: The partnership is set to have 850 physical locations in total.

- AtMacy’s, cosmetics sales are covered under the company’s largest revenue-generating category, “women's accessories, intimate apparel, shoes, cosmetics and fragrances,” which accounted for $7.2 billion in sales in fiscal 2020. Macy’s reported in May 2021 that it plans to “double down” on beauty and is building out experiences that will enhance its makeup, skincare and fragrance businesses, including virtual try-on.

- Nordstrom’s beauty sales represented 12% of its total sales in fiscal 2020, totaling $1.3 billion.

- Macy’s announced on August 19, 2021, that it would open 400 Toys“R”Us shop-in-shop locations in its stores. Management reported that the company aims to be a one-stop shop for the “millennial mom” and to grow its toy category. The company reported that its toy business doubled in two weeks in August 2021 when Toys“R”Us was available on the Macy’s website. It had also reported on 1Q21 earnings call that it is expanding into “emerging categories”—including toys, pet, food and wine, and health and fitness—through its Vendor Direct Program and through its owned inventory. The company has added hundreds of new brands and categories in apparel, home and beauty over the past year, allowing it to capture additional spending from new and existing customers.

- Nordstrom reported that it sees opportunities to grow its home business by 5X within the next three to five years, tripling its selections in bedding, office and even pet products.

- Kohl’s tested self-pickup and self-returns in about 100 stores during the 2021 holiday season. The company reported that its store fulfillment accounted for 40% of its online orders in 2020.

- Macy’s launched a partnership with same-day delivery provider DoorDash in 2020. We expect that such partnerships will become an industry standard in 2021 as standard carriers are under increasing pressure and retailers look to own the last-mile delivery process to attract consumers and build loyalty.

What We Think

We expect that US department store sector revenue will slightly decrease in 2022, remaining 15.9% below pre-pandemic 2019 levels. Retailers in the sector will also likely see a shift in spending, as consumers look to refresh their wardrobes due to returning to more normalized ways of living amid pandemic recovery—with a focus on occasion wear, workwear items and "going out" clothes. We are already seeing signs of consumers shopping for apparel: Major department stores reported that apparel sales were up in fiscal 2021. Looking ahead, the department store sector will continue to become smaller, dominated by the three players: Kohl’s, Macy’s and Nordstrom. We estimate that the three retailers will hold 75% of the market by 2025, up from around 70% in 2020. Recent bankruptcy filings in the sector have supported this sector consolidation. JCPenney and Neiman Marcus have both emerged from bankruptcy, but even for robust retailers, the department store sector is challenging, so the road to recovery will not be easy. E-commerce represents the next frontier for the department store sector. At the height of the Covid-19 pandemic, we saw online sales replace physical store sales. Department stores will continue to invest in virtual selling to bridge the online and offline gap and appeal to changing consumer preferences for shopping. Macy’s and Nordstrom are both investing in virtual selling tools including virtual chat, virtual consultations and livestreaming. The major department store retailers are expecting that online sales will account for at least 40% revenue in 2022 and beyond. The company that succeeds in maintaining physical store sales while growing online sales will be the one that wins in the long run. Finally, we expect that department stores will look to expand categories to meet consumers’ needs and to be less reliant on the apparel category. Beauty, home, and toys will be the categories to watch.Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved