DIpil Das

What’s the Story?

The state of deployment of retail technology took two steps backward and one step forward in 2020: Retailers faced the sudden temporary closure of many of their stores, while at the same time having to transition into fire-fighting mode to accelerate the deployment of IT projects planned over several years and fortify supply chains. Thus far in 2021, challenges such as a fickle, fragmented consumer base, wide demand swings and an acceleration of e-commerce penetration are increasing the urgency with which retailers are looking for tools that help them engage with customers and manage demand and supply chains, while enhancing business efficiency. In this Market Outlook, we discuss the drivers, key players and themes that we are seeing in the global retail technology market and provide an outlook for 2021 and beyond.Retail Technology Market Performance and Forecast

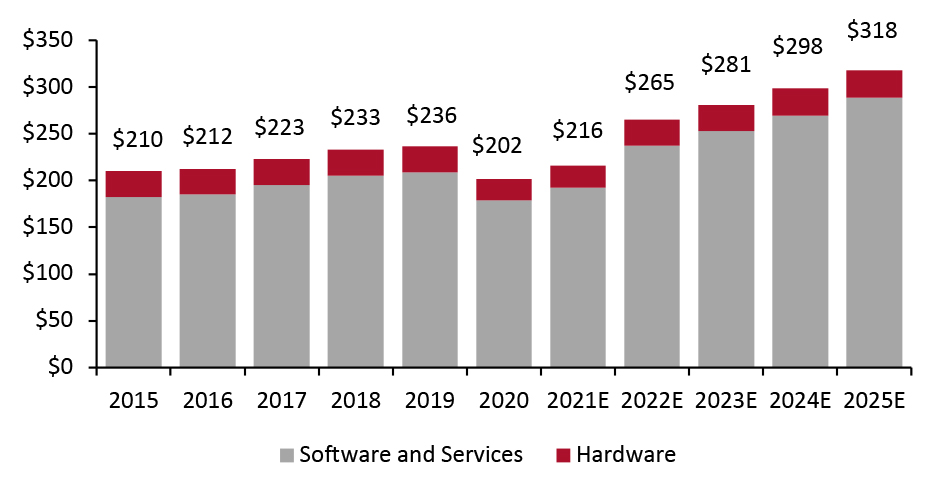

Retailers’ technology investments are generally categorized into two main categories: capital expenditures and IT services. Capital expenditures (capex) represent the purchase of physical items of property, plant and equipment. With the advent of cloud computing, retailers will require fewer of their own servers and equipment and the IT staff to maintain them, moving this spending to a recurring expense for cloud computing and other software as a service. Global Market Forecast We estimate that global spending on technology by retailers will total $216 billion in 2021, up 7% from the trough in 2020, before rebounding to exceed pre-pandemic levels in 2022. We estimate that retailers spend about 1.5% of revenues on technology globally, with spending on software and services set to account for nearly 89% of that proportion in 2021 and increase to nearly 91% in 2025.Figure 1. Global Spending on Technology by Retailers (USD Bil.) [caption id="attachment_123929" align="aligncenter" width="725"]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Key Market Segments

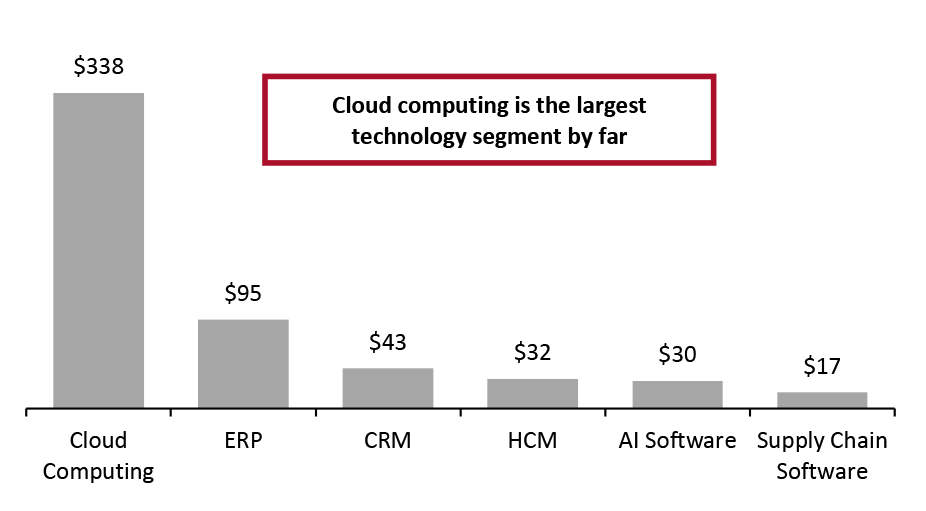

Key segments within the global technology market are artificial intelligence (AI), cloud computing, supply chain software and three enterprise software categories: enterprise resource planning (ERP), human capital management (HCM) and customer relationship management (CRM).

As shown in Figure 2, cloud computing is by far the largest segment by estimated spending in 2021 (data includes total spending, not just by retailers).

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Key Market Segments

Key segments within the global technology market are artificial intelligence (AI), cloud computing, supply chain software and three enterprise software categories: enterprise resource planning (ERP), human capital management (HCM) and customer relationship management (CRM).

As shown in Figure 2, cloud computing is by far the largest segment by estimated spending in 2021 (data includes total spending, not just by retailers).

Figure 2. Global Technology Market: Estimated Spending by Segment, 2021 (USD Bil.) [caption id="attachment_123930" align="aligncenter" width="725"]

Cloud computing includes platform as a service, infrastructure as a service and hosted private-cloud services

Cloud computing includes platform as a service, infrastructure as a service and hosted private-cloud services Source: Apps Run The World/Omdia/Statista/Coresight Research [/caption]

Market Drivers

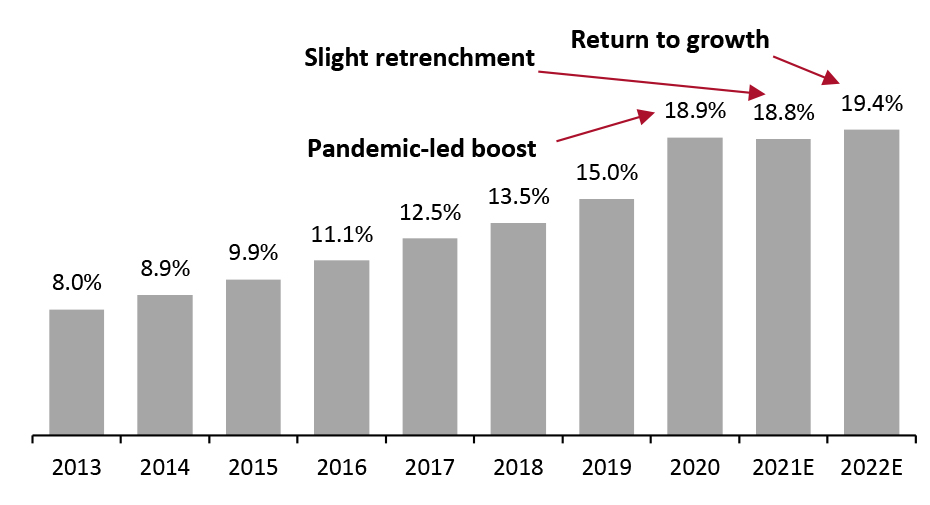

There are several drivers behind retailers’ investment in technology. Retailers need to invest in technology to remain competitive online and support increases in digital demand, as well as to accommodate wide swings in demand and engage consumers via multiple channels. We discuss the drivers in detail below. Surge in E-Commerce Penetration E-commerce continues to increase its penetration of retail sales, having surged in 2020 as consumers turned to online shopping during lockdowns and to avoid physical stores. However, we forecast that e-commerce penetration in the US will see a slight retrenchment in 2021 as shoppers become more comfortable with returning to physical stores, followed by a resumption of growth in 2022 (see Figure 3).Figure 3. US E-Commerce Penetration (% of Total Retail Sales) [caption id="attachment_123931" align="aligncenter" width="725"]

Source: US Census Bureau/Coresight Research[/caption]

There are several implications for retailers arising from the boom in e-commerce penetration:

Source: US Census Bureau/Coresight Research[/caption]

There are several implications for retailers arising from the boom in e-commerce penetration:

- By virtue of being online, e-commerce retailers have collected customer data and are likely to leverage it in marketing and assortment planning.

- E-commerce share gains translate directly into increased revenues for online retailers, enabling them to invest at a faster rate than physical retailers.

- The surge in e-commerce penetration in 2020 means that all retailers that sell online will have to make investments to ensure that their order management, supply chain and fulfillment systems can keep up with increased order volumes.

Competitive Landscape

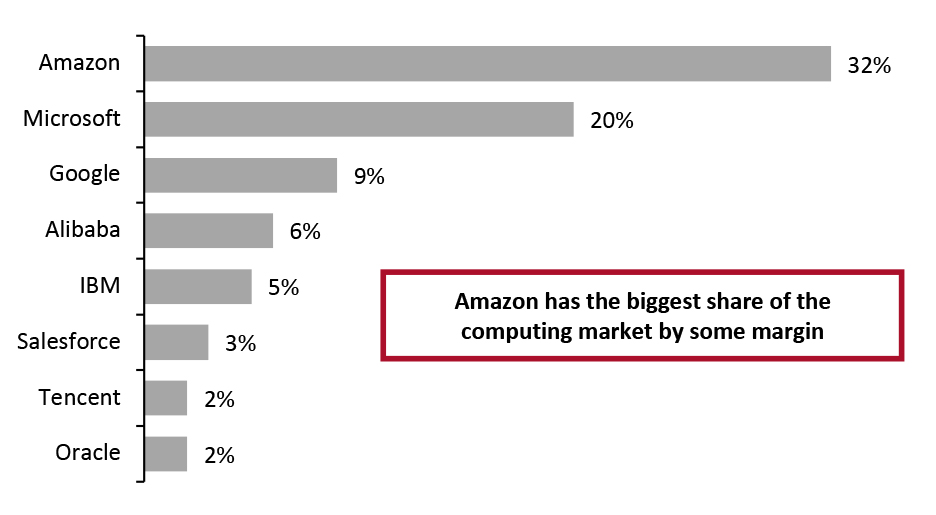

The thriving technology landscape comprises established leaders and a host of innovators. Below, we highlight the leaders in several key segments: cloud computing, enterprise software, supply chain software, AI software and retail hardware. Major technology providers—including Google, IBM, Microsoft, Oracle, SAP and Salesforce—feature heavily in the market as they offer platforms in key categories such as cloud computing and enterprise software. Amazon is both a retailer and a cloud computing provider by virtue of its Amazon Web Services (AWS) division. Cloud Computing The global cloud computing services market includes primarily US and Chinese vendors, whose market share in the fourth quarter of 2020 is detailed in the figure below.Figure 4. Cloud Computing Market Share by Vendor, 4Q20 [caption id="attachment_123932" align="aligncenter" width="725"]

Source: Synergy Research Group[/caption]

Not included in the above figure is Snowflake, a US cloud-based data-warehousing company that completed an initial public offering in September 2020. The company offers a platform called Data Cloud that interoperates with data on the Amazon, Google and Microsoft platforms.

For more information on cloud computing, please read our Introduction to Retail Tech report.

Enterprise Software

Enterprise software is a very broad category, encompassing infrastructure, platforms and applications.

ERP Software

ERP software is the central nervous system of an enterprise, interconnecting the supply chain, commerce, inventory, warehousing, fulfillment, analytics and finance. Initially focused on manufacturing, ERP has added functions to address nearly every aspect of business, including human resource management and CRM.

In 2019, the top 10 vendors accounted for about one-third of the market, according to Apps Run The World. The top three ERP vendors (and their market share) in this highly fragmented market are as follows:

Source: Synergy Research Group[/caption]

Not included in the above figure is Snowflake, a US cloud-based data-warehousing company that completed an initial public offering in September 2020. The company offers a platform called Data Cloud that interoperates with data on the Amazon, Google and Microsoft platforms.

For more information on cloud computing, please read our Introduction to Retail Tech report.

Enterprise Software

Enterprise software is a very broad category, encompassing infrastructure, platforms and applications.

ERP Software

ERP software is the central nervous system of an enterprise, interconnecting the supply chain, commerce, inventory, warehousing, fulfillment, analytics and finance. Initially focused on manufacturing, ERP has added functions to address nearly every aspect of business, including human resource management and CRM.

In 2019, the top 10 vendors accounted for about one-third of the market, according to Apps Run The World. The top three ERP vendors (and their market share) in this highly fragmented market are as follows:

- SAP—6.5%

- Oracle—4.0%

- Intuit—3.0%

- Salesforce—31%

- Adobe—8%

- Oracle—5%

- Workday—8%

- SAP—7%

- Microsoft—6%

- Product design

- Manufacturing/sourcing

- Transportation/warehousing

- In-store operations

- Sales

- Delivery

- CRM

- Demand forecasting

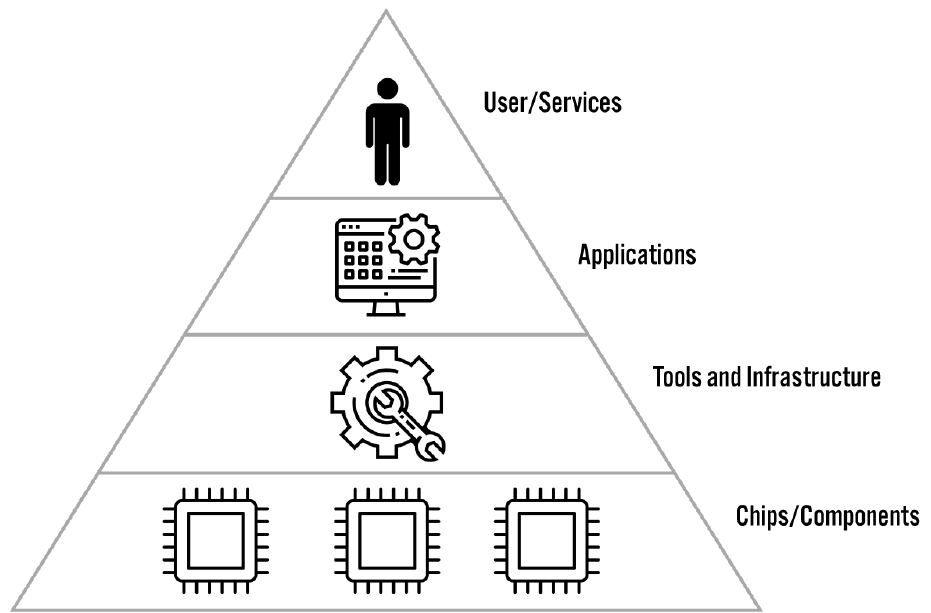

Figure 5. AI Technology Pyramid [caption id="attachment_123933" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Applications. AI applications include intelligent digital assistants for consumers, offered by Alibaba, Amazon, Google and many other technology providers. There is a rich landscape of enterprise application vendors using AI, including Adobe (Sensei), Blue Yonder, Infor (Coleman), Salesforce (Einstein) and Zebra Technologies, in addition to other companies that use machine learning (ML, which has several applications in demand forecasting and supply chain management) and image processing.

Tools and Infrastructure. Cloud computing services such as Alibaba Cloud, Amazon AWS, Google Cloud, Huawei Cloud, IBM Cloud, Microsoft Azure and Oracle Cloud offer AI software infrastructure and applications.

Chips and Components. Nvidia has adapted its graphics-processing chips for AI applications, and most major global technology vendors are developing their own AI chips—including Alibaba, Amazon, AMD, Apple, Facebook, Google, IBM, Intel, Microsoft and Samsung (and many other companies).

Retail Hardware

There is a variety of in-store hardware in retail that is used to communicate with, serve and collect data on consumers and items within the store.

Deploying sensors and devices is becoming increasingly important for retailers, as they need to gather data on customer behavior to inform their engagement and assortment strategies. Data capture enhances forecasting, while automated machines help solve labor issues and increase efficiencies in stocking and other store operations.

In-store hardware items include the following:

Source: Coresight Research[/caption]

Applications. AI applications include intelligent digital assistants for consumers, offered by Alibaba, Amazon, Google and many other technology providers. There is a rich landscape of enterprise application vendors using AI, including Adobe (Sensei), Blue Yonder, Infor (Coleman), Salesforce (Einstein) and Zebra Technologies, in addition to other companies that use machine learning (ML, which has several applications in demand forecasting and supply chain management) and image processing.

Tools and Infrastructure. Cloud computing services such as Alibaba Cloud, Amazon AWS, Google Cloud, Huawei Cloud, IBM Cloud, Microsoft Azure and Oracle Cloud offer AI software infrastructure and applications.

Chips and Components. Nvidia has adapted its graphics-processing chips for AI applications, and most major global technology vendors are developing their own AI chips—including Alibaba, Amazon, AMD, Apple, Facebook, Google, IBM, Intel, Microsoft and Samsung (and many other companies).

Retail Hardware

There is a variety of in-store hardware in retail that is used to communicate with, serve and collect data on consumers and items within the store.

Deploying sensors and devices is becoming increasingly important for retailers, as they need to gather data on customer behavior to inform their engagement and assortment strategies. Data capture enhances forecasting, while automated machines help solve labor issues and increase efficiencies in stocking and other store operations.

In-store hardware items include the following:

- Communication devices, such as beacons

- Customer-, traffic- and mood-tracking sensors

- Electronic shelf labels

- Smart displays and magic mirrors

- Inventory control, tracking, and loss prevention

- Point-of-sale and self-checkout terminals

- Store-associate mobile devices

- Robots for assisting customers, tracking inventory, dispensing purchases, store cleaning and store security

Retail Innovators

There is a healthy group of innovators developing solutions within the category of retail technology. Our Coresight Labs database includes more than 5,000 of the most innovative companies focusing on creating retail-focused and technology solutions. Coresight Research has published several Retail-Tech Innovator Landscapes on individual technology categories and geographies. In Figure 6, we summarize selected retail-tech innovators in the global market.Figure 6. Selected Retail-Tech Innovators [wpdatatable id=775 table_view=regular]

Source: Coresight Research

Themes We Are Watching

The key technology themes in 2021 include digitalization/the move to the cloud, data and analytics, and supply chain management. Digitalization/The Move to Cloud Computing Digitalization refers to converting information into a digital format so that it can be manipulated by digital tools. This is an essential step before retailers can employ analytical tools and AI/ML. Moving to the cloud offers enormous benefits to retailers and enterprises overall, including the following:- Eliminating the need to purchase IT hardware, such as servers

- Enabling IT staff to shift from maintenance to development

- Offering the ability to scale on demand

- Enabling more frequent software updates

- Providing the ability to develop new types of applications that leverage cloud computing

- Descriptive—What happened?

- Predictive—What will happen?

- Prescriptive—What should we do about it?

- Resilience—The ability to return to the previous, pre-surge state

- Agility—The ability to adapt to new changes

What We Think

We think that retail technology has become even more crucial in 2021, as retailers need to engage with customers wherever they are, maintain command of their supply chains and evolve to handle ever-increasing e-commerce volumes and customer fragmentation. Partnerships are becoming increasingly necessary, with single companies unable to stitch together solutions with multiple technologies that exceed their expertise. There are several possible endgames for innovators—partnerships and acquisitions (the most likely results) and going public. Large companies are reluctant to work with unknown startups that lack a solid track record, but once acquired by, or in partnership with, an established company, innovators become equipped and trusted to serve large, established customers. Implications for Brands/Retailers- With an increasingly fragmented consumer base, brands and retailers can use technologies such as AI to understand their customers better and develop strategies to reach them wherever they are.

- Retailers can make use of the many tools within supply chain software to optimize their businesses, improving allocation and assortment and identifying hidden cost-saving opportunities.

- Retailers can leverage many types of in-store technology to collect data on the activity of consumers within the physical store, as well as to inform inventory management.

- Retail real estate firms can implement technology to increase engagement with stores and shoppers.

- Landlords can provide leading-edge technology infrastructure to make it easier for retailers and brands to reach and delight consumers.

- The developments of 2020 have placed renewed emphasis on retail technology, primarily within the supply chain, which vendors can leverage to promote the importance of their solutions moving forward.

- Technology segments such as AI are in their infancy and offer numerous opportunities for the development of new tools and applications.

- Vendors who are more able to make technology invisible to retailers—offering solutions rather than products—are more likely to increase adoption and deployment.