DIpil Das

What’s the Story?

The UK’s apparel and footwear improved but did not fully recover from pandemic-driven declines in 2021. With the rollout of vaccinations and rapid Covid tests, as well as reduced restrictions, we expect to see full recovery in 2022. In this report, we discuss the UK apparel and footwear market and identify key drivers and trends. In addition, we examine what brands, innovators and retailers are doing to better serve consumers and players in the UK apparel and footwear space.Market Performance and Outlook

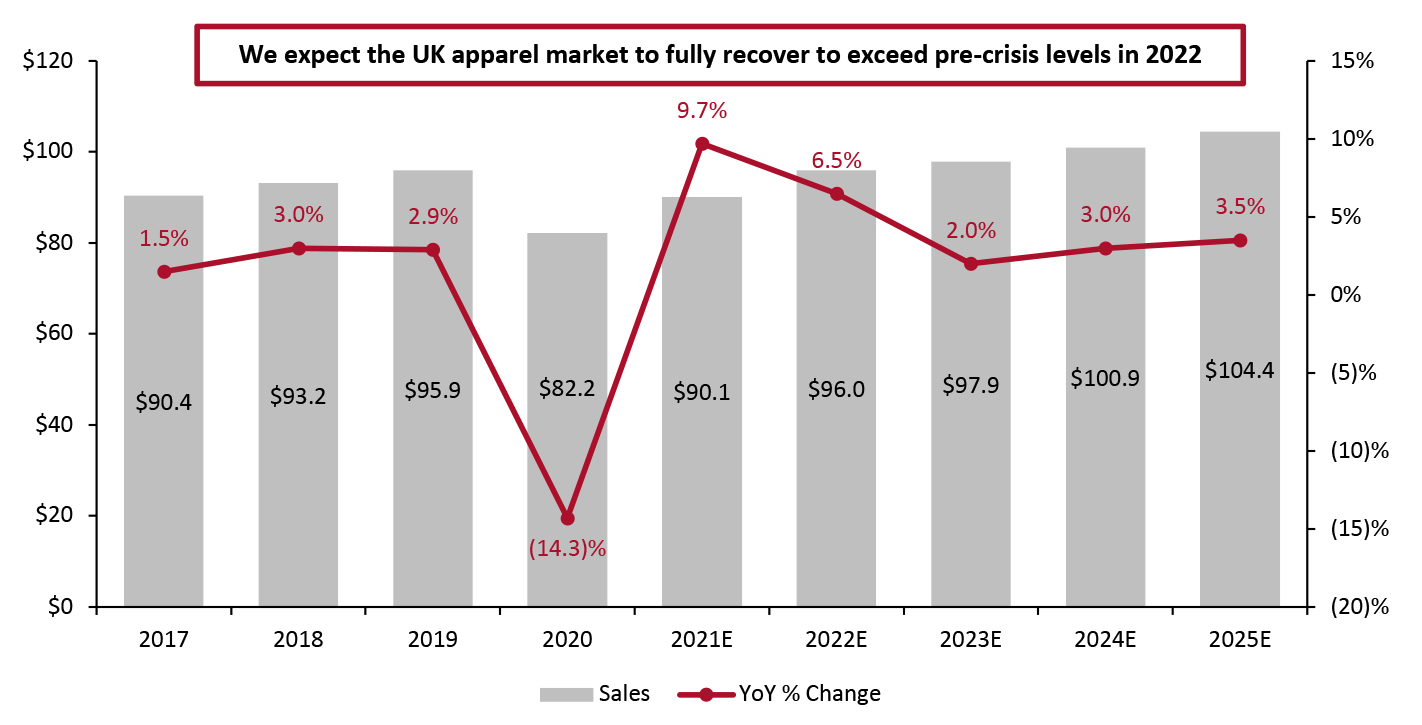

Market Size We expect the UK apparel and footwear market to grow 6.5% in 2022, taking the market to full recovery to pre-crisis levels. We estimate that UK apparel and footwear market grew 9.7% in 2021, following a decline of 14.3% in 2020 amid the pandemic, according to the ONS. In 2023 and beyond, we expect the market to grow at a low-single-digit percentage rate.Figure 1. UK Apparel and Footwear Consumer Spending (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_141221" align="aligncenter" width="700"]

Sales converted to USD at constant exchange rates for December 31, 2021

Sales converted to USD at constant exchange rates for December 31, 2021 Source: ONS/Coresight Research [/caption]

Market Drivers

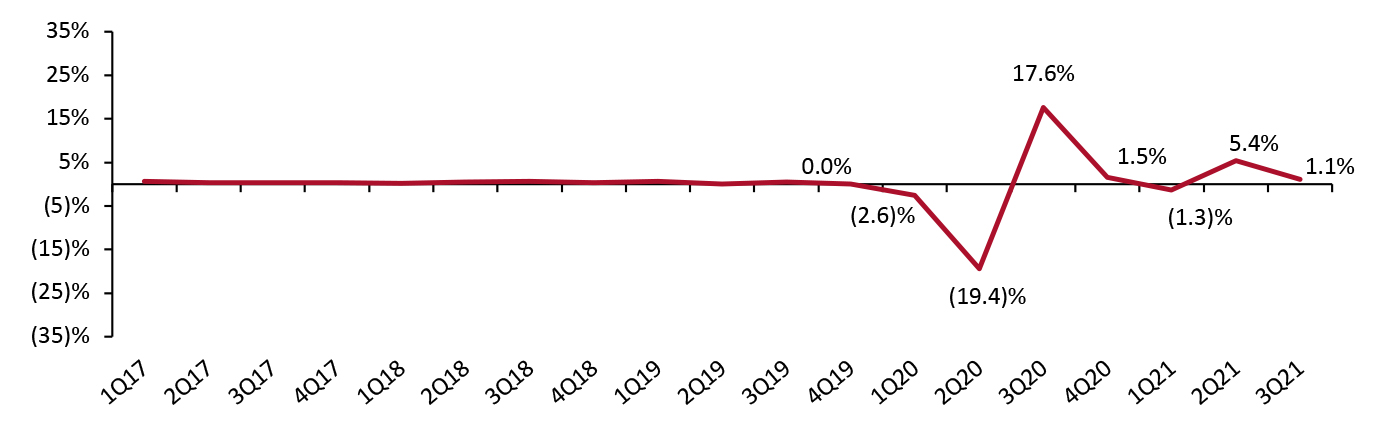

1. Overall Economic Recovery We saw momentum in GDP recovery in the UK in the latter part of 2021. The UK economy grew at a rate of 5.4% and 1.1% from the preceding quarter in the second and third quarters of 2021, respectively, following a decrease of 1.3% in the first quarter, according to the most recent ONS data. The fluctuations in GDP indicate that the impact of the pandemic is ongoing. However, we believe the GDP recovery momentum will continue, driving increases in personal consumer expenditure and fueling the recovery of the UK’s apparel and footwear market in 2022.Figure 2. GDP: Change from Preceding Quarter (%) [caption id="attachment_141224" align="aligncenter" width="700"]

Source: ONS[/caption]

2. Vaccinations and Consumers’ Return to More Normal Living

While 2020 saw pandemic-led retail shutdowns, 2021 brought vaccine rollouts and path out of the pandemic toward market recovery for 2022.

In the UK, approximately 71.2% of the UK population have received two vaccine shots as of January 11, 2022, based on government data. New case numbers appear to be declining following a surge with the arrival of the Omicron variant toward the end of 2021 and early January 2022. England now has a liberal approach to living with Covid-19, with no meaningful restrictions (apart from self-isolation upon infection) impacting retail or services; some rules differ in the devolved nations of Northern Ireland, Scotland and Wales. Coupled with currently falling case rates, this should support recovery in earnest of the retail market to pre-crisis levels in 2022.

3. UK Government Support for Sustainable Fashion

In March 2021, the UK government unveiled plans to reduce waste across multiple sectors, including proposals for measures that will ramp up action on fast-fashion production in the UK and hold manufacturers accountable for textile waste.

This governmental action is likely to drive the sustainable apparel market in the UK, therefore fueling the overall apparel and footwear market recovery. The government’s voluntary Textiles 2030 agreement also aims to promote ambitious industry action on environmental impact.

4. Increase in UK Households’ Savings

We saw high savings rates among UK households in the first three quarters of 2021 (latest data available), following a sharp increase in savings in the second quarter of 2020 as the pandemic shut down many spending outlets, such as restaurants and discretionary shops. This marks a potential boost to consumer spending power for discretionary categories such as apparel in 2022.

The UK households’ savings rate measures the income households save as a proportion of disposable income, as shown in Figure 3.

Source: ONS[/caption]

2. Vaccinations and Consumers’ Return to More Normal Living

While 2020 saw pandemic-led retail shutdowns, 2021 brought vaccine rollouts and path out of the pandemic toward market recovery for 2022.

In the UK, approximately 71.2% of the UK population have received two vaccine shots as of January 11, 2022, based on government data. New case numbers appear to be declining following a surge with the arrival of the Omicron variant toward the end of 2021 and early January 2022. England now has a liberal approach to living with Covid-19, with no meaningful restrictions (apart from self-isolation upon infection) impacting retail or services; some rules differ in the devolved nations of Northern Ireland, Scotland and Wales. Coupled with currently falling case rates, this should support recovery in earnest of the retail market to pre-crisis levels in 2022.

3. UK Government Support for Sustainable Fashion

In March 2021, the UK government unveiled plans to reduce waste across multiple sectors, including proposals for measures that will ramp up action on fast-fashion production in the UK and hold manufacturers accountable for textile waste.

This governmental action is likely to drive the sustainable apparel market in the UK, therefore fueling the overall apparel and footwear market recovery. The government’s voluntary Textiles 2030 agreement also aims to promote ambitious industry action on environmental impact.

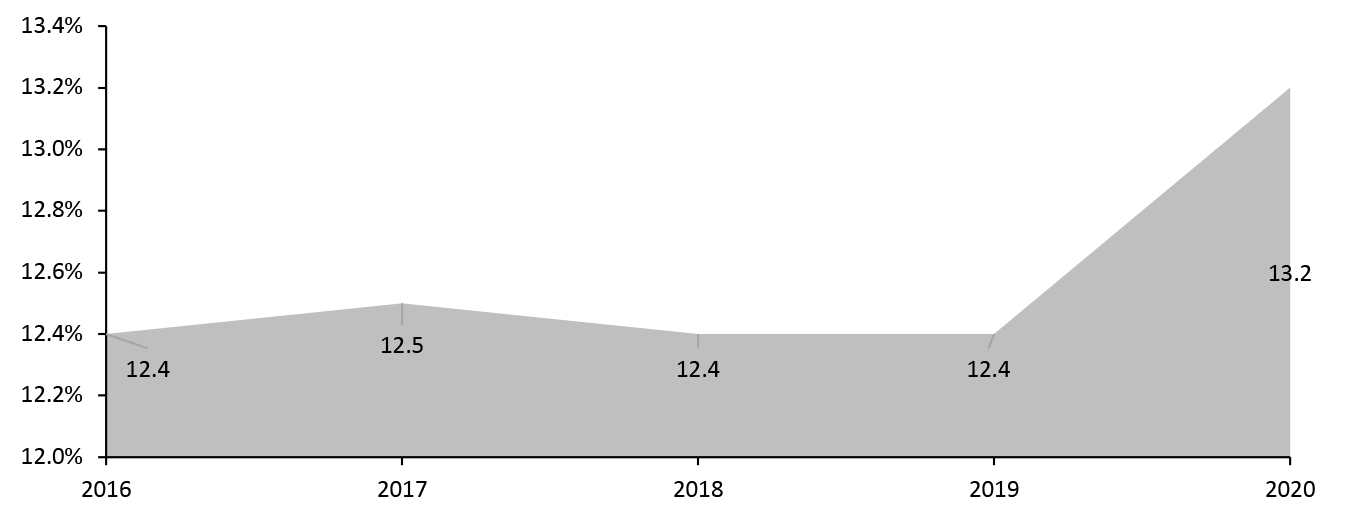

4. Increase in UK Households’ Savings

We saw high savings rates among UK households in the first three quarters of 2021 (latest data available), following a sharp increase in savings in the second quarter of 2020 as the pandemic shut down many spending outlets, such as restaurants and discretionary shops. This marks a potential boost to consumer spending power for discretionary categories such as apparel in 2022.

The UK households’ savings rate measures the income households save as a proportion of disposable income, as shown in Figure 3.

Figure 3. UK Households’ Savings Rate (%) [caption id="attachment_141225" align="aligncenter" width="700"]

Source: ONS[/caption]

Source: ONS[/caption]

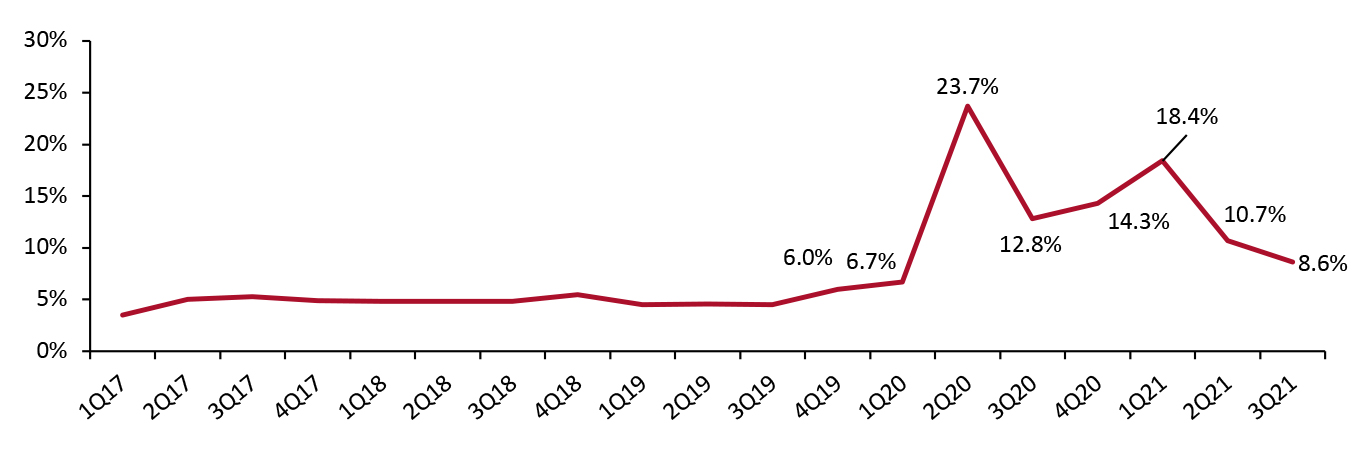

Online Market

E-Commerce Penetration The penetration rate of e-commerce in the total UK apparel and footwear market jumped to almost 40% in 2020 and consolidated those gains in 2021, according to Euromonitor International. The increasing share of e-commerce in the market in 2021 indicates the relative stickiness of online shopping. Euromonitor expects online penetration in the apparel and footwear category to remain level in 2022; we think that may be optimistic, given that the ONS has been recording negative year-over-year growth in online sales (across several sectors) in recent months.Figure 4. E-Commerce Penetration Rate in the UK Apparel and Footwear Market (% of Total Apparel and Footwear Sales) [caption id="attachment_141226" align="aligncenter" width="700"]

E-commence benchmarked to the total market size from Euromonitor International

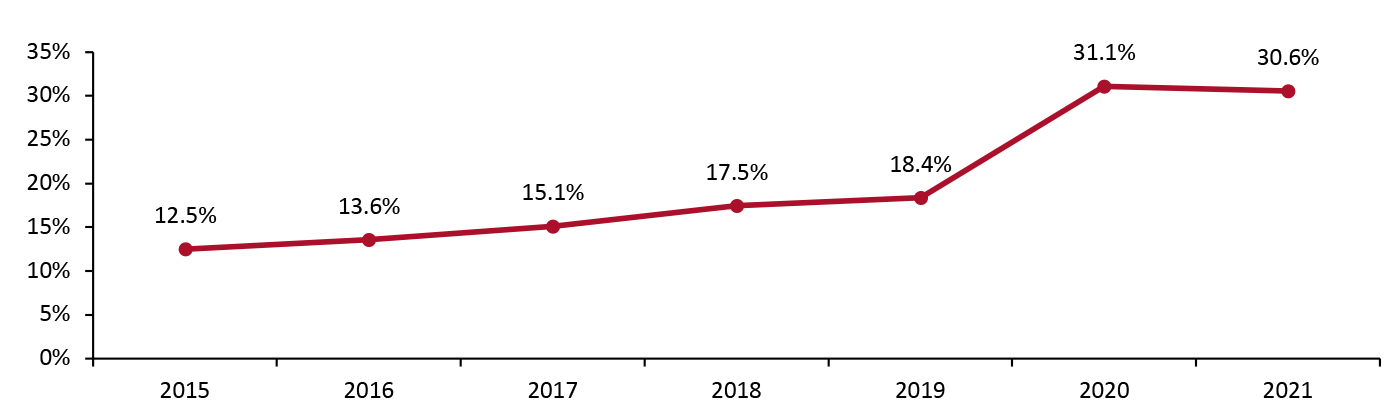

E-commence benchmarked to the total market size from Euromonitor International Source: Euromonitor International Limited 2022 © All rights reserved [/caption] Specialty Retail Online Sales The e-commerce penetration rate in the UK specialty apparel and footwear market began to unwind in 2021, following an increase to 31.1% in 2020 from 12.5% in 2015, according to ONS data. These data comprise online sales by textile, clothing and footwear stores as a proportion of the UK’s total specialty apparel retail sales, as shown in Figure 5. Online sector sales began to decline, year over year, toward the end of 2021, falling by 10.2% in November and 12.1% in December, per the ONS. The ONS has been reporting negative year-over-year growth for online sales by nonstore retailers (which includes online-only retailers) and for online retail sales in total since around the middle of 2021.

Figure 5. Online Sales Proportion of the UK’s Total Specialty Apparel Retail Sales (%) [caption id="attachment_141228" align="aligncenter" width="700"]

Source: ONS[/caption]

Source: ONS[/caption]

Competitive Landscape

The UK apparel and footwear market is fragmented—top apparel and footwear retailers and brands include Frasers Group (including Sports Direct), Primark, Next, JD Sports Fashion, Marks & Spencer (M&S) and ASOS. The failure of Debenhams and Arcadia Group, both of which exited the market in 2021, provides opportunities for existing retailers to capture a larger share of the growing market. Long-struggling M&S has seen an apparent recovery, fueled by sharpening entry-level prices, simplifying its private-label clothing ranges and bringing in third-party brands; we see these as solid moves that will support M&S’s market share in a rapidly changing market, characterized by players such as Debenhams failing. For the 13 weeks ended January 1, 2022, M&S grew Clothing and Home (C&H) segment sales by 3.2% on a two-year basis (i.e., versus pre-pandemic); this growth was an acceleration from 2.0% in the prior quarter and marked the first time in over a decade that M&S has reported two consecutive quarters of positive C&H sales growth (when benchmarked to year-over-year comparable sales growth in prior years; M&S did not report comparable sales growth in the latest two quarters). Next has bounced back very strongly from the pandemic hit of 2020. In its most recent trading update for the eight weeks ended December 25, 2021, Next reported that full-price sales were up 20.0% versus two years earlier. For the 16 weeks ended January 8, 2022, Primark reported that its sales were up 36% year over year, when it had seen enforced Covid-19 shutdowns in the UK and Europe; however, its UK comparable sales were still down 10% versus two years earlier. Primark does not sell online. Grocery retailers Asda (with its George brand) and Tesco (with its F&F brand) are major retailers of clothing and footwear (historically, bigger than rival Sainsbury’s, with its Tu fashion brand), but we do not have recent confirmed sales data from these companies.- The data in Figure 6 are for 2020 (or closest fiscal year to calendar 2020), during which the pandemic, including lockdowns, impacted some retailers and formats more than others.

Figure 6. Selected Top UK’s Apparel and Footwear Retailers, Ranked by UK Apparel and Footwear Revenue [wpdatatable id=1705]

Sales were converted to USD at constant FX; Zalando’s revenues for Europe (except Germany, Austria and Switzerland) were $4.6 billion, including beauty, in 2020; Inditex’s revenues for Europe (excluding Spain) were $11.9 billion, including beauty and home, in 2020 *Closest fiscal year to calendar 2020 Source: Company reports

Retail Innovators

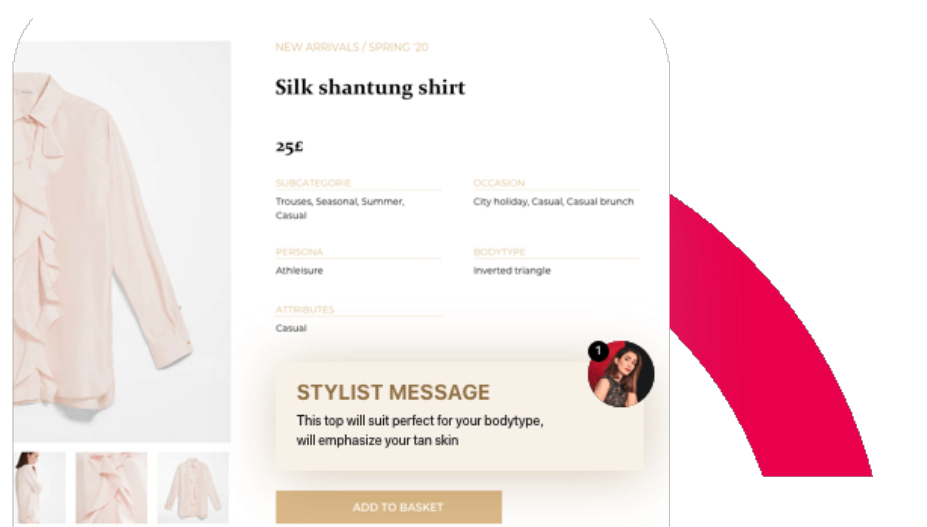

We discuss three UK-based innovators whose products or solutions are disrupting the UK apparel and footwear market. Intelistyle Intelistyle uses artificial intelligence (AI) to analyze catwalk photography and social media data to help fashion brands and retailers provide customers with personalized suggestions, both online and in store. The company creates outfit recommendations for clothes that retail customers already own or want to buy. The goal of the platform is to enable brands and retailers to use data to augment customer profiles and deliver deeper levels of personalization, targeting customers with products that will better fit their body shapes. Brick-and-mortar retail faces new challenges in a post-covid environment—related to inventory, fitting rooms and contactless store associate procedures—driving the importance of contactless solutions that address customer concerns. This suggests that there will be growth in demand for the types of fit optimization and online selling personalization services offered by Intelistyle. With the assistance of Intelistyle’s technology, traditional apparel retailers will be able to establish their true size DNA, and feed customer data into the supply chain to streamline inventory and allow for improved sales planning. [caption id="attachment_141231" align="aligncenter" width="700"] Intelistyle’s AI-powered styling advice

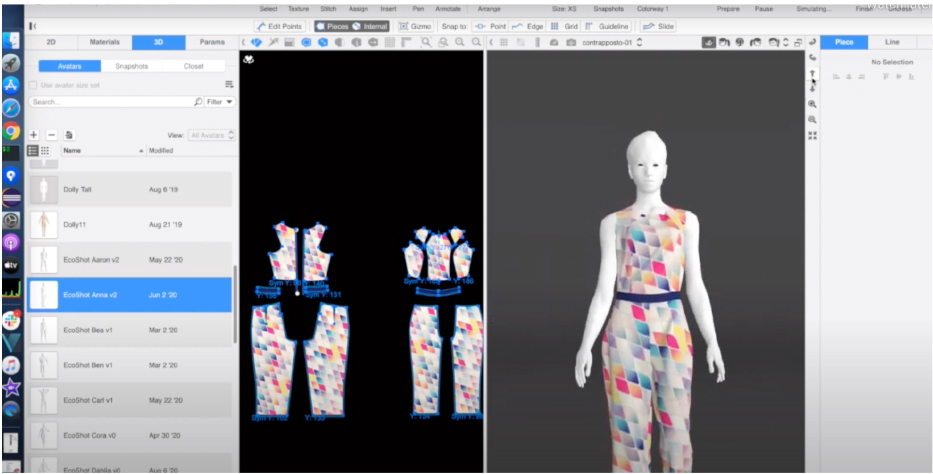

Intelistyle’s AI-powered styling advice Source: Intelistyle [/caption] Metail Metail provides fashion brands and retailers 3D technology solutions for the design process, including 3D garment design applications, on-model 3D outfit visualization on e-commerce websites, and virtual reality (VR) garment try-on and fit recommendations. The company’s innovations offer shorter time spans for product development, reduced labor requirements, lower costs, reduced wastage, shorter production times and higher precision. Metail also claims it helps clients to streamline their communications as all 3D renderings can be reviewed through cloud-based platforms, enabling designers, suppliers and retailers to collaborate more effectively. We expect more apparel and footwear brands and retailers to seek advanced 3D technology solutions to meet fast-changing consumer demand, while also improving product quality and cutting costs, creating opportunities for Metail to disrupt the market. It is also important for Metail to make steady improvements in what its technologies can do and expand the benefits and competitiveness in the coming years. [caption id="attachment_141232" align="aligncenter" width="700"]

Metail’s 3D design application

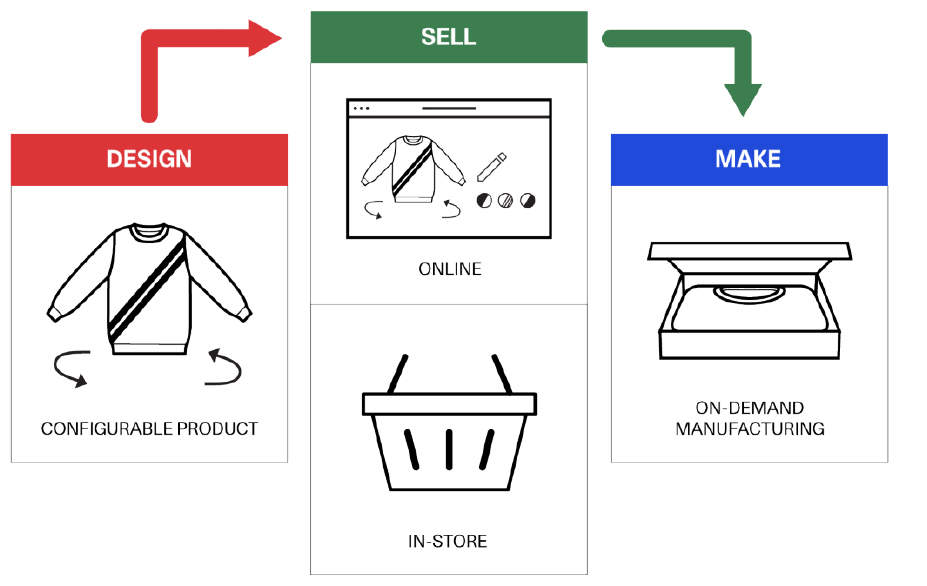

Metail’s 3D design application Source: Metail [/caption] Unmade Unmade is an operating platform that enables fashion and sportswear brands to connect and plan the manufacturing process from design to production. The company has raised $13.2million in funding as of September 2021, according to Crunchbase. UnmadeOS is the company’s featured product, providing a platform that connects fashion and sportswear brands directly to suppliers. Apparel designers can add products to UnmadeOS digitally or use the product configurator tool to create new designs. The tool also allows designers to create their own customized designs. After the design process, UnmadeOS will convert the design pattern into a physical sample using 3D printing—a key part of its on-demand manufacturing concept that reduces a product’s speed to market and reduces waste across the supply chain. Apparel companies can order highly customized products to markets in quantities of 1, 100 or 1,000 items. The UnmadeOS platform is entirely cloud and web-based so the designs can be viewed even when the platform is integrated into other channels, including in-store screens and tablets. [caption id="attachment_141233" align="aligncenter" width="700"]

The workflow of Unmade’s on-demand manufacturing operating platform

The workflow of Unmade’s on-demand manufacturing operating platform Source: Unmade [/caption]

Themes We Are Watching

We discuss six key themes we are watching in the UK apparel and footwear market. 1. New Strategies To Stay Competitive Apparel and footwear retailers and brands such as ASOS, Boohoo and Next Plc have seen success in recent years, mainly driven by expanding their product assortments and investing in logistics and inventory management. Retailers such as Arcadia Group and Debenhams were slower to adapt to digital commerce and address their financial stress and unclear brand propositions and reaped the consequences of this delay. Apparel and footwear brands and retailers can focus on three key strategies to stay competitive: expanding product assortment, improving supply chain agility and adapting to digital commerce. Figure 7 presents successful strategies under these three pillars that have been adopted by major UK apparel and footwear retailers.Figure 7. Strategies of Selected UK Apparel and Footwear Retailers in 2021 [wpdatatable id=1699 table_view=regular]

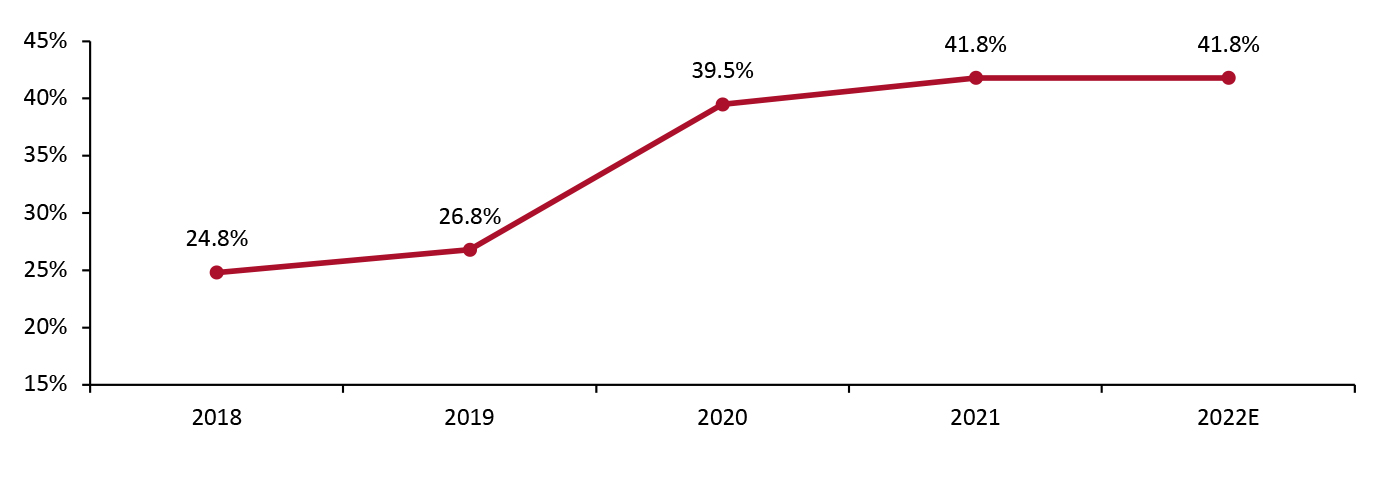

Source: Company reports 2. Decreasing Private-Label Focus In 2022 and beyond, we believe that some UK apparel retailers will move away from private labels to focus on multi-brand retail. Euromonitor reported that the share of apparel and footwear private-label sales increased somewhat amid the pandemic in 2020 (Figure 8). However, we expect this to have been an exception, given that, especially in the middle market, we are seeing an increase in consumers migrating to strong brands amid greater brand accessibility enabled by digital channels. M&S is one key retailer shifting from private-label apparel to third-party brands. In addition, John Lewis has been shifting its focus away from own brands in women’s fashion, as announced by Chairman Sharon White in 2020. Moreover, major UK private-label retailer Next Plc’s third-party branded apparel offering under its online “Label” division has been a driver of Next’s total sales growth since it launched in 2014.

- Click hereto read our global learnings on the decline of private-label clothing in Europe.

Figure 8. UK Apparel and Footwear Private Labels: Market Share (%) [caption id="attachment_141237" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Figure 9 shows a selected list of retailers that offer private-label apparel and footwear.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Figure 9 shows a selected list of retailers that offer private-label apparel and footwear.

Figure 9. Selected Private-Label Offerings in the UK’s Apparel and Footwear Market [wpdatatable id=1700 table_view=regular]

Source: Company reports 3. Uptick in Merger and Acquisition Activity (M&A) Apparel brand owners and retailers in the UK are rethinking their strategies and business models to recover from the crisis and thrive going forward. M&A activity provides a strong option for value creation. We expect to see an uptick in M&A activities involving the UK’s apparel and footwear sector in 2022. Increasing M&A activities also aligns with our belief that apparel retailers are shifting focus toward multi-brand retail. Figure 10 provides case examples for completed M&A transactions from January 1, 2020, to September 30, 2021.

Figure 10. Selected M&A Activities in the UK’s Apparel and Footwear Market (January 1, 2020–September 30, 2021) [wpdatatable id=1701 table_view=regular]

Source: Company reports 4. Sustainability We are seeing a wave of sustainable apparel and footwear offerings by brands and retailers in the UK such as ASOS, Boohoo and Clarks. UK consumers have become more focused on sustainability: 59% of UK consumers prefer sustainably made clothes over fast-fashion apparel, according to a survey of UK consumers by clothing retailer Superdry in June 2021. With shopping choices being influenced by consumers’ growing awareness of environmental sustainability, there are likely to be opportunities in sustainable apparel and footwear products, sustainable fabrics and textiles in the near future. We have seen a spike in launches of sustainable apparel and footwear among retailers and brands in 2021, as shown in Figure 11. We expect the sustainability trend to sustain in the long term.

Figure 11. Selected Sustainable Offerings by Apparel and Footwear Brands and Retailers in the UK [wpdatatable id=1702 table_view=regular]

Source: Company reports 5. Alternative Selling Models: Rental and Resale With the rise of consumer awareness of sustainability, rental and resale business models are gaining traction in the UK apparel and footwear market in a bid to avoid overconsumption and fashion items going to landfill. Brands and retailers moving into this space aim to capitalize on changing consumer patterns, especially among millennials and Gen Z shoppers, who are more likely than older generations to value access over ownership and affordability over newness.

Figure 12. Selected Brands and Retailers’ Offerings in the UK Apparel Rental and Resale Space [wpdatatable id=1703 table_view=regular]

Notes: Berlin-based e-commerce website Zalando launched a resale platform Zircle in 2021 but it is not yet available in the UK market so is not included in this figure. Source: Company reports 6. Collaboration We are seeing more apparel and footwear retailers and brands in the UK launch products in collaboration, aiming to leverage the unique strengths of each brand and take advantage of surprising partnerships to generate intrigue. The strategic mix provides a novelty that often attracts younger consumers and provides shoppers with a more affordable way to access two brands. Celebrity or influencer endorsement is also one of the most coveted forms of collaboration. We expect to see more apparel and footwear brands and retailers use joint product creation to meet consumers’ needs and drive shoppers’ excitement.

Figure 13. Selected Apparel and Footwear Collaborations in the UK in 2021 [wpdatatable id=1704 table_view=regular]

Source: Company reports

What We Think

Implications for Brands/Retailers- The UK apparel and footwear market is likely to fully recover in 2022. The failure of retailers such as Debenhams and Arcadia Group provides opportunities for existing brands and retailers to gain a greater stake in the recovering market. Key strategies that can be adopted to stay competitive include expanding product categories to suit ongoing consumer needs such as casualization, investing in marketing and inventory capabilities to expand product capacity, and bringing in third-party brands. We are impressed with the strategy and performance at M&S and the trajectory at Next—both of whom have made meaningful moves to bring in third-party brands.

- UK apparel and footwear retailers will move away from private labels to focus on multi-brand retail. We will likely see continued M&A activity as apparel retailers aim to build strong brands portfolios, presenting opportunity for small and medium brands to be acquired and grow.

- Sustainability continues to be the core theme in the UK apparel and footwear market. Supported by this demand, we are seeing selling models such as rental and resale becoming more mainstream. To capitalize on this growing trend, improve the utilization of materials and fabrics, and turnover outdated or extra inventories efficiently, we see opportunities for apparel brands and retailers to launch resale/rental services or work with resale/rental platforms.