DIpil Das

What’s the Story?

Grocery retail is one of the categories that saw increased consumer spending during the Covid-19 pandemic in India in 2020, with consumers stockpiling grocery essentials fearing the nationwide lockdown. In addition, consumers largely switched to online channels to purchase groceries last year—a sector typically dominated by offline players across the unorganized and organized retail sectors.

In this report, we discuss these recent shifts in grocery retail in India and provide an outlook for the market through the remainder of 2021 and beyond, including opportunities for online and offline players.

Grocery Retail in India: Market Performance and Outlook

Consumer Spending

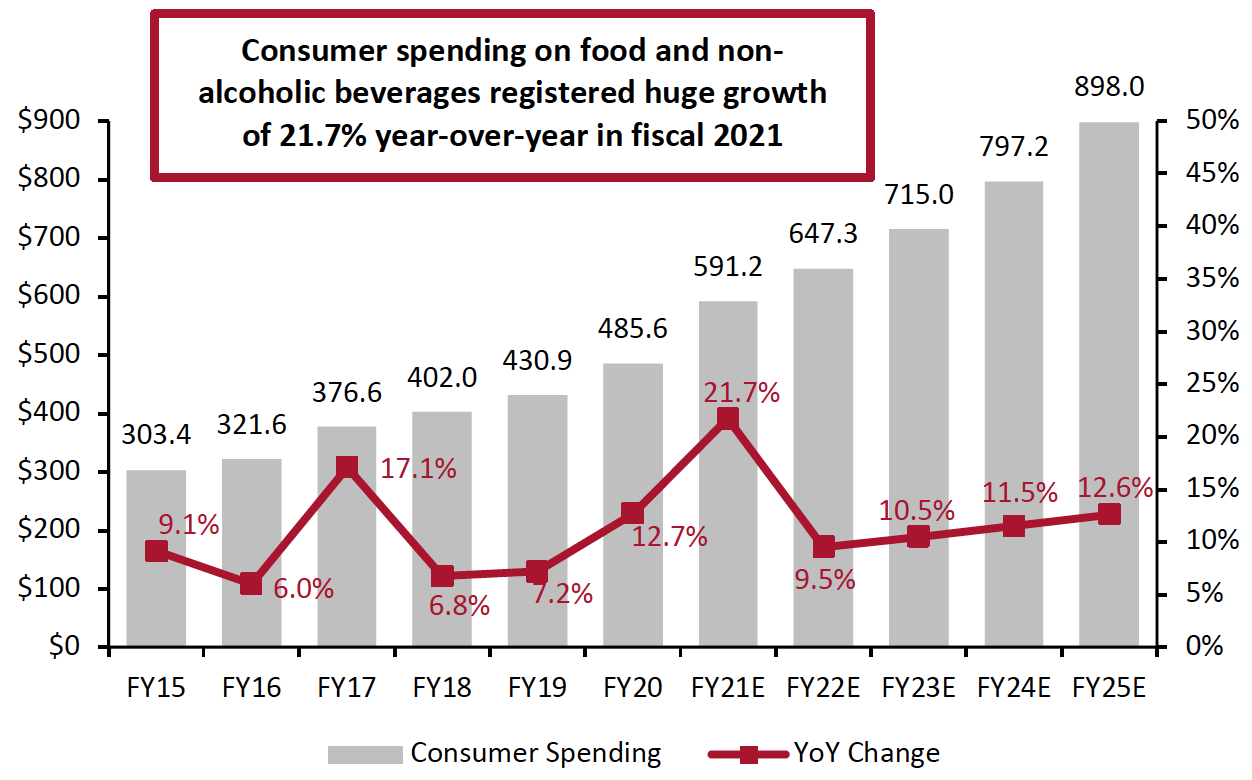

In fiscal 2021, which covered the Covid-19 outbreak in India (the fiscal year runs from April 1 to March 31), spending on food and non-alcoholic beverages by Indian consumers increased by 21.7% year over year to $591.2 billion—up from $485.6 billion in fiscal 2020, as estimated by India’s Ministry of Statistics and Programme Implementation (MOSPI).

This huge growth was primarily due to increased consumer spending on groceries as they stockpiled grocery essentials during the pandemic-led nationwide lockdown from March to June 2020—and this trend continued to some extent even post lockdown, with consumers fearing product scarcity in grocery essentials.

Due to the strong comparatives, we expect growth in consumer spending on food and non-alcoholic beverages to moderate in fiscal 2022. However, spending is likely to remain strong: With the second wave of Covid-19 hitting the country in April 2021, the majority of the employed workforce have resumed working from home, and lockdowns in some cities will see increased tendency to stockpile grocery essentials. Coresight Research estimates year-over-year growth of 9.5% in fiscal 2022—reaching $647.3 billion—with the rate then set to increase by roughly one percentage point each year to fiscal 2025 (see Figure 1).

Figure 1. India Consumer Spending on Food and Non-Alcoholic Beverages (Left Axis; USD Bil.) and YoY Change (Right Axis; %) [caption id="attachment_132091" align="aligncenter" width="550"]

Fiscal year runs from April 1 to March 31

Fiscal year runs from April 1 to March 31Conversions to USD are at average 2020 exchange rates

Source: MOSPI/Coresight Research[/caption]

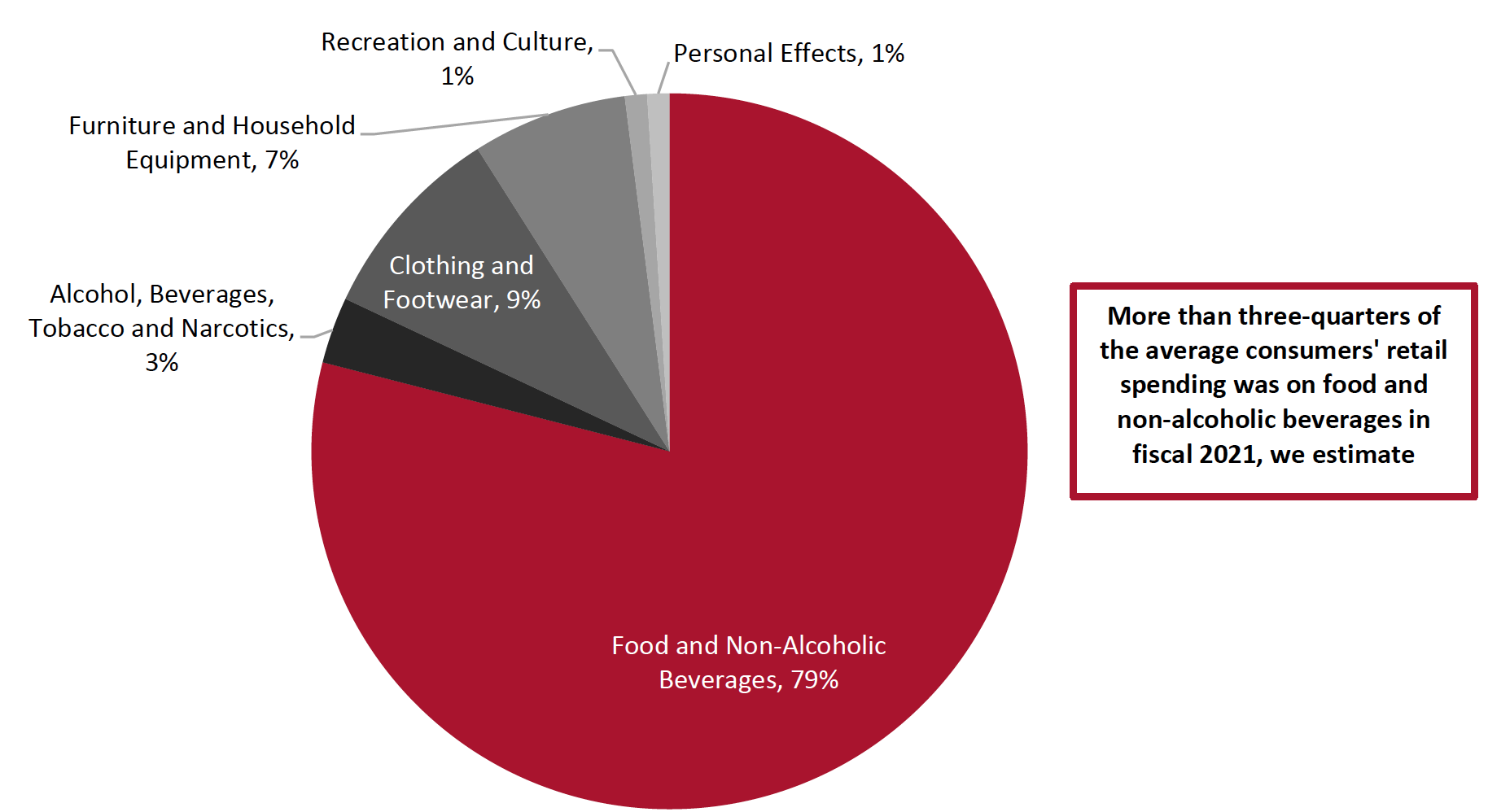

Based on data from MOSPI, we estimate that Indian consumers spent nearly 80% of their total retail spending on food and non-alcoholic beverages in fiscal 2021 (in India, the fiscal year runs from April 1 to March 31).

Figure 2. Breakdown of Retail Spending by Indian Consumers in FY21, by Category [caption id="attachment_132092" align="aligncenter" width="700"]

Categories as published by MOSPI

Categories as published by MOSPISource: MOSPI/Coresight Research[/caption]

Market Size

The grocery business in India operates across diverse channels, ranging from mom-and-pop stores in the unorganized sector to supermarkets and hypermarkets in the organized sector to online grocers.

The unorganized sector comprises about 90%–95% of the grocery market. Kirana stores operate through a fragmented distribution network and source products from relatively local wholesale markets and distributors. They benefit from being local to consumers and building a personal connection with shoppers.

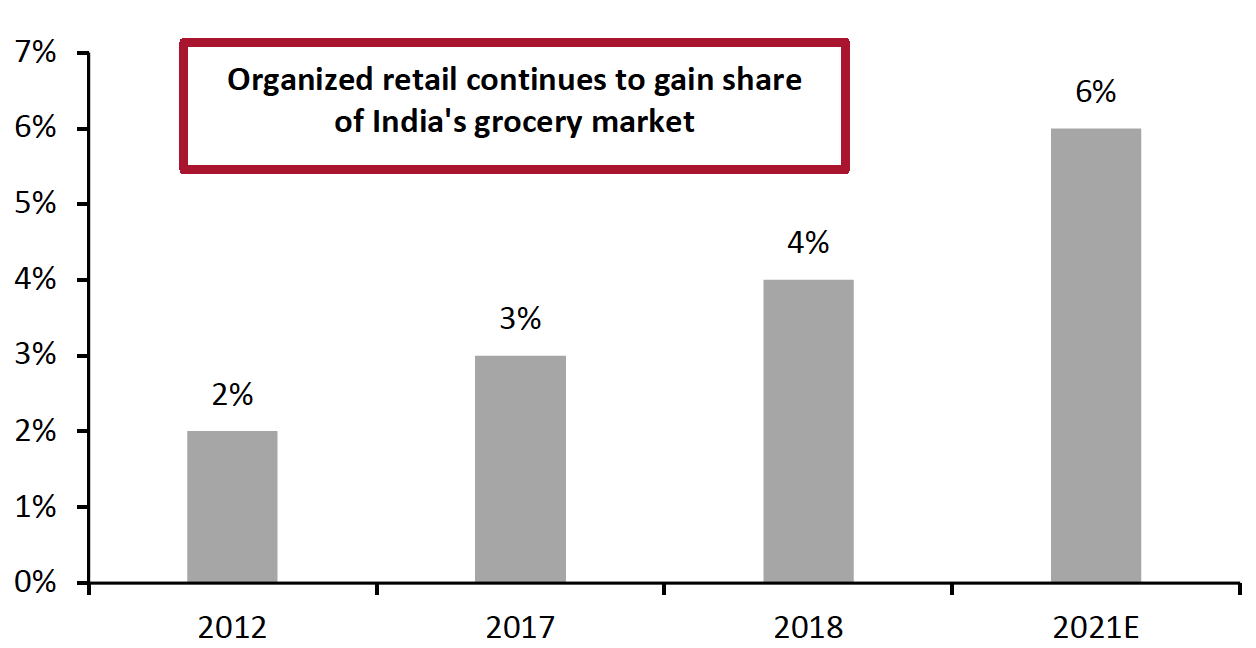

The penetration rate of organized food and grocery retail was about 4% in 2018 and is likely to touch 6% in 2021, according to an April 2019 survey by management consulting firm Technopark Advisors, financial services companies Motilal Oswal group and HDFC securities (see Figure 3). According to Statista and various industry estimates, there were around 12.9 million grocery retail outlets in India, including traditional and modern retailers—with the total having increased steadily from around 12.4 million in 2013.

The growth of the organized sector is being driven by evolving urban lifestyles and consumer preferences to shop at modern grocery retail outlets such as hypermarket and supermarket chains on a weekly or monthly basis. These grocery retail outlets are becoming one-stop shops, offering a wide range of brands and products through innovative product displays and in-store services to enhance the shopping experience; modern grocery retail outlets in the organized sector are developing new marketing strategies and investing in technologies to attract consumers to their stores.

Figure 3. Organized Food and Grocery Retail as a Proportion of India’s Total Grocery Market (%) [caption id="attachment_132093" align="aligncenter" width="550"]

Source: Technopak Advisors/Motilal Oswal Group/HDFC Securities/Coresight Research[/caption]

Source: Technopak Advisors/Motilal Oswal Group/HDFC Securities/Coresight Research[/caption]

Market Drivers

Increased Focus on Health and Wellness

The pandemic has seen consumers place heightened emphasis on health and wellness, including in healthier eating habits and exercising more to maintain a healthier lifestyle. Consumers are seeking nutritious food products that are rich in vitamins, minerals and ingredients that boost the immune system, as well as chemical-free or organic ingredients. According to an August 2020 paper by TechSci Research entitled India Immunity Boosting Packaged Products Market, the Indian immunity-boosting packaged products market is projected to reach $347 million by fiscal 2026 due to increasing focus among Indian consumers on preventive health. This presents opportunities for grocery brands and retailers to add healthier options into their product ranges to drive sales.

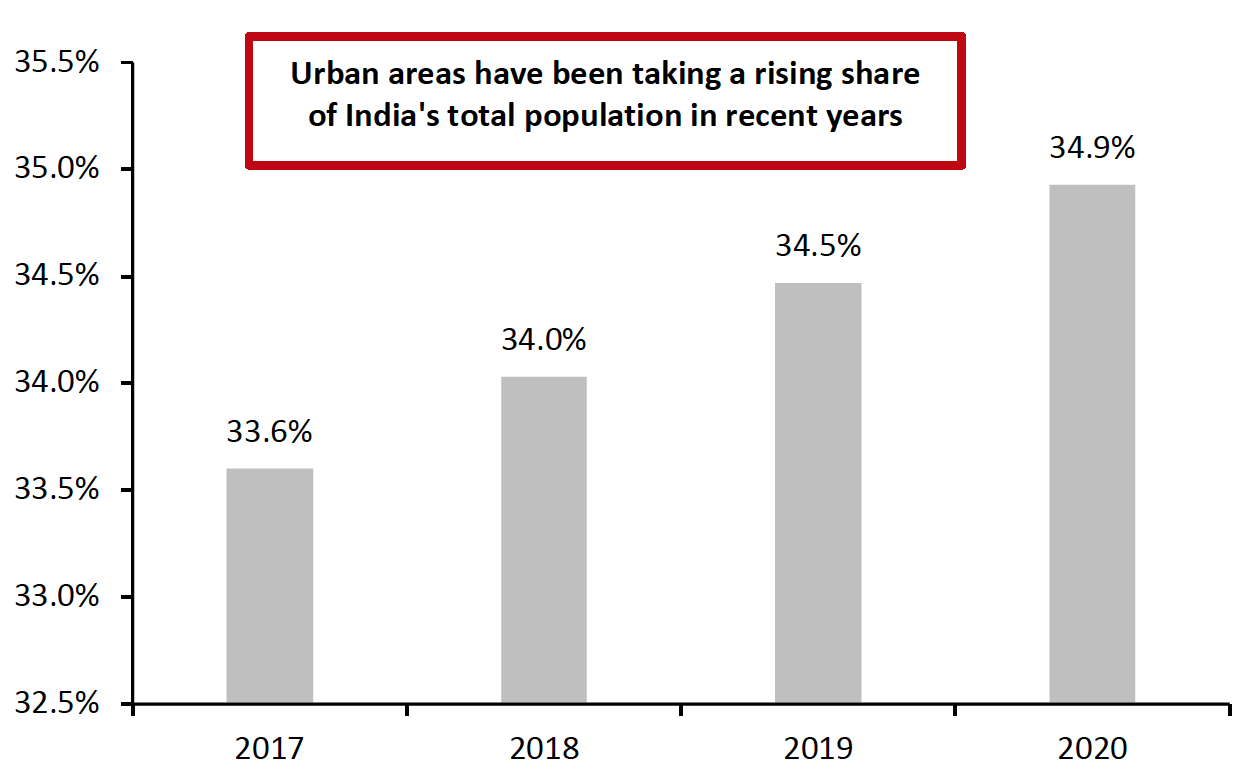

Demand for Convenience Foods Boosted by Urbanization

The urbanization trend in India is resulting in a number of societal shifts: an increase in the size of the working population, changes in the types of occupations that urban residents have, growth in the number of nuclear households and an increase of women in the workforce. The figure below shows the upward movement in the percentage share of urban population in India.

Figure 4. Urbanization in India, 2017–2020 (Urban Population as a % Share of Total Population) [caption id="attachment_132094" align="aligncenter" width="550"]

Source: World Bank[/caption]

Source: World Bank[/caption]

In terms of their impacts on grocery, lifestyle changes driven by urbanization are leading to convenience taking priority among consumers who are less willing to spend time on food preparation. Convenience foods (also known as ready-to-eat products) require no, or minimal, effort to cook—they may just need heating up in a microwave, for example.

Increased demand and the higher disposable income of the working population presents opportunity for grocery brands and retailers to establish and expand their presence in the convenience foods category.

Online Market

In grocery retail, the majority of Indian consumers typically depended on small neighborhood stores known as “kirana” stores and organized offline retail formats. However, the Covid-19 pandemic prompted a shift to online channels, fueled by increasing Internet and smartphone penetration and the boom of digital payments among predominantly young consumers who prefer an omnichannel shopping experience.

Government initiatives promoting the digital economy and digital literacy are likely to further support the growth of online grocery in India moving forward, alongside consumer demand for convenience and ongoing health/hygiene concerns amid the pandemic recovery. Although online players will face tough competition from kirana stores, competitive pricing (including sales, offers and discounts), digital payment options and fast, cheap home delivery will stand e-commerce grocery retailers in good stead to build market share.

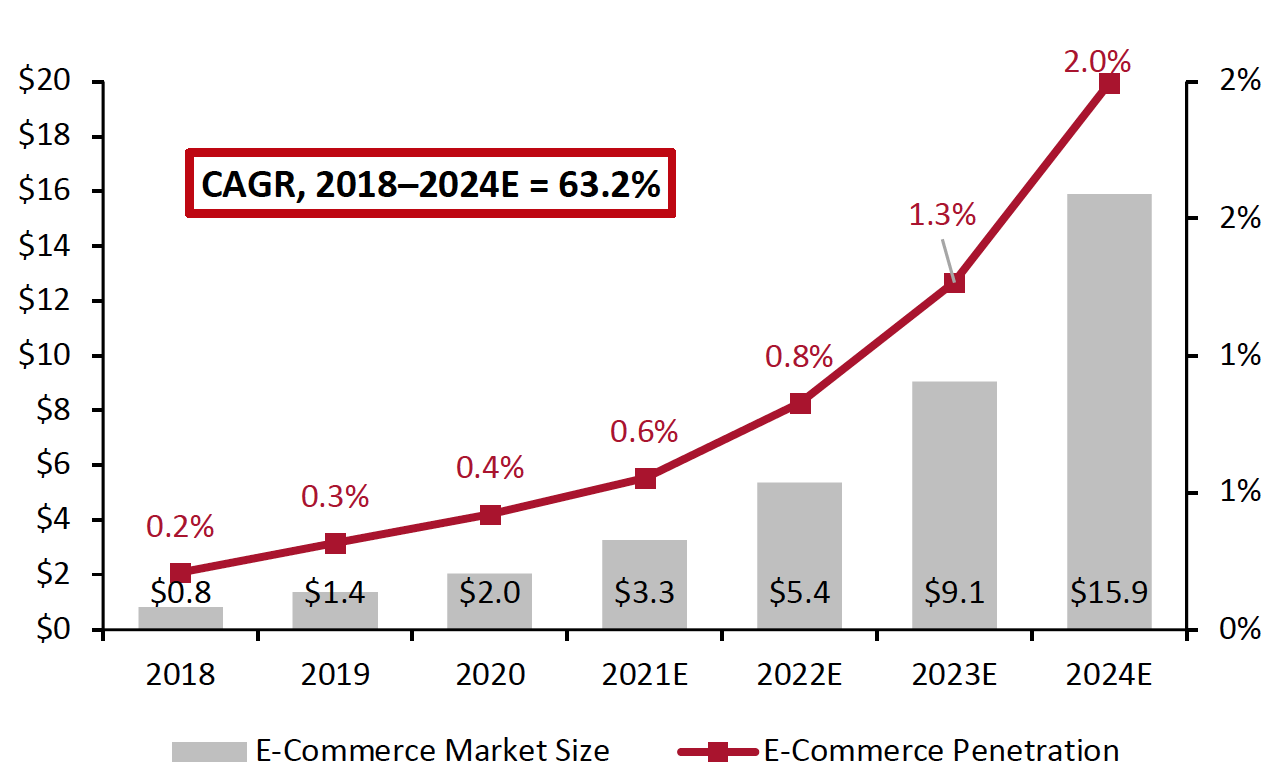

According to an April 2020 survey by global data and insights firm Netscribes and The Times of India, India’s grocery e-commerce market is set to total around $3.3 billion in 2021 and will grow to $15.9 billion by 2024. Coresight Research estimates that e-commerce penetration in the Indian grocery market will increase from 0.6% to 2.0% in the same period (see Figure 4).

Figure 5. India: Grocery E-Commerce Market Size (Left Axis; USD Bil.) and E-Commerce Penetration (Right Axis; Online Sales as a % of Overall Grocery Sales) [caption id="attachment_132095" align="aligncenter" width="550"]

Source: Netscribes/The Times of India/Coresight Research[/caption]

Source: Netscribes/The Times of India/Coresight Research[/caption]

Competitive Landscape in Grocery E-Commerce

There are three primary players in India’s grocery e-commerce market: Amazon, BigBasket and Grofers. However, the online space is set be a battleground for growth in the grocery market, with the entry of Reliance Retail’s JioMart likely to disrupt the competitive landscape. We discuss some of the prominent players in the online grocery market below.

BigBasket

Big Basket (Innovative Retail Concepts Private Limited) offers a wide range of products and brands across fresh fruit and vegetables, rice and dals, spices and seasonings, packaged products and beverages. BigBasket has a pan-India presence and delivers products to consumers’ doorsteps. According to The Economic Times, the company reported 36% revenue growth in fiscal 2020, to a total $517.3 million. BigBasket is in the final stages of closing a deal to sell a 60% stake to multinational conglomerate Tata Group for $1.2 billion. The deal includes a plan to launch an IPO (initial public offering) as early as 2022–23.

Grofers

Indian online grocery-delivery service provider Grofers is based in Gurugram and facilitates the online ordering of groceries through its mobile app and website. The company has raised around $535.5 million from investors, including Sequoia Capital, SoftBank and Tiger Global, as of 2018. Grofers currently operates in 33 cities across India. The company reported year-over-year revenue growth of 111% in fiscal 2020 (latest available data), from $11.3 million to $23.9 million.

Amazon

Amazon announced in January 2021 that it has discontinued its Pantry service and has rolled out grocery items into its main e-commerce website. Amazon Pantry previously enabled Prime members to shop grocery items online. According The Economic Times, the company expanded its services to over 300 cities in India in June 2020, offering 3,000 products from more than 200 brands.

Amazon had injected $32.5 million in its India retail business in 2019. The company has started to roll out its Amazon Fresh-branded stores, which will continue to offer online shopping services in addition to in-person shopping.

Flipkart Supermart

Walmart-owned e-commerce firm Flipkart unveiled Flipkart Supermart, its online grocery store, in Bengaluru in August 2018. Flipkart Supermart has since expanded its operations to other cities, including Chennai, Hyderabad, Delhi-NCR, Mumbai, and Pune. Flipkart Supermart offers home delivery of groceries, which consumers can shop via Flipkart’s app and its desktop and mobile websites.

Reliance JioMart

JioMart, an Indian online grocery-delivery service, started as a joint venture between Reliance Retail and Jio Platforms. It delivers groceries and daily essentials from nearby stores. The platform launched as a pilot in select areas of Mumbai and nearby areas in April 2020, was rolled out to 200 cities and towns across India, in May 2020.

JioMart is fast evolving into a full-scale e-commerce venture with options across product categories. It extended its partnerships with neighborhood kirana stores to 20 cities in July 2020 and experienced a 4X increase in orders over the first quarter of fiscal 2021. JioMart claims to have received about 250,000 orders in a single day during the lockdown period.

Other Notable Companies

Godrej’s Nature’s Basket is an online grocery store that also operates physical stores in Indian cities. It has been acquired by Spencer’s Retail.

DMart Ready is DMart’s online service that enables consumers to collect their online orders through dedicated pickup points at specific locations.

Zopnow is a technology platform for online grocery shopping. It was founded in 2011 in Bengaluru and currently operates in more than 29 cities in India.

Competitive Landscape in the Overall Grocery Market

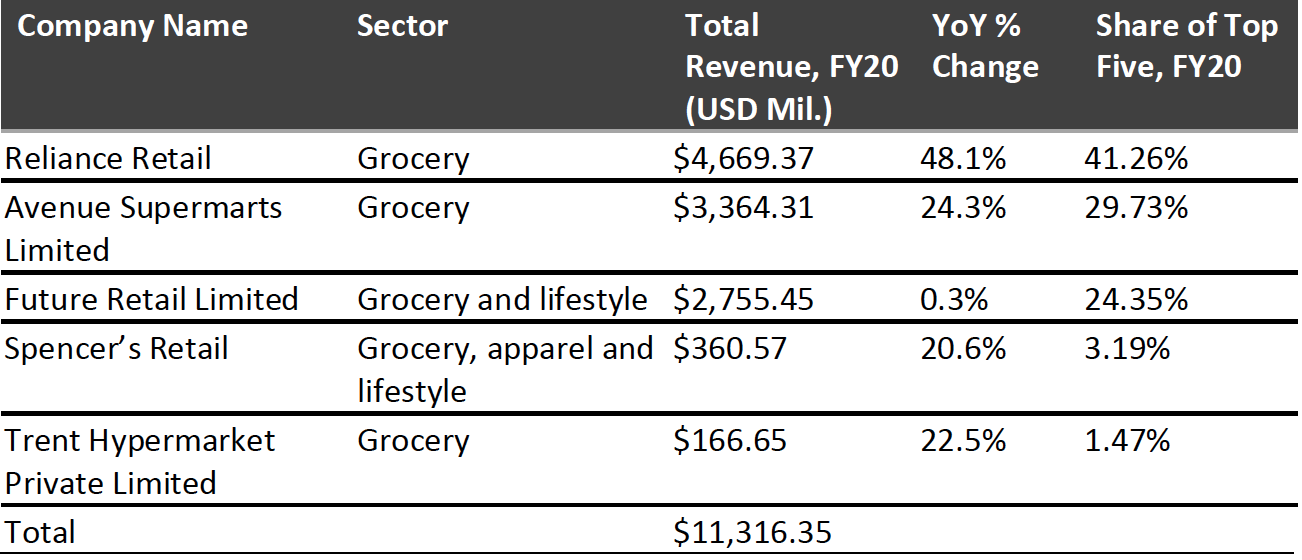

The figure below presents the top five grocery retail companies in India, based on fiscal 2020 reported revenue. We discuss each company in further detail below.

Figure 6. India: Major Grocery Retail Players by Revenue [caption id="attachment_132096" align="aligncenter" width="700"]

Conversions to USD are at average 2020 exchange rates

Conversions to USD are at average 2020 exchange ratesSource: Company reports[/caption]

Reliance Retail Limited

Reliance Retail is the top grocery retailer in India, with a 41.3% share of the top five in fiscal 2020. The company has 797 stores across 180+ towns and cities. It operates four store concepts: Reliance Fresh, a neighborhood store format focused on convenience and quality that offers essential items in the categories of fresh food, staples, FMCG (fast-moving consumer goods), home and personal care; Reliance SMART, a destination-store concept offering essential items in a one-stop-shop; SMART Point, a smaller version of the SMART format that provides a one-stop multipurpose store concept offering grocery essentials in residential neighborhoods; and Reliance Market, which comes under the wholesale cash-and-carry store concept and serves households, kirana stores, hotels, restaurants, institutions and B2B (business-to-business) member partners.

Reliance Retail is now on its way to establishing a strong online presence through its JioMart digital commerce platform, as we discussed earlier.

Avenue Supermarts Limited

Avenue Supermarts, popularly known as DMart, is an Indian retail corporation that operates a chain of hypermarkets across the country. The company, founded in 2002, currently has 214 stores across 72 cities. DMart’s operations are supported by a network of 36 distribution centers and seven packing centers. The company offers a wide range of everyday products to its customers under three broad categories: food, nonfood and general merchandise. The food category generated 52.4% of total revenues in fiscal 2020, according to company reports. DMart opened 38 new stores in fiscal 2020 and is now on the lookout for locations within and outside its clusters for future expansion.

Future Retail Limited

Future Retail has some of India’s most popular grocery retail chains operating under it, including Big Bazaar (its flagship hypermarket chain), Easyday Club, Foodhall, Foodworld, Heritage Fresh and Hypercity. The group has over 1,350 stores covering over 16 million square feet of retail space and serves millions of customers across 400 cities in India. There are about 290 Big Bazaar/Hypercity stores, nine Foodhall stores and 956 small-format stores under the group as of March 31, 2020 (latest available data). Future Retail had added 26 new, large-format stores in fiscal 2020 and believes that its well-placed store network will capture the growth in the organized sector.

Other Notable Companies

More Retail is the fourth-largest supermarket chain in India (behind the three companies discussed above). More was previously known as Aditya Birla Retail Limited and owned by Aditya Birla Group before being acquired and renamed by Wltzig Advisory in 2019. The company now has more than 600 stores across the country and provides products under its own labels. More Retail also has an online presence through its MyMoreStore app.

Spar Hypermarkets is a strategic partnership between Dubai-based Landmark Group’s Max Hypermarkets India Private Limited and Amsterdam-based Spar International. Spar India has 25 stores across nine cities. It has an online presence through sparindia.com.

Spencer’s Retail is a multiformat retailer offering a range of products across food, personal care, fashion and home essentials. Spencer’s Retail is part of the RP Sanjay Goenka Group, which operates around 120 stores, including 37 hyperstores, in 35 cities across India.

Star Bazaar operates under Tata’s Trent Hypermarket Private Limited. It sells fresh food and groceries under two formats: Star Hyper hypermarkets and Star Market supermarkets.

Retail Innovators

With kirana stores unable to offer delivery and supermarkets being shut during the pandemic-induced lockdowns in India last year, new players ventured into the online grocery-delivery space to meet increasing consumer demand. Grocery startups came up with technology-powered solutions to drive operational efficiency and reduce contact in the in-store shopping experience amid consumer health concerns. While many such technology initiatives have existed for years in Western markets, they are relatively new in India. The Indian grocery market has continued to see new innovations being launched this year, too.

- BharatPe, the QR-based payments platform for offline merchants, came up with a consumer-facing feature that enables its users to connect with retailers and order grocery essentials. BharatPe was able to connect potential customers to its network of 2 million neighborhood grocery, dairy and pharma stores when e-commerce deliveries were delayed or halted during the lockdown.

- In April 2021, Big Bazaar announced the launch of its “two-hour delivery promise” on every product across food, FMCG and home products—making it the first retailer in the country to offer instant home delivery on almost every consumer product ordered online. The service will be available in Mumbai, Bengaluru and Delhi before being rolled out to around 150 cities in total.

- Food-technology platform Limetray rolled out an online ordering system in April 2020 to help local grocery shops accept customer orders online through its platform. Limetray customized the specialized software suite for the use of local stores. The company claims that the initiative improved local players’ visibility of their customers and helped them achieve multi-fold growth.

- In July 2020, SunnyBee Market, a Chennai-based premium food and grocery startup, introduced a self-checkout store in Besant Nagar, Chennai—the first of its kind in India. The self-checkout counter, powered by WayCool Labs, comes with a built-in high-speed scanner, touchscreen panel and billing printer. After shoppers scan their purchases, the screen will display a QR code that they can scan on their mobile device using any UPI (Unified Payments Interface) payment method and make payment. This solution frees up billing staff to focus their time on managing store operations and improving customer service.

- Swiggy, an online food-ordering and delivery platform, has partnered with several brands such as Dabur,Godrej, Hindustan Unilever Limited, ITC, Marico, Procter & Gamble and other large-format retailers to deliver groceries to over 125 cities in India. In April 2020, Swiggy introduced a “grocery” category in its app that enables consumers to view available stores in their local area, add items to their cart and make payment. The company also offers “no-contact” delivery.

Themes We Are Watching

Focus on Technology

Technology can give grocery retailers a competitive edge in attracting consumers and providing an engaging in-store experience. Some large brick-and-mortar grocery stores provide product-related information and inventory details to their customers and in-store staff instantly using smart devices such as tablets and smartphones. Grocery retailers are also using advanced analytics to inform product pricing strategies, helping them to compete with online players and push sales during slow business days/hours through real-time pricing updates.

Furthermore, using advanced analytical tools such as artificial intelligence, machine learning and quantum computing helps grocery retailers process data quickly to gain valuable business insights into customer behavior, trends and preferences. This allows retailers to offer better recommendations to customers and thus boost conversion.

Seamlessness in E-Commerce

The consumer shift to online grocery, fueled by the pandemic, provided a boon to online grocery retailers in 2020. Online consumption of groceries has even picked up in Tier 2 and Tier 3 cities due to increased digital adoption. However, to remain competitive, e-commerce players need to focus on making order fulfillment more convenient and efficient, as well as improving their platforms to enhance the customer experience—for example, voice search functionality can save time for consumers when ordering groceries, particularly with repeat orders, by saving shipping and payment information.

To capture consumer attention and increase conversion amid rising shopper expectations, grocery retailers should look to offer a personalized online shopping journey that takes into account consumers’ personal browsing preferences and purchase history, with a focus on targeted marketing.

Hyperlocal Delivery

Consumer demand for fast home delivery has increased in recent years and has been boosted by the pandemic. Hyperlocal is a same-day delivery service that can also provide live or regular tracking updates and estimated delivery times to both the retailer and customer.

While margins for hyperlocal delivery are thin for grocery products, the opportunity lies in convenience by constantly reducing delivery times to benefit consumers. However, established online grocers that source directly from kirana stores and wholesalers pose a threat to hyperlocal providers.

Premium, Organic and Health Food

The pandemic has accelerated the already progressing consumer shift toward healthy foods and organic products. According to organic industry-focused magazine Pure & Eco India, players in the organic food industry saw a 25%–100% spike in sales last year compared to pre-pandemic times.

Retail chain Modern Bazaar, which has 10 outlets in Delhi National Capital Region and online at modernbazaar.online, witnessed a 25% rise in the sale of organic food products between March and July 2020, according to Kunaal Kumar, Director at the company. Food brands Organic Tattva and 24 Mantra Organic, Bengaluru-based organic retail chain The Organic World, and natural and organic fruit aggregator FarmerUncle all reported an increase in sales last year.

Moreover, the pandemic has allowed smaller players such as FarmerUncle to gain visibility among consumers owing to unfulfilled and delayed orders of major players such as BigBasket and Grofers. Some of the satisfied customers of these smaller players are likely to stay loyal even after the pandemic as the focus on health foods . With an increase in sales and revenue, this sector is likely to attract more players in the future, leading to a rise of premium and health-food retail formats.

What We Think

We expect consumer spending on food and non-alcoholic beverages to continue to rise over the next few years—although the growth rate will decline in fiscal 2022 from the huge growth in fiscal 2021 (as consumers stockpiled grocery essentials during the pandemic-induced lockdown). In addition, there remains substantial opportunity to consolidate the market, given organized retail will capture only around 6% of grocery sales this year. We expect the online grocery space to help drive the market due to increased Internet and smartphone penetration and a young digitally inclined generation fueling growth.

Implications for Brands/Retailers

- As consumers expect a seamless shopping experience across offline and online channels, brands and retailers need to simplify and improve processes—from product discovery to checkout. They should focus on implementing technologies across offline and online channels.

- With consumers willing to spend more on health and wellness products, there is ample scope for existing players in the grocery space to enter this sector.

- Brands and retailers should focus on targeted marketing through personalized recommendations to consumers. It is therefore important that they understand customers’ shopping habits and brand/product preferences.

Implications for Technology Vendors

- Brick-and-mortar stores in the organized retail sector need to focus on in-store technologies to attract customers back to their stores. Such stores require technological innovation to turn their stores into experiential destinations and may turn to advanced analytics tools to process consumer data and gain business insights—providing opportunity for technology vendors offering such solutions.

- To compete against online players and organized retail players, kirana stores are adopting technological innovations to revamp their stores, including for inventory management. This provides opportunities for various platform providers to offer services and technology customized to each kirana store.

Implications for Real Estate Companies

- Real estate providers can use empty physical space as distribution centers for brands adopting hyperlocal delivery models.

- With organized grocery retailers thinking of turning some of their stores into experiential destinations, real estate companies may benefit from increased requirements for physical space.