Nitheesh NH

What’s the Story?

The UK grocery sector has been one of the major beneficiaries of the shift in behavior amid the pandemic as consumers have spent more time at home, visited restaurants less frequently, and been on holiday less due to pandemic-related lockdowns. We discuss the size and trajectory of the UK grocery market and key drivers impacting its growth. We also analyze the performance and outlook for online grocery in the UK, as well as the overall market’s competitive landscape, retail innovators, and three themes we are watching in 2021 and beyond.UK Grocery Retail: Market Performance and Outlook

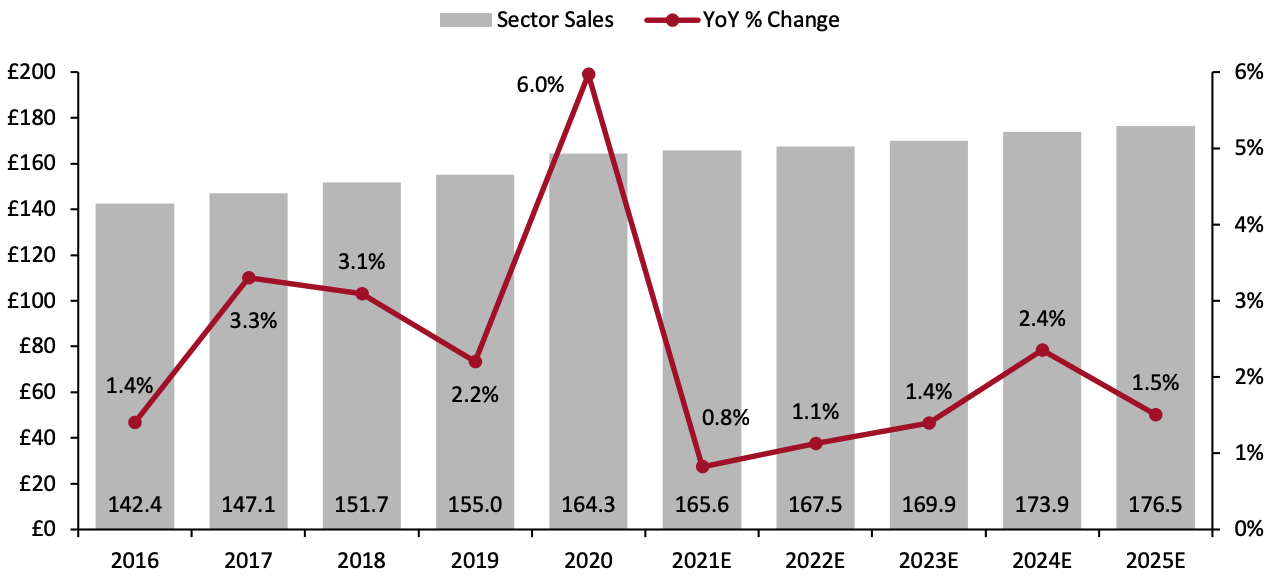

Consumer Spending Sales by UK food retailers reached £164.3 billion ($220.4 billion) in 2020, with growth of 6% year over year, we calculate from ONS data. England and the devolved nations of Northern Ireland, Scotland and Wales were under various degrees of lockdown restrictions for the first three months of 2021, which led the grocery sector to maintain its solid run following pandemic-impacted 2020. With the governments allowing restaurants and pubs to serve indoors from May, some demand has naturally ebbed away from the grocery sector. As foodservice demand has moved closer to normalcy in the second half of 2021 and as we cycle tough comparisons from 2020, we expect the market to slow to 0.8% growth in 2021 and recover modestly to 1.1% in 2022. However, we expect demand to settle at a higher level than it was historically, given that behavior changes, which have persisted for more than a year, will create tailwinds in the years ahead for food-at-home demand.Figure 1. UK Grocery Sector Size: Total Sales (Left Axis; GBP Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_136730" align="aligncenter" width="700"]

Source: ONS/Coresight Research[/caption]

Food-price inflation, which is one input into grocery sector growth, has recently been increasing—but to a still-low level (just 1.3% in October 2021) and following a run of deflation from November 2020 to July 2021.

Key Segments

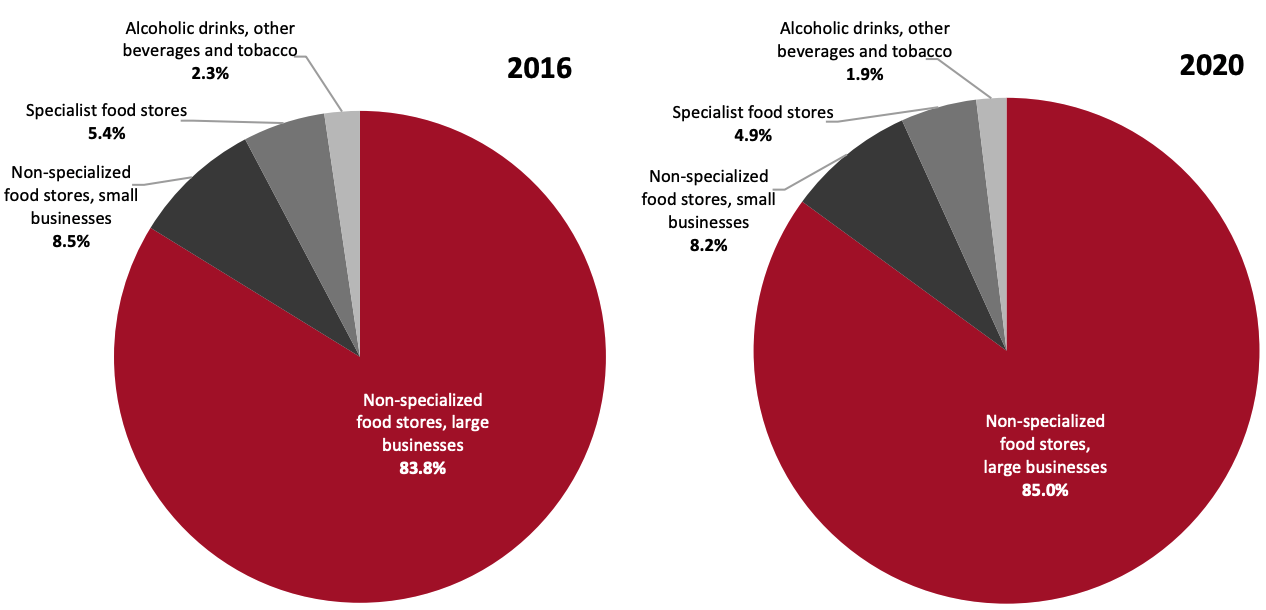

Non-specialized food stores of large businesses—which predominantly include chain convenience stores, supermarkets, superstores and hypermarkets—account for more than 80% of the UK food retail sector, according ONS.

These large grocery retailers have captured a greater share from 2016 to 2020, largely at the expense of specialist food stores, as shown in Figure 2.

Source: ONS/Coresight Research[/caption]

Food-price inflation, which is one input into grocery sector growth, has recently been increasing—but to a still-low level (just 1.3% in October 2021) and following a run of deflation from November 2020 to July 2021.

Key Segments

Non-specialized food stores of large businesses—which predominantly include chain convenience stores, supermarkets, superstores and hypermarkets—account for more than 80% of the UK food retail sector, according ONS.

These large grocery retailers have captured a greater share from 2016 to 2020, largely at the expense of specialist food stores, as shown in Figure 2.

Figure 2. Breakdown of UK Food Retail Sector by Channel Type [caption id="attachment_136731" align="aligncenter" width="700"]

Source: ONS/Coresight Research[/caption]

Market Drivers

1. Rise in Consumption of Healthy and Organic foods

The pandemic has contributed to a shift in British consumers’ preferences toward health and wellness. A significant number of consumers are turning to foods marketed as chemical-free or organic, as well as more healthy ingredients that fit in with their wellness goals.

Source: ONS/Coresight Research[/caption]

Market Drivers

1. Rise in Consumption of Healthy and Organic foods

The pandemic has contributed to a shift in British consumers’ preferences toward health and wellness. A significant number of consumers are turning to foods marketed as chemical-free or organic, as well as more healthy ingredients that fit in with their wellness goals.

- Read about other markets where we have also identified this shift in wellness focus, including the US and India.

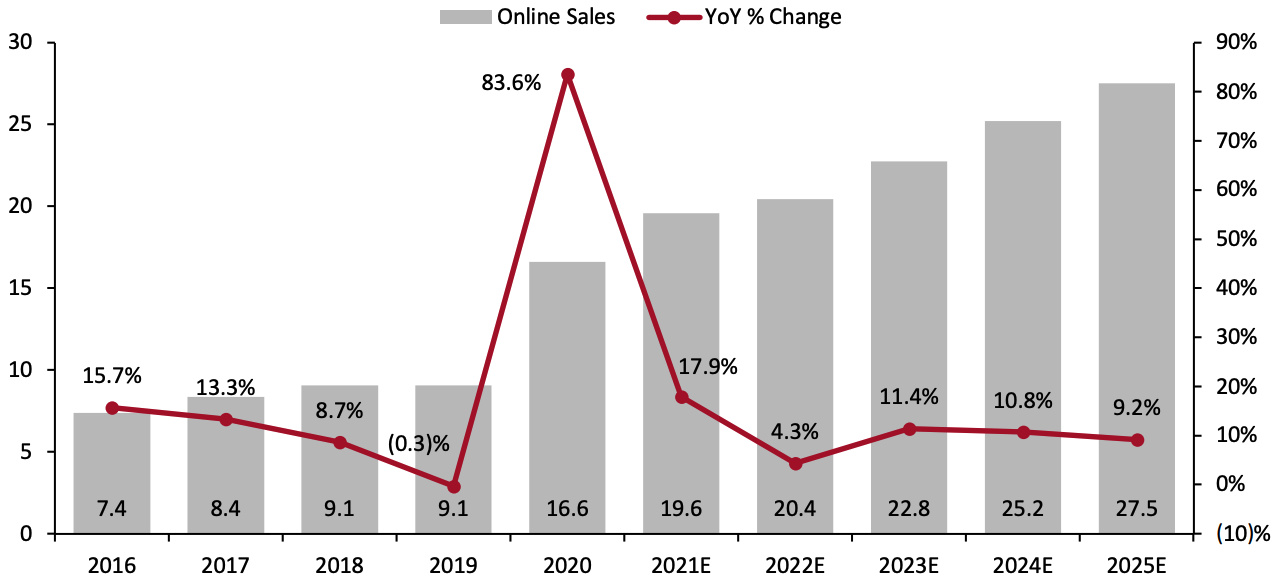

Figure 3. UK Online Grocery Sector Size: Online Sales (Left Axis; GBP Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_136742" align="aligncenter" width="700"]

Source: ONS/Coresight Research[/caption]

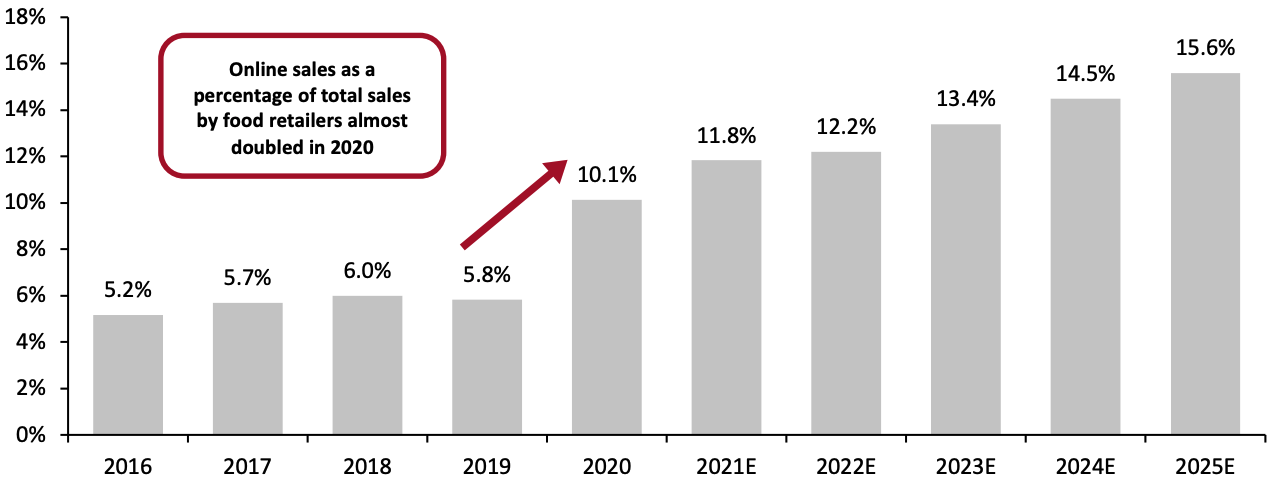

The acceleration of e-commerce in 2020 saw online sales represent 10.1% of total food retailers’ sales, almost double the penetration from 2019, according to Coresight Research estimates using ONS data, as shown in Figure 4.

Two major grocery retailers in the UK—Tesco and Sainsbury’s—reported a steep acceleration in their online penetration rates in fiscal 2021, and both continued to report further growth in the current fiscal year:

Source: ONS/Coresight Research[/caption]

The acceleration of e-commerce in 2020 saw online sales represent 10.1% of total food retailers’ sales, almost double the penetration from 2019, according to Coresight Research estimates using ONS data, as shown in Figure 4.

Two major grocery retailers in the UK—Tesco and Sainsbury’s—reported a steep acceleration in their online penetration rates in fiscal 2021, and both continued to report further growth in the current fiscal year:

- Tesco reported that its UK online sales surged by 77% to £6.3 billion ($8.6 billion) in fiscal 2021, accounting for 13.6% of its total UK revenue. In the first half of fiscal 2022, Tesco UK saw 2.3% comparable growth in online sales (although that incorporated a year-over-year dop in the second quarter).

- Sainsbury’s reported that almost 17% of its grocery sales in fiscal 2021 were online, compared with 8% in the previous fiscal year. In the first half of its current fiscal year, Sainsbury’s reported 13% growth in online grocery sales, taking e-commerce penetration to 17% versus 15% for the first half one year earlier.

Figure 4. UK Online Sales by Food Retailers (% of Total Sales) [caption id="attachment_136733" align="aligncenter" width="700"]

Source: ONS/Coresight Research[/caption]

Competitive Landscape

Offline Market Shares

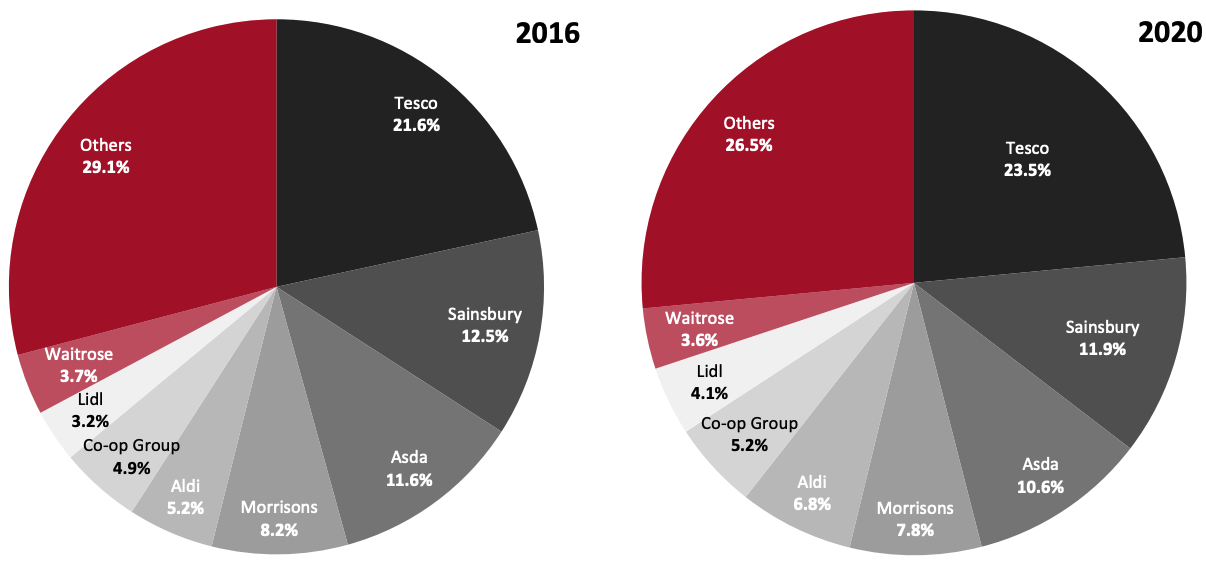

The UK grocery sector is saturated, highly consolidated and competitive. Asda, Morrisons, Sainsbury’s and Tesco are the leading supermarket chains in the UK—commonly known as the Big Four. Together they controlled over 50% of the offline market in 2020, according to Euromonitor.

Over the past decade, grocery discounters Aldi and Lidl have taken the UK by storm, stealing market share from major incumbent rivals and forcing them to take radical measures to slash costs, lower prices and overhaul their offerings. Aldi’s market share increased by 1.6 percentage points from 2016 to 2020 while Lidl’s share increased by 0.9 percentage points during the same period.

Source: ONS/Coresight Research[/caption]

Competitive Landscape

Offline Market Shares

The UK grocery sector is saturated, highly consolidated and competitive. Asda, Morrisons, Sainsbury’s and Tesco are the leading supermarket chains in the UK—commonly known as the Big Four. Together they controlled over 50% of the offline market in 2020, according to Euromonitor.

Over the past decade, grocery discounters Aldi and Lidl have taken the UK by storm, stealing market share from major incumbent rivals and forcing them to take radical measures to slash costs, lower prices and overhaul their offerings. Aldi’s market share increased by 1.6 percentage points from 2016 to 2020 while Lidl’s share increased by 0.9 percentage points during the same period.

Figure 5. UK Offline Grocery Market Share [caption id="attachment_136734" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

There has been a growing appetite from private equity players for British supermarket chains, which are seen as attractive investments because of their cash generation and freehold assets. In February 2021, Walmart sold a majority stake in Asda for an enterprise value of £6.8 billion ($9.3 billion) to the Issa brothers, founders of retailer EG Group and private equity firm TDR Capital.

On July 3, 2021, Morrisons reported that it has accepted a £6.3 billion) ($8.3 billion) takeover offer by a consortium led by Softbank-owned Fortress Investment Group, which was trumped by private equity group Clayton, Dubilier & Rice with a takeover offer of £7 billion ($9.7 billion) in August. The latter bid proved successful and Morrisons was delisted from the London Stock Exchange on October 27, 2021. That means there are just two major UK grocery retailers remaining as public companies: market leader Tesco and second-place retailer Sainsbury’s.

Online Market Shares

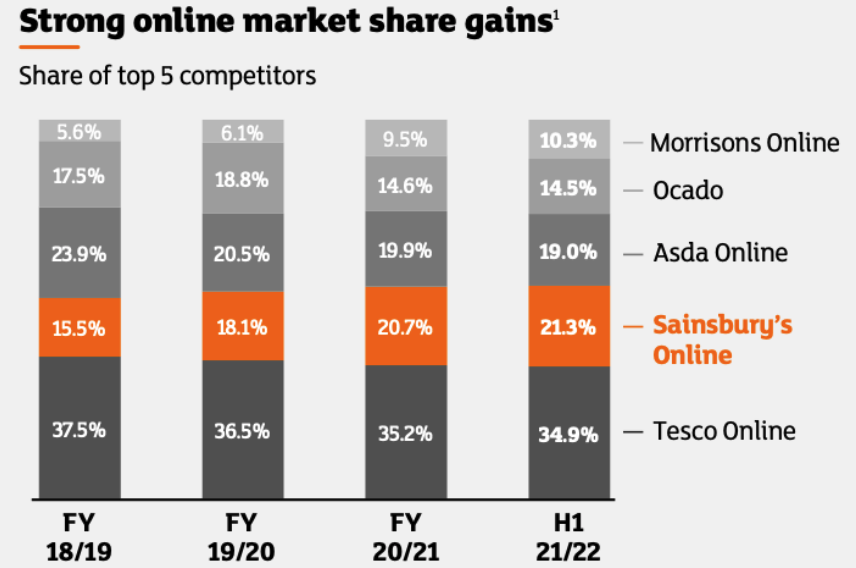

Figure 6 presents how grocery e-commerce for the five biggest online grocery retailers broke down in the retailer’s most recent fiscal years and latest half year, according to Sainsbury’s, citing Nielsen data. Sainsbury’s highlighted that it captured the second-place position from Asda in fiscal 2021.

Ocado is the online grocery pure play of note in the UK market and is in fourth place online—which confirms both the strength of the major established retailers (three of which were early to launch online) and the appeal of omnichannel propositions. Fifth-place Morrisons was late to e-commerce, having struck a deal with Ocado only in January 2014. The Nielsen data suggest that Morrisons has virtually doubled its online share (among the top five) in less than three years, while Ocado has ceded share—particularly in 2020 when its fixed-capacity structure meant that it struggled to keep pace with the boom in demand.

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

There has been a growing appetite from private equity players for British supermarket chains, which are seen as attractive investments because of their cash generation and freehold assets. In February 2021, Walmart sold a majority stake in Asda for an enterprise value of £6.8 billion ($9.3 billion) to the Issa brothers, founders of retailer EG Group and private equity firm TDR Capital.

On July 3, 2021, Morrisons reported that it has accepted a £6.3 billion) ($8.3 billion) takeover offer by a consortium led by Softbank-owned Fortress Investment Group, which was trumped by private equity group Clayton, Dubilier & Rice with a takeover offer of £7 billion ($9.7 billion) in August. The latter bid proved successful and Morrisons was delisted from the London Stock Exchange on October 27, 2021. That means there are just two major UK grocery retailers remaining as public companies: market leader Tesco and second-place retailer Sainsbury’s.

Online Market Shares

Figure 6 presents how grocery e-commerce for the five biggest online grocery retailers broke down in the retailer’s most recent fiscal years and latest half year, according to Sainsbury’s, citing Nielsen data. Sainsbury’s highlighted that it captured the second-place position from Asda in fiscal 2021.

Ocado is the online grocery pure play of note in the UK market and is in fourth place online—which confirms both the strength of the major established retailers (three of which were early to launch online) and the appeal of omnichannel propositions. Fifth-place Morrisons was late to e-commerce, having struck a deal with Ocado only in January 2014. The Nielsen data suggest that Morrisons has virtually doubled its online share (among the top five) in less than three years, while Ocado has ceded share—particularly in 2020 when its fixed-capacity structure meant that it struggled to keep pace with the boom in demand.

Figure 6. UK Online Grocery Market Share of Top Five Players [caption id="attachment_136735" align="aligncenter" width="580"]

Source: Sainsbury/Nielsen panel data[/caption]

Retail Innovators

We present three retail players that are disrupting the UK grocery market with innovative technology solutions.

Trax

Trax uses computer vision and analytics to help consumer goods companies and grocery retailers get actionable insights on inventory. Its solutions use complex image processing algorithms that use digital images of shelves—taken via a smartphone or auto-captured by fixed cameras or robots to provide detailed product and category information, including out-of-shelf, share of shelf, planograms and pricing to a mobile phone within minutes. It also immediately alerts the user if any product is out of place or missing from the shelves.

Trax helps retailers to leverage up-to-date inventory data to ensure high on-shelf availability and improve margins in retail stores. According to Trax, its solutions can reduce out-of-stocks by an average of 30%, improve price accuracy by 80%, and win back 250 labor hours per associate. Trax’s global clients include CPG brands Coca-Cola, Nestlé and Diageo and international retailers Carrefour, Shufersal and Tesco.

Trigo

Trigo develops artificial intelligence (AI)-based checkout-free systems that can be retrofitted in an existing store. The solution uses ceiling-mounted cameras and computer-vision technology to track products as a shopper picks them up and digitally adds them to a virtual shopping cart in its app. The customer is then required to scan the related code on their smartphone before exiting the store to be charged via the app.

In June 2021, Trigo raised $10 million in funding from German supermarket chain REWE Group, bringing its total funding raised to $104 million. In October 2019, Tesco made an undisclosed equity investment in Trigo as part of their partnership. The company announced in June 2021 that it is set to deploy its Trigo-powered checkout-free system in a second UK location following a successful trial for employees at its head office Express store in Welwyn Garden City.

Trigo estimates that around 500,000 convenience and small grocery stores (up to 1,000 square meters) worldwide have the potential to be retrofitted with AI-based frictionless technology.

Whisk

Whisk’s consumer recipe app allows users to save a recipe from any cooking website or app into a personal recipe box. It then uses AI and machine learning capabilities to organize the recipes and export the ingredients to an interactive shopping list that can be used to shop with Whisk’s grocery partners across the UK and other countries.

In addition to the consumer app, Whisk works with consumer packaged goods (CPG) brands and retailers to help them drive product purchases at every stage of the customer food journey—from inspiration and consideration to purchase and preparation.

Whisk clients include Asda, Ocado, Sainsbury's, Tesco and Waitrose. It has 46 retailer partners globally and works with over 50 major brands across its different product offerings, including General Mills, KraftHeinz and Unilever.

Themes We Are Watching

We present three key themes in the UK grocery market space.

1. A New Wave of Ultrafast Delivery

Prior to the pandemic, online grocery was mostly fulfilled and delivered by established supermarkets (with items picked from stores and then delivered via vans to consumers) or by online-only players. Since the onset of the pandemic in the UK, restaurant delivery aggregators such as Deliveroo and Uber Eats have capitalized on more people ordering groceries online and have partnered with various supermarkets to deliver products for more or less immediate delivery.

The onset of the pandemic brought aggressive expansion of a new breed of delivery startups—primarily in London—with the promise of grocery delivery within 10–15 minutes via bike or moped. Key players have launched London operations following the pandemic in 2020, comprising:

Source: Sainsbury/Nielsen panel data[/caption]

Retail Innovators

We present three retail players that are disrupting the UK grocery market with innovative technology solutions.

Trax

Trax uses computer vision and analytics to help consumer goods companies and grocery retailers get actionable insights on inventory. Its solutions use complex image processing algorithms that use digital images of shelves—taken via a smartphone or auto-captured by fixed cameras or robots to provide detailed product and category information, including out-of-shelf, share of shelf, planograms and pricing to a mobile phone within minutes. It also immediately alerts the user if any product is out of place or missing from the shelves.

Trax helps retailers to leverage up-to-date inventory data to ensure high on-shelf availability and improve margins in retail stores. According to Trax, its solutions can reduce out-of-stocks by an average of 30%, improve price accuracy by 80%, and win back 250 labor hours per associate. Trax’s global clients include CPG brands Coca-Cola, Nestlé and Diageo and international retailers Carrefour, Shufersal and Tesco.

Trigo

Trigo develops artificial intelligence (AI)-based checkout-free systems that can be retrofitted in an existing store. The solution uses ceiling-mounted cameras and computer-vision technology to track products as a shopper picks them up and digitally adds them to a virtual shopping cart in its app. The customer is then required to scan the related code on their smartphone before exiting the store to be charged via the app.

In June 2021, Trigo raised $10 million in funding from German supermarket chain REWE Group, bringing its total funding raised to $104 million. In October 2019, Tesco made an undisclosed equity investment in Trigo as part of their partnership. The company announced in June 2021 that it is set to deploy its Trigo-powered checkout-free system in a second UK location following a successful trial for employees at its head office Express store in Welwyn Garden City.

Trigo estimates that around 500,000 convenience and small grocery stores (up to 1,000 square meters) worldwide have the potential to be retrofitted with AI-based frictionless technology.

Whisk

Whisk’s consumer recipe app allows users to save a recipe from any cooking website or app into a personal recipe box. It then uses AI and machine learning capabilities to organize the recipes and export the ingredients to an interactive shopping list that can be used to shop with Whisk’s grocery partners across the UK and other countries.

In addition to the consumer app, Whisk works with consumer packaged goods (CPG) brands and retailers to help them drive product purchases at every stage of the customer food journey—from inspiration and consideration to purchase and preparation.

Whisk clients include Asda, Ocado, Sainsbury's, Tesco and Waitrose. It has 46 retailer partners globally and works with over 50 major brands across its different product offerings, including General Mills, KraftHeinz and Unilever.

Themes We Are Watching

We present three key themes in the UK grocery market space.

1. A New Wave of Ultrafast Delivery

Prior to the pandemic, online grocery was mostly fulfilled and delivered by established supermarkets (with items picked from stores and then delivered via vans to consumers) or by online-only players. Since the onset of the pandemic in the UK, restaurant delivery aggregators such as Deliveroo and Uber Eats have capitalized on more people ordering groceries online and have partnered with various supermarkets to deliver products for more or less immediate delivery.

The onset of the pandemic brought aggressive expansion of a new breed of delivery startups—primarily in London—with the promise of grocery delivery within 10–15 minutes via bike or moped. Key players have launched London operations following the pandemic in 2020, comprising:

- Dija—November 2020 (acquired by Gopuff in August 2021)

- Getir—January 2021. As we went to press, Getir announced that it had agreed to acquire Weezy.

- Gorillas—March 2021

- Jiffy—April 2021

- Weezy—July 2020

- Zapp—January 2021

Figure 7. London’s Instant Commerce Grocery Operators [wpdatatable id=1472]

Source: Company reports/Coresight Research

The rapid delivery operators have plans to launch operations beyond London. In addition to six warehouses in the capital city, Weezy plans to open 40 more across the UK by the end of 2021. Dija announced plans in March 2021 to expand its service beyond London by acquiring Cambridge-based delivery startup Genie. Moreover, Jiffy plans to open over 20 warehouses across the UK by the end of year. After its London launch in March 2021, Getir intends to expand its operations in Birmingham and Manchester. Nearly all of these superfast grocery delivery platforms have raised significant seed or sequential financing rounds in 2021. For example, Getir’s valuation jumped from $850 million to $7.5 billion following three funding rounds between January and June. Similarly, Gorillas achieved unicorn status in March with a $290 million Series B funding. According to financial data provider Pitchbook, on-demand grocery operators have attracted more than $14 billion in investments since the start of the pandemic and over $8 billion from January to April 2021, already surpassing 2020 levels.Figure 8. Recent Funding Rounds Raised by Key Instant Commerce Players Operating in the UK [wpdatatable id=1473]

Source: Coresight Research

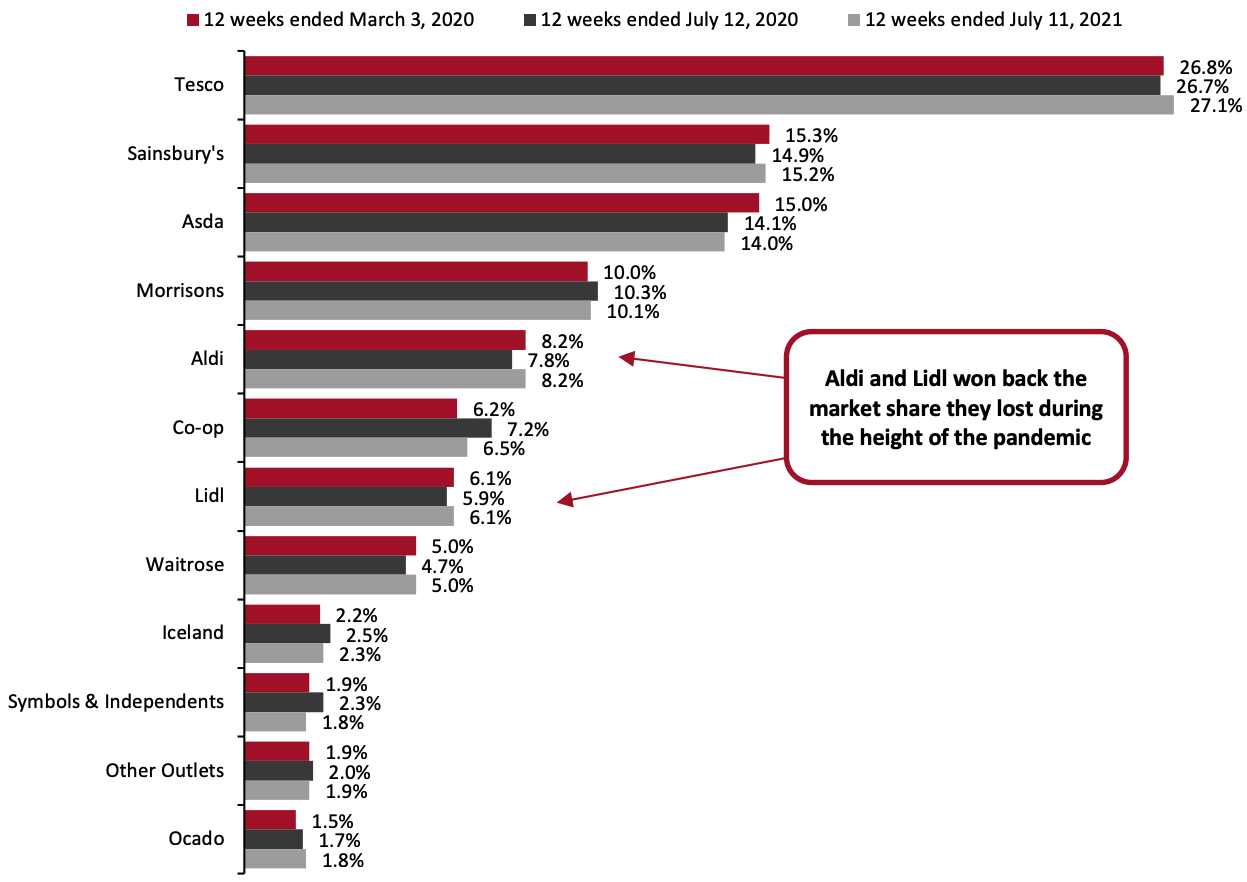

As the instant delivery via dark store model is still emerging, the companies operating in this space are still loss-making, which can be attributed to the high level of discounts to attract customers, as well as investments in real estate, marketing and technology. However, early signs are encouraging. As part of its acquisition of UK-based instant delivery startup Fancy in May 2021, Gopuff highlighted it has achieved profitability in cities where it has been operating for more than 18 months. Additionally, looking to rapid commerce operators in other markets, Berlin-based prepared food/grocery retail delivery operator Delivery Hero disclosed a profit contribution of €1.3 ($1.5) per order in its DMart dark store business. We believe that basket sizes and order frequency will rise if consumers come to trust in instant commerce services and products, eventually improving their unit economics. However, operators may face difficulty in increasing delivery fees once a regular order habit among consumers has been created, especially given the competitive environment. Additionally, on-demand delivery works best in areas with high population density and as more platforms enter the market, the risk of increasing rental prices for dark stores could drive up upfront investment. Read more about business models in rapid delivery, here. 2. Aldi and Lidl Recapture Lost Market Share Grocery discounters have been a persistent strategic threat to traditional food retailers during much of the past decade. However, this changed significantly amid the pandemic as limited online presences became a major hindrance for Aldi and Lidl. Additionally, as customers consolidated their shopping trips to minimize social contact, their limited product ranges and stock availability at the discounters meant that most customers struggled to do a full shop in their stores. As shoppers returned to making more supermarket trips amid restrictions lifting and cases dropping in summer 2021, Aldi and Lidl saw sales rise strongly again and have regained their lost market share. According to Kantar Worldpanel, for the 12 weeks ended July 13, 2021, Aldi’s market share increased from 7.5% to 8.2%, matching its highest level since March 2020. Lidl saw its share increase by 0.2 percentage points to 6.1% in the same time frame. Much growth was driven by older shoppers who regained confidence about visiting stores following vaccination rollouts.Figure 9. UK Grocery Market Share [caption id="attachment_136736" align="aligncenter" width="700"]

Source: Kantar Worldpanel[/caption]

In October 2021, Aldi UK announced that it will open 100 new stores across the UK in next two years, in addition to its current portfolio of 920 UK stores. In the same month, Lidl, which has 860 stores in the UK as of June 2021, announced that it will open 50 new stores by the end of 2021. The retailer plans to invest £1.3 billion ($1.9 billion) to bring its total store count to 1,000 by the end of 2023.

If Aldi and Lidl meet their store opening targets, they will move up the market share ladder and again increase the margin pressure on the Big Four. However, pandemic-related shipping behaviors have now been in place for more than 12 months and discounters will likely face more strategic challenges going forward. The Big Four had introduced competing product ranges that were largely struggling to gain traction pre-Covid but should have been boosted as customers gravitated toward these retailers amid the pandemic.

Additionally, discounters will need to strategize on how they compete in a world where e-commerce plays an increasingly important role.

Source: Kantar Worldpanel[/caption]

In October 2021, Aldi UK announced that it will open 100 new stores across the UK in next two years, in addition to its current portfolio of 920 UK stores. In the same month, Lidl, which has 860 stores in the UK as of June 2021, announced that it will open 50 new stores by the end of 2021. The retailer plans to invest £1.3 billion ($1.9 billion) to bring its total store count to 1,000 by the end of 2023.

If Aldi and Lidl meet their store opening targets, they will move up the market share ladder and again increase the margin pressure on the Big Four. However, pandemic-related shipping behaviors have now been in place for more than 12 months and discounters will likely face more strategic challenges going forward. The Big Four had introduced competing product ranges that were largely struggling to gain traction pre-Covid but should have been boosted as customers gravitated toward these retailers amid the pandemic.

Additionally, discounters will need to strategize on how they compete in a world where e-commerce plays an increasingly important role.

- Read about the impact of Aldi and Lidl on US grocery, here.

Source: Amazon[/caption]

Amazon has taken a steady approach to UK grocery expansion, gradually building its online service, notably in collaboration with Morrisons, and its investment in the rapid delivery channel through Deliveroo. We anticipate that the direct impact of the opening of brick-and-mortar stores on incumbent UK grocery retailers will almost certainly be minimal even over the medium term, as building any meaningful market share in grocery is a long-term task.

Nevertheless, Amazon’s entry in brick-and-mortar grocery retail shows that it is committed to the UK market, against the backdrop of its total UK revenues soaring to £19.3 billion ($26.7 billion) in 2020, up 51% year over year, higher than other reported regions (US, Germany, Japan and Rest of World).

We anticipate that Amazon’s physical expansion will not be the full extent of its UK ambitions. The company may eventually take a major place in the UK by acquiring a British supermarket chain to cement its position. The whole UK grocery ecosystem would be wise to take note of Amazon’s physical store openings and set their mindset around this being a major player in the sector at some stage in this decade.

Source: Amazon[/caption]

Amazon has taken a steady approach to UK grocery expansion, gradually building its online service, notably in collaboration with Morrisons, and its investment in the rapid delivery channel through Deliveroo. We anticipate that the direct impact of the opening of brick-and-mortar stores on incumbent UK grocery retailers will almost certainly be minimal even over the medium term, as building any meaningful market share in grocery is a long-term task.

Nevertheless, Amazon’s entry in brick-and-mortar grocery retail shows that it is committed to the UK market, against the backdrop of its total UK revenues soaring to £19.3 billion ($26.7 billion) in 2020, up 51% year over year, higher than other reported regions (US, Germany, Japan and Rest of World).

We anticipate that Amazon’s physical expansion will not be the full extent of its UK ambitions. The company may eventually take a major place in the UK by acquiring a British supermarket chain to cement its position. The whole UK grocery ecosystem would be wise to take note of Amazon’s physical store openings and set their mindset around this being a major player in the sector at some stage in this decade.

What We Think

The chance UK grocers had last year, and which has continued into 2021, to reset their relationship with the UK consumers should not be underestimated. The industry has served consumers well when they needed it and there will likely be a lasting benefit to this, both at an industry level and at company level, despite a return to on-premise consumption. Implications for Retailers- Retaining the loyalty of shoppers who switched to them at the start of the pandemic should be the priority for traditional retailers. Revamping loyalty programs, boosting healthy product assortments and making stores easier to navigate is vital for retailers.

- With the influx of funds into the ultrafast delivery space, the market has reached the point of saturation, with many startups operating with the same underlying technology and broadly offering the same products. As the sector matures, we anticipate some consolidation in the near term, as evidenced by Gopuff acquiring small UK grocery delivery operator Fancy and Dija in March 2021 and Getir announcing its acquisition of Weezy in November 2021.

- Discounters have got back on their feet in 2021 after a tough 2020. However, grocery e-commerce has traditionally been an Achilles heel for discounters as costs associated with picking, packing and delivering orders sit uneasily with their no-frills model. Amid the pandemic-induced online demand spike, grocery discounters should look toward a more aggressive omnichannel approach to stay competitive, including acquiring a delivery startup or tech startup to overhaul their entire online operations.

- Amid the rise in online shopping, grocery retailers are focusing on artificial intelligence, highly personalized engagement and innovative technologies to grow stronger and more resilient in the face of change. Technology vendors must capitalize on the environment and pitch in the importance of their solutions for grocery retailers’ pain points.