DIpil Das

Introduction

In this Market Outlook, we discuss the US apparel and footwear market in a pandemic-impacted retail environment. We provide our market sizing estimates for 2022 and beyond, and we consider the primary trends that will impact demand. This report also explores e-commerce penetration, the competitive landscape, key themes and US retail innovators.Market Performance and Outlook

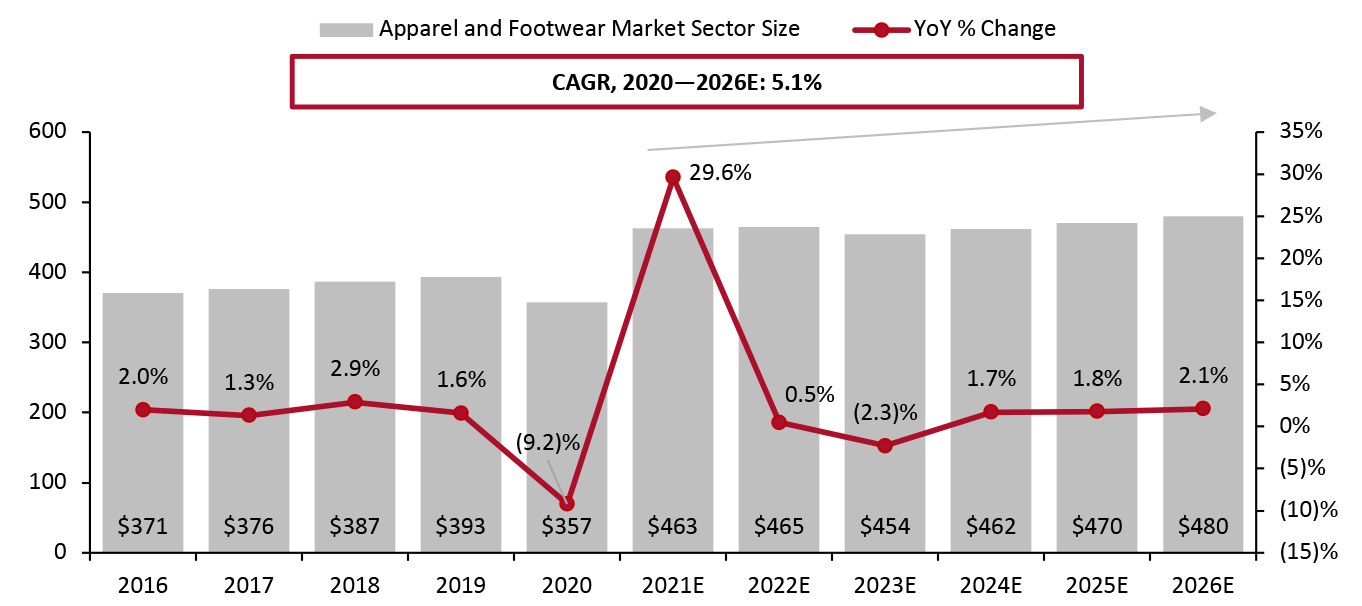

The US Apparel and Footwear Market Overview Our coverage of the apparel and footwear market includes women’s, men’s, children’s and infants’ apparel and footwear. In our definition of the market, we exclude military clothing and clothing materials. We estimate that the US apparel and footwear market will grow 0.5% in 2022, reaching $465 billion. As the health crisis appears to moderate and consumers resume more normal activities, from travel to working in the office, we believe some momentum in consumer spending growth on apparel and footwear will continue in 2022—however, the market will be annualizing very strong growth from 2021. US consumer spending on apparel and footwear totaled $463 billion in 2021—up 29.6% year over year and to 17.7 above the pre-crisis level, according to the Bureau of Economic Analysis (BEA). This growth was primarily driven by the rollout of vaccinations and consumers’ return to more normal living. We expect the market to see a low-single-digit percentage decline in 2023 as consumers will have already updated their wardrobes in 2021 and 2022, plus pent-up demand and the effect of stimulus checks will have faded. We estimate that the market will fully normalize in 2024 and return to low-single-digit percentage annual growth rates, similar to those seen before the crisis.Figure 1. US Apparel and Footwear Market Sector Size (Left Axis; USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_144952" align="aligncenter" width="700"]

Note: US data representing consumer spending (including sales taxes)

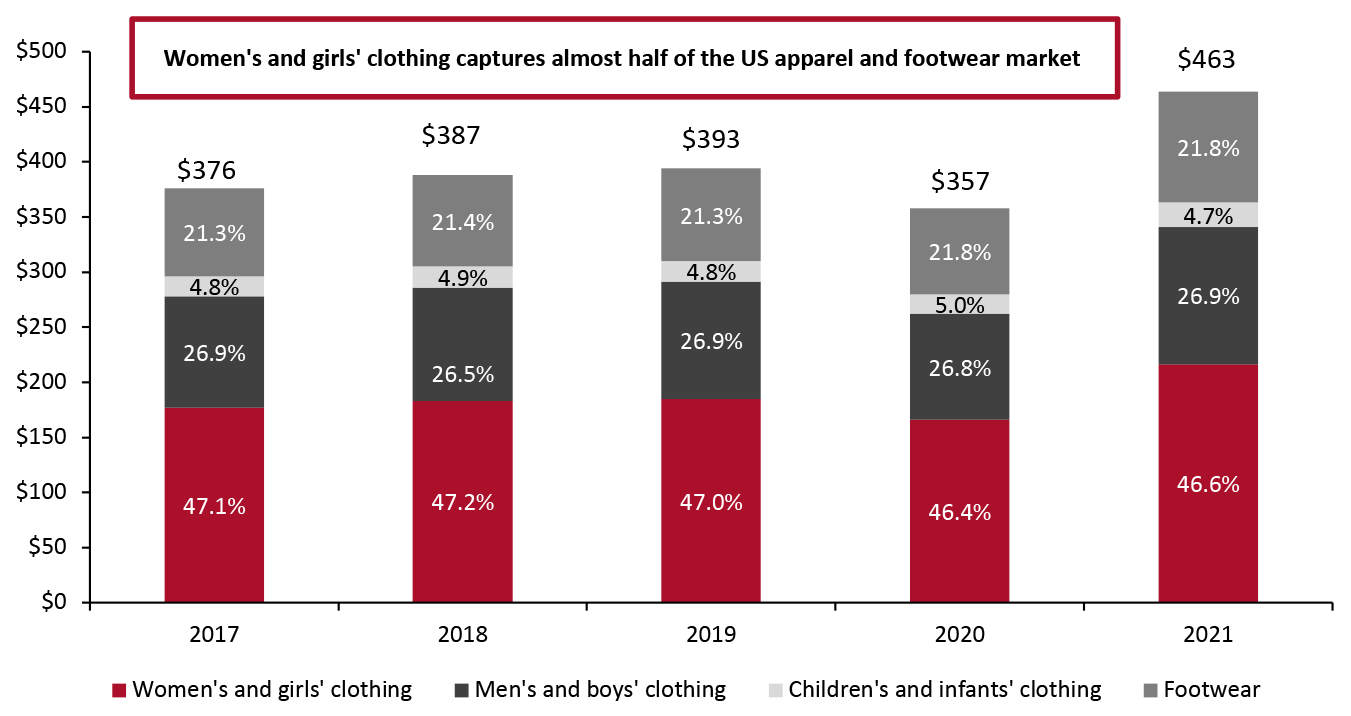

Note: US data representing consumer spending (including sales taxes) Source: Bureau of Economic Analysis/Coresight Research [/caption] By category, women’s and girls’ clothing captures the largest share of the US apparel and footwear market. The category share of each category in Figure 2 within total market sales was fairly stable from 2017 to 2021 and we expect this stability to continue over the next five years.

Figure 2. US Apparel and Footwear Sales by Category (USD Bil.) [caption id="attachment_144953" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

Source: Bureau of Economic Analysis[/caption]

Market Factors

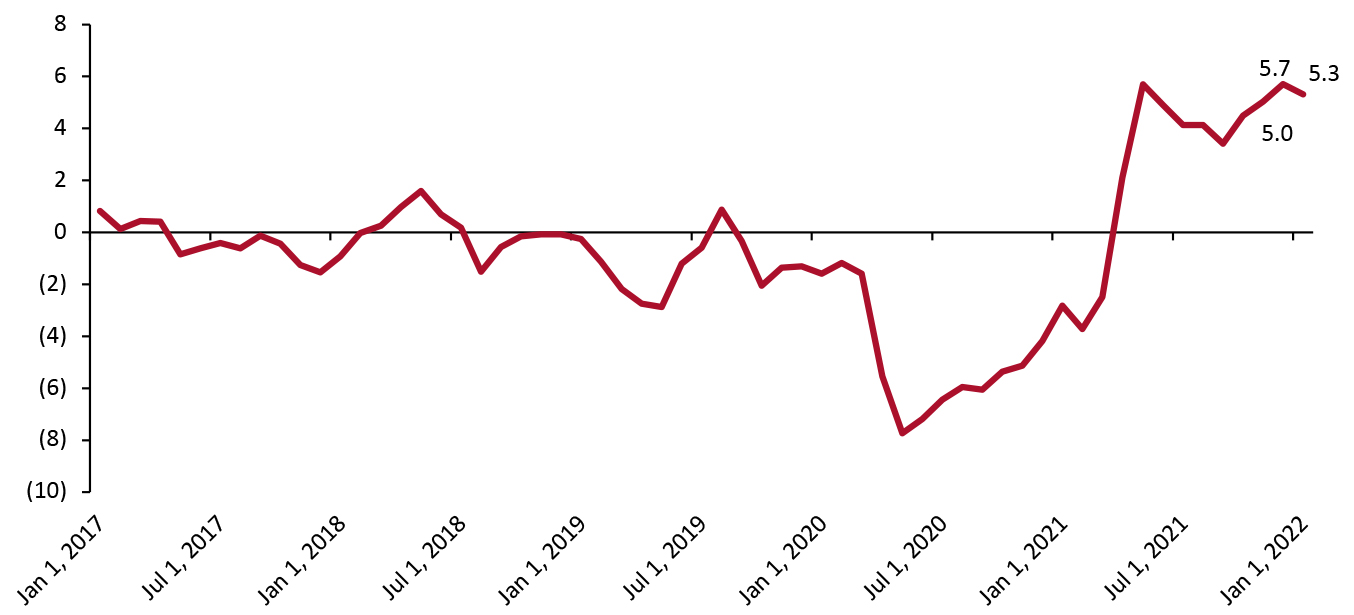

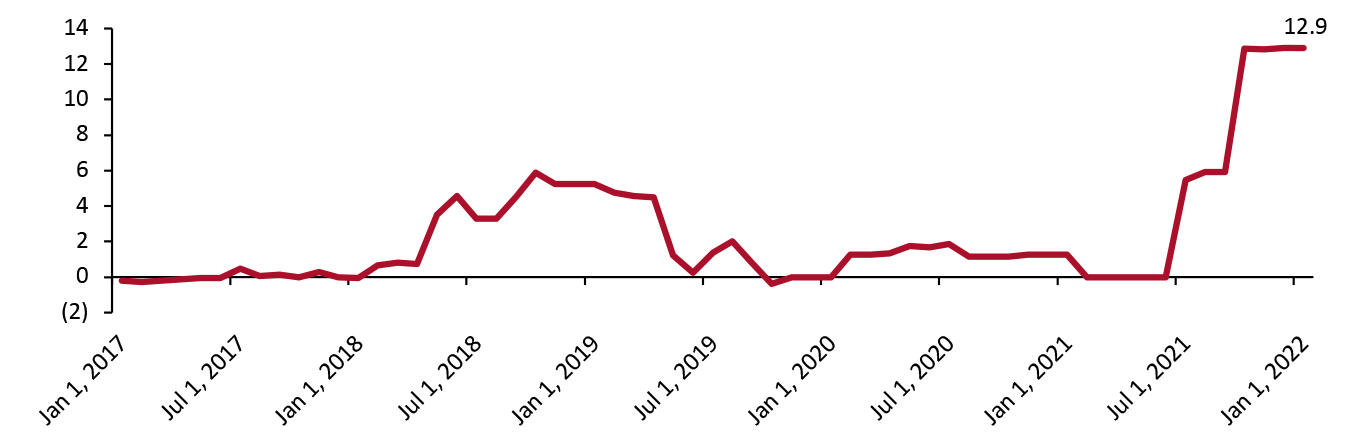

Vaccinations and Consumers’ Return to More Normal Living Habits The US rolled out Covid-19 vaccines in early 2021 and booster doses were released in September 2021. Continued vaccine deliveries in 2022 will offer a path out of the pandemic, allowing more consumers to have normalized living habits and need to update their wardrobes. Continued Demand for Casual Apparel Silhouettes Consumer preference for causal styles, including for both workplaces (pre-pandemic and in the future) and at home, is transforming the global apparel and footwear market. The trend has likely been further accelerated by Covid-19, as consumers have become increasingly accustomed to wearing what they like while working from home in 2020 and 2021. Expectations are growing for greater comfort in apparel. We anticipate a sustained casualization trend over the next three years, with consumers opting to wear casual apparel and footwear while working more at home and workplaces increasingly relaxing dress codes. Categories such as athleisure, fleece and T-shirts will see continued growth in 2022 and drive the apparel market. We predict that US athleisure sales will grow 7.0% in 2022 to reach $142.7 billion, representing almost one-third of the total US apparel and footwear market. Rise of the Fashion Resale Market Consumer emphasis on the importance of sustainability will drive the growing fashion resale market. More consumers will consider buying secondhand clothes, bags and accessories to avoid resource waste and extend the lifecycles of fashion products. We expect increasing consumer interest in the secondhand fashion market will drive the overall apparel and footwear market. The sneaker trend is one of the most visible manifestations of the success of secondhand fashion. We have seen a proliferation of sneakers sold at normal prices by brands such as NIKE, Adidas and LV that are then valued much higher on resale platforms such as StockX. We expect the sneaker mania to continue as another driver of the overall apparel and footwear market. Inflation We see inflation as an important driver of the US apparel and footwear market. The US inflation rate in the apparel and footwear sector rose by 5.3% in January 2022 compared to the same month in 2021, according to the Bureau of Labor Statistics. Raised prices will support the size of the apparel and footwear market in 2022.Figure 3. YoY Changes in Consumer Price Index in Apparel and Footwear for All Urban Consumers (%, Seasonally Adjusted) [caption id="attachment_144954" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

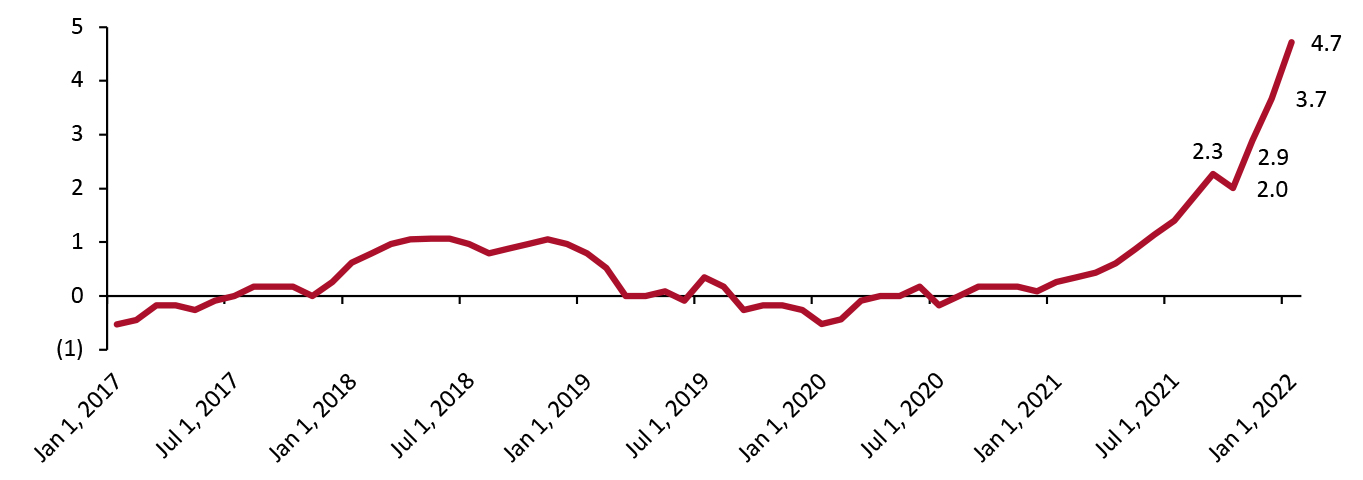

We are also seeing price increases in imported textile and textile articles, which are drivers of the US apparel and footwear market size. The import price index of textiles and textile articles rose 4.7% in January 2022 over the same month in 2020, the highest increase since 2012, according to the Bureau of Labor Statistics.

Source: US Bureau of Labor Statistics[/caption]

We are also seeing price increases in imported textile and textile articles, which are drivers of the US apparel and footwear market size. The import price index of textiles and textile articles rose 4.7% in January 2022 over the same month in 2020, the highest increase since 2012, according to the Bureau of Labor Statistics.

Figure 4. YoY Changes in Import Price Index by Commodity: Textile and Textile Articles (%, Not Seasonally Adjusted) [caption id="attachment_144955" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

From a domestic producer’s perspective, we are seeing price increases in materials such as finished cotton broad woven fabrics and finished manmade, silk and other natural fibers, which are also drivers of the US apparel and footwear market size. The price index of the finished cotton broad woven fabrics rose 12.9% in January 2022 over the same month in 2020, the highest increase since 2012, according to the Bureau of Labor Statistics.

Source: US Bureau of Labor Statistics[/caption]

From a domestic producer’s perspective, we are seeing price increases in materials such as finished cotton broad woven fabrics and finished manmade, silk and other natural fibers, which are also drivers of the US apparel and footwear market size. The price index of the finished cotton broad woven fabrics rose 12.9% in January 2022 over the same month in 2020, the highest increase since 2012, according to the Bureau of Labor Statistics.

Figure 5. YoY Changes in Producer Price Index by Commodity: Textile Products and Apparel: Finished Cotton Broad Woven Fabrics (%, Not Seasonally Adjusted) [caption id="attachment_144956" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

Online Market

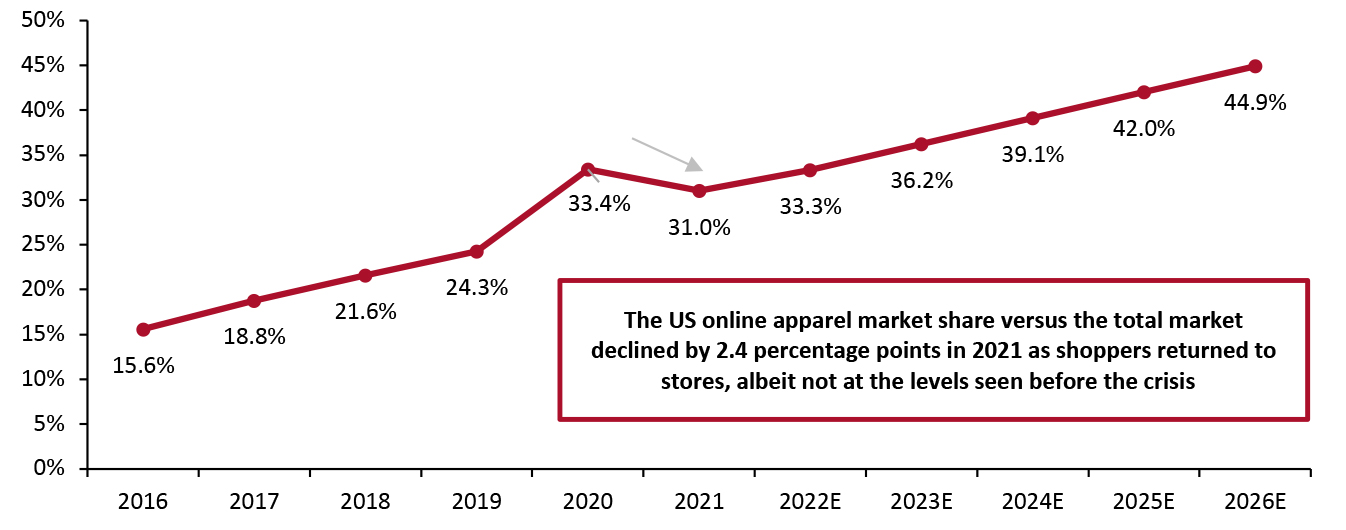

We expect US online apparel and footwear sales to grow 8% in 2022, reaching $154.8 billion and capturing 33.3% of the total US apparel and footwear market. The penetration rate of e-commerce in the US apparel and footwear market will increase to 36.2% in 2023, according to our estimates, driven by consumers’ continuing online shopping habits and retailers’ greater capacities on the digital supply side. Coresight Research estimates that the US online apparel market grew to account for 31.0% of the country’s total apparel and footwear sales in 2021, versus just over one-fifth in 2018.Figure 6. US Apparel and Footwear Online Sector Sales as % of Total Sales [caption id="attachment_144957" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis/Coresight Research[/caption]

Source: Bureau of Economic Analysis/Coresight Research[/caption]

Competitive Landscape

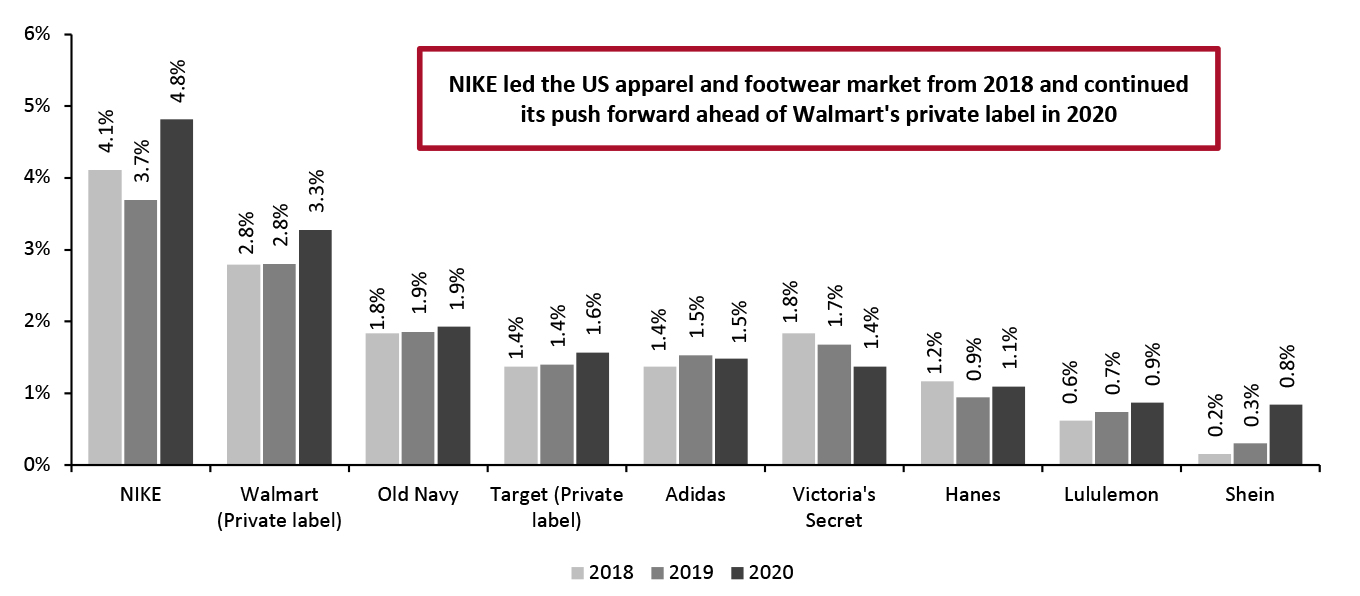

A Fragmented Market by Brand The US apparel and footwear industry is fragmented, with the top five apparel brands accounting for around 13% of US apparel and footwear sales in 2020, according to Coresight Research estimates. NIKE, which sells in 170 countries worldwide, holds just 4.8% of the US apparel and footwear market, followed by Walmart private-label sales totaling 3.3%. By looking at the three-year market share growth of the top apparel and footwear brands, we find that the athleticwear and casualwear categories are the biggest winners. NIKE, Old Navy, Adidas, Hanes and Lululemon went from a combined market share of the total US apparel and footwear market of 9.1% in 2018 to 10.2% in 2020. Private labels from some major retailers continue to gain shares in the market. Walmart’s private labels and Target’s private labels have seen gains over the past three years, from a combined market share of 4.2% in 2018 to 4.8% in 2020.Figure 7. Major Apparel and Footwear Brands’ US Revenues (USD Bil.) [wpdatatable id=1871 table_view=regular]

Notes: NIKE’s and Adidas’s apparel sales represent apparel sales from North America; Victoria’s Secret apparel sales include sales from personal care and beauty Walmart (private label) and Target (private label) sales are sourced from Euromonitor Source: Company reports/Euromonitor International Limited 2022 © All rights reserved/Coresight Research

Figure 8. US Major Apparel and Footwear Sector Brands’ Share of Total Sales (%) [caption id="attachment_144974" align="aligncenter" width="700"]

Source: Company reports/Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Amazon, Walmart and TJX Are the Top Three Retailers

By retailer, the US apparel and footwear industry is relatively concentrated, with the top 10 apparel and footwear retailers accounting for 45.7% of the US apparel and footwear sales in 2020, according to Coresight Research estimates. Amazon holds 10.7% of the US apparel and footwear market, followed by Walmart (7.6%) and TJX (4.3%).

Source: Company reports/Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Amazon, Walmart and TJX Are the Top Three Retailers

By retailer, the US apparel and footwear industry is relatively concentrated, with the top 10 apparel and footwear retailers accounting for 45.7% of the US apparel and footwear sales in 2020, according to Coresight Research estimates. Amazon holds 10.7% of the US apparel and footwear market, followed by Walmart (7.6%) and TJX (4.3%).

Figure 9. Major Apparel and Footwear Retailers’ US Category Revenues (USD Bil.) [wpdatatable id=1874]

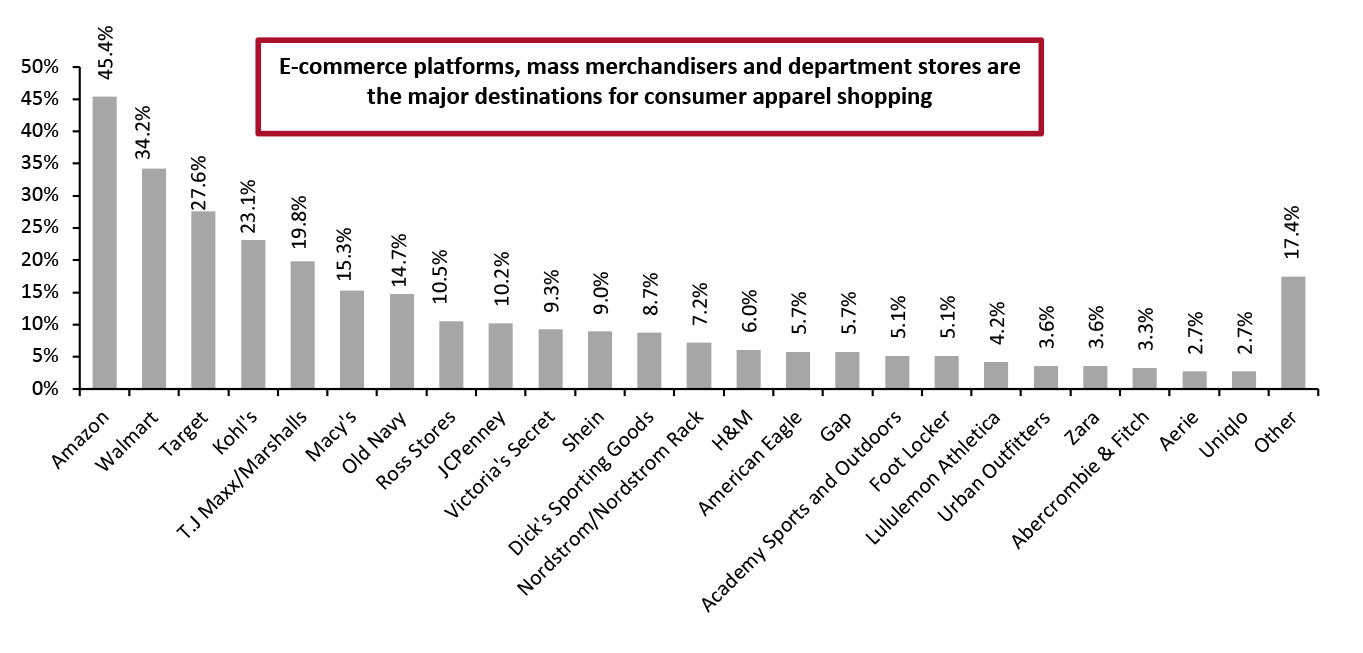

Notes: Walmart’s apparel sales include jewelry and are under Walmart banner only, excluding Sam’s Club; TJX’s apparel sales include jewelry and accessories; Target’s apparel sales include jewelry and accessories; Macy’s apparel sales include sales from Bloomingdale’s and include sales from cosmetics and fragrances; Costco’s apparel sales include all softline sales; Ross’s apparel sales include jewelry and fragrances Source: Company reports/Coresight Research Where Consumers Are Shopping and What They Are Buying Amazon, Walmart and Target are the top three retailers US shoppers bought clothing or apparel accessories from in the past three months ended February 7, 2022, according to Coresight Research survey data. Our findings indicate that compared to specialty retailers such as Dick’s Sporting Goods and American Eagle Outfitters, e-commerce platforms, mass merchandisers and department stores are major destinations for apparel shopping—mainly due to larger product assortments, more convenient services such as buy online, pick up in-store (BOPIS), fast delivery and easy inventory requests, according to our analysis.

Figure 10. Respondents Who Purchased Clothing or Apparel Accessories in the Past Three Months: Retailers That Consumers Purchased from (%), February 2022 [caption id="attachment_144975" align="aligncenter" width="700"]

Base: 332 US Internet users aged 18+ that purchased clothing or apparel accessories in the past three months ended February 7, 2022

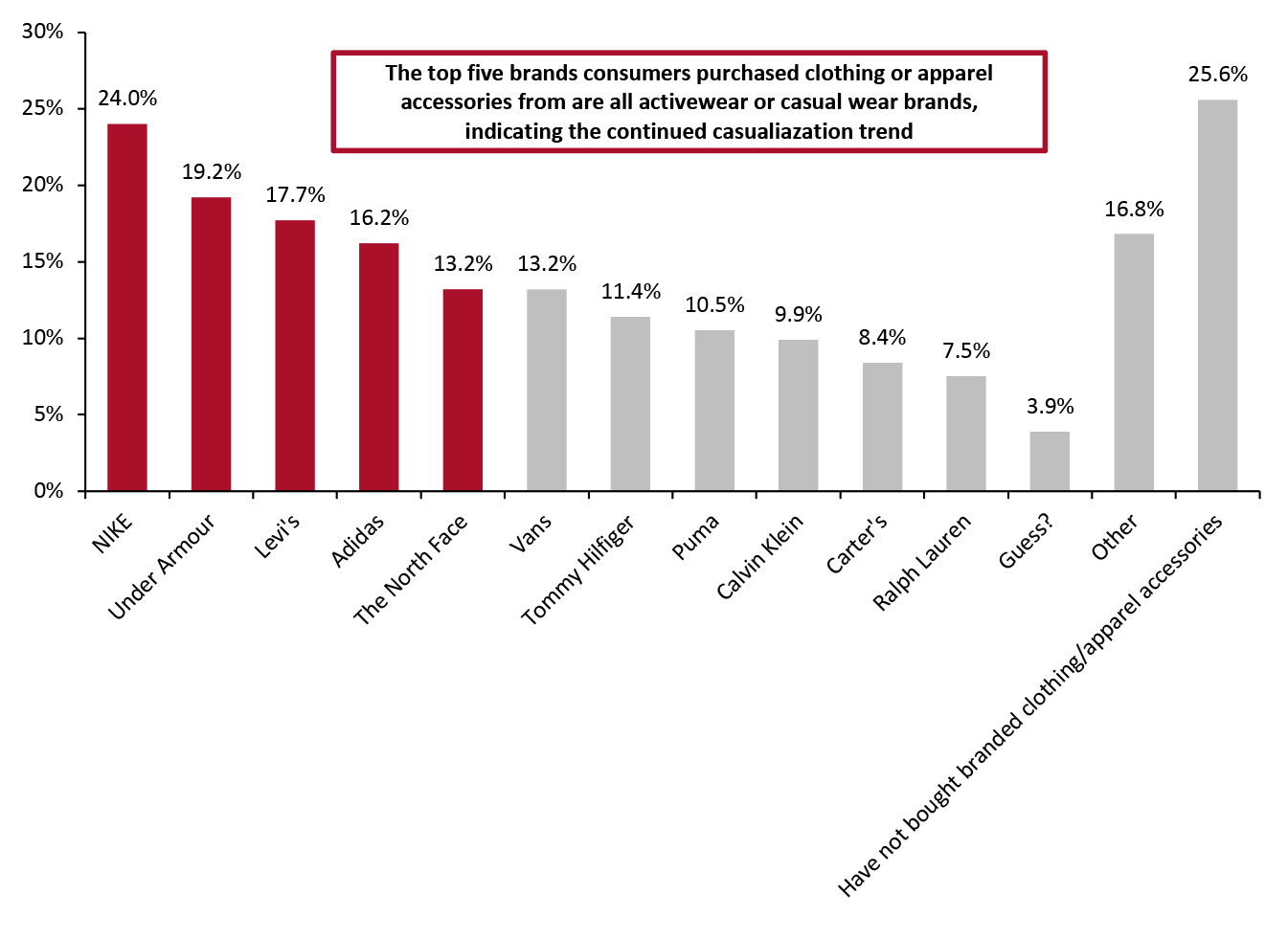

Base: 332 US Internet users aged 18+ that purchased clothing or apparel accessories in the past three months ended February 7, 2022 Source: Coresight Research [/caption] By brand, NIKE, Under Armour and Levi’s are the top three brands that US shoppers bought clothing or apparel accessories from in the three months, ended February 7, 2022, followed by Adidas, The North Face, and Vans, according to our survey. The results fully demonstrate the continued casualization trend in apparel shopping, with categories such as activewear, denim and casual apparel winning consumers. We also found that a significant portion (25.6%) of consumers had not bought branded clothing or apparel accessories.

Figure 11. Respondents Who Purchased Clothing or Apparel Accessories in The Past Three Months: Brands That Consumers Purchased from (%) February 2022 [caption id="attachment_144976" align="aligncenter" width="700"]

Base: 332 US Internet users aged 18+ that purchased clothing or apparel accessories in the past three months ended February 7, 2022

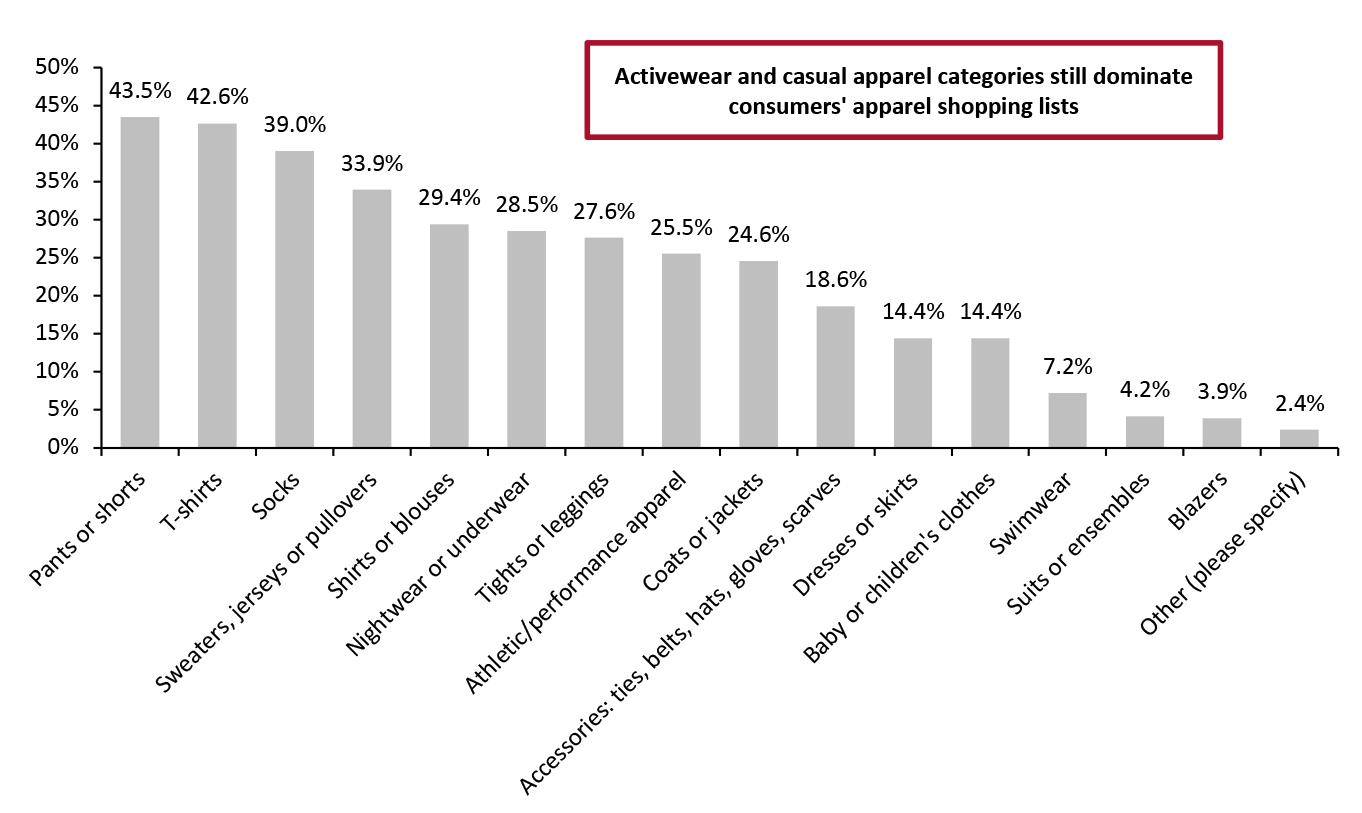

Base: 332 US Internet users aged 18+ that purchased clothing or apparel accessories in the past three months ended February 7, 2022 Source: Coresight Research [/caption] By categories, pants or shorts, T-shirts and socks are the top three clothing or apparel accessories categories US shoppers bought from in the past three months ended February 7, 2022, according to our survey. Suits or ensembles and blazers are on the bottom of the list, indicating the cold market for dress wear categories, reinforcing our insights on the continued casualization trend.

Figure 12. Respondents Who Purchased Clothing or Apparel Accessories in the Past Three Months: Categories That Consumers Purchased (%) February 2022 [caption id="attachment_144977" align="aligncenter" width="700"]

Base: 332 US Internet users aged 18+ that purchased clothing or apparel accessories in the past three months ended February 7, 2022

Base: 332 US Internet users aged 18+ that purchased clothing or apparel accessories in the past three months ended February 7, 2022 Source: Coresight Research [/caption]

Themes We Are Watching

Factors Impacting Gross Margins: Pricing Strategy, Product Mix and Freight Costs We are closely tracking the factors that impact the gross margins of apparel brands and retailers in order to examine the impacts on companies’ business performances. Based on the operating results reported by apparel brands and retailers in the most recent quarter, we identify appropriate pricing strategies, better product or channel mix, and the focus on direct-to-consumer (DTC) businesses as positive drivers of gross margins and increasing freight costs as the negative driver of gross margins. We are seeing the majority of apparel brands and retailers using full-price strategies and adjusting product mix to combat inflation and rising freight costs.Figure 13. Gross Margin Metrics of Selected Apparel and Footwear Brands and Retailers [wpdatatable id=1873 table_view=regular]

Source: Company reports Supply Chain Agility Improvements Slower production speeds and delayed inventory transitions between manufacturers and distribution centers presented increasing challenges during the Covid-19 pandemic. As the world gradually returns to prepandemic ways of living, working and spending, we expect both US-based and global apparel brands and retailers to look for modern technologies and alternative strategies to improve the efficiency, agility and resiliency of the supply chain. We present three primary strategies that we expect apparel brands and retailers to implement in 2022.

- Re-examining sourcing mixes: Several major apparel retailers, including Guess? and Levi’s, have reduced their sourcing or manufacturing exposure to China in 2020 and 2021. Levi’s is using a globally diversified sourcing strategy to help it deal with supply chain disruptions. The company reduced its sourcing exposure to China from mid-teens in 2015 to 8% in 2019 and then to 1% in 2021. It increased sourcing from countries such as Vietnam, according to the company. The company sources from 24 countries around the world as of October 12, 2021. Guess? is trying to source closer to its distribution points. For example, for European business, the company increased sourcing from places such as Tunisia and Turkey in 2021. For American business, the company increased sourcing from Guatemala and Mexico in 2021. We expect to see more onshoring or nearshoring of apparel production to build a more flexible supply chain.

- Investing in innovative technology: For example, NIKE added more than 1,000 robots in its distribution centers in December 2021 to improve the efficiency of product allocation and order processing. In the digital distribution center in Memphis, US, robots can handle more than 10 million units that would have otherwise required manual labor, according to the company. Gap Inc. is also accelerating its implementation of warehouse robots for order processing. Supplied by artificial intelligence and robotics company Kindred, Gap’s robotic technology system, known as SORT, uses industrial robotic arms to pick merchandise. Warehouse robotics technology is becoming increasingly popular as retailers take steps to streamline operations and reduce costs. In 2022, we believe apparel brands and retailers will increasingly look for automation technologies and solutions that will help to support their supply chain efficiency.

- Upgrading fulfillment models: UK retailer ASOS is upgrading its fulfillment model in the US to enable its global warehouse network to fulfill any order from any warehouse. The new model will allow US orders to be fulfilled from the US (Atlanta), the UK or Germany, depending on where items are in stock, which will increase the inventory turnover rate, prevent delayed shipments and better meet consumer demand.

- In December 2021, Ralph Lauren partnered with Roblox, another metaverse creation platform, to debut a holiday-themed experience allowing consumers to explore products and socialize with others.

- In the same month, Forever 21 entered the metaverse with a Roblox store.

- NIKE released Nikeland on Roblox in November 2021.

- In August 2021, Ralph Lauren partnered with ZEPETO, a metaverse platform, to create a virtual world that allows consumers to view apparel products digitally and create 3D avatars.

Ralph Lauren’s metaverse allows customers to participate in activities such as ice skating while wearing Ralph Lauren apparel

Ralph Lauren’s metaverse allows customers to participate in activities such as ice skating while wearing Ralph Lauren apparel Source: Ralph Lauren [/caption] Sustainability Developments In 2022, we expect apparel and footwear to continue to trend toward sustainability. A Coresight Research survey of US consumers conducted on August 26, 2020, found that a substantial 29.0% of respondents believed that the Covid-19 pandemic has made sustainability more of a factor when shopping. We are seeing the rise of sustainable apparel and footwear, led by brands including Levi’s, NIKE and Wrangler, as well as digitally native brands such as Allbirds. We have seen recent notable examples of sustainability developments in the apparel and footwear sector.

- Levi’s launched its iconic 501 jeans with new sustainable materials (crafted from organic cotton and post-consumer recycled denim) in January 2022.

- NIKE launched new sustainable footwear shoes named “The Nike Air Zoom Alphafly Next Nature” in September 2021. The shoes have at least 50% total recycled content by weight.

- Denim brand Wrangler and sustainable footwear company Twisted X launched their first shoe collaborative collection with a focus on sustainability in December 2021. The collection features many sustainable elements, including uppers and shoe linings made from upcycled plastic water bottles. Midsoles are made from sugarcane molasses and outsoles are made with rice husk, an agricultural byproduct, and footbeds are made with 85% upcycled production waste.

The second Public Lands store of Dick’s Sporting Goods

The second Public Lands store of Dick’s Sporting Goods Source: Dick’s Sporting Goods [/caption] In January 2022, Amazon announced plans to open its first Amazon Style store in Los Angeles by late 2022. Shoppers will need to rely heavily on their smartphones in order to browse the apparel items because there will be only one size and color of a particular product in the front of the store (the remaining inventory will be kept in the back of the store). Consumers will need to scan a QR code to view additional sizes, colors, product ratings and other information, such as personalized recommendations for similar items. After scanning the code, shoppers can also choose to add the item to a fitting room or send it to a pick-up counter. In the fitting rooms, Amazon will add touchscreen displays, which shoppers can use to rate items or request different styles or sizes to be delivered to their fitting rooms. [caption id="attachment_144964" align="aligncenter" width="700"]

Amazon’s first Amazon Style store will feature touch screens in fitting rooms

Amazon’s first Amazon Style store will feature touch screens in fitting rooms Source: Amazon [/caption] Alternative Selling Models Apparel brands and retailers are increasingly looking to adjust their strategies to effectively cater to consumer demand and maintain competitive positioning in the evolving retail landscape. In 2022, we expect more brands and retailers to turn to the following alternative models in retail.

- Resale: Driven by increasing consumer awareness of sustainability, the US fashion resale marketis growing. The US fashion resale market evolved from a single-billion-dollar market in 2008 to a $22.3 billion market in 2021, according to Coresight Research. We expect the market to continue its growth momentum in 2022 and 2023, with an expected growth of 16.0% and 15.0%, respectively. This further implies that fashion resale will capture a 4.7% share of the total US fashion market in 2022 and 5.6% in 2023. More apparel brands and retailers will enter the fashion resale market in 2022, either working with third-party marketplaces such as thredUP or launching their own resale programs or marketplaces.

- Launching marketplaces: We are seeing the rise of the marketplace model because brands and retailers want to grow assortments with third-party sellers. For example, Forever 21 is testing a strategy that involves selling other brands’ products on its e-commerce site. This approach will begin in the first quarter of 2022, according to the company. Stadium Goods and Express have already moved toward marketplace models. Saks Fifth Avenue is also testing the marketplace model to accelerate growth and expand its offerings to customers. Currently, it is still operating under a traditional wholesale model.

- Focusing on the DTC channel: Impacted by the pandemic, many apparel brands and retailers—including Kontoor Brands, Levi’s and Under Armour—saw margins through wholesale channels (such as department stores and specialty stores) drop, while margins for DTC sales (a brand’s own websites and stores) achieved gains. Brands and retailers are therefore adjusting their channel mix to skew more toward DTC business, and we expect this shift to continue in 2022 as more apparel brands and retailers reduce their exposure to wholesale.

Retail Innovators

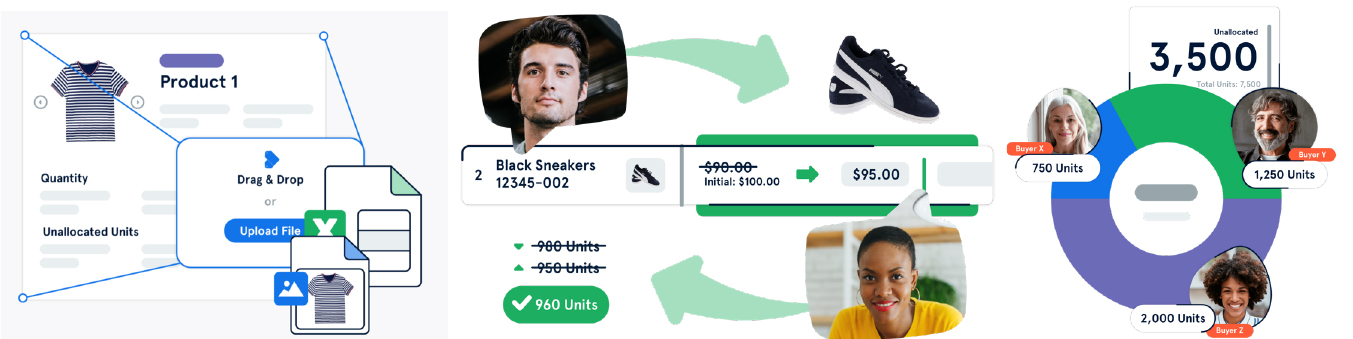

INTURN Founded in 2013 and headquartered in the Greater New York Area, INTURN is an innovator that provides brands and retailers solutions to identify and proactively address inventory that will soon become slow-moving or excess, enabling them to reduce potential waste earlier in the product lifecycle. Its INTURN 360 solution is a software solution for brands and retailers to manage slow-moving or excess inventory, streamline workflows, optimize supply chain, reduce inefficiencies and improve margins. The platform consolidates complex inventory files and large data sets, giving brands and retailers full visibility of their inventory status in real-time. Also, the platform helps brands and retailers streamline the product pricing process, individually or in bulk. As of February 2022, the company has raised $67 million. Apparel brands and retailers are facing potential inventory accumulation problems, presenting opportunities for INTURN to solve relevant pain points. Some notable companies with these inventory problems include Levi’s, Columbia Sportswear and Skechers. Levi’s reported that its total inventories increased 10% in 2021 compared to the end of 2020; Columbia Sportswear reported that its inventories increased by 16% year-over-year in 2021; Skechers reported that its inventory increased by 44.7% year-over-year in 2021. INTURN helps apparel brands and retailers to better understand their inventories, reduce manual work processes and see content-rich product information, and integrate analytics into the brand-retailer negotiation process. [caption id="attachment_144965" align="aligncenter" width="700"] From left to right: INTURN’s function that allows users to upload and manage inventories, price products and improve the go-to-market strategies

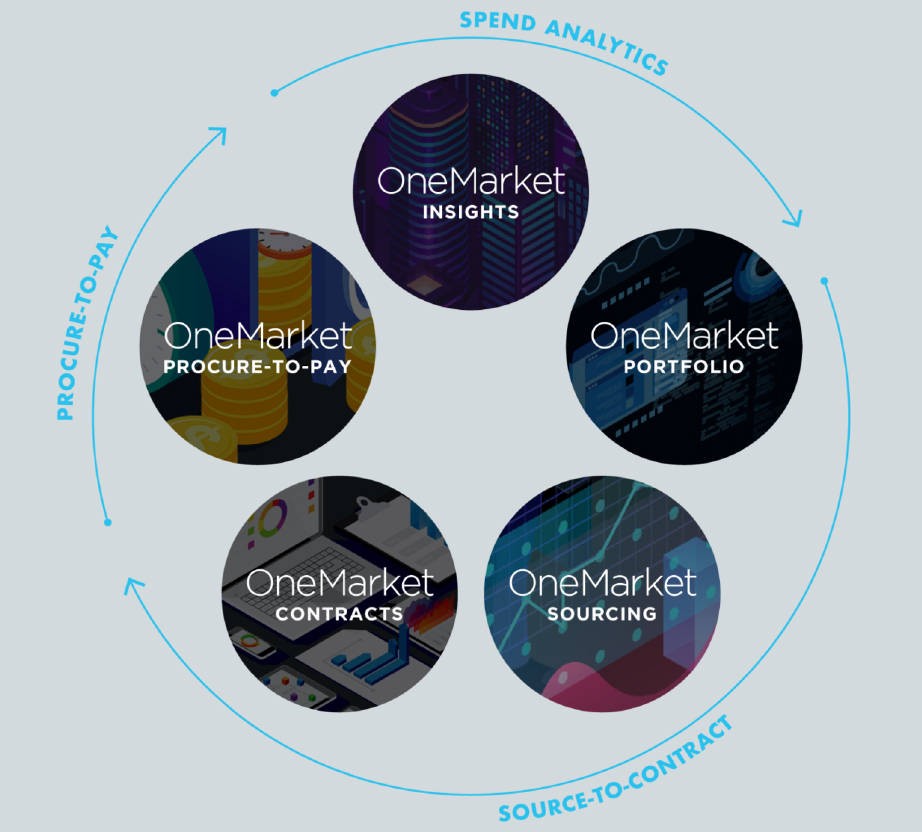

From left to right: INTURN’s function that allows users to upload and manage inventories, price products and improve the go-to-market strategies Source: INTURN [/caption] LogicSource Founded in 2009 and headquartered in New England in the Northeastern US, LogicSource is a procurement services and technology provider focused exclusively on indirect, or not-for-resale, expenditures. The company helps brands and retailers drive cost reductions in areas including marketing, packaging, information technology, corporate services, facilities, distribution and logistics and store development. As of February 2022, LogicSource has raised $49.3 million. LogicSource’s OneMarket platform brings together a range of technology modules, enabled with market intelligence and benchmark information, to help brands and retailers effectively source and procure across the indirect landscape. Brands and retailers are looking at ways to enhance their operational efficiencies and reduce costs, presenting opportunities for LogicSource. LogicSource has worked with several apparel retailers in the US and helped them realize profit improvement as well as a material uplift in goods not for resale (GNFR)-related value for finance and business unit stakeholders. [caption id="attachment_144966" align="aligncenter" width="700"]

The ecosystem of LogicSource’s OneMarket Platform

The ecosystem of LogicSource’s OneMarket Platform Source: LogicSource [/caption] Trivver Founded in 2013 and headquartered in Los Angeles, US, Trivver was originally an in-game advertising platform but quickly discovered that its technology could be used to help companies optimize marketing in other realms. The company now works with brands and retailers to easily utilize XR (extended reality, including virtual reality (VR) and augmented reality (AR)) in their advertisements. In addition to offering the ability to market using XR, Trivver also empowers clients to collect meaningful data on consumer engagement. In all forms of marketing, many brands and retailers frequently ask the same question: Did the consumer have the opportunity to see the ad, and if so, how impactful was it? Trivver’s XR platform can answer these questions by quantifying user visibility and engagement metrics and providing insights on advertisements’ effectiveness to clients. Trivver has seen its business accelerate during the pandemic, as more consumers crave immersive shopping experiences from the comfort and safety of their homes. Apparel brands and retailers are looking to provide these experiences, presenting opportunities for Trivver to help create XR ads and measure engagement rates. Trivver’s platform includes several features that differentiate it from other XR providers. First, for 3D immersive environments such as online games, the company has created an auto-scaling technology that allows brands to create a 3D digital asset and deploy it to countless locations within these environments. Second, Trivver created a clickable portal that allows any brand to attach the company’s shoppable 3D/AR Portal to any digital content, such as video advertisements, display advertisements, apps, websites or emails. Lastly, Trivver has created a user-friendly XR advertisement platform that enables advertisers to set up their XR ad campaigns within a few minutes. [caption id="attachment_144967" align="aligncenter" width="700"]

An example of the consumer-engagement metrics that Trivver’s platform can provide brands and retailers

An example of the consumer-engagement metrics that Trivver’s platform can provide brands and retailers Source: Trivver [/caption]

What We Think

Implications for Brands/Retailers- We see e-commerce as a significant opportunity for apparel and footwear brands and retailers to drive sales as we expect many consumers to cement pandemic-driven online shopping habits in 2022 and beyond. We recommend that brands and retailers enhance their digital capabilities, such as deepening digital direct-to-consumer businesses, launching experiential services and planning engaging activities through the metaverse.

- To capitalize on the growing sustainability trend, improve the utilization of materials and fabrics, and turnover outdated or extra inventories efficiently, brands and retailers should launch resale services or work with resale platforms.

- 2022 will be an important turning point for commercial real estate owners as they will likely have more opportunities to rent space to brands and retailers seeking to recover sales that were lost during the pandemic years of 2020 and 2021. We encourage commercial real estate owners to work with brands and retailers and develop innovative solutions to utilize space efficiently and attract customers back to stores.

- Innovators have strong opportunities to partner with apparel and footwear brands and retailers to drive the push into e-commerce expansion, lower inventory levels and improve supply chain agility.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved