albert Chan

Introduction

Beauty is a relatively mature market in the US, driven by population increases, changes in demographic trends and the creation of new categories and/or launches of new brands/brand extensions supported by advertising and marketing.

In this report, we discuss the growth and drivers of the US beauty market, comprising the color cosmetics, fragrance, haircare and skincare categories (excluding sun care and men’s grooming). We look at the competitive landscape and key trends in the market for 2022 and beyond, as well as technology innovators whose solutions can be applied in the beauty market.

Market Performance and Outlook

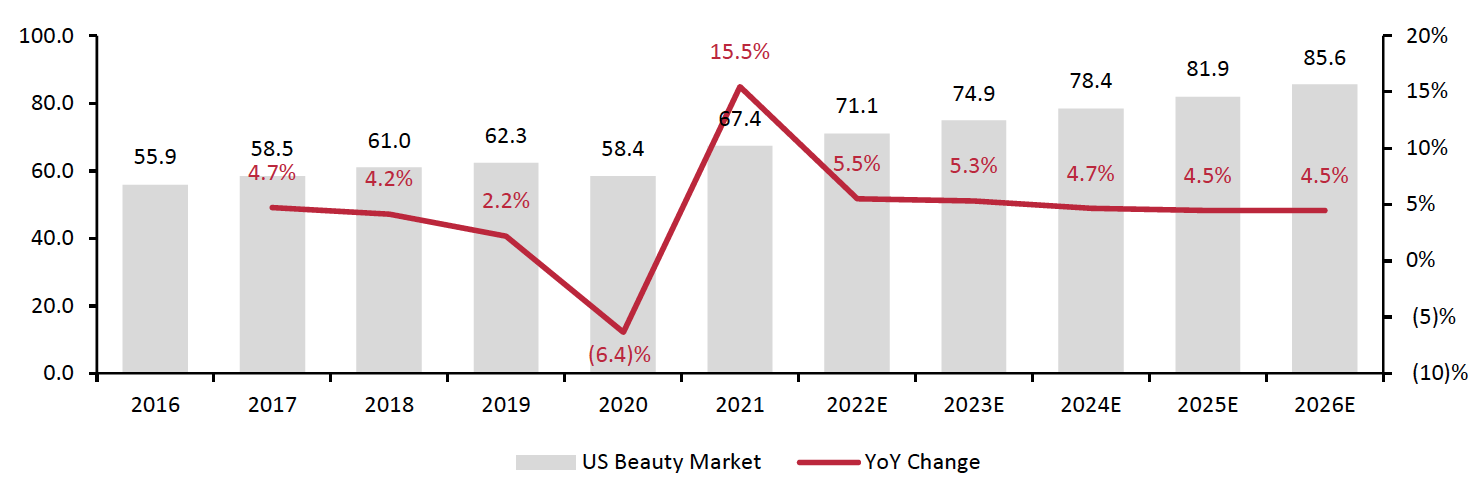

Beauty is generally a low-cost and feel-good category that can withstand economic slowdowns, as consumers continue to purchase lipstick, nail polish and fragrance as token indulgences while holding back from larger discretionary purchases. Despite the end of Covid-19 governmental assistance, Coresight Research expects beauty spending in the US to total $71.1 billion in 2022, up 5.5% year over year.

We expect this growth to be driven by a vibrant return to physical retail this year as consumers abandon some pandemic-led behaviors such as avoiding brick-and-mortar stores. In addition, sales growth in color cosmetics will likely accelerate as consumers return to more normal ways of living and socializing. We discuss these market factors in more detail in the following section of this report.

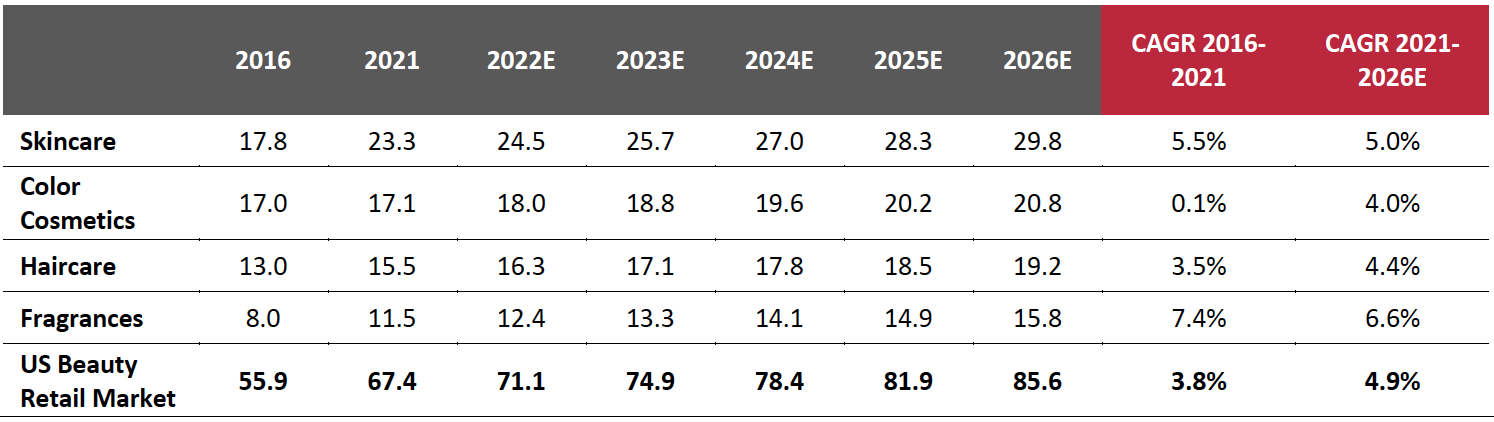

Looking ahead through 2026, we estimate that total beauty sales will grow at a CAGR of 4.9% from 2021, supported by premiumization, price increases and favorable consumer trends. Growth will be driven by the fragrances category, which we calculate will see a 6.6% CAGR in the same period (see Figure 1).

The US beauty market declined by 6.4% in 2020, year over year, according to Euromonitor International data, propelled by an 18.7% drop in sales of color cosmetics due to pandemic-altered consumer behavior, social distancing and work-from-home measures. Fragrance purchases also suffered during the pandemic in 2020, declining by 7.4%.

Beauty rebounded in 2021, led by 41.9% growth in the fragrance market. Color cosmetics also rebounded, up 16.8% and outperforming the overall beauty market, which achieved 15.5% growth. The haircare and skincare categories grew by 7.7% and 9.8%, respectively, in 2021.

Figure 1. US Beauty Products Retail Market Size (USD Bil.)

[caption id="attachment_146249" align="aligncenter" width="700"] Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research estimates[/caption]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research estimates[/caption]

Figure 2. US Beauty Products Retail Market Size Breakdown (USD Bil.) [caption id="attachment_146250" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Market Factors

Clean Beauty

During the pandemic, consumers have focused more on wellness, clean product ingredients and sustainability—and many beauty brands have successfully repositioned their offerings to align with the health and wellness focus. As a result, the beauty category now is more deeply integrated into consumers’ lifestyles and their sense of wellbeing.

Clean beauty, once a niche strategy, is now virtually an imperative for new product launches. Broadly speaking, clean beauty is a designation that brands use to convey products are not made with harmful ingredients, such as phthalates, parabens, talc and formaldehyde. Other descriptors that apply to clean beauty include natural or all natural, organic, chemical-free, nontoxic, green or sustainable, vegan and cruelty-free.

A new specialization we see growing is the expansion of clean beauty to vegan and botanical ingredients that purify and detoxify skin, which appeal to the health and wellness priorities of many consumers. Plant-based claims resonate with a growing consumer base that seeks out brands with strong social and environmental values, such as on animal rights and climate change.

Premiumization

In 2022, we see further premiumization of beauty, specifically in fragrance and haircare, as new formulations combine with enhanced educational efforts and personalized marketing.

Premiumization in fragrance reflects a trading up in the scent strength continuum, from eau de cologne to eau de toilette to eau de parfum to perfume, at increasingly higher price points. Furthermore, many brands are suggesting that consumers combine scents to create their own signature scent, such as Chloé Atelier Des Fleurs, which is a collection of 15 exclusive fragrances. Like buying flowers at a florist, consumers can pick their favorite scents to compose their olfactive bouquet. This level of personalization is likely to deepens brand/client relationships and drive higher sales volumes.

Coty’s premiumization strategy includes its recent investment in Orveda, a skincare label known for its vegan, gender-free offerings, and microbiome and prebiotics focus. At the same time, Coty is going back to the clean roots of its mass-distributed 60-year-old Cover Girl makeup collection by launching the brand’s first skincare collection, a 100% vegan skincare formulation. Coty has numerous skincare launches/relaunches planned for 2022 that have a clean formulation focus.

We also see mass marketed beauty going upscale via online education and direct-to-consumer (DTC) marketing. This will result in the expansion of the “masstige” beauty market, providing an additional boost to haircare, color cosmetics and skincare.

Return to “Normal”

Covid-19 accelerated the digitization of beauty sales and the use of beauty tech to assist in online and contact-light in-store selling. At the same time, sales of color cosmetics were significantly impacted amid pandemic-led lockdowns, as we discussed above. We expect color cosmetics so see sales growth accelerate as consumers return to the office and social occasions in 2022 and as they return to physical stores to shop. The beauty market is likely to see a release of pent-up demand as consumers look to refresh their personal assortments.

Increasing Age Diversity

Beauty is not just for the young. We believe that there is significant opportunity for beauty brands and retailers to expand the diversity of their customer base by targeting older consumers. Focusing on women—the typical target consumer of the beauty sector—the US female population overall grew by 9.4 million between 2010 and 2019, according to the latest US Census Bureau data, and the proportion of women over aged 55 and above also grew to 31.2% from 26.7% in 2010.

Oddity, the parent company of Il Makiage, just launched its second wellness and beauty brand offering a personalized approach to aging. SpoiledChild, its new digital-first brand, will use a proprietary machine learning tool, SpoiledBrain, to provide tailored recommendations for each consumer, matching them with the product or sequence of products that fits their needs and preferences.

“There is an entirely new generation of consumers that are redefining the rules of aging on their own terms,” said Suzanne Fitzpatrick, Co-General Manager of SpoiledChild. “We created a range of best-in-class products that address a wide spectrum of different goals and made it easy for consumers to find the products that match their needs.”

- Read our separate report, Inclusive Beauty: Opportunities to Reach Older Consumers.

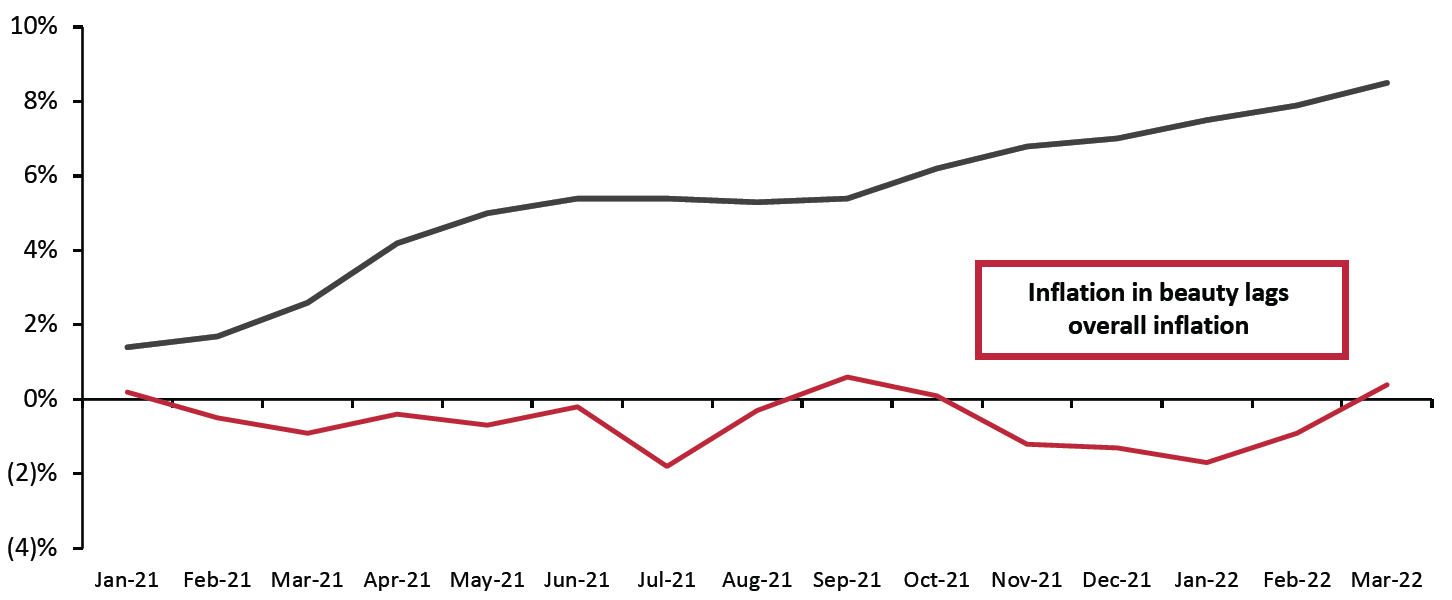

Inflation

Inflation in beauty typically lags inflation in the overall US economy. Between 2011 and 2021, the average 12-month percentage change in the beauty consumer price index (CPI) was (0.2)%, versus a 2% average gain in the CPI for all items.

In 2021, the CPI for selected beauty products declined by an average 0.6% versus a gain of 4.7% in the overall CPI. As of March 2022 (latest available data), beauty products saw a 0.4% increase in CPI for the latest 12-month period versus an 8.5% gain in CPI for all items in the same timeframe.

However, beauty companies have discussed increased costs and strategic price increases via premiumization for 2022. L’Oréal stated in the first three months of 2022 consumers beauty purchasing behavior was unaffected by inflation. The Estée Lauder Companies expects price increases to average 3.5% for its fiscal year ending June 30, 2022, having implemented 3% increases in its first half of fiscal 2022 and planning for 4% increases in the second half. Widespread increases in pricing will support the growth of the US beauty market in 2022.

Figure 3. Consumer Price Index (CPI): Selected Beauty Products vs. Overall (YoY % Change) [caption id="attachment_146251" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

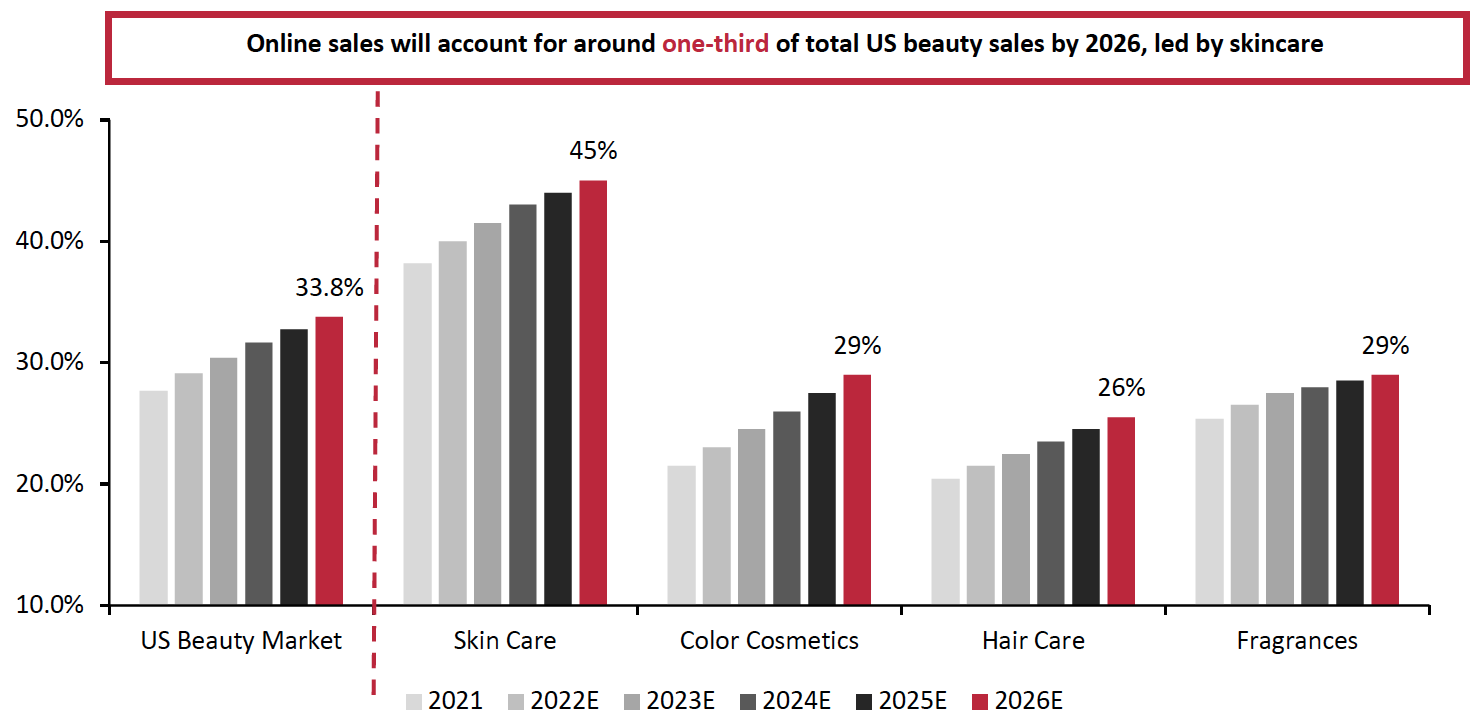

Online Market

Over the next five years, we expect increased e-commerce penetration in beauty, led by skincare and followed by haircare and fragrance. Beauty technology will support the channel shift, as will educational/marketing efforts and greater consumer acceptance of new forms of selling, such as livestreaming.

The US beauty market has gradually migrated online since 2016, achieving a 20.9% five-year CAGR in e-commerce sales between 2016 and 2021, versus the 3.8% CAGR in total US beauty sales, according to Euromonitor International data. Pandemic-impacted 2020 was an outlier, as the total market contracted by 6.4% while e-commerce sales grew 32.2%. We estimate that in 2020, the online beauty market captured an additional 804 basis points (8.0 percentage points) in market share, accounting for 27.6% of overall sales (up from 19.5% in 2019 and 12.9% in 2016). In 2021 e-commerce beauty sales continued to grow, but at half the pace achieved in 2020, or 16.1%, and modestly expanded market share to 27.7%.

We believe that Covid-19 grew online adoption at a rate three to four times the norm, and we expect penetration to increase moving forward, albeit at a slower pace. We estimate that the online channel will gain an approximate additional one-percentage-point share of total sales each year from 2022 to 2026, at which point e-commerce will account for around one-third of the US beauty market. Increased penetration will be led by skincare, which will see online sales account for around 45% of category sales, in 2026, we estimate.

Figure 4. US Beauty E-Commerce Penetration, Total US Beauty Market and by Category (Online Sales as a % of Total Beauty Sales)

[caption id="attachment_146252" align="aligncenter" width="700"] Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Competitive Landscape

The US beauty market is highly competitive—with several retailers and brands holding dominant positions. Beauty is also sold through many different channels, ranging from direct selling to department stores.

Direct selling is a nonstore retail channel that represents a significant share of beauty, according to Euromonitor International data:

- Direct selling accounted for 13.1% of 2021 US skincare sales. In skincare, word of mouth, trust in the brand representative (who is often a friend or micro-influencer) and auto-replenishment are important features in the success of direct selling.

- Direct selling accounted for 7.0% of color cosmetics sales in 2021. The category relies on fashion newness along with marketing and product launches to create category excitement.

- Direct selling is a small portion of US fragrance sales; however, home-shopping channels (Qurate Retail’s QVC, HSN and Zulily) captured 4.6% of the US fragrance market in 2021. As direct selling evolves with livestreaming on branded sites as well as marketplaces, we believe it will attract younger shoppers and increase the channel’s penetration of fragrance and beauty sales generally.

In 2021 e-commerce became the primary channel for fragrances, accounting for 25.4% of US category sales, followed by department stores at 24.8%, beauty specialists at 23.6% and apparel and footwear specialty retailers at 9.6%, according to Euromonitor International data. Many brands launch a fragrance in pursuit of a lifestyle and/or luxury branding strategy, as fragrance is an aspirational yet accessible entry to a fashion/luxury brand.

Leading US Beauty Specialist Retailers

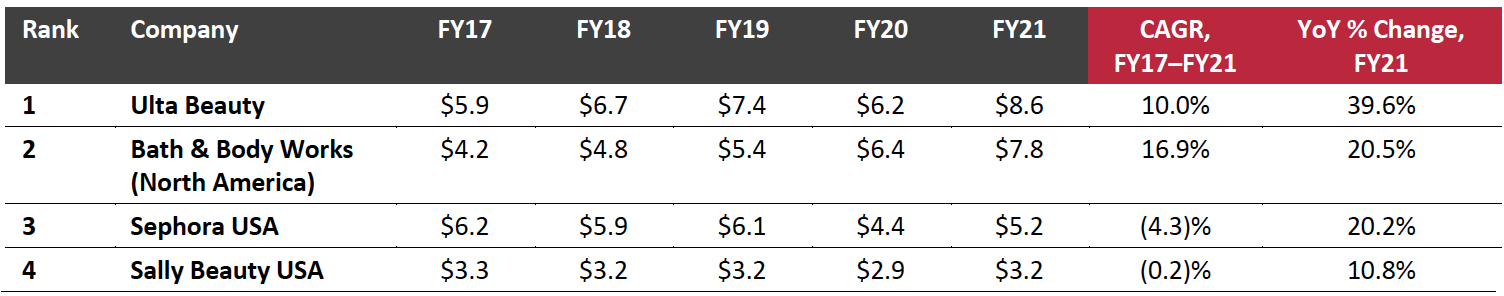

Among US beauty specialty retailers, Ulta Beauty leads the way, reporting $8.6 billion in revenue in fiscal 2021. The retailer operates more than 1,200 stores. Bath & Body Works overtook Sephora to take second spot in 2021, likely due to Sephora’s weakness at its approximate 500 shops in JCPenney (the retailer also operates more than 500 standalone stores in the Americas). Founded in 1964, Sally Beauty is the oldest of the top four beauty specialty retailers and has the largest store portfolio with 3,785 locations in the US under its Sally Beauty Supply and Beauty Systems Group (targeted at the beauty professional). All four major beauty retailers achieved double-digit sales growth in fiscal 2021, according to company reports.

Figure 5. Major US Beauty Specialty Retailers: Revenue (USD Bil.) [caption id="attachment_146253" align="aligncenter" width="700"]

Fiscal year ends in January for Ulta Beauty; December for Bath & Body Works and Sephora; and September for Sally Beauty

Fiscal year ends in January for Ulta Beauty; December for Bath & Body Works and Sephora; and September for Sally BeautySource: Company reports/Coresight Research[/caption]

Where Beauty Consumers Are Shopping and What They Are Buying

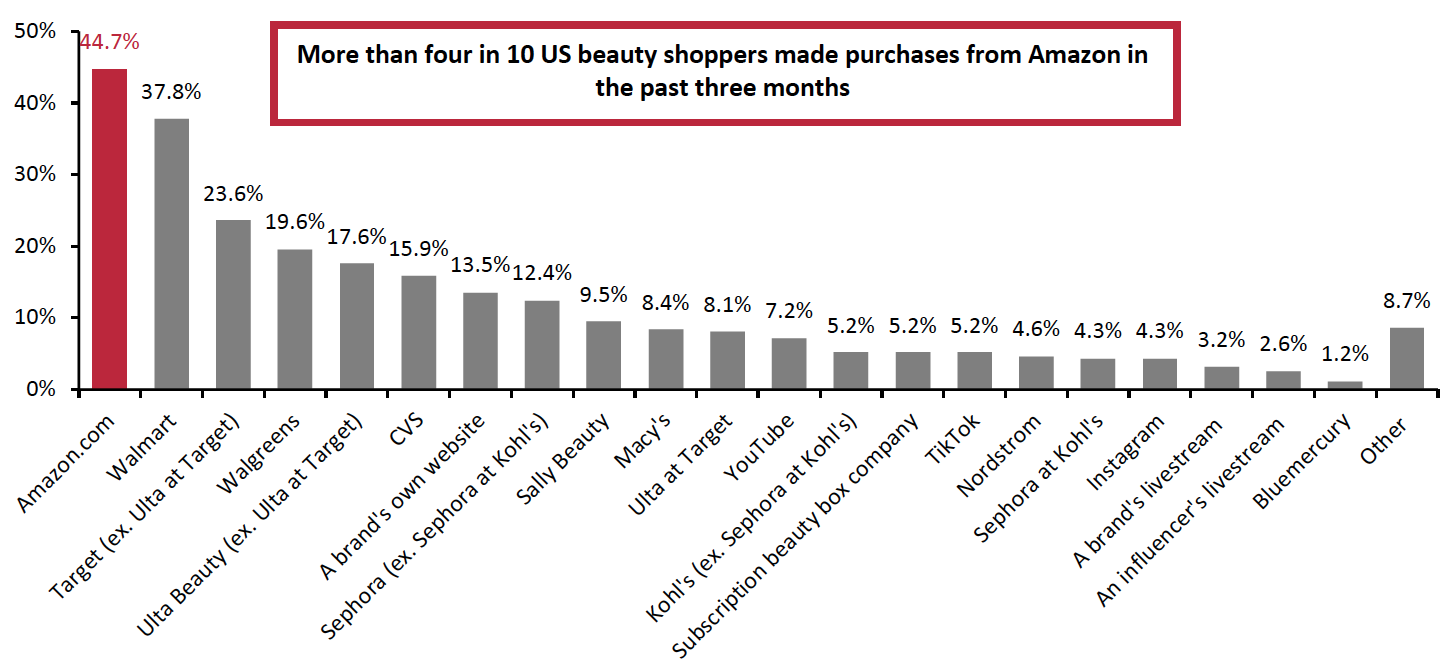

Interestingly, the specialty retailers discussed above are not the primary beauty destinations among US shoppers. According to a Coresight Research survey of US consumers conducted on March 21, 2022, 44.7% of respondents that shopped for beauty and personal care products in past three months made purchases from Amazon, making the e-commerce giant the most-shopped retailer for that category. Amazon captured the same 44.7% of our survey respondents in the 12 months ended December 27, 2021, implying it maintained a steady market share. Walmart followed closely behind (37.8% of respondents, in both the three-month period ended March 21, 2022 and the 12 months ended December 27, 2021) and Target rounded out the top three most-shopped retailers for beauty in each period, 23.6% in the period ending March 21, 2022 and 28.6% in the period ending December 27, 2021. In terms of beauty specialty retailers, Ulta Beauty is the most popular, with 20.8% of shoppers (fifth overall).

We believe that mass retailers and drugstore chains benefited during Covid-19 as consumers sought out one-stop shopping destinations. We expect the enhanced discovery of beauty at shop-in-shops such as Sephora at Kohl’s and Ulta at Target to attract consumers through 2022 and 2023.

- For more on these partnerships and the business models of Sephora and Ulta Beauty, read our separate report, Head-to-Head in Beauty: Sephora vs. Ulta.

In addition to shopping at multibrand beauty specialty and mass retailers, many US beauty shoppers opt to make purchases directly through a brand’s e-commerce site (13.5%, according to our survey). Although livestreaming (shoppable video) currently has low penetration in terms of US beauty shopping preferences, we expect that the channel will become increasingly popular in the beauty space as more brands host their own live sessions and leverage influencers to reach consumers.

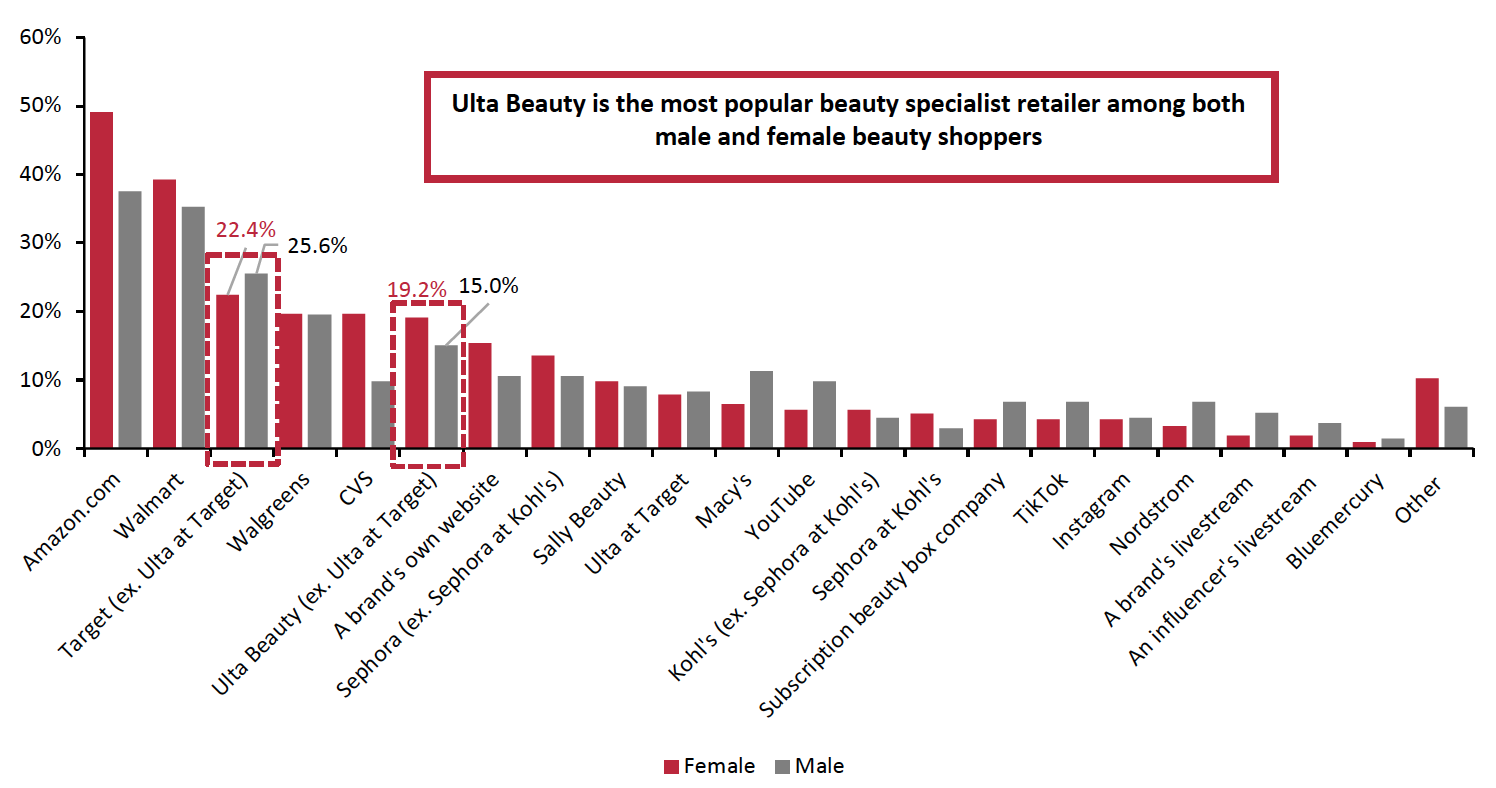

Our survey found that top beauty shopping destinations vary somewhat by gender (see Figure 6):

- Amazon and Walmart are the most popular among both men and women, with the proportions of female beauty shoppers that made purchases at these retailers in the past three months (49.1% and 39.3%, respectively) exceeding the proportions of male beauty shoppers (37.6% and 35.3%, respectively).

- In third place overall, Target is more popular among male shoppers (25.6%) than female shoppers (22.4%).

- Male shoppers also prefer Macy’s as a beauty destination over CVS, Sephora and Sally Beauty, which are more popular among female shoppers. Nearly double the proportion of male shoppers (11.3%) bought beauty products from Macy’s in the past three months than the proportion of female shoppers (6.5%).

Figure 6. Retailers from Which US Beauty Shoppers Had Purchased Beauty Products in the Last Three Months: Overall (Top) and by Gender (Bottom) (% of Respondents), March 2022

[caption id="attachment_146255" align="aligncenter" width="700"]

[caption id="attachment_146255" align="aligncenter" width="700"] Base: 347 US consumers aged 18+ who bought beauty products in the past three months, surveyed on March 21, 2022

Base: 347 US consumers aged 18+ who bought beauty products in the past three months, surveyed on March 21, 2022Source: Coresight Research[/caption]

According to our survey, the most purchased beauty products for men were lip balm (purchased by 29.3% of men who bought beauty products in the three months ended March 21, 2022), followed by moisturizer/anti-aging products (24.8%) and deep hair conditioners (23.3%). For women surveyed, moisturizer/anti-aging products were the most purchased category (42.1%) followed by lip balm (37.9%) and mascara (33.6%). For women, foundation and eyeliner tied with 27.6% of women surveyed who bought beauty products to round out the top five purchased categories, while for men, fragrance was fourth at 19.6% and eyeliner was the fifth most purchased beauty product purchased by 18.1% of men who bought beauty products in the three months ended March 21, 2022.

Major US Beauty Companies

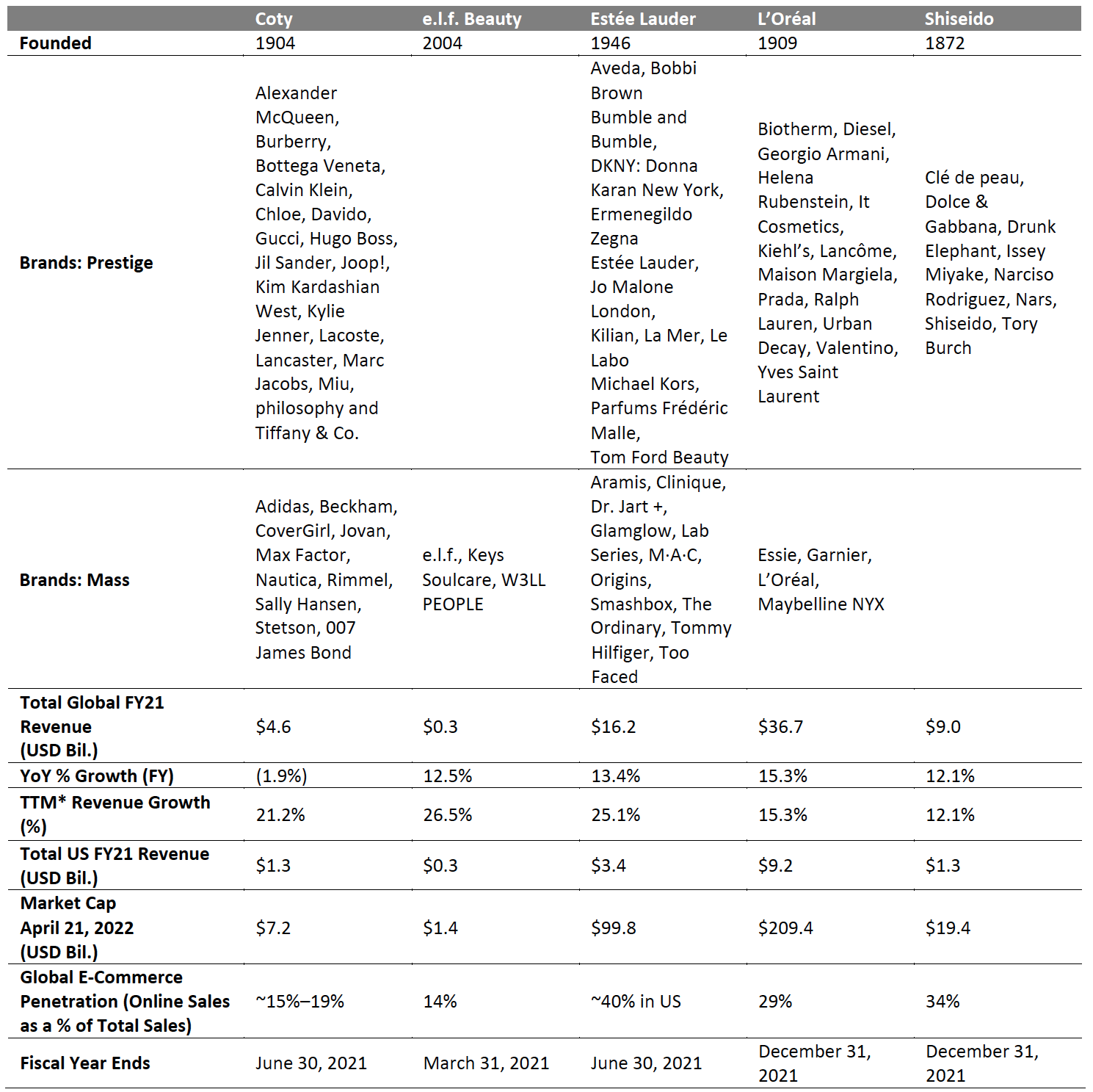

In Figure 7, we present key metrics for selected major beauty companies in the US.

Figure 7. Major US Beauty Brands: Selected Metrics [caption id="attachment_146256" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Themes We Are Watching

Mergers and Acquisitions

BeautyMatter Deal Index tracked 407 deals in 2021, a 52% increase from 2020 and 48% increase from 2019. Seed, venture and minority stakes dominated the deal landscape (56% of deals) and traditional mergers, acquisitions and majority stakes followed (40%).

We expect 2022 to be another year of M&A activity with many transactions already announced or closed, including luxury marketplace Farfetch’s intent to purchase beauty curator platform Violet Grey, subject to shareholder approval. At established retailers, DNVB (digitally native vertical brands) are attracting new and young shoppers while providing larger beauty brands with insights into digitally savvy shoppers.

Premiumization of Beauty

We see brands working to elevate their brand positioning via reformulations, new introductions and adding sustainability and/or vegan attributes to formulations. This is most notably occurring in the mass market. The creation of “masstige” is blurring the distinction between premium and traditional mass products. Mass retailers such as Target and Walmart are expanding and elevating their beauty assortments.

Dermatological Science-Based Brands

At the luxury end of beauty, skin care created by scientists, medical doctors or professors is building momentum. One such brand is Noble Panacea, founded in 2019 by Nobel Laureate Sir Fraser Stoddart. It is differentiated by its technology, the organic molecular vessel, which enables deeper penetration and improves the efficacy of skincare lines’ active ingredients.

Wellness

Over the past two years, wellness has become a key priority for consumers, so beauty is increasingly being marketed based on wellness attributes. In our September 27, 2021, survey of US consumers, 21.9% of respondents said that spending on wellness and/or fitness is more of a priority than it was about three years ago.

Helen Lambert, Founder of brand discovery platform The Style Pulse, told Coresight Research that there has been a real shift since the beginning of the pandemic in consumer attitudes to wellness as it relates to beauty. She expects forthcoming innovations to drive hair care, oral care and new types of makeup, as well as health supplements and natural feminine-care products. According to Lambert, new product activity is booming and will continue to do so over the next year.

Retail Innovators

Retail innovators can assist beauty brands and retailers in a variety of ways, from livestreaming to marketing to better understanding their customers.

Firework

Firework offers an end-to-end digital experience platform designed to help businesses engage and grow in the emerging “open web” era. Firework enables its customers to create and host native, shoppable video content for engaging product discovery, seamless shopping experiences and, ultimately, a meaningful connection with consumers. Its technology is also designed to connect the entire open web with short, shoppable video and livestream infrastructure, creating a powerful suite that drives traffic and targets audiences, according to the company.

- Read Coresight Research and Firework’s report, Six Livestreaming Myths Debunked: How To Optimize US Livestreaming E-Commerce Strategies.

Freeosk

Freeosk is a digital discovery and automated sampling company that provides an omnichannel marketing solution to consumer packaged goods (CPG) brands that need to drive product awareness, trial and conversion. Freeosk has 1,400+ interactive kiosks in the US that provide both out-of-aisle display and automated sampling. The company provides contactless sampling solutions and on-screen video media that enable brands and retailers to deliver consistent brand experiences and product information to shoppers. Freeosk also provides analytics solutions for retailers and CPG brands to learn more about consumer purchasing behaviors and retarget shoppers through customized email offers before and after the store visit.

- Read Coresight Research and Freeosk’s report, Rethinking Product Sampling: Are Retailers and CPG Brands Doing It Right?

ciValue

ciValue provides an AI-powered software-as-a-service (SaaS) platform that helps retailers (grocery, drug and specialty) and CPG suppliers collaborate to better understand and serve their customers. The company offers omnichannel personalization, retail media and brand collaboration and monetization services. ciValue’s approach helps retailers offer their suppliers aggregated market insights and identify customer segments with significant growth potential. The platform can analyze purchase history owned by the retailer and translate it into brand-oriented shopper profiling. The company also provides predefined analytical dashboards and ad-hoc query tools that enable brands to identify shopping trends early.

What We Think

We see beauty industry growth remaining in the mid-single digits through 2026 based on innovative products meeting new needs and upscaling existing mass beauty brands. Consumer focus on wellness is driving interest in vegan and sustainable product ingredients with a beauty from within philosophy. This is creating the opportunity for the development of well-rounded lifestyle beauty brands that are good for you as well as that make you look good.

We believe the shift to e-commerce will moderate in 2022 as pent-up demand for the attributes of physical retail, both tactile and social, will drive a return to stores. However, we see continued shares drifting to the e-commerce channel, which will approach one-third of the market by 2026.

Implications for Brands

- Brands matter in beauty; Coresight Research’s recent survey found that a higher proportion of beauty shoppers buy from brand websites compared to Sephora, Macy’s and other retailers. Brands therefore have a strong DTC opportunity, which provides greater understanding of the shopper and facilitates ongoing product and marketing development.

- New brands should explore multiple distribution channels and consider livestreaming and social media as platforms for discovery.

Implications for Retailers

- We see significant opportunity for all retail channels, from high-end luxury department and specialty shops to drug and mass retailers. Consumers shop high-low, across brands and channels, and retailers that curate assortments to their customer base using localization strategies will win.

- Department stores and beauty specialty shops can offer beauty/wellness services that deepen customer relationships and create return visits, driving customer loyalty and increased customer lifetime value. Mass and drug retailers can bring new and exciting DNVBs to their shoppers, providing a context for discovery and engagement.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved