DIpil Das

What’s the Story?

This report provides an overview of the retail industry in China, including its scale, sector composition and trajectory. We consider sector data and definitions from the National Bureau of Statistics in August 2020, as well as providing retail sales analysis and discussion of the opportunities arising from key retail trends.Why It Matters

Analyzing China’s retail industry sheds light on the current state of the market and enables better understanding of retail trends, consumer behavior and consumption patterns. Our discussion of retail development as of August 2020, against the backdrop of a post-crisis environment in China, also indicates how the nation’s retail industry has weathered the impacts of the pandemic and its expected trajectory for recovery. Singles’ Day (also termed 11.11 Global Shopping Festival by Alibaba), will be held on November 11. As the largest global shopping festival, the event features both domestic and international brands, offering a sales boost for many retailers and insights into retail demand in China.China Retail Overview: Understanding the Market’s Scale, Trajectory and Breakdown

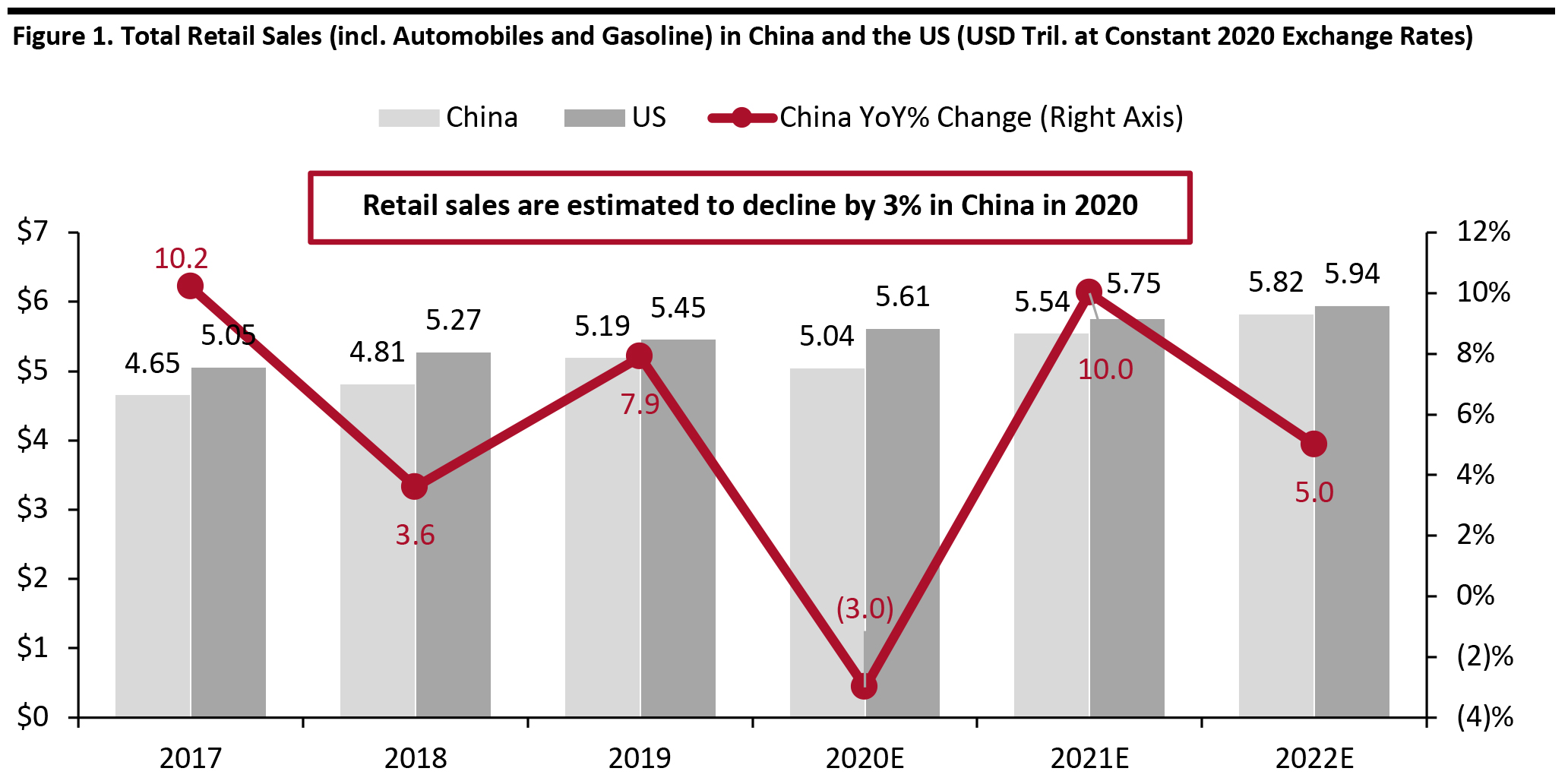

China’s Total Retail Sales of Consumer Goods To Decline by 3% in 2020- We estimate that China’s total retail sales will decline by around 3% year over year in 2020, reaching around ¥35.4 trillion (around $5.0 trillion) versus around ¥36.5 trillion ($5.2 trillion) in 2019. This total excludes food-service businesses and includes automobiles and gasoline.

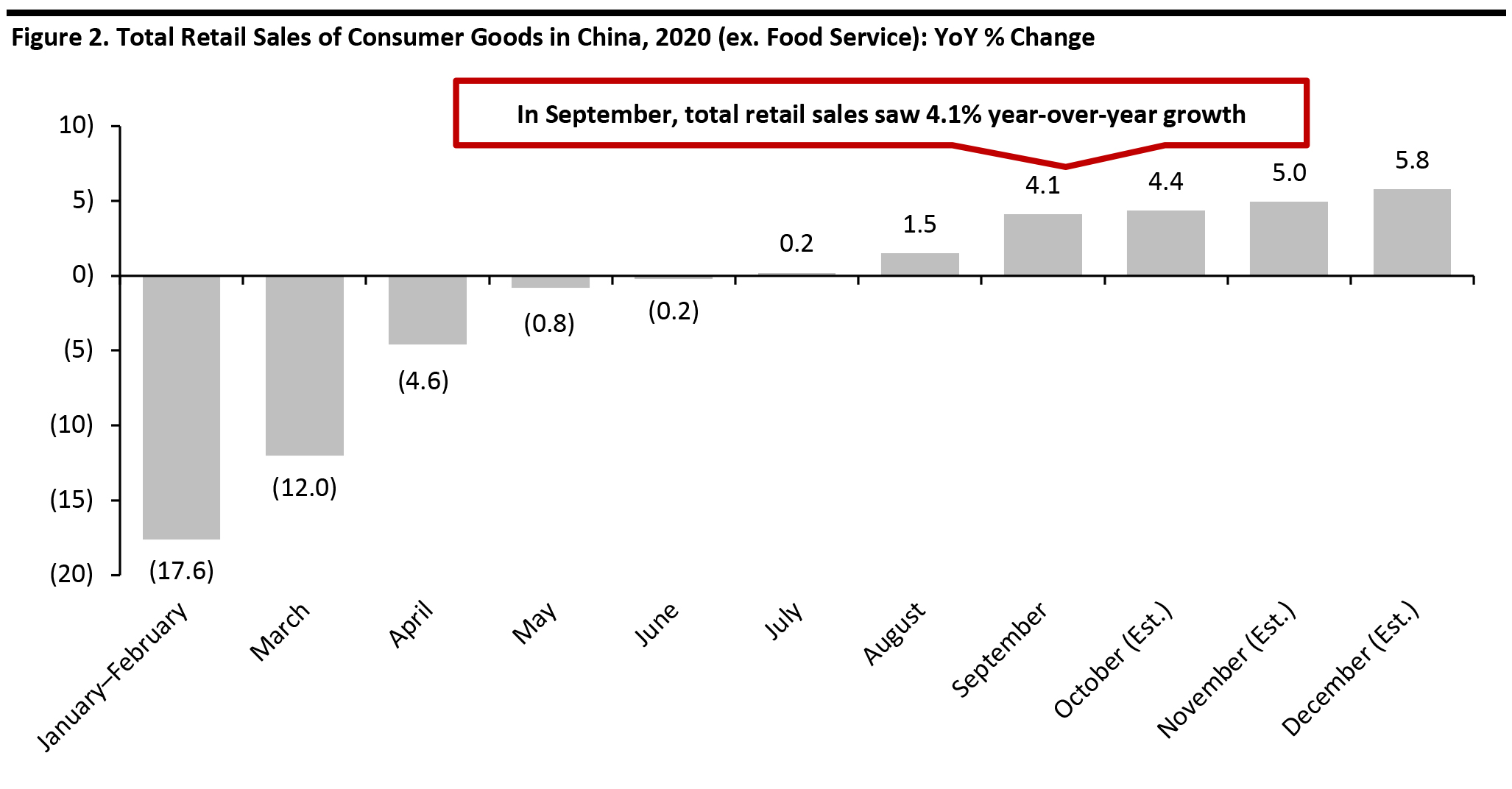

- The decline is largely due to the impact of Covid-19, especially in the first half of the year—China’s retail sales of consumer goods (ex food service) declined by 7.2% year over year in the first eight months of 2020, according to the National Bureau of Statistics (see Figure 2 for month-by-month trend data in 2020).

- In 2021, we expect China’s retail sales to jump by over 10%, the lower end of which would put China’s retail sales at ¥38.9 trillion ($5.5 trillion at 2020 exchange rates). The predicted sales are approximately 7% ahead of 2019’s pre-crisis levels. An expected continual return to more normal ways of living, coupled with a rerouting of some purchases from overseas to domestic (due to still-limited travel), should support growth in 2021.

- For comparison, we chart US retail sales below in Figure 1. Also including automobiles and gasoline, we expect US retail sales to rise by around 6% to $5.6 trillion in 2020 and to remain ahead of retail sales in China in the coming years.

All retail sales data cited in this report exclude food service

All retail sales data cited in this report exclude food service Source: National Bureau of Statistics/US Census Bureau/Coresight Research [/caption] Retail Performance in 2020 Total retail sales declined for six consecutive months prior to July. In July, year-over-year growth finally turned positive, at 0.2%. Growth strengthened considerably in September, and we anticipate further strengthening through the end of the year. [caption id="attachment_118757" align="aligncenter" width="700"]

January–February reported in total only

January–February reported in total only Source: National Bureau of Statistics/Coresight Research [/caption] Market Breakdown

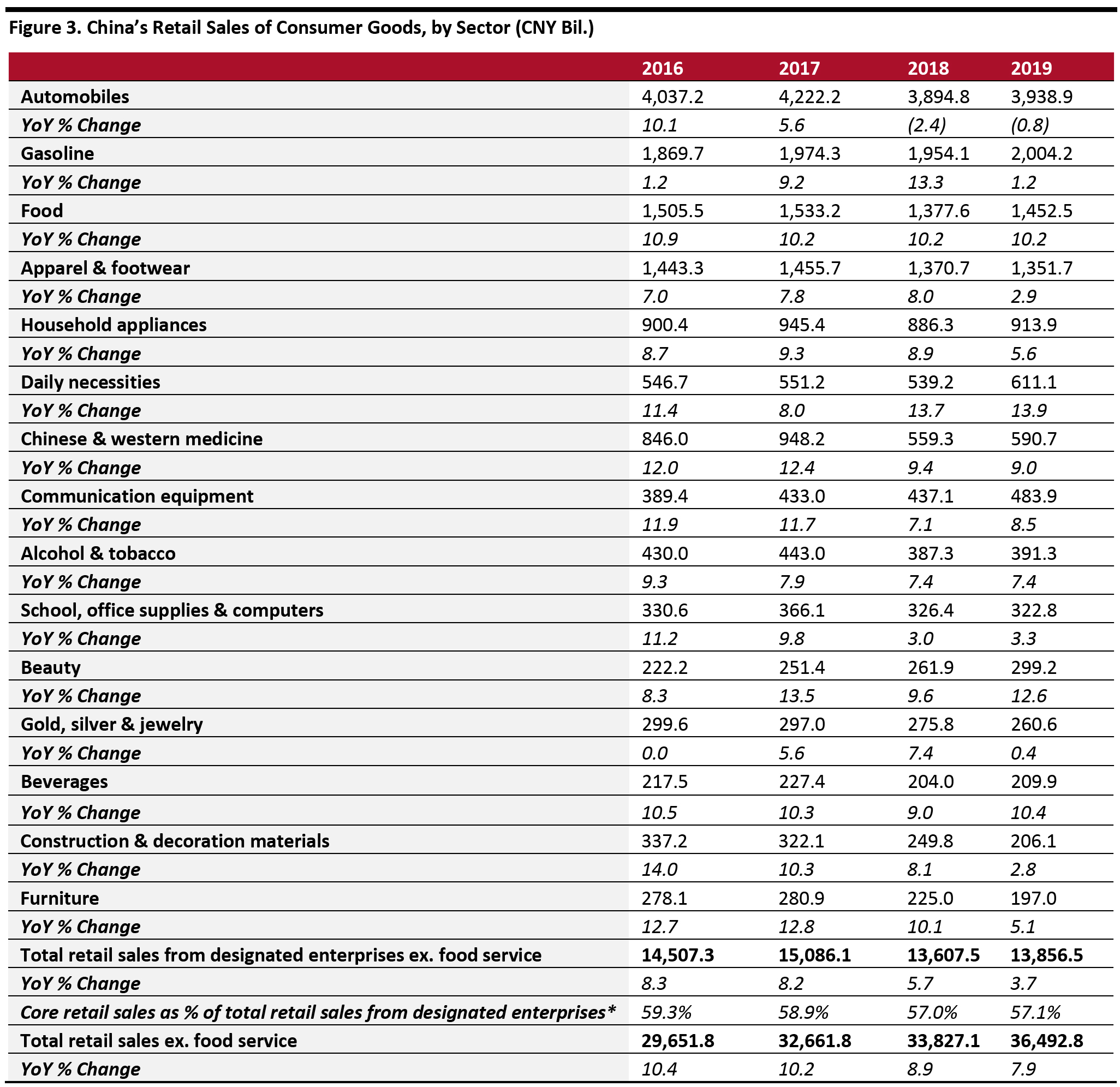

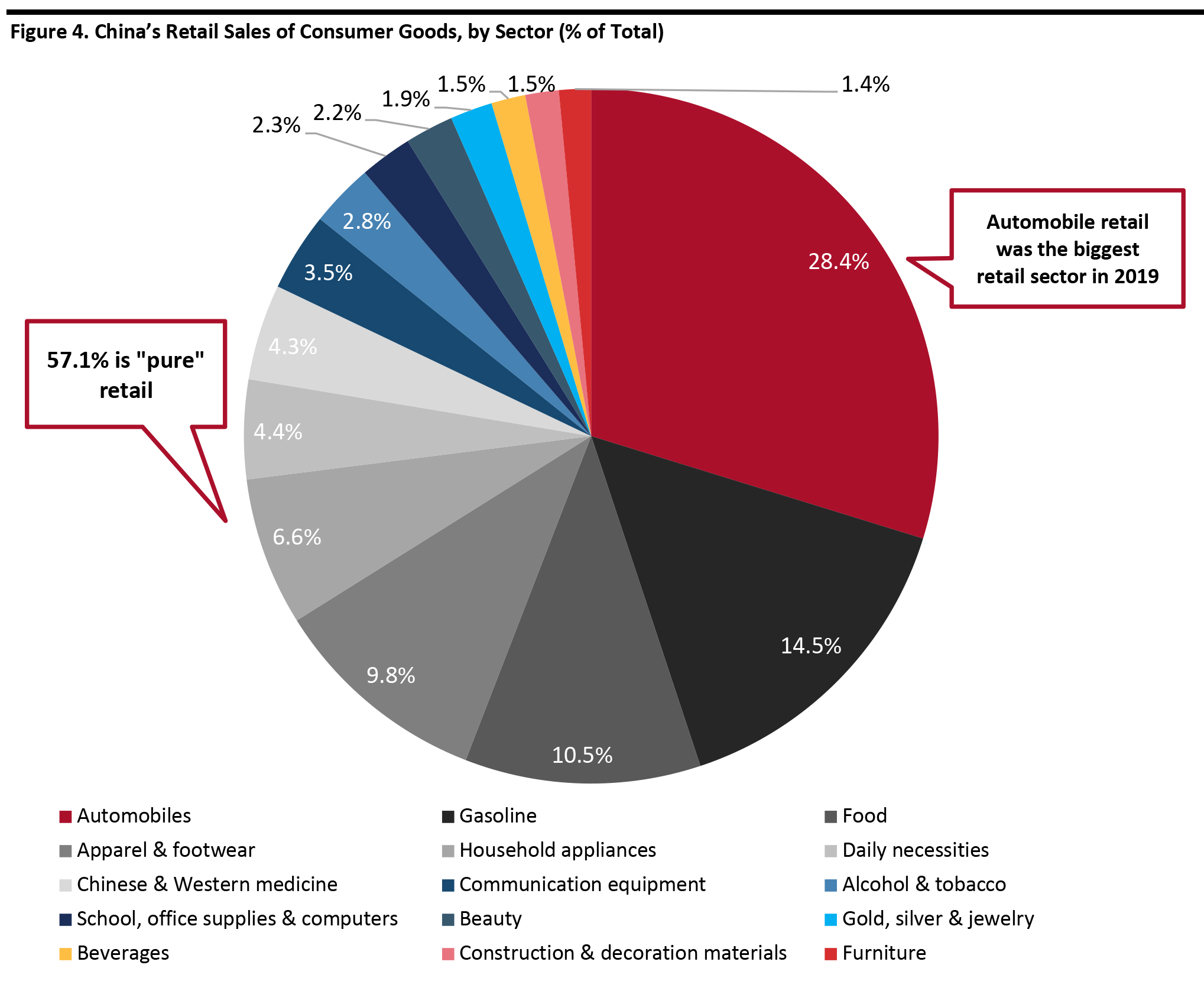

- The four biggest sectors in China’s retail market are automobiles (28.4% of 2019 retail sales), gasoline and related products (14.5%), food (10.5%), and apparel and footwear (9.8%).

- Excluding automobiles and gasoline as non-core retail sectors indicates that 57.1% of 2019 retail sales consisted of “pure” retail sales—consumer goods sold through shops and online.

- The sector breakdown is based on surveys from enterprises above a designated size, which refers to those with annual sales of ¥5 million (around $730,000) and above.

- Retail sales from enterprises above the aforementioned designated size accounted for around 38.0% of total retail sales in 2019, reflecting the highly fragmented nature of China’s retail market.

- Assuming that the “pure” retail contribution is the same for enterprises of all sizes (which is a considerable assumption) suggests that total core retail sales reached ¥20.8 trillion ($3 trillion) in 2019.

- The sectors with the fastest year-over-year growth from 2019 include daily necessities (13.9%), beauty (12.6%), beverages (10.4%) and food (10.2%). Daily necessities cover a wide range of everyday products, including children’s toys, eye glasses, household tableware and lighting appliances.

The sector data are for enterprises above the designated size; the overall total is for all retail sales. There is a discrepancy between the YoY % change as reported and as inferred from absolute values: The YoY % change figures given above are as reported by the National Bureau of statistics and are based on adjusted/modified values which were not publicly disclosed, according to the National Bureau of Statistics; only the unmodified absolute values were published. The National Bureau of Statistics listed one of the conditions that they might adjust the data—if the size of some enterprises got changed.

The sector data are for enterprises above the designated size; the overall total is for all retail sales. There is a discrepancy between the YoY % change as reported and as inferred from absolute values: The YoY % change figures given above are as reported by the National Bureau of statistics and are based on adjusted/modified values which were not publicly disclosed, according to the National Bureau of Statistics; only the unmodified absolute values were published. The National Bureau of Statistics listed one of the conditions that they might adjust the data—if the size of some enterprises got changed. *Ex. automobiles and gasoline

Source: National Bureau of Statistics/Coresight Research [/caption] [caption id="attachment_118759" align="aligncenter" width="700"]

The sector data are for enterprises above the designated size. Due to rounding, the total might not sum to 100%.

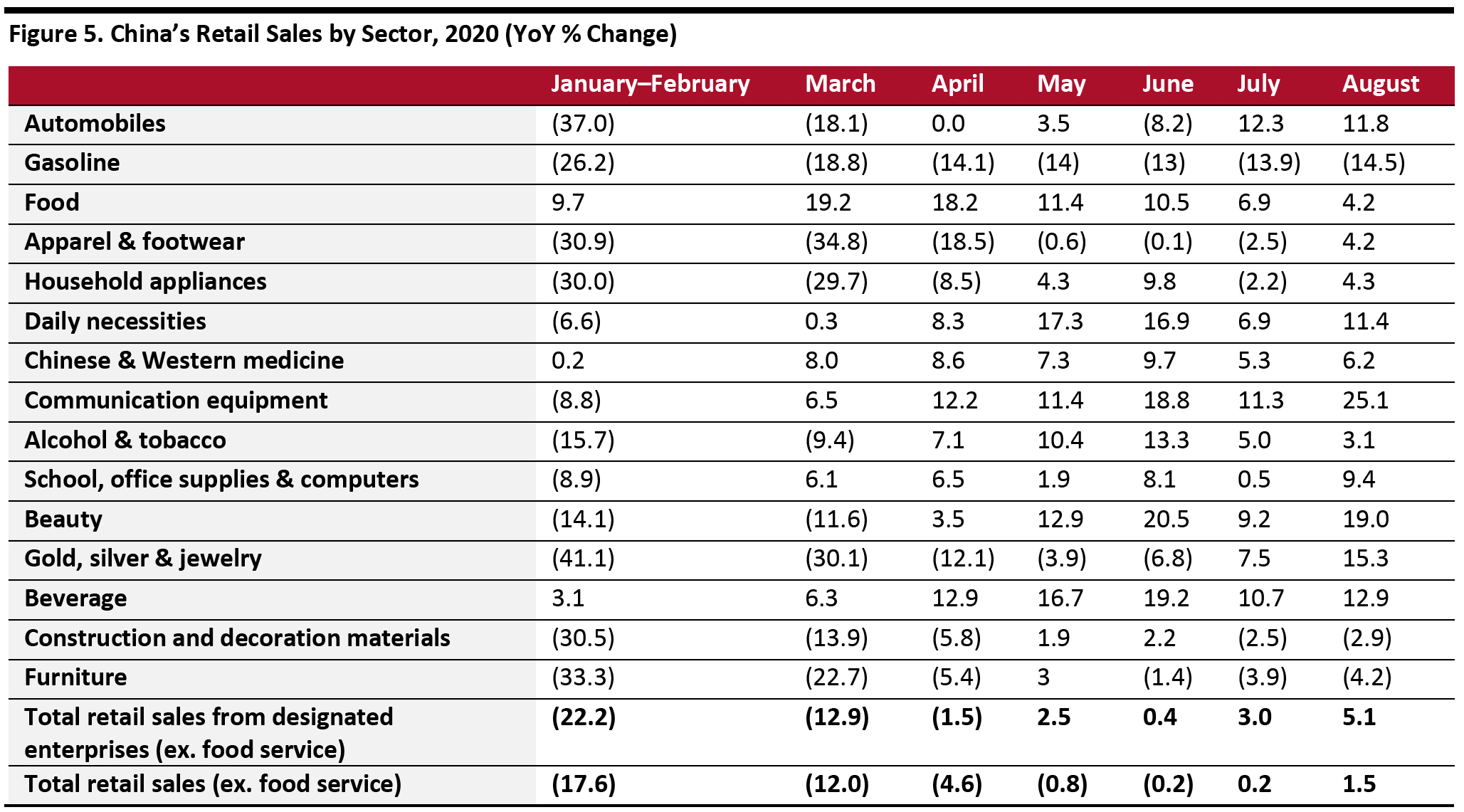

The sector data are for enterprises above the designated size. Due to rounding, the total might not sum to 100%. Source: National Bureau of Statistics/Coresight Research [/caption] Retail Performance in 2020 The sectors that experienced the highest year-over-year growth in August 2020 include communication equipment (e.g., mobile phones) retailers (25.1%), beauty retailers (19.0%), gold, silver and jewelry retailers (15.3%) and beverage retailers (12.9%). The jump in sales for gold, silver and jewelry retailers likely reflects the redirection of some luxury spending from overseas purchases to domestic purchases, amid the significant reduction in international travel. We discuss the performance of major sectors in more detail later in this report. The August growth rates are significantly higher than the growth rates in 2019 for the same sectors: communication equipment (8.5%), beauty (12.6%), gold, silver and jewelry (0.4%) and beverages (10.4%). This suggests that the August 2020 bounceback was driven in part by pent-up spending following coronavirus-related lockdowns. Growth for total retail sales from enterprises above the designated size stood at 5.1% year over year in August, compared to 1.5% for total retail. This represents the fifth consecutive month of outperformance by larger retailers—in turn implying renewed consolidation in the market. Retail sales from enterprises above the designated size accounted for around 37.9% of total retail sales in August. [caption id="attachment_118760" align="aligncenter" width="700"]

Sector data are for enterprises above the designated size.

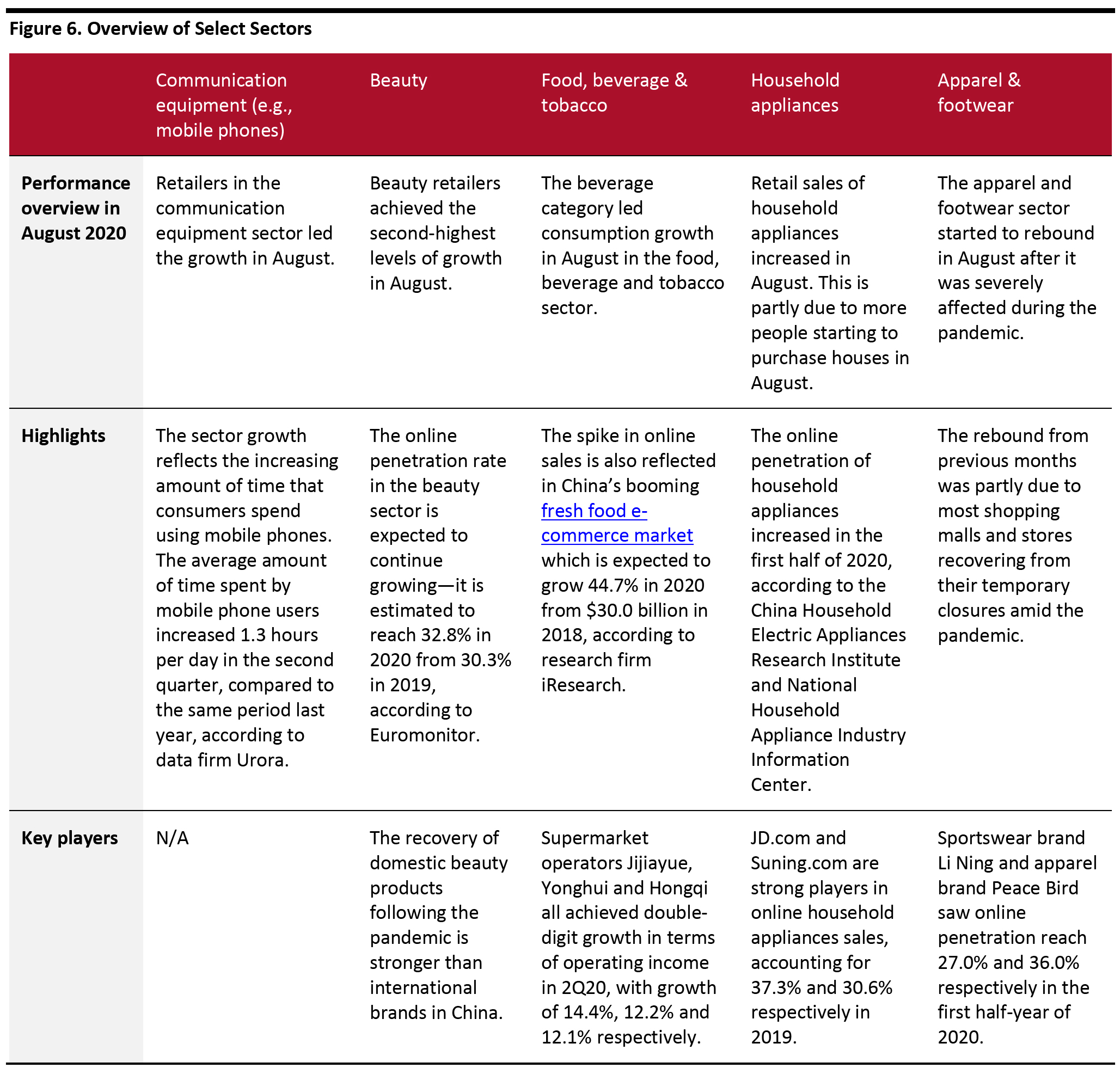

Sector data are for enterprises above the designated size. Source: National Bureau of Statistics [/caption] For the remainder of 2020 and into 2021, depressed rates of international travel are likely to support China’s domestic retail sales—and more so in those categories that have hitherto overindexed on purchases abroad. Our 2019 survey of Chinese travelers found that the most popular categories for purchases made abroad were (in descending order of number shopper numbers) fragrances and beauty, clothing, footwear and accessories, health supplements and vitamins, electronics, alcoholic drinks, and jewelry and watches. In Figure 6 below, we provide an overview of select retail sectors. We include the communication equipment and beauty sectors as these were among the fastest growth sectors in August. We group food, tobacco and alcohol categories into the food, beverage and tobacco sector to gain a full picture of this market. We include the household appliances and apparel and footwear sectors as they were the highest-growth sectors in 2019. [caption id="attachment_118761" align="aligncenter" width="700"]

Source: Company reports/China Household Electric Appliances Research Institute/Euromonitor/National Bureau of Statistics/National Household Appliance Industry Information Center/iResearch/Urora/Coresight Research[/caption]

Source: Company reports/China Household Electric Appliances Research Institute/Euromonitor/National Bureau of Statistics/National Household Appliance Industry Information Center/iResearch/Urora/Coresight Research[/caption]

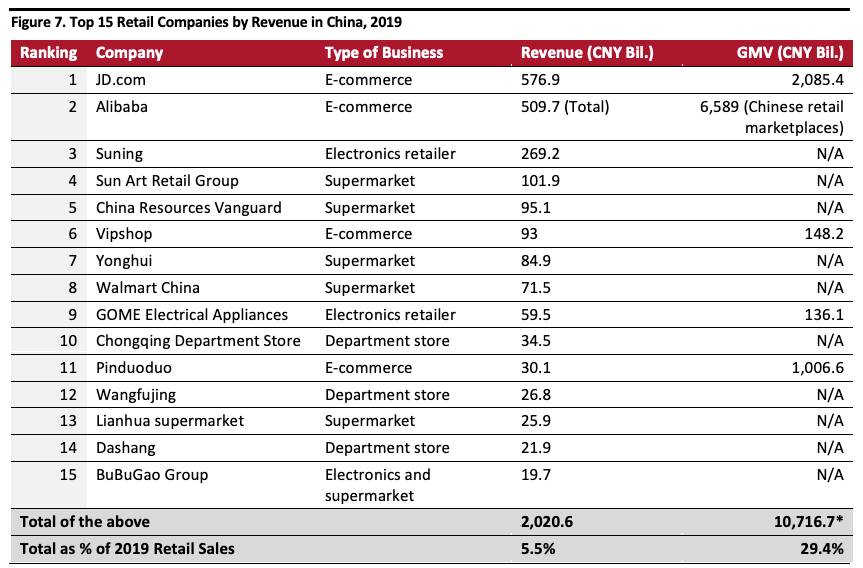

China’s Leading Retail Companies

We rank the top 15 retail companies in China, based on revenue data from their annual reports and data from the General Chamber of Commerce and National Commercial Information Center in China.- The combined revenue generated by China’s top 15 retail companies exceeded ¥2.0 trillion (around $301.5 billion) in 2019.

- This revenue is equivalent to 5.5% of total retail sales in 2019, underscoring the highly fragmented nature of the total market. Although using GMV for major e-commerce marketplaces increases this total share radically, as shown in the table below, the GMV of those marketplaces represents the sales of a large number of third-party sellers.

- The revenues of the top 15 companies increased by 17.6% year over year in 2019—well ahead of the 7.9% increase in total retail sales, reflecting ongoing consolidation of the market.

- The table below ranks companies by revenue. Alibaba has a considerably larger GMV than JD.com: Alibaba reported GMV of ¥6.6 trillion ($984.7 billion) for its Chinese retail marketplaces in the year ended March 2020 while JD.com reported GMV of nearly ¥2.09 trillion ($311.1 billion).

*The sum of GMV and revenue where GMV is not provided/relevant

*The sum of GMV and revenue where GMV is not provided/relevant Source: Company reports/China General Chamber of Commerce/China National Commercial Information Center/Coresight Research [/caption]

Channels and Sectors: Reviewing Performance

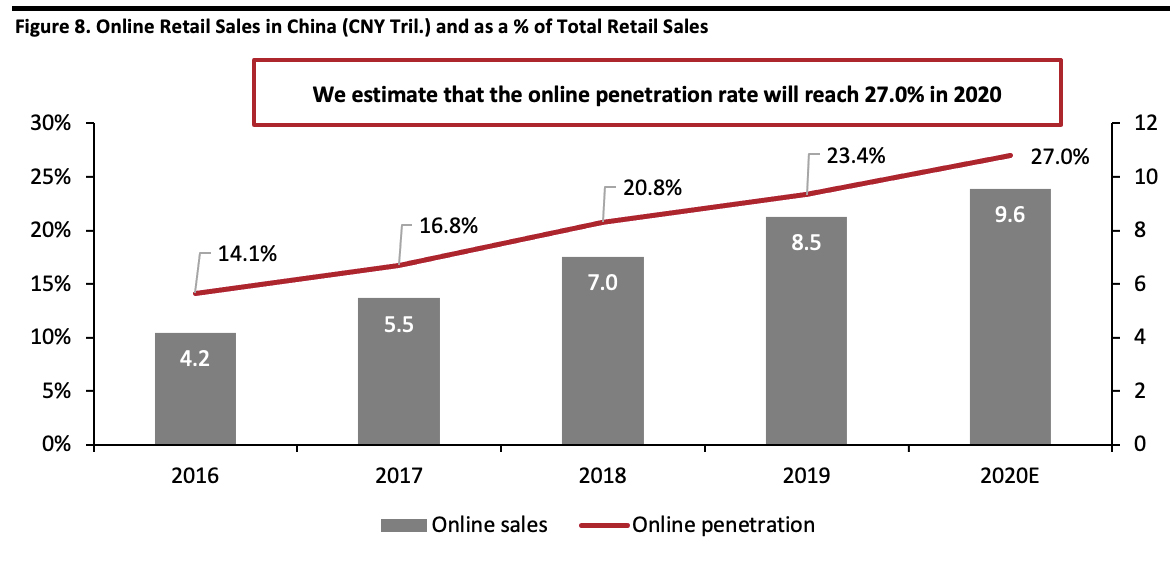

Online Shopping Continues to Grow- Online retail sales reached ¥8.5 trillion ($1.3 trillion) in 2019, an increase of 19.5% year over year but a slowdown of six percentage points from the growth rate in 2018, according to the National Bureau of Statistics.

- We estimate that online retail sales will account for more than one-quarter of all retail sales for the first time in 2020. E-commerce accounted for 23.4% of total retail sales in 2019, and we estimate that online penetration will reach around 27% in 2020.

- We expect e-commerce to be a major driver of consolidation in the retail sector, due to the online channel’s rapid growth, the scalability of online retail operations and the highly concentrated nature of e-commerce in China—we estimate that Alibaba (through its various platforms) and JD.com accounted for around 70% of online retail sales in China in 2019. Multicategory online platforms such as Tmall and JD.com are by far the biggest beneficiaries of channel shifts and are driving consolidation.

- As e-commerce captures a greater share of the growing retail market (excluding Covid-hit 2020), we see opportunities for more specialized platforms—such as Jiuxian for wine and Babytree for parent-and-baby products—to meaningfully build a share of retail sales.

Source: National Bureau of Statistics/Coresight Research[/caption]

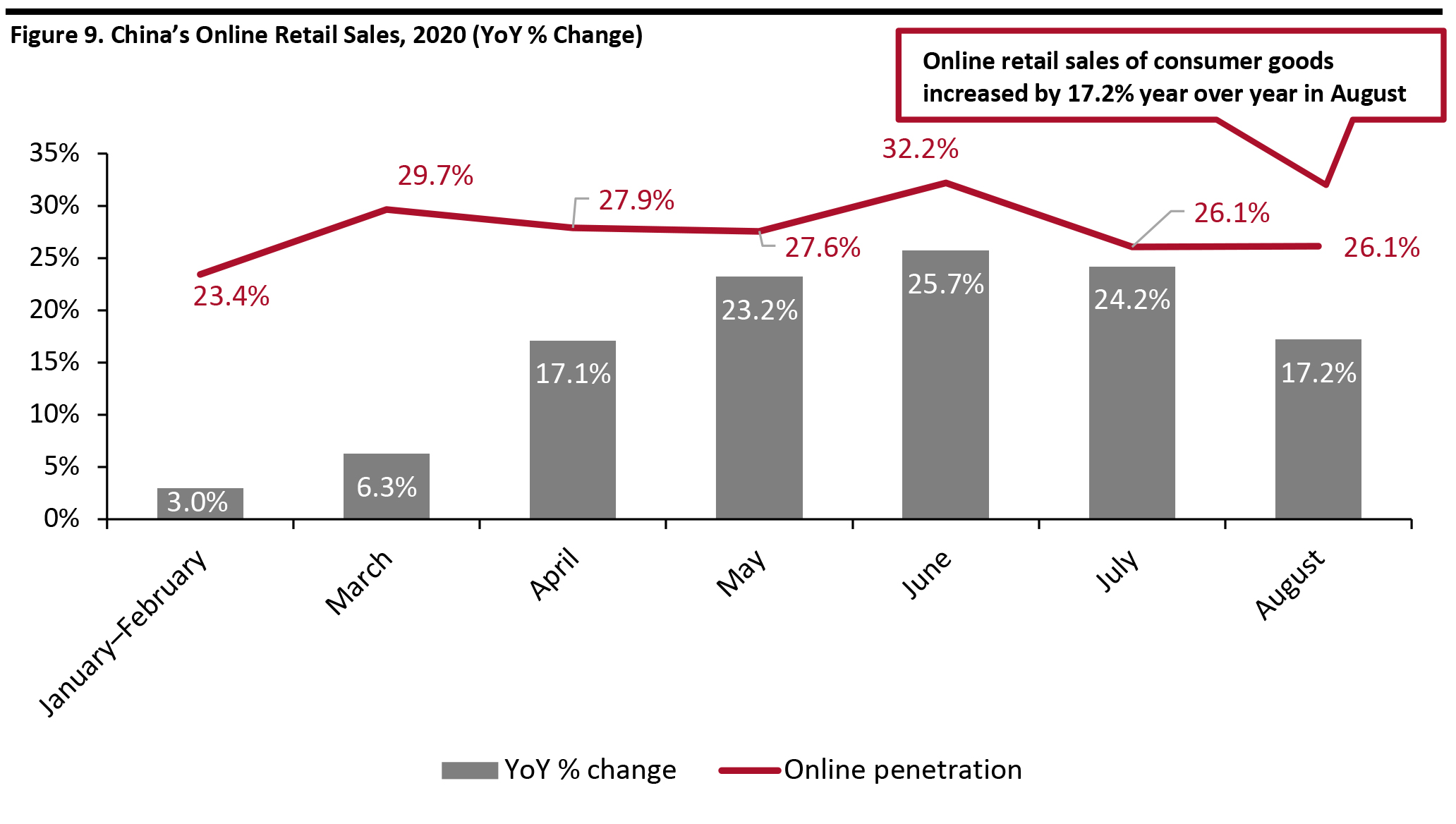

In August 2020, online retail sales of consumer goods increased by 17.2% year over year to ¥763.3 billion (around $114.2 billion), slowing from a 24.2% rise in July. The growth rate of online sales slowed from June to August, partly due to consumers returning to stores to shop as they reopened after temporary coronavirus-related closures.

Driven by the growth of online shopping, the express delivery business has grown rapidly. According to data from the State Post Bureau in China, the business volume of express-service companies across the country reached 7.24 billion in August, a 36.5% year-over-year increase.

[caption id="attachment_118766" align="aligncenter" width="700"]

Source: National Bureau of Statistics/Coresight Research[/caption]

In August 2020, online retail sales of consumer goods increased by 17.2% year over year to ¥763.3 billion (around $114.2 billion), slowing from a 24.2% rise in July. The growth rate of online sales slowed from June to August, partly due to consumers returning to stores to shop as they reopened after temporary coronavirus-related closures.

Driven by the growth of online shopping, the express delivery business has grown rapidly. According to data from the State Post Bureau in China, the business volume of express-service companies across the country reached 7.24 billion in August, a 36.5% year-over-year increase.

[caption id="attachment_118766" align="aligncenter" width="700"] Source: National Bureau of Statistics/Coresight Research[/caption]

High Demand for Communication Equipment

The growth of retail sales in the communications sector, which was up one-quarter in August, was partly due to increased usage of mobile phones among consumers under stay-at-home restrictions.

The average amount of time spent using mobile phones was six hours per day in the second quarter of 2020, according to data firm Urora—representing a decrease of 0.7 hours compared to the first quarter but a 1.3 hour increase compared to the second quarter of 2019.

Consumers are also more likely to discover the shortcomings of existing mobile phones while using them for longer periods of time, thus driving upgrades among smartphone users.

Domestic Players Lead Growth in the Beauty Sector on Tmall

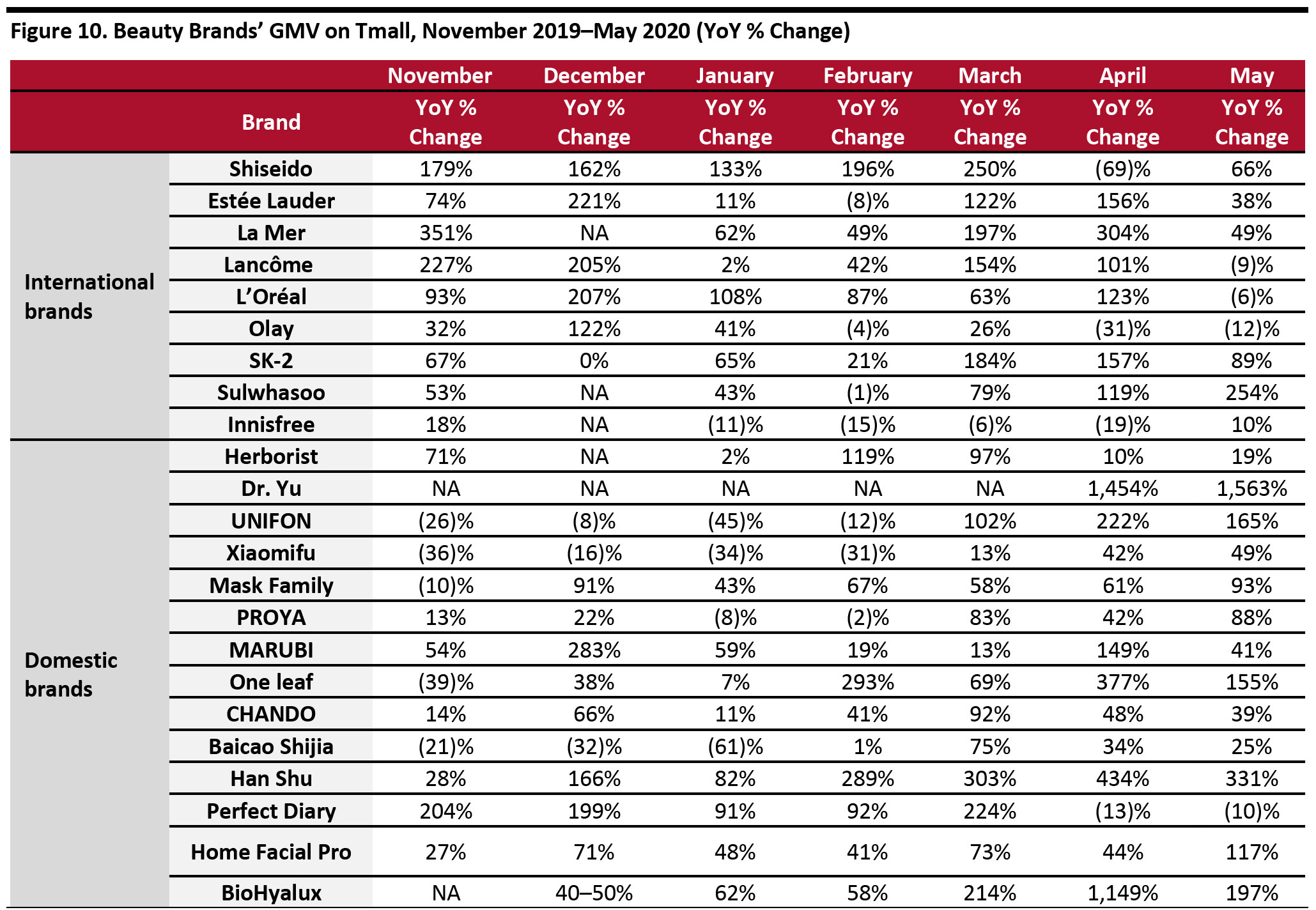

Beauty retailers saw double-digit growth in August. The recovery of domestic beauty products after the pandemic is stronger than international brands on online platforms. For instance, Chinese brand Dr. Yu achieved four-digit GMV growth on Tmall in April and May, rising by 1,563% and 1,454% each month.

This strong performance also reflects the brand’s innovations to cater for changing consumer needs. For instance, some consumers reported skin concerns related to extensive mask use. The Dr. Yu brand responding quickly by launching a skincare product specifically designed for “masked faces”—the Dr. Yu Centella Asiatica Relief Repairing Mask. It became the most popular product among beauty and skincare goods on Tmall in February. The company also sold 1.56 million units of the product in a 12-hour livestreaming session on Taobao hosted by key opinion leader Waterdrop.

Five of the nine selected international beauty brands in Figure 10 saw declining online sales growth from April to May, compared to half of domestic brands during the same period. This is partly due to consumers turning to offline channels to shop beauty products.

Chinese brand Perfect Diary opened at least eight brick-and-mortar stores from May to June this year, and the beauty brand planned to open over 200 stores throughout 2020. Another niche domestic beauty player, The Colorist, opened more than 25 new stores between May and June.

[caption id="attachment_118803" align="aligncenter" width="700"]

Source: National Bureau of Statistics/Coresight Research[/caption]

High Demand for Communication Equipment

The growth of retail sales in the communications sector, which was up one-quarter in August, was partly due to increased usage of mobile phones among consumers under stay-at-home restrictions.

The average amount of time spent using mobile phones was six hours per day in the second quarter of 2020, according to data firm Urora—representing a decrease of 0.7 hours compared to the first quarter but a 1.3 hour increase compared to the second quarter of 2019.

Consumers are also more likely to discover the shortcomings of existing mobile phones while using them for longer periods of time, thus driving upgrades among smartphone users.

Domestic Players Lead Growth in the Beauty Sector on Tmall

Beauty retailers saw double-digit growth in August. The recovery of domestic beauty products after the pandemic is stronger than international brands on online platforms. For instance, Chinese brand Dr. Yu achieved four-digit GMV growth on Tmall in April and May, rising by 1,563% and 1,454% each month.

This strong performance also reflects the brand’s innovations to cater for changing consumer needs. For instance, some consumers reported skin concerns related to extensive mask use. The Dr. Yu brand responding quickly by launching a skincare product specifically designed for “masked faces”—the Dr. Yu Centella Asiatica Relief Repairing Mask. It became the most popular product among beauty and skincare goods on Tmall in February. The company also sold 1.56 million units of the product in a 12-hour livestreaming session on Taobao hosted by key opinion leader Waterdrop.

Five of the nine selected international beauty brands in Figure 10 saw declining online sales growth from April to May, compared to half of domestic brands during the same period. This is partly due to consumers turning to offline channels to shop beauty products.

Chinese brand Perfect Diary opened at least eight brick-and-mortar stores from May to June this year, and the beauty brand planned to open over 200 stores throughout 2020. Another niche domestic beauty player, The Colorist, opened more than 25 new stores between May and June.

[caption id="attachment_118803" align="aligncenter" width="700"] Source: Tao Data/Anxin Research[/caption]

Online Penetration Rate Continues To Rise

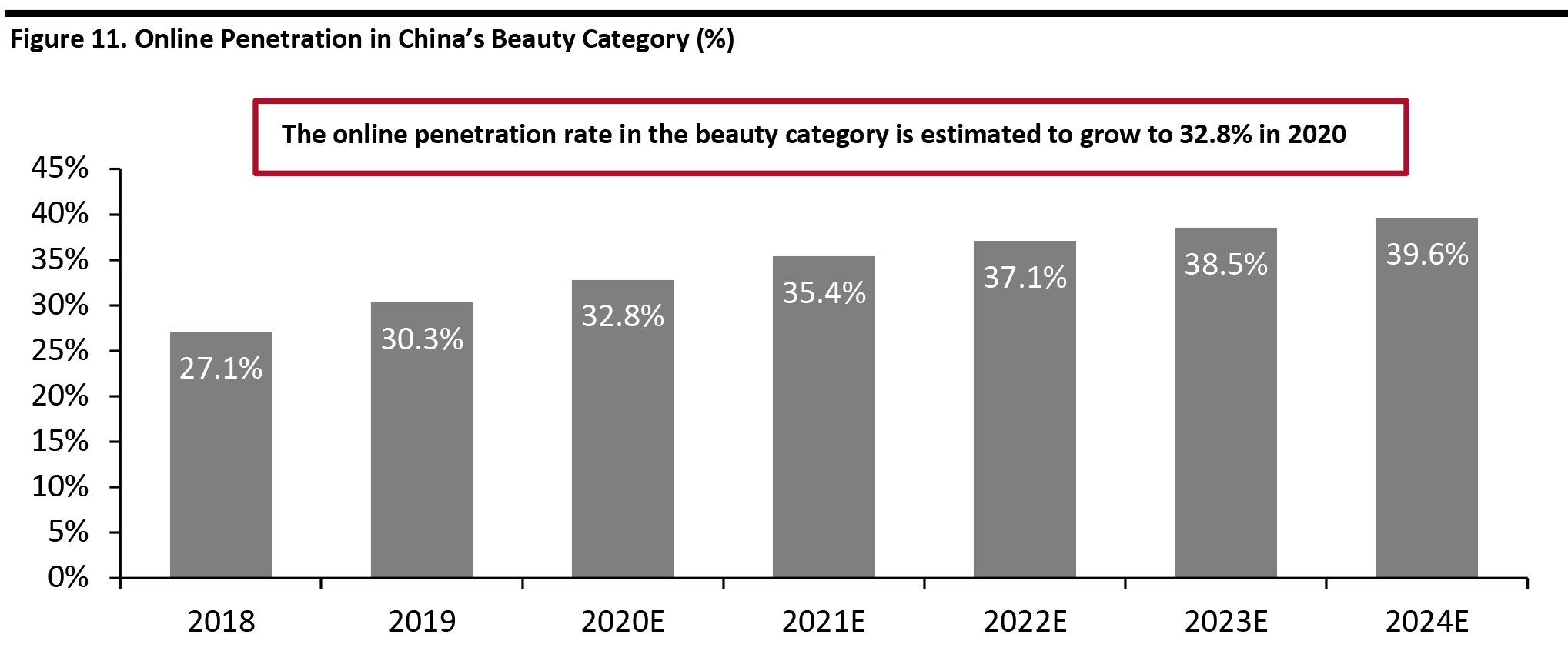

The online penetration rate in the beauty category is estimated to grow to 32.8% in 2020 from 30.3% in 2019, according to Euromonitor International. This growth will be supported by the newly added digital users and greater channel adoption in the wake of Covid-19.

[caption id="attachment_118768" align="aligncenter" width="700"]

Source: Tao Data/Anxin Research[/caption]

Online Penetration Rate Continues To Rise

The online penetration rate in the beauty category is estimated to grow to 32.8% in 2020 from 30.3% in 2019, according to Euromonitor International. This growth will be supported by the newly added digital users and greater channel adoption in the wake of Covid-19.

[caption id="attachment_118768" align="aligncenter" width="700"] Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

Food, Beverage & Tobacco: Growth in Both Online and Offline Channels

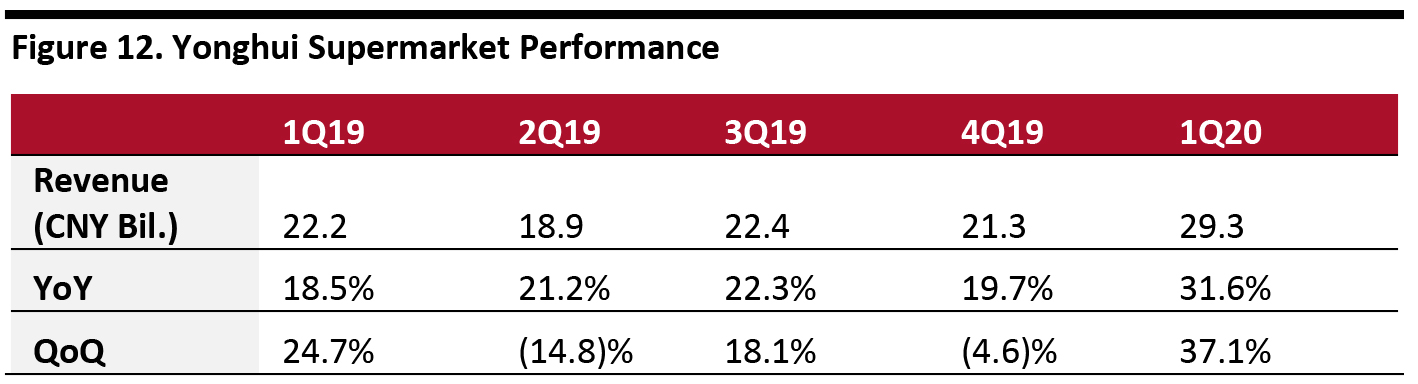

Selling essential items, the food, beverage and tobacco sector has seen growth in both online and offline channels. Revenue growth among several grocery retailers reached higher levels than pre-Covid. For instance, China’s Yonghui supermarket retailer saw its revenue grow 31.6% year over year in the first quarter of 2020, to ¥29.3 billion ($4.4 billion). This year-over-year growth rate is higher than last year’s figure of 18.5%.

[caption id="attachment_118769" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

Food, Beverage & Tobacco: Growth in Both Online and Offline Channels

Selling essential items, the food, beverage and tobacco sector has seen growth in both online and offline channels. Revenue growth among several grocery retailers reached higher levels than pre-Covid. For instance, China’s Yonghui supermarket retailer saw its revenue grow 31.6% year over year in the first quarter of 2020, to ¥29.3 billion ($4.4 billion). This year-over-year growth rate is higher than last year’s figure of 18.5%.

[caption id="attachment_118769" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Food, tobacco and alcohol saw relative decreases in the year-over-year growth rate in retail sales: Food saw 4.2% growth in August 2020 compared to 5.1% in 2019, whereas the tobacco and alcohol category saw a 3.1% increase in August compared to 3.3% year-over-year growth in 2019. Specifically, the growth rate of retail sales from the food sector has seen a continuous decline since March. This is likely due to consumers not stockpiling food after stores reopened in March.

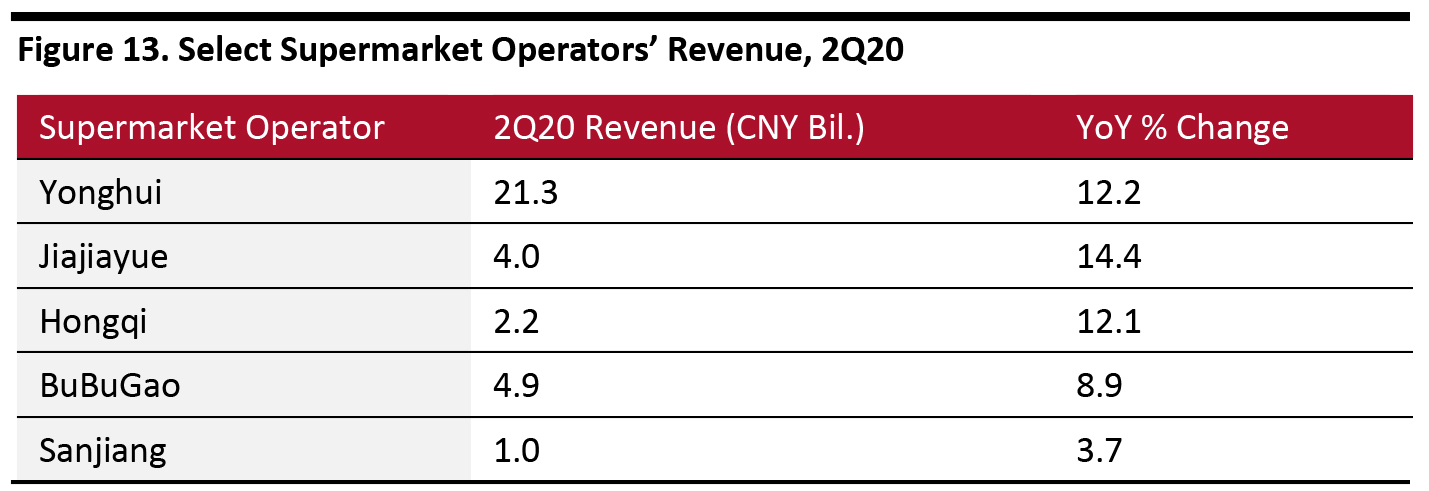

Strong Players Among Supermarket Operators

Retail sales in supermarkets from enterprises above the designated size increased by 3.8% year over year in the second quarter of 2020, up from 1.9% in the previous quarter, according to the National Bureau of Statistics in China. The 3.8% increase is lower than growth rate of total retail sales in food and lower than the levels witnessed by four of the five select supermarket retailers in Figure 13. The discrepancy is likely due to increasing grocery sales from fresh food e-commerce players, such as online fresh food grocer Miss Fresh. The grocer reported that transaction volumes on its WeChat mini-program grew by 465% during January 24 to 31, 2020.

The select supermarket operators in Figure 13 all achieved double-digit year-over-year revenue growth in 2Q20. These players will continue to focus on expanding their business to meet consumers’ growing demand, according to their company reports. For instance, Yonghui plans to open 150 new stores throughout 2020.

[caption id="attachment_118770" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Food, tobacco and alcohol saw relative decreases in the year-over-year growth rate in retail sales: Food saw 4.2% growth in August 2020 compared to 5.1% in 2019, whereas the tobacco and alcohol category saw a 3.1% increase in August compared to 3.3% year-over-year growth in 2019. Specifically, the growth rate of retail sales from the food sector has seen a continuous decline since March. This is likely due to consumers not stockpiling food after stores reopened in March.

Strong Players Among Supermarket Operators

Retail sales in supermarkets from enterprises above the designated size increased by 3.8% year over year in the second quarter of 2020, up from 1.9% in the previous quarter, according to the National Bureau of Statistics in China. The 3.8% increase is lower than growth rate of total retail sales in food and lower than the levels witnessed by four of the five select supermarket retailers in Figure 13. The discrepancy is likely due to increasing grocery sales from fresh food e-commerce players, such as online fresh food grocer Miss Fresh. The grocer reported that transaction volumes on its WeChat mini-program grew by 465% during January 24 to 31, 2020.

The select supermarket operators in Figure 13 all achieved double-digit year-over-year revenue growth in 2Q20. These players will continue to focus on expanding their business to meet consumers’ growing demand, according to their company reports. For instance, Yonghui plans to open 150 new stores throughout 2020.

[caption id="attachment_118770" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

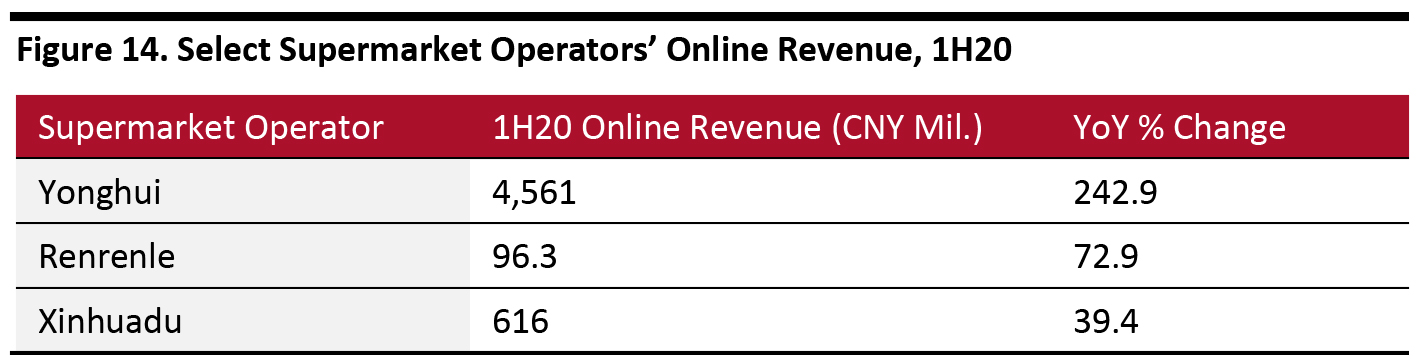

Food and beverage retailers also saw good performance in online channels. For instance, BuBuGao saw its GMV reach ¥3.3 billion ($494.8 million) in the first half of 2020, exceeding 2019’s full-year GMV of ¥2.3 billion ($344.8 million). Other supermarket operators, such as Yonghui, also saw online revenue growth, as shown in Figure 14.

[caption id="attachment_118771" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Food and beverage retailers also saw good performance in online channels. For instance, BuBuGao saw its GMV reach ¥3.3 billion ($494.8 million) in the first half of 2020, exceeding 2019’s full-year GMV of ¥2.3 billion ($344.8 million). Other supermarket operators, such as Yonghui, also saw online revenue growth, as shown in Figure 14.

[caption id="attachment_118771" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

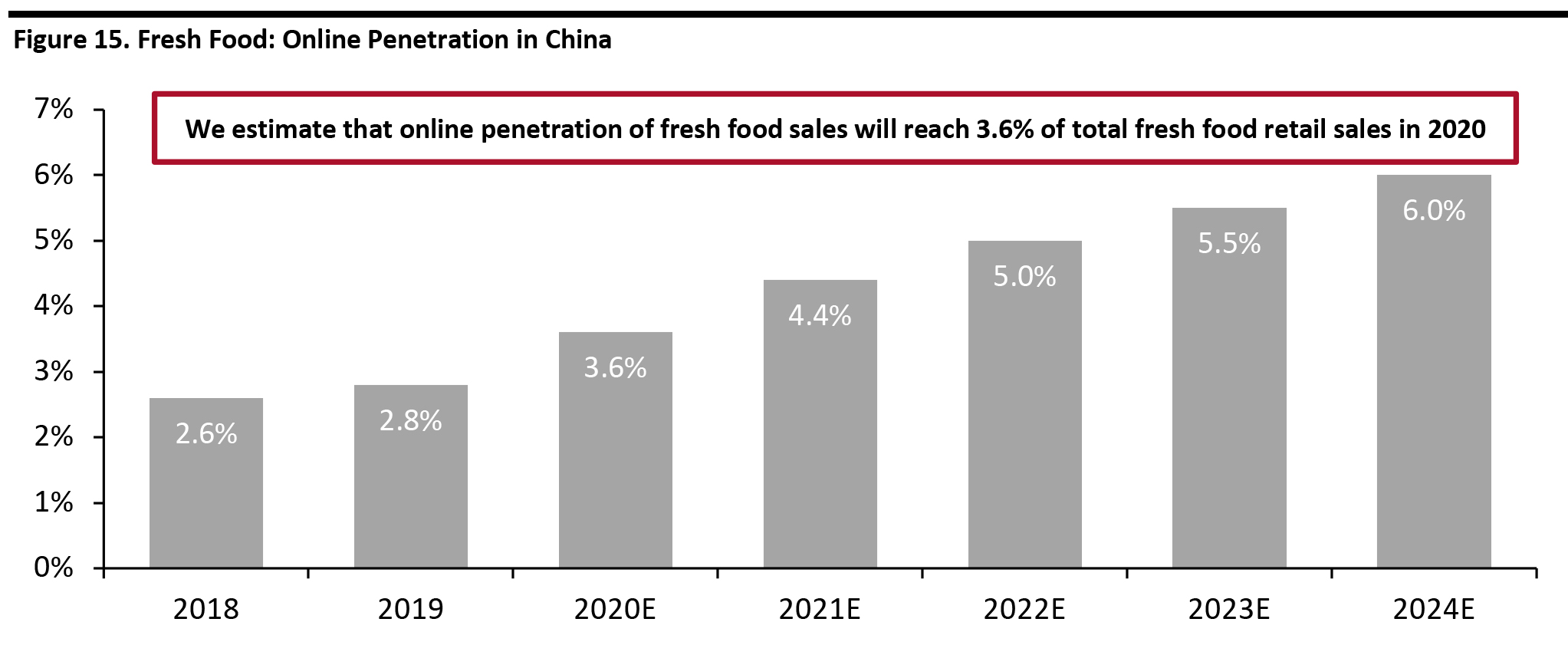

China’s booming fresh food e-commerce market is expected to grow 44.7% to ¥404.7 billion (around $59.3 billion) in 2020, from ¥204.5 billion (around $30.0 billion) in 2018, according to data from research firm iResearch and Coresight Research. This estimate was made after the Covid-19 outbreak.

The online penetration of fresh food sales is expected to reach 3.6% of total retail sales of fresh food in 2020, according to iResearch.

[caption id="attachment_118772" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

China’s booming fresh food e-commerce market is expected to grow 44.7% to ¥404.7 billion (around $59.3 billion) in 2020, from ¥204.5 billion (around $30.0 billion) in 2018, according to data from research firm iResearch and Coresight Research. This estimate was made after the Covid-19 outbreak.

The online penetration of fresh food sales is expected to reach 3.6% of total retail sales of fresh food in 2020, according to iResearch.

[caption id="attachment_118772" align="aligncenter" width="700"] Source: iResearch/Coresight Research[/caption]

Growing Retail Sales in Household Appliances

Appliance retailers returned to positive growth in August, partly due to more people starting to purchase houses in August than in July. Real estate sales in August decreased by 3.3% year over year, compared to a 5.8% year over year decline in July, according to the National Bureau of Statistics.

Looking ahead, the rebound in household appliances is likely to be partly due to consumer willingness to buy houses. The restoration of medium- and long-term loans was also partly due to consumers requiring loans to buy houses. Medium- and long-term loans increased by ¥557.1 billion ($81.7 billion) in August from July—an increase of ¥103.1 billion ($15.1 billion) compared to the same period last year, according to China’s Central Bank.

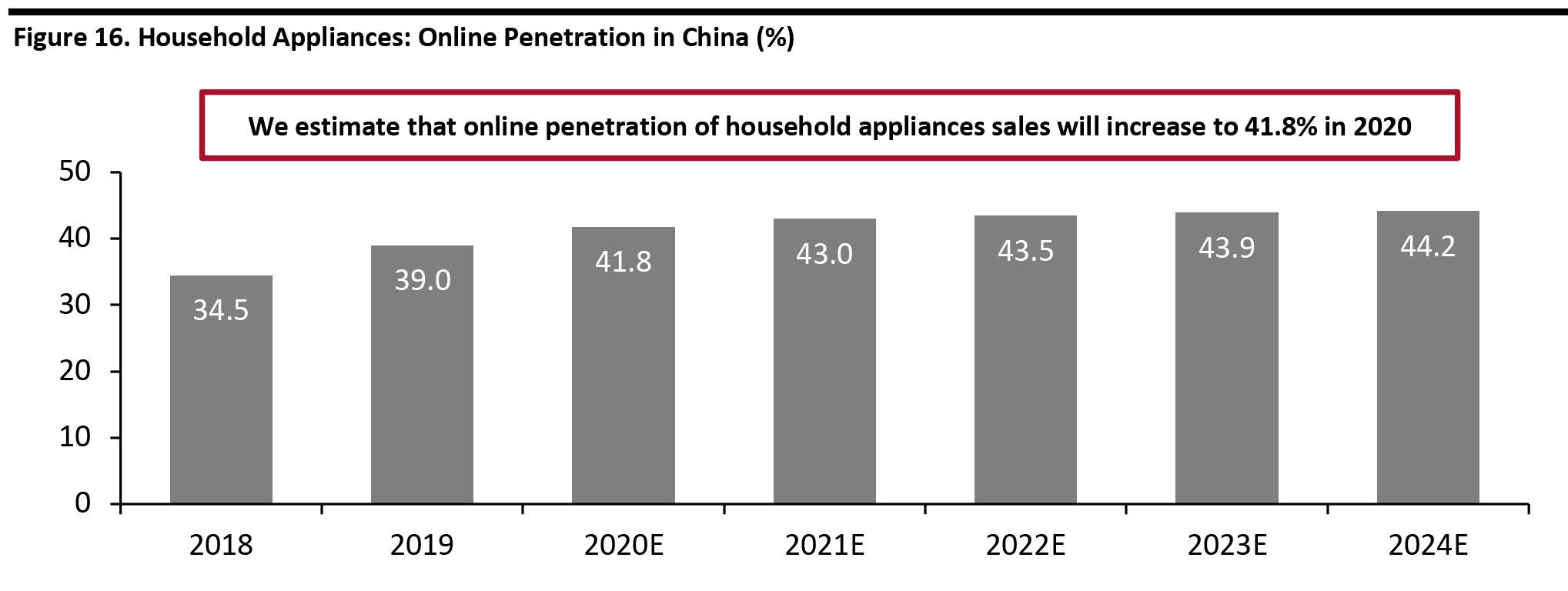

Increasing Online Penetration

We estimate that online penetration of household appliances will increase to 41.8% in 2020, up three percentage points from 2019, based on historical data from iResearch.

[caption id="attachment_118773" align="aligncenter" width="700"]

Source: iResearch/Coresight Research[/caption]

Growing Retail Sales in Household Appliances

Appliance retailers returned to positive growth in August, partly due to more people starting to purchase houses in August than in July. Real estate sales in August decreased by 3.3% year over year, compared to a 5.8% year over year decline in July, according to the National Bureau of Statistics.

Looking ahead, the rebound in household appliances is likely to be partly due to consumer willingness to buy houses. The restoration of medium- and long-term loans was also partly due to consumers requiring loans to buy houses. Medium- and long-term loans increased by ¥557.1 billion ($81.7 billion) in August from July—an increase of ¥103.1 billion ($15.1 billion) compared to the same period last year, according to China’s Central Bank.

Increasing Online Penetration

We estimate that online penetration of household appliances will increase to 41.8% in 2020, up three percentage points from 2019, based on historical data from iResearch.

[caption id="attachment_118773" align="aligncenter" width="700"] Source: iResearch/Coresight Research[/caption]

JD.com and Suning.com are strong players in the online household appliances market in China, accounting for 37.3% and 30.6% of sales, respectively, in 2019, according to China’s Household Electric Appliances Research Institute and its National Household Appliance Industry Information Center. Tmall took third place, accounting for 22.9%.

Apparel and Footwear Sector Sees Growth for the First Time Post Crisis

The apparel and footwear sector saw sales return to positive growth in August for the first time since the start of the Covid-19 crisis. In China, as in other markets, including the US, apparel retailers have seen some of the most enduring negative impacts on sales. The rebound in August was partly due to shopping malls and stores recovering following temporary closures during the pandemic.

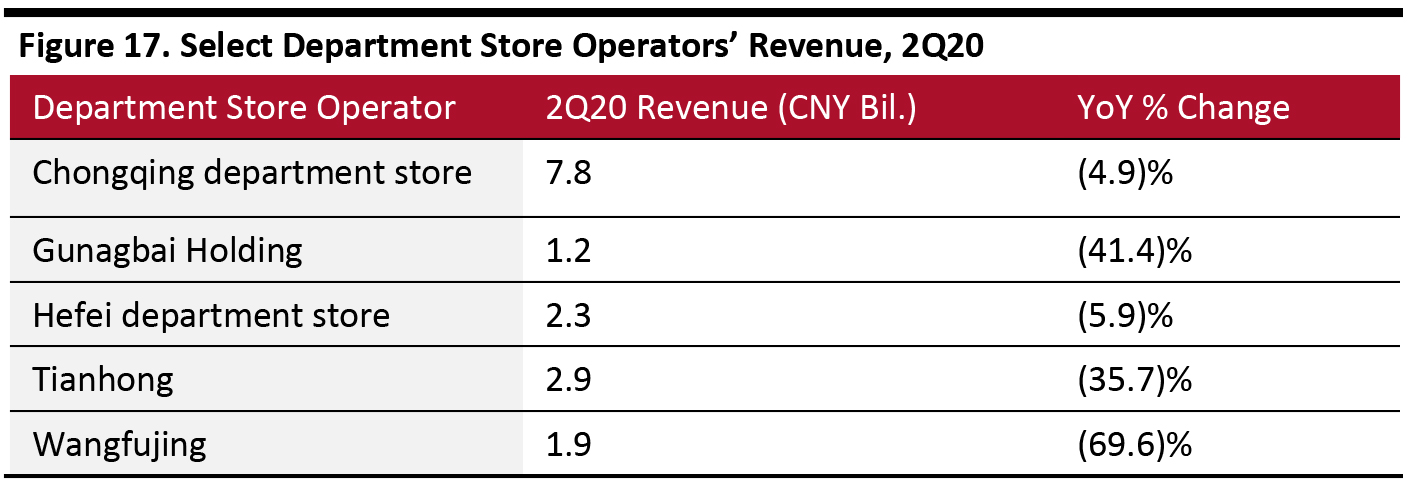

Department stores are an important sales channel for apparel and footwear retailers. Retail sales in department stores from enterprises above the designated size decreased by 23.6% year over year in the second quarter of 2020, up from a 34.9% year-over-year decline in the previous quarter.

Many department store operators are trying to use duty-free formats to increase sales. For instance, Wangfujing Group, one of China’s largest department store chains, announced in June that it has been granted a duty-free license to operate downtown duty-free shops in Beijing, Chengdu and Xi’an. Downtown duty-free stores offer more favorably priced products than traditional department stores. This format also offers more space and increased product variety compared to in-airport shops, providing a shopping experience with less time pressure.

[caption id="attachment_118774" align="aligncenter" width="700"]

Source: iResearch/Coresight Research[/caption]

JD.com and Suning.com are strong players in the online household appliances market in China, accounting for 37.3% and 30.6% of sales, respectively, in 2019, according to China’s Household Electric Appliances Research Institute and its National Household Appliance Industry Information Center. Tmall took third place, accounting for 22.9%.

Apparel and Footwear Sector Sees Growth for the First Time Post Crisis

The apparel and footwear sector saw sales return to positive growth in August for the first time since the start of the Covid-19 crisis. In China, as in other markets, including the US, apparel retailers have seen some of the most enduring negative impacts on sales. The rebound in August was partly due to shopping malls and stores recovering following temporary closures during the pandemic.

Department stores are an important sales channel for apparel and footwear retailers. Retail sales in department stores from enterprises above the designated size decreased by 23.6% year over year in the second quarter of 2020, up from a 34.9% year-over-year decline in the previous quarter.

Many department store operators are trying to use duty-free formats to increase sales. For instance, Wangfujing Group, one of China’s largest department store chains, announced in June that it has been granted a duty-free license to operate downtown duty-free shops in Beijing, Chengdu and Xi’an. Downtown duty-free stores offer more favorably priced products than traditional department stores. This format also offers more space and increased product variety compared to in-airport shops, providing a shopping experience with less time pressure.

[caption id="attachment_118774" align="aligncenter" width="700"] Source: Company reports[/caption]

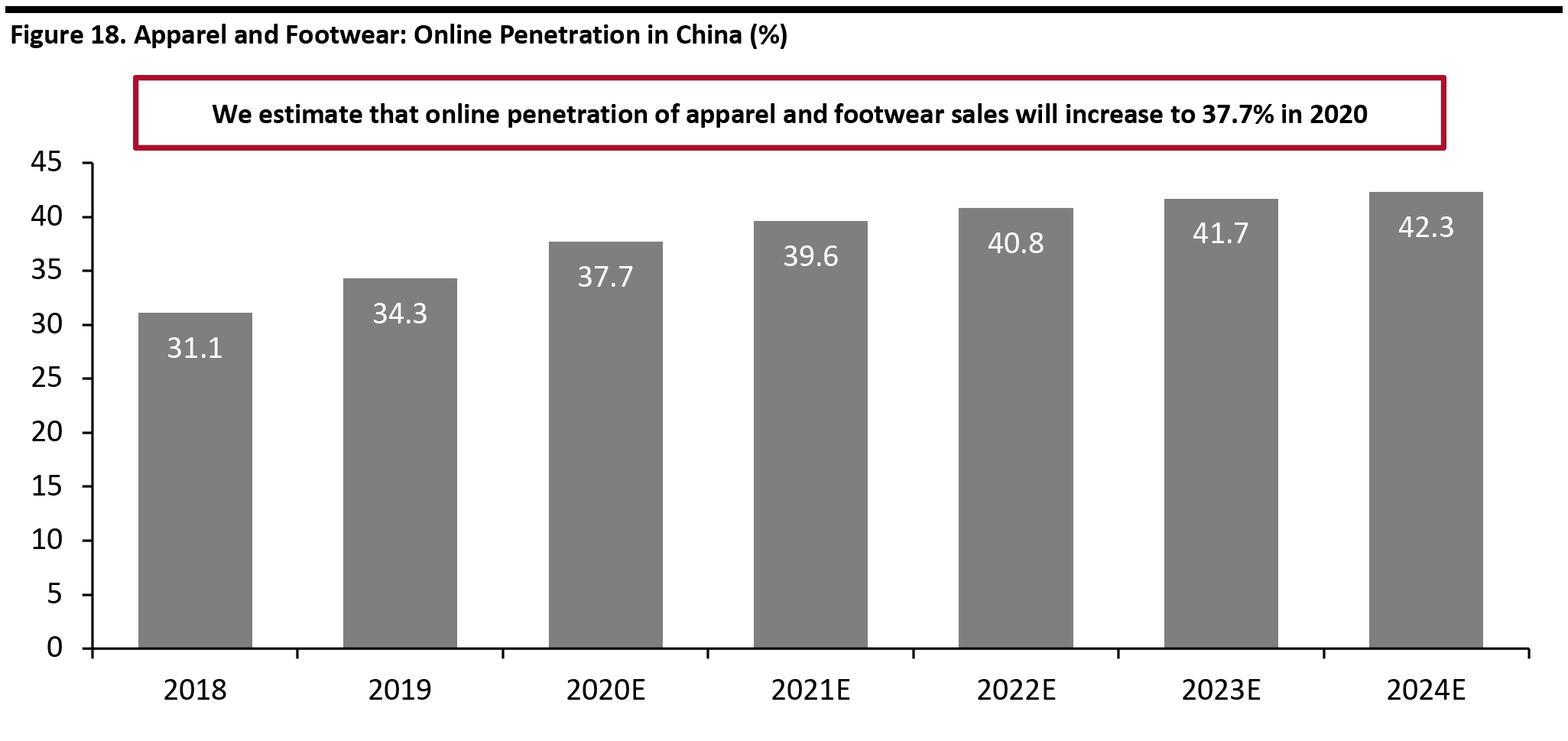

Apparel Online Sales Continue To Rise

The laggardly return to growth among store-based apparel retailers reflects not only the reduced propensity for clothing purchases but also the shift to e-commerce. On Alibaba’s Tmall and Taobao platforms in August 2020, the men’s clothing category saw year-over-year growth of 46%. Other apparel categories also saw high year-over-year growth, including women’s clothing (44%), children’s clothing (27%) and sportswear categories (17%).

We estimate that the online penetration rate in the apparel and footwear sector will reach 37.7% in 2020, up three percentage points from 2019. This estimate is based on Euromonitor International’s historical data from 2010 to 2019.

[caption id="attachment_118775" align="aligncenter" width="700"]

Source: Company reports[/caption]

Apparel Online Sales Continue To Rise

The laggardly return to growth among store-based apparel retailers reflects not only the reduced propensity for clothing purchases but also the shift to e-commerce. On Alibaba’s Tmall and Taobao platforms in August 2020, the men’s clothing category saw year-over-year growth of 46%. Other apparel categories also saw high year-over-year growth, including women’s clothing (44%), children’s clothing (27%) and sportswear categories (17%).

We estimate that the online penetration rate in the apparel and footwear sector will reach 37.7% in 2020, up three percentage points from 2019. This estimate is based on Euromonitor International’s historical data from 2010 to 2019.

[caption id="attachment_118775" align="aligncenter" width="700"] Source: Source: Euromonitor International Limited 2020 © All rights reserved/Coresight Research[/caption]

Source: Source: Euromonitor International Limited 2020 © All rights reserved/Coresight Research[/caption]

What We Think

We estimate that China’s retail market, excluding food service, will decline by 3.0% to $5.0 trillion in 2020. Total retail sales, excluding food service, saw year-over-year growth for consecutive two months in July and August—and we expect this growth to continue for the remainder of 2020, presenting many opportunities for brands and retailers.- China’s retail market remains highly fragmented: Retail companies with annual sales of ¥5 million (around $730,000) or above (enterprises above the designated size) accounted for around 38.0% of total retail sales in 2019. The combined revenue of the top 15 retail companies accounted for just 5.5% of total retail sales in 2019. Using GMV for major e-commerce marketplaces increases this share radically, to 29.4%, but those marketplaces represent the aggregated sales of many third-party sellers.

- We expect e-commerce to continue to be the major driver of consolidation in the market, due to the online channel’s rapid growth, the scalability of online retail operations and the highly concentrated nature of e-commerce in China—with Alibaba and JD.com accounting for at least a 70% share of channel sales.

- Heightened use of e-commerce in 2020 will accelerate structural channel shifts, leading to consolidation. Sustained channel shifts should bolster the online channel’s growth in the coming years. We expect online retail to account for over one-quarter of all China retail sales for the first time in 2020—specifically, 27% or $1.35 trillion. Each time e-commerce gains an extra 1% share of total retail sales, an approximate $50 billion is added to the pool for online retailers to play for.

- In turn, we anticipate a battle for a share of the e-commerce channel. While the biggest generalist platforms will inevitably drive the bulk of consolidation, we see opportunities for more specialized e-commerce platforms, too. We expect wine retailer Jiuxian and parent-and-baby product specialist Babytree to meaningfully build their shares of retail sales.

- We envisage a dual-tier online retail market, where the largest generalist platforms coexist with niche players to resonate with consumers seeking more specialized offerings. In turn, this suggests two opportunity areas for brands and retailers to capture a share of this $5 trillion segment:

- Firstly, recent trajectories suggest that near-term opportunities exist in the communication equipment, beauty and beverage sectors, as they were the fastest growth sectors in August. Household appliances and apparel and footwear sectors were the highest-growth sectors in 2019, suggesting additional opportunities.

- Secondly, as we are likely to see depressed rates of international travel for the remainder of 2020 and into 2021, there is an opportunity for retailers in the domestic market. Coresight Research’s 2019 survey of Chinese travelers indicated that the most popular categories for purchases made abroad (in descending order) were fragrances and beauty, clothing, footwear and accessories, health supplements and vitamins, electronics, alcoholic drinks, and jewelry and watches. Brands that would otherwise have sold to Chinese tourists traveling abroad must direct their efforts to serving demand within China—both online and in stores. Retailers with an existing Chinese presence should attempt to capture sales of products that consumers would likely have purchased overseas.