Nitheesh NH

Introduction

Convenience stores are retail outlets with a relatively small average selling space, mainly focused on selling food, beverages, tobacco and other convenience-oriented items. These stores are generally open during extended hours, facilitate short shopping trips and typically charge higher prices than supermarkets or drugstores in return for quick access. In this Market Outlook, we examine the size and trajectory of the US convenience store sector and key factors impacting growth. We also cover the overall sector’s competitive landscape and three themes we are watching in 2022 and beyond.Market Performance and Outlook

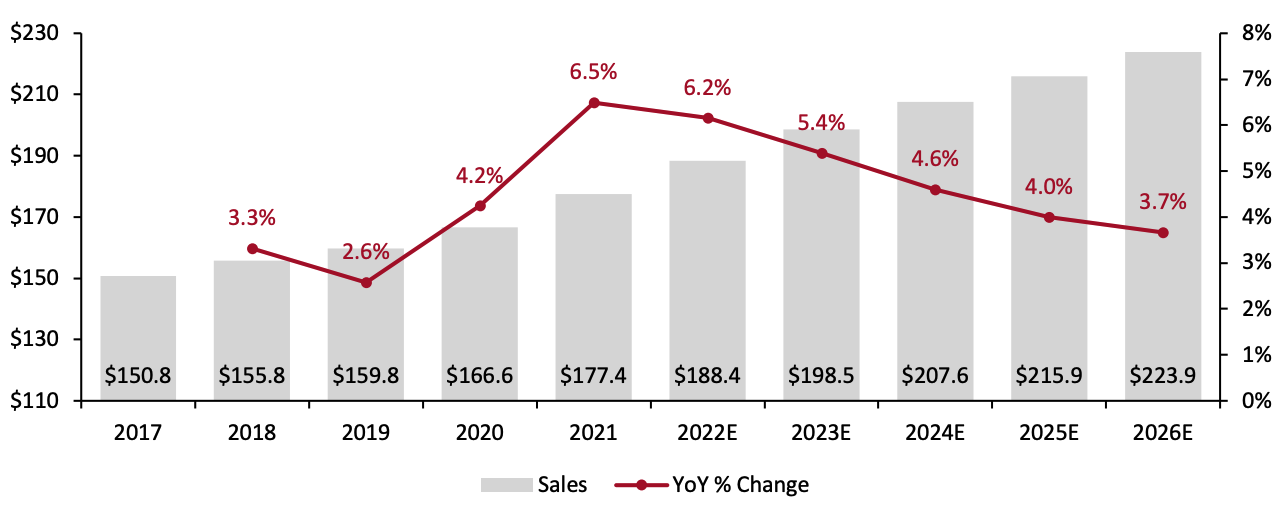

The US convenience channel faced complicated dynamics in 2020 due to the pandemic, with consumers’ ability to travel shifting through the year. Many consumers turned to e-commerce for everyday needs or consolidated their shopping trips and visited larger-format “one-stop” retailers. Fewer daily commutes to work also impacted on-the-go purchases. However, the channel proved resilient as convenience stores became key shopping destinations for consumers unwilling or unable to venture far from home during the pandemic, as well as benefiting from a broader trend of increased at-home consumption. Despite challenging circumstances, the US convenience store sector grew 4.6% to reach $166.6 billion (ex. gasoline) in 2020, according to IRI. The sector continued to grow in 2021, experiencing a 6.5% year-over-year increase, which was largely the result of increased mobility as consumers returned to stores and made more frequent trips.- Tobacco sales accounted for 92.3% of total non-edible sales.

- In the edible category, non-alcoholic beverages performed strongly, growing 12.8% year over year.

Figure 1. US Convenience Stores: Total Sales (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_153856" align="aligncenter" width="700"]

Excludes fuel and online sales

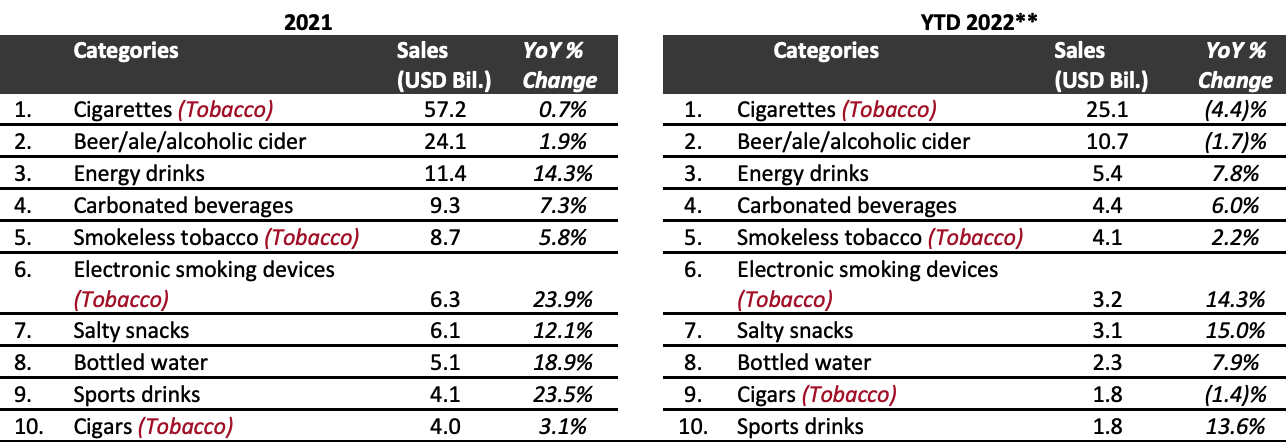

Excludes fuel and online salesSource: IRI POS Data/Coresight Research[/caption] The US convenience store sector is heavily reliant on tobacco sales. Led by cigarettes, four of the top 10 products sold in convenience stores were from the tobacco segment in 2021 and year-to-date 2022 (as of June 12, 2022), as shown in Figure 2. The bestselling category was cigarettes, which generated more than twice the sales of second-placed beer/ale/alcoholic cider. However, cigarettes saw near-flat growth 2021 and a decline in year-to-date 2022. We anticipate that sales in this category will fall in the coming years as health concerns, higher prices and strict regulations deter consumers from smoking. Despite declining cigarette sales, electronic smoking devices, such as e-cigarettes, have grown in recent years, and are becoming popular among tobacco smokers and non-smokers. This product category offers convenience stores a new and growing opportunity to increase revenue and draw customers into their stores more often. The category, however, is not without controversy. According to a recent statement from the American Heart Association (published in June 2022), e-cigarettes have adverse effects that may accrue over time, leading to an increased risk of cardiovascular and respiratory diseases. The US Food and Drug Administration has also prioritized e-cigarette prevention messaging in many public education campaigns aimed at discouraging young people from first using e-cigarettes. (We discuss the tobacco segment further in the next section.)

Figure 2. US Convenience Stores: Top 10 Categories by Sales* [caption id="attachment_153855" align="aligncenter" width="700"]

*Excludes online sales

*Excludes online sales**As of June 12, 2022

Source: IRI POS Data[/caption]

Market Factors

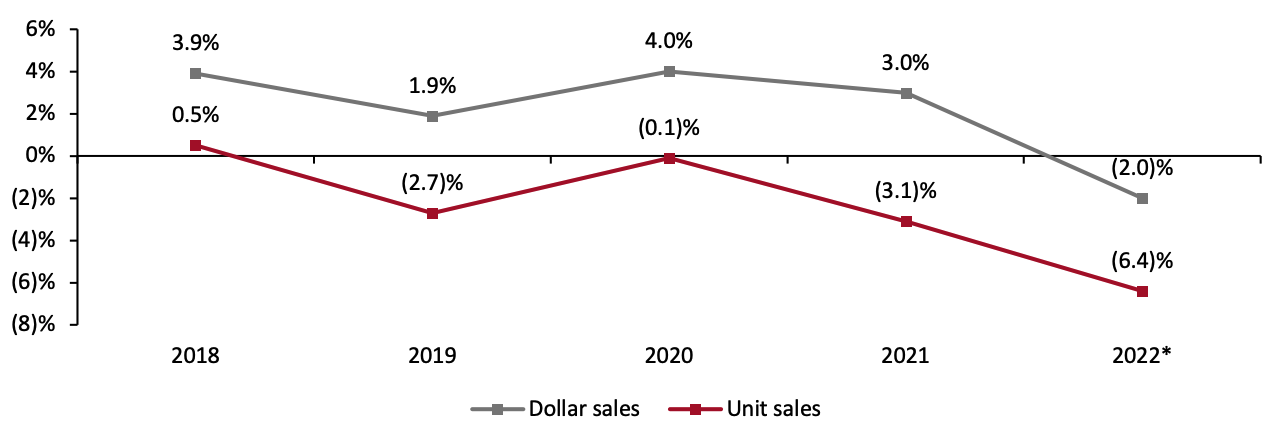

Increased Taxes and Regulations on Tobacco As highlighted above, tobacco has historically been the leading product segment sold at convenience stores. However, tobacco regulation and legislation are under review constantly at the local, state and federal levels. Public education and health campaigns have increased awareness of the dangers of tobacco, while government taxes and duties have increased prices. Additionally, the government has imposed laws to ban smoking in public areas, including restaurants and bars. As such, tobacco sales by unit have declined in recent years (see Figure 3). In dollar terms, though, tobacco sales at convenience stores has seen negative growth in year-to-date 2022.- In April 2021, US Congress proposed the Tobacco Tax Equity Act 2021. The bill seeks to effectively double the federal excise tax on cigarettes and cigars and equalize rates on alternative nicotine products to match the new higher cigarette rate. If implemented, the bill would result in substantial tax increases on chewing tobacco and pipe tobacco. Vapor products, which are not currently taxed at the federal level, would also be taxed at the level of cigarettes.

- California Proposition 56, which went into effect in April 2017, increased the excise tax by $2.00 from $0.87 per pack of 20 cigarettes on distributors selling cigarettes in California, with an equivalent excise tax rate increase on other tobacco products.

- Convenience stores will pass the ensuing cost increases to consumers, but they may, in turn, see reduced demand and store traffic.

Figure 3. US Convenience Stores: Tobacco Sales Growth, in Dollar and Unit Terms (YoY %) [caption id="attachment_153854" align="aligncenter" width="700"]

Excludes online sales

Excludes online sales*YTD June 12, 2022

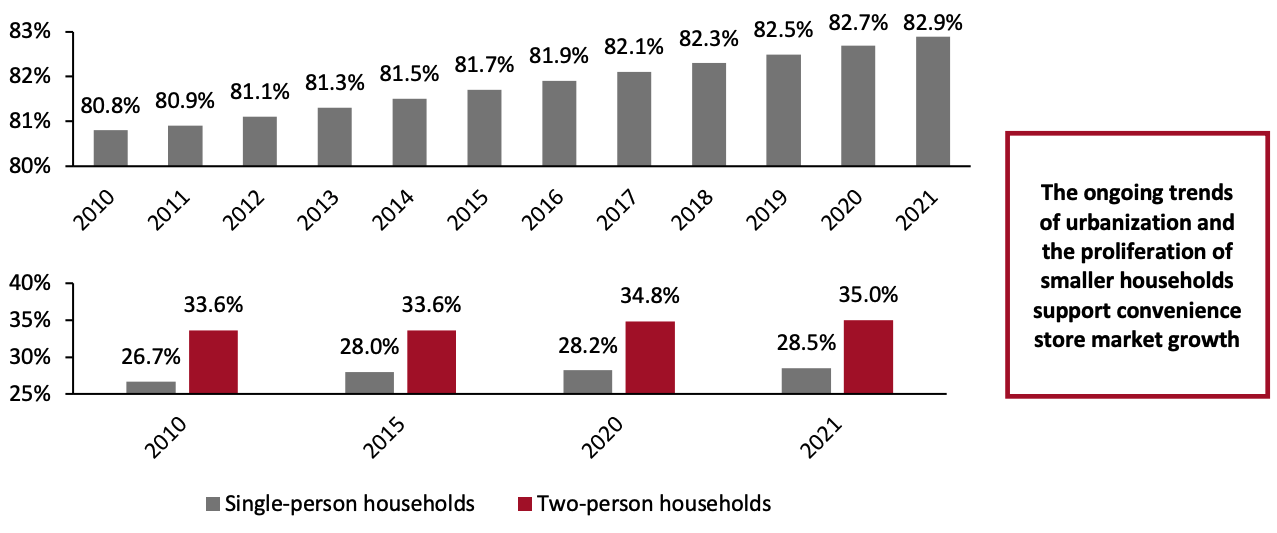

Source: IRI POS Data[/caption] Growing Urbanization and Smaller Households Globally and in the US, the urbanization trend is supporting the growth of the convenience store sector: consumers in densely populated areas are highly receptive to the convenience store format. Urban consumers shop more often than their peers in other areas, but for fewer items at a time, and they prefer shorter trips and smaller stores. Also benefiting the convenience store market is the growing trend toward smaller households. The number of single- and two-person households is growing—these households tend to buy smaller amounts at a higher frequency instead of buying in bulk, which will likely underpin convenience store sales growth in the future.

Figure 4. US: Urban Population Penetration (Above; % of Total Population) and Proportion of Single-/Two-Person Households (Below; % of Total Households) [caption id="attachment_153857" align="aligncenter" width="700"]

Source: US Census Bureau/Worldbank.org[/caption]

Inflation in Gasoline Prices

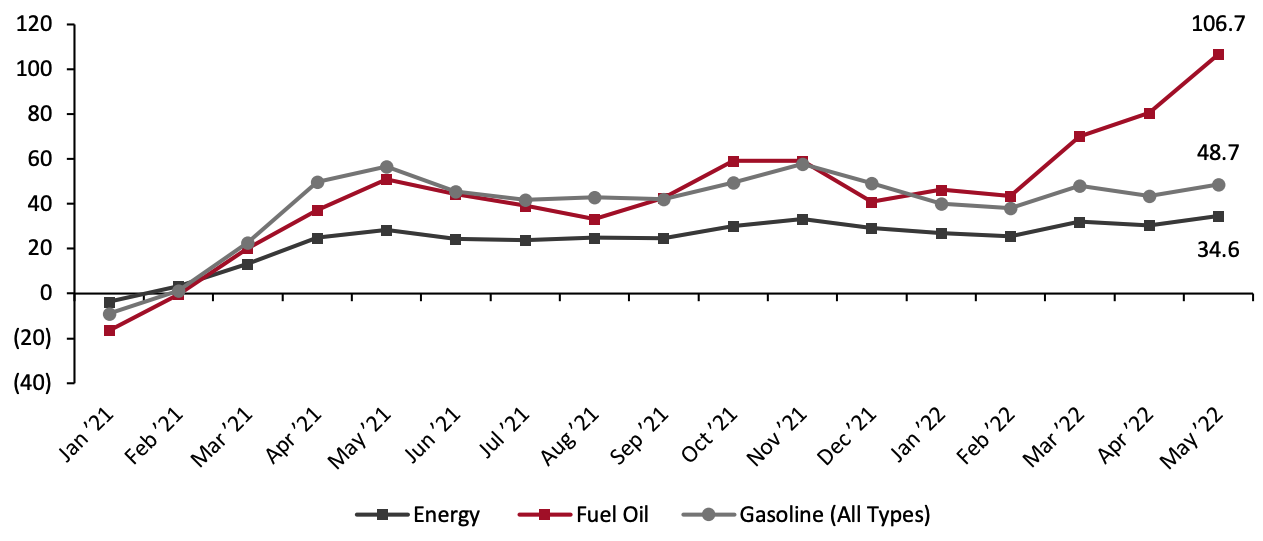

Inflation has been at a 40-year high since May 2021 and is being driven by overall price increases in essential categories such as energy, fuel and food at home. Specifically, Russia’s invasion of Ukraine has exacerbated the issue of rising gas prices. Since the start of the war in February 2022, the average price of gas per gallon in the US has risen by 29.3%, according to the US Energy Information Administration.

According to the National Association of Convenience Stores (NACS), 78.8% of US convenience stores sell motor fuel, as of December 2021. High fuel inflation will drive these convenience stores’ top line (including gasoline), but may prompt fewer visits to gas stations, impacting in-store traffic and sales. On the plus side, higher gas prices may see some consumers switch more of their spending to inner-city independent stores due to their proximity.

Source: US Census Bureau/Worldbank.org[/caption]

Inflation in Gasoline Prices

Inflation has been at a 40-year high since May 2021 and is being driven by overall price increases in essential categories such as energy, fuel and food at home. Specifically, Russia’s invasion of Ukraine has exacerbated the issue of rising gas prices. Since the start of the war in February 2022, the average price of gas per gallon in the US has risen by 29.3%, according to the US Energy Information Administration.

According to the National Association of Convenience Stores (NACS), 78.8% of US convenience stores sell motor fuel, as of December 2021. High fuel inflation will drive these convenience stores’ top line (including gasoline), but may prompt fewer visits to gas stations, impacting in-store traffic and sales. On the plus side, higher gas prices may see some consumers switch more of their spending to inner-city independent stores due to their proximity.

Figure 5. US Consumer Price Inflation: Energy, Gasoline and Fuel Oil (YoY % Change) [caption id="attachment_153858" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

Competitive Landscape

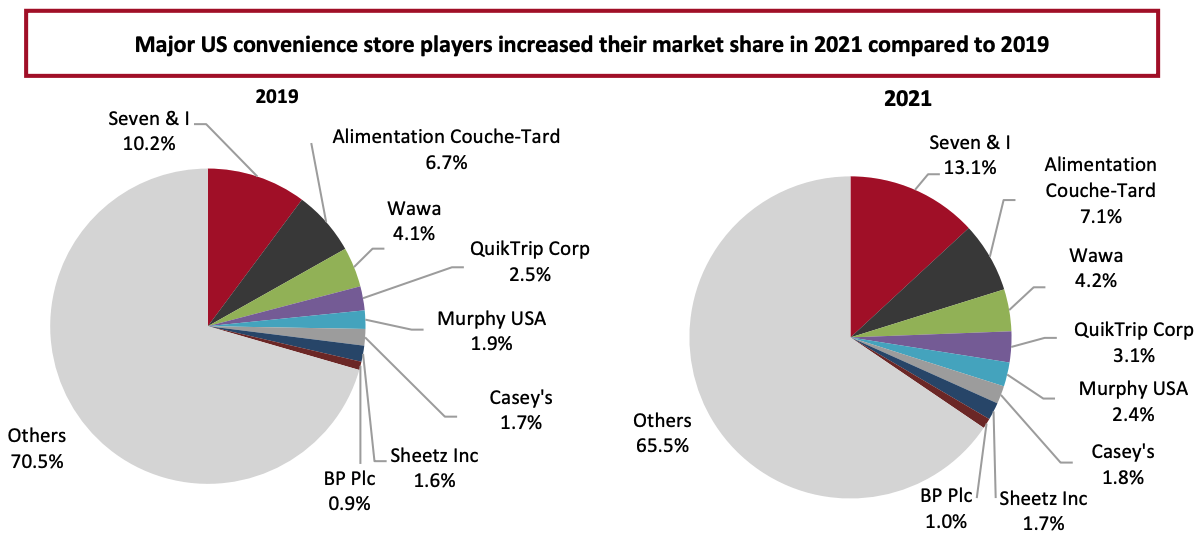

The US convenience store sector is fragmented due to the dominance of single-store and small chain operators. However, many prominent players in the sector increased their market share in 2021 versus 2019, according to Euromonitor International (see Figure 6). The industry has seen consolidation in recent years, with large chain operators benefiting from integrated oil companies selling their convenience stores as they gradually exit the retail business in favor of concentrating on oil exploration and production. These acquisitions have helped major convenience operators to achieve economies of scale and enter new geographic regions with relative ease. Reflecting this trend, 7-Eleven acquired convenience store and gas station operator Speedway (owned by Marathon Petroleum) for $21 billion in May 2021. The acquisition diversified 7-Eleven’s presence to 47 of the 50 most populated metro areas in the US and brought 7-Eleven’s total North American portfolio to approximately 14,000 stores, according to the company.Figure 6. US Convenience Stores: Market Share Breakdown (%) [caption id="attachment_153859" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Store Networks

As noted above, the US convenience store sector is in a consolidation phase. Even before the pandemic, intensifying competition and rising operating costs had forced small and mid-sized operators to exit the market or undergo acquisition by major players. The challenging operating environment induced by the pandemic has only expedited this process. Large chains looking for opportunities to scale the business are willing to pay up for the deals, encouraging owners of smaller chains to sell off their convenience store assets.

For example, Alimentation Couche-Tard considers building scale through acquisitions a significant part of its growth strategy. The company claims that acquisitions should create value and not necessarily favor store count growth at the expense of profitability.

As shown in Figure 7, major US convenience store operators have increased their net store count between 2019 and 2022.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Store Networks

As noted above, the US convenience store sector is in a consolidation phase. Even before the pandemic, intensifying competition and rising operating costs had forced small and mid-sized operators to exit the market or undergo acquisition by major players. The challenging operating environment induced by the pandemic has only expedited this process. Large chains looking for opportunities to scale the business are willing to pay up for the deals, encouraging owners of smaller chains to sell off their convenience store assets.

For example, Alimentation Couche-Tard considers building scale through acquisitions a significant part of its growth strategy. The company claims that acquisitions should create value and not necessarily favor store count growth at the expense of profitability.

As shown in Figure 7, major US convenience store operators have increased their net store count between 2019 and 2022.

Figure 7. Store Count of Major US Convenience Store Operators

| Company | Store Count (as of May 2019) | Store Count (as of May 2022) | |

| 1. | 7-Eleven | 7,925 | 9,412 |

| 2. | BP Plc | 6,732 | 6,817 |

| 3. | Alimentation Couche-Tard (Circle K, Corner Store, Flash Foods, Kangaroo Express, On The Run) | 5,586 | 6,798 |

| 4. | Casey’s General Stores | 2,200 | 2,278 |

| 5. | Murphy USA | 1,451 | 1,514 |

| 6. | EG Group (Cumberland Farms, Kwik Shop, Loaf N’ Jug, Quik Stop, Tom Thumb, Turkey Hill) | 1,297 | 1,410 |

| 7. | Wawa | 840 | 964 |

| 8. | QuikTrip Corp. | 800 | 941 |

| 9. | Sheetz, Inc. | 585 | 648 |

| 10. | QuickChek | 159 | 169 |

Source: ChainXY

Themes We Are Watching

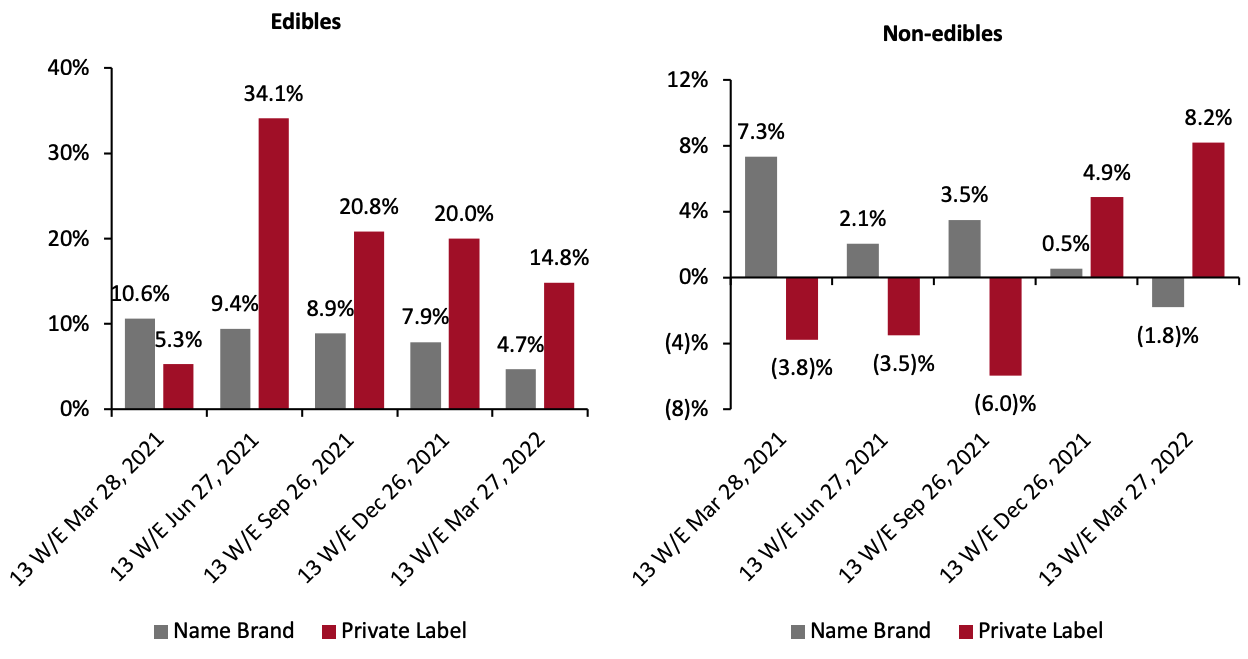

Private-Label Growth Is Outpacing Name Brands in Edible Category In the US convenience store sector, the sales growth of private labels has outpaced name brands in the edible category in the last four 13-week periods, according to IRI. High inflation in non-edible product categories has helped eke out private-label growth recently.Figure 8. US Convenience Store: Edible and Non-edible Category Growth (YoY %) [caption id="attachment_153860" align="aligncenter" width="700"]

Source: IRI POS Data[/caption]

Many convenience store chains have stepped up their private-label game to differentiate themselves and increase consumer loyalty:

Source: IRI POS Data[/caption]

Many convenience store chains have stepped up their private-label game to differentiate themselves and increase consumer loyalty:

- 7-Eleven has been the convenience store leader in launching and promoting private-label merchandise. The company offers 1,500 private labels under two lines, 7-Select and 24/7 Life by 7-Eleven. It posted $1 billion in private-label sales in 2020.

- Casey’s rolled out private-label packaged beverage and bakery items in 2020. In January 2021, the convenience store chain broadened its private-label assortment by launching more than 100 new snack and beverage items, including chips, jerky and nuts. Its store-reset initiative, launched in the first quarter of fiscal 2021, involves freeing up space to expand its private-label assortment across its store network.

- In October 2020, regional convenience store chain Kwik Chek, which rebranded as TXB, announced focus on including new private-label brand products, starting with staples like jerky, trail mix, coffee and water.

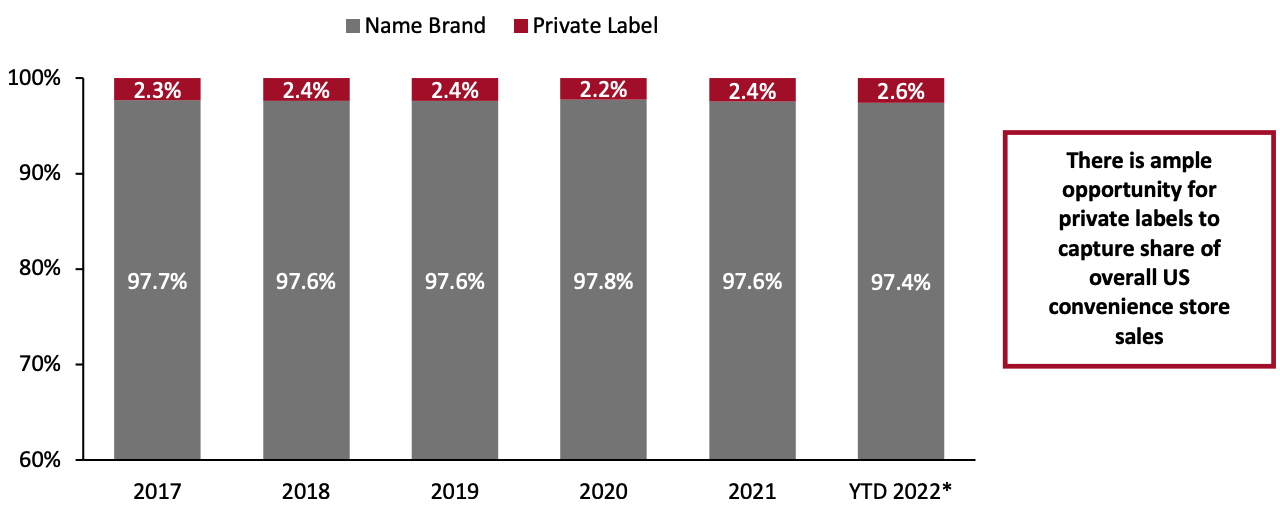

Figure 9. US Convenience Stores: Market Breakdown, by Name Brand and Private-Label Sales Value (% of Total Sales) [caption id="attachment_153861" align="aligncenter" width="700"]

*As of June 12, 2022

*As of June 12, 2022Source: IRI POS Data[/caption] Convenience Stores Are Placing a Greater Emphasis on Foodservice US convenience store operators have been adjusting their in-store product mix away from tobacco toward foodservice items to drive the top line and in-store traffic. Convenience is a major factor driving the popularity of these products, as more consumers are pressed for time and willing to spend more on quick and convenient service. As consumers’ eating habits continue to trend toward more health-oriented products, many companies have seized this opportunity by diversifying their product mix with healthy offerings. According to NACS, foodservice—which includes prepared food, commissary, hot dispensed beverages, cold dispensed beverages and frozen dispensed beverages—saw sales grow 24.1% year over year and by 10.6% on a two-year basis (versus 2019) in 2021. Sales of prepared food—the largest foodservice segment—surged 25.9% year over year and 15.2% on a two-year basis in 2021. Many convenience store chains have recently beefed up their foodservice offerings:

- In September 2021, Casey’s, known for its made-from-scratch pizzas, launched a new lineup of breakfast foods, including bacon and egg croissants, breakfast burritos and mini sausages. The company also announced that it will install coffee machines that grind beans for each cup at over 2,300 stores across the Midwest.

- Alimentation Couche-Tard rolled out its “Fresh Food, Fast” foodservice program in July 2020 for its network of Circle K stores. In the earnings call for the quarter ended January 30, 2022, the company said the program is active in 2,900 North American stores. The company added that stores with fresh food continue to outperform those without in the same markets.

- 7-Eleven has rolled out a series of “evolution stores” since 2019 that serves as an experiential ground for new concepts. Apart from the usual convenience assortment, the new concept stores offer a broad range of unique foodservice items, including made-to-order hot and cold drinks, self-serve bean-to-cup coffee, novelty beverages on tap, cold treat bars and freshly baked goods with restaurant-style seating. The company opened its ninth Evolution Store in Texas in June 2022.

- In March 2022, Instacart announced a 15-minute rapid delivery program using automated nano-fulfillment centers. The company added that Florida-based Publix will be the first Instacart partner to offer 15-minute delivery through the Instacart app. Publix debuted the service in Miami in April 2022. Previously, Instacart had launched a nationwide 30-minute delivery service with Kroger in September 2021. The same month, the company also unveiled the Convenience Hub on the Instacart Marketplace, a new product feature streamlining convenience shopping for customers. Through the new Convenience Hub, customers in nearly every major US city can shop for convenience essentials 24/7 with free Priority Delivery in as fast as 30 minutes for Instacart Express (now Instacart+) members.

- In December 2021, DoorDash introduced ultrafast grocery deliveries in 10 to 15 minutes through its DashMart location in New York City. The company said that it will continue to expand its ultrafast delivery option to more locations and partners over time.

Retail Innovators

Standard AI Standard AI provides autonomous checkout solutions that can retrofit retailers’ existing stores. Its technology enables customers to purchase items without the need to scan each product or interact with a payment terminal. The company uses ceiling-mounted cameras and artificial intelligence (AI)-powered computer vision technology to track products as a shopper selects them and digitally adds the items to a virtual shopping cart. The customer is then charged via the app when they scan a code on their smartphone before exiting the store. In August 2020, Standard AI partnered with Alimentation Couche-Tard to install its checkout-free technology at Circle K locations. The company integrated its technology at two Circle K stores in Arizona—the first in Tampa in October 2021 and the second in Phoenix in April 2022. Caper AI Caper offers AI-based automated checkout solutions for offline retail. It launched an autonomous point-of-sale countertop named Caper Counter in October 2020 that uses AI to offer a seamless self-checkout experience. Caper Counter uses computer vision technology to detect and instantly identify items placed on the countertop and automatically adds the items to the total amount. The plug-and-play solution is aimed at stores that carry fewer than 10,000 SKUs and occupy less than 10,000 square feet. In October 2021, Instacart acquired Caper AI for $350 million.What We Think

The US convenience store sector has seen significant shifts in consumer behavior. We expect to see continued consolidation through M&A (mergers and acquisitions), category expansion and innovation in this space. Although inflation and global political uncertainties weigh on consumer sentiment and spending, the global trend toward urbanization and smaller households will likely support growth in the sector. Implications for Retailers- Capturing on-the-go purchases is still an opportunity that channels outside convenience stores cannot do as effectively. However, with shrinking tobacco sales, convenience store operators should reconsider their in-store product assortment, such as adding prepared and ready-to-eat/drink products, which should be displayed upfront to appeal to time-pressed consumers.

- With higher gas prices affecting trips and baskets, convenience store operators should develop strong promotional strategies to draw more shoppers inside their stores and improve pump-to-store conversion rates.

- We expect consolidation in the US convenience space to continue as large chains step up in-store offerings and store renovations, while the single-store operators and small chains fail to invest due to a lack of scale. The withdrawal of small players will create opportunities for the large chains to gain share.

- Convenience store operators should look to expand and improve foodservice options, including bakery/pastry items, onsite menus for breakfast and fresh coffee that would help drive in-store traffic, provide higher margins and encourage purchase across categories. This may mean giving more of the outlet space over to prepared food.

- Convenience store operators are exploring and testing autonomous checkout stores to the optimize checkout process and reduce labor costs. Technology vendors should make cost savings central to their pitch and ensure that their solutions generate an appealing and fast return on investment.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved Data sourced to ChainXY are owned and were developed by ChainXY.

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.