DIpil Das

What’s the Story?

India’s apparel retail market continues to see significant changes in consumer buying behavior and e-commerce penetration following the impacts of the Covid-19 pandemic in 2020. In this report, we discuss the recent shifts and consumer spending momentum in apparel retail in India and provide an outlook for the market into 2022 and beyond, including key trends and opportunities for fashion brands and retailers. We use data and definitions from the Ministry of Statistics and Programme Implementation (MOSPI) released in January 2021 (latest available data).Market Performance and Outlook

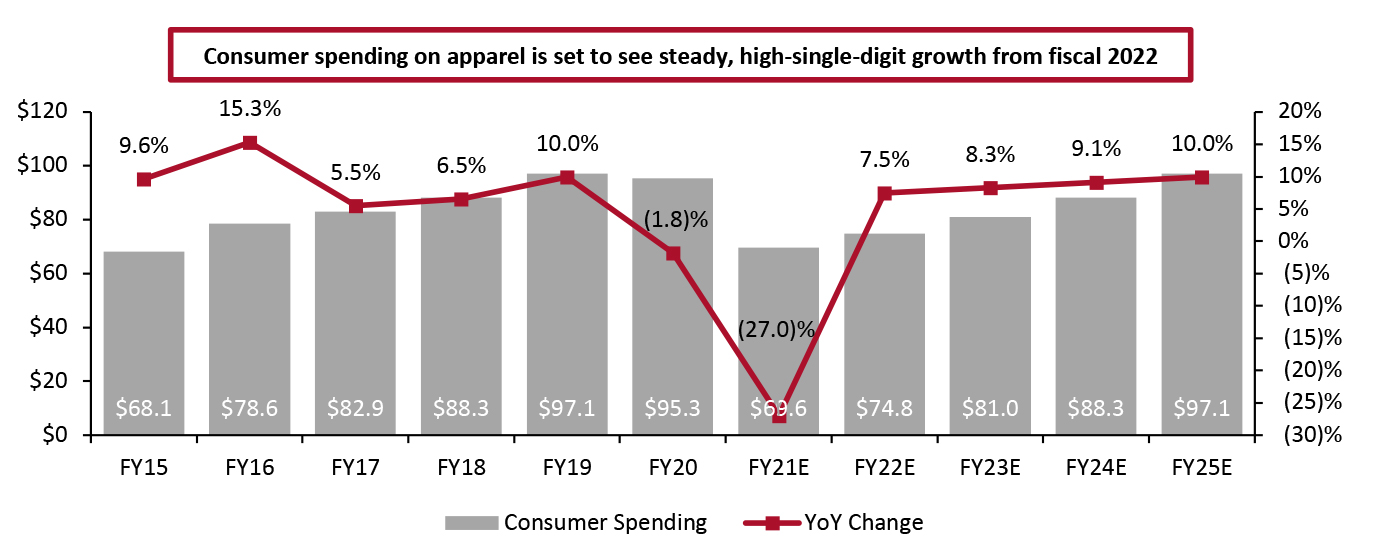

Consumer Spending and Growth Estimates India’s apparel market (including clothing and footwear) is one of the biggest contributors to the economy in terms of revenue, investment, trade and employment. It is the second-largest retail market after food and grocery in India, totaling $69.6 billion in fiscal 2021, according to MOSPI estimates. The apparel market comprises women’s clothing, men’s clothing and kids’ clothing. Until recently, men’s clothing held a higher market share than women’s clothing, but according to a recent study by business consulting firm Wazir Advisors, the gap is gradually narrowing, and both are likely to have a more or less equal share of about 36% by 2022. Kids’ clothing accounts for the rest, at 28%. In fiscal 2022 (in India, the fiscal year runs from April 1 to March 31), we estimate that consumer spending on apparel in India will increase by about 7.5% year over year, reaching $74.8 billion. Although this is a huge improvement from the estimated pandemic-impacted negative growth of 27.0% in fiscal 2021, we do not expect consumer spending on apparel to reach pre-pandemic 2020 levels until fiscal 2025 (see Figure 1).Figure 1. India Consumer Spending on Apparel (Left Axis: USD Bil.) and YoY Change (Right Axis; %) [caption id="attachment_134709" align="aligncenter" width="724"]

Conversions to USD at average 2020 exchange rates

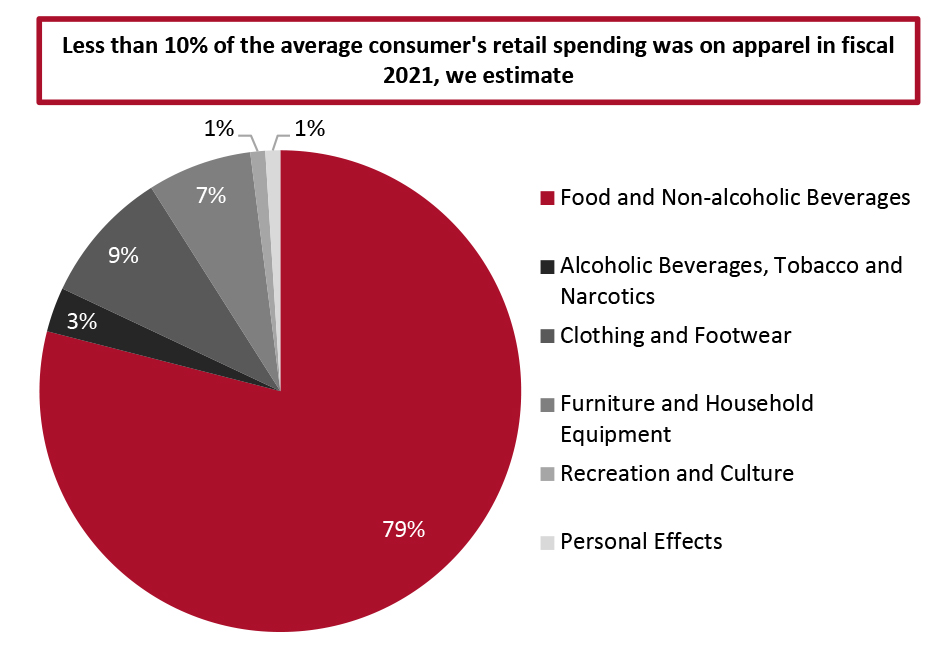

Conversions to USD at average 2020 exchange rates Source: MOSPI/Coresight Research [/caption] One reason for the slow return to pre-pandemic levels is that it will take time for employment levels to recover. According to The Centre for Monitoring Indian Economy (CMIE), the Indian labor market is in its worst condition since the nationwide lockdown during March–June 2020, exacerbated by lockdowns across certain states during April–June 2021 during the second wave of the pandemic in the country. Stay-at-home measures, salary cuts and fear of job losses forced consumers to cut down their spending on non-essential categories such as apparel. Based on data from MOSPI, we estimate that Indian consumers spent just 9% of their total retail spending on clothing and footwear in fiscal 2021—though this represents the second-highest share of the average consumer’s retail spending, behind grocery retail (see Figure 2). However, CMIE estimates that the unemployment rate has fallen from 8.3% in August 2021 to 6.9% in September 2021, which we expect to have positive impacts on consumer spending across discretionary categories, including in the apparel market. As consumers return to workplaces and social activities amid ongoing vaccination rollouts, we expect spending on apparel to gain momentum through the second half of fiscal 2022.

Figure 2. Share of Categories in Retail Consumer Spending, Fiscal 2021 [caption id="attachment_134710" align="aligncenter" width="726"]

Categories as published by MOSPI

Categories as published by MOSPI Source: MOSPI/Coresight Research [/caption]

Market Drivers

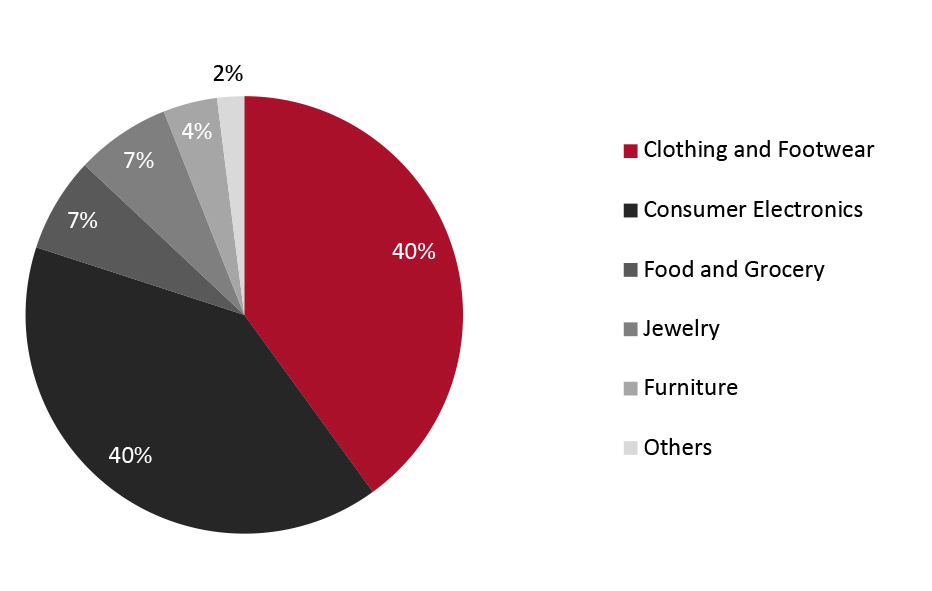

Increased E-Commerce Penetration Forced store closures during nationwide and statewide lockdowns in fiscal 2021 and the first quarter of fiscal 2022 have resulted in a huge shift to online shopping among Indian consumers, driving brands and retailers to enhance their e-commerce presence to maximize revenues. Demonstrating the pandemic-led consumer shift to online shopping in the India market, e-commerce order volume grew by 36%, and online GMV by 30%, year over year, in the fourth quarter of 2020, according to a recent report by cloud-based e-commerce solutions provider Unicommerce and global management consulting firm Kearney. According to the India Brand Equity Foundation (IBEF), a trust established by the Government of India’s Ministry of Commerce and Industry, “The Indian e-commerce industry has been growing upward and is expected to reach $99 billion by 2024 from $30 billion in 2019, expanding at a CAGR of 27%, with consumer electronics and fashion/apparel likely to be the key drivers of incremental growth.” As shown in Figure 3, IBEF data shows that the apparel sector accounted for 40% of India’s e-commerce market in 2020.Figure 3. India’s E-Commerce Retail Market: Breakdown by Sector, 2020 (%) [caption id="attachment_134711" align="aligncenter" width="725"]

Source: IBEF[/caption]

Although consumers typically want to feel and try on apparel products before making a purchase decision—making the brick-and-mortar channel favorable among clothing and footwear shoppers—we expect many consumers to at least partially retain some online shopping behaviors moving forward, due to convenience. Growing Internet penetration and smartphone usage in India are also giving rise to digitally savvy consumers and transforming their purchase behavior. Furthermore, the online shift is happening at all levels within the fashion industry—for example, the Fashion Design Council of India’s annual fashion week, India Couture Week, was held digitally in August 2021 for the second year.

Having an online presence has become a necessity for brands and retailers to survive in the current market and set themselves up for future success.

Shifting Preferences for Apparel Categories

Until the first half of fiscal 2022, with the majority of the people working from home and staying indoors, comfort wear and loungewear gained popularity.

Many Indian companies (barring some in the hospitality, banking and government services sectors), accept casual attire in the workplace, leading to the casualization of fashion among Indian consumers. This means that as offices reopen and consumers return to work, we expect casual wear to be in demand among apparel shoppers, as well as professional workwear.

The young Indian population is health-conscious and fitness-oriented. During the pandemic, activities including aerobics, swimming, running, yoga and home fitness became embedded in their daily lives—driving growth in the athleisure segment. With consumers now venturing outside for physical activities while maintaining fitness regimens adopting during lockdowns, we expect high growth in the athleisure segment to contribute to overall apparel market growth. Walmart-owned Flipkart’s Big Billion Days 2021 in early October saw a spike in sales of sports shoes, outdoor wear and men’s clothing categories.

In the longer term, once the impacts of the pandemic wane, we expect consumers to increase apparel spending in the occasion wear category, for festivals, weddings, parties and other social gatherings, which will be more prevalent as the world settles into a post-pandemic normal.

Growth of Western Wear

India is seeing rapid growth in Western wear categories such as pants, shirts, jeans, trousers, tops, skirts, jackets, jumpsuits and coats (compared to traditional Indian clothing, such as sarees or salwar kameez). The major contributing factors to the growth of Western wear in India are as follows:

Source: IBEF[/caption]

Although consumers typically want to feel and try on apparel products before making a purchase decision—making the brick-and-mortar channel favorable among clothing and footwear shoppers—we expect many consumers to at least partially retain some online shopping behaviors moving forward, due to convenience. Growing Internet penetration and smartphone usage in India are also giving rise to digitally savvy consumers and transforming their purchase behavior. Furthermore, the online shift is happening at all levels within the fashion industry—for example, the Fashion Design Council of India’s annual fashion week, India Couture Week, was held digitally in August 2021 for the second year.

Having an online presence has become a necessity for brands and retailers to survive in the current market and set themselves up for future success.

Shifting Preferences for Apparel Categories

Until the first half of fiscal 2022, with the majority of the people working from home and staying indoors, comfort wear and loungewear gained popularity.

Many Indian companies (barring some in the hospitality, banking and government services sectors), accept casual attire in the workplace, leading to the casualization of fashion among Indian consumers. This means that as offices reopen and consumers return to work, we expect casual wear to be in demand among apparel shoppers, as well as professional workwear.

The young Indian population is health-conscious and fitness-oriented. During the pandemic, activities including aerobics, swimming, running, yoga and home fitness became embedded in their daily lives—driving growth in the athleisure segment. With consumers now venturing outside for physical activities while maintaining fitness regimens adopting during lockdowns, we expect high growth in the athleisure segment to contribute to overall apparel market growth. Walmart-owned Flipkart’s Big Billion Days 2021 in early October saw a spike in sales of sports shoes, outdoor wear and men’s clothing categories.

In the longer term, once the impacts of the pandemic wane, we expect consumers to increase apparel spending in the occasion wear category, for festivals, weddings, parties and other social gatherings, which will be more prevalent as the world settles into a post-pandemic normal.

Growth of Western Wear

India is seeing rapid growth in Western wear categories such as pants, shirts, jeans, trousers, tops, skirts, jackets, jumpsuits and coats (compared to traditional Indian clothing, such as sarees or salwar kameez). The major contributing factors to the growth of Western wear in India are as follows:

- People aged 15–34 comprise around one-third of the population in India, according to United Nations Population Division data. Western wear is popular among these younger consumers, who are typically more brand conscious and have higher disposable income for discretionary spending (with no dependents).

- The presence of international fashion brands such as H&M and Zara in the Indian market is driving the acceptance of Western wear among consumers, who are widely accepting of the new trends and styles introduced by these players. Digitally savvy consumers are particularly aware of global trends, and international brands provide them more range and variety to choose from to meet their growing fashion needs and keep up with trends.

- Rural markets are developing at a fast pace, through the expansion of agriculture and government-created employment opportunities. India is seeing an increase in awareness of, and inclination toward, Western wear among the rural population.

Competitive Landscape

In Figure 4, we present the prominent apparel retail and footwear companies in India, based on revenue data from their fiscal 2020 annual reports (latest available data). The combined revenue generated by these players was around $7.2 billion in fiscal 2020, based on average 2020 exchange rates.- Reliance Retail is the top player in the sector, with a 25.5% share in fiscal 2020.

- Among exclusive footwear players, Bata India Limited is leading, with a 5.9% share of the overall apparel market.

Figure 4. India: Top 12 Apparel Retail Players by Revenue [wpdatatable id=1358 table_view=regular]

Conversions to USD are at average 2020 exchange rates Source: Company reports/Coresight Research Reliance Retail Limited (Reliance Trends) Reliance Retail operates in the value segment through Reliance Trends in various formats:

- Trends Small Town is a banner offering products addressing the entire family’s dressing needs in Tier 3 and Tier 4 towns.

- Trends Footwear offers affordable and fashionable footwear for everyday needs, ranging from value-for-money merchandise under Trends’ own brands to leading footwear brands.

- Trends operates three apparel store concepts: Trends Woman, Trends Man and Trends Junior. These are destination stores for women, men and kids (aged up to 14 years) and offer apparel, footwear and accessories in a differentiated store environment.

Source: Company reports/Coresight Research[/caption]

Adithya Birla Fashion Retail Limited (ABFRL)

ABFRL houses multiple apparel brands:

Source: Company reports/Coresight Research[/caption]

Adithya Birla Fashion Retail Limited (ABFRL)

ABFRL houses multiple apparel brands:

- Four of India’s iconic lifestyle apparel brands—Allen Solly, Louis Philippe, Peter England and Van Heusen

- Pantaloons in the value fashion segment

- Forever 21 in the fast fashion segment

- Renowned global brands such as American Eagle, The Collective, Fred Perry, Hackett London, Ralph Lauren and Ted Baker

- Ethnicwear brands Jaypore and Shantanu & Nikhil, through which ABFRL entered the ethnicwear segment when it invested in these brands in July 2019

Figure 5. India: Online Apparel Retail Players’ Revenue, Fiscal 2020 [wpdatatable id=1359 table_view=regular]

Conversions to USD are at average 2020 exchange rates Source: Company reports/Financial Express Reliance Retail’s Ajio Reliance Retail’s online fashion platform Ajio, which is not currently a frontrunner in the market, has seen huge growth amid the Covid-19 pandemic. The company saw a spike in the number of app downloads and 4X growth in orders by November 2020 compared to pre-pandemic levels, as reported by Business Insider. In its annual report for fiscal 2020, Reliance Retail stated that Ajio offers over 250,000 styles of curated collections across its own brand and 1,400+ national and international brands. In its earnings results during October 2020, Reliance Retail said that Ajio’s quarterly revenue was equivalent to the previous year’s total revenue. While Ajio is gaining ground, it faces tough competition in the online fashion market, with Myntra controlling 60% of the market, according to a 2020 report by Bank of America. Myntra was one of the first online-only apparel retailers and further strengthened its market leadership through its acquisition of Indian fashion and lifestyle e-commerce portal Jabong in 2016. However, with Ajio’s access to the inventory of Reliance Trends and Reliance Retail’s omnichannel approach to growth, Ajio is set to pose a threat to Myntra in the near future. Niche Players In the e-commerce sector, apparel players need to offer differentiated products to stand out. While the large, established e-commerce platforms will continue to dominate, emerging players such as Koovs, Limeroad, Voonik and Yepme will likely increase their market share moving forward, carving their own individual niche in order to not directly compete against the dominant players. The consumer shift to online will benefit niche players in the e-commerce space. Such companies tend to focus on narrow consumer bases, such as younger generations, providing customization in design and differentiation in pricing.

Themes We Are Watching

Digitalization According to credit rating agency CARE, 20% of apparel sales in India are made in the top metros of Bangalore, Chennai, Delhi and Mumbai. With metro cities reaching a state of saturation for further expansion, fashion brands and retailers are expanding to Tier 2 and Tier 3 cities—a trend that has been brought forward by the Covid-19 pandemic as consumers in these cities shift to online shopping for apparel and accessories. Digitalization in lower-tier cities is being supported by increasing Internet penetration and the growing adoption of social commerce. Brands and retailers should focus on enhancing their delivery services, app content (such as by adding multiple languages) and digital payment capabilities to strengthen their competitive positioning and distribution network. Rise of AI, AR and VR Artificial intelligence (AI) is one of the biggest technology advances that is helping fashion retail brands to cater to consumer preferences. AI enables fashion brands and retailers to analyze huge volumes of online data and gather insights about bestselling products, consumer pain points and preferences to identify broader trends and help customize their offerings. AI and predictive analytics plays an important role in helping fashion brands with demand forecasting. As well as AI, we expect India’s apparel market to embrace augmented and virtual reality technologies (AR and VR) to provide a seamless and engaging shopping experience for consumers, revolutionizing the way shoppers interact with a brand online and in brick-and-mortar stores. Reality technologies enable shoppers to virtually try on apparel products, find the right fit and improve customer satisfaction—which all contribute to reduced returns for the retailer. Direct-To-Consumer (DTC) Strategies In order to have a strong connect with the consumers, brands are increasingly adapting DTC strategies. Most sellers are switching to their own brand websites to drive sales. Earlier, only large brands were setting up their online stores. But now, with the pandemic accelerating the consumer shift to online, even small retailers are setting up their own online stores. Platforms such as Magento, Shopify and WooCommerce are helping brands to easily build their online stores without the need for a large investment. These brands have actually played a major role in the growth of DTC brands in the country. The fashion and accessories category saw 92% year-over-year growth in DTC websites, compared to a much lower rate of 9% growth on marketplaces during 2020, according to the Unicommerce-Kearney report. According to a June 2021 report in The Economic Times, fashion brand websites have reported 66% order volume growth against 45% in marketplaces, and 77% GMV growth against 33% on marketplaces in fiscal 2021—which strongly implies that fashion brands are succeeding with a stronger DTC presence. Sustainability Consumers are becoming increasingly conscious about their social and environmental impacts when shopping and so are turning to brands and retailers that are embracing sustainability as part of their business, mission and values. As part of embracing sustainability, there is a growing trend among consumers to repair and up-cycle rather than use and throw. We expect these practices to gain popularity moving forward as shoppers shift away from a fast-fashion mindset. Sustainable products in the apparel sector also include upcycled accessories, such as headbands or handbags, made out of waste clothes or used fabrics. Shopping for secondhand products is not new in India, where it is common practice for children to wear clothes worn by older siblings and cousins. We expect the secondhand apparel retail market to grow, particularly with the emergence of rental services for occasion wear.What We Think

We expect India’s apparel retail market to witness positive growth from the second half of fiscal 2022, with Covid-19 vaccinations becoming widespread and consumers returning to socializing. While there had been a pandemic-induced consumer shift toward casual wear, we expect occasion wear, athleisure and Western wear to drive sales in the apparel market moving forward, driven by India’s sizeable young population. Implications for Brands/Retailers- With the impacts of the e-commerce surge likely to continue, brands and retailers should remain focused on enhancing their online presence and adopting advanced technologies such as AI, AR and VR to provide seamless shopping experiences.

- Western-wear and athleisure brands should target the sizeable young population in India, as these consumers are typically brand conscious, seek quality products, are interested in Western culture and a modern lifestyle through the influence of social media, and have high disposable income. Brands should also look to engage with young shoppers through social media to understand their needs and better align product offerings accordingly.

- With consumers moving to the online space, DTC offers a channel for brands maintain a strong connection with shoppers.

- Consumers are turning to fashion brands and retailers that have social and environmental causes as core to their values and mission. As awareness of sustainability increases, brands and retailers should consider how to integrate practices such as upcycling, recycling and improved waste management into their operations, to appeal to environmentally minded fashion consumers.

- With fashion brands and retailers going digital, technology vendors can offer AI and analytics technologies to enable them to process huge volumes of online consumer data to support demand forecasting, for example.

- Fashion brands are trying to offer a superior virtual shopping experience to their customers through which they can virtually try-on clothing while shopping online and in-store. AR and VR technology vendors can provide digital fitting solutions.

- Fashion retailers need to know the themes, language options and communication styles preferred by their audience. The Indian market is heterogeneous with diversity in language, culture and other social and economic factors. Vendors should offer technology and applications that support brands and retailers in adapting to different consumer demographics, such as natural language processing technology.

- Fashion brands and retailers may expand to Tier 2 and Tier 3 cities, providing opportunity for real estate companies.

- Real estate firms should cater to fashion brands’ and retailers’ digital offerings, such as by providing designated spaces for online order pickup at shopping centers.

- Real estate providers can revamp existing physical stores to emphasize experiential retail to attract shoppers. Such locations would gain traffic close to residential areas or office spaces due to convenience for consumers.