DIpil Das

What’s the Story?

As part of our Market Outlook series, we examine the size and trajectory of India’s online retail market. We also detail the market’s competitive landscape, retail innovators, and key themes we are watching.Market Performance and Outlook

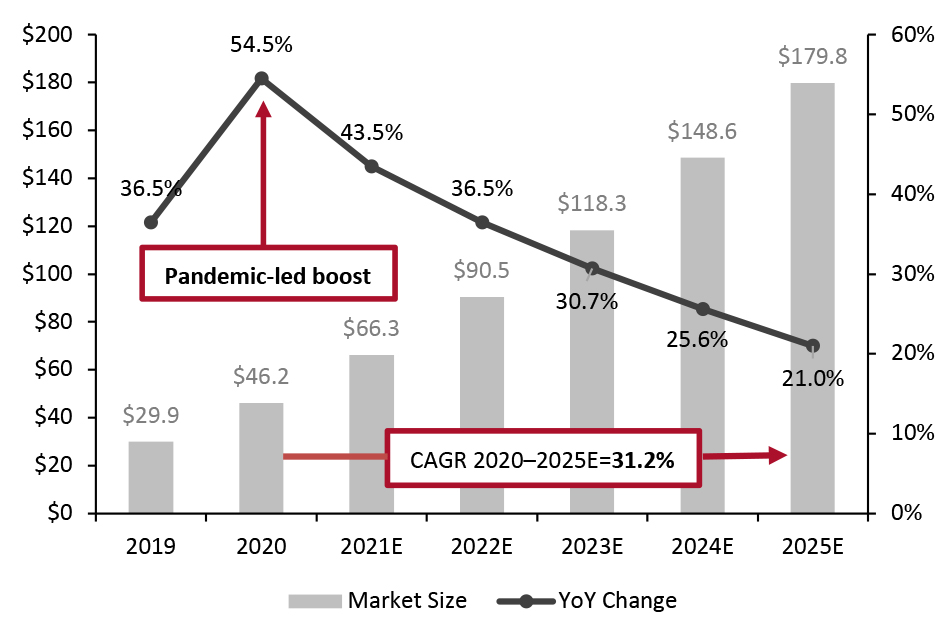

Market Size Coresight Research expects India’s e-commerce market to total $90.5 billion in 2022, up 36.5% from an estimated $66.3 billion in 2021. This continues the trend of decelerating growth from the pandemic-led boost in 2020: Online sales were up 54.5% from 2019, according to Coresight Research analysis of India Brand Equity Foundation (IBEF) data—before growth dropped to 43.5% in 2021.Figure 1. India E-Commerce Market Size (Left Axis; USD. Bil.) and YoY Change (Right Axis; %) [caption id="attachment_138251" align="aligncenter" width="700"]

Source: IBEF/Coresight Research[/caption]

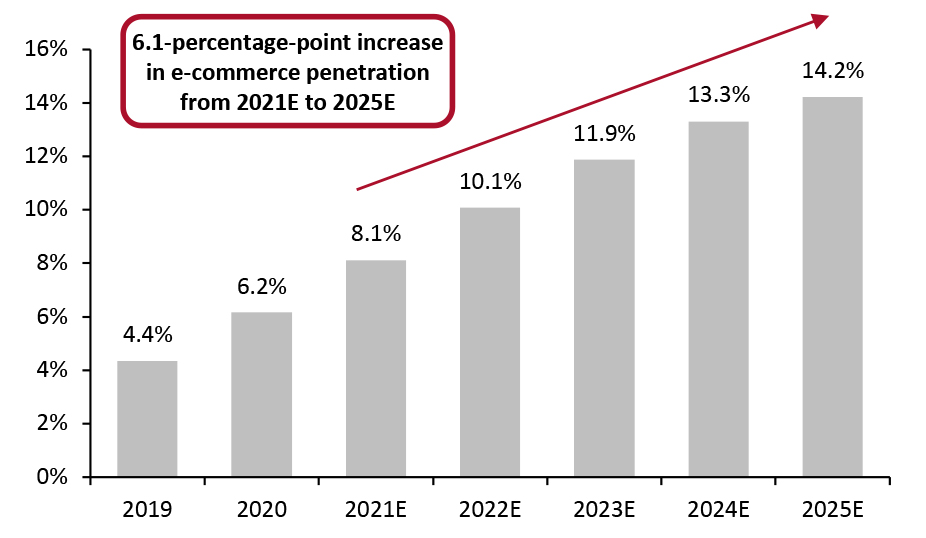

Furthermore, we expect that e-commerce penetration (online retail sales as a proportion of total retail sales) in India will reach 14.2% by 2025, up from 8.1% in 2021.

Source: IBEF/Coresight Research[/caption]

Furthermore, we expect that e-commerce penetration (online retail sales as a proportion of total retail sales) in India will reach 14.2% by 2025, up from 8.1% in 2021.

Figure 2. India E-Commerce Penetration (Online Retail Sales as a % of Total Retail Sales) [caption id="attachment_138252" align="aligncenter" width="701"]

Source: Coresight Research[/caption]

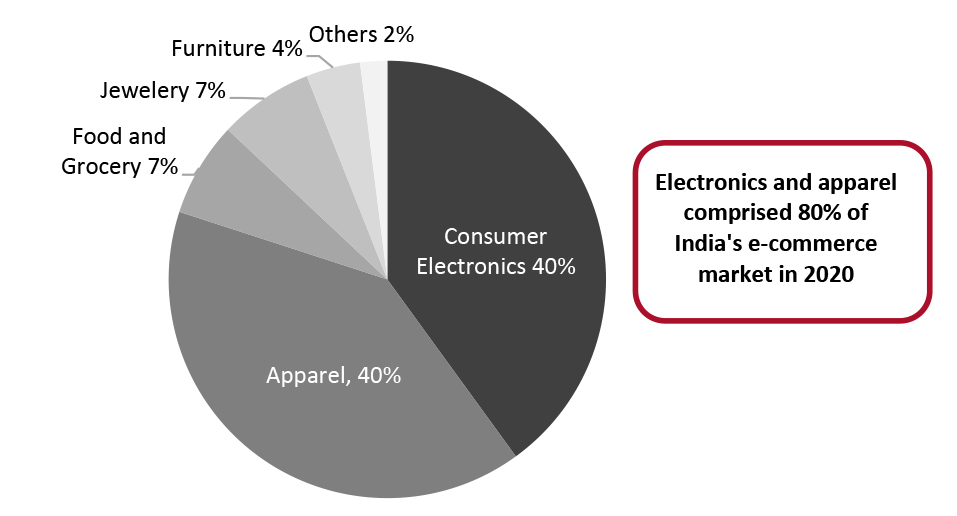

Figure 3 indicates the share of various categories in e-commerce, as of 2020. Electronics and apparel comprised the majority of online retail sales. Grocery and fashion/apparel categories will drive incremental growth in the e-commerce market, going forward.

Source: Coresight Research[/caption]

Figure 3 indicates the share of various categories in e-commerce, as of 2020. Electronics and apparel comprised the majority of online retail sales. Grocery and fashion/apparel categories will drive incremental growth in the e-commerce market, going forward.

Figure 3. India: Segmentation of E-Commerce Retail Sales by Value, 2020 [caption id="attachment_138253" align="aligncenter" width="699"]

Source: IBEF[/caption]

Pandemic Impacts

The first wave of the Covid-19 pandemic was an inflection point for Indian e-commerce as demand soared and buyers and sellers shifted to digital platforms. According to the Bain-PRICE consumer survey by management consultancy Bain & Company, the outbreak saw significant impacts on shopper behavior—most notably, one in 10 Indian consumers reported that they shopped online for the first time amid the first wave of the pandemic (see Figure 4).

Source: IBEF[/caption]

Pandemic Impacts

The first wave of the Covid-19 pandemic was an inflection point for Indian e-commerce as demand soared and buyers and sellers shifted to digital platforms. According to the Bain-PRICE consumer survey by management consultancy Bain & Company, the outbreak saw significant impacts on shopper behavior—most notably, one in 10 Indian consumers reported that they shopped online for the first time amid the first wave of the pandemic (see Figure 4).

Figure 4. Changes in Online Shopper Behavior During the First Wave of the Covid-19 Pandemic (% of Respondents) [caption id="attachment_138254" align="aligncenter" width="700"]

Base: 2,540 Indian consumers, surveyed April 1–May 6, 2020

Base: 2,540 Indian consumers, surveyed April 1–May 6, 2020 Source: Bain & Company [/caption] A second wave of Covid-19 hit India in April 2021, affecting consumer demand for nonessential goods. Online retail volumes dipped 11%, month over month, in April 2021, and sales in the fashion and accessories category were down 22%, according to cloud-based e-commerce solutions provider Unicommerce. However, the appetite for shopping online saw a quick revival: Unicommerce reported a 16.5% increase in overall e-commerce order volumes in May 2021, month over month, and June saw a further increase of 14%.

Online Market Drivers

In Figure 5, we present six key drivers of e-commerce in India, and discuss each in detail below.Figure 5. India: E-Commerce Market Drivers [caption id="attachment_138304" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Tech-Savvy Millennial and Gen Z Consumers

Millennials (people born between 1980 and 2000) comprise around 46% of the working population in India; they are one of the key contributors to the growth of e-commerce as they are tech-savvy and have high spending power. Millennials spend 54.1% of their disposable income on entertainment and shopping, particularly in the apparel and accessories categories, according to Deloitte India.

Gen Zers—people born after 2000—are also tech-savvy. Indian Gen-Z consumers spend an average of eight hours per day online, according to market research firm Ipsos. Both generations have a mobile-first mentality for shopping, with online reviews and discounts influencing their purchase decisions. Gen Zers increasingly rely on influencers and social media when shopping and look for quality and sustainable products, driving retail trends.

Growing Internet Penetration and Smartphone Adoption

A rise in smartphone adoption and increased Internet access through affordable broadband solutions and mobile data will continue to drive e-commerce growth in India. According to the Telecom Regulatory Authority of India, a statutory authority under the Department of Telecommunications, Ministry of Communications, the total number of Internet subscribers in India is 825.3 million, as of March 2021. Invest India, the National Investment Promotion and Facilitation Agency, estimates that the country sees approximately 10 million daily active Internet users added every month—one of the highest rates in the world.

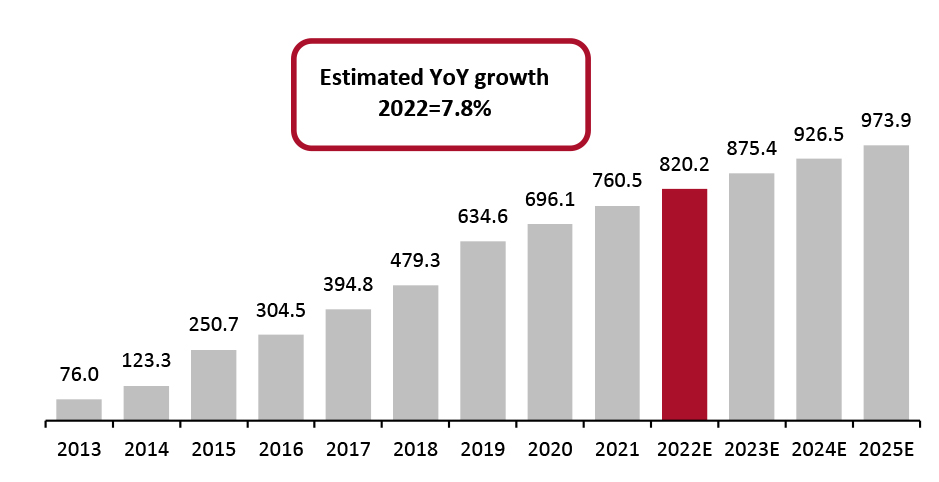

In addition, India’s base of smartphone users is set to reach 820 million in 2022, according to Statista data—more than double the total from 2017 and representing high-single-digit growth from 2021 (see Figure 6).

Increased ownership of smartphones among Indian consumers and the evolution of digital payment solutions (which we discuss below) will lead to ever greater adoption of mobile commerce.

Source: Coresight Research[/caption]

Tech-Savvy Millennial and Gen Z Consumers

Millennials (people born between 1980 and 2000) comprise around 46% of the working population in India; they are one of the key contributors to the growth of e-commerce as they are tech-savvy and have high spending power. Millennials spend 54.1% of their disposable income on entertainment and shopping, particularly in the apparel and accessories categories, according to Deloitte India.

Gen Zers—people born after 2000—are also tech-savvy. Indian Gen-Z consumers spend an average of eight hours per day online, according to market research firm Ipsos. Both generations have a mobile-first mentality for shopping, with online reviews and discounts influencing their purchase decisions. Gen Zers increasingly rely on influencers and social media when shopping and look for quality and sustainable products, driving retail trends.

Growing Internet Penetration and Smartphone Adoption

A rise in smartphone adoption and increased Internet access through affordable broadband solutions and mobile data will continue to drive e-commerce growth in India. According to the Telecom Regulatory Authority of India, a statutory authority under the Department of Telecommunications, Ministry of Communications, the total number of Internet subscribers in India is 825.3 million, as of March 2021. Invest India, the National Investment Promotion and Facilitation Agency, estimates that the country sees approximately 10 million daily active Internet users added every month—one of the highest rates in the world.

In addition, India’s base of smartphone users is set to reach 820 million in 2022, according to Statista data—more than double the total from 2017 and representing high-single-digit growth from 2021 (see Figure 6).

Increased ownership of smartphones among Indian consumers and the evolution of digital payment solutions (which we discuss below) will lead to ever greater adoption of mobile commerce.

Figure 6. Number of Smartphone Users in India, 2013–2025E (Mil.) [caption id="attachment_138256" align="aligncenter" width="699"]

Source: Statista[/caption]

Evolution and Acceptance of Digital Payment Solutions

The pandemic resulted in a shift from popular cash-on-delivery e-commerce transactions to digital payments, as consumers looked for contactless solutions throughout the shopping journey. With shoppers having realized the convenience that digital payment solutions provide, they are likely to remain popular in the online retail market moving forward.

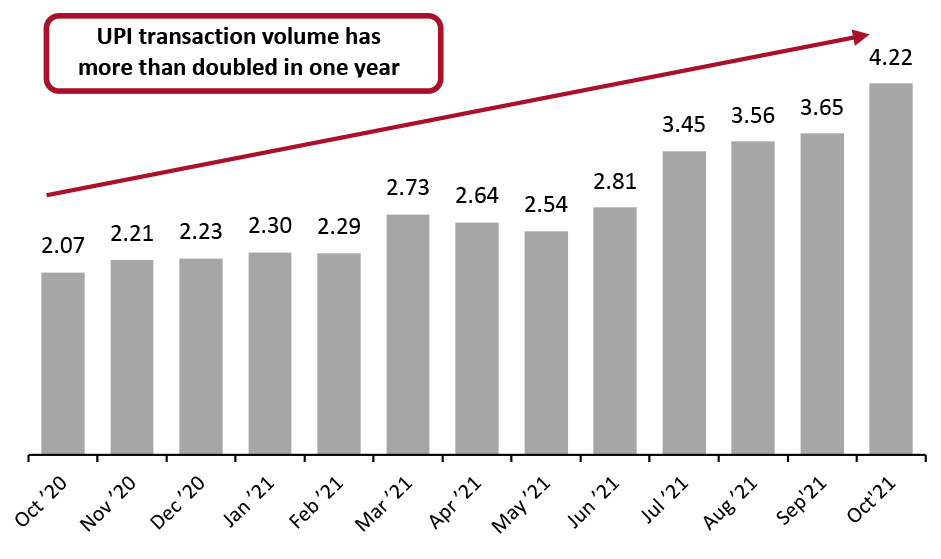

Digital payment solutions include Unified Payments Interface (UPI, a payment system developed by the National Payments Corporation of India), which is popular in Tier 2, Tier 3 and rural markets. Data from the National Payments Corporation of India (NPCI) show that the volume of UPI transactions in India has increased by 104% over the past year (see Figure 7).

Source: Statista[/caption]

Evolution and Acceptance of Digital Payment Solutions

The pandemic resulted in a shift from popular cash-on-delivery e-commerce transactions to digital payments, as consumers looked for contactless solutions throughout the shopping journey. With shoppers having realized the convenience that digital payment solutions provide, they are likely to remain popular in the online retail market moving forward.

Digital payment solutions include Unified Payments Interface (UPI, a payment system developed by the National Payments Corporation of India), which is popular in Tier 2, Tier 3 and rural markets. Data from the National Payments Corporation of India (NPCI) show that the volume of UPI transactions in India has increased by 104% over the past year (see Figure 7).

Figure 7. Volume of UPI Transactions in India (Bil.) [caption id="attachment_138257" align="aligncenter" width="700"]

Source: NPCI[/caption]

We also expect greater adoption of digital wallets such as Amazon Pay, Google Pay, Paytm and PhonePe, by both retailers and consumers. The Indian government is also promoting QR code-based payments to push digital payment adoption among retailers. According to the Reserve Bank of India, there were about 20 million UPI QR codes and 2 million Bharat QR codes deployed in India as of October 2020.

According to payment systems company ACI Worldwide, digital payments in India will account for 71.7% of total payments (by volume) in 2025, leaving cash and cheques at 28.3%.

Favorable Government Policies and Support Initiatives

The Government of India is contributing to the growth of e-commerce through various initiatives. For example, Digital India is the Government’s campaign to digitally empower the country by developing a secure and stable digital infrastructure that connects rural markets with high-speed Internet networks. The Government aims to create a trillion-dollar online economy by 2025 by enabling initiatives such as Bharat Net (a broadband connectivity across rural India) and Bharat Interface for Money (a UPI digital payment app).

In addition, Startup India, a flagship initiative of the government, is intended to catalyze startup culture and build a strong and inclusive ecosystem for innovation and entrepreneurship in India. The initiative has helped launch about 74 startups in the e-commerce sector as of November 2021.

Source: NPCI[/caption]

We also expect greater adoption of digital wallets such as Amazon Pay, Google Pay, Paytm and PhonePe, by both retailers and consumers. The Indian government is also promoting QR code-based payments to push digital payment adoption among retailers. According to the Reserve Bank of India, there were about 20 million UPI QR codes and 2 million Bharat QR codes deployed in India as of October 2020.

According to payment systems company ACI Worldwide, digital payments in India will account for 71.7% of total payments (by volume) in 2025, leaving cash and cheques at 28.3%.

Favorable Government Policies and Support Initiatives

The Government of India is contributing to the growth of e-commerce through various initiatives. For example, Digital India is the Government’s campaign to digitally empower the country by developing a secure and stable digital infrastructure that connects rural markets with high-speed Internet networks. The Government aims to create a trillion-dollar online economy by 2025 by enabling initiatives such as Bharat Net (a broadband connectivity across rural India) and Bharat Interface for Money (a UPI digital payment app).

In addition, Startup India, a flagship initiative of the government, is intended to catalyze startup culture and build a strong and inclusive ecosystem for innovation and entrepreneurship in India. The initiative has helped launch about 74 startups in the e-commerce sector as of November 2021.

- Learn more about India’s startup ecosystem in our separate report.

Competitive Landscape

Major Players India’s e-commerce sector comprises categories such as consumer electronics, apparel and footwear, food and grocery, home décor and furniture, beauty and personal care, pharma, and more. In Figure 8, we present selected major e-commerce companies in India. The combined revenue generated by the top 26 companies (by revenue) totaled over $10.1 billion in fiscal 2020 (ended March 31, 2020), based on average 2020 exchange rates. We examine some of these top players and their expansion/investment and development plans below.Figure 8. Top 26 E-Commerce Players in India, by Revenue, FY20* [wpdatatable id=1556 table_view=regular]

*Fiscal 2020 ended March 31, 2020 N/A=Data not available Conversions to USD are at average 2020 exchange rates Source: Company reports BigBasket BigBasket (Innovative Retail Concepts Private Limited) is one of India’s largest online food and grocery retailers. The company closed a deal with Tata Digital on May 28, 2021, in which the latter acquired a 64% stake in the BigBasket. Tata Digital has since infused primary capital of $200 million at a post-money valuation of $2 billion. Big Basket has an assortment of more than 50,000 SKUs (stock-keeping units) and a presence in more than 25 cities in India. The company reported gross sales of $1.1 billion in fiscal 2021. Flipkart Walmart-owned e-commerce firm Flipkart recently bolstered its grocery supply chain infrastructure to provide a seamless ordering and delivery experience to its customers: Flipkart has added over 10 million square feet of space through 66 new fulfillment centers, the company reported in September 2021. The retailer has also hired 115,000 people, including delivery executives, to strengthen the supply chain and meet growing demand for e-commerce services across India. Myntra Online fashion and lifestyle retailer Myntra has curated a section for sustainable products through its dedicated “Myntra for Earth” store. The retailer partners with more than 70 brands, offers more than 5,500 sustainable products for environmentally conscious customers, across handloom and handcrafted, organic, natural-dyed, recyclable and eco-friendly, vegan, and cruelty-free categories. According to the company, the Myntra for Earth store sees the highest traffic from women, and metro cities comprise about 40% of overall visits. Consumers aged 21–35 are the biggest contributors to the growth of the store, Myntra claims. The company plans to scale the number of brands by 2X and add another 4,000 styles to the existing assortment over the next quarter. Paytm Paytm is an Indian e-commerce digital payment system and financial technology company. Paytm’s parent company, One 97 Communications, went public with the launch of its initial public offering (IPO) in early November 2021, raising $2.5 billion. Paytm sees 122 million completed transactions annually and connects more than 21 million merchants with over 303 million users in its total ecosystem, as per financial services portal Chittorgarh.com in November 2021. Zomato Food-delivery services provider Zomato went public in July 2021 to raise ₹93.8 billion ($1.3 billion) through an IPO. The company’s IPO was highly anticipated as Zomato was the first technology unicorns (startup companies valued at over $1 billion) to be listed in India. As of the end of fiscal 2021, Zomato has a presence in 525 cities in India with 389,932 active restaurant listings, along with an international presence. Recent Investment Activity B2C (business-to-consumer) e-commerce is attracting significant funding to support innovation, product offerings, supply chain, logistics and expansion. B2C e-commerce companies are also venturing into DTC (direct-to-consumer) operations and offering personalization. Figure 9 shows key investments in the e-commerce sector in 2021.

Figure 9. India: Funding/Investments in the E-Commerce Sector CY 2021 [wpdatatable id=1557 table_view=regular]

Source: Index/company reports/Coresight Research Figure 10 shows companies in the e-commerce sector that are planning to go public in the next two to three years.

- Coresight Research has identified corporate evolution (including IPOs) as a key trend in global retail for 2022.

Figure 10. Indian E-Commerce Companies’ Plans for Fundraising Through IPO, 2021–2023 [wpdatatable id=1558 table_view=regular]

N/A=Data not available Source: Company reports/Coresight Research We saw many acquisitions in India’s e-commerce market in 2020 and 2021. We summarize key deals in Figure 11.

Figure 11. Acquisitions in India’s E-Commerce Market, 2020–2021 [wpdatatable id=1559 table_view=regular]

N/A=Data not available Source: Index/company reports/Coresight Research B2B E-Commerce B2B e-commerce is slowly gaining ground in India, fueled by the pandemic due to the digital transformation of large and small enterprises. B2B e-commerce enables higher capital efficiencies and more effective digital supply chains through automated processes and data-driven insights. The segment is also expanding into categories such as consumer durables, mobile accessories, apparel, home furnishings and healthcare. Recent investments in B2B e-commerce include $51 million raised by product-packaging solutions provider Bizongo in April 2021 (with CDC and Thailand-based AddVentures as investors) and $280 million by B2B trade platform Udaan in January 2021 (with Moonstone Capital Partners and Octahedron Capital as investors).

E-Commerce Innovators

With e-commerce and social commerce gaining traction among consumers, many businesses are venturing into this sector with innovative ideas, concepts, products and solutions. Retail innovators are primarily focusing on young Indian consumers who have high disposable income. New e-commerce businesses benefit from lower setup and operating costs versus brick-and-mortar retail, the potential to understand customers and their preferences, and the ability to improve the customer experience backed by technology. In addition, having an online presence offers scope for a much broader reach to consumers across the country than physical retailers. Below, we present selected e-commerce startups from across various sectors. Bulbul Bulbul is a shopping app that uses video content and livestreaming to engage with consumers. Rather than reading product descriptions or reviews, Bulbul explains products and features through its videos. It uses influencers to create videos and aims to involve local context, offering a range of languages. Cora Health Cora Health, a Bangalore-based health and wellness startup, helps users discover suitable nutritional food products based on their health conditions. The startup currently sells over 1,000 products across 50 brands, covering categories such as breakfast, beverages, chocolates and sweets. It also has an in-house team of nutritionists and product experts to help people make food choices, address product queries and offer chat-based assisted buying. Cora Health operates on a marketplace model and currently has access to 27,000 pin codes across India through 10 courier partners. According to the company in mid-2021, it is also looking to launch a content and guidance platform to deliver personalized insights. LaYuva LaYuva offers high-quality imported goods under the clothing, electronics, beauty and skincare, home utility and home décor categories. The company is the first e-commerce website in India to operate a multilevel marketing model. It allows customers to earn money by sharing products on social media. LaYuva, which has a robust supply chain network across Europe, Asia, Australia and America, reported in mid-2021 that it plans to expand into more countries and add more product categories. LetsDressUp Online tailoring service LetsDressUp offers custom-made Indian, Western and Ethnic outfits with fast delivery (typically one week). The company aims to address the sizing concerns of women when buying clothing online. LetsDressUp has built an end-to-end technology stack to bring customers, logistics partners, tailor partners and the startup’s central hub together in one place. Shop101 Shop101 is a social commerce startup that helps small business owners sell their products online through resellers. It also allows individuals to earn through margins for products they share on social media platforms such as Facebook, Instagram and WhatsApp. Shop101 handles shipment and delivery. Shopmatic Shopmatic is an international e-commerce company provides tailored solutions for small retailers and kirana shops in India to help build their web stores. Shopmatic’s tech-centric solutions allow shop owners to use their phones to track inventory, sales, orders, customers and more. The company facilitates the use of multiple online payment options, such as UPI. Along with pre-built catalogs, shop owners can also share product links on WhatsApp.- Read more about retail innovators in Indian e-commerce in our separate report.

Themes We Are Watching

Omnichannel Experiences Consumer expectations are constantly evolving, and the pandemic has seen consumers prioritize safety and convenience---making omnichannel strategies more important than ever. Brands are focusing on creating targeted and personalized experiences to boost customer acquisition, satisfaction and retention through consumer-centric business models. While traditional offline retailers switch to online channels, the reverse is also true as online channels look to expand their offline footprint through experiential brick-and-mortar stores and expansion into Tier 2, Tier 3 and rural markets. The BOPIS (buy online, pick up in store) trend is gaining traction too: Brands need to ensure the shopping journey is convenient for their customers. Ultimately, an omnichannel strategy helps drive increased sales and revenue. Voice and Vernacular Searches With future e-commerce growth poised to be driven by Tier 2 cities and beyond, it will be crucial for e-commerce platforms to provide their services in vernacular languages in order to appeal to more consumers and provide an easy shopping journey. Voice search is gaining popularity in India as it enables the faster discovery of products and services. According to a report by the Mobile Marketing Association and digital agency Isobar, voice search queries in India are currently growing at a rate of 270% per year. Businesses need to optimize their websites and user experiences to accommodate voice search functionality, effectively integrating it with artificial intelligence/machine learning (AI/ML) technology to capture shopper behavior and recommend products based on past shopping lists. Voice search is more conversational, and businesses need to tweak their voice search programs to find results quickly. As voice search will accelerate mobile commerce, businesses need to optimize their websites, apps and networks for faster loading. Video Content and Social Commerce Videos have proven to be a great way to convert visitors into buyers. Consumers engage in video content for entertainment, as well as for recommendations, tutorials and guidance, etc. We expect video-content consumption in Tier 2/3 and smaller cities in India to grow alongside improved access to smartphones and the Internet. Brands should create videos for their website to instantly grab customer attention, showcase products, convert and increase sales and revenue. Furthermore, Coresight Research has identified livestreaming and social commerce as a key global retail trend for 2022. A robust social commerce strategy is vital in today’s environment, enabling brands and retailers to engage consumers through interactive, shareable and immersive content, as well as supporting new product launches. We expect social media influencers to play a more prominent role in influencing consumers’ purchase decisions and will have the power to generate revenues for brands. Brands should integrate influencers into their marketing strategy to ensure their content resonates with the millennial and Gen Z audiences in particular. Advanced Technologies E-commerce companies need to deploy advanced technologies such as AI, ML, the Internet of Things and AR/VR (augmented reality/virtual reality) to provide personalization and immersive experiences to their customers.- E-commerce can leverage AI and ML for analyzing customer data to understand their buying behavior and shopping habits and curate product offerings for an automated and personal shopping experience.

- Reality technology enables shoppers to get a better feel for products before they make a purchase—and is especially effective in home categories.

What We Think

We expect the growth of e-commerce in India to be driven by categories such as food and grocery, apparel and footwear, and consumer electronics. We also believe that some other categories—furniture, beauty and personal care, and pharmacy products—will enhance their sectoral share due to the entry of various players with robust product offerings. We anticipate the growth of e-commerce to be driven by Tier 2 and Tier 3 consumers with their increased e-commerce spending year-over-year, including festive season sales. We believe the sector will witness increased funding from investors as players look for business expansion plans, and launching their own DTC arms, moving away from marketplaces. With the pandemic still lingering around with the entry of new variants such as Omicron and continued consumer inclination towards online channels, we expect the sector to scale further heights in future. Implications for Brands/Retailers- Consumers prefer to shop through multiple channels owing to convenience. Hence, brands and retailers must adopt an omnichannel strategy and ensure brand and customer experience consistency across all channels. Brands should also identify the correct channels through which their customers shop and offer optimum solutions such as BOPIS.

- It is time for brands and retailers to embrace social commerce and create social features for their products to reach out to social media consumers. This will help them tap customers who are not regular visitors of their websites due to issues like language barriers.

- With D2C gaining popularity, large e-commerce brands should also launch their D2C arms for better growth prospects. This will directly connect brands with their consumers, understands their shopping behavior and habits, and offers customized products addressing their needs to improve sales and revenue.

- Brands should increasingly offer subscription services to retain their customers and subsequently increase their sales and revenue through up-selling and cross-selling relevant products. The subscription also facilitates greater business predictability regarding what products need refills, how much, and at what frequency.

- AI and ML help brands analyze their customer data collected using AI tools and leverage the same to offer individualized customer experience as this will be a clear differentiator from the competitors. Brands and retailers should also rollout technologies like AR/VR to provide a virtual and personalized shopping experience to customers, which is now crucial from their perspective.

- Brands can use chatbots to improve the consumers’ shopping experience. Chatbots interact with online shoppers just like store associates do, and chatbots help consumers find their desired products in just a few clicks, thereby improving their satisfaction.

- Consumers are becoming more conscious about where they shop and its impact on the environment and related effects. It is therefore critical for brands to embrace sustainability by implementing initiatives such as sustainable shipping, reduced packaging, and improving recycling policies.

- Startups specializing in warehousing and logistics solutions can offer great automation opportunities to B2B e-commerce companies.

- AR/VR is increasingly becoming a must-have for e-commerce brands in the fashion and home-improvement categories. AR/VR technology vendors can enter into strategic partnerships with fashion and home-improvement e-commerce brands and offer customized solutions.

- B2B e-commerce is on the rise in India and drastically embracing technology to streamline supply chain processes through automation, providing growth avenues for technology firms.

- AI and ML technology vendors can offer solutions integrated with voice searches as brands will increasingly use voice searches to capture shopper behavior and habits.

- With e-commerce logistics and warehousing attracting huge investments, real estate companies can offer ample spaces to support warehousing facilities, especially in Tier 2 and Tier 3 cities.

- E-commerce companies need to process huge volumes of their customer data to curate relevant product offerings and require big data centers. Real estate firms can leverage this opportunity and offer commercial spaces in Metro and Tier 1 cities.

- E-commerce players are also rolling out massive flagship and experience stores to showcase their products and further the company’s growth strategies, providing real estate players opportunities to develop and offer such spaces.

- Start-up e-commerce players are increasingly operating out of co-working space as they focus on building technology and outsourcing everything else. Commercial real-estate service providers can create and offer co-working spaces focusing on these e-commerce start-ups.