albert Chan

Introduction

Each report in our Market Outlook series provides an analysis of a particular retail sector or consumer market. In this report, we cover the US beauty market, with a focus on brands and retailers. We provide insights into the size and growth of the market, as well as its competitive landscape and three major themes to watch. We consider the factors that are impacting the beauty market’s resilience and look ahead to the areas of future opportunity.

Beauty Market Size and Growth

Looking Ahead to the Rest of 2020 and 2021

Spending

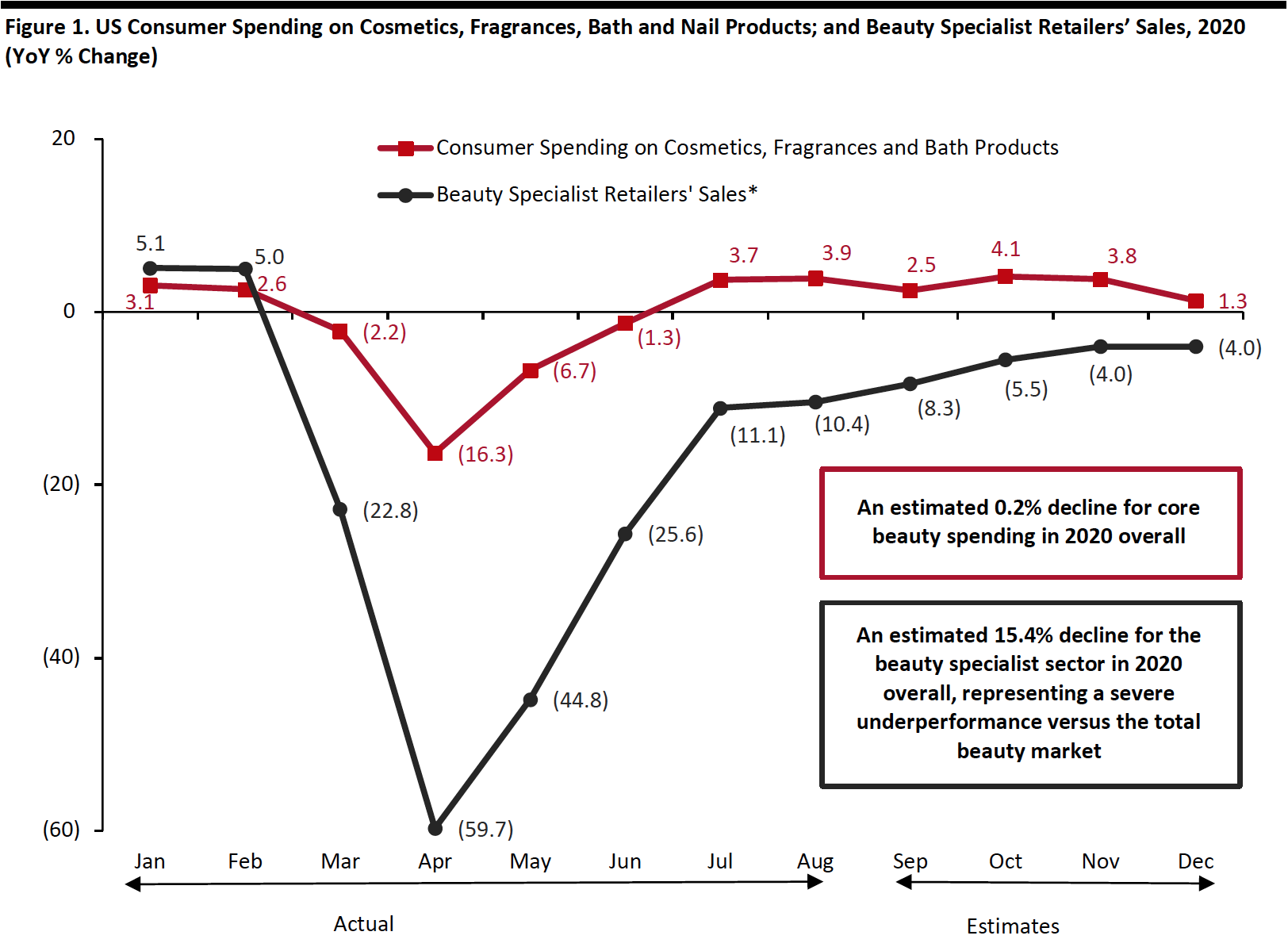

We estimate that 2020 consumer spending on core beauty categories will be broadly flat—down by just 0.1% to $55.6 billion (incl. sales tax); that is a dollar decline of about $120 million versus 2019. This includes spending on cosmetics, fragrances, bath products and nail products (as defined by the Bureau of Economic Analysis) through all channels, including lockdown-resilient, higher-growth e-commerce.

- As shown in Figure 1, the category had recovered from a deep lockdown-driven decline in April to virtually flat growth by August.

- Between May and July, category declines eased substantially as stores reopened and demand improved gradually.

- We estimate stronger year-over-year growth in October as consumers pull forward holiday spending; Coresight Research survey data confirm that a sizeable proportion of shoppers plan to start holiday shopping earlier. An October Amazon Prime Day and other shopping events—such as rival promotions from Target and Walmart and the new 10.10 Shopping Festival—are likely to have encouraged this early shopping. December 2020 is against demanding comparatives from December 2019, when category spending rose by 7.5%.

Beauty Specialty Retailers

For over a decade, US beauty specialist retailers have witnessed consistently positive sales growth. However, the coronavirus pandemic has severely impacted sector sales this year. For 2020 overall, we estimate that sales through US beauty specialist retailers will decline by around 15.4% to $52.6 billion (ex. sales tax). This sector includes sales by specialist retailers of cosmetics, beauty products, perfume, optical goods and other health and personal care products, as defined by the US Census Bureau; it excludes drugstores and pharmacies.

- That 15.4% decline compares unfavorably to the estimated 0.1% decline in total beauty spending, noted above, and implies a meaningful loss of share to alternative channels, such as mass merchandisers that remained open during lockdown and online-only retailers.

- In the first half of 2020, beauty specialist retailers’ sales declined by 25%, primarily due to store closures but also impacted by reduced demand for beauty products amid lockdowns and working from home, declining consumer sentiment and a decrease in disposable income led by high unemployment. In July, the sales decline eased to 11.1%, from the 25.6% decrease in June.

- Assuming beauty demand moves closer to normalcy in the second half of 2020 as sentiment improves and more consumers return to in-store shopping, we expect total sales growth at beauty specialist retailers to improve to a low-single-digit year-over-year decline in December. However, this still lags the estimated positive growth in beauty category spending, of 1.3% (see Figure 1).

- Earlier holiday shopping should support a sequential improvement in October. However, October’s promotional events are less likely to benefit the specialist sector than category spending, given that major participants such as Amazon (with Prime Day), Target and Walmart (with rival events) are outside of the sector.

*Includes sales through specialist retailers of cosmetics, beauty products, fragrances, optical goods and other health and personal care products

*Includes sales through specialist retailers of cosmetics, beauty products, fragrances, optical goods and other health and personal care productsSource: US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

October to December 2020

This period could see a return to positive year-over-year growth in beauty retail sales: We estimate consumer spending on cosmetics and fragrances will grow by low-single digits, year over year, toward the end of 2020. The holiday season brings opportunities for beauty retailers to drive sales through promotions, discounts and special shopping events or festivals. To start driving holiday traffic, retailers may have to incur promotion-related expenses ahead of time—i.e., in October. Given the surge in demand online (which we discuss later), retailers can ease peak-period constraints in fulfillment by encouraging early holiday shopping online.

Sales in December will be against demanding comparatives from a very solid performance for consumer spending and specialists’ sales in December 2019. By the tail end of the year, consumers may generally be more confident about shopping offline—although this is likely to vary by region according to the number of Covid-19 cases. However, there is a possibility that the spread of the coronavirus may peak again in the October-to-November period. Any resurgence of the virus could force beauty stores to close again in certain areas, if not nationally, thus impacting sales.

Outlook for 2021

Against a broadly flat 2020, we estimate that consumer spending on core beauty categories will climb by around 4–5% in 2021, supported by an expected, incremental return to pre-crisis normality, such as returning to workplaces and public spaces and holding/attending more social events. At the 4.5% midpoint, this would take core beauty spending to $58.0 billion.

In 2021, the specialists sector will face exceptionally week comparatives, although it is likely to see a headwind from channel shifts induced by the crisis remaining permanent among some consumers. Again on the assumption of a return to more normal circumstances, we estimate a double-digit bounce for the specialist sector in 2021. An approximate 10–12% rise would take sector sales to $58.4 billion at the midpoint of 11%—but even with such a rise, sector sales would be around 6% below the level of 2019.

Our estimates assume a sustained, gradual return to more normal ways of living and working and are on the basis of no further lockdowns in 2021.

Online Beauty Market

Owing to the Covid-19 pandemic, there has been an unprecedented surge in demand for online beauty in the US. The new necessity of social distancing and self-quarantine has spurred homebound consumers to turn to online beauty shopping in greater numbers and more frequently.

Online Beauty Market Size and Growth Rate

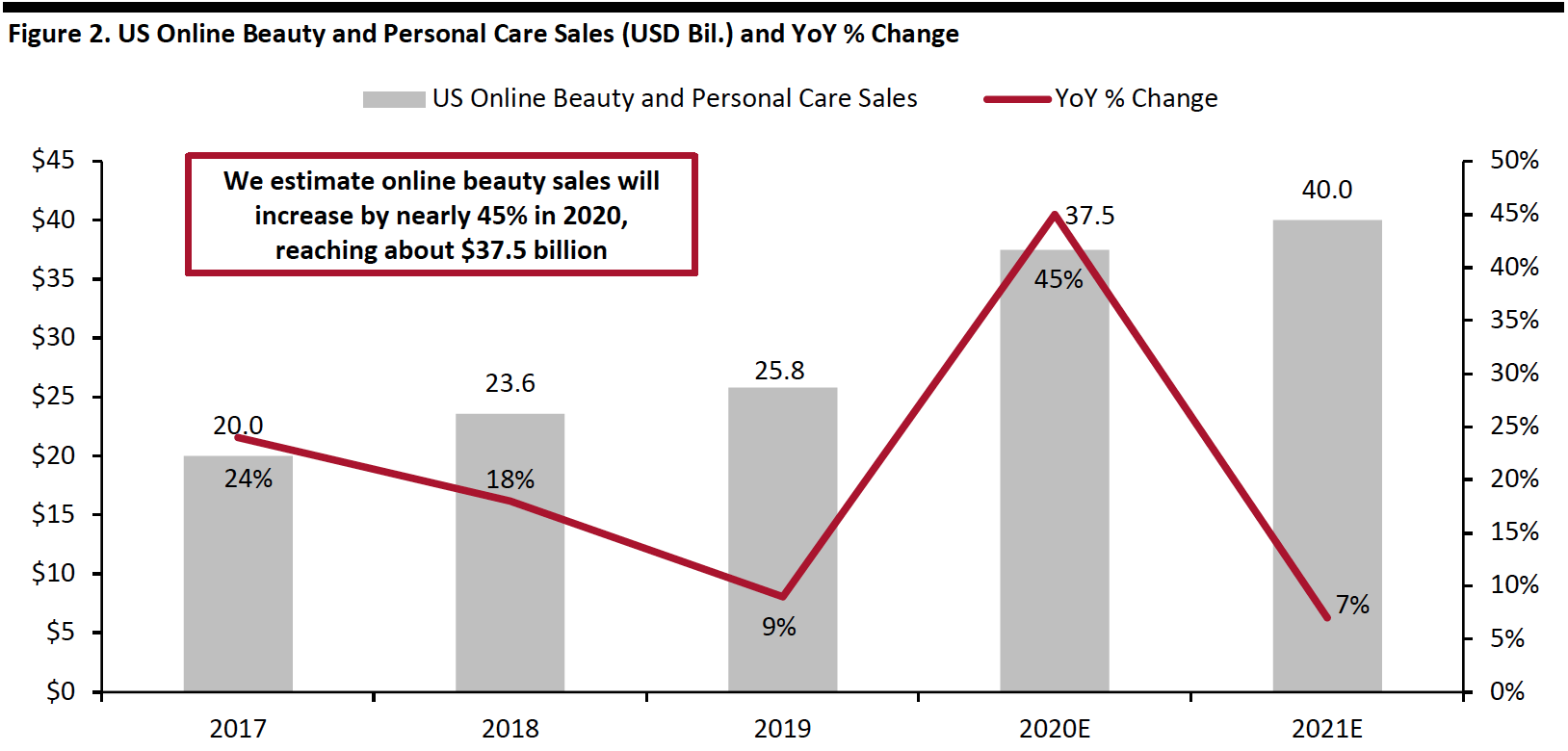

US online beauty retail sales totaled around $26 billion in 2019, we calculate from IRI data. We estimate that online retail sales of beauty products will surge by about 45% in 2020, fueled by substantial growth during the lockdown in the first half of the year, sustained high levels of online shopping post lockdown and our expectation that the e-commerce channel will play an important role in holiday-season sales.

This will take the online beauty market close to $37 billion for 2020. This market size includes personal care categories—such as haircare, bath and shaving products—as well as the core beauty categories of cosmetics, skin care and fragrances.

In 2021, we expect total online beauty sales growth to decelerate to about 7%, assuming that consumer online demand will stabilize in the overall beauty market as the coronavirus is tamed by the first half of 2021.

[caption id="attachment_117952" align="aligncenter" width="700"] Includes sales of cosmetics, skincare, fragrances, haircare, bath and shaving products

Includes sales of cosmetics, skincare, fragrances, haircare, bath and shaving productsSource: IRI E-Market InsightsTM/Coresight Research[/caption]

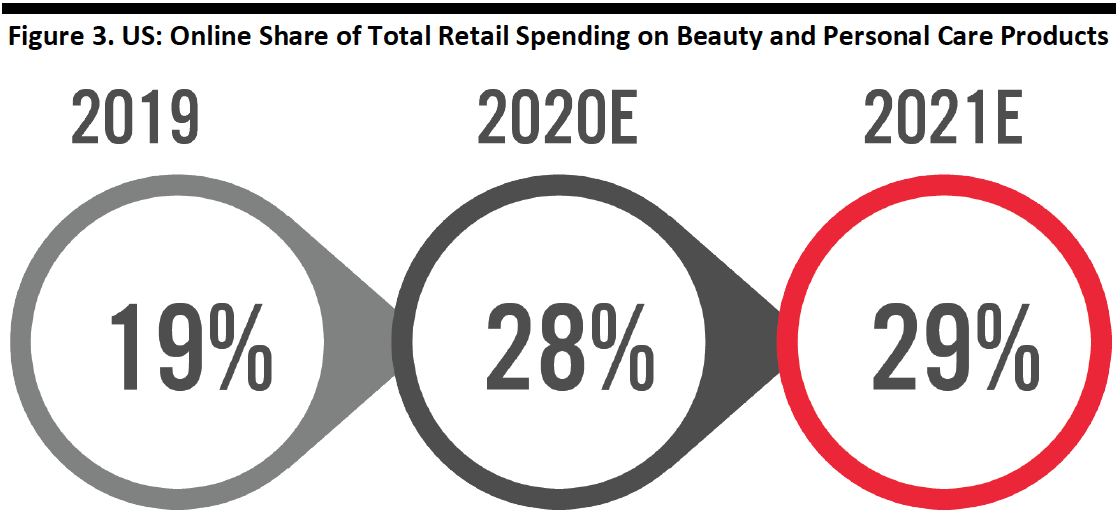

E-Commerce Sales Penetration

In 2019, the online share of US beauty retail sales was close to 19%, we calculate from IRI data and US Bureau of Economic Analysis data. We estimate the e-commerce share of beauty spending to jump by nine percentage points to 28% in 2020. We estimate any increase in share in 2021 to be minimal, assuming that demand moderates in beauty e-commerce.

This market size includes sales of personal care categories—such as haircare, bath and shaving products—as well as the core beauty categories of cosmetics, skin care and fragrances. It is calculated as a proportion of estimated total sales for all those categories. (Earlier in Figure 1, we charted growth in US consumer spending only on cosmetics, fragrances, bath products and nail products; and beauty specialist retailers’ sales separately.)

[caption id="attachment_117953" align="aligncenter" width="550"] Includes spending on cosmetics, skincare, fragrances, haircare, bath and shaving products

Includes spending on cosmetics, skincare, fragrances, haircare, bath and shaving productsSource: IRI E-Market InsightsTM/US Bureau of Economic Analysis/Coresight Research[/caption]

Competitive Landscape

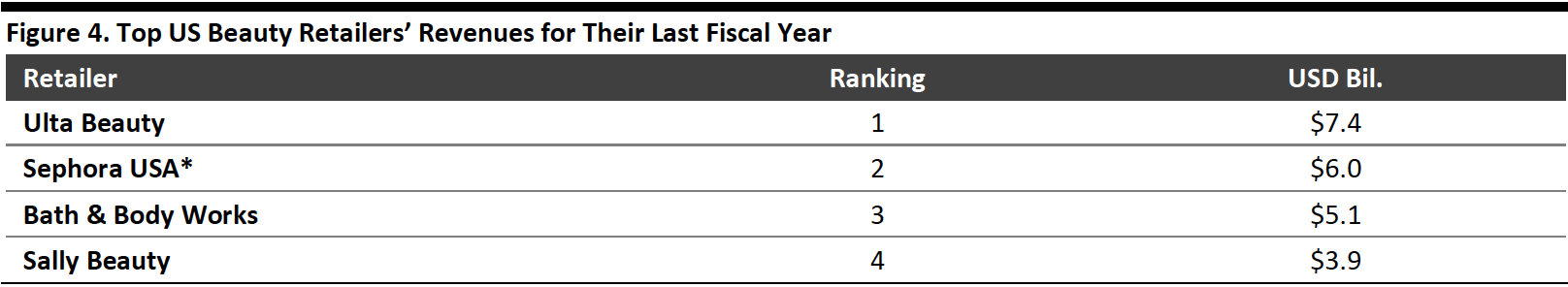

The US beauty market has always been one of the most competitive commercial niches—with several retailers and brands holding dominant positions in this fragmented retail space. Furthermore, in recent years, the landscape is increasingly being shaped by direct-to-consumer (DTC) beauty brands and start-ups. Below, we have listed some of the leading beauty brands and retailers, ranked in terms of their latest-fiscal-year revenues:

Leading US Beauty Retailers

Ulta Beauty and Sephora are leading the US beauty retail space, followed by Bath & Body Works and Sally Beauty. Meanwhile, Amazon is expanding its offering of beauty and personal care products, including the launch of its private-label skincare brand Belei. According to Coresight Research survey data, beauty and personal care products are the second-most-shopped categories on Amazon. Furthermore, Amazon is causing disruption during the crisis, with more consumers preferring to shop for beauty categories via e-commerce.

[caption id="attachment_117954" align="aligncenter" width="700"] Ulta Beauty’s fiscal year ended on January 31, 2020; Sephora’s ended on December 31, 2019; Bath & Body Works’ ended on February 1, 2020; and Sally Beauty’s ended on September 30, 2019

Ulta Beauty’s fiscal year ended on January 31, 2020; Sephora’s ended on December 31, 2019; Bath & Body Works’ ended on February 1, 2020; and Sally Beauty’s ended on September 30, 2019*Coresight Research’s estimate of Sephora USA’s revenues

Source: Company reports/Coresight Research[/caption]

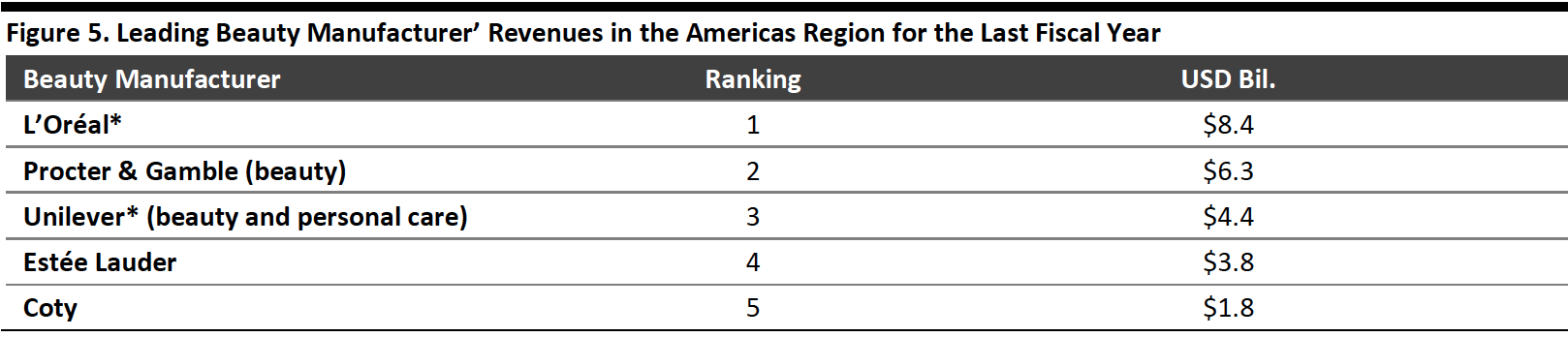

Leading Beauty Manufacturers

The US continues to be one of the most important markets for global beauty manufacturers. L’Oréal and Procter & Gamble are dominating the US beauty industry in terms of revenues, followed by Unilever, Estée Lauder and Coty.

These beauty manufacturers not only face heavy competition from each other, but also from retailers and e-commerce players, mainly Amazon.

[caption id="attachment_117955" align="aligncenter" width="700"] Revenues of L’Oréal, Procter & Gamble and Unilever are from the North America region; Estée Lauder’ and Coty’s from the Americas region

Revenues of L’Oréal, Procter & Gamble and Unilever are from the North America region; Estée Lauder’ and Coty’s from the Americas regionL’Oréal’s fiscal year ended on December 31, 2019; Unilever’s ended on December 31, 2019; Estée Lauder’s ended on June 30, 2020; Proctor & Gamble’s ended on June 30, 2020; and Coty’s ended on August 27, 2020

*L’Oréal’s and Unilever’s revenues are converted from euros to dollars using the exchange rate as of January 2, 2020

Source: Company reports/Coresight Research[/caption]

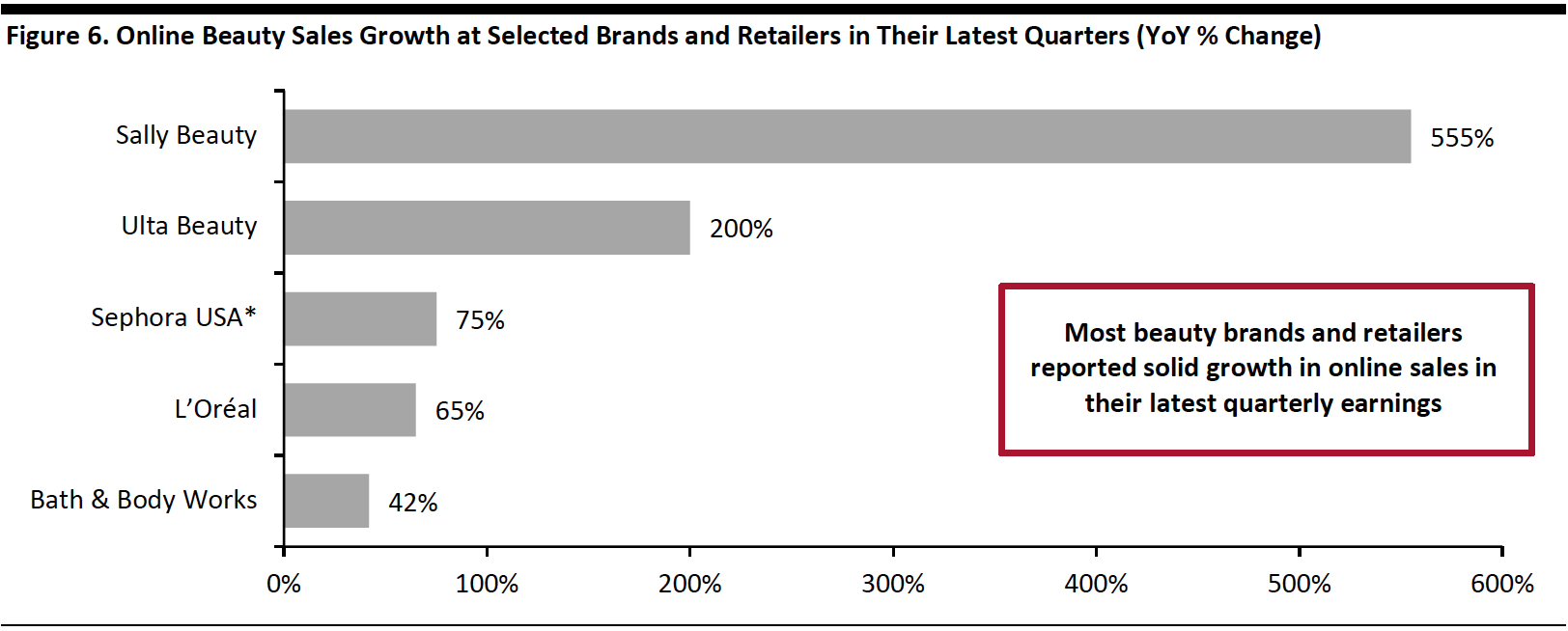

Brands and Retailers Witnessing Strong Online Sales Growth

In response to the crisis-led store closures and social distancing requirements, beauty brands and retailers ramped up their e-commerce and omnichannel fulfillment capabilities. As a result, many beauty brands and retailers reported solid growth in online sales in their latest quarterly earnings.

[caption id="attachment_117956" align="aligncenter" width="700"] Sally Beauty’s third quarter of fiscal 2020 ended on June 30, 2020; Ulta Beauty’s second quarter of fiscal 2020 ended on August 1, 2020; Sephora’s second quarter of fiscal 2020 ended on June 30, 2020; L’Oréal’s first half of fiscal 2020 ended on June 30, 2020; and Bath & Body Works’ second quarter of fiscal 2020 ended on August 1, 2020

Sally Beauty’s third quarter of fiscal 2020 ended on June 30, 2020; Ulta Beauty’s second quarter of fiscal 2020 ended on August 1, 2020; Sephora’s second quarter of fiscal 2020 ended on June 30, 2020; L’Oréal’s first half of fiscal 2020 ended on June 30, 2020; and Bath & Body Works’ second quarter of fiscal 2020 ended on August 1, 2020*Coresight Research’s estimate of Sephora USA’s online sales growth

Source: Company reports/Coresight Research[/caption]

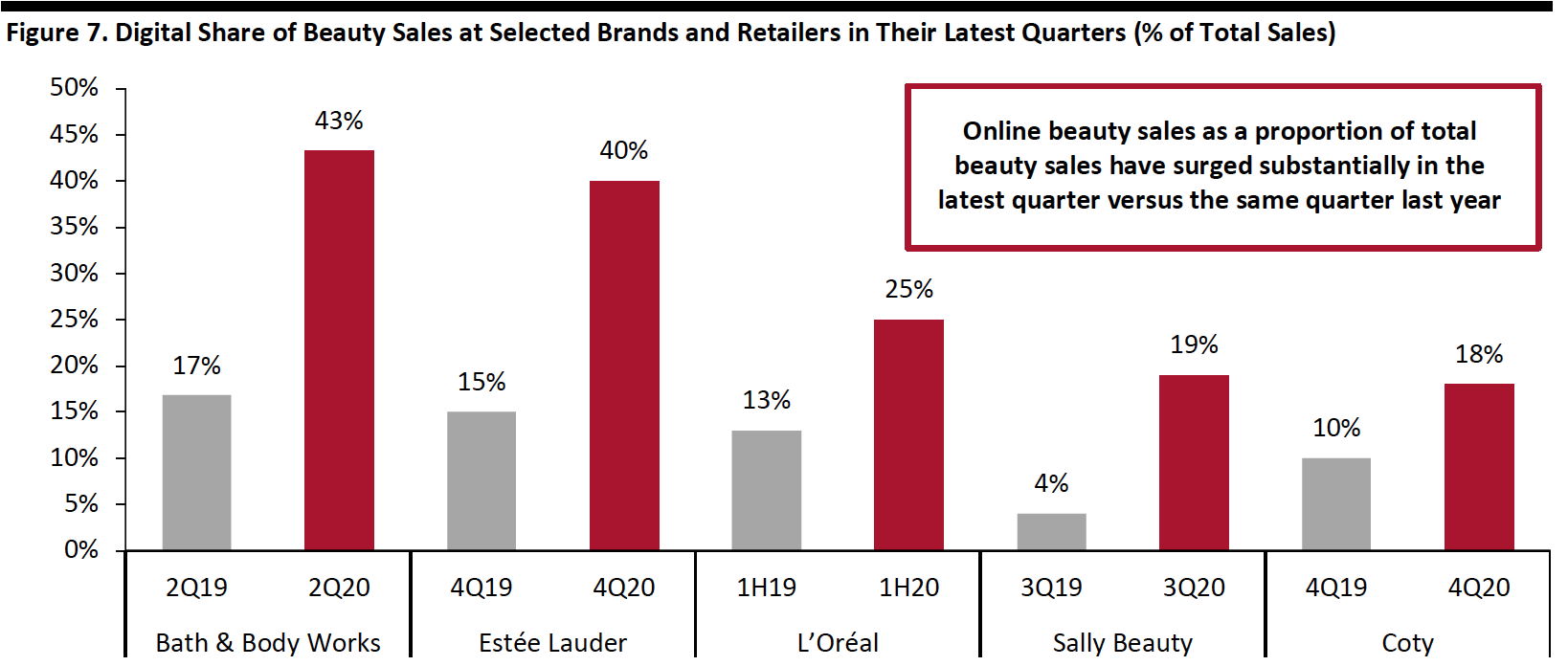

- Bath & Body Works’ digital sales contributed 42% to the company’s total revenues in the second quarter, ending August 1, 2020. Management said that even as the majority of stores reopened through July and into August, online sales as a proportion of total revenues have continued in the 20–30% range, and the company expects a similar contribution from the online business going forward. In the quarter, the retailer added BOPIS capability in more than 65 locations.

- Coty reported strong momentum and market share gains in e-commerce in the fourth quarter of fiscal 2020, ended June 30, 2020. Within the e-commerce channel, the company saw good performance for its Covergirl Clean Fresh and Sally Hansen “Good. Kind. Pure” brands.

- Estée Lauder reported that its online business delivered nearly triple-digit organic sales growth in the fourth quarter of fiscal 2020, which ended on June 30, 2020. Online sales, including through retailers that the company supplies, represented more than 40% of total sales in the fourth quarter—brand sites saw growth of nearly 90% globally.

- L’Oréal reported that its e-commerce sales surged by more than 65% in the first half of fiscal 2020, ended June 30, 2020, growing about twice the speed of the beauty market, according to the company, and accelerating every month even as stores reopened. E-commerce sales now represent 25% of the company’s total sales. L’Oréal said that for the first time, online sales are increasing more quickly in countries outside China, such as the US; in the US, e-commerce sales grew more than 100%.

- Sally Beauty noted that its US and Canada business delivered e-commerce growth of 555% for the third quarter, ending June 30, 2020.

- Sephora USA has seen its online sales grow 70–80% since the pandemic hit, making up for some lost sales from stores, according to CEO Jean-André Rougeot in an interview with WWD in August 2020. Before the pandemic, the e-commerce channel contributed about 40% of the retailer’s sales.

- Ulta Beauty’s sales from e-commerce increased by more than 200% in the second quarter of fiscal 2020, which ended on August 1, 2020. Curbside pickup and BOPIS (buy online, pick up in store) totaled about 20% of total e-commerce orders, and online-only members represented 7.5% of its total members, 2.5 times the penetration last year. Since the beginning of the pandemic, Ulta Beauty reported that it has seen more than 2 million online transactions from non-members, more than four times the number from the year-ago period. Ulta Beauty said that omnichannel members are the most productive members, spending about three times more per year than store-only guests. In the second quarter, omnichannel guests (non-members) grew to 21% of the company’s total member base, approximately double the penetration from the same quarter last year.

Bath & Body Works’ second quarter of fiscal 2020 ended on August 1, 2020; Estée Lauder’ fourth quarter of fiscal 2020 ended on June 30, 2020; L’Oréal’s first half of fiscal 2020 ended on June 30, 2020; Sally Beauty’s third quarter of fiscal 2020 ended on June 30, 2020; and Coty’s fourth quarter of fiscal 2020 ended on June 30, 2020

Bath & Body Works’ second quarter of fiscal 2020 ended on August 1, 2020; Estée Lauder’ fourth quarter of fiscal 2020 ended on June 30, 2020; L’Oréal’s first half of fiscal 2020 ended on June 30, 2020; Sally Beauty’s third quarter of fiscal 2020 ended on June 30, 2020; and Coty’s fourth quarter of fiscal 2020 ended on June 30, 2020Source: Company reports/Coresight Research[/caption]

What Beauty Brands and Retailers Are Reporting on the Coronavirus Impact and Outlook

The coronavirus pandemic has caught beauty companies unprepared, and the resulting societal and economic shutdowns present unprecedented challenges. Below, we summarize key commentary from major beauty retailers and brand owners on the impact of the coronavirus crisis on recent performance, as well as their future outlook.

Figure 8. Beauty Brands and Retailers: Key Commentary and Outlook

[wpdatatable id=508]Source: Company reports

How Are DTC Beauty Companies Positioned Post Covid-19?

The growth of e-commerce in the beauty industry in the last few months has been beneficial for DTC brands and retailers. Several DTC beauty brands are witnessing strong growth in traffic. For example, US-based Mented Cosmetics saw traffic increase by 165% quarter over quarter in the second quarter of fiscal 2020, with average monthly visits to its website totaling 407,604, according to a July 2020 report by web analytics service provider SimilarWeb, which shortlisted the 25 fastest-growing DTC brands. According to the same report, skincare and clothing brand Youth to the People witnessed traffic growth of 212% quarter over quarter in the second quarter, with average monthly visits to the website totaling 180,161.

A similar study of the fastest-growing DTC brands by SimilarWeb in May 2020 found that several DTC beauty brands witnessed substantial growth in their traffic in the first quarter of fiscal 2020:

- Function of Beauty saw traffic growth of 121% quarter over quarter, with average monthly visits of 1 million.

- BioClarity witnessed traffic growth of about 76%, with average monthly visits of 114,000.

- Public Goods saw traffic growth of 54%, with average monthly visits of 209,000.

- Youth to the People’s traffic grew 54%, with average monthly visits of 58,000.

- The Honest Company witnessed traffic growth of 48%, with average monthly visits of 880,000.

- Rael saw traffic growth of 31%, with average monthly visits of 77,000.

At present, DTC beauty companies are in expansion mode. They are witnessing stronger traffic, and unlike physical retailers, they do not incur fixed costs associated with operating stores, including rent and labor costs.

However, achieving profitability remains challenging for DTC brands, given the substantial costs associated with their approaches to marketing and fulfillment. The variable nature of these costs mitigates the benefits of scale that may otherwise be enjoyed—and in the broader pure-play space, such costs have often risen even when measured as a share of (growing) revenues. In other words, the marketing- or fulfillment-cost ratio often does not get eroded even as online-only retailers reach much greater scale.

Furthermore, DTC beauty brands are facing other hurdles during the pandemic, such as not being able to access additional funding or not having experts or specialists (unlike big companies) to guide them through this crisis.

We believe that the pandemic might create an environment for increased merger and acquisition activities in the US beauty landscape. Beauty companies with deeper pockets are already looking for new ways to enhance consumer engagement across the various channels; for them, acquiring valuable DTC brands seems a good option.

Innovators Enable Beauty Companies’ Push into E-Commerce Expansion

The dramatic surge in online orders has prompted many brands and retailers to adopt beauty technology more quickly. Many technology innovators are emerging as a significant enabler to drive beauty retailers’ push into e-commerce expansion.

Sweden-based video streaming platform Bambuser continues to make progress with partners worldwide. At the beginning of the pandemic, the company partnered with Estée Lauder to host shoppable livestreaming sessions for the latter’s beauty brands on its US websites. Bambuser hosted Clinique’s first livestream on April 8 and since the spring, it has hosted similar shoppable livestreams for Estée Lauder, La Mer and Bobbi Brown. These livestreams feature influencers, celebrities, dermatologists and makeup artists.

Livestreaming increases revenue and loyalty. “Consumers who watch the livestreams spend between two and three times more time on the sites than average,” said Carolyn Dawkins, Clinique’s Senior Vice President of Consumer Engagement, Analytics and Online, in an interview with Glossy in June 2020. Estée Lauder’s Bobbi Brown, which hosted its first site livestream on May 2020 with the in-house brand’s artist Nikki DeRoest, witnessed a conversion rate of 5% and an average order value of $99 for those who watched the livestream, versus a general conversion rate of 2% and an $87 average order value.

Like Bambuser, Canada-based video platform Livescale has been offering shoppable livestreaming sessions for beauty brands in North America during the pandemic. Since late March, Livescale has hosted the first-ever shoppable livestreams for several L’Oréal Group brands, including Urban Decay’s US site, NYX Cosmetics, Kiehl’s and It Cosmetics.

[caption id="attachment_117958" align="aligncenter" width="350"] Shoppable livestreaming of a beauty product on the Livescale platform

Shoppable livestreaming of a beauty product on the Livescale platformSource: Livescale[/caption]

Since late March, California-based Perfect Corp., the developer of augmented reality (AR) app YouCam Makeup, has been offering beauty brands and retailers a free subscription to its browser plug-in YouCam for Web to help retailers integrate virtual makeup “try-ons” into their websites, letting shoppers sample makeup and hair colors virtually before they buy.

In May 2020, Perfect Corp. launched three new comprehensive AR and artificial intelligence (AI) beauty services in WeChat mini-programs to help beauty brands showcase their products on the messaging app, which has around 1.2 billion users worldwide. In May, the US-based beauty products manufacturer Benefit Cosmetics, a subsidiary of LVMH, partnered with Perfect Corp. to launch its first-ever real-time eyebrow virtual try-on program within the brand’s flagship WeChat official account.

Themes We Are Watching

Skincare Is Trending, but Demand for Makeup Weakens

In recent years, the skincare category has witnessed a shift of demand from older consumers to an increasing younger consumer base, mainly driven by the beauty wellness trend. Consumers are beginning to use skincare products at an increasingly young age to delay the signs of aging. The skincare category is also benefitting from growing demand for organic and natural products. In 2019, the global skincare market grew 8%, beating the overall global cosmetics market’s growth of 5%, according to L’Oréal.

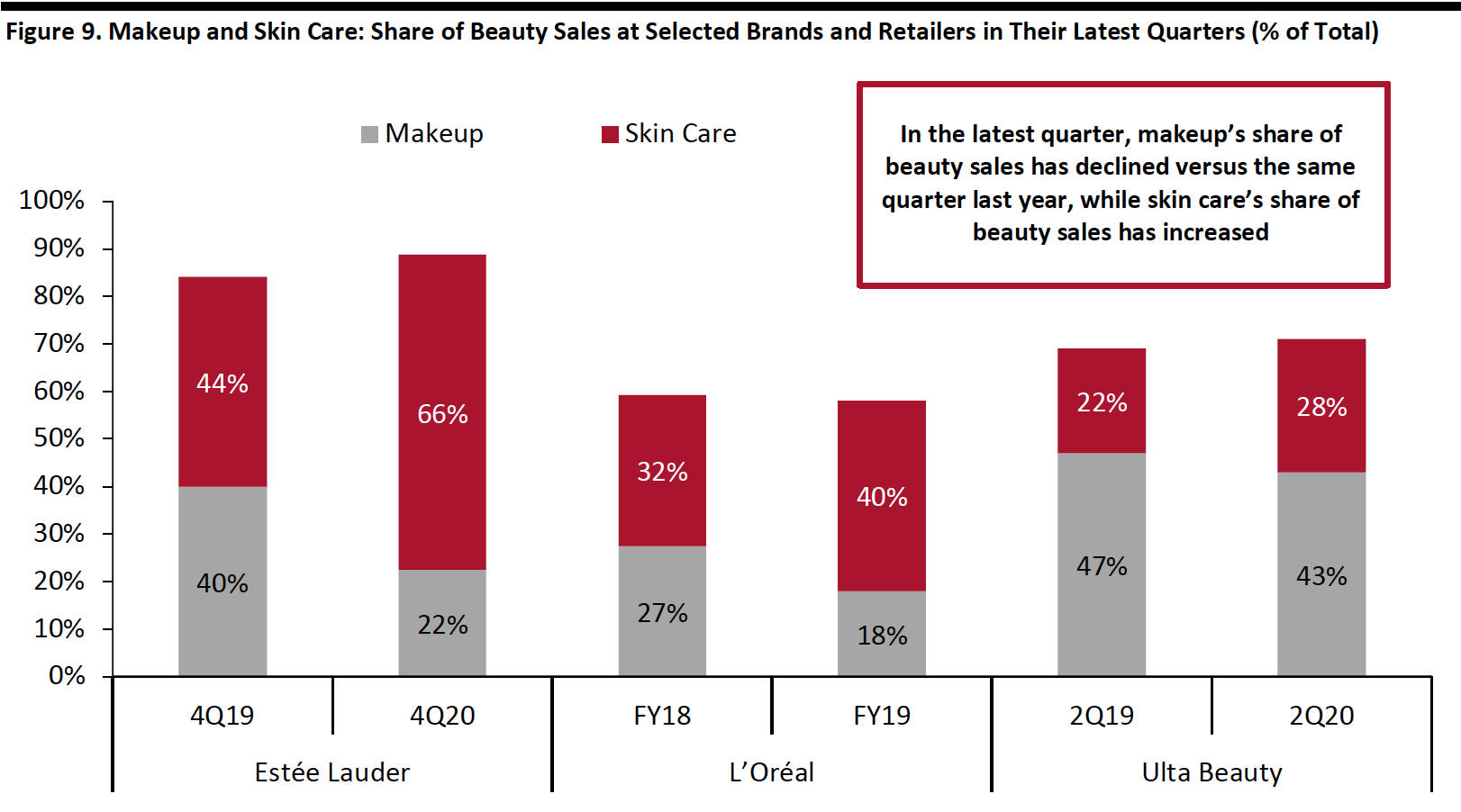

The Covid-19 crisis has further accelerated interest in skin care, mainly due to the rising self-care and pampering trends. Some of the leading beauty brands and retailers, such as Estée Lauder, L’Oréal and Ulta Beauty, noted a substantial increase in the skincare segment’s share of total beauty sales in their latest quarters versus prior-year levels (as shown in Figure 9). We expect these trends to continue through next year.

On the other hand, the importance of wearing makeup has lessened in recent years as more consumers are turning to a “no-makeup” look and are increasingly prioritizing beauty wellness. Furthermore, demand for makeup was sharply curtailed by Covid-19 due to the realities of masks, working from home, self-quarantines and social distancing requirements. US sales of prestige makeup fell 52% year over year in the second quarter of fiscal 2020, according to market research firm NPD. Estée Lauder, L’Oréal and Ulta Beauty witnessed a decline in the makeup share of total beauty sales in their latest quarters as compared to prior-year levels (see Figure 9).

[caption id="attachment_117959" align="aligncenter" width="700"] Ulta Beauty’s second quarter of fiscal 2020 ended on August 1, 2020; Estée Lauder’ fourth quarter of fiscal 2020 on June 30, 2020; L’Oréal’s first half of fiscal 2020 on June 30, 2020

Ulta Beauty’s second quarter of fiscal 2020 ended on August 1, 2020; Estée Lauder’ fourth quarter of fiscal 2020 on June 30, 2020; L’Oréal’s first half of fiscal 2020 on June 30, 2020Source: Company reports/Coresight Research[/caption]

Face Masks Fuel Opportunities for Eye Makeup

As consumers lean into the habit of wearing masks post Covid-19, the beauty market is seeing growing demand for micro-categories of cosmetics that can be seen while wearing masks, such as eyeshadow, mascara, eyeliner and concealer. In the three months ending June 28, 2020, global online sales of eye makeup surged 204% year over year versus 128% growth in the total cosmetics market, according to data insights and consulting company Kantar Group. We believe that the growth in the eye-makeup category is not only due to mask mandates but also due to the growing desire to look polished for meetings and video calls.

Post Covid-19, several beauty companies reported a solid sales growth in their eye-makeup and eye-grooming segments. For example, beauty platform MyBeautyBrand saw a 480% growth in sales of eye paint since lockdowns began in late March. Similarly, beauty-tools brand Tweezerman posted 331% sales growth in eyelash curlers since the pandemic began, as cited by The Telegraph in July 2020.

In addition to eye-makeup tools, demand is also growing for eye-focused cosmetology services, such as eyelash extensions and permanent color tinting for eyebrows. For example, Amazing Lash Studios, an eyelash-extension service provider with over 250 boutiques in the US, posted 22% growth in digital client leads since March, as cited by Fortune in August 2020.

Beauty giant L’Oréal is also looking to expand its eye-makeup category. In the company’s conference call for its first-half-of-fiscal-2020 earnings, held in July 2020, CEO Jean-Paul Agon said, “When you can’t see the lips, eyes are super important, and so we want to develop very strongly the makeup for eye or foundation or stay-on foundations, and there will be opportunities.”

[caption id="attachment_117960" align="aligncenter" width="550"] Mask-friendly eye-makeup tutorial by beauty blogger and influencer Ankita Chaturvedi, known as “Corallista”

Mask-friendly eye-makeup tutorial by beauty blogger and influencer Ankita Chaturvedi, known as “Corallista”Source: L’Oréal/YouTube[/caption]

Touchless Retail for the Contactless In-Store Shopping Experience

Consumers’ in-store shopping preferences are evolving. Where shops have reopened, most shoppers no longer want to touch or try on products that others have already touched. They are also increasingly reluctant to interact with sales associates to try cosmetics or fragrances. Beauty stores across the globe are adding everything from automatic doors to touchless checkout to minimize physical contact.

To encourage beauty shoppers to try/test beauty products, Hong Kong-based global beauty company Meiyume, a unit of Li & Fung, is offering touchless sampling testers for skincare products and fragrances. The new device, powered by battery packs or AC power, is motion-activated and uses existing off-the-shelf products—there is no need to design new tester packaging or change the existing supply chain.

We believe more beauty brands and retailers should adopt touchless technologies to provide an enhanced but contact-light in-store shopping experience.

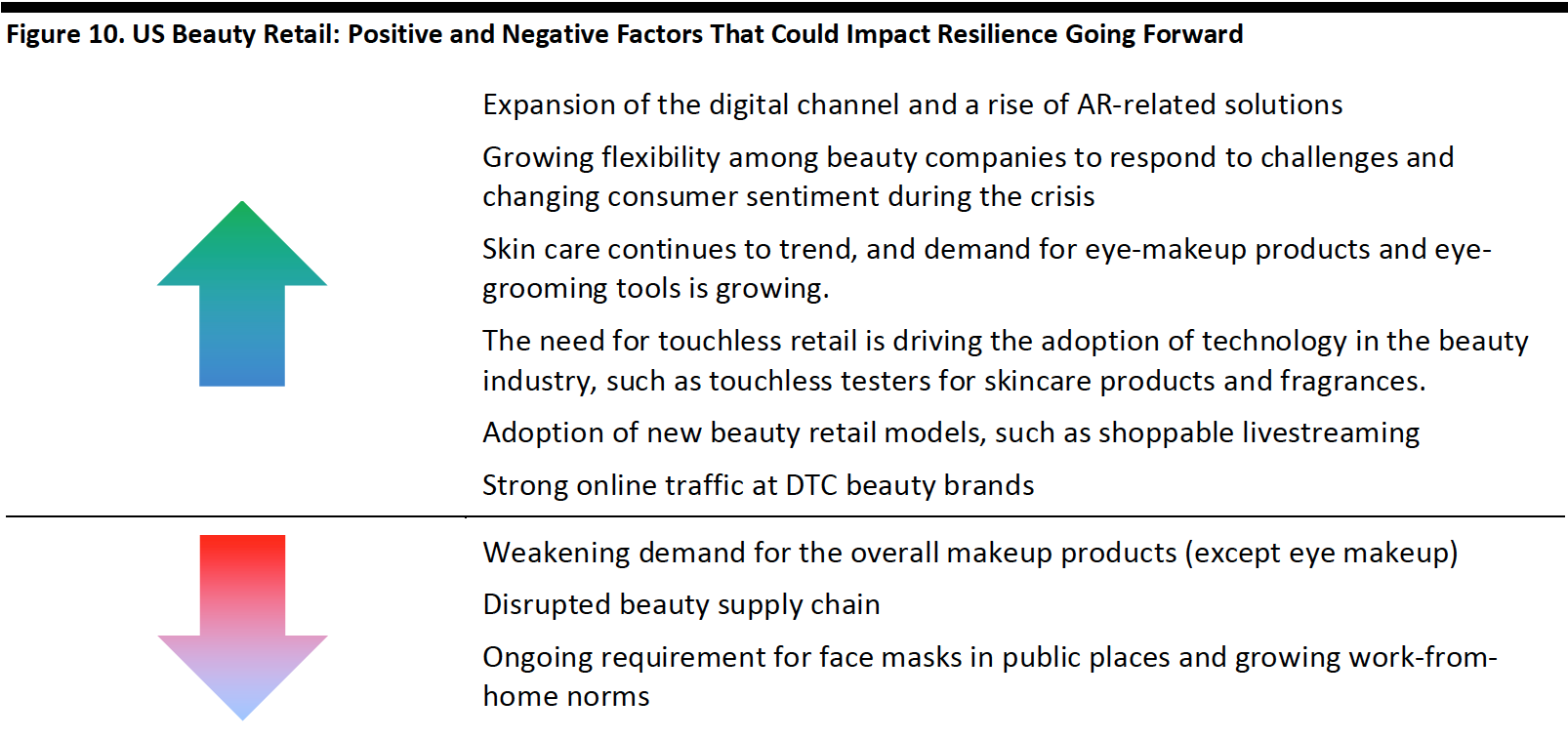

Factors Impacting the Beauty Sector’s Resilience

As we have seen the crisis unfold, the issues of resilience, or lack thereof, have come to the fore within the beauty retail space. Below, we list some of the key factors that could impact the resilience of the beauty sector going forward.

[caption id="attachment_117961" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Looking Forward

Although the Covid-19 pandemic has substantially impacted sales in the US beauty market, the industry appears to be one of the few to experience a rapid rebound—emphasizing its resilience. We expect core beauty spending to return to growth in 2021, while the specialist store-focused retail sector will be annualizing a very weak 2021. However, some crisis-induced shopping behaviors may be retained, and we do not expect sector growth to return to pre-crisis levels, in dollar terms, in 2021.

While the role of e-commerce is growing drastically, in-store sales are also rebounding substantially. Beauty spending declines substantially eased during the May-to-July period as stores reopened and restrictions eased. Some retailers remain optimistic about their existing stores reopening as well as new store opening plans. Ulta Beauty believes that it can ultimately operate 1,500–1,700 stores in the US. Sephora plans to open 40 new stores this year and plans to open more stores in 2021 and thereafter.

Going forward, we will see more beauty brands and retailers adopting new retail models, such as livestreaming, to enhance shoppers’ engagement. To ensure a engaging online interactions with beauty consumers, beauty technologies such as AI, AR and 3D printing may be increasingly adopted by brands and retailers.

Within the beauty market, we believe that the skincare category will continue to grow in the coming years. Makeup will be hit the hardest in 2020, and its recovery will be hampered by greater working from home and requirements to wear masks in public. However, certain subcategories of makeup, such as eyeshadows and eyeliners, will continue to gain momentum.