DIpil Das

What’s the Story?

This report provides an overview of the retail sector in India, including its scale, sector composition and trajectory. We use sector data and definitions from the Ministry of Statistics and Programme Implementation (MOSPI) released in November 2020, and analyze recent consumer spending momentum. We also discuss the opportunities arising from key retail trends.

Market Performance and Outlook

India’s Consumer Spending: Estimated Growth in Fiscal 2021

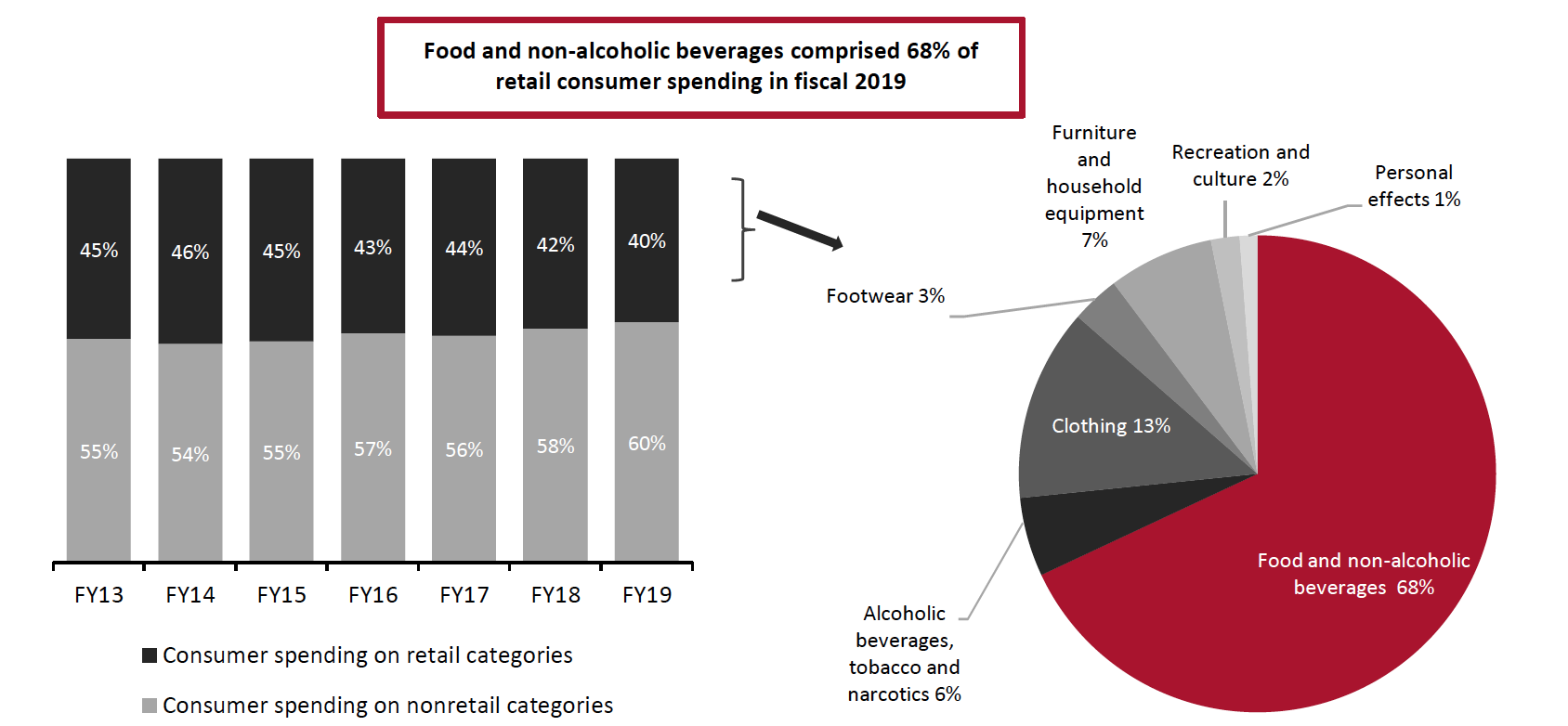

- We consider the following as the core retail categories, as provided by MOSPI: Food and non-alcoholic beverages; alcoholic beverages, tobacco and narcotics; clothing; footwear; furnishing, household equipment and routine household maintenance; recreation and culture; and personal effects. The fiscal years we discuss end March 31.

- The furnishing, household equipment and routine household maintenance, and recreation and culture categories include an element of services.

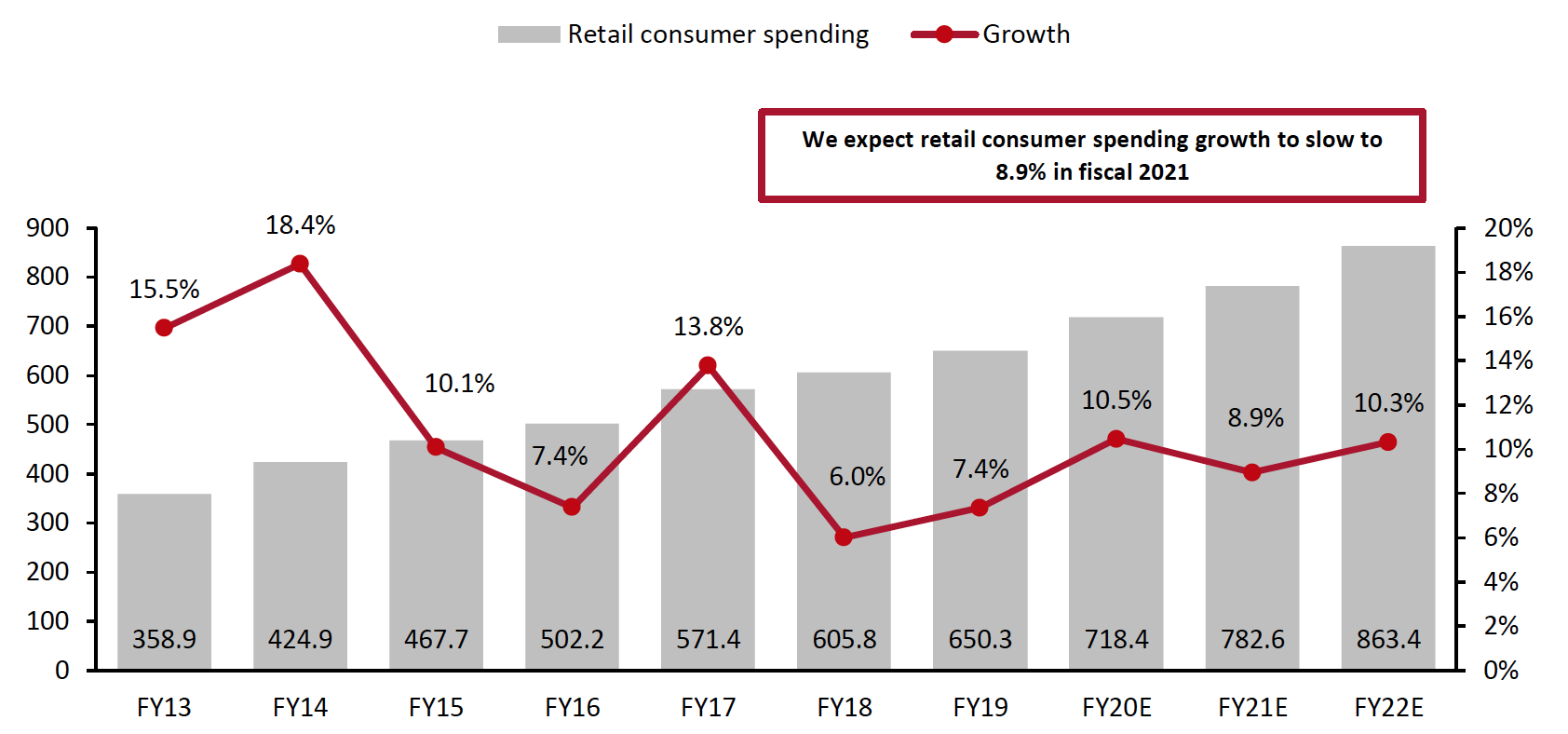

- We estimate that India’s total consumer spending on core retail categories will increase by around 8.9% year over year in fiscal year 2021, reaching $782.6 billion. This growth is a slowdown from an estimated 10.5% growth to $718.4 billion in fiscal 2020, from $650.3 billion in fiscal 2019 recorded by MOSPI. (All conversions to dollar figures are at constant 2019 exchange rates.)

- We think the total consumer spending growth on core retail in fiscal 2021 will mainly be driven by a 25.0% year-over-year jump in spending on food and non-alcoholic beverages while being offset by deep declines in spending on clothing, footwear and recreation during fiscal year 2021. This reflects pandemic-induced consumer shifts in spending to staples from discretionary in a market that is already largely weighted toward spending on staples.

- Food and non-alcoholic beverage spending comprised 68.2% of total consumer spending on core retail categories in fiscal year 2019. We estimate that this accounted for 68.0% in fiscal 2020 and will increase to 78.1% in fiscal 2021.

- In fiscal 2022, we expect growth in consumer spending on core retail categories to return close to pre-pandemic growth, of 10.3%.

Figure 1. India Consumer Spending on Retail Categories (Left Axis; USD Bil.) and YoY % Change (Right Axis)

[caption id="attachment_122769" align="aligncenter" width="700"] Conversions to USD are at constant 2019 exchange rates

Conversions to USD are at constant 2019 exchange ratesSource: MOSPI/Coresight Research[/caption]

Consumer Spending on Retail

- In 2019, Indian consumers spent 40.0% of their total spending on retail categories, and 60.0% on nonretail categories, such as education, healthcare, hotels, restaurants, transport and utilities. Indian consumers allocated 68.0% of their spend on retail categories to food and non-alcoholic beverages, and 13.0% to clothing.

- We estimate that clothing and footwear spend will decline by about 40.0% in fiscal 2021 as the demand decreased in line with lockdowns and temporary business closures. Although the lift of lockdowns has remained, most educational institutions are only partially open and a number of businesses continue to work from home throughout the country. Gatherings and events, such as weddings which are one of the key drivers of clothing spend, are capped to a limited crowd, further reducing the need to spend on clothing. An August 2020 survey by Standard Chartered bank found that some 56% of Indian consumers have spent less on clothing since the pandemic began compared to what they spent the year before.

- As people continue to spend more time at home, we expect purchases of food and furniture to rise and to drive spending throughout fiscal 2021 and in the early quarters of fiscal 2022.

Figure 2. India: Share of Consumer Spending on Retail Categories and Share of Categories in FY19

[caption id="attachment_122770" align="aligncenter" width="700"] Source: MOSPI/Coresight Research[/caption]

Source: MOSPI/Coresight Research[/caption]

Market Drivers

Pandemic-Induced Behaviors To Determine Near-term Spending

In the near-term, the focus of consumer spending will largely be driven by changes adopted during the pandemic.

- Indian consumers are likely to be conscious spenders until the economic effects of the pandemic recede. Some 90% of Indian consumers surveyed by Standard Chartered bank reported that the pandemic has made them more careful about their spending decisions, with 73% stating that it has made them more inclined to buy goods from small businesses and 72% more inclined to buy goods produced locally.

- Reduced incomes will reduce consumer spending in the near-term. Some 87% of Indian consumers expect their incomes to reduce this fiscal year compared to the one ended March 31, 2020, according to an April 2020 survey by Indian community-based social network Local Circles. Around one-quarter expect their income to fall between 25% to 50% while 26% expect it to decline by over 50%.

- Indian consumers are likely to focus on purchases related to health and wellbeing—50% of consumers surveyed by consulting firm Accenture between March and June 2020 said that they have increased their purchases of hygiene products while 85% said they are shopping more health-consciously.

India’s Large Youth Population

In the longer term, we expect India’s large youth population, in combination with increasing urbanization and rising incomes, to drive spending.

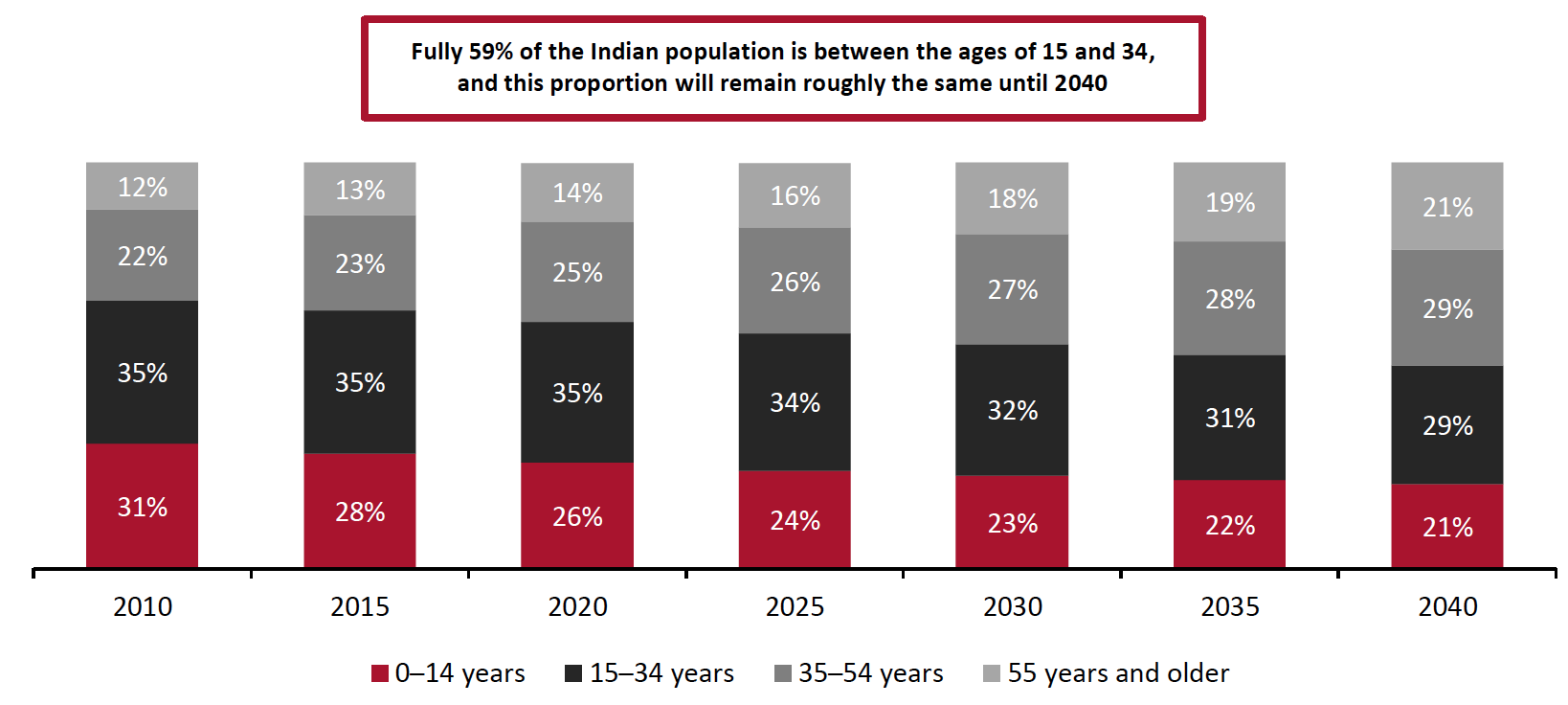

- India’s population is young—about 59% of its 1.3 billion people are between the ages of 15 and 54, according to UN data, with 35% between the ages of 15 to 34. As young people enter employment and as those already in employment begin to start families or lay down roots, they are likely to contribute significantly to consumption in the country.

Figure 3. India: Demographic Composition of Population

[caption id="attachment_122772" align="aligncenter" width="700"] Source: UN/Coresight Research[/caption]

Source: UN/Coresight Research[/caption]

Steady Urbanization to Prompt Changes in Consumption Behavior

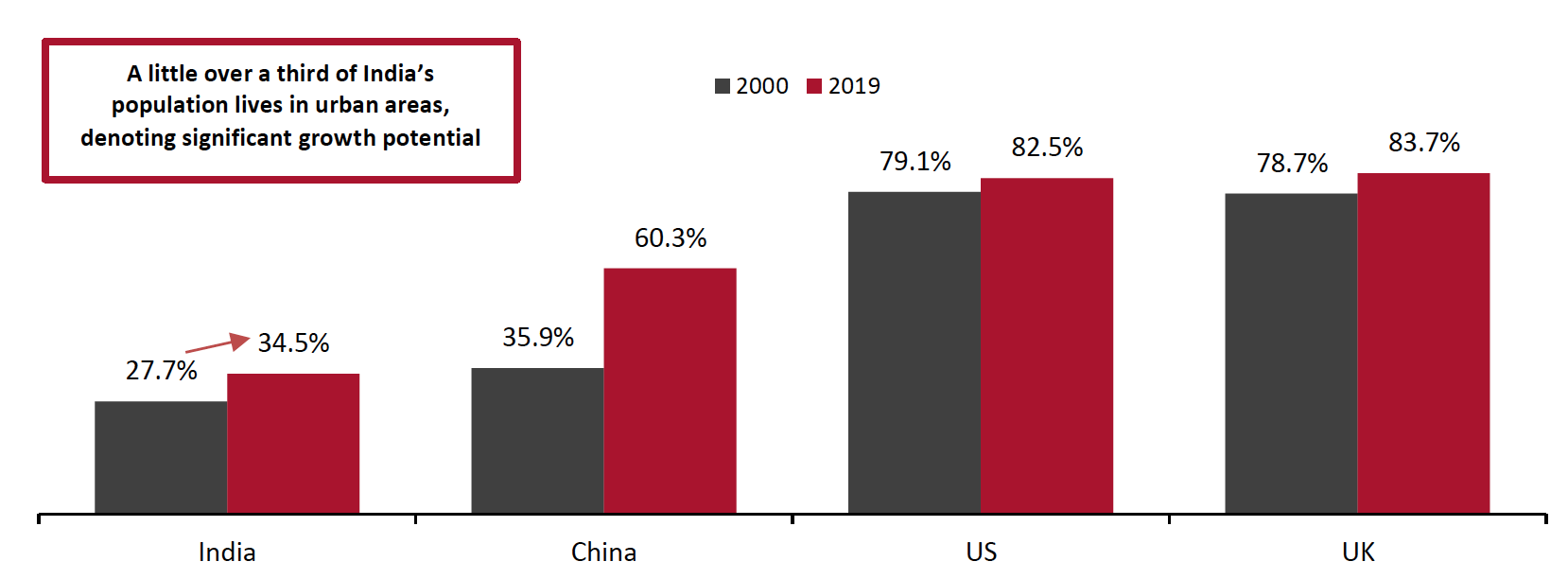

India’s population has been steadily urbanizing—the urban population grew from 27.7% in 2000 to 34.5% in 2019, according to the World Bank. This brings with it social and lifestyle changes, leading consumers to adapt the way they live and shop. India’s urban population has room to grow significantly when compared to its global counterparts with more mature retail markets, such as China, the US, and the UK, where urban population levels are above 60%.

Figure 4. Urban Population Levels: India and Selected Markets

[caption id="attachment_122774" align="aligncenter" width="700"] Source: World Bank/Coresight Research[/caption]

Source: World Bank/Coresight Research[/caption]

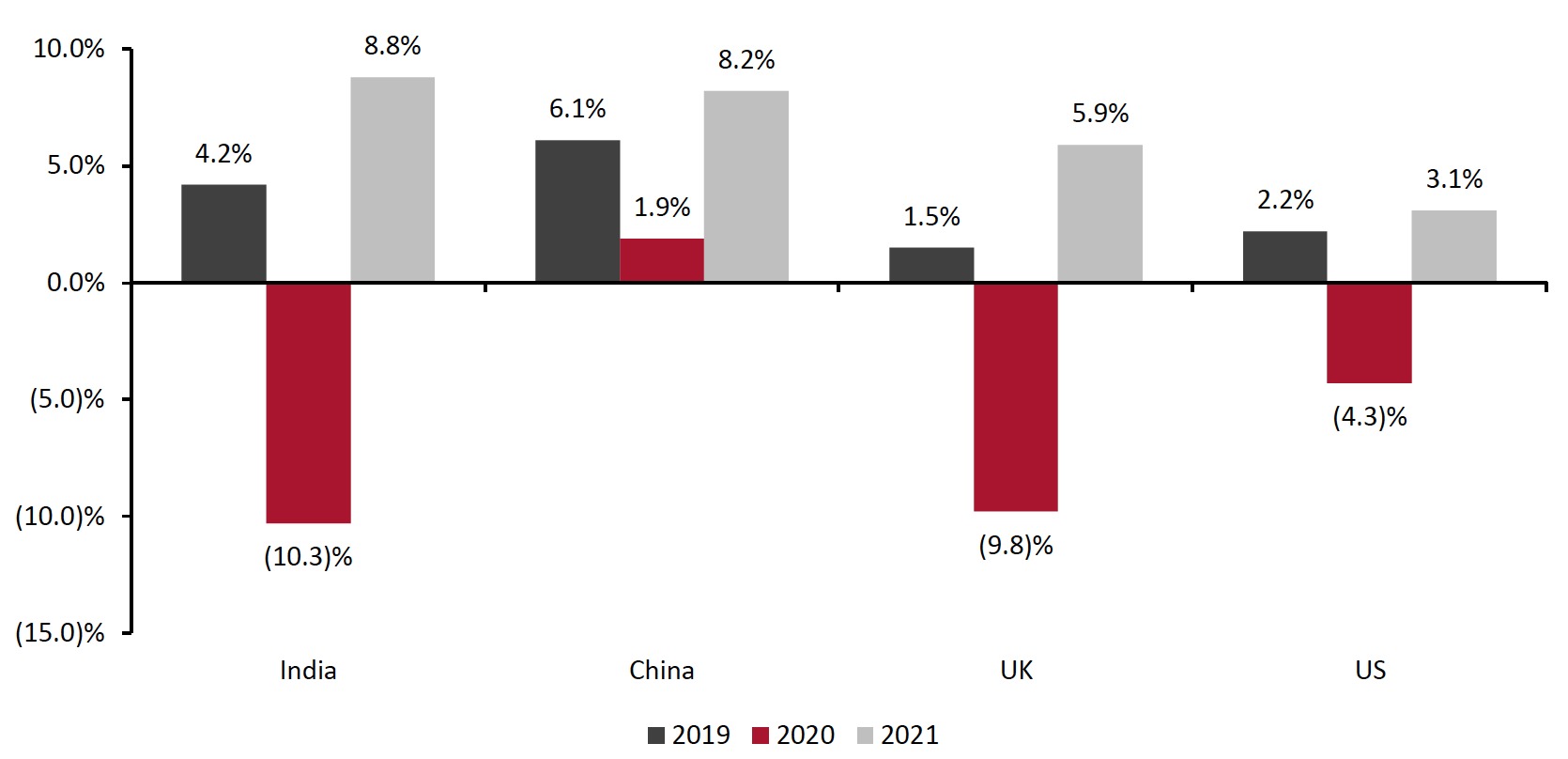

Strong GDP Growth Projections

In 2021, India’s GDP growth is expected to surpass that of China’s, according to projections from the International Monetary Fund (IMF). India’s GDP growth is expected to come in at 8.8%, recovering from a 10.3% decline in 2020—while China’s GDP growth is estimated at 1.9% in 2020 and project to increase to 8.2% in 2021.

Figure 5. GDP Projections: India and Selected Markets

[caption id="attachment_122775" align="aligncenter" width="700"] Source: IMF/Coresight Research[/caption]

Source: IMF/Coresight Research[/caption]

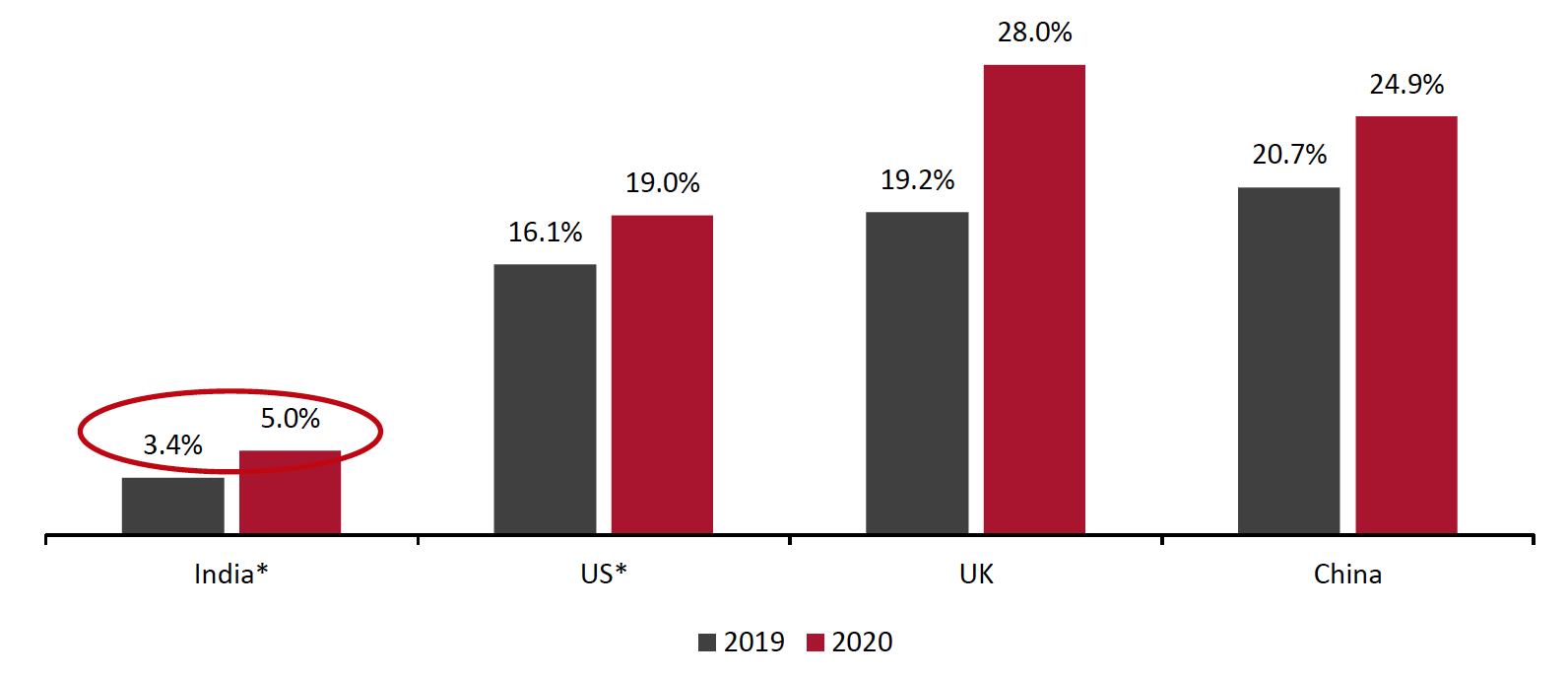

Online Market

India has a low e-commerce penetration rate compared to other global markets, indicating room for growth. In 2019, India’s e-commerce penetration rate was at 3.4%, according to Bain & Company, compared to 16.1% in the US and 24.9% in China, based on government data. The pandemic has triggered migration from offline to online retail in India, as it has in other countries; in 2020, consulting firm Redseer expects the penetration rate to have reached 5.0%.

In its survey, Standard Chartered bank found that some 54% of Indian respondents used to shop online before the pandemic, with this proportion changing to 69% during the pandemic.

Nevertheless, local markets and neighborhood stores still command a strong presence and loyalty from consumers due to their accessibility and proximity to consumers. A survey by Indian social network Local Circles conducted during the initial lockdowns in India between March and June 2020 found that some 40% of consumers shopped for essentials and nonessentials via e-commerce or had them delivered from local stores, while 47% shopped at local markets.

Figure 6. E-Commerce Penetration Rate, Selected Countries

[caption id="attachment_122776" align="aligncenter" width="700"] *The 2020 e-commerce penetration rates for India and the US are estimates.

*The 2020 e-commerce penetration rates for India and the US are estimates.Source: Bain & Company/Redseer Consulting/ONS/US Census Bureau/NBS China/Coresight Research[/caption]

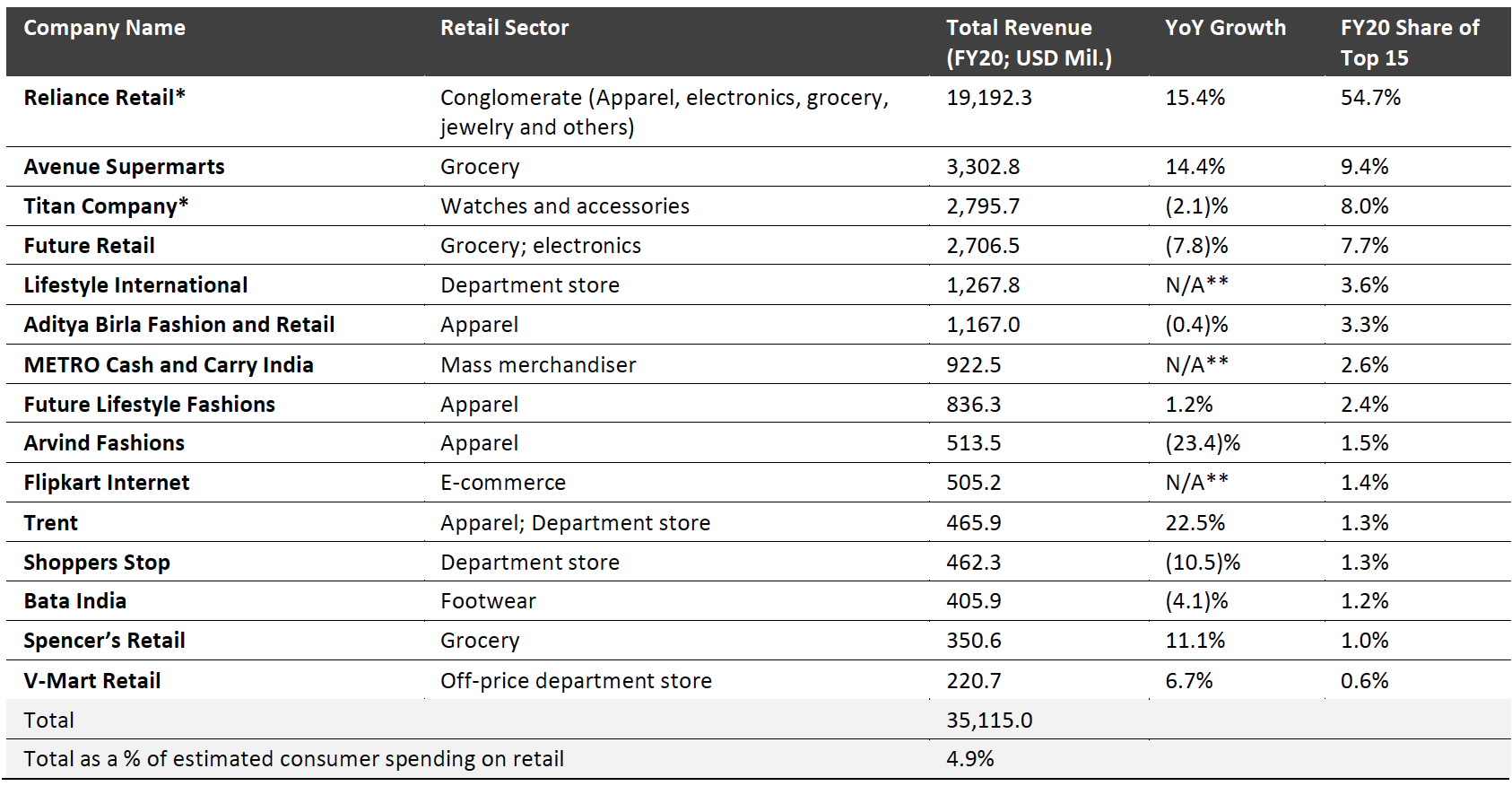

Competitive Landscape

India’s retail sector is highly fragmented, with informal retail comprising a majority of the sector—the India Brand Equity Foundation puts its share at 75% by the end of 2021, down from over 90% of the total sector a few years ago. The formal or organized sector is consolidated with a few major firms commanding substantial market share. In Figure 7, we rank the top 15 retail companies in India, based on revenue data from their annual reports.

- The combined revenue generated by India’s top 15 retail companies exceeded $35 billion in fiscal year ended March 31, 2020, based on constant 2019 exchange rates.

- The retailers covered in Figure 7 include department stores (Lifestyle, Trent and Shoppers Stop), e-commerce platforms (Flipkart Internet), grocery retailers (Avenue Supermarts) and multicategory retailers (Reliance Retail among others). We have excluded retailers that solely sell jewelry from the below table, however, Reliance Retail and Titan Company do not split out their jewelry retail businesses.

- The revenue of these firms is equivalent to 4.9% of estimated consumer spending on retail in fiscal year 2020.

- Flipkart Internet, Lifestyle International and METRO Cash and Carry India are privately held. Excluding these firms, as we do not have data for previous years, revenues increased 8.7% year over year for the remaining 12 companies.

- Reliance Retail commands the biggest lead, with a market share of 54.7% out of the top 15 retailers, which is unsurprising considering its depth of reach across retail sectors. The company operates over 10,000 stores across India while its closest contender Avenue Supermarts operates 216 stores.

Figure 7. India: Top 15 Retail Companies by Revenue

[caption id="attachment_122777" align="aligncenter" width="700"] *Includes jewelry retail banners

*Includes jewelry retail banners**N/A: Private companies; historic data are not available.

Source: S&P Capital IQ/Coresight Research[/caption]

Retail Innovators

Technological innovation in India’s retail sector is still nascent compared to its more mature counterparts in the West and China. There are several startups that are innovating in this space—either to help mom-and-pop stores set up online or to help established retailers streamline business, or simply to bring new concepts and formats to Indian consumers.

Myntra: India’s Leading Fashion Pureplay

Myntra is a fashion-only platform, featuring a mix of Indian and international brands, along with private labels. Myntra is part of Walmart-owned e-commerce firm Flipkart. It targets premium consumers with a curated mix of merchandise and engaging experiences through Myntra studio, which showcases products from the platform and advice from stylists and influencers.

Nykaa: Capturing Market Share in India’s High-Growth Online Beauty Market

Digitally native beauty retailer Nykaa owns a 33% share of the Indian online beauty market with 3 million active users, according to Switzerland-based consulting firm Frederic Fernandez & Associates—the firm also reported that Nykaa’s annual revenues increased from $10 million in fiscal 2016 to $157 million in fiscal 2019. The beauty retailer’s closest competitor is India-based direct-to-consumer (DTC) beauty retailer Purplle, but by comparison, Nykaa offers a broader product range and has more followers, higher incoming traffic and higher annual revenue.

The Indian beauty market is expected to grow at a CAGR of 8.1% (almost twice as fast as that of the US), from an estimated $25.9 billion in 2020 to $32.7 billion by 2023, according to Statista's projections.

Delhivery: Spearheading E-commerce Deliveries

Delhivery, launched in 2011, is India’s first logistics firm that concentrated solely on e-commerce deliveries. Unlike other delivery firms that catered to businesses across sectors, Delhivery’s focus allowed it to create services tailored to the needs of the e-commerce sector, such as back-office infrastructure for web shops.

Since its launch, it has branched out to serve over 3,000 clients across sectors, including 150 offline brands. Backed by Softbank, Delhivery competes with Amazon Transportation Services and Flipkart’s own delivery firm Ekart in India’s e-commerce logistics sector. The sector was valued at over $1.4 billion in 2018 and projected to grow at a CAGR of 36% to $6.3 billion by 2023, according to data from KPMG and trade body Confederation of Indian Industry.

ShopX: Digitalizing Local Convenience Stores

ShopX is a technology provider for local convenience stores, also known as mom-and-pop stores or kirana stores. The company’s objective is to help offline retailers get online with minimal investment in technological infrastructure, in order to reap the benefits of e-commerce. The platform also offers credit options with its ShopX Suvidha service. ShopX has around 181,600 partners in over 460 towns.

Read our India Retail Tech Landscape for more profiles of innovators in this space.

Themes We Are Watching

Acceleration in Digitalization and E-Commerce

The Covid-19 pandemic has boosted digitalization and e-commerce adoption in India, as it has across other markets. This development is particularly significant in India because, similar to China, it has almost bypassed the intermediary stages of retail and e-commerce development and moved directly toward mobile-centered, marketplace-focused retailing.

For instance, in the initial weeks of the lockdown, offline-only grocery retailer Big Bazaar pivoted to taking orders by phone for doorstep delivery across several cities. Customers could place orders by calling or WhatsApp messaging their local Big Bazaar stores and paying on delivery.

Online-only grocery retailers such as Bigbasket and Grofers witnessed a surge in online users once lockdowns were announced and had to hire additional staff to expand capacity rapidly. Both companies have managed to retain a substantial number of customers that came on board early-on during the pandemic. Grofers’ CEO Albinder Dhindsa told newspaper Livemint in October 2020, that over 70% of shoppers who used Grofers for the first time during the pandemic are still shopping on the app.

After the start of the pandemic and over the course of last year, a number of offline-only retailers in India, such as UNIQLO, launched their own apps or websites while others, such as Lifestyle and Arvind Fashions, looked to expand their online presence further. These initiatives may not have been a key focus if not for the pandemic, and we expect retailers to continue to push expansion across their online channels in India.

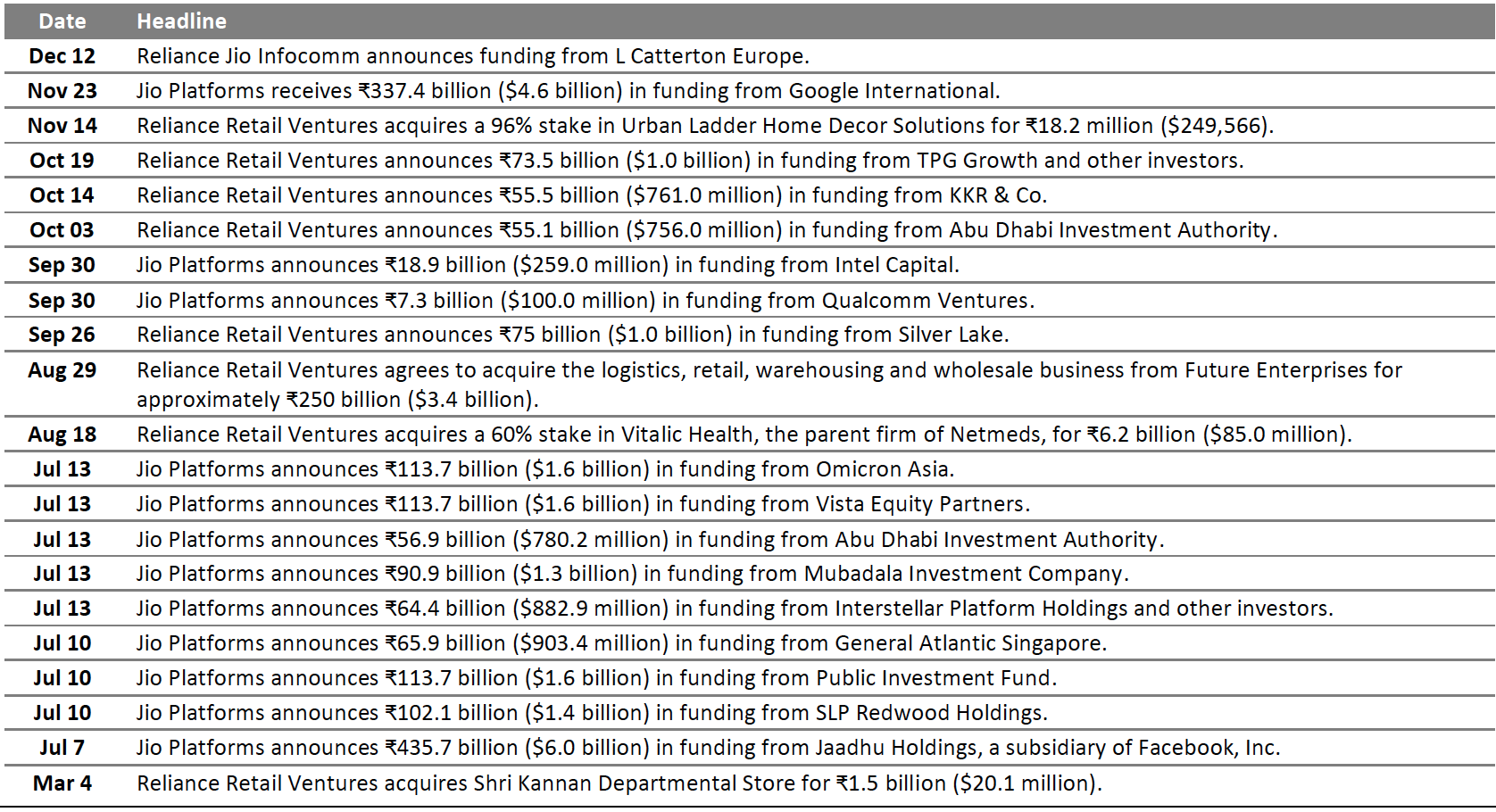

Consolidation in Retail Driven by Reliance’s Acquisitions

Reliance Industries, the multi-sector conglomerate that owns Reliance Retail and mobile network provider Jio Platforms, saw a flurry of investments in 2020. One notable investment during the year was Facebook’s purchase of a 9.9% stake in Jio Platforms via its subsidiary Jaadhu Holdings.

Recent speculation suggests that Reliance Retail plans to embed JioMart, its e-commerce platform, into Facebook-owned WhatsApp within the next six months to tap into the messenger service’s 400 million userbase in India.

Reliance Retail has made further inroads into Indian retail with its acquisition of or investments in online-only retailers across sectors, such as Urban Ladder (furniture) and Netmeds (pharmacy). Reliance Retail’s imminent acquisition of Future Retail is disputed by Amazon India as it holds a stake in Future Retail. As of February 2, 2021, the transaction has been put on hold by an Indian court pending inquiry, however, should the deal go through, it would give Reliance Retail a stronger lead in the Indian retail sector.

In Figure 8, we outline the investments that Jio Platforms, Reliance Jio Infocomm (a subsidiary of Jio Platforms) and Reliance Retail received in 2020, as well as acquisitions made by Reliance Retail. We have included the group’s mobile network business, Jio Platforms, as it closely ties in with the group’s strategy of expanding its retail and e-commerce presence.

In 2020, Reliance Retail and Jio Platforms together received investments of ₹1.8 trillion ($24.3 billion). During the year, Reliance Retail made acquisitions worth ₹7.7 billion ($110 million) and announced an acquisition worth ₹250 million ($3.4 million).

Figure 8. Jio Platforms, Reliance Jio Infocomm and Reliance Retail: Timeline of Investments and Acquisitions in 2020

[caption id="attachment_122778" align="aligncenter" width="700"] Source: S&P Capital IQ/Coresight Research[/caption]

Source: S&P Capital IQ/Coresight Research[/caption]

If Reliance Retail continues its current momentum of expansion and acquisitions, it could spark similar moves from other major players in order to hold their ground, such as Tata Group (which owns Titan and Trent and a number of e-commerce platforms). Tata Group is already rumored to be in discussions to invest in online pharmacy 1mg and online grocery retailer BigBasket, and working on a “super app” to counter Amazon’s and Reliance’s dominance, according to people that spoke to news site Inc42.

The Coming of Age of Social Commerce in India

India is a mobile-first nation when it comes to e-commerce, so the transition to social commerce among social media-savvy users seems only natural. Indians already spend an average of 156 minutes per day on social media according to 2020 data from social media measurement firm Global Web Index. In China, consumers spent 117 minutes, compared to 128 in the US and 101 minutes in the UK.

In 2020, social commerce platforms such as BulBul, Meesho and Shop101 and others have acquired over 10 million resellers and raised over $100 million in new funding, according to a news report from The Economic Times.

Just as social commerce grew to be a substantial medium in China, we think India will experience a similar growth curve—considering the growing awareness and usage of this channel among consumers and the increasing affordability of smartphones and mobile data services.

What We Think

We think the pandemic behaved as a double-edged sword in India’s consumer sector—slowing down consumer spending while prompting a shift to e-commerce and speeding up digitalization by several years.

We estimate that India’s total consumer spending on core retail categories will increase by around 8.9% year over year in fiscal 2021, reaching $782.6 billion, slowing from an estimated 10.5% growth to $718.4 billion in fiscal 2020.

Growth in 2021 is mainly driven by a 25.0% jump in spending on food and non-alcoholic beverages while being offset by deep declines in spend on clothing, footwear and recreation, we estimate. This reflects the pandemic-prompted consumer shifts in spending to staples from discretionary in a market that is already largely weighted toward spending on staples.

The deep declines in discretionary sectors are not expected to pull down overall spending in fiscal year 2021, as spending on food and beverages accounts for over two-thirds of total consumer spending.

India’s e-commerce penetration is still very low compared to other major markets—at 3.4%, compared to 16.1% in the US and 20.7% in China in 2019. With the pandemic-triggered migration from offline to online retail, consulting firm Redseer expects the penetration rate to have reached 5.0% in 2020. This presents a number of opportunities to brands, retailers and tech providers alike.

Implications for Brands/Retailers

- With the ongoing migration to e-commerce and the looming threat of further consolidation from Reliance Retail, brands and retailers that do not yet have a strong digital presence should move quickly to do so. This could involve establishing an online store or strengthening existing digital offerings.

- Retailers and brands should look to their counterparts in more mature retail markets and adopt strategies as applicable to their size and the sector they operate in. Our Retail and Technology Outlook provides insights on headwinds and tailwinds as well as themes for specific sectors, which Indian retailers and brands can look to for guidance.

Implications for Real Estate Firms

- With mass migration to e-commerce, real estate firms should rethink the relevance of physical spaces and go beyond simply offering showroom spaces. They could look to develop further mixed-use spaces so that consumers are likely to visit stores for the convenience of proximity. For example, if a mixed-use property consists of offices, homes and a shopping mall, people that work and live at the property are more likely to shop at the mall.

- Real estate firms should also look to work collaboratively with retailers and brands in terms of the latter’s digital offering—offering spaces for pickup of online orders, such as buy online, pickup in mall (BOPIM), will help them remain relevant in the era of digitalization.

Implications for Technology Vendors

- Retailers, brands and real estate players are likely to seek out convenient plug-and-play applications that can integrate seamlessly with their legacy systems. Vendors should look to offer such technological infrastructure and software that cause minimal disruption and allow retailers to scale digital efforts or digitalize their existing offerings easily.

- Vendors need to consider aspects unique to India, the impact of road conditions and unmapped terrain on autonomous delivery vendors, as well as diversity in languages for providers of technology that are dependent on speech or text.

- As the market lacks homogeneity across the country in terms of language, culture, weather, terrain and a number of other factors, vendors should offer applications that are adaptable to varying environments and types of consumers.