Nitheesh NH

Introduction

In this Market Outlook, we examine the market size and trajectory of the personal luxury goods market in Europe, major factors impacting the market, the competitive landscape and themes we are watching in 2022 and beyond. This report only covers the personal luxury segment, which includes apparel, accessories, beauty, footwear, jewelry and watches, and excludes experiential luxury categories, such as art, hospitality, travel, vehicles and wines and spirits, as well as the secondhand luxury market.Market Performance and Outlook

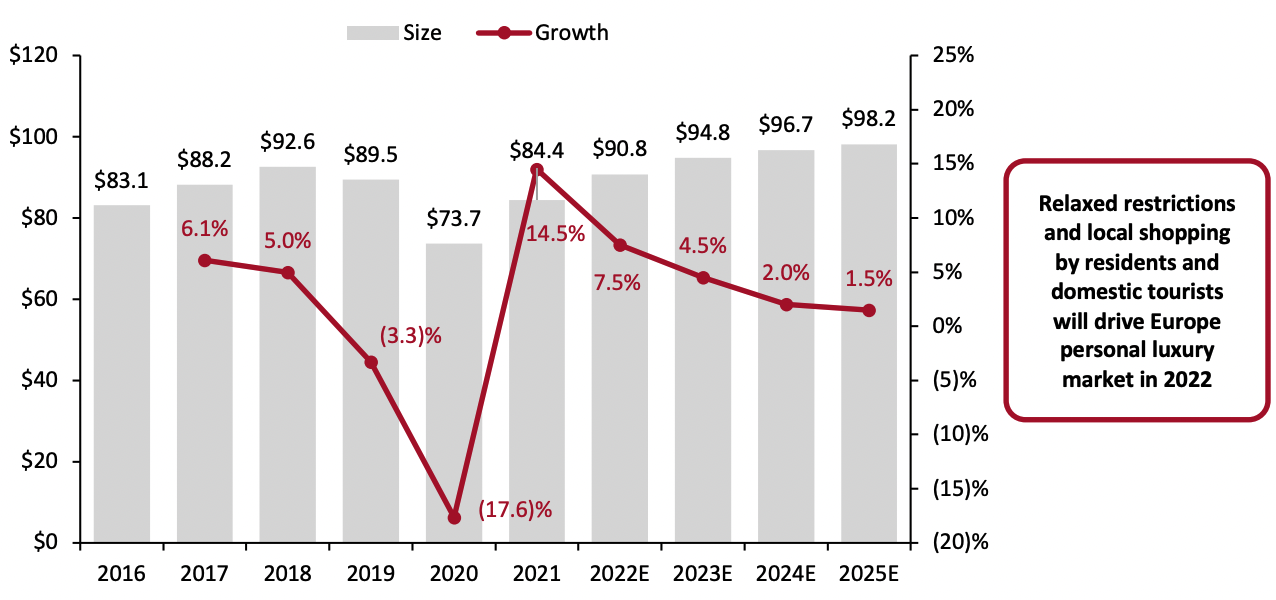

Local Consumers To Drive Europe and Thus Global Luxury Growth in 2022 Coresight Research estimates that the European personal luxury market grew 14.5% year over year to $84.4 billion in 2021—remaining below pre-pandemic levels. Going forward, growth in Europe will be dependent on local consumers.- In 2022, we expect the European luxury market to grow by 7.5% to $90.8 billion as local shopping recovers, driven by residents and domestic tourists. With the current economic slowdown in Asia due to prolonged lockdowns in China, Europe and the US will drive global luxury growth in 2022.

- Beyond 2022, we expect growth to moderate as other markets with rising younger and middle-income populations and reinforced local shopping habits, such as China and the US, draw luxury spending away from Europe.

Figure 1. Europe Personal Luxury Goods Market Size (Left Axis; USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_150610" align="aligncenter" width="700"]

Data converted to USD at constant 2020 exchange rates

Data converted to USD at constant 2020 exchange ratesSource: Coresight Research[/caption] Slow Recovery in Europe in 2021

- In Europe in 2021, European luxury companies Kering, LVMH and others reported slow or negative growth for the first three quarters and positive growth in the last quarter.

- In early 2022, in support of Ukraine, several luxury companies reported they would pull out of Russia, including LVMH, Kering, Richemont, Chanel, Prada and Hermès. We think the Russia-Ukraine war will ultimately impact Europe’s global market share if the conflict continues, as we estimate Russian consumers account for 2%–4% of the global luxury market, as of May 2022.

- On average, in 2021, most luxury companies on the Coresight 100 list reported a recovery in sales led by China and the US, but a slower recovery in Europe due to extended lockdowns in the region.

Market Factors

Localization of Demand in US and Asia and Negative Consumer Confidence To Drag on Europe Growth Several factors are currently impacting the Europe luxury goods market:- Demand repatriation—Previously, luxury shoppers travelled to Europe where several major brands are based for their shopping, a phenomenon most prevalent among Chinese and US shoppers. Over the last two years, with limitations on travel, these shoppers began shopping for luxury locally—repatriating demand to their countries—and we expect this behavior to continue in 2022 and beyond. However, as intra-European tourism rises and as consumers return to near pre-pandemic normalcy in terms of social events and working out of physical offices, we expect local consumers to drive luxury growth in the region.

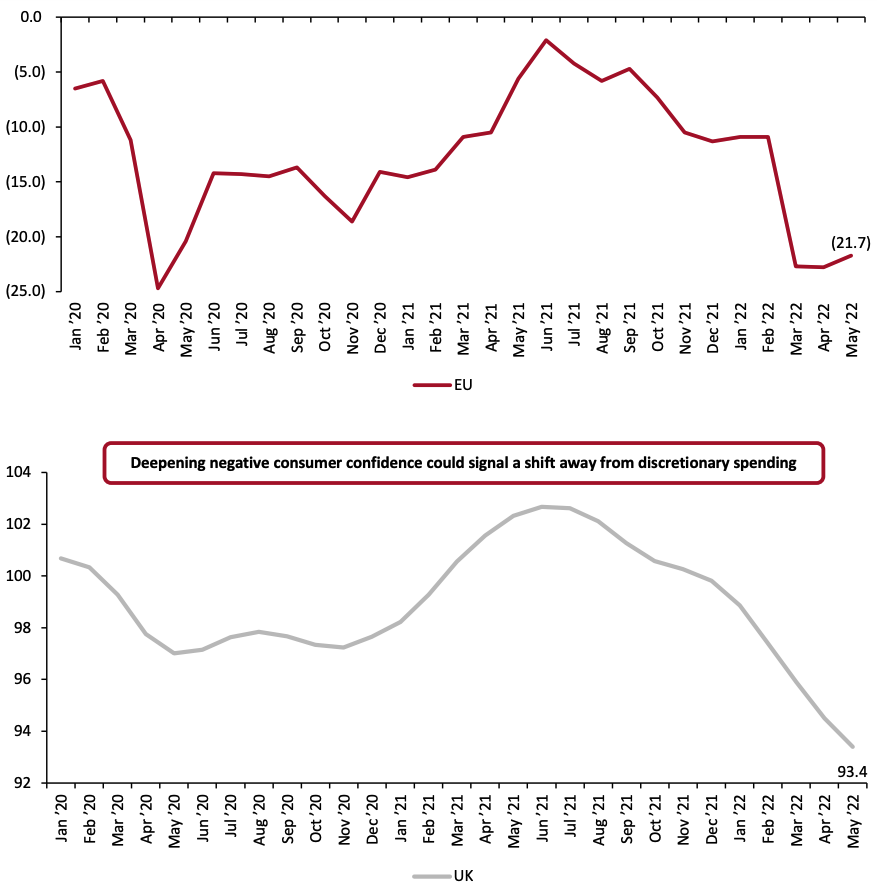

- Negative consumer sentiment—While European consumer confidence has been negative since before the pandemic began, recent events—including prolonged lockdowns in 2021, supply chain challenges, rising inflation and the Russia-Ukraine war—have led to steep declines, with the region registering a reading of (21.7) points in May, according to data from Eurostat. In the UK, consumer confidence recovered in early 2021 after the lows of 2020, but it has been on a downward trend since the middle of 2021, falling to 93.4 points in May 2022, the lowest in the last two years, according to data from the Organisation for Economic Co-operation and Development (OECD). Falling consumer confidence and a recessionary environment will cause some consumer segments, such as new earners and aspirational shoppers, to become more frugal and deprioritize discretionary purchases, such as luxury goods.

Figure 2. Consumer Confidence Indicator in the EU and the UK [caption id="attachment_150611" align="aligncenter" width="700"]

Source: Eurostat/OECD[/caption]

Source: Eurostat/OECD[/caption]

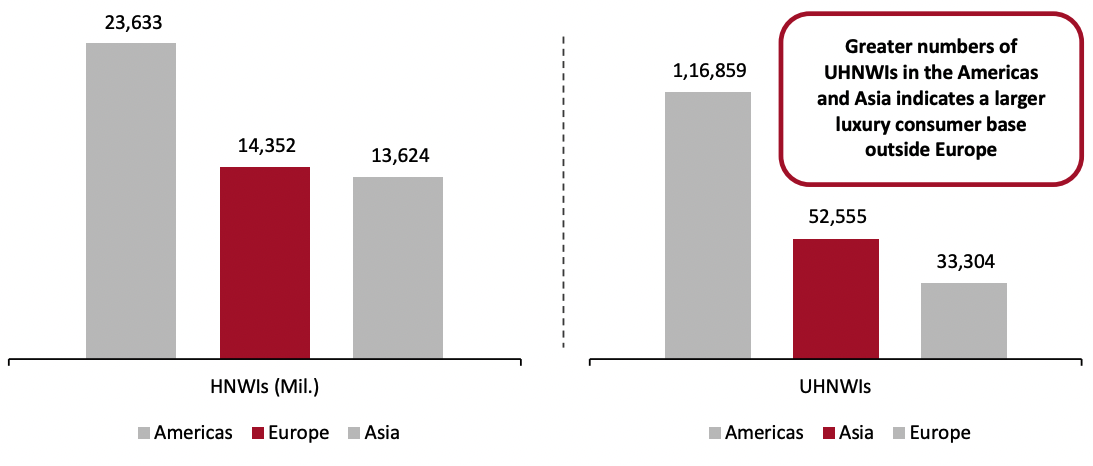

- Lower share of affluent consumers compared with other regions—Collectively, European countries have a lower number of affluent residents compared to the US and many Asian countries. 14.4 million people with net worth over $1 million, or high-net-worth individuals (HNWIs), reside in 11 major European countries—including France, Germany, Italy, Spain, Switzerland and the UK—as of the end of 2020, according to Credit Suisse’s Global Wealth Databook 2021, accounting for 28% of the global total. Of this total, 33,304 individuals are ultra-high-net-worth individuals (UHNWIs)—those with assets exceeding $50 million—significantly less than the amount that live in the US and Asia.

Figure 3. Number of HNWIs (Left) and UHNWIs (Right) in 2020 by Major Regions [caption id="attachment_150612" align="aligncenter" width="700"]

Source: Credit Suisse/Coresight Research[/caption]

Inflation

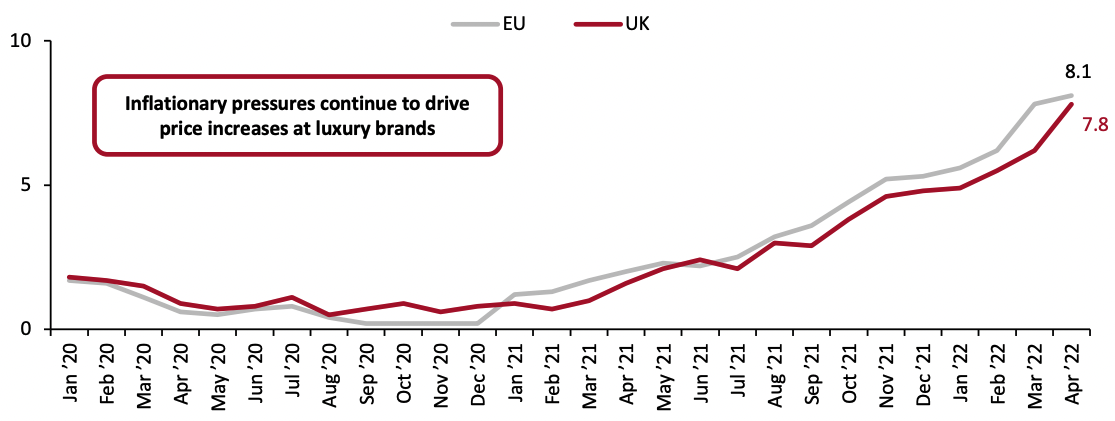

As personal luxury goods cover several product categories, the CPIs of the EU and the UK can provide insights on the impact of the current inflationary environment on the Europe luxury market.

Source: Credit Suisse/Coresight Research[/caption]

Inflation

As personal luxury goods cover several product categories, the CPIs of the EU and the UK can provide insights on the impact of the current inflationary environment on the Europe luxury market.

- The CPIs in the EU and the UK have been rising steadily since early 2021. In April 2022, the CPI in the EU reached 8.1% and 7.8% in the UK, based on data from Eurostat and the UK’s Office for National Statistics (ONS), respectively. Rising prices impact consumer-spending on discretionary segments.

- Burberry stated during its May 2022 earnings call that it sees opportunities for selective price increases as “the world is suffering…from major inflationary pressures,” but it will consult its merchandising team and approach prices increases cautiously.

Figure 4. CPI in the EU and the UK [caption id="attachment_150613" align="aligncenter" width="700"]

Source: Eurostat/ONS[/caption]

In addition to CPI increases, inflation has also impacted exchange rates and supply chains, further affecting the luxury market.

Source: Eurostat/ONS[/caption]

In addition to CPI increases, inflation has also impacted exchange rates and supply chains, further affecting the luxury market.

- As luxury is a global sector with companies operating in multiple markets, foreign exchange volatility plays a significant role in how companies price their products. While Richemont typically follows a global pricing policy, management stated on its May 2022 earnings call, “…the euro is very low, dollar is very high, and it creates some pricing imbalances,” referring to higher price increases in Europe as exchange rates were more favorable in the US.

- Global supply chain disruptions continue with brands and retailers across many sectors, including luxury companies, needing to contend with increased raw material and shipping costs over the last two years. While their margins absorbed some costs early in the pandemic, it has become unfeasible to do so further.

Online Market

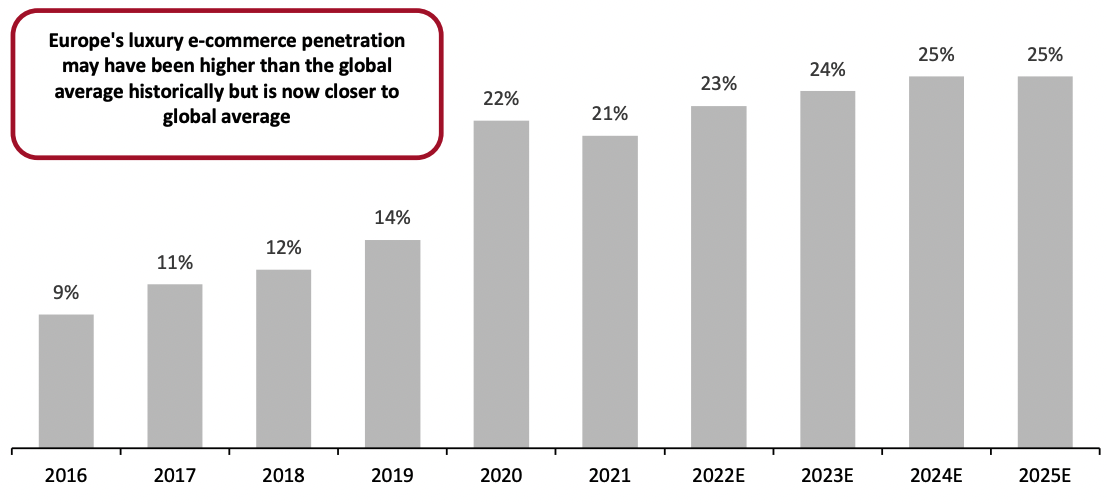

Luxury has been slow to adopt e-commerce, but the pandemic changed this. Previously, the European luxury e-commerce penetration rate may have been higher than the global average; however, we now expect it to be closer to the current global penetration rate. There may be an exception for some groups, such as Kering, which reported an online penetration rate of around 25% for Europe and the US during its February 2022 earnings call, while its worldwide average was 15%. The group also stated that there was further room for growth in Asia, where online penetration rates are lower. Coresight Research estimates that online sales in the global personal luxury goods market totaled $71.7 billion in 2021, representing 19.9% growth, accounting for 21.0% of the global market. We expect e-commerce to reach $83.7 billion in 2022, growing 16.6% from 2021 and accounting for 23.0% of the global market.Figure 5. Global: Luxury E-Commerce Penetration Rate [caption id="attachment_150614" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Competitive Landscape

Europe is home to some of the world’s biggest luxury conglomerates, but many of these groups tend to gain most of their revenues outside the region. Additionally, slow recovery from pandemic lockdowns and a lack of tourists led to some companies reporting revenue declines in Europe on a two-year basis. Global leader LVMH dominates in Europe, as it does in other major regions. Its sales in Europe in 2021 were up 43.9% on a two-year basis. CEO Bernard Arnault stated on LVMH’s earnings call on January 27, 2022, that tourism accounts for a meaningful part of its European business, and, with tourism being down in the region and consumers shopping locally in Asia and North America, those regions reported greater sales growth. In our rankings table below, beauty major Estée Lauder ranks second by regional revenues in European luxury, displacing Kering’s global second rank, but this may be in part due to the company’s revenues being for Europe, the Middle East and Africa, and not purely Europe alone. The company reported slower growth in the region due to the lack of tourists in its last quarter of 2021, but in its most recent quarter ended March 31, 2022, the company said travel retail traffic increased throughout Europe. Richemont experienced single-digit sales growth in Europe its latest fiscal year. The company reported “strong demand from local clientele” as “inbound tourism remains… subdued in Europe.” Kering experienced a tough year in Europe in its latest fiscal: sales were down 19.9%. The company reported that in the last quarter of the fiscal year, revenues jumped 59% on a two-year basis. The company remarked that its biggest brand Gucci reported improved performance in the region thanks to local clientele and intra-Europe tourism. Overall, it has altered its customer relationship activities to focus further on clients in the region, including holding private previews and one-on-one appointments.Figure 6. Major Luxury Companies’ Revenues (USD Bil.)* [wpdatatable id=2088]

*The table excludes Rolex as we do not have a region-wise split of its total revenues **Revenues converted to USD at historical exchange rates on the day of the annual report’s release Source: Company reports/S&P Capital IQ/Coresight Research

Themes We Are Watching

Growing Supply Network As the pandemic exposed supply chain vulnerabilities across industries, luxury companies are now looking to increase control over their supply network and prepare against future supply chain disruptions. Specifically, they are expanding their supply network within Europe, and we think these actions will be more pronounced during the rest of the year. Hermès, for example, already has a heavily vertically integrated supply chain, tightly guarding its source of raw material and supply. The heritage luxury house plans to open two new leather goods workshops in France in 2025 and 2026 that will support the production of its leather goods and saddlery collections. This is in addition to three workshops in France for which construction is already underway. LVMH also opened two leather workshops in France earlier in 2022 to further localize production; much of its leather goods were being produced in Italy. The group plans to open two more workshops this year. Accepting Payments with Cryptocurrency Gucci and Balenciaga have already announced accepting cryptocurrency payments online and at select US stores. In June 2022, Farfetch announced it would accept cryptocurrency payments in Europe, the UK and the US later this year. We think more brands will follow suit and roll out this payment method online and in their stores. Rationalizing Store Network With luxury consumption by tourists migrating out of Europe, luxury companies are dependent on making sales to European residents. We think this will lead to a restructuring of their store networks within Europe to cities where they can tap into the local consumer base. And as brands have plans for network expansion in Asia and the US, where sales are rising, we think they may consider cutting down on the quantity of stores in Europe and instead focus on improving the quality and customer service in the existing European retail network.Retail Innovators

Arianee, a Paris-based startup founded in 2018, provides end-to-end Web 3.0 products and applications, including helping brands do away with physical certificates of authenticity and replaces them with nonfungible tokens (NFTs), enabling a traceable journey. It has raised €20 million ($21.2 million) in funding so far and counts luxury watch brands Breitling and the Richemont Group’s Vacheron Constantin among its clients. Founded in 2021, The ShowCase is a Geneva-based startup that developed hardware and software to enable live-video presentations of jewelry and watches to remote clients. The hardware consists of a camera that features high-definition video and automatic focus that works within a range of 2–20 centimeters of the product. The hardware also has built-in lights and white paneling, creating a studio-like look. The software integrates with Teams, WhatsApp, WeChat and Zoom, and the startup is working to integrate with other video communication tools, such as Signal and Twitch. Viewers can zoom in on the video presented to them to get a closer look while interacting with sales associates. The ShowCase’s current clients include Chaumet, Louis Vuitton and TAG Heuer. [caption id="attachment_150615" align="aligncenter" width="700"] The ShowCase’s video product presentations hardware and software

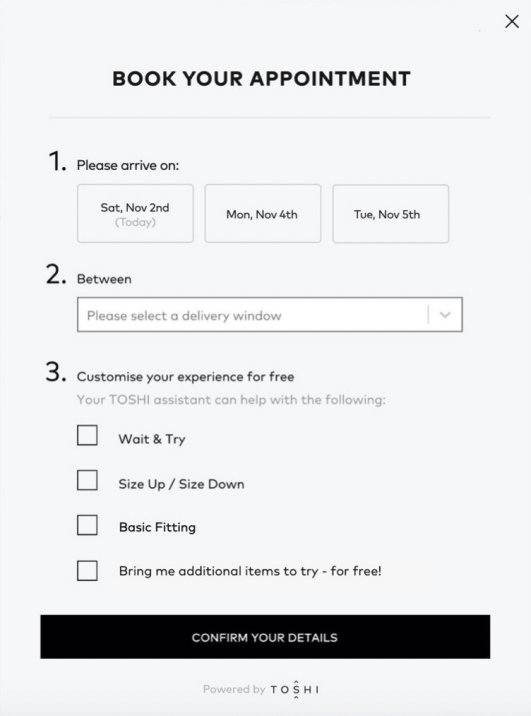

The ShowCase’s video product presentations hardware and softwareSource: Company website[/caption] TOSHI, based in London and founded in 2017, brings in-store shopping services to online customers. At checkout, customers can choose a date and time slot for delivery and add on other services, such as having the delivery associate wait while they try on items or bringing additional items that are a size up or down. The startup is an advocate of sustainability and uses public transport or electric vehicles for deliveries. TOSHI’s offering integrates with brands’ e-commerce websites and options show up during checkout for customers in its coverage areas. Its clients include Berluti, Christian Dior and Rimowa, and it earned the LVMH Innovation Award in 2022. [caption id="attachment_150616" align="aligncenter" width="320"]

TOSHI’s services at checkout

TOSHI’s services at checkoutSource: Company website[/caption]

What We Think

The European luxury goods market experienced a slower recovery in 2021 than other major markets due to prolonged lockdowns, a slowdown in international travel and the lack of tourists from overseas that drove a significant share of luxury spending in the area. With the Asian and US luxury markets becoming increasingly locally driven, luxury growth in Europe will moderate in the medium term. However, in 2022, as Asia’s luxury market growth is dampened by China’s lockdowns and uncertain macroeconomic environment, Europe and the US are set to steer global growth. Implications for Brands/Retailers- Brands and retailers with stores in Europe should offer opportunities for local consumers to not only experience brands, but also socialize and mingle with other consumers in engaging retail experiences, focusing on the local consumer. Brands previously focused on global consumers or Asian tourists, which may have led to a diluted experience for local European consumers.

- Brands and retailers should leverage appropriate technologies and tools to remain relevant with younger and increasingly digitally savvy consumers, such as cryptocurrency and NFTs.

- As brands and retailers look to open stores in new cities and areas where luxury consumers reside, real estate firms should proactively approach these companies with research and offer suitable locations that will help drive sales for luxury brands.

- Technology vendors that can help luxury brands and retailers to adopt new and emerging technology easily and integrate it into companies’ legacy systems will be at an advantage.