DIpil Das

Introduction

Indian furniture is well-known and internationally acclaimed for its build quality and unique and contemporary designs inspired by India’s rich culture, art and traditions. The sector, traditionally dominated by unorganized and local players, has witnessed an increase in the number of organized players over the last decade. We expect their share to rise further as multinational players enter the Indian market. We also expect India's growing trend of online and mobile shopping to boost the demand for furniture through online channels. In this report, we discuss the growth and drivers of the furniture and home improvement sector, innovative players in the sector and trends for 2022 and beyond.Market Performance and Outlook

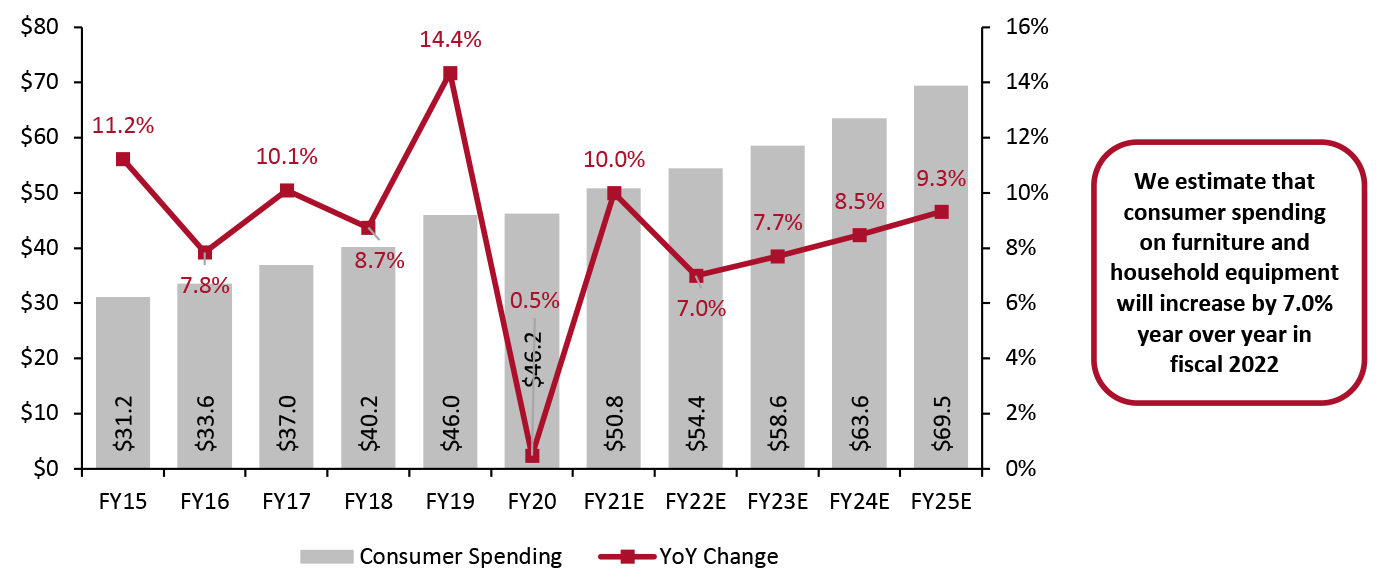

Consumer Spending and Growth Estimates The following estimates are for fiscal years (FY), which in India run from April 1 to March 31.- We estimate that consumer spending on furniture and home improvement in India will increase by 7.0% year over year in FY22, reaching $54.4 billion, based on data from India’s Ministry of Statistics and Program Implementation (MOSPI).

- We expect that FY22 growth rates will moderate from FY21’s 10.0% year-over-year growth, which saw consumer spending reach $50.8 billion from $46.2 billion in FY20.

- This increased consumer spending in FY21 was a revival after a slump in FY19–20 due to a liquidity crisis denting the growth of the Indian real estate sector. FY19–20’s real estate slowdown was also reflected across associated sectors, including furniture and home improvement, leading to negligible growth. However, government reforms and initiatives to bring liquidity in the market helped bring about a revival of the industry and its associated sectors.

- FY21’s strong growth was also a result of the pandemic-led increase in consumer spending on office and study furniture from June 2020 due to the newly widespread practice of working or studying from home.

- The second wave of the pandemic arrived in India in the first quarter of FY22 and forced consumers to stay indoors, contributing to the moderate growth of the sector as consumers focused on home improvements and renovation while confined to their homes. We expect this trend to persist as some consumers will continue to work from home indefinitely.

- Therefore, we estimate a steady increase in growth rates by 0.7%–0.8% year over year from FY22, to reach $69.5 billion in FY25.

Figure 1. India: Consumer Spending on Furniture, Household Equipment, and Routine Household Maintenance (Left Axis: USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_142657" align="aligncenter" width="700"]

Fiscal year runs from April 1 to March 31

Fiscal year runs from April 1 to March 31Conversions to USD at average 2020 exchange rates

Categories published by MOSPI include furniture, furnishings, floor coverings, household appliances, glassware and household utensils, home and garden tools, and household maintenance goods and services

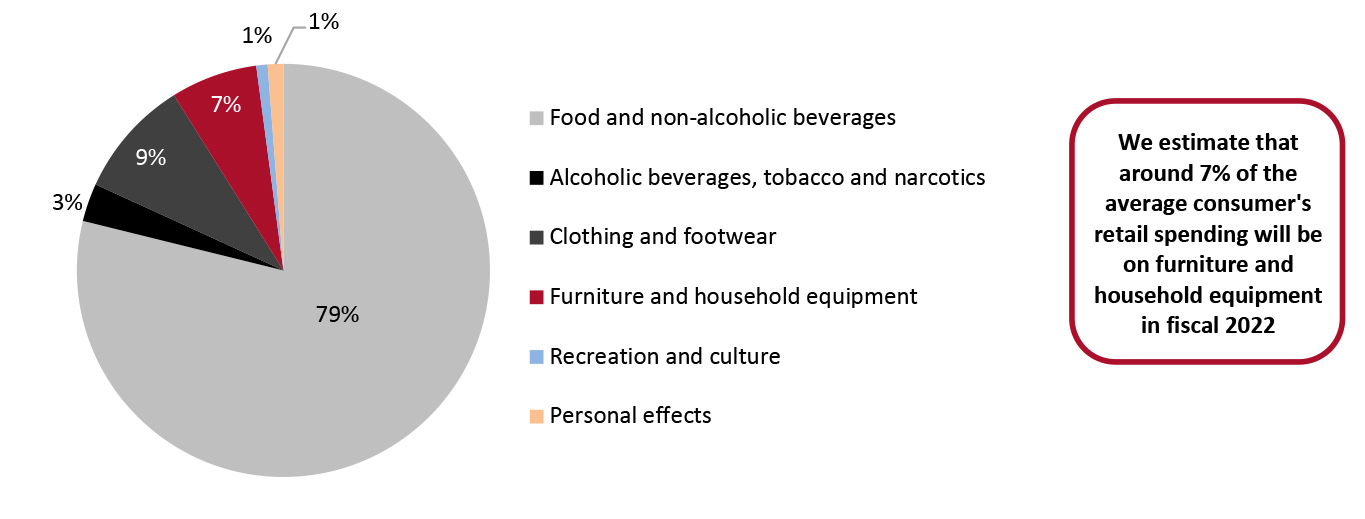

Source: MOSPI/Coresight Research [/caption] Based on data from MOSPI, we estimate that Indian consumers will spend nearly 7% of their total retail spending on furniture and home improvement in fiscal 2022.

Figure 2. India: Estimated Breakdown of Retail Spending by Indian Consumers in FY22 by Category [caption id="attachment_142658" align="aligncenter" width="700"]

Categories as published by MOSPI

Categories as published by MOSPI Source: MOSPI/Coresight Research [/caption]

Market Factors

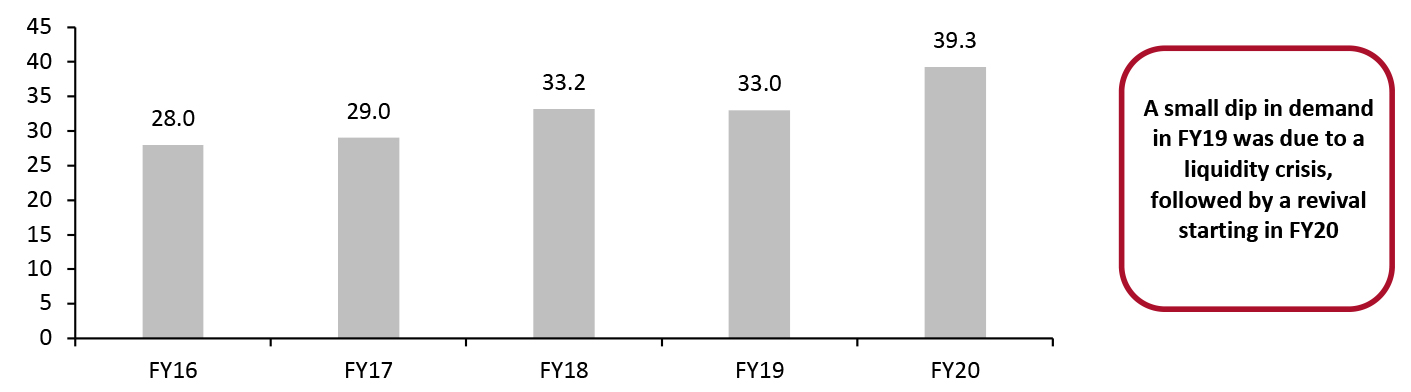

Increasing urbanization in India, a growing middle-class population with higher disposable income, and their increasing desire for urban homes with modular and state-of-the-art furniture has contributed to the growth of the furniture and home improvement sector. Below, we examine the key growth factors for this sector for 2022 and beyond. Growing Commercial, Residential and Retail Real Estate In India, real estate is one of the biggest sectors after agriculture, comprising housing, retail, hospitality and commercial. The real estate market size will reach $1 trillion in 2030 from $120 billion in 2017, at a CAGR of 17.7%, and contribute 13% to the country’s GDP, according to estimates from the India Brand Equity Foundation (IBEF). The growth of this sector is complemented by the growth in demand for office spaces and urban and semi-urban accommodations. The demand for commercial space has been on the rise for the past five to six years, as shown in Figure 3 below.Figure 3. India: Demand for Commercial Space in Top Eight Indian Cities FY16–FY20 (Million Sq. Ft.) [caption id="attachment_142641" align="aligncenter" width="700"]

Source: IBEF[/caption]

Though the liquidity crisis in the real estate sector affected furniture and home improvement as well, government reforms, policy changes and initiatives—including an alternative investment fund of ₹250 billion ($3.3 billion) to bring liquidity into the market—brought about a revival of the industry, which, in turn, helped the furniture and home improvement sector.

Following the revival, housing sales increased by 29% and new project launches (residential gated communities and apartment complexes) by 51% in the top seven Indian cities during the fourth quarter of FY21 compared to the fourth quarter of FY20. The demand for residential real estate also peaked in the fourth quarter of FY21 as buyers enjoyed the added advantages of low mortgage rates offered by banks and financial institutions and incentives from developers.

Furthermore, India gained around 100 new malls in 2021, of which 70% are in the top seven Indian cities and the remaining 30% in Tier 2 and Tier 3 cities, according to property consultant Anarock.

The above developments in real estate such as office spaces, housing projects, and malls will lead to an increased demand for office and home furniture, and home improvement and décor items, driving the growth of the furniture and home improvement sector in 2022 and beyond.

Increasing Demand for Home-Office Furniture

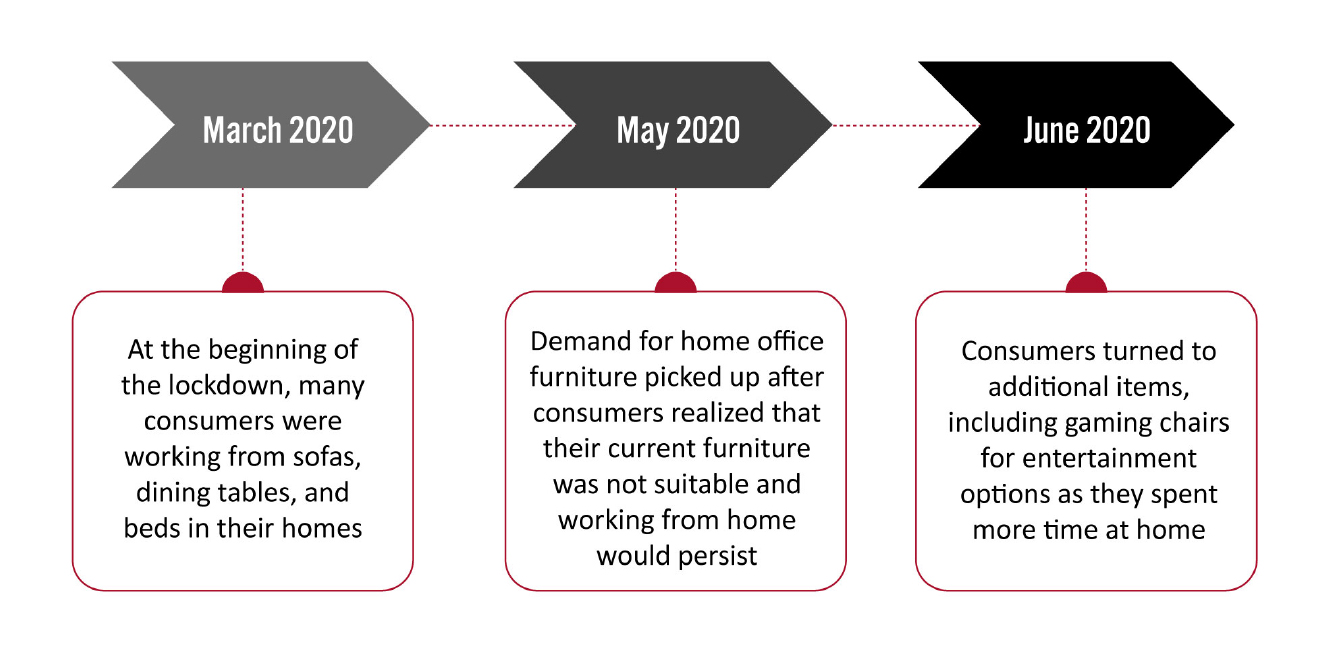

The onset of the Covid-19 pandemic in India in March 2020 made many customers switch to office furniture at home when they realized that their existing home furniture was unsuitable, as depicted in Figure 4 below.

Source: IBEF[/caption]

Though the liquidity crisis in the real estate sector affected furniture and home improvement as well, government reforms, policy changes and initiatives—including an alternative investment fund of ₹250 billion ($3.3 billion) to bring liquidity into the market—brought about a revival of the industry, which, in turn, helped the furniture and home improvement sector.

Following the revival, housing sales increased by 29% and new project launches (residential gated communities and apartment complexes) by 51% in the top seven Indian cities during the fourth quarter of FY21 compared to the fourth quarter of FY20. The demand for residential real estate also peaked in the fourth quarter of FY21 as buyers enjoyed the added advantages of low mortgage rates offered by banks and financial institutions and incentives from developers.

Furthermore, India gained around 100 new malls in 2021, of which 70% are in the top seven Indian cities and the remaining 30% in Tier 2 and Tier 3 cities, according to property consultant Anarock.

The above developments in real estate such as office spaces, housing projects, and malls will lead to an increased demand for office and home furniture, and home improvement and décor items, driving the growth of the furniture and home improvement sector in 2022 and beyond.

Increasing Demand for Home-Office Furniture

The onset of the Covid-19 pandemic in India in March 2020 made many customers switch to office furniture at home when they realized that their existing home furniture was unsuitable, as depicted in Figure 4 below.

Figure 4. India: Key Phases of Consumers’ Working from Home Arrangements [caption id="attachment_142642" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

- For online furniture company Pepperfry, study tables and chairs accounted for 35–40% of its post-lockdown business in June 2020, compared to just 10% of its overall business before the pandemic, according to its CMO, Kashyap Vadapalli.

- Some 80% of office furniture company Featherlite’s business before the pandemic was business-to-business (B2B), but the company pivoted to business-to-consumer (B2C) to address the growing demand for laptop tables and office chairs from individual customers in Metro and Tier 1 cities, ultimately seeing an order volume of 200 per city per day.

- Walmart-owned Indian e-commerce giant Flipkart witnessed a tripling in demand for study tables, office chairs and laptop tables in June 2020, according to the company.

- Snapdeal saw 70% growth in its home category between March 2020 and June 2021, led by kitchenware and home improvement products, according to the company.

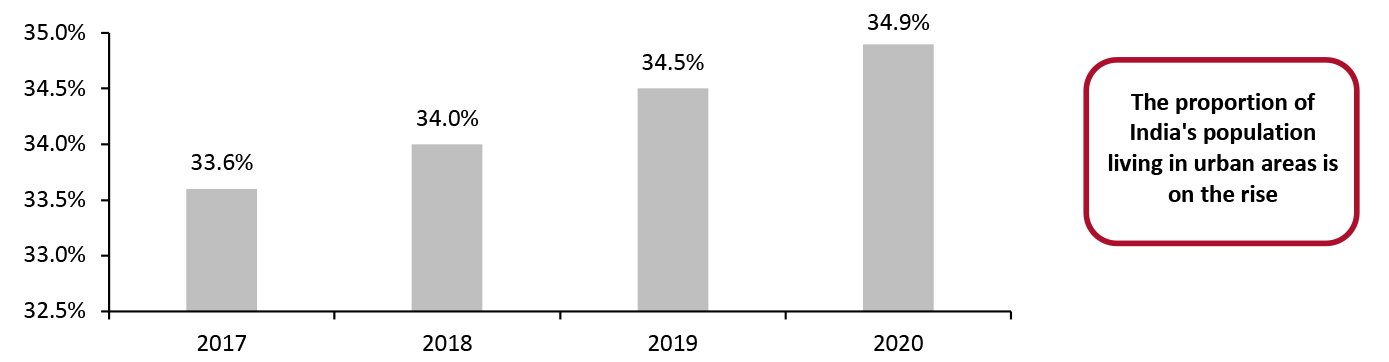

Figure 5. India: Urban Population as a % Share of Total Population [caption id="attachment_142643" align="aligncenter" width="700"]

Source: World Bank[/caption]

Higher disposable income allows consumers to use superior home interior products. While real estate developers have recognized this trend and highlight the quality of home products and materials in their offerings, certain consumers are willing to spend over and above to improve the look and feel of their homes.

Consumer Preferences and Increased Spending on Home Improvement and Home Décor Items

Being forced to stay at home during the pandemic has prompted consumers to pay more attention to home improvement. While government restrictions were in place for international and domestic travel, some consumers diverted their travel spending to home improvements.

Furthermore, the opportunity to address maintenance work, minor repairs and renovation also led to a rise in the purchase of do-it-yourself (DIY) repair products.

E-commerce platform Snapdeal’s July–August 2020 survey, covering 2,000 respondents, revealed interesting insights about consumers’ mood for home improvement, as shown in Figure 5 below.

Source: World Bank[/caption]

Higher disposable income allows consumers to use superior home interior products. While real estate developers have recognized this trend and highlight the quality of home products and materials in their offerings, certain consumers are willing to spend over and above to improve the look and feel of their homes.

Consumer Preferences and Increased Spending on Home Improvement and Home Décor Items

Being forced to stay at home during the pandemic has prompted consumers to pay more attention to home improvement. While government restrictions were in place for international and domestic travel, some consumers diverted their travel spending to home improvements.

Furthermore, the opportunity to address maintenance work, minor repairs and renovation also led to a rise in the purchase of do-it-yourself (DIY) repair products.

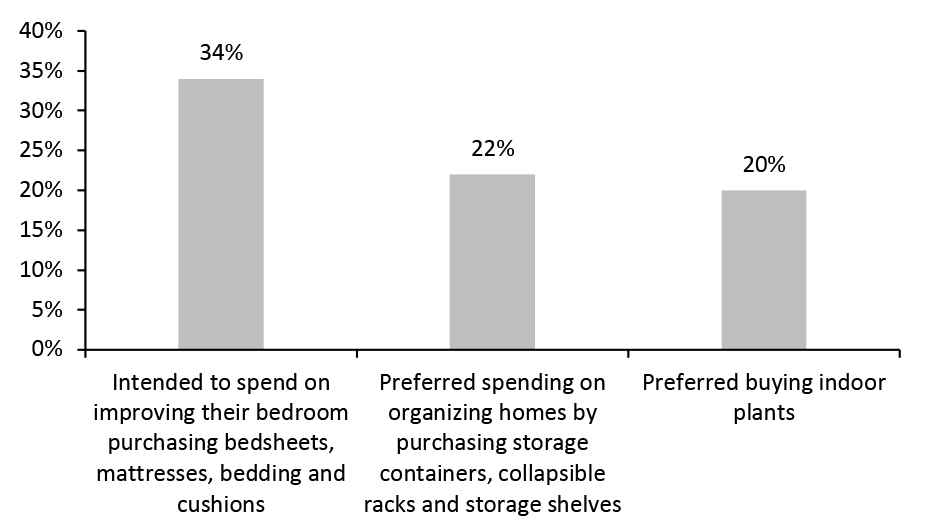

E-commerce platform Snapdeal’s July–August 2020 survey, covering 2,000 respondents, revealed interesting insights about consumers’ mood for home improvement, as shown in Figure 5 below.

Figure 6. India: Snapdeal Survey on Consumers’ Mood for Home Improvement–July–August 2020 [caption id="attachment_142644" align="aligncenter" width="700"]

Source: Snapdeal survey/Coresight Research[/caption]

Consumers have realized the need to make their homes more comfortable and we expect their willingness to spend on home improvement will be on the rise in the coming years as well. Home improvement retailers and e-commerce players also curate products keeping in mind the consumers’ needs and preferences, leading to the long-term growth of this sector.

Inflation

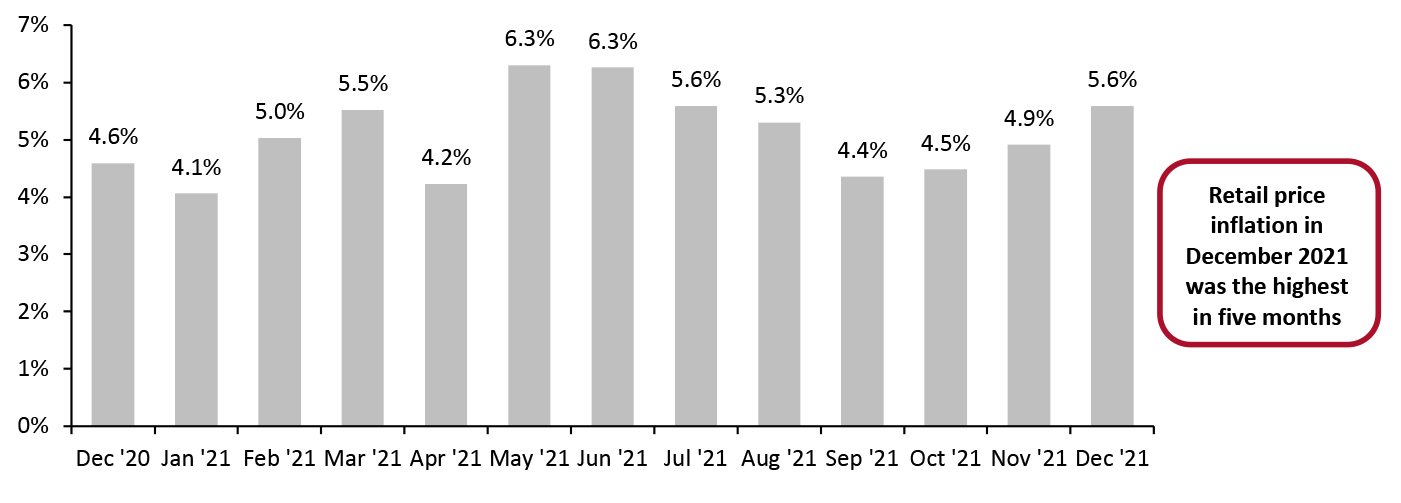

India’s retail price inflation reached 5.6% in December 2021, its highest level for the last five months, up from 4.9% in November 2021, according to January 2022 data from MOSPI. Figure 6 below shows retail price inflation over the past 12 months before Dec 2021.

Source: Snapdeal survey/Coresight Research[/caption]

Consumers have realized the need to make their homes more comfortable and we expect their willingness to spend on home improvement will be on the rise in the coming years as well. Home improvement retailers and e-commerce players also curate products keeping in mind the consumers’ needs and preferences, leading to the long-term growth of this sector.

Inflation

India’s retail price inflation reached 5.6% in December 2021, its highest level for the last five months, up from 4.9% in November 2021, according to January 2022 data from MOSPI. Figure 6 below shows retail price inflation over the past 12 months before Dec 2021.

Figure 7. India: Retail Price Inflation [caption id="attachment_142645" align="aligncenter" width="700"]

Source: Trading Economics[/caption]

Inflation, as measured by the Wholesale Price Index (WPI), stood at 13.6% in December 2021, down from 14.2% in November, according to data released by the Ministry of Commerce and Industry, having been just 2.0% in December 2020. Higher prices for food, fuel and commodities along with supply-side bottlenecks contributed to a spike in both retail and wholesale inflation rates. With input price pressures, supply-side shortages and the Omicron variant destabilizing global commodity prices, we expect double-digit rates for WPI to prevail through the first quarter of 2022.

Furthermore, the Consumer Price Index (CPI) for household goods and services—furnishings, household equipment and routine maintenance—rose to 122.7 in 2021 from 116.7 in 2020 and will reach 127.9 in 2022, according to Statista estimates using data from Eurostat, IMF, UN and World Bank.

However, the Government’s prediction that the economy will grow 8%–8.5% in FY23, the supply-side measures it has announced and the waning impact of Covid-19 is likely to help the Reserve Bank of India to reduce inflation rates. We expect that lower inflation rates will help consumers with more disposable income for discretionary spending.

Source: Trading Economics[/caption]

Inflation, as measured by the Wholesale Price Index (WPI), stood at 13.6% in December 2021, down from 14.2% in November, according to data released by the Ministry of Commerce and Industry, having been just 2.0% in December 2020. Higher prices for food, fuel and commodities along with supply-side bottlenecks contributed to a spike in both retail and wholesale inflation rates. With input price pressures, supply-side shortages and the Omicron variant destabilizing global commodity prices, we expect double-digit rates for WPI to prevail through the first quarter of 2022.

Furthermore, the Consumer Price Index (CPI) for household goods and services—furnishings, household equipment and routine maintenance—rose to 122.7 in 2021 from 116.7 in 2020 and will reach 127.9 in 2022, according to Statista estimates using data from Eurostat, IMF, UN and World Bank.

However, the Government’s prediction that the economy will grow 8%–8.5% in FY23, the supply-side measures it has announced and the waning impact of Covid-19 is likely to help the Reserve Bank of India to reduce inflation rates. We expect that lower inflation rates will help consumers with more disposable income for discretionary spending.

Online Market

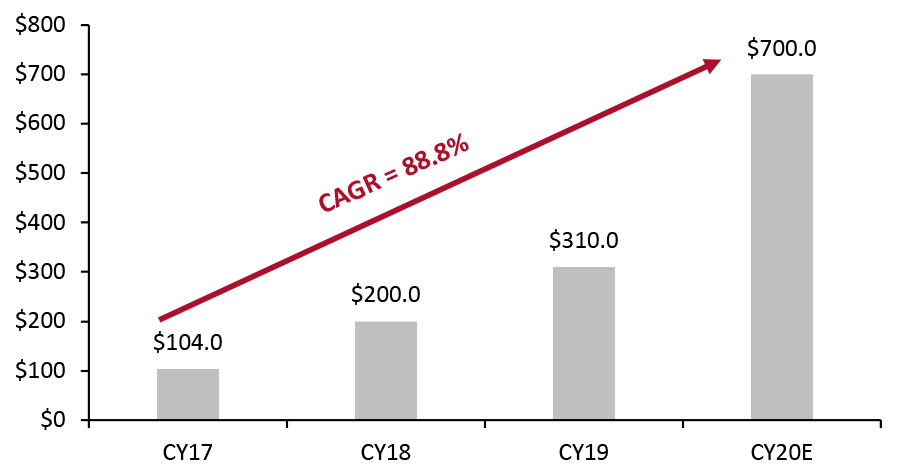

The pandemic has led to growing adoption of hybrid business models in the furniture and home improvement sector. With safety concerns and convenience still governing consumer behavior, online is now a more favored channel to buy furniture and home improvement products. Factors driving the online furniture market include a rise in digitalization among consumers, growth of online sales channels, increasing urbanization, customized offerings by online players, and convenience of home delivery. Research and consulting firm RedSeer estimates that the online furniture market size was $700 million in calendar year (CY) 2020, up from $104 million in 2017, at a CAGR of 80%–85%, out of a total estimated furniture market size of $20 billion in CY20.Figure 8. India: Online Furniture Market Size 2017–2020E (USD Mil.) [caption id="attachment_142646" align="aligncenter" width="700"]

Source: RedSeer Consulting[/caption]

Another factor behind consumers’ shift from physical stores to online channels was the integration of technology-powered solutions by online furniture retailers and e-commerce platforms. New technologies allowed home improvement brands to focus on innovative technologies to showcase their products in real-time, helping consumers understand the fit and suitability before purchase. Online players also offer personalization in terms of fabric, color and upholstery to match individual preferences.

In addition to convenient and safe delivery, many online furniture platforms also have easy return or exchange policies and offer value-added services such as furniture assembly. Driven by growing digitalization and millennial and Gen Z consumers’ spending, online furniture and home improvement retail is set to capture a greater share of the market, leveraging higher levels of consumer engagement through consultation, personalization and convenience.

Below, we also examine three prominent online furniture and home improvement retailers in India.

Pepperfry

Pepperfry, founded in November 2011, is an Indian online marketplace for furniture and home décor. The company is headquartered in Mumbai, and offers more than 120,000 products across categories including décor, furniture, lighting, mattresses and modular furniture. Pepperfry has a presence in more than 500 cities and over 40 experience centers, and it operates 17 fulfillment hubs across the country as of January 2022. The company claims that it sells an item every 15 seconds. Pepperfry has a highly engaging app, offering its users superior augmented reality (AR) features. The company raised $40 million in November 2021 in a debt-funding round led by over 47 investors, including debt firm Norwest Venture. The company plans to go public in early 2022.

LivSpace

LivSpace is a home interior and renovation company founded in 2014 by Anuj Srivastava and Ramakant Sharma. LivSpace platform connects people to designers, services and products to design, decorate and furnish their homes. It also provides end-to-end home interior services, including renovations such as kitchen upgrades or repainting a room. As of January 2022, it has a presence in 21 cities across India. LivSpace has raised a total of $251.7 million in funding over nine rounds; its latest funding was in November 2021 from a corporate round.

Urban Ladder

Urban Ladder is an omnichannel furniture and home décor retailer founded by Ashish Goel and Rajiv Srivatsa in July 2012. It offers over 1,000 products across 25 categories such as bedroom, décor, dining, living, mattresses, storage and study. Urban Ladder, which has an offline presence in seven cities across India, offers a range of contemporary designs and high-quality handcrafted furniture. Reliance Retail acquired Urban Ladder in November 2020 for $24 million.

Source: RedSeer Consulting[/caption]

Another factor behind consumers’ shift from physical stores to online channels was the integration of technology-powered solutions by online furniture retailers and e-commerce platforms. New technologies allowed home improvement brands to focus on innovative technologies to showcase their products in real-time, helping consumers understand the fit and suitability before purchase. Online players also offer personalization in terms of fabric, color and upholstery to match individual preferences.

In addition to convenient and safe delivery, many online furniture platforms also have easy return or exchange policies and offer value-added services such as furniture assembly. Driven by growing digitalization and millennial and Gen Z consumers’ spending, online furniture and home improvement retail is set to capture a greater share of the market, leveraging higher levels of consumer engagement through consultation, personalization and convenience.

Below, we also examine three prominent online furniture and home improvement retailers in India.

Pepperfry

Pepperfry, founded in November 2011, is an Indian online marketplace for furniture and home décor. The company is headquartered in Mumbai, and offers more than 120,000 products across categories including décor, furniture, lighting, mattresses and modular furniture. Pepperfry has a presence in more than 500 cities and over 40 experience centers, and it operates 17 fulfillment hubs across the country as of January 2022. The company claims that it sells an item every 15 seconds. Pepperfry has a highly engaging app, offering its users superior augmented reality (AR) features. The company raised $40 million in November 2021 in a debt-funding round led by over 47 investors, including debt firm Norwest Venture. The company plans to go public in early 2022.

LivSpace

LivSpace is a home interior and renovation company founded in 2014 by Anuj Srivastava and Ramakant Sharma. LivSpace platform connects people to designers, services and products to design, decorate and furnish their homes. It also provides end-to-end home interior services, including renovations such as kitchen upgrades or repainting a room. As of January 2022, it has a presence in 21 cities across India. LivSpace has raised a total of $251.7 million in funding over nine rounds; its latest funding was in November 2021 from a corporate round.

Urban Ladder

Urban Ladder is an omnichannel furniture and home décor retailer founded by Ashish Goel and Rajiv Srivatsa in July 2012. It offers over 1,000 products across 25 categories such as bedroom, décor, dining, living, mattresses, storage and study. Urban Ladder, which has an offline presence in seven cities across India, offers a range of contemporary designs and high-quality handcrafted furniture. Reliance Retail acquired Urban Ladder in November 2020 for $24 million.

Competitive Landscape

The furniture and home improvement sector is predominantly unorganized and dominated by localized players. RedSeer estimates the total furniture market size to be $28 billion by CY23E, up from $20 billion in CY20 and growing at a CAGR of 11.9%. It further estimates the organized market share to grow from 15% in CY20 to 21.4% in CY23E, with the unorganized market share reducing from 85% to 78.6% during the same period. On these projections, the unorganized furniture market size will be $22 billion by CY23E and the remaining $6 billion will be the organized market size. The furniture sector has been witnessing an increase in the number of organized players over the last decade. The liberalization of restrictions on foreign direct investment (FDI) in multi-brand retail to permit up to 51% FDI has led various multinational players such as IKEA to enter the Indian market, a pattern we expect to continue. Prominent organized domestic players include Damro, Durian, Godrej Interio, Nilkamal, Usha Furniture, Wipro Furniture and Zuari. Figure 9 below presents the largest furniture and home improvement companies in India (domestic and international), based on the revenue from their annual reports for the past three years. The combined revenue generated by these prominent players in the year 2021 was around $1.6 billion, based on average 2021 exchange rates.Figure 9. India: Major Furniture and Home Improvement Retailers’ Revenue (USD Mil.) [wpdatatable id=1792 table_view=regular]

Conversions to USD at average 2021 exchange rates Source: Company reports We profile four of these companies below. Godrej Interio Godrej Interio is an Indian furniture brand headquartered in Mumbai. Founded in 1923, the company caters to both home and institutional segments. Godrej Interio is one of the divisions of Godrej & Boyce Manufacturing Company Limited, part of the Godrej group, one of India’s largest engineering and consumer product groups. As of January 2022, it has a presence in over 430 cities across India through 52 company-owned stores and over 800 dealerships. It offers a wide range of products across categories such as beds, chairs, dining, mattresses, recliners, sofas, tables and wardrobes. Wipro Furniture Wipro Furniture is a part of the Wipro Consumer Care and Lighting Group, one of the prominent fast-moving consumer goods (FMCG) companies in India. Wipro Furniture offers a wide range of office furniture such as board room seating, conference tables, educational furniture, office chairs and workstations. Nilkamal Nilkamal is a molded furniture manufacturer offering budget-friendly items across home furniture, mattresses and office furniture. Its products are available in more than 30 countries. It has a strong retail presence in India with 80 retail stores, 1,100 distributors, and more than 30,000 dealerships across the country. Nilkamal also has eight plants and 42 depots across India, offering quick doorstep delivery. The brand also has a digital platform that offers consumers online access to its products. Hometown Hometown offers a range of furniture, home furnishings and décor, home improvement and modular kitchens. Hometown is part of the Future Group and has over 44 stores across 28 cities in India.

Themes We Are Watching

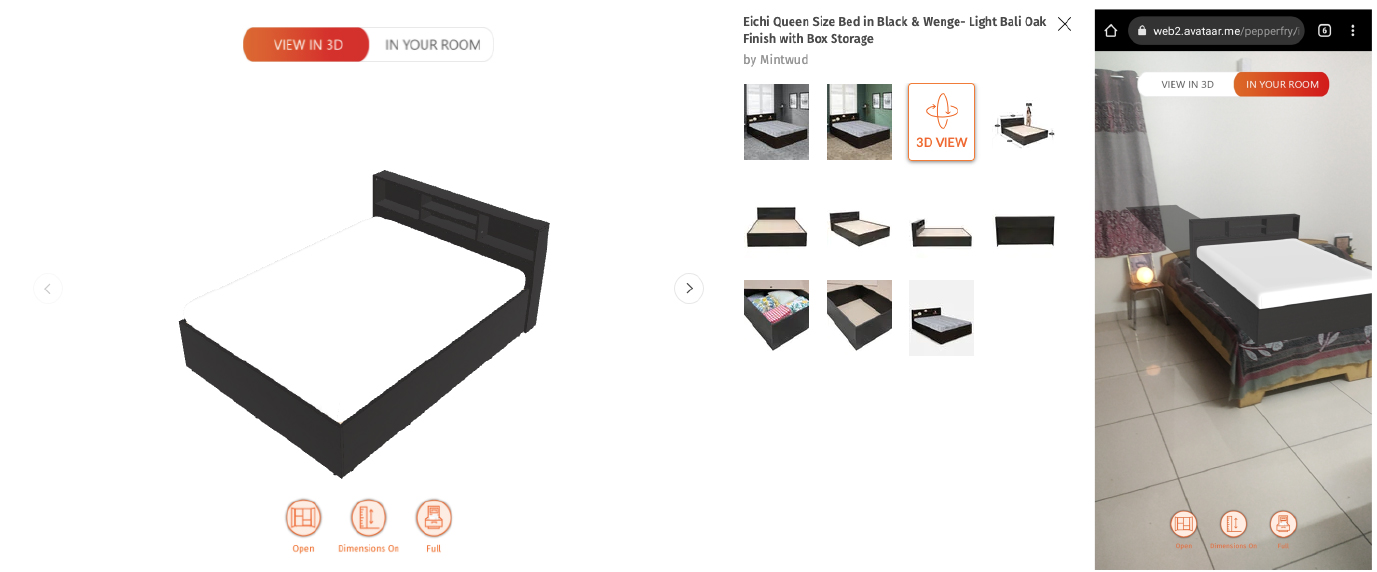

Online Furniture Retailers’ Deployment of AR/VR Technologies and 3D Visualization With consumers switching to online channels to purchase furniture and home décor items, brands and retailers should leverage augmented reality (AR) and virtual reality (VR) technologies to provide an immersive furniture shopping experience. E-commerce marketplaces and online direct-to-consumer (DTC) brands increasingly help consumers to set up their home or office spaces and visualize products to help them select the most suitable items. Furniture retailers also use data-driven analytics to research consumer buying patterns and offer personalized product recommendations that suit their unique tastes and preferences. Technologies also enable consumers to compare and evaluate products before purchase. Online furniture retailer Pepperfry invests in new technologies including serverless architecture, machine learning, 3D, AR and VR. It uses 3D technology to help customers visualize products better. Pepperfry’s 3D experience enables consumers to change the furniture’s orientation to view it from different angles, zoom in and out and experience opening cabinet doors and pulling out drawers. [caption id="attachment_142647" align="aligncenter" width="700"] A bed shown in 3D view and visualization in the room

A bed shown in 3D view and visualization in the room Source: Pepperfry [/caption] It also leverages AI and machine learning to highlight the most relevant products for customers during their searches, increasing the chances of conversion. Pepperfry also plans to leverage VR technologies to create a furniture-free studio, according to its Chief Technology Officer, Sanjay Netrabile. Another Chennai-based interior design startup, Pixel and Mortar, has developed an AR platform that enables users to visualize interior décor. It combines physical and digital elements to create a virtual world and uses mood boards to understand consumer preferences to suggest furniture, lamps, wallpapers and other items for them. The platform helps users to visualize what the décor will look like in their room in 3D and enables them to rearrange and replace the items as required. Rental Services’ Growing Popularity Among Young, Urban Consumers As rental services expand in various categories, there is an increasing trend for the renting of furniture and appliances. Within the furniture category, renting benefits consumers by letting them avoid the large investment required for big-ticket purchases and the commitment of owning a piece of furniture, particularly for those in short-term accommodation. Furthermore, consumers can conveniently upgrade or swap items to change the look of their rooms. Consumers that work from home only intermittently may prefer to rent rather than buy the furniture for it.

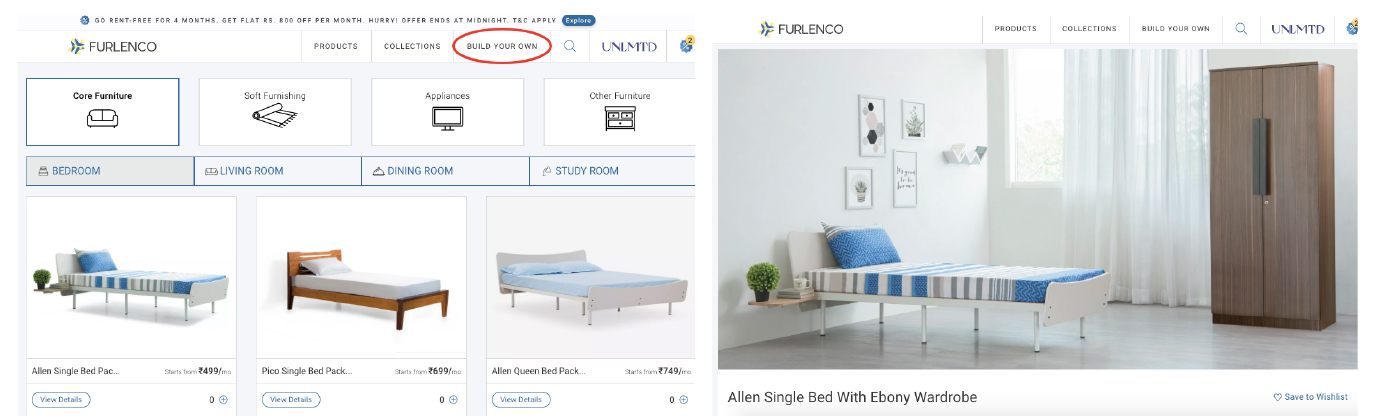

- Furlenco is a furniture company that offers furniture and home décor for rent to urban Indian consumers. It also provides décor, accessories and appliances. The company offers a subscription model and provides the entire range of home items required to furnish every room. Furlenco also provides additional benefits such as swapping of furniture, relocation across cities, pausing subscriptions and deep cleaning services as part of the subscription. It also offers customization by enabling consumers to pick individual furniture items and bundle them together for a subscription price.

Furlenco’s customization of rental furniture and furniture combo offerings

Furlenco’s customization of rental furniture and furniture combo offerings Source: Furlenco [/caption]

- Rentomojo is another online rental platform that offers furniture, appliances and electronics on a monthly rental basis. It offers products across a wide range of categories including beds, chairs, dining tables mattresses and sofas.

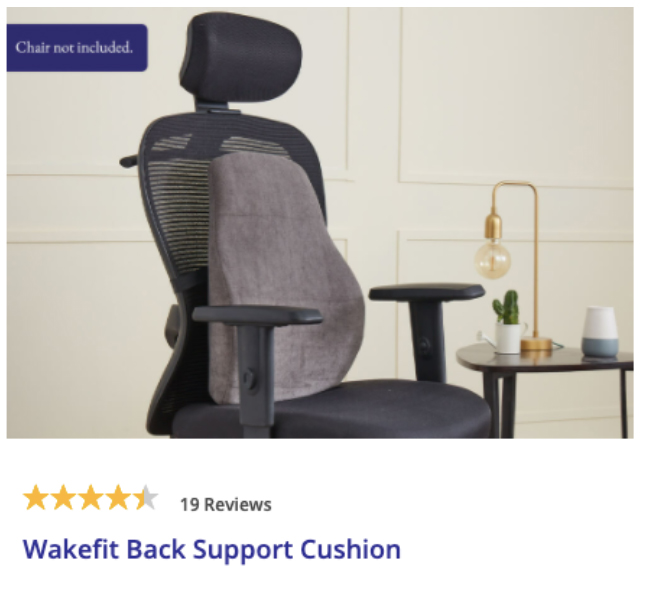

- Furniture and home improvement retailer Wakefit bundles comfort accessories with its range of office chairs to improve customer comfort.

Wakefit bundles back support cushion with office chairs for improved comfort

Wakefit bundles back support cushion with office chairs for improved comfort Source: Company website [/caption] A New Focus on Sustainability and Wellness Pandemic restrictions isolated many consumers, especially those living in urban areas, from open and green spaces; consumers have responded by seeking to bring green spaces into their homes. Many have started nurturing kitchen or floral gardens on their balconies and adding plants in corners and on tabletops—indoor plants, vertical gardens and vegetable gardens are now a larger part of consumers’ home décor.

- E-commerce platform Snapdeal said that it witnessed more than a doubling of sales in the gardening category between March and July 2020, year over year. Customers were buying more indoor plants and attempting to grow fruits and vegetables, according to the company.

- Indian flower and gifts retailer Ferns N Petals said that it received 1000–2000 daily orders for plants after April 2020. The demand for plants to uplift home interiors has grown by 30% compared to pre-Covid times. Since April 2020, orders for herbal plants, air-purifying plants and other indoor plants started “pouring in,” according to Manish Saini, the company’s COO.

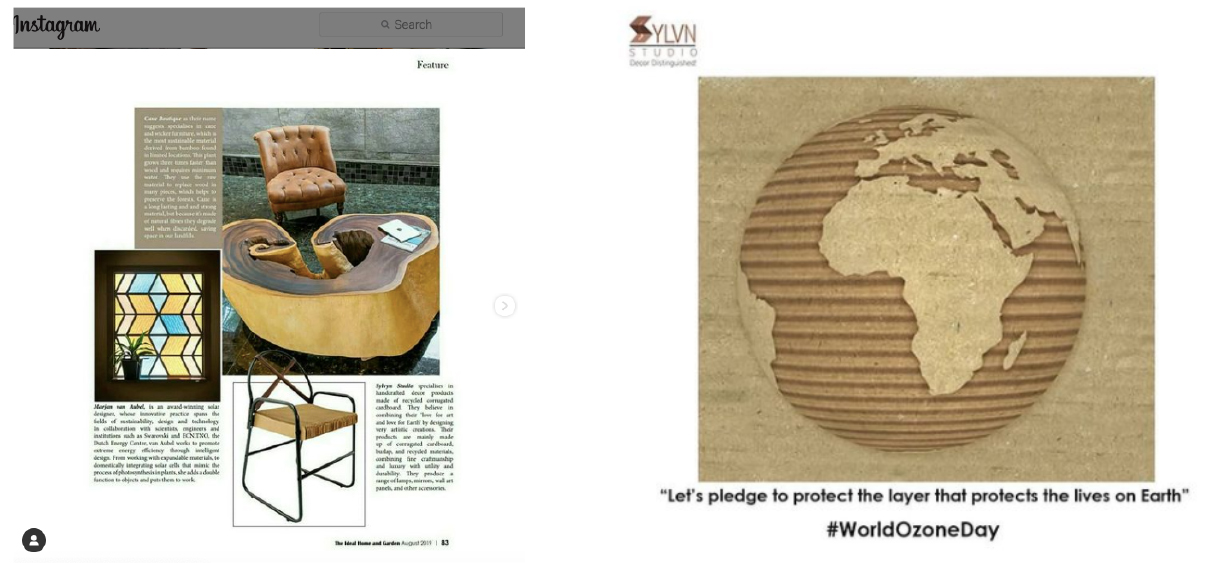

- Sylvn Studio is a Mumbai-based design label specializing in handcrafted décor products using corrugated cardboard, burlap and other recycled materials. Its range of sustainable home décor products includes hanging lamps, floor lamps and larger pieces of furniture.

Sylvyn Studio’s table using recycled wood and earth on corrugated cardboard

Sylvyn Studio’s table using recycled wood and earth on corrugated cardboard Source: Instagram-Sylvn Studio [/caption]

- Differniture is a furniture design atelier embracing an alternative and sustainable approach to design. It offers a sustainably designed furniture range that blends sculptural art and design. Differniture’s products are made using reclaimed and salvaged materials, and it also uses natural and non-toxic oils and waxes for product finishes. It offers alternative and customized pieces of furniture for a niche audience, while adopting a zero or minimal waste design philosophy.

Source: Company website[/caption]

Source: Company website[/caption]

Retail Innovators

Brands Leveraging Technology, Personalization and Innovative Concepts and Designs Furniture and home improvement brands and retailers now leverage technology and bring in innovative concepts and designs to differentiate their products. With consumers switching to online channels to buy furniture, brands and retailers increasingly look at the DTC space to expand their reach. We examine some of the innovators and startups in this sector below.- Furdo, founded in 2014, is a Bangalore-based online interior design and home décor platform that leverages 3D and VR technologies to inform consumers’ purchase decisions. Its 3D interior solution “Try, before you buy” feature enables consumers and homebuyers to virtually walk through their newly designed home and customize things before they buy any décor item. Customers can send their floor plans and select a theme from Furdo’s website, after which the company will create a 3D video to help them visualize the design and home décor items from every angle of the home.

- Gosh, founded in 2020, manufacturers handcrafted imaginative furniture for children. Its products include a pop-up teepee, an art trolley, art stations and a portable sand and water station. Gosh currently operates out of Bengaluru and is looking to expand its presence to other Indian cities.

- Founded in 2014, Bangalore-based HomeLane is a tech-enabled home interior company that offers personalization in interior design for home buyers. It helps buyers with the design, delivery, installation and post-installation services of home interiors. HomeLane has a proprietary 3D rendering platform called “Spacecraft” that allows customers to interact remotely with its designers to customize their homes in real time and calculate budget estimates for each design they select. The company has delivered more than 15,000 homes across 10 cities in the last six years.

- Skipper Furnishings is a home décor brand that leverages personalization in its product offerings to customers. The brand is known for creating new trends in home décor through custom-made designs in a wide range of colors and fabrics. Skipper Furnishings has 19 stores across India and its product range includes bed linen, carpets, curtains, wall coverings and wooden floorings. It also has a strong online presence through e-commerce marketplaces Flipkart and Snapdeal.

- SleepyHead is an online mattress store that offers a range of mattresses in various sizes. The company claims its memory foam technology hugs the sleeper’s body and relieves pressure points, irrespective of sleeping position. It also offers a range of mattresses that can be used on both sides, with hard and soft layers on either side. The mattresses also come in a unique packing style: They are rolled like mats and expand upon opening.

- Launched in May 2020, Transteel is a DTC brand that offers premium office furniture for startups and small-and-medium-sized businesses. Transteel has generated over 40,000 online orders since its inception and has a presence across India. The company claims to offer transparent pricing and automatically applied volume discounts to customers. It helps customers to place online orders and directly handles delivery, assembly, and after-sales support. The company generated funding of ₹40 million ($0.53 million) in October 2021, from revenue-based financing player Klub.

What We Think

With the commercial and residential real estate market picking up pace in Tier 2 markets, we expect further demand in furniture and home improvement to stem from these markets. We feel that the sector will move towards omnichannel business models backed by technology and innovation due to consumers’ pandemic-led switch to online shopping and the entry of international players in the market. We also believe that personalization will be a key differentiator for furniture and home décor players, with urban consumers increasingly demanding products that match their tastes, preferences and cozy interiors. We anticipate an increasing demand for multifunctional furniture enabling better space utilization at home due to the persistence of working from home and the home and office integration it demands. We expect the effects of the pandemic will likely accelerate the consolidation of furniture retail in India, with bigger players leveraging technology and infrastructure to woo consumers. International players entering the Indian market through online marketplaces and DTC arms should also focus on offline channels for their flagship or experience stores. Implications for Brands/Retailers- Furniture brands and retailers investing in technology, innovation and personalization will see sustained growth due to greater consumer demand for their products.

- International furniture and home improvement brands and retailers entering the Indian market must look at Tier 2 cities and beyond for their offline expansion.

- Furniture brands and retailers can become more responsible by promoting furniture made with recycled materials or sustainable woods such as bamboo and acacia, addressing the growing consumer demand for sustainable furniture.

- Online furniture retailers will have to augment their shipping and fulfillment capabilities and scale up to manage higher return volumes.

- Real estate developers building urban homes and gated residential communities can look at faster conversion of their housing units by offering personalized and tailor-made interior design and home décor services through strategic partnerships with home décor and furniture brands and retailers.

- With the offline expansion of furniture brands and retailers, including international players, into Tier 2 markets, real estate companies can build and develop spaces for them to launch flagship stores and experience centers.

- Furniture and home improvement brands offering personalization need to leverage artificial intelligence (AI) and predictive analytics for data-driven insights, providing growth avenues for AI technology vendors.

- Online furniture brands and retailers will invest in technologies to improve the visualization of their products and help consumers to test them in a real environment, providing opportunities for AR/VR application providers.

- The growth in smart home automation integrating Internet of Things (IoT) will benefit tech companies offering IoT tags and technologies.