DIpil Das

What’s the Story?

The luxury market looks strong in 2022, overtaking 2021’s significant recovery from the pandemic slump. Despite global headwinds in the form of inflation and supply chain disruptions, luxury’s growth seems undeterred, fanned by worldwide luxury consumer appetite to shop and brands meeting demand in consumers’ local regions. In this report, we examine the market size and trajectory of the global luxury market, key factors impacting the market, the competitive landscape (including legacy brands and disruptors) and themes we are watching in 2022 and beyond. This report only covers the personal luxury goods segment, which includes apparel, accessories, beauty, footwear, jewelry and watches, and excludes experiential luxury categories, such as art, hospitality, travel, vehicles and wines and spirits, as well as the secondhand luxury market.Market Performance and Outlook

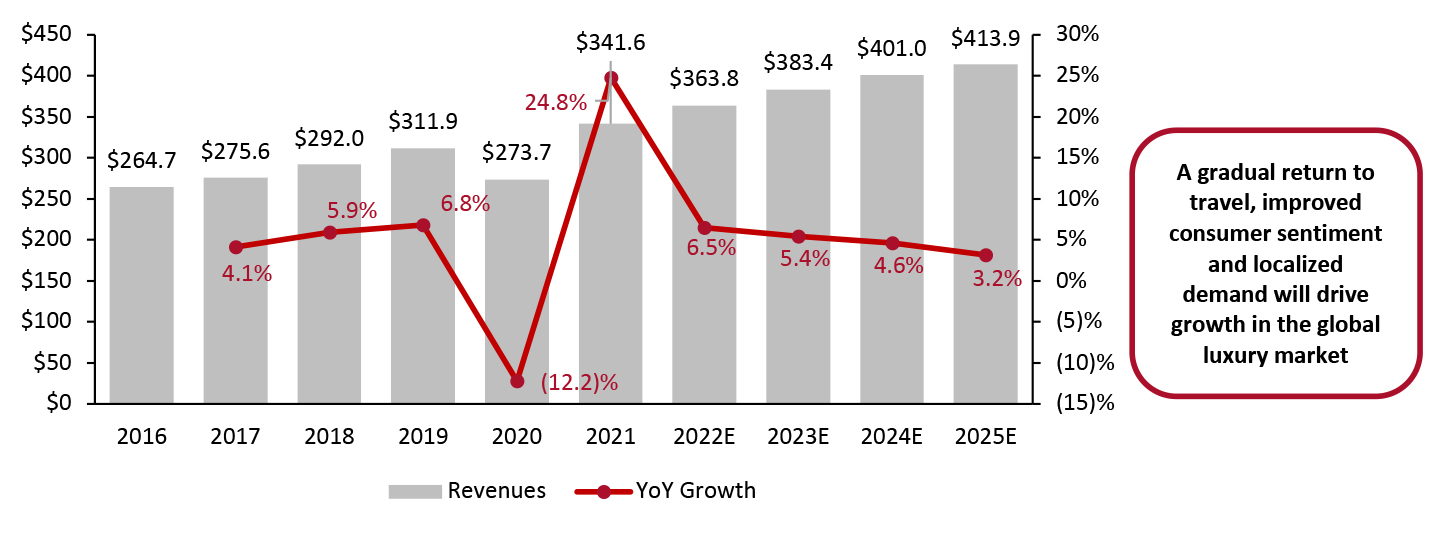

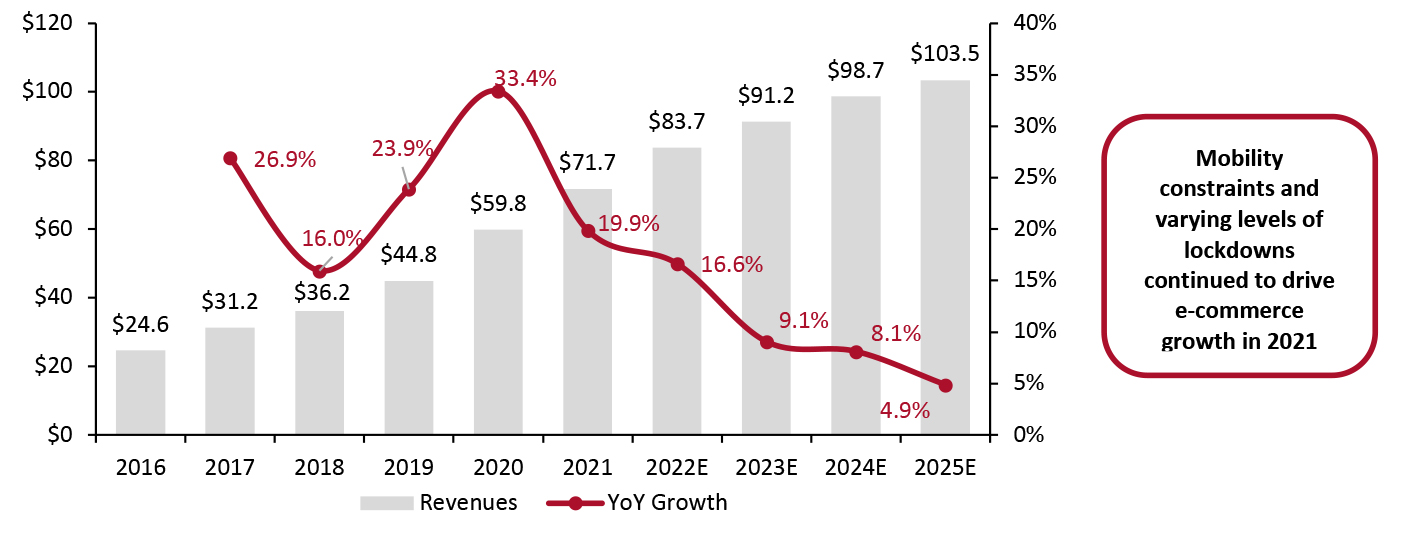

Global Personal Luxury Goods Market To Maintain Steady Growth Trajectory Coresight Research estimates that the global personal luxury goods market grew 24.8% year over year to $341.6 billion in 2021—surpassing pre-pandemic levels—and 9.5% on a two-year basis. Luxury is heavily dependent on tourism and in-person shopping, both of which were at a virtual worldwide standstill for a substantial part of 2020 and only began to pick back up in 2021.- In 2022, we estimate that the global personal luxury goods market will grow 6.5% to $363.8 billion. This estimate is based on several drivers, including pent-up demand, the rising strength of the Chinese consumer and improved consumer sentiment.

- After 2022, we expect growth to continue to moderate in the single digits. This trend will be driven by a return to a semblance of pre-pandemic normalcy in social events and travel. Additionally, luxury companies’ aggressive digital strategies, growth in local purchasing and China becoming the largest luxury consumption market will support sustained growth.

Figure 1. Global Personal Luxury Market Size (USD Bil.; Left Axis) and Growth (%; Right Axis) [caption id="attachment_148180" align="aligncenter" width="700"]

Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

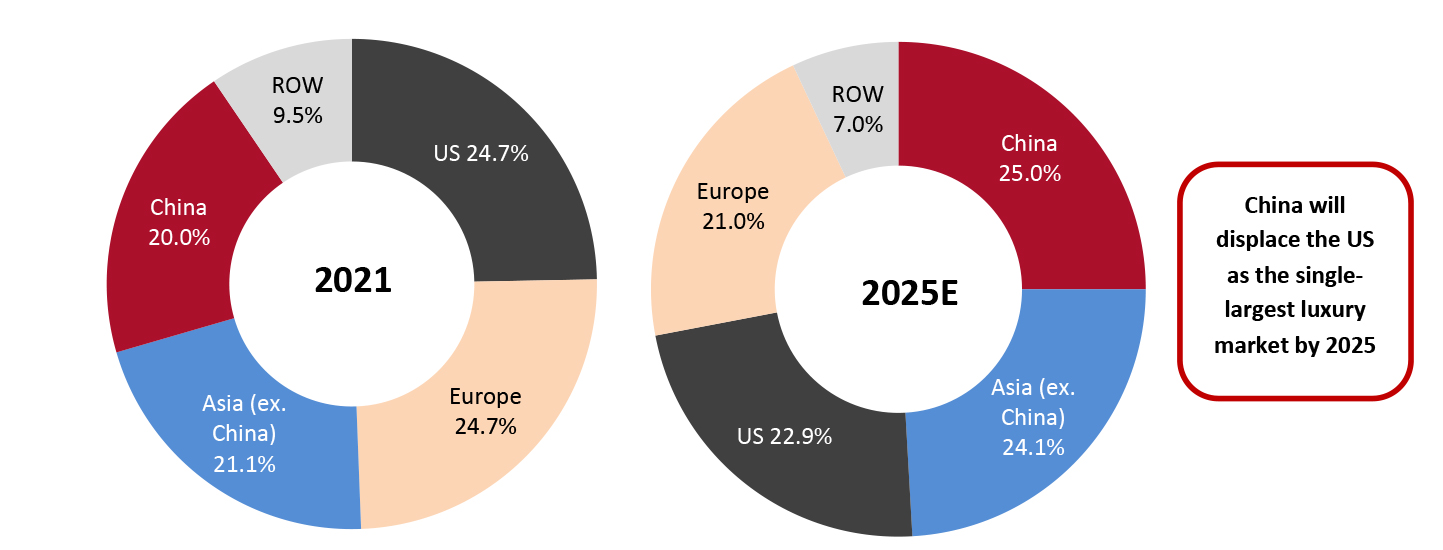

China To Form Largest Luxury Market by 2025

Luxury sales are fairly evenly split between the Western markets—Europe and the Americas—with the US currently commanding a dominant market share of 24.7%, based on Coresight Research estimates. The next single-largest market is China, with an 20.0% share.

The US has historically been the single-largest market for luxury, but China looks poised to usurp its top position by 2025. We expect the shares of Europe and the US to decrease while China and other major Asian markets see growth as their young, working populations continue to expand.

Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

China To Form Largest Luxury Market by 2025

Luxury sales are fairly evenly split between the Western markets—Europe and the Americas—with the US currently commanding a dominant market share of 24.7%, based on Coresight Research estimates. The next single-largest market is China, with an 20.0% share.

The US has historically been the single-largest market for luxury, but China looks poised to usurp its top position by 2025. We expect the shares of Europe and the US to decrease while China and other major Asian markets see growth as their young, working populations continue to expand.

Figure 2. Share of Global Luxury Market by Region [caption id="attachment_148181" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

European Companies Recovering Faster than US Counterparts

In 2021, European luxury companies saw stronger recoveries than US luxury companies. LVMH, Kering, Richemont and Hermès all reported positive double-digit growth on a two-year basis, while Capri Holdings reported sales levels lower than the same period in 2019. Tapestry, meanwhile, only returned to positive growth (on a two-year basis) in the second calendar quarter of 2021 and posted double-digit growth in its most recent quarter.

On average, in 2021, luxury companies on the Coresight 100 list reported 15% revenue growth year over year and 7% on a two-year basis, indicating strong recovery for the market. Most companies noted a renewal in sales in Asia—led by China—and the US, but a slower recovery in Europe due to prolonged lockdowns in 2021.

The ongoing Russia-Ukraine conflict could materially impact Europe’s global market share if it continues. Several major luxury groups, including LVMH, Kering, Richemont, Chanel, Prada and Hermès, have stopped business in Russia as of this writing. We estimate that Russian consumers account for 2%–4% of the global luxury market, as of May 2022.

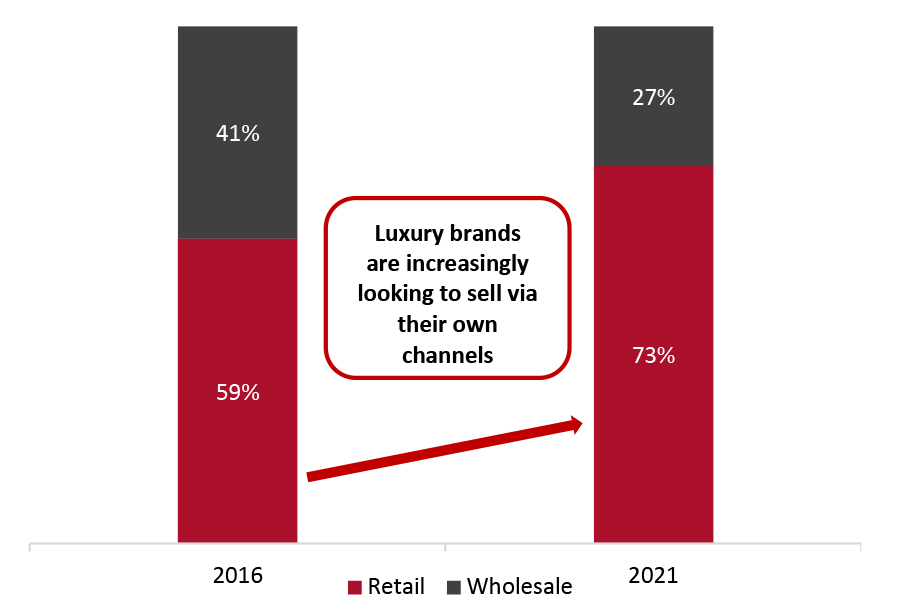

Retail Versus Wholesale Revenues

Historically, wholesale has been the dominant distribution channel in the luxury market—but companies in the sector have been working on expanding their owned retail channels. We think the growth of owned retail sales accelerated in 2020 because independent stores were shut for prolonged periods, allowing brands the opportunity to sell more via their direct and online channels. As stores reopened in 2021, brands had captured and retained some consumer share away from wholesale.

In 2021, we estimate that owned retail comprised 73% of total luxury market revenues—up from the 59% share it contributed in 2016 (latest available data)—while wholesale comprised 27%.

Over the past few years, many luxury brands have indicated that they want to cut back on wholesale and focus further on their owned channels:

Source: Coresight Research[/caption]

European Companies Recovering Faster than US Counterparts

In 2021, European luxury companies saw stronger recoveries than US luxury companies. LVMH, Kering, Richemont and Hermès all reported positive double-digit growth on a two-year basis, while Capri Holdings reported sales levels lower than the same period in 2019. Tapestry, meanwhile, only returned to positive growth (on a two-year basis) in the second calendar quarter of 2021 and posted double-digit growth in its most recent quarter.

On average, in 2021, luxury companies on the Coresight 100 list reported 15% revenue growth year over year and 7% on a two-year basis, indicating strong recovery for the market. Most companies noted a renewal in sales in Asia—led by China—and the US, but a slower recovery in Europe due to prolonged lockdowns in 2021.

The ongoing Russia-Ukraine conflict could materially impact Europe’s global market share if it continues. Several major luxury groups, including LVMH, Kering, Richemont, Chanel, Prada and Hermès, have stopped business in Russia as of this writing. We estimate that Russian consumers account for 2%–4% of the global luxury market, as of May 2022.

Retail Versus Wholesale Revenues

Historically, wholesale has been the dominant distribution channel in the luxury market—but companies in the sector have been working on expanding their owned retail channels. We think the growth of owned retail sales accelerated in 2020 because independent stores were shut for prolonged periods, allowing brands the opportunity to sell more via their direct and online channels. As stores reopened in 2021, brands had captured and retained some consumer share away from wholesale.

In 2021, we estimate that owned retail comprised 73% of total luxury market revenues—up from the 59% share it contributed in 2016 (latest available data)—while wholesale comprised 27%.

Over the past few years, many luxury brands have indicated that they want to cut back on wholesale and focus further on their owned channels:

- Kering stated during its fiscal 2021 earnings call in February 2022 that it has “resolved to reduce the share of wholesale for its larger houses” and has made “massive progress” toward that goal. In 2019, wholesale at Gucci was 15% and in 2021 it was down to 9%.

- Tapestry attributed four percentage points of a 13% decline in its Kate Spade business in the second quarter of fiscal 2020 to “a strategic pullback of the low-margin wholesale disposition business,” the company reported during its earnings call in February 2021.

Figure 3. Global Personal Luxury Goods Market: Share of Revenues by Distribution Channel [caption id="attachment_148182" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Accessories and Jewelry Drove Initial Post-Pandemic Recovery

Several luxury houses reported that their accessories and jewelry categories remained strong through the pandemic. As restrictions remained in place around the world throughout most of 2020 and 2021, people had little use for expensive clothing, but they indulged in accessories and jewelry which are considered timeless.

On a two-year basis, Richemont reported revenue growth of 47% in its jewelry business in the nine months ended December 2021. Likewise, LVMH reported organic growth of 7% in 2021 within its watches and jewelry business segment.

In the US, Kering said that its “jewelry houses had an outstanding year” during its full-year earnings call in February 2022.

Capri Holdings reported strong accessories sales across its brands during its first-quarter 2022 earnings call, held in July 2021. The company plans to expand its accessories assortment further and turn the category into a $1 billion business at Versace alone. It also reported strong growth in its watches and jewelry category at Michael Kors, with particular consumer interest in its sterling silver jewelry. The company transitioned from the fashion jewelry business in 2019 to focus on the higher-priced sterling silver segment, which, it said, is paying off and has seen increased interest this year.

Recently, interest in apparel has renewed, as many regions have relaxed restrictions. LVMH reported 42% organic growth in its fashion and leather goods segment in 2021, while several other groups noted a rise in ready-to-wear from the second half of 2021.

Source: Company reports/Coresight Research[/caption]

Accessories and Jewelry Drove Initial Post-Pandemic Recovery

Several luxury houses reported that their accessories and jewelry categories remained strong through the pandemic. As restrictions remained in place around the world throughout most of 2020 and 2021, people had little use for expensive clothing, but they indulged in accessories and jewelry which are considered timeless.

On a two-year basis, Richemont reported revenue growth of 47% in its jewelry business in the nine months ended December 2021. Likewise, LVMH reported organic growth of 7% in 2021 within its watches and jewelry business segment.

In the US, Kering said that its “jewelry houses had an outstanding year” during its full-year earnings call in February 2022.

Capri Holdings reported strong accessories sales across its brands during its first-quarter 2022 earnings call, held in July 2021. The company plans to expand its accessories assortment further and turn the category into a $1 billion business at Versace alone. It also reported strong growth in its watches and jewelry category at Michael Kors, with particular consumer interest in its sterling silver jewelry. The company transitioned from the fashion jewelry business in 2019 to focus on the higher-priced sterling silver segment, which, it said, is paying off and has seen increased interest this year.

Recently, interest in apparel has renewed, as many regions have relaxed restrictions. LVMH reported 42% organic growth in its fashion and leather goods segment in 2021, while several other groups noted a rise in ready-to-wear from the second half of 2021.

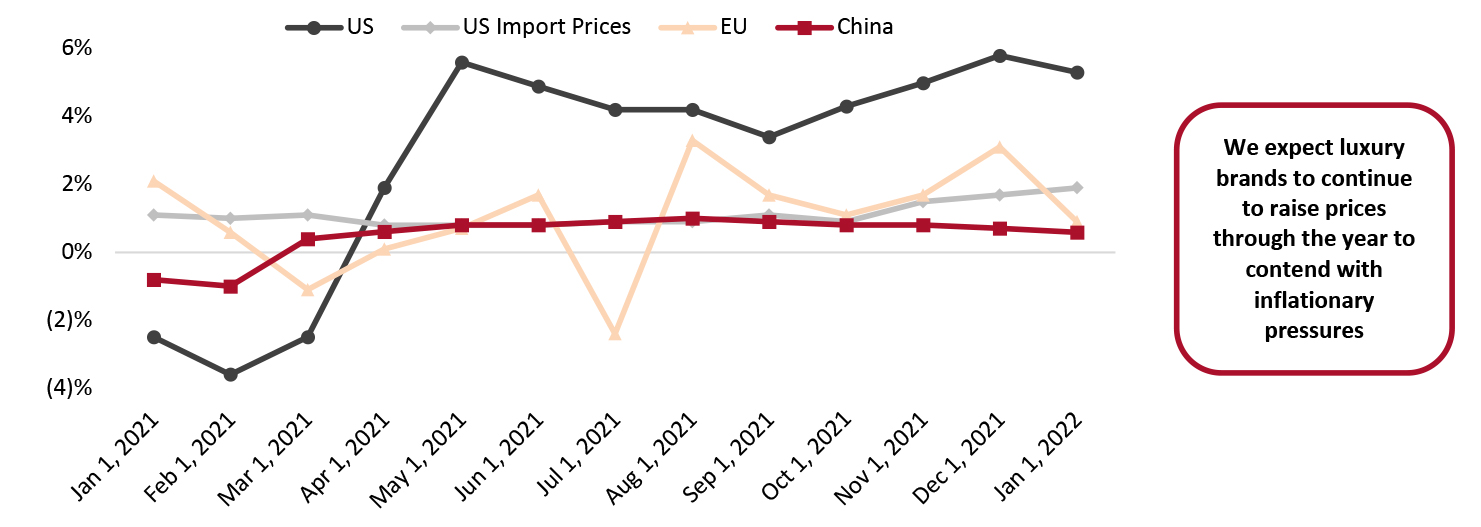

Market Factors

Headwinds: Geopolitical and Macroeconomic Factors In the near term, we expect several factors to slow the pace of recovery in the global personal luxury goods market.- Uncertain macroeconomic environment: Much of the luxury segment depends on existing wealth for consumers to maintain their luxury lifestyle. However, if luxury brands price products too high, the market could miss out on new luxury and aspirational shoppers that are spending conservatively in response to a harsh inflationary environment. A Coresight Research survey conducted August 30, 2021, found that over one-fourth of US consumers plan to cut back on discretionary spending due to recent inflation. The ongoing Russia-Ukraine war could also pose a risk to consumer sentiment, leading shoppers to cut back on indulgences amid a humanitarian crisis. In China, we expect the lockdowns to have a significant impact on near-term sales: Burberry stated on its May 18, 2022, earnings call that about 40% of its distribution in China was affected by stores being closed or people not being able to shop. Other luxury brands have noted similar challenges in China.

- Lockdown adopted behaviors: Behaviors adopted over prolonged periods of staying at home—such as the casualization of fashion—have become more deeply ingrained in consumers’ lifestyles. They may find they need less dressy, formal or tailored fashion or luxury goods in general.

- Increase in prices: Some luxury brands, such as Louis Vuitton and Chanel, have announced price increases to contend with the rise in global input and shipping costs, and we think other brands may follow suit. This could deter some young and aspirational luxury consumers who may find the new prices too high.

- Companies’ accelerated digital strategies: Several luxury companies have accelerated their digitalization strategies, increasing accessibility worldwide. Beyond launching brand sites, they have expanded their presence to Chinese platforms on which they were previously absent, heightened their social media engagement and leveraged new tech (such as augmented and virtual reality (AR/VR) and livestreaming) to reach consumers. For example, last year, Burberry unveiled a mixed-reality store for shoppers in Shenzen, China, while Balenciaga revealed a new collection via the video game Afterworld: The Age of Tomorrow.

- Localization: The inability to travel in 2020 and parts of 2021 prompted more people to purchase luxury goods locally. For example, Moncler, on its earnings call in February 2022, highlighted that “exceptional local demand” in all markets drove growth during the year—Asia, specifically, accounted for 49% of its 2021 revenues. Likewise, Kering remarked on its full-year earnings call in February 2022 that local clients primarily drove growth and that it has localized its customer relationship management activities. As China continues to go in and out of regional lockdowns in 2022, we think local shopping will continue. And globally, as local shopping for luxury becomes a more ingrained habit, more luxury brands will adapt their strategies to meet consumers in their regions.

- Increased online purchasing: Lack of international travel also led to an increase in the online purchasing of luxury goods. Tapestry stated on its earnings call in August 2021 that its full-year digital sales nearly doubled versus the previous year and were almost $1 billion ahead of pre-pandemic levels, accounting for over one-third of total revenues. Meanwhile, at Kering, online sales were up 55% on a two-year basis in 2021 and the company is also using its partnership with Tmall to showcase its brands to Chinese consumers and increase online purchasing. The online market is covered in more detail below.

- The rise of China’s luxury consumer: China has a large population, a high proportion of young, working consumers and a growing middle class, many of whom seek a better quality of living. Over the past five years, Chinese luxury purchases increasingly took place in the domestic market due to reduced import duties and greater customs regulations on incoming parcels by the Chinese government. Luxury brands are also narrowing the price gaps between goods sold in their home markets and in China, making domestic purchasing more attractive. Despite China’s escalation of its “Common Prosperity” policy—meant to narrow the gap between various economic classes by 2050 and increase scrutiny of consumers’ displays of wealth—and the recent lockdowns which have temporarily dented sales, we think the above factors and the retention of pandemic-driven habits will push China to become the largest geographical luxury market by 2025.

Figure 4. Apparel and Footwear Inflation in China, the EU and the US [caption id="attachment_148183" align="aligncenter" width="700"]

Source: BLS/Eurostat/NBS[/caption]

Online Market

Like many other markets, 2020 was the year of e-commerce for luxury. Traditionally, luxury houses have aggressively shied away from digitization as they believed online stores could not provide the personalized customer service offered in brick-and-mortar stores.

However, in 2020 and 2021, with lockdowns and restricted travel forcing luxury brands to digitalize and new technologies allowing for immersive, intimate experiences, luxury brands sought avenues for digital interactions with customers. We think this shift to digital will continue even after the pandemic ends, with brands looking to merge in-store experiences with digital channels. And with new lockdowns in China and retention of pandemic-driven habits, we think it will continue to fuel the luxury market’s e-commerce growth.

Source: BLS/Eurostat/NBS[/caption]

Online Market

Like many other markets, 2020 was the year of e-commerce for luxury. Traditionally, luxury houses have aggressively shied away from digitization as they believed online stores could not provide the personalized customer service offered in brick-and-mortar stores.

However, in 2020 and 2021, with lockdowns and restricted travel forcing luxury brands to digitalize and new technologies allowing for immersive, intimate experiences, luxury brands sought avenues for digital interactions with customers. We think this shift to digital will continue even after the pandemic ends, with brands looking to merge in-store experiences with digital channels. And with new lockdowns in China and retention of pandemic-driven habits, we think it will continue to fuel the luxury market’s e-commerce growth.

- Kering stated on its February 2022 earnings call that online sales accounted for 15% of retail sales in 2021, with e-commerce penetration in Western Europe and North America exceeding 25%. E-commerce revenues were up 82% year over year and more than tripled over two years.

- Moncler already had a 10% e-commerce penetration rate of total revenues before the pandemic; in 2021, this rate rose to 15%.

- Tapestry saw an online sales penetration rate of about 33% in the second half of fiscal 2022 (ended January 1, 2022), with strong double-digit growth across all regions.

- Many other brands reported double-digit or triple-digit online sales growth in 2020 and sustained growth through 2021.

Figure 5. Global Personal Luxury Goods Market: E-Commerce Sales (USD Bil.; Left Axis) and Growth Rate (%; Right Axis) [caption id="attachment_148184" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

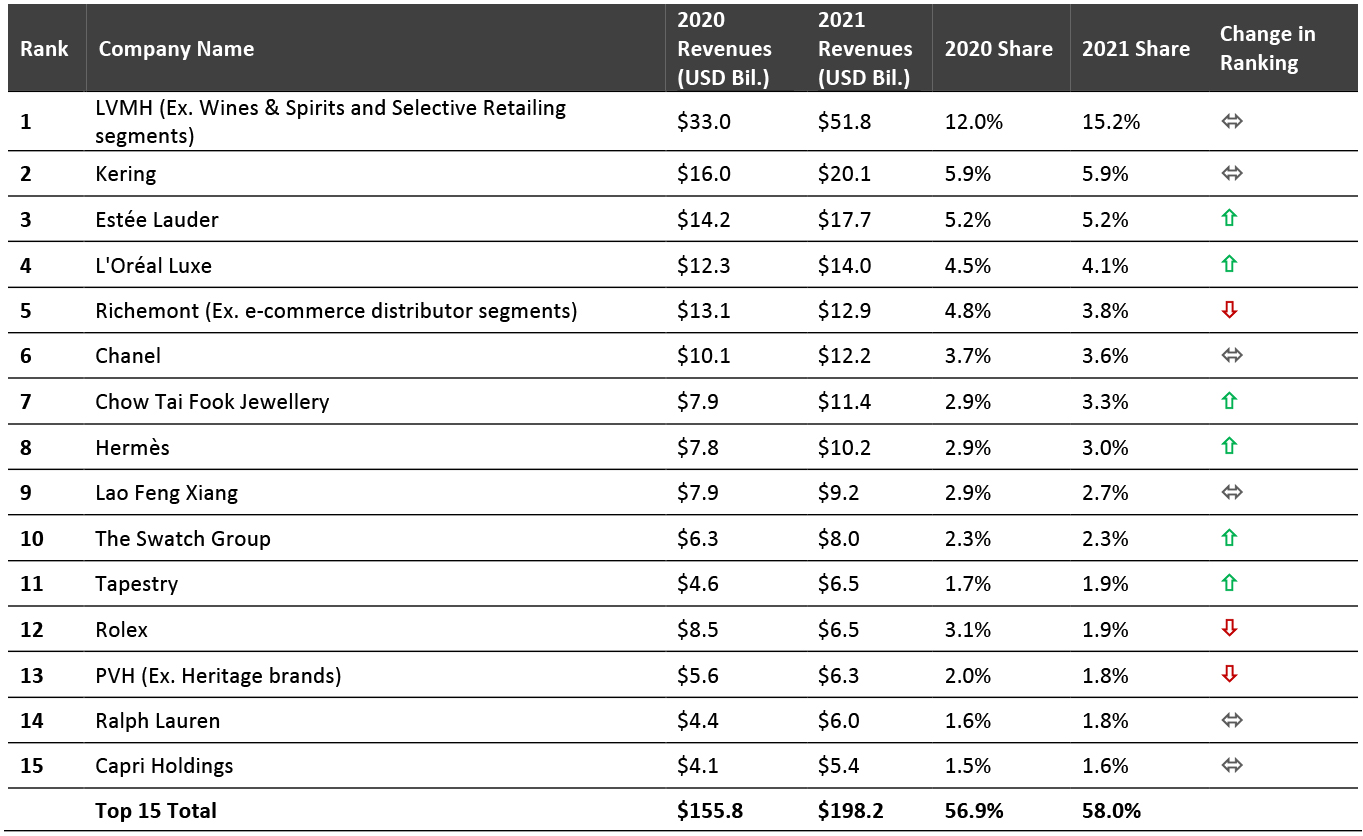

Competitive Landscape

The global personal luxury goods market remains highly concentrated, with the top 15 companies accounting for 58.0% of total market revenue in 2021, up 110 basis points from 2020.- The top two companies, LVMH and Kering, have retained their market position in 2021. LVMH commands the majority share of revenues in the luxury market, at 15.2%. In fiscal 2021, LVMH posted a strong recovery from the crisis—witnessing a 57.0% year-over-year increase in revenues to $51.8 billion, excluding its Wines and Spirits and Selective Retailing segments. Asia’s burgeoning luxury market is important to the company, with the region accounting for over one-third of LVMH’s revenues during the period, while the US accounted for 26%. Both regions posted strong growth on a two-year basis. We believe that LVMH’s scale, diversity of businesses and legacy will keep the company at the number one position in luxury in the future.

- Kering undertook strategic moves to capitalize on several trends in the luxury sector in fiscal year 2021. For instance, it staked its claim in the high-growth luxury resale market by acquiring a 5% share in Vestiaire Collective. The group has also enhanced its logistics hub in Northern Italy with an additional 100,000 square meters of space to meet rising e-commerce demand and avoid future supply chain congestions.

- Estee Lauder and L’Oréal Luxe moved up due to significant jumps in revenues. As a result, they displaced Richemont, although its revenues were only slightly down on an annual calendar year basis.

- The biggest mover in 2020 was Rolex, rising seven places to rank seven. The watchmaker reported revenue growth of 47% in 2020. In 2021, however, it was relegated to rank 12. Chinese jewelry company Chow Tai Fook Jewellery, Hermès, The Swatch Group and Tapestry are other companies that climbed in the 2021 rankings.

Figure 6. Top 15 Global Luxury Companies by Revenues: Financial Metrics* [caption id="attachment_148227" align="aligncenter" width="699"]

*As companies have different fiscal year endings, calendarized data have been used, so they are comparable.

*As companies have different fiscal year endings, calendarized data have been used, so they are comparable. Source: Company reports/S&P Capital IQ/Coresight Research [/caption] .

Retail Innovators

There are several innovators in the luxury market, and as digitalization is picking up pace, their technology and applications are increasingly coming to the forefront. While we discuss a few below, we have explored luxury innovators in greater detail in our report High-Tech Enablers in The Global Luxury Ecosystem. Amazon Luxury Stores: In a bid to tap into a new segment and establish itself as “the everything store,” Amazon introduced a platform called Luxury Stores in September 2020. The invitation-only platform—accessed by select Prime users in the US—allows consumers to rotate product images online, giving them a 360-degree view. Amazon hired designer Oscar de la Renta as its first official partner and plans to add more designers to the platform soon. Cappasity: Cappasity is a cloud-based platform that allows brands to create 3D images using existing product photos and embed them into their e-commerce sites and AR/VR applications. Cappasity says that its clients see an uptick of 10–30% in mobile conversion rates and at least six times higher dwell times on product pages. Cappasity also offers an AI-powered 3D analytics tool that helps brands track customer behavior and deliver a personalized online shopping experience. The tool can identify quality traffic and real buyers from the total site visitors and present targeted marketing campaigns to them. [caption id="attachment_148185" align="aligncenter" width="699"] Cappasity’s gallery offering 3D views of some of the products it has converted for its client brands.

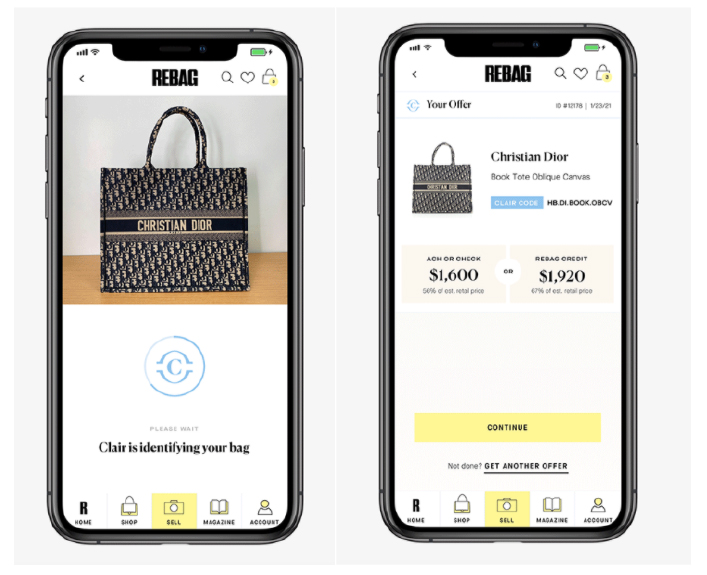

Cappasity’s gallery offering 3D views of some of the products it has converted for its client brands. Source: Cappasity [/caption] Rebag: Rebag is a platform to resell secondhand luxury handbags, jewelry, watches and accessories. Established in the US in 2014, the platform raised $15 million in May 2020, taking its total funding to $68 million. In February 2021, Rebag implemented an artificial intelligence (AI)-powered image-recognition engine, Clair AI, in its app to recognize and establish the resale value of handbags. According to the company, Clair—which stands for Comprehensive Luxury Appraisal Index for Resale—can currently recognize over 15,000 handbags and identify them with 91% accuracy. Rebag app or website users scan the bag they wish to resell, and the tool will identify the bag’s brand, model and style, ultimately providing the price Rebag is willing to pay for the bag. If satisfied with the quote, users can accept it and ship the handbag to Rebag or drop it off at a Rebag store. Users receive payment instantly for in-store drop-offs or within three working days after shipping the product. [caption id="attachment_148186" align="aligncenter" width="700"]

The Clair AI engine identifying a Christian Dior bag and calculating an offer.

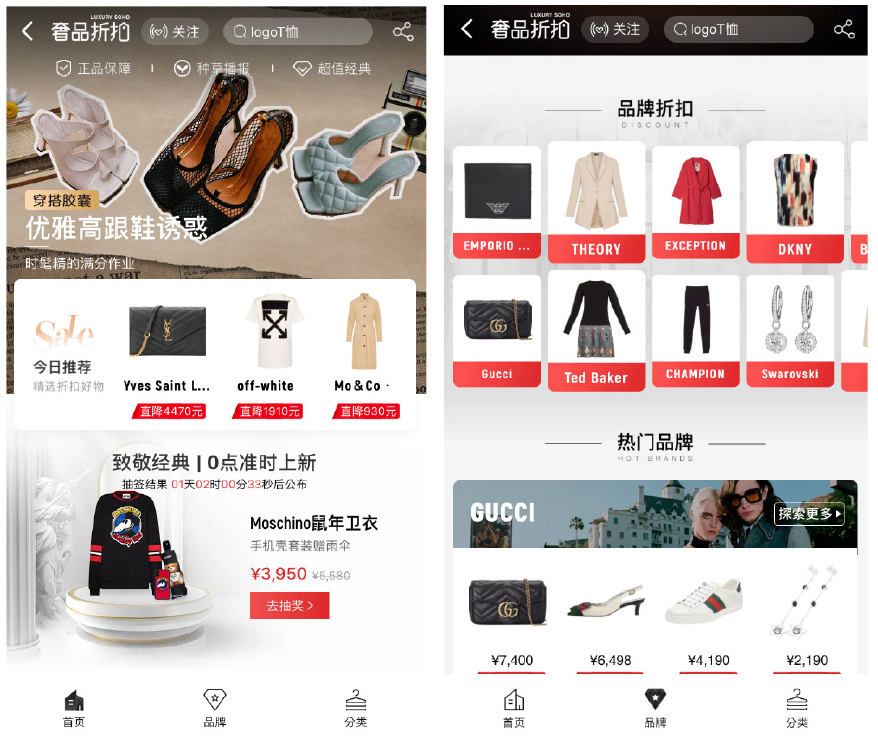

The Clair AI engine identifying a Christian Dior bag and calculating an offer. Source: Rebag [/caption] Tmall Luxury Soho: In 2020, brands amassed substantial unsold inventory as consumers could not travel and purchase products. To provide an outlet to offload unsold stock, Alibaba launched a luxury discount platform, Luxury Soho, in April 2020, which sells products from luxury brands at discount prices. It targets the younger luxury consumer segment, which—while typically price-sensitive—also values quality and craftsmanship. Brands have the flexibility to tailor their Luxury Soho storefronts and differentiate them from their full-price stores on Tmall Luxury Pavilion. Luxury Soho also offers brands a route to price-sensitive—yet aspirational—Chinese consumers looking to discover and experiment with new products. [caption id="attachment_148187" align="aligncenter" width="700"]

Alibaba’s Tmall Luxury Soho discount platform

Alibaba’s Tmall Luxury Soho discount platform Source: Tmall [/caption]

Themes We Are Watching

Strength of the Chinese Consumer Chinese consumers are poised to overtake US consumers in the luxury market by 2025. The new Chinese luxury consumer is young, discerning and willing to spend on quality products. Brands are rethinking ways to engage with this consumer, and those that have not yet established contact are tenaciously implementing digital strategies to do so.- See our Think Tank report for more on the Chinese luxury consumer and China as the vanguard in luxury consumption.

- Kering launched a video-call service, Gucci Live, in 2020 to replicate its personalized, in-store experience. Customers call advisors at Gucci 9, a client services hub in Florence, to view and shop the latest collection of handbags and other products. On the company’s fiscal 2020 earnings call, CEO François-Henri Pinault said that the company implemented “very strong initiatives in terms of client engagement in Europe using…Gucci 9 (including) distant selling, distant payments, very high-end video call, private phone calls, consignments.” Pinault noted that this elicited “a very strong reaction from clients in Europe, growing the local customers significantly last year in all brands.”

- In 2021, Gucci announced several mashups, including one with fellow Kering stable-mate Balenciaga. Then, in February 2022, Gucci unveiled a new collection with Adidas, including suits, gloves, caps and other items with monograms featuring design elements from both brands. Gucci has also partnered with The North Face, for an outerwear collection, and with Japanese animation franchise Doraemon, for a collection of bags and accessories.

- In 2022, Adidas announced a collaboration with Prada.

- In 2020, Dior unveiled limited-edition Air Jordan 1 OG sneakers in collaboration with

- Louis Vuitton announced a collaboration with the US National Basketball Association (NBA) in 2020 for a collection featuring clothing, bags and accessories.

- Luxury brand Balenciaga has been an early adopter of new technologies and gamifying techniques. For instance, to safely launch new collections during Covid-19 lockdowns, the company used AR and VR to replicate an in-person experience.

- Later, in December 2020, Balenciaga launched its Fall 2021 collection through an interactive video game titled Afterworld: The Age of Tomorrow, which users could play for free through their web browser. The game, set in 2031, takes users through a virtual world populated with characters dressed in clothing from the new collection. Users had to “walk” through five different levels, including a store, a street and a forest, to view the 50 looks of the collection.

- Balenciaga’s website also included a virtual lookbook, where shoppers could view clothing from the Fall 2021 collection on 3D models from the game, allowing 360-degree views of the clothing.

- More recently, in September 2021, Balenciaga released a new digital clothing collection in collaboration with the video game Fortnite. Players could purchase clothes and skins from the collection for their digital characters to wear in-game. Alongside the digital outfits, the brand also released a limited collection of Fortnite-branded clothing.

- Gucci collaborated with Nintendo’s Animal Crossing video game to create a virtual island where players could meet a digital avatar of its brand ambassador, actor Jared Leto.

- Read more of Coresight Research’s metaverse coverage here.

What We Think

The luxury market recovered strongly in 2021. Several forces could continue this trajectory, including easing travel restrictions, the growing Chinese luxury market, enhanced digital strategies from luxury brands and improved consumer sentiment. But other factors could also offset it, such as rising inflation, supply chain challenges and global conflicts like the Russia-Ukraine war. Implications for Brands/Retailers- Luxury brands and retailers need to forego traditional selling methods—which were dependent on in-person customer service—and explore new ways to engage local and young consumers.

- The future of the luxury consumer segment, primarily driven by China, will likely be comprised of younger consumers. Brands and retailers must identify ways to creatively engage with such consumers, including digital interactions, limited-time pop-up events and in-store, immersive experiences.

- With the ubiquity of information and social media, the new, young luxury consumer will likely meticulously research products before purchasing. Brands and retailers should leverage appropriate technologies and tools to remain relevant with such consumers.

- Brands and retailers will increasingly look to tap local consumer markets. Real estate providers should identify spaces suitable for both short-term events and longer engagements to help luxury brands and retailers reach local consumer segments.

- Despite e-commerce continuing to surge within luxury, the market likely does not have a well-established fulfillment strategy or last-mile delivery network, unlike markets with deeper e-commerce penetration. Real estate firms could look to offer secure locations to store and process high-value products, specifically those strategically placed near affluent neighborhoods.

- Providers of emerging technology applications made specifically for luxury are likely to benefit from the acceleration in digital strategies in the market.

- As luxury companies also look to focus on local markets and shift away from wholesale to retail or DTC, their supply chains may need revising. Supply chain technology providers who work with luxury brands could benefit significantly from this.