DIpil Das

What’s the Story?

Fast fashion, initially refined by H&M and Inditex (the owner of Zara), the world’s two largest apparel and footwear specialist retailers by revenue, has become one of the fastest-growing segments in the global apparel and footwear sector. While Inditex and H&M have long dominated the fast-fashion space, we recently have recently seen the Chinese brand Shein taking the US fast-fashion market by storm. With strong growth expectations for 2021 and beyond, we explore the global fast-fashion market in detail, analyzing the business model and focusing on the competitive landscape, key growth drivers and major trends.Global Fast Fashion: Market Performance and Outlook

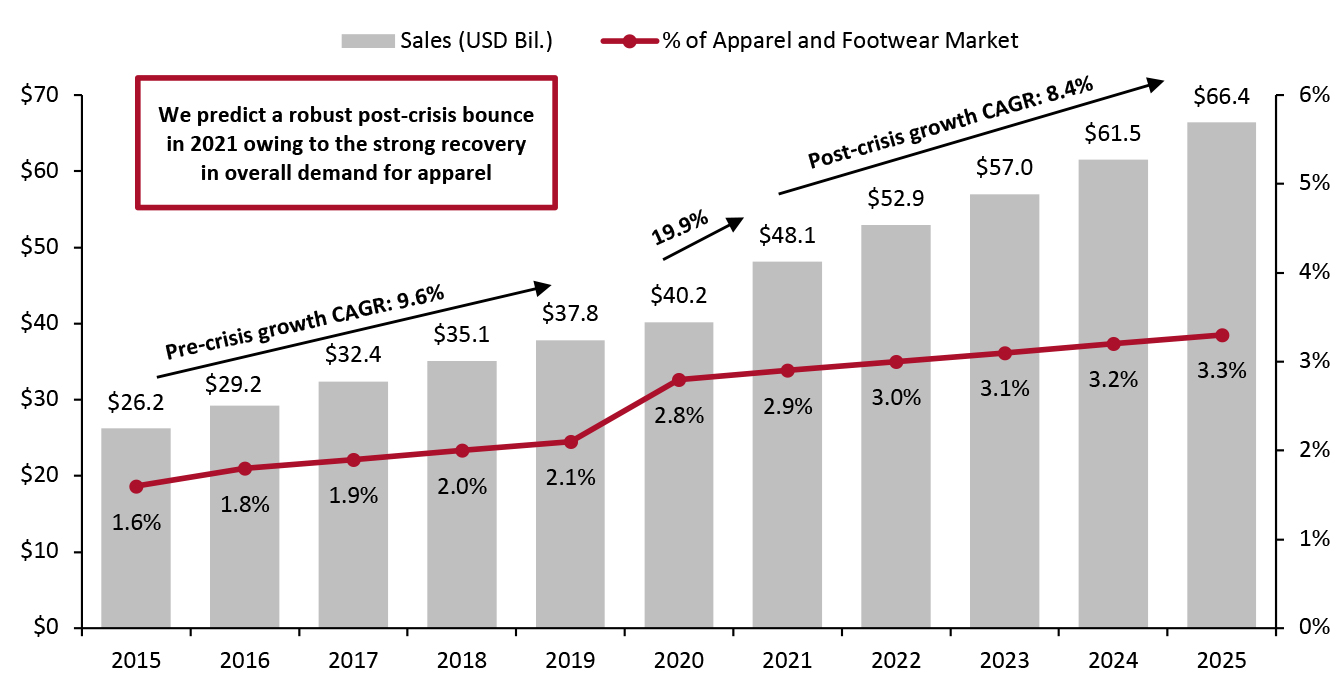

Outlook for 2022 and Beyond Coresight Research estimates that the global fast-fashion market grew by 19.9% year over year in 2021 and reached $48.1 billion. Noteworthy growth in 2021 was mainly driven by offline fast-fashion companies, such as H&M and Inditex, resuming their operations fully and adapting while recovering strongly from the pandemic. The fast-fashion category accounts for a small share of the total global apparel and footwear market: just 2.9% of all sales in 2021, we estimate. In 2020, we saw global fast-fashion sales increase by 6.4% year over year, primarily driven by e-commerce players such as ASOS, Boohoo and Shein, which reported solid sales growth. Conversely, store-focused fast-fashion companies, such as H&M, Inditex and Primark, saw their sales negatively impacted by pandemic-related store closures and restrictions. In the medium term, Coresight Research estimates that the market will grow at a stabilized high-single-digit percentage rate. From 2021 to 2025, we forecast global fast-fashion sales to grow at a CAGR of 8.4%, reaching $66.4 billion by 2025—accounting for 3.3% of total global apparel and footwear sales. In the next segment, we discuss the key growth drivers of the global fast-fashion market in detail.Figure 1. Estimated Global Fast-Fashion Sales (USD Bil.) and as a Percentage of Total Apparel and Footwear Sales [caption id="attachment_138964" align="aligncenter" width="700"]

Market size is based on estimated fast fashion-only sales, not total sales by fast-fashion companies

Market size is based on estimated fast fashion-only sales, not total sales by fast-fashion companiesSource: Company reports/Euromonitor International Limited 2022 © All rights reserved/Coresight Research [/caption]

Market Drivers and Challenges

Drivers of Growth Fast fashion is a growing category that benefits from increasing demand for affordable clothing following up-to-the-minute style trends. We expect the global fast-fashion market to be positively driven by a number of factors, as outlined below:- Favorable demographic changes: The target audience for fast-fashion companies is primarily consumers aged 20–30, a group that is growing rapidly worldwide. The global youth population is expected to increase at a 7% CAGR between 2019 and 2030 and reach 1.3 billion by 2030, according to United Nations estimates. We expect to see rising adoption of fast fashion by this growing youth population across the globe.

- The influence of the internet and social media: A large number of fast-fashion companies, including Boohoo, H&M, Inditex and Shein, primarily reach their audience through influencers and key opinion leaders (KOLs) on social media platforms such as Facebook, Instagram, Pinterest and TikTok. We believe use of influencers and aggressive social media marketing by fast-fashion companies will continue to drive consumers’ appetite for novelty and the consumption of new designs as soon as possible after the point of creation.

- Adoption of innovative technologies: Many fast-fashion companies, including H&M, Inditex and Shein, are incorporating innovative technologies, such as augmented reality (AR) and virtual reality (VR), into their businesses. These companies are using these new technologies to support their e-commerce offerings by enabling consumers to try products online and visualize how they will look. We believe this will increase purchases among online fast-fashion shoppers and also reduce product returns. Furthermore, we believe technological advancements like AR and VR will enable fast-fashion companies to augment their marketing and launch innovative campaigns.

- Rise of emerging economies: Many fast–fashion brands and retailers, such as H&M and Inditex, are looking to expand their international operations—particularly in emerging economies like China and India, which are expected to see strong rises in their gross domestic product (GDP) in the coming years. Between 2021 and 2026, GDP per capita is forecast to increase at a 7.5% CAGR in China and at a 7.3% CAGR in India, according to an April 2021 report by the International Monetary Fund (IMF). We believe the improvement in living and working conditions in emerging countries will also bolster demand for fast–fashion products.

- High profit-margin business model: The fast-fashion sector is a high-profit-margin business. The business model entails a short lead time from apparel design to production and on to sale. Furthermore, the usual markdown percentage for fast-fashion brands and retailers is only around 15% versus overall apparel and footwear retailers’ 30% or more. This entails higher profit margins for fast-fashion companies (as compared to traditional retailers).

Online Market

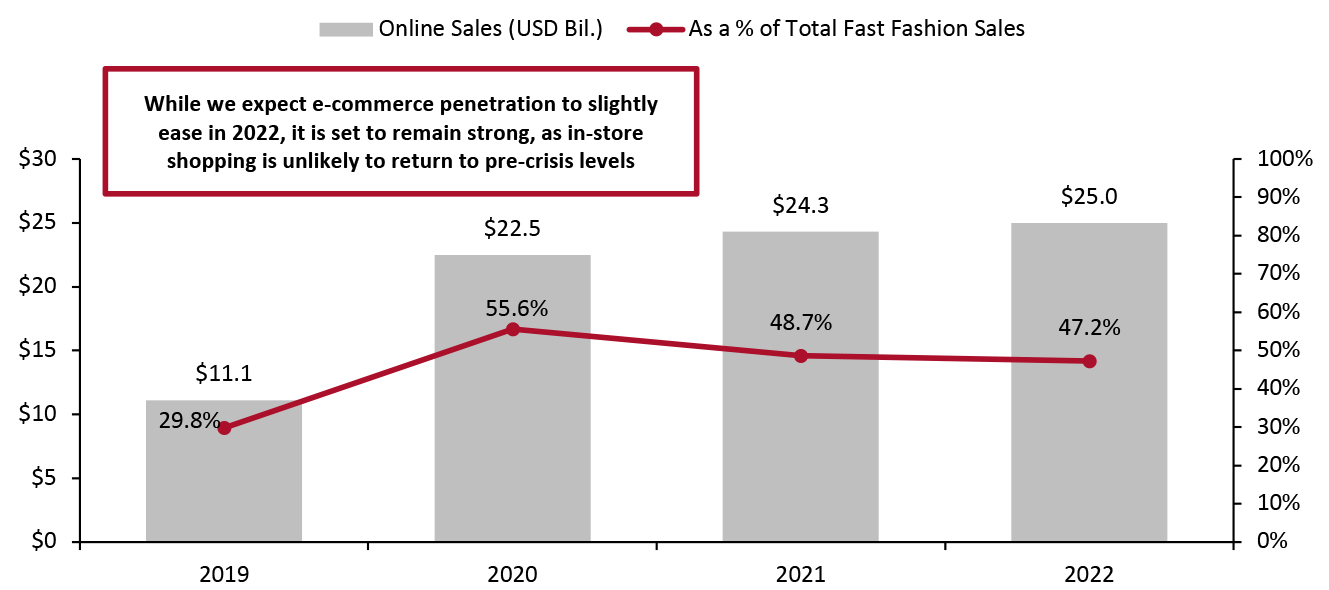

The Covid-19 pandemic has driven an unprecedented online-channel demand surge for fast fashion. Coresight Research estimates that the e-commerce penetration rate of fast-fashion companies’ sales slightly decreased to 48.7% in 2021, after more than doubling in 2020 and accounting for 55.6% of the year’s global total fast-fashion sales. Online market growth was primarily driven by strong performances from fast-fashion e-commerce companies, particularly Shein, which witnessed nearly 250% year-over-year sales growth in 2020. H&M and Inditex both reported a steep acceleration of online sales in fiscal 2020:- H&M’s fiscal 2020 online fast-fashion sales accounted for 28% of its total fast-fashion sales, increasing from 14% in fiscal 2019.

- Inditex’s fiscal 2020 online sales comprised 32% of its total fast-fashion sales, up from 14% in fiscal 2019.

Figure 2. Estimated Global Fast Fashion Online Sales (USD Bil., Left Axis) and as a Percentage of Total Fast Fashion Market (Right Axis) [caption id="attachment_138965" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Fast-Fashion Business Model

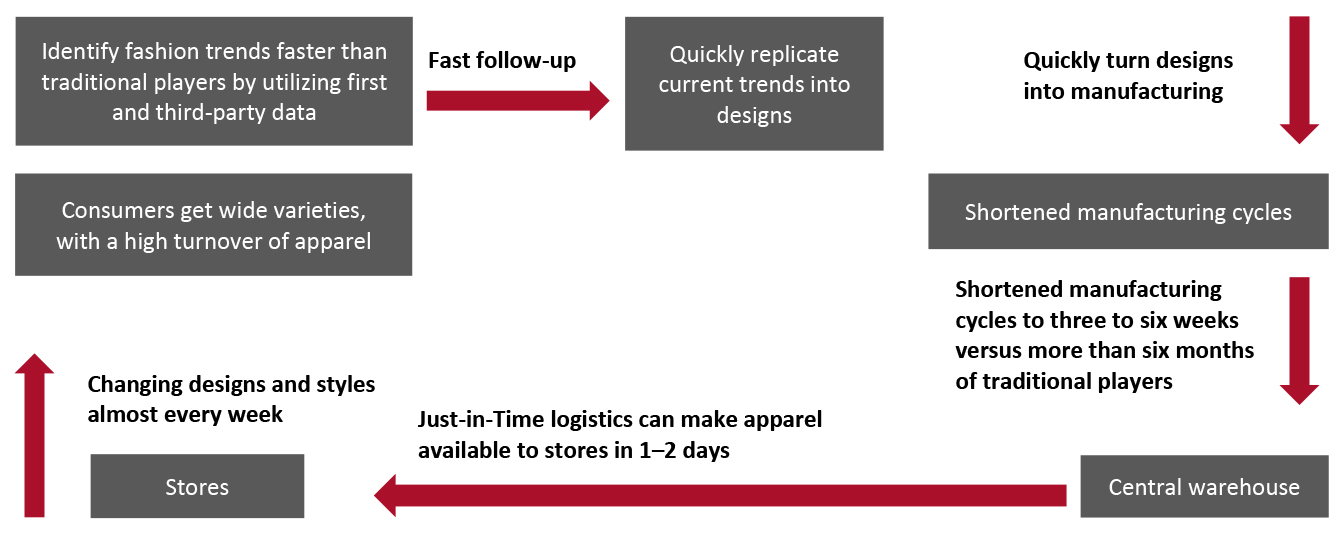

We summarize the typical fast-fashion business model in Figure 3 and discuss key elements of fast-fashion strategies in further detail below.Figure 3. Typical Fast-Fashion Business Model [caption id="attachment_138966" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

The fast-fashion business model entails capitalizing on shorter design-manufacturing-distribution cycles, reducing these cycles from months to a few weeks. In recent years, the fast-fashion model has evolved substantially with the entry of online-only apparel retailers, such as ASOS, Boohoo and Shein, further reducing the time from design to production and distribution.

The typical fast-fashion model starts with identifying new apparel trends and forecasting consumer demand using a combination of algorithms and human judgment. Shein, for example, utilizes three sources of data to identify new fashion trends:

Source: Coresight Research[/caption]

The fast-fashion business model entails capitalizing on shorter design-manufacturing-distribution cycles, reducing these cycles from months to a few weeks. In recent years, the fast-fashion model has evolved substantially with the entry of online-only apparel retailers, such as ASOS, Boohoo and Shein, further reducing the time from design to production and distribution.

The typical fast-fashion model starts with identifying new apparel trends and forecasting consumer demand using a combination of algorithms and human judgment. Shein, for example, utilizes three sources of data to identify new fashion trends:

- Huge volumes of first-party customer data from its app, including, search terms, color and style preferences and age and body measurements

- Third-party data from sources such as Google Trends for real-time tracking of apparel-related search terms around the world

- Competitors’ websites, utilizing machine learning and human insights

Competitive Landscape

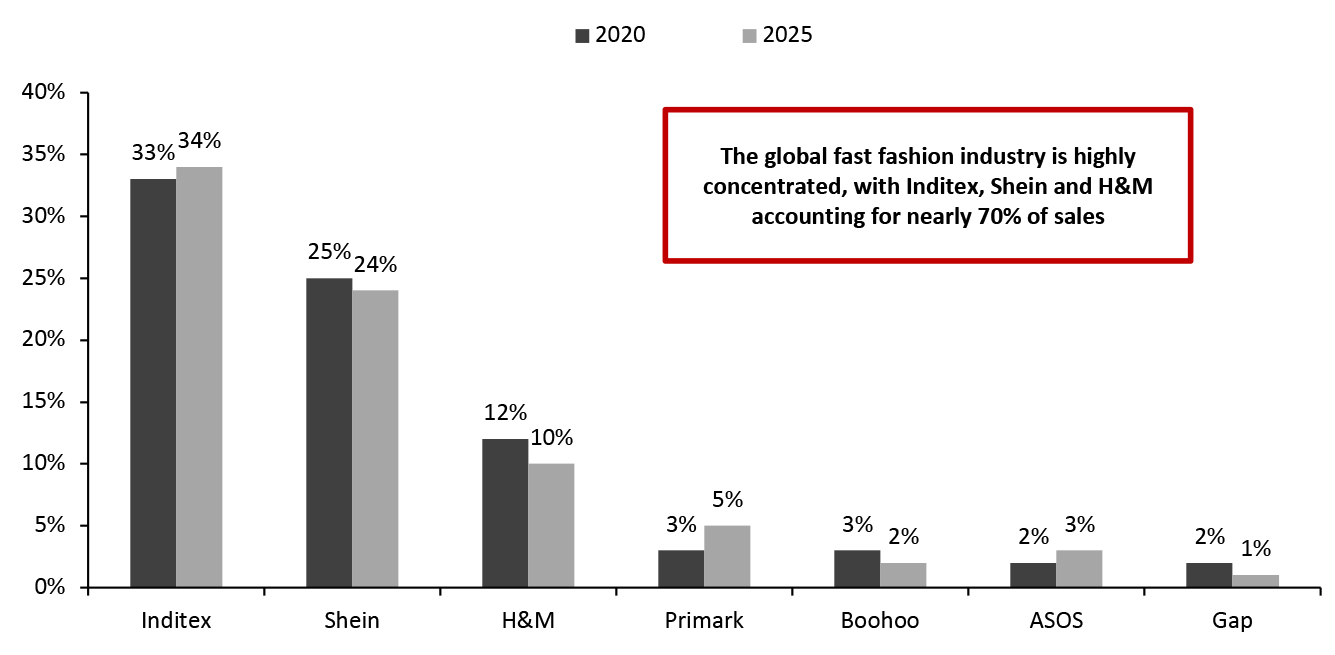

The global fast-fashion industry is highly concentrated—H&M, Inditex and Shein accounted for 71% of global fast-fashion sales in 2020, Coresight Research estimates. As shown in Figure 4, Inditex holds the leading position with a 33% market share, followed by Shein (25%) and H&M (12%). Other key global fast-fashion players include Primark and Boohoo, with a 3% share each, followed by ASOS (2%) and Gap (2%). We estimate that by 2025, the three leading fast-fashion companies will hold a 69% share of the market, with Inditex slightly gaining share, and Shein and H&M marginally losing share of the market. Another rising player in the global fast-fashion market is Turkey-based DeFacto (not charted in Figure 4 as the company currently holds less than 1% global market share). In recent years, the company’s sales have been growing at over 30% year over year, and DeFacto is aggressively expanding its international presence. In December 2021, DeFacto entered the Indian fashion market through a launch on the India-based Flipkart-owned fashion e-commerce platform Myntra. Through the collaboration with Myntra, DeFacto plans to target the mass-premium consumer segment in India and build its brand recognition in the country. Similarly, in October 2021, DeFacto entered the UK market with the launch of a new UK website. As of December 2021, DeFacto provides online order fulfillment in 100 countries and operates 503 offline stores in 47 countries.Figure 4. Estimated Market Share of Top Seven Global Fast-Fashion Companies, in 2020 and 2025 (%) [caption id="attachment_138967" align="aligncenter" width="699"]

Market shares are based on estimated fast fashion-only sales, not total sales by fast-fashion companies, with the exception of Shein, where estimated total sales are used. Fast-fashion sales have been estimated based on the retailers’ proximity factory locations to target geography and lead time from design to production.

Market shares are based on estimated fast fashion-only sales, not total sales by fast-fashion companies, with the exception of Shein, where estimated total sales are used. Fast-fashion sales have been estimated based on the retailers’ proximity factory locations to target geography and lead time from design to production. Source: Company reports/Coresight Research [/caption] Strategy-Based Metrics of Key Players In Figure 5, we present key strategy-based metrics of the major global fast fashion companies: Inditex, Shein and H&M.

Figure 5. Strategy-Based Metrics of H&M, Inditex and Shein [wpdatatable id=1600 table_view=regular]

Source: Company reports

Fast Fashion Retailers: Latest Quarterly Growth and Outlook Reports We present recent quarter growth numbers of major publicly listed fast-fashion retailers and summarize key commentary on their outlook.Figure 6. Selected Leading Global Fast-Fashion Retailers: Estimated Quarterly Sales Growth, E-Commerce Growth, Online Penetration (%) and Key Commentary [wpdatatable id=1601 table_view=regular]

Source: Company reports/Coresight Research

Retail Innovators

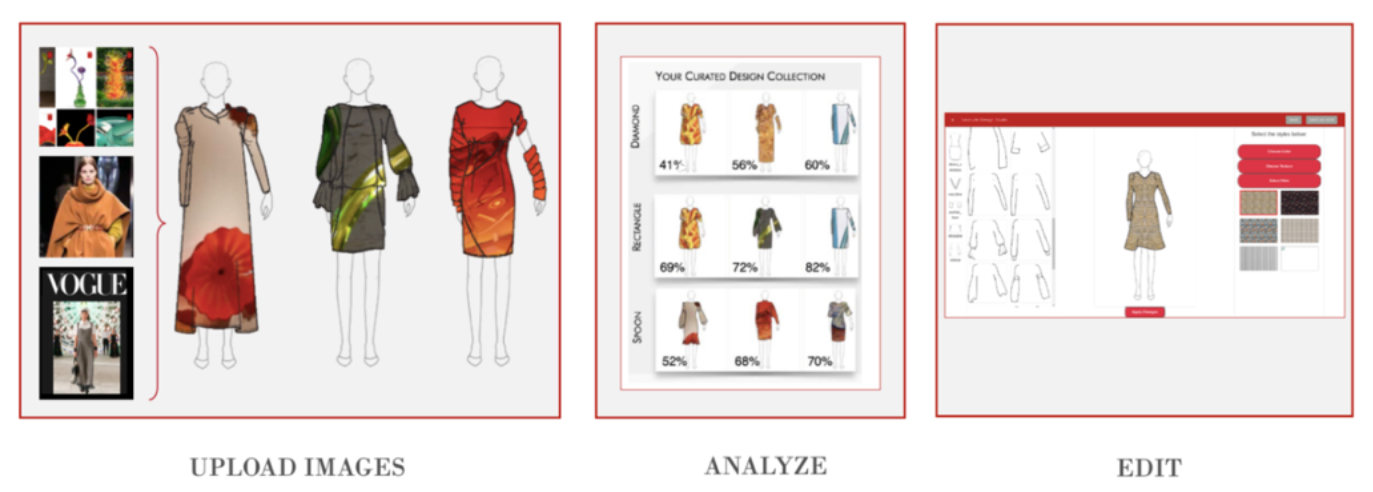

We discuss three US-based innovators whose solutions can benefit the global fast fashion market. These companies are part of Coresight Research’s innovator client list. FindMine Founded in 2016 and headquartered in New York, FindMine is an analytics company that uses artificial intelligence (AI) to automatically generate complete recommended outfits, both online and offline, when shoppers browse an individual item. FindMine’s platform integrates with a range of third-party tools, including SAP, Salesforce, Oracle, Facebook and Instagram, to automate data synchronization. FindMine’s “Complete the Look” platform utilizes shoppers’ trend data and mimics a company’s stylists through machine learning to understand which products sell best when paired together and to gain insights into how consumers interact with the retailer. The cloud-based platform automates and scales the creation of content about similar looks or recommended combinations for each individual clothing item, helping shoppers complete their look and helping retailers save time. Furthermore, FindMine’s platform facilitates the retailer’s email and SMS campaigns to win back consumers or encourage them to buy related products; and offers data on which merchandising strategies will lead to more conversions. Additionally, FindMine’s cloud platform adjusts for inventory levels and does not require custom feeds or product tagging. FindMine works with brands including Adidas, Original Penguin, Perry Ellis, Reebok and Shopping Channel. We believe that FindMine’s “Complete the Look” platform can help fast-fashion companies significantly increase their customer average order value (AOV). When Adidas first partnered with FindMine in early 2019, the footwear giant witnessed a 95% decline in the time spent for building complete recommended outfits and a 960% increase in the number of items included in outfits. Impact Analytics Founded in 2015 and based in India, Impact Analytics is a software-as-a-service (SaaS) and AI-focused company that develops monitoring tools, product assortment tools, testing platforms, auditing tools and dashboard applications, for retailers and brand owners. Through these solutions, Impact Analytics allows retailers to forecast demand, conduct replenishment, assortment and merchandise planning, and determine price, promotion and markdown optimization strategies. We believe Impact Analytics’ forecasting solutions can help fast-fashion companies with recommendations for swifter consumer demand forecasting, personalization and store customization, adjusted pricing and efficient budgeting. Furthermore, with predictive analytics aiding stores’ efficiency and inventory management, the time required for product assortments is reduced. Impact Analytics is working with several notable fashion companies, including Calvin Klein, Dick’s Sporting Goods, PVH, Tapestry and Tommy Hilfiger. Savitude Founded in 2016 and based in San Francisco, Savitude is a digital fashion design solution provider that pairs machine learning with human judgment to help apparel companies create personalized fashion designs based on over 700 body type templates—incorporating different trends, inspirations and body types simultaneously while speeding up the design process. While designing particular apparel, the designer uploads patterns, pictures and other images, which are integrated seamlessly into the ideation process, and analyzed and edited to create a digital design. We believe that Savitude’s platform can be of great help to fast-fashion companies, who usually deploy influencers or KOLs for social media marketing: Savitude’s platform will allow influencers to design products entirely on their own, reducing costs for the retailer and boosting the creative abilities of the influencers that are the face of the offerings. Furthermore, the digital design technology will likely help fast-fashion brands get their products to market significantly faster, enabling them to cater to increasingly demanding consumers and leverage inventory, sales and consumer behavior insights. [caption id="attachment_138968" align="aligncenter" width="700"] Savitude platform’s process to create digital designs

Savitude platform’s process to create digital designs Source: Savitude [/caption]

Themes We Are Watching

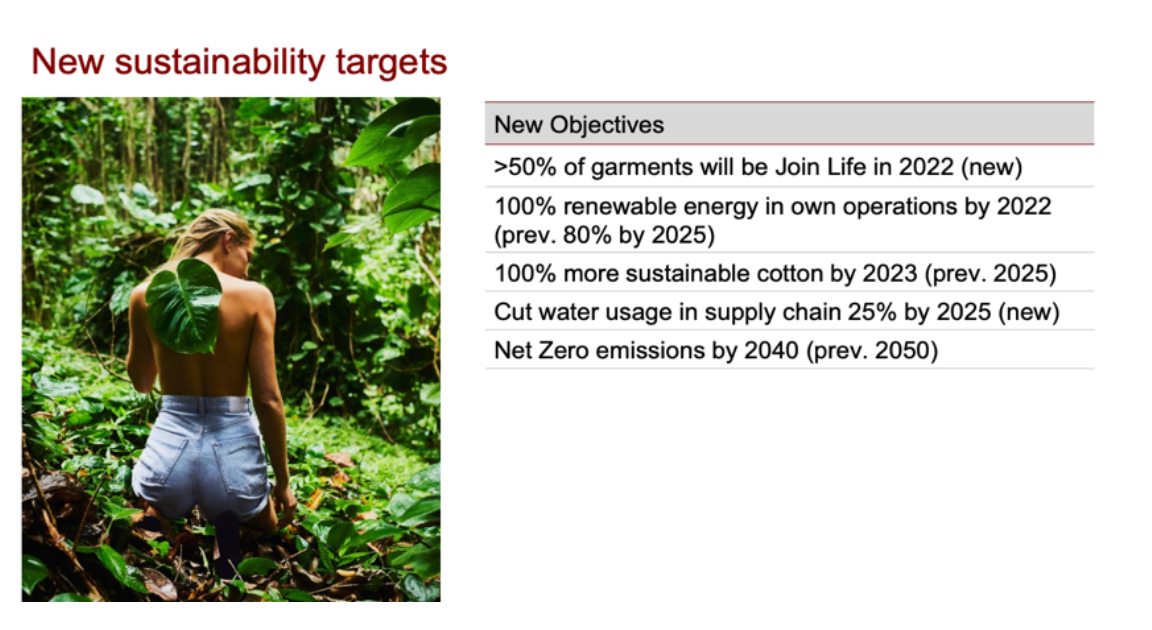

1. Switching Focus to E-Commerce Many fast-fashion retailers lagged in the scope and quality of their e-commerce offerings, and are now playing catchup. The e-commerce penetrations at both H&M and Inditex surged to 28% and 32%, respectively, in 2020, from 14% for each retailer in fiscal 2019. Both retailers have taken learnings from pandemic-related lockdowns and restrictions—including that they can retain greater sales than they expected without stores. As part of its shift toward e-commerce, Inditex is investing substantially in integrating online and offline channels to improve the customer experience and enhance engagement. From 2020 to 2022, the Spanish retailer will be spending €1.0 billion ($1.1 billion) to automate its fulfillment centers and bolster its online capabilities, including offering curbside pickup and buy online pick up in stores (BOPIS), and €1.7 billion ($1.9 billion) to upgrade its integrated store platform through new advanced technology solutions. Similarly, H&M has been ramping up the integration of its physical and online stores—as well as partnering with e-commerce platforms to extend its footprint. In April 2021, H&M partnered with Philippines-based e-retailer Zalora, enabling it to reach 400 million shoppers across Indonesia, Malaysia, Singapore and the Philippines. In contrast, Primark, which does not own any e-commerce business, has no plans to sell its clothes online in the near future. However, the UK-based retailer is boosting its digital marketing capability to enable it to deliver more personalized offerings to its consumers. Primark is working on an improved customer-facing website, to be launched in fiscal 2022. 2. Ramping up Environment, Social and Governance (ESG) Initiatives In recent years, fast-fashion retailers including Boohoo, H&M and Inditex have ramped up their environmental, social and governance (ESG) initiatives. We believe these initiatives will help fast-fashion companies to attract customers and investors. Boohoo Boohoo is taking big steps forward in its sustainability and ethical practice initiatives to build consumer confidence. In June 2021, Boohoo announced plans to grow its own sustainable cotton in Pakistan amid increasing concerns over the mass production of the raw material in Xinjiang, China, where suppliers face allegations of human rights violations. The retailer will start sourcing its cotton from Pakistan in the first half of 2022. Similarly, in May 2021, the retailer launched a new recycled clothing range that uses 95% recycled polyester and 5% elastane. Boohoo is also taking significant steps towards its social responsibility commitments. In July 2020, the company launched an independent review into its UK supply chain and committed to investing £10 million ($12.6 million) into eradicating supply chain malpractice following slavery allegations. Furthermore, in December 2020, Boohoo unveiled plans to open a huge factory with about 60 machinists in Leicester after ending relationships with 64 suppliers in recent months, after the company was criticized over concerns about poor working conditions and overworked and underpaid staff in the company’s suppliers’ factories. H&M Lately, H&M has been making significant efforts towards its sustainable and ethical initiatives. The Swedish retailer aims to use 100% recycled or sustainably sourced materials for its fashion products by 2030, compared to 57% in 2019. To this end, H&M reached a multi-year partnership with a Swedish textile recycling company to supply thousands of tons of circulose fibers made from unusable textile waste in November 2020. Furthermore, in December 2020, in partnership with The Hong Research Institute of Textiles and Apparel, the H&M Foundation announced plans to invest $100 million over five years in the Planet First program, an initiative aimed at finding sustainable solutions for the fashion industry. As part of its social responsibility commitments, H&M has been investing in supporting communities. For example, in April 2021, the company launched worldwide digital initiatives to identify and give a platform to young people who are making a difference in education, equality and sustainability. H&M will support their causes by donating from the proceeds of its new sustainable H&M Kids line. Inditex Sustainability has become a key priority for Inditex in recent years. In the annual general meeting held in July 2021, Inditex’s Executive Chairman Pablo Isla said that the company is bringing its net-zero carbon emissions target forward by 10 years to 2040. Furthermore, Isla highlighted the company’s plans to accelerate delivery of other sustainability targets and introduce new ones:- By 2022, Inditex now aims to convert 100% of its stores and e-commerce websites into “sustainability hubs,” up from the previously targeted 80%. Under the initiative, the company’s stores and online platforms will use renewable energy, eliminate single-use plastic, incorporate more recycled materials and promote garment reuse.

- Inditex aims to use 100% sustainable fabrics in all of its collections by 2023, two years ahead of its initial target of 2025.

- By 2022, more than 50% of all Inditex’s offerings will carry the company’s Join Life sustainability seal.

- By 2025, Inditex aims to reduce water usage across its entire supply chain by 25%.

Inditex’s new sustainability target unveiled during the first half 2021 earnings presentation held on September 15, 2021

Inditex’s new sustainability target unveiled during the first half 2021 earnings presentation held on September 15, 2021 Source: Inditex [/caption] 3. Adoption of Innovative Technologies Fast-fashion companies, notably DeFacto, H&M, Inditex and Shein, have been aggressive in incorporating innovative technologies including AI, radio frequency identification (RFID), robotics and big data into their business strategies and supply chains. DeFacto DeFacto was the first in Turkey’s apparel sector to automate its warehouse, in two phases across 2014 and 2017. The smart warehouse, located in Çerkezköy, is entirely run by robots. About 85% of the company’s Turkish distribution and all of its e-commerce operations are managed through this warehouse. Similarly, DeFacto launched its “Smart Store” concept in 2019: these stores feature robot sales assistant, smart mirrors and virtual reality glasses, which guide customers on how to use the systems and help them to try products they would like to purchase. Smart Stores does not have cash desks and customers can pay through smart checkouts. Building on its experience with the Smart Store, DeFacto created and launched a more hybrid version in November 2020—the “Phygital Smart Store.” The Phygital Smart Store model stands out with its omnichannel inventory shipping capability—allowing customers to buy products available in its stores and warehouses. It also allows customers to have purchased products delivered in-store or to their homes. Inditex Since 2018, Inditex has been aggressively incorporating innovative technologies, including AI, big data and robotics, into its business strategy and supply chain. It has partnered, for example, with US-based Fetch Robotics on robot deployment for stock inventory, with Intel on technology innovations for gauging clothing volume in boxes, and with microchip provider Tyco for tracking product data and locations along the supply chain. Inditex has also collaborated with US-based AI consumer behavior forecasting platform Jetlore and Spanish big data startup El Arte de Medir. In 2020, Inditex implemented radio frequency identification (RFID) technology across all its brands, having used the technology for some time at its Zara and Massimo Dutti brands. Over the past few years, RFID has helped Zara in inventory tracking and management and in reducing shrinkage. During the second quarter of fiscal 2021 ended July 31, 2021, the Zara and Massimo Dutti apps added virtual fitting rooms for their collections, combining AI and AR technologies, to offer an enhanced customer experience by enabling digital interaction with the products. H&M H&M has been ramping up its AR- and VR-based offerings lately. In January 2021, the Swedish retailer, through its innovation lab H&Mbeyond, collaborated with AR and VR solution company NeXR Technologies to develop a virtual fitting room service for shoppers, with the prototype launching in its Berlin stores in October 2021. The technology scans a customer’s body and creates a personal avatar, in the form of their exact digital image. H&M expects this technology to not only improve customers’ shopping experiences but also help the retailer in increasing conversion rates and reducing returns. Furthermore, the Swedish retailer utilizes algorithms and data science to forecast market demand, avoid overproduction of merchandise and determine competitive prices. Shein Shein has been deploying new and innovative technologies across its businesses. The Chinese fast-fashion company relies primarily on algorithms and data science, complemented by human judgment, to forecast consumer demand. Furthermore, Shein employs AI-based predictive analytics to automate its distribution centers and enhance order fulfillment. Shein’s website is tied to the enterprise resource planning (ERP) system that allows the company to closely monitor its manufacturing progress and efficiently match manufacturing capabilities with real-time demand. For instance, if a new product that is designed based on Shein’s first- and third-party data starts getting clicks, taps and sales when it is launched online, an algorithm expands the manufacturing quota and updates the supplier factory floor in real-time to have extra materials ordered. Another algorithm recommends the product to more customers with similar profiles.

What We Think

We estimate that global fast-fashion sales increased by around 20% year over year in 2021. The year-over-year increase was driven by an overall return to apparel spending. As 2021 brought new opportunities for consumers to socialize, go to parties and attend events—activities they missed out on during 2020’s lockdowns—we expect that apparel companies will see a strong boost in fast-fashion sales. Leading fast-fashion companies H&M and Inditex have reported robust sales growth in 2021. From 2021 to 2025, Coresight Research estimates that global fast-fashion sales will grow at a more stabilized 8% CAGR. The key long-term growth drivers for fast fashion include its high profit margin, the growing global youth population, the increasing influence of the internet and social media, the rising adoption of new technologies such as AR and VR, and growing economies in emerging countries, such as China and India. We see e-commerce as a great opportunity for fast-fashion retailers to adjust their product and service offerings and drive sales. We expect consumers to retain their pandemic-driven online shopping habits in 2022, although some spending will return to physical stores. Looking ahead, we believe the global fast-fashion market will continue to be dominated by the same three players: H&M, Inditex and Shein. However, we estimate that their share of the global fast-fashion market will shrink slightly to 69% by 2025, down from 71% in 2020. Implications for Brands/Retailers- We expect a large number of consumers to retain their pandemic-driven online shopping habits in 2022 and beyond, and recommend that retailers continue to offer convenient online product discovery and enhance their digital capabilities, such as with new distribution centers and expanded ship from store capabilities, to increase customer loyalty.

- Automation at scale is key to sustainable personalization in fast-fashion retail. Retailers and brands must strategically decide which aspects of their businesses can be automated, such as inventory management or manufacturing orders.

- Fast-fashion brands and retailers must recognize today’s consumers’ interest in shopping fairly and ecologically produced items. Adopting ethical and sustainable measures can help fast-fashion companies differentiate themselves from the competition, attracting customers, investors and employees.

- Innovators have strong opportunities to partner with fast-fashion retailers as they expand into e-commerce. Innovators can also support fast-fashion companies in lowering their inventory levels and improving efficiency, agility and resilience across their supply chains.