albert Chan

What’s the Story?

The pandemic-driven acceleration in e-commerce presents a huge opportunity for retailers but has also given rise to challenges in infrastructure development, logistics and regulation. In this Market Outlook, we explore how the e-commerce market in the US and China has been impacted by the Covid-19 pandemic and provide an outlook for the sector moving forward.

We also explore notable growth drivers, the competitive landscape, merger and acquisition (M&A) activity, retail innovators and four themes we are watching in the market in 2021 and beyond.

Market Performance and Outlook

US: Booming Food Sales Drive Total Online Growth

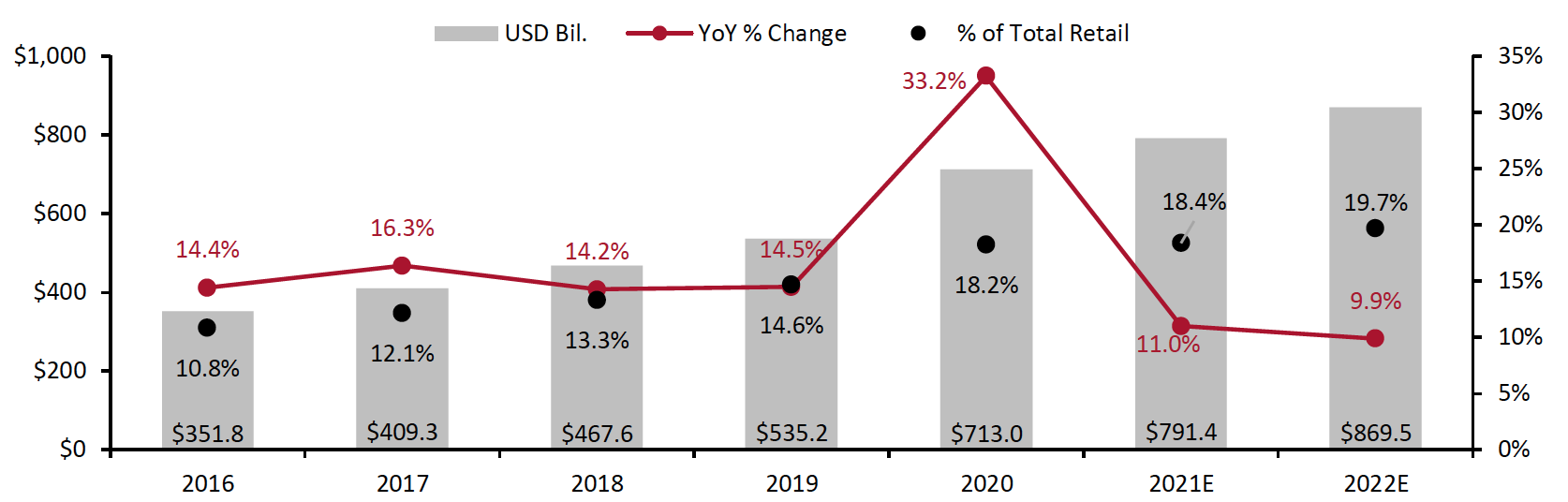

In 2020, US online retail sales climbed 33.2% to total $713 billion, or 18.2% of all retail sales (up 360 basis points), according to our analysis of US Census Bureau data.

We estimate that total US e-commerce sales will grow by approximately 11% in 2021, with roughly similar rates of growth across both food and nonfood. This solid overall pace represents an uplift on our prior estimates, fueled by an increase in our expectations for growth in total retail sales, in turn partly supported by raised inflation.

This anticipated growth will take online sales to $791 billion in 2021, or around 18.4% of total estimated retail sales. We expect food to be the driver of this further uptick in e-commerce penetration, with the online channel’s share of nonfood sales receding in 2021.

Figure 1. US: Online Retail Sales (Left Axis; USD Bil.); YoY % Change and Proportion of Total Retail Sales (Right Axis; %) [caption id="attachment_129592" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

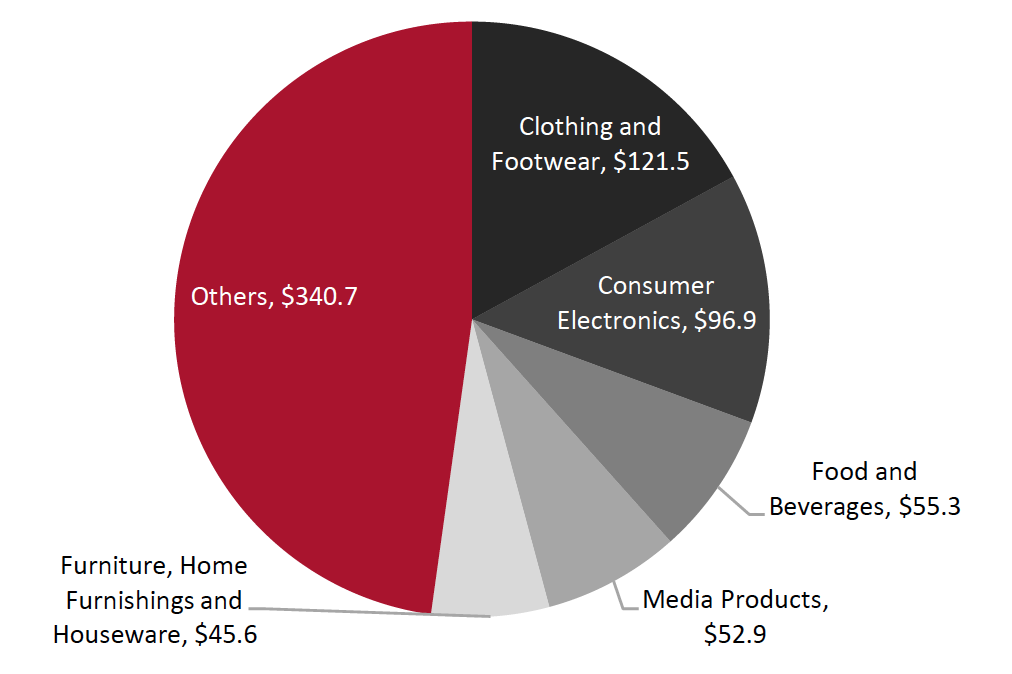

Amid soaring demand for groceries online, food leapfrogged media products to become the third-biggest category in US e-commerce in 2020. Online food sales jumped 81.6% in 2020, according to IRI. Online sales of media products increased by just 6.6%, according to Euromonitor International. This shift—and expected sustained growth in food e-commerce—underscores the importance of platforms such as Amazon making successful inroads into grocery.

Our own estimates peg the rate of increase in clothing and footwear e-commerce at 27.2% in 2020—this was in a total apparel market that declined 12.2%.

Source: US Census Bureau/Coresight Research[/caption]

Amid soaring demand for groceries online, food leapfrogged media products to become the third-biggest category in US e-commerce in 2020. Online food sales jumped 81.6% in 2020, according to IRI. Online sales of media products increased by just 6.6%, according to Euromonitor International. This shift—and expected sustained growth in food e-commerce—underscores the importance of platforms such as Amazon making successful inroads into grocery.

Our own estimates peg the rate of increase in clothing and footwear e-commerce at 27.2% in 2020—this was in a total apparel market that declined 12.2%.

Figure 2. US: Online Retail Sales by Five Biggest Categories (USD Bil.) [caption id="attachment_129547" align="aligncenter" width="550"]

Source: Euromonitor International Limited 2021 © All rights reserved/IRI E-Market Insights/US Census Bureau/Coresight Research[/caption]

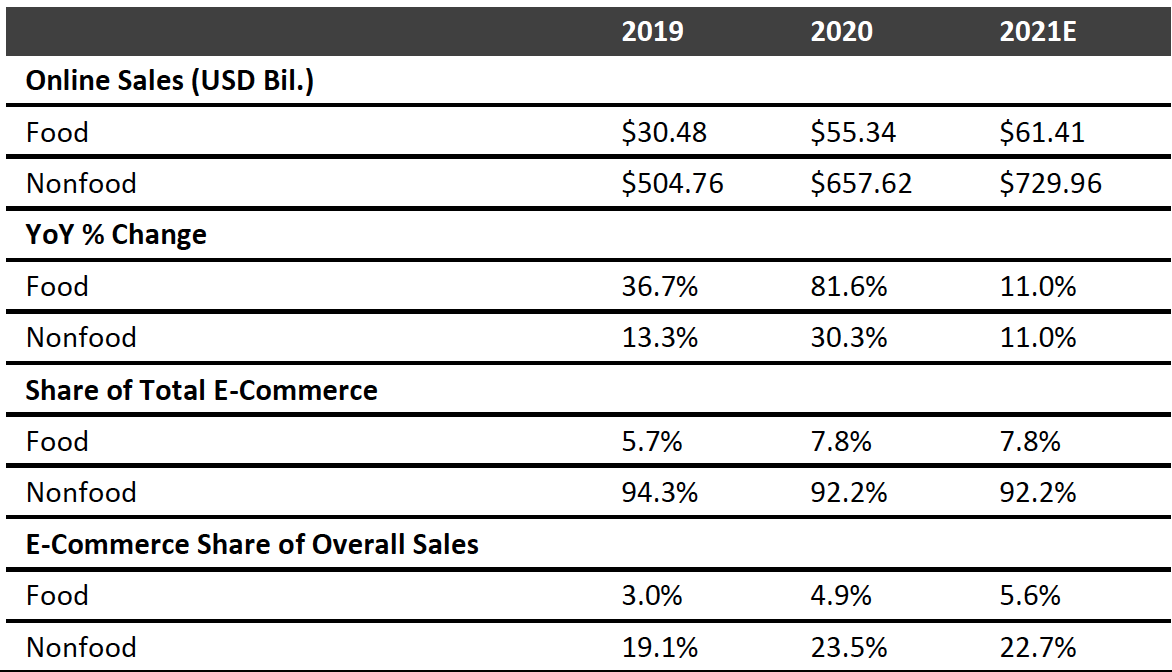

Across nonfood retail, our 2021 projections reflect the online channel ceding some share (80 basis points) of total sales back to stores: As shown in Figure 3, we anticipate around 22.7% of all nonfood retail sales to be online in 2021, versus 23.5% in 2020.

In food, we expect the online channel to continue to gain share in 2021: Unlike nonfood, the sector will not be annualizing enforced store closures, and the immature online grocery market has further to grow from a much smaller base than nonfood e-commerce does.

Source: Euromonitor International Limited 2021 © All rights reserved/IRI E-Market Insights/US Census Bureau/Coresight Research[/caption]

Across nonfood retail, our 2021 projections reflect the online channel ceding some share (80 basis points) of total sales back to stores: As shown in Figure 3, we anticipate around 22.7% of all nonfood retail sales to be online in 2021, versus 23.5% in 2020.

In food, we expect the online channel to continue to gain share in 2021: Unlike nonfood, the sector will not be annualizing enforced store closures, and the immature online grocery market has further to grow from a much smaller base than nonfood e-commerce does.

- See our Market Outlook on US grocery for more.

Figure 3. US: Online Retail Sales, by Major Category [caption id="attachment_129549" align="aligncenter" width="550"]

Totals may not sum due to rounding. Food includes beverages except alcoholic beverages.

Totals may not sum due to rounding. Food includes beverages except alcoholic beverages.Source: IRI E-Market Insights/US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

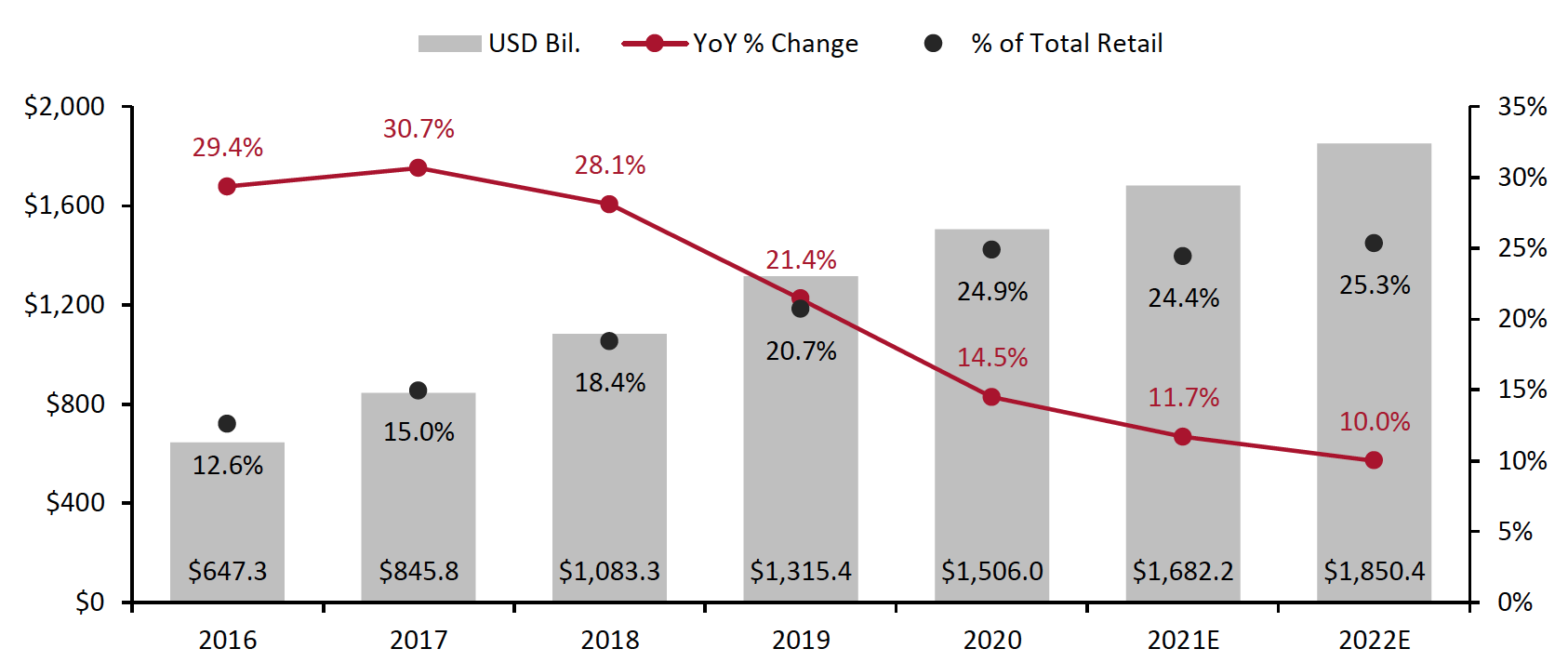

China: Food Gaining Share of E-Commerce

China’s online sales increased by 14.5% to $1.51 trillion in 2020 (¥9.8 trillion), according to our analysis of data from the National Bureau of Statistics (NBS). This was in the context of total retail sales (including food service) declining 4.8% in the year, and meant that e-commerce’s share of that total market increased by 420 basis points to 24.9% in 2020.

In 2021, we estimate that physical retail will regain some share, yielding an approximate 50-basis-point slide in the online channel’s share of total retail sales. But in the context of expected double-digit growth in total retail sales, that still equates to a solid 11.7% estimated uplift in online retail sales in 2021, taking channel sales to around $1.68 trillion (¥10.9 trillion).

The NBS does not split out food service e-commerce from retail e-commerce so, unlike the US data above, the figures mentioned here include online sales by restaurants and other food-service operators.

Figure 4. China: Online Retail Sales (Left Axis; USD Bil. at Fixed 2021 Exchange Rates); YoY % Change and Proportion of Total Retail Sales (Right Axis; %)

[caption id="attachment_129593" align="aligncenter" width="700"] Online retail sales include food service sales and are represented as a percentage of total retail sales including food service sales. Converted to USD at a June 22, 2021, rate of ¥6.48 = $1.

Online retail sales include food service sales and are represented as a percentage of total retail sales including food service sales. Converted to USD at a June 22, 2021, rate of ¥6.48 = $1.Source: NBS/Coresight Research[/caption]

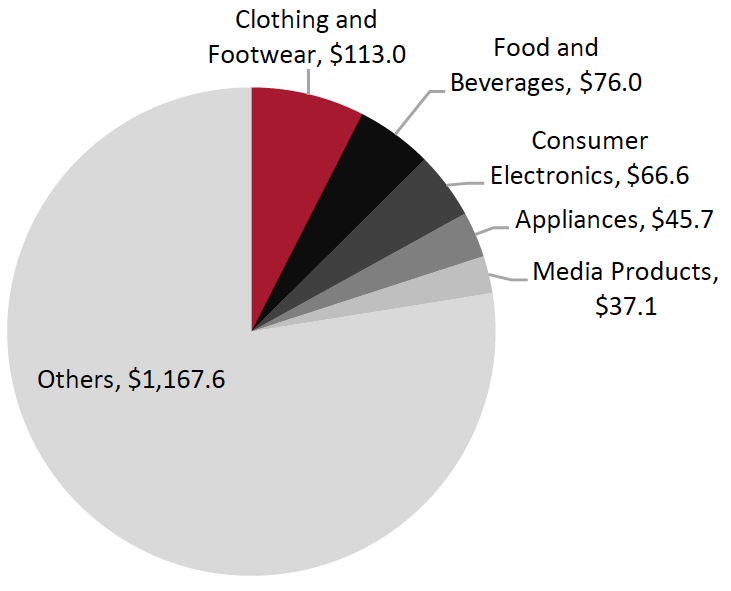

As in the US, apparel and food are the leading categories in China’s online retail sales. The share captured by the five biggest categories is depressed by the total market value including food-service sales. According to Euromonitor data, food and beverages overtook consumer electronics to become the second-biggest online retail category in 2020, the former growing by 24.9% to the latter’s 8.5%. Apparel grew by 26.6% online in 2020, per Euromonitor.

As in the US, dominant platforms must prepare for a future in which e-commerce is increasingly about “tangible” categories such as groceries and less focused on traditional hardline categories (such as electronics and appliances) that are bought on specification.

Figure 5. US: Online Retail Sales by Five Biggest Categories (USD Bil.)

[caption id="attachment_129553" align="aligncenter" width="550"] Total includes food service sales. Converted to USD at a June 22, 2021, rate of ¥6.48 = $1.

Total includes food service sales. Converted to USD at a June 22, 2021, rate of ¥6.48 = $1.Source: Euromonitor International Limited 2021 © All rights reserved/NBS/Coresight Research[/caption]

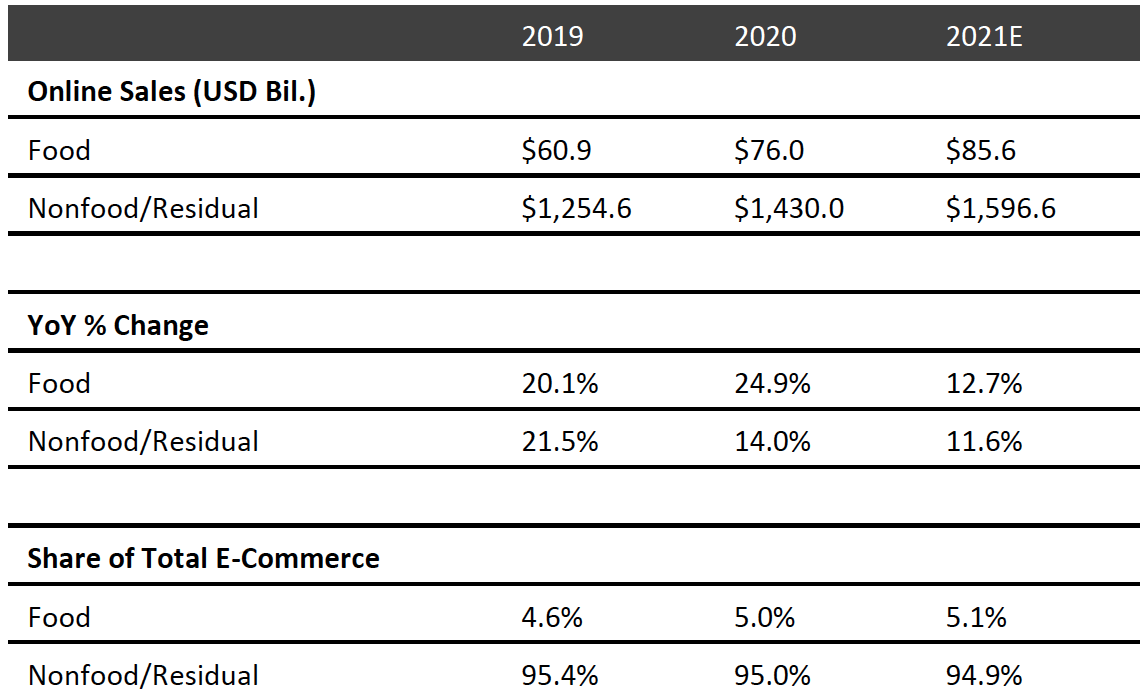

We break out food retail sales from the remainder of China e-commerce below. Unlike in the US data, the nonfood residual will include food-service revenues.

As in the US, food retail sales are capturing an increasing, although still small, share of total online sales. In 2020 and 2021E, this segment is growing faster than nonfood, too.

Figure 6. China: Online Retail Sales, by Major Category

[caption id="attachment_129555" align="aligncenter" width="550"] “Nonfood/Residual” includes food service sales. Converted to USD at a June 22, 2021, at a rate of ¥6.48 = $1.

“Nonfood/Residual” includes food service sales. Converted to USD at a June 22, 2021, at a rate of ¥6.48 = $1.Source: Euromonitor International Limited 2021 © All rights reserved/NBS/Coresight Research[/caption]

Market Drivers

We discuss three key drivers of e-commerce in the US and China.

1. Elevated Levels of Online Shopping Are Here To StayUnderpinning our expectations for further solid growth in US e-commerce for calendar 2021 have been our weekly surveys of US consumers. These surveys have recorded consistently strong rates of online shopping—and rates have proved highly resilient for the kind of tangible categories that have traditionally been a stronghold for stores. For example, our weekly surveys consistently find that around one-quarter of all respondents had purchased food or beverages online in the past two weeks.

While there is no doubt that shoppers are returning to stores and physical retail will recover some share of discretionary categories this year versus an exceptional 2020, we see little evidence of a slowdown in online shopping that would indicate a regression to precrisis habits.

For generalist platforms without the advantages of cross-channel propositions, we think this shift to tangible products requires greater investment in experiential e-commerce and away from the more functional propositions that characterized much of e-commerce in the past. Areas of investment could include livestreaming and augmented reality tools, to drive excitement and help customers make choices, respectively.

2. Infrastructure and Technology Development To Support Online ExperiencesExisting investment in digital transformation accelerated amid the pandemic to cater to the shift in demand toward e-commerce. Brands and retailers will look to capitalize on their newly acquired or enhanced digital infrastructure in the long term as they make efforts to keep consumers spending online by providing the best possible digital shopping experiences.

In China, we expect to see the development of new technologies support brands and retailers in providing optimum online shopping experiences. At the Retail Leaders Circle MENA Summit in March 2021, Deborah Weinswig, CEO and Founder of Coresight Research, discussed China’s focus on developing 5G Internet capabilities, which comprises part of the government’s latest five-year plan.

Moreover, 5G networks are gaining traction in the US, with major carriers having launched 5G wireless services in August 2020. This technology presents significant opportunity for retailers in the e-commerce market, enabling low-latency digital experiences for increasing numbers of online shoppers.

3. Increased E-Commerce Market RegulationWe expect the development of e-commerce market regulations to boost consumer and retailer confidence in online sales channels, particularly in China. For instance, in March 2021, Chinese market regulators formulated new responsibility requirements for e-commerce operators and drafted new regulations for the sector—as announced by state-owned news agency Xinhua.

As part of stricter regulation of the country’s e-commerce market, Chinese authorities are targeting false online sales information: Between October and December 2020, China saw the issuance of some 23,100 rectification orders to online platforms, and 6,665 non-compliant online stores were shut down.

Similarly, in the US, the Federal Trade Commission and Food and Drug Administration have routinely reminded retailers of marketing and advertising requirements.

Competitive Landscape

While leading players retained their dominant e-commerce market share in the US and China in 2020, some smaller players witnessed rapid growth amid the Covid-19 pandemic.

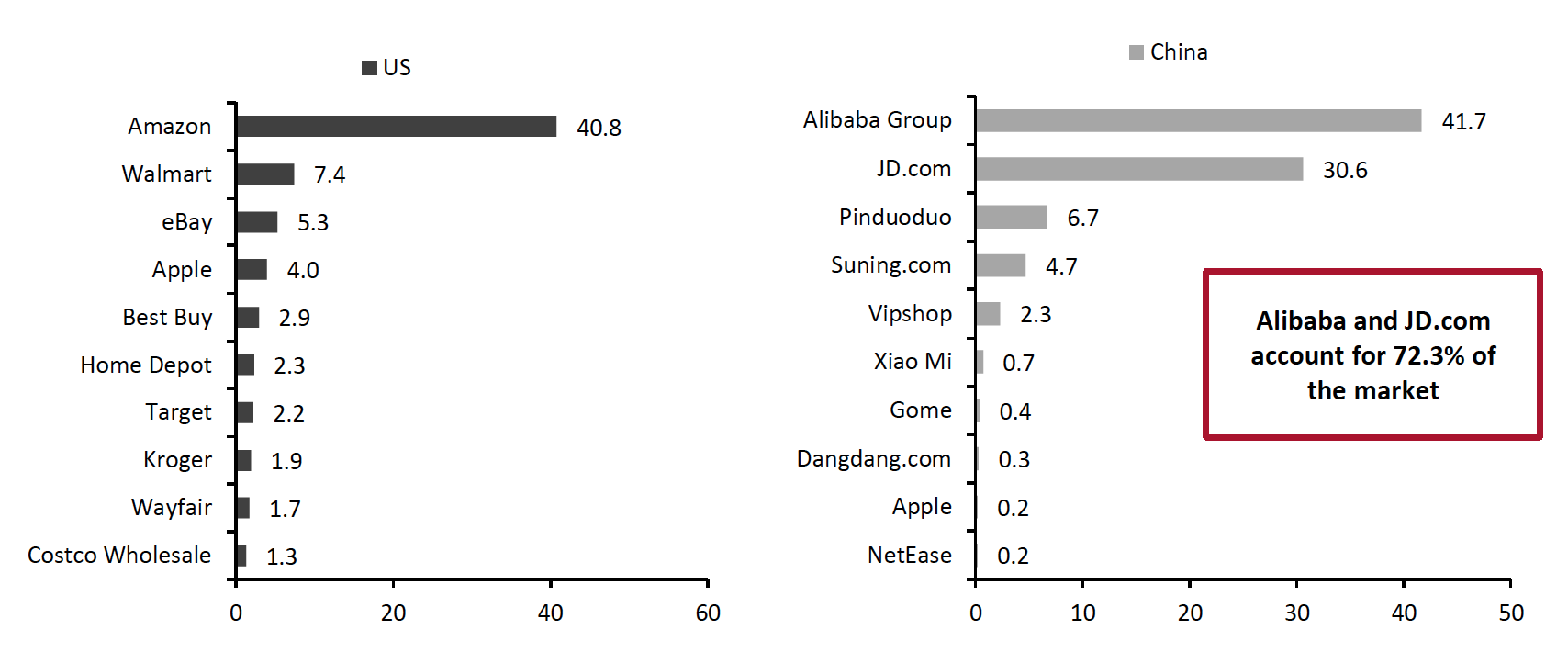

US Leading the US e-commerce market, Amazon held a 40.8% share of channel sales in 2020, according to Coresight Research estimates. This is a dominant lead: Walmart, the next closest player, accounted for less than 10% of the market, as shown in Figure 8. Focusing on its omnichannel strategy to boost market share, Walmart enhanced its in-store pickup and drive-thru services in 2020, with the aim of offering a seamless digital customer experience, according to the company.We estimate that Amazon recorded $291.1 billion in GMV in the US in 2020, representing year-over-year growth of 40.9%—outperforming total online retail sales growth in the US last year, at 33.2%. However, eBay—which ranked third in terms of market share in 2020—saw GMV growth of 22.1% in the US in 2020, according to the company, underpacing the increase in total US e-commerce sales.

China

E-commerce platforms remain much more prominent in China e-commerce than in the US. In total, Alibaba’s platforms and JD.com account for just over 72% of total online retail sales, according to Euromonitor data. Adding in Pinduoduo takes the aggregate share to 79%.

E-commerce giant Alibaba’s retail marketplaces accounted for 41.7% of sales in 2020. The company’s closest rival JD.com accounted for 30.6% of channel sales, as shown in Figure 8. The two companies employ different business models to achieve success. JD.com functions both as a retailer and as a marketplace, while Alibaba operates as an intermediary between buyers and sellers and does not conduct first-party e-commerce.

- Read Coresight Research’s Head-to-Head report for more on Alibaba and JD.com.

Launched in 2015 and having witnessed rapid growth, Pinduoduo now accounts for a 6.7% share of the Chinese e-commerce market. The company uses a group-buying model, whereby users form groups to shop in bulk and access lower prices. Its annual active user base grew faster than that of Alibaba and JD.com in the fourth quarter of 2020. Pinduoduo’s GMV growth outpaced that of rival JD.com in 2020, reaching 65.7% at ¥1,667.6 billion ($255.6 billion), compared to the latter’s 25.3% year-over-year growth to ¥2,612.5 billion ($397.0 billion)

Figure 7. US and China: E-Commerce Market Share in 2020, Top 10 Retailers (%)

[caption id="attachment_129557" align="aligncenter" width="700"] Source: Euromonitor International Limited 2021 © All rights reserved/company reports/Coresight Research[/caption]

Source: Euromonitor International Limited 2021 © All rights reserved/company reports/Coresight Research[/caption]

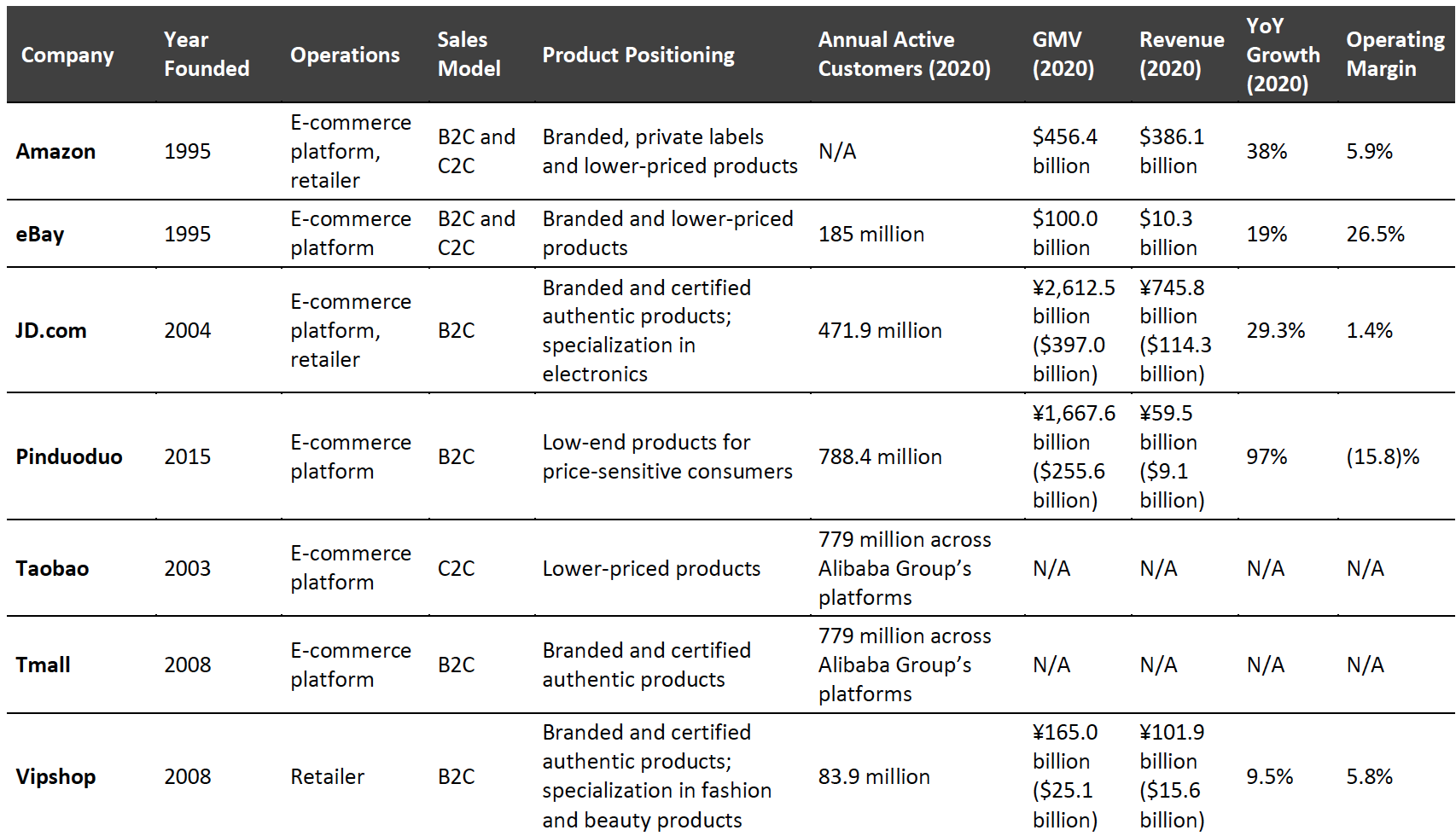

Figure 8 provides an overview of major e-commerce platform profiles in the US and China.

Figure 8. A Comparison of Major E-Commerce Platforms

[caption id="attachment_129558" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

M&A Activity

In 2020 and so far in 2021, we have seen strong M&A activity among key e-commerce players in the US and China, indicating that the e-commerce companies are consolidating their businesses and building out their ecosystems by investing in other marketplaces, retailers and logistics players.

For instance, Alibaba is using M&A as a strategy to develop its New Retail ecosystem. Following its first investment in hypermarket chain Sun Art Retail in 2017, on October 19, 2020, Alibaba announced that its control takeover from French owner Auchan Retail. Alibaba has applied its New Retail strategies to Sun Art Retail stores, including advanced online and offline integration and logistics upgrades. The investment and conversion of stores provides further evidence of e-commerce platforms seeking to tap the grocery market—a trend also evidence by Amazon’s ongoing rollout of grocery stores including under the newer Amazon Fresh supermarket format.

We expect to see continued M&A activity among e-commerce players in China and the US, particularly in retail, logistics and payments, over the rest of the year.

Figure 9. US and China: E-Commerce Mergers and Acquisitions (2020 and 1Q21)

[wpdatatable id=1083] Source: Company reports/Coresight ResearchRetail Innovators

The e-commerce market has recently seen a number of innovative newcomers aiming to challenge the status quo in China and the US. In Figure 10, we profile three Chinese platforms set to gain traction in beauty, luxury and streetwear in 2021. Figure 11 details three key innovators across apparel and retail solutions in the US e-commerce space.

Figure 10. China: Selected E-Commerce Innovators and Disruptors

[wpdatatable id=1077] Source: Company reportsFigure 11. US: Selected E-Commerce Innovators and Disruptors [wpdatatable id=1078] Source: Company reports

Themes We Are Watching

1. Online Grocery DemandWe see a structural shift in which food will be a key driver of total online growth, especially in the US market which has until very recently been a nascent market for online grocery. Reflecting this, and propelled by a 116% increase in its digital sales, US supermarket leader Kroger entered the top 10 US retail e-commerce companies for the first time in 2020, with a 1.9% market share, according to Euromonitor International (as shown earlier).

Coresight Research expects US online food and beverage sales to reach $101 billion in 2024, up from $55.3 billion in 2020. As grocers scale up their e-commerce operations, they are focusing specifically on fulfillment technology and services, with omnichannel fulfillment options, such as ship from store, curbside pickup and BOPIS.

However, as we showed earlier in this report, food sales made up only around 8% of US e-commerce and 5% of all online sales in China in 2020 (the share in China is depressed by total e-commerce including food service). For comparison, in the UK, a mature grocery e-commerce market, food sales accounted for around 16% of total e-commerce sales in 2020 (per Euromonitor), showing the potential for long-term changes in e-commerce mix. This likely shift in mix underscores the need for market-leading generalist platforms—such as Amazon in the US—to cater to grocery demand.

Despite this burgeoning of online sales, we expect grocery to remain strongly a cross-channel category, with customers looking to buy offline with omnichannel convenience and looking for trusted and convenient offerings online. We think this cross-channel demand is underpinning the moves of Amazon (most recently via Amazon Fresh) and Alibaba (via its Sun Art acquisition) into multichannel grocery retailing.

At the same time, Internet giants in China are jostling to capture spend from online grocery, leading to a spike in community group-buying developments among e-commerce retailers. The model represents a multibillion-dollar industry in China, and it has expanded rapidly amid the Covid-19 pandemic, primarily as it enables shoppers to avoid visiting brick-and-mortar stores for essential grocery purchases.

- For more on this topic, read Coresight Research’s Think Tank on the benefits and future prospects of community group buying in China.

Luxury brands, which have typically been slow to digitalize, have had to accelerate their digital strategies amid the Covid-19 pandemic, given the impact of store closures and depressed rates of international travel.

Among the major global markets, the US has historically been the biggest consumer of luxury. However, China, with the sheer size of its youthful and working consumers, looks poised to become one of the biggest consumers of luxury goods by 2025. In this context and amid a challenging retail environment in 2020, Kering’s brands Balenciaga and Gucci joined Alibaba’s luxury e-commerce platform Tmall Luxury Pavilion in 2020 to expand their reach among Chinese consumers.

In addition, we expect to see more e-commerce platforms launch initiatives in the luxury e-commerce sector. Amazon has already initiated this foray, having launched a new luxury store in September 2020 specifically for brands offering luxury goods on Amazon’s mobile app, with high-end brand Oscar de la Renta as the first official partner.

3. Livestream Shopping ExperiencesCapturing share in “touch-and-feel” categories such as beauty, clothing, food and luxury goods is likely to require a renewed focus on experiential e-commerce and less of a focus on functional experiences. Livestreaming, which is being spearheaded by China’s e-commerce retail market, is one way in which platforms can connect with consumers.

Coresight Research estimates that China’s livestreaming e-commerce market will reach $300 billion in 2021. Douyin and Kuaishou are the most popular short-video apps in China, holding a 10% and 16% share, respectively, of China’s livestreaming e-commerce market in 2020, we estimate—behind only Taobao Live, which held a majority share of 52%. Both Douyin (the Chinese version of TikTok) and Kuaishou host shoppable livestream sessions within their apps, with the former primarily targeting users from Tier 1 and Tier 2 cities while the latter’s main users reside in lower-tier cities.

With livestreaming gaining traction in the US, Coresight Research expects the livestreaming e-commerce market to total $11 billion by the end of 2021, driven by the confluence of social commerce, the influencer economy and advanced livestreaming technology. Recent key trends in the US livestreaming e-commerce market among retailers such as Macy’s and Nordstrom include personalization and community-building initiatives.

We have seen Amazon take interest in livestreaming in the US for some time, launching its first live video marketing option for brands in 2019. Moreover, during its 2020 Prime Day event (October 13–14), Amazon launched Prime Exclusive Deals to be shared with consumers by its network of influencers through live video content on featured products.

- Our US livestreaming e-commerce Playbook covers five best practices for brands and retailers to develop winning livestreaming strategies.

- Read our Think Tank for more on the US livestreaming e-commerce opportunity.

Upgrading logistics efficiency and capacity has become an essential task within the e-commerce market, as platforms strive to meet consumer demand for fast delivery services. In a move toward labor-light and technology-heavy logistics strategies, China’s e-commerce giants and logistics firms are increasing their usage of autonomous delivery technologies such as drones and robots.

For example, JD.com initiated the use of its self-developed logistics drone known as JDX-500 (“Jingting”) in Sichuan province on December 16, 2020. Moreover, the company piloted the use of last-mile delivery robots in early 2021, fulfilling its first autonomous order in Wuhan shortly after the Covid-19 outbreak. As well as increased demand for rapid delivery, we expect demand for contact-free delivery to continue to drive logistics innovation in the e-commerce market.

Within logistics, returns present a double-edged sword for retailers: Attractive returns options—including transparent policies—drive customer retention and loyalty but also add costs and complexity. As e-commerce gains a greater share of the retail market, the overall returns rate will continue to climb, adding significant pressure to retailers’ bottom lines. According to the NRF (National Retail Federation), the US returns rate for online purchases was 18.1% in 2020—much higher than the overall retail industry rate of 10.6% (totaling $428 billion).

- Read more about retail returns strategies and the hidden environmental costs of retail returns in our separate reports.

What We Think

We expect the e-commerce space to continue to grow in the US and China based on the retention of online shopping habits among many consumers and following on from accelerated infrastructure and policy improvement. The e-commerce market still has significant opportunities for emerging retailers to capture share.

Implications for Brands/Retailers

- Given current trends and data points, we see food remaining a key driver of total online growth: The US, in particular, has far to go to catch up with more mature grocery e-commerce markets, suggesting a long runway for growth and a long-term change in the product mix within the e-commerce space. We expect to see major e-commerce platforms to continue to invest to capture share in online and omnichannel grocery sales.

- However, we expect grocery to remain strongly a cross-channel category, with customers looking to buy offline with omnichannel convenience (such as in-store pickup) and looking for trusted offerings online. As Amazon appeared to recognize when it shifted from a pure-play online grocery model to a multichannel offering, food shoppers want to buy across channels even as they purchase more online. We expect to see sustained omnichannel moves from major e-commerce platforms in the US and China.

- The increased online penetration in tangible, or “touch-and-feel,” products from food to luxury may fuel greater investment by generalist platforms in experiential e-commerce and away from the more functional propositions that characterized much of e-commerce (especially in the US) in the past. Livestreaming is one tool that retailers and platforms can deploy to increase engagement.

- Also, in terms of the quality of the experience, retailers should continue to invest in logistics, for example, in store-enabled digital fulfillment capabilities—such as BOPIS (buy online, pick up in store), curbside pickup, rapid delivery or ship-from-store. Similarly, they must continue to improve the experience and efficiency of reverse logistics—product returns—to provide greater convenience and so gain a competitive advantage.

Source for all Euromonitor data: Euromonitor International Limited 2021 © All rights reserved

IRI DISCLAIMER: The information contained herein is based in part on data reported by IRI through its Market Advantage service, interpreted solely by Coresight Research, Inc. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinions expressed herein reflect the judgment of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.