Nitheesh NH

What’s the Story?

We discuss China’s apparel and footwear market, covering market performance and outlook. We present key trends that drive growth and examine what brands and retailers are doing to better serve the country’s apparel and footwear space.Market Performance and Outlook

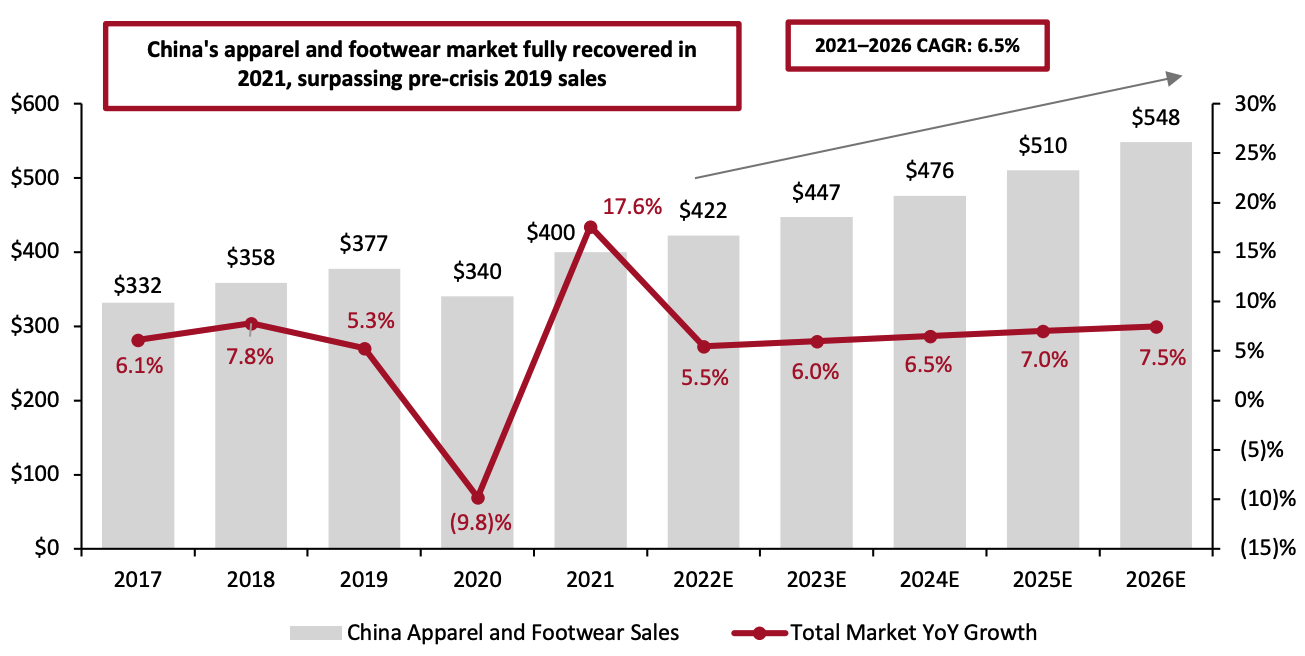

Total Apparel and Footwear Market Size We believe that China’s apparel and footwear market fully recovered in 2021, surpassing pre-crisis levels with growth of 17.6% to $400 billion (at December 31, 2020, constant exchange rates). This is up from a decline of 9.8% to $340 billion in 2020 amid the pandemic. We estimate that the market will grow at a mid-single-digit percentage rate in 2022 and 2023 to reach $422 billion and $447 billion, respectively, as shown in Figure 1. While China’s estimated apparel market size in 2022 is lower than our latest estimate for $471 billion in the US apparel and footwear market in 2022, we expect China’s apparel and footwear market sales to surpass the US by 2024. We expect China’s apparel and footwear market to grow at a CAGR of 6.5% between 2021 and 2026.Figure 1. China Apparel and Footwear Sales (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_140320" align="aligncenter" width="700"]

China’s apparel and footwear sales were converted to USD at December 31, 2020, constant exchange rates

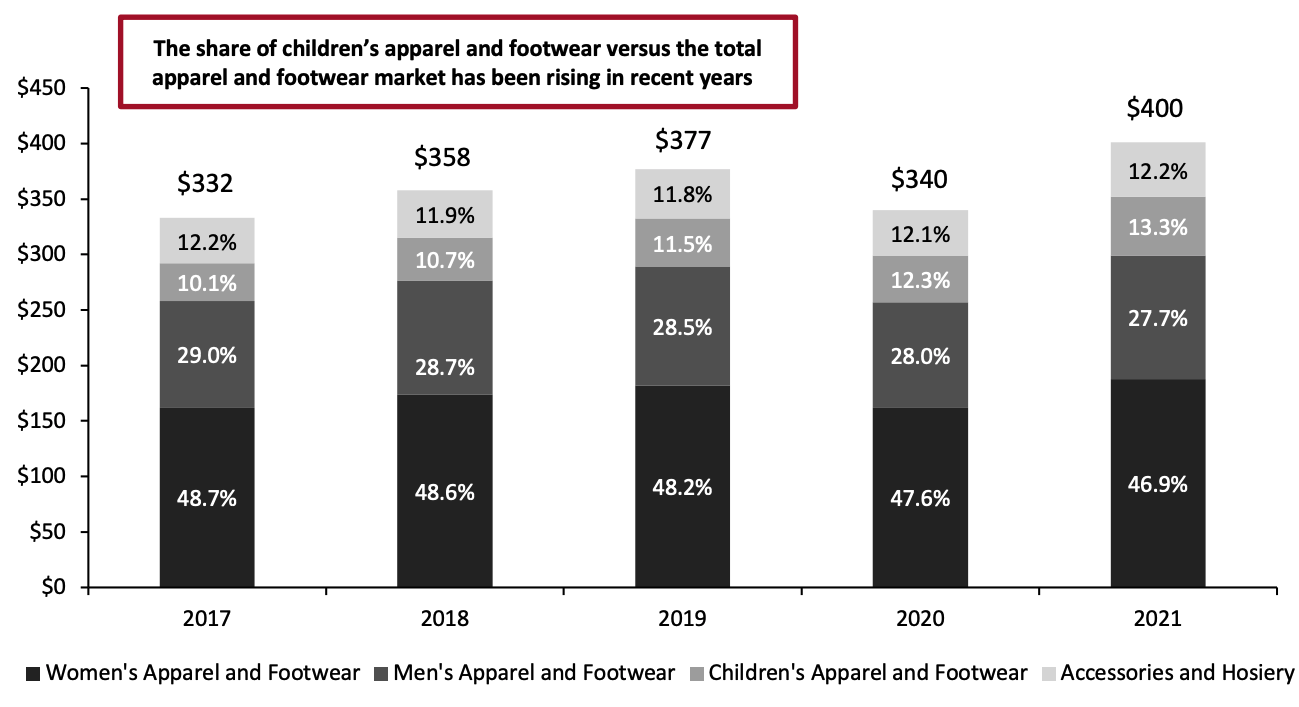

China’s apparel and footwear sales were converted to USD at December 31, 2020, constant exchange ratesSource: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption] By category, the share of children’s apparel and footwear versus the total market has been rising in recent years, as shown in Figure 2. We discuss drivers that likely contribute to this trend in our market factors section below. Women’s apparel and footwear versus the total market has been declining in recent years and this trajectory is set to continue. Men’s apparel and footwear as a share of the total market has also been declining but at a slightly slower pace. The category share of accessories and hosiery within total market sales has been relatively stable since 2018 at around 12%.

Figure 2. China Apparel and Footwear Sales by Category (USD Bil.) [caption id="attachment_140321" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Apparel and Footwear Yearly Consumer Spending per Capita

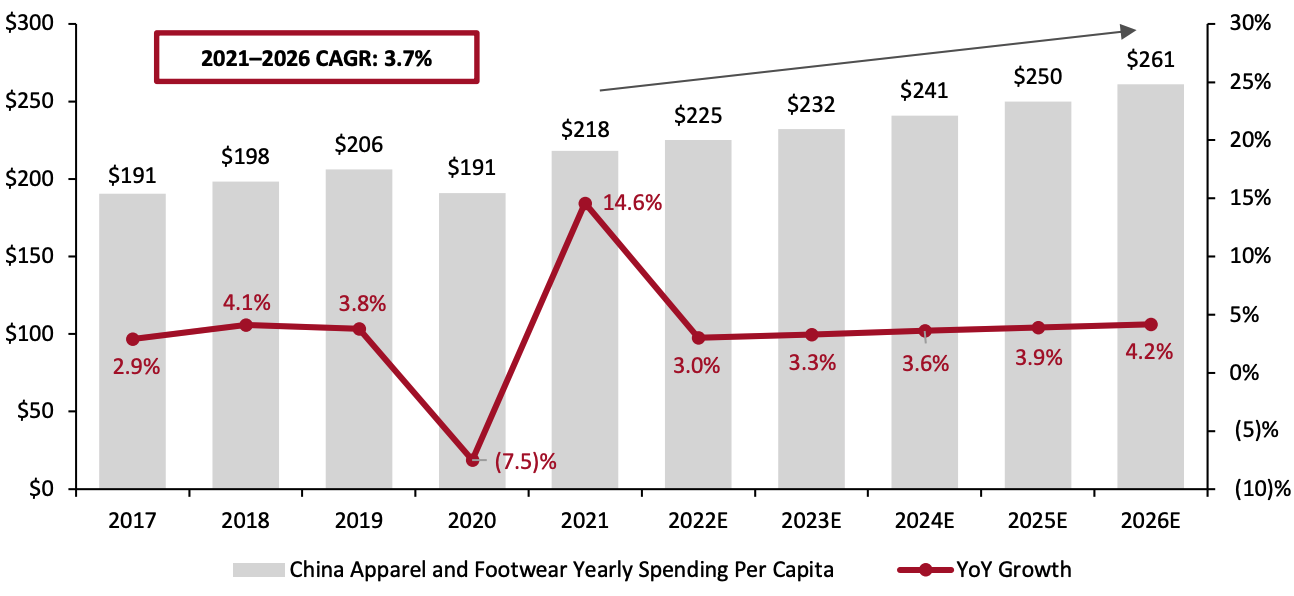

Yearly per capita consumer spending on apparel and footwear in China increased to $218 in 2021 (¥1,419)—up 14.6% year over year, according to the National Bureau of Statistics of China. We expect to see per capita spending grow at a low-single-digit percentage rate in 2022 and 2023 to reach $225 and $232, respectively. We expect China’s yearly per capita consumer spending on apparel and footwear to grow at a CAGR of 6.5% between 2021 and 2026.

Excluding the influence of the pandemic, China’s yearly consumer spending on apparel and footwear per capita has grown at a stable rate of around 3%–4% year over year since 2016.

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Apparel and Footwear Yearly Consumer Spending per Capita

Yearly per capita consumer spending on apparel and footwear in China increased to $218 in 2021 (¥1,419)—up 14.6% year over year, according to the National Bureau of Statistics of China. We expect to see per capita spending grow at a low-single-digit percentage rate in 2022 and 2023 to reach $225 and $232, respectively. We expect China’s yearly per capita consumer spending on apparel and footwear to grow at a CAGR of 6.5% between 2021 and 2026.

Excluding the influence of the pandemic, China’s yearly consumer spending on apparel and footwear per capita has grown at a stable rate of around 3%–4% year over year since 2016.

Figure 3. China Apparel and Footwear Yearly Spending per Capita (Left Axis; USD) and YoY Growth (Right Axis; %) [caption id="attachment_140322" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China/Coresight Research[/caption]

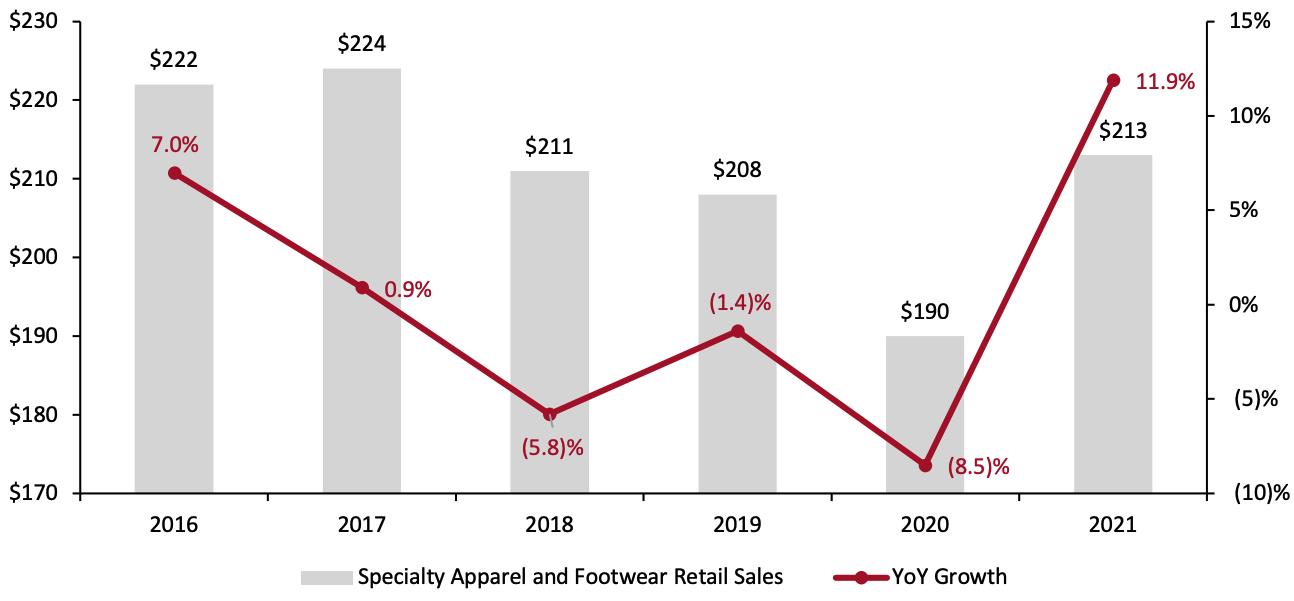

Specialty Apparel and Footwear Retail Sales

Specialty apparel and footwear retail sales in China declined by 9.8% in pandemic-impacted 2020 to $190 billion and recovered with 11.9% growth in 2021 to $213 billion—2.4% higher than the pre-crisis level, according to the National Bureau of Statistics of China. This compares to $303 billion in sales and 48.4% growth recorded in the US specialty apparel and footwear retail sales in 2021, according to US Census Bureau data.

Although positive for the year overall, December 2021 (latest data) marked the fifth consecutive month of year-over-year declines in apparel and footwear retailers’ sales, with a 2.3% fall versus December 2020. Recent sector sales declines varied from a low of 0.5% in November 2021 to a peak of 6.0% in August 2021.

Source: National Bureau of Statistics of China/Coresight Research[/caption]

Specialty Apparel and Footwear Retail Sales

Specialty apparel and footwear retail sales in China declined by 9.8% in pandemic-impacted 2020 to $190 billion and recovered with 11.9% growth in 2021 to $213 billion—2.4% higher than the pre-crisis level, according to the National Bureau of Statistics of China. This compares to $303 billion in sales and 48.4% growth recorded in the US specialty apparel and footwear retail sales in 2021, according to US Census Bureau data.

Although positive for the year overall, December 2021 (latest data) marked the fifth consecutive month of year-over-year declines in apparel and footwear retailers’ sales, with a 2.3% fall versus December 2020. Recent sector sales declines varied from a low of 0.5% in November 2021 to a peak of 6.0% in August 2021.

Figure 4. China Specialty Apparel and Footwear Retail Sales (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_140323" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]

Market Factors

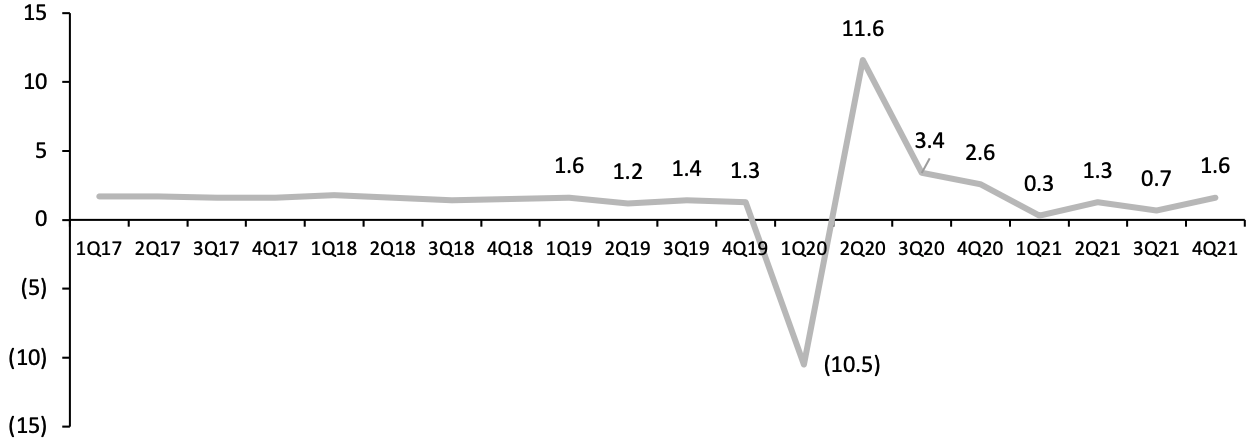

We discuss three key drivers of China’s apparel and footwear market in 2022 and beyond. Overall Economic Recovery in China GDP (gross domestic product) recovered strongly in China in the second, third and fourth quarters of 2020 and grew stably in 2021, as shown in Figure 5. This momentum is likely to continue, supporting increases in personal consumer expenditure in 2022. At the same time, in recent months, retail sales growth has been weak in total and negative in the clothing and footwear specialty sector (see above).Figure 5. GDP: Change from Preceding Quarter (Seasonally Adjusted and Annualized; %) [caption id="attachment_140324" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

Further Liberation of China’s One-Child Policy

In May 2021, China announced that it will allow couples to have up to three children, after census data showed a steep decline in birth rates. The move scrapped the country’s two-child policy, which was brought in in 2016 to replace the longstanding one-child policy in force in the country since 1980.

The three-child policy will likely bring about an increase in the number of births—driving China’s children’s apparel sales. The share of children’s apparel and footwear versus the total market has been rising in recent years—momentum will likely continue in years to come following this policy development.

The Five-Year Plan

In May 2021, China National Textile and Apparel Council (CNTAC), the governing body for China’s textile and apparel industry, released its latest five-year plan, detailing the development objectives, growth strategies and priority tasks for China’s textile and apparel sector from 2021 to 2025.

China intends to develop a more sophisticated and tech-driven textile and apparel industry and engage in more value-added functions in the supply chain. We expect this to be a key driver of China’s apparel and footwear market.

Source: National Bureau of Statistics of China[/caption]

Further Liberation of China’s One-Child Policy

In May 2021, China announced that it will allow couples to have up to three children, after census data showed a steep decline in birth rates. The move scrapped the country’s two-child policy, which was brought in in 2016 to replace the longstanding one-child policy in force in the country since 1980.

The three-child policy will likely bring about an increase in the number of births—driving China’s children’s apparel sales. The share of children’s apparel and footwear versus the total market has been rising in recent years—momentum will likely continue in years to come following this policy development.

The Five-Year Plan

In May 2021, China National Textile and Apparel Council (CNTAC), the governing body for China’s textile and apparel industry, released its latest five-year plan, detailing the development objectives, growth strategies and priority tasks for China’s textile and apparel sector from 2021 to 2025.

China intends to develop a more sophisticated and tech-driven textile and apparel industry and engage in more value-added functions in the supply chain. We expect this to be a key driver of China’s apparel and footwear market.

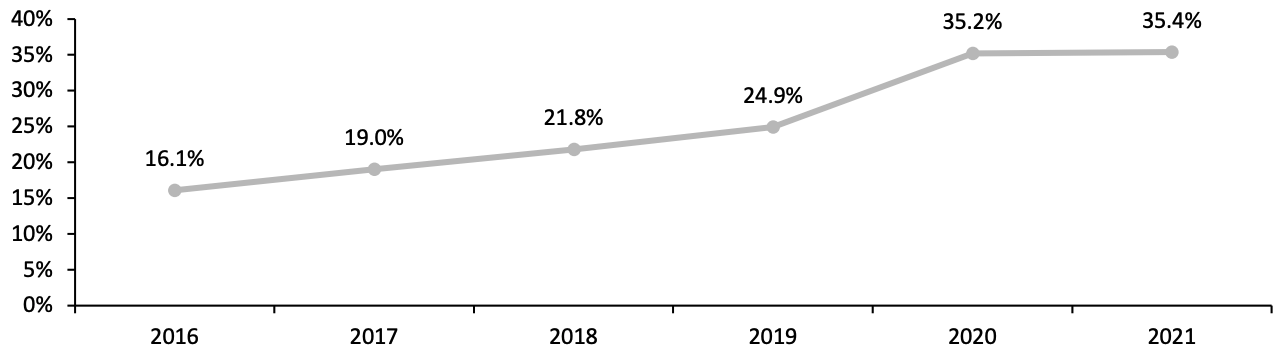

Online Market

China’s online apparel and footwear channel grew to account for 35.4% of total apparel and footwear sales in 2021, versus 35.2% in 2020, according to Euromonitor. We expect the e-commerce penetration rate for apparel and footwear to see another small increase in 2022 as the country is still dealing with new-Covid-19 cases and a large portion of Chinese consumers will likely retain their online shopping habits this year.Figure 6. E-Commerce Share of Total Apparel and Footwear Sales in China (%) [caption id="attachment_140325" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

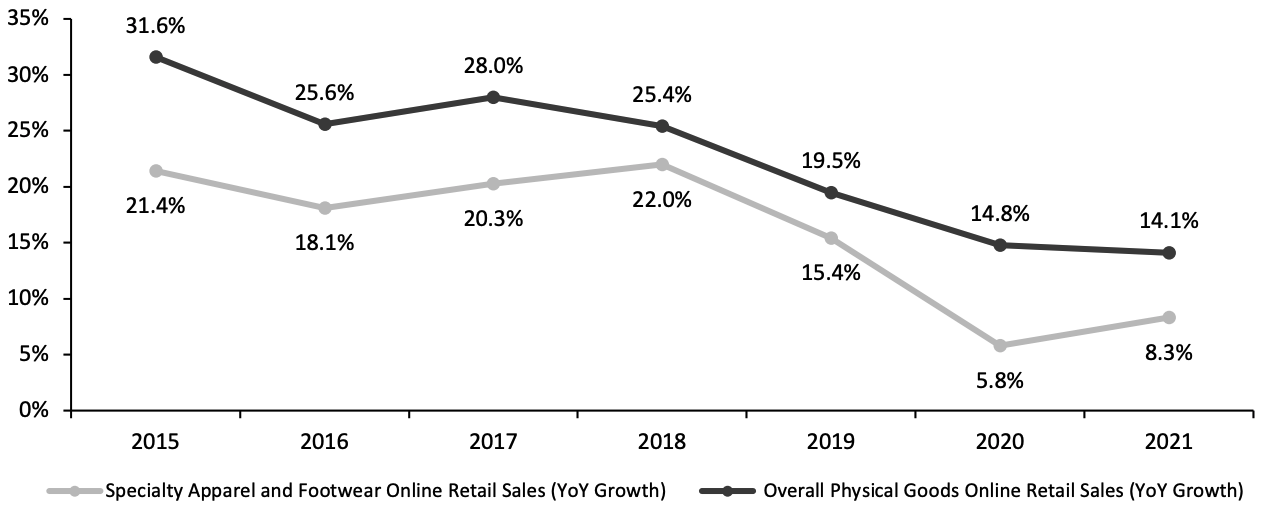

From 2015 to 2021, year-over-year growth in online specialty apparel and footwear retail sales was slower than that of overall physical goods, largely due to rapid growth in online food retail sales outpacing apparel and footwear e-commerce demand. (Food online retail sales grew 17.8% in 2021, 30.6% in 2020, 30.9% in 2019, 33.8% in 2018, 28.6% in 2017, 28.5% in 2016 and 40.8% in 2015.)

Figure 7 compares e-commerce sales growth between specialty apparel and footwear and overall physical goods. The National Bureau of Statistics of China does not disclose absolute numbers.

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

From 2015 to 2021, year-over-year growth in online specialty apparel and footwear retail sales was slower than that of overall physical goods, largely due to rapid growth in online food retail sales outpacing apparel and footwear e-commerce demand. (Food online retail sales grew 17.8% in 2021, 30.6% in 2020, 30.9% in 2019, 33.8% in 2018, 28.6% in 2017, 28.5% in 2016 and 40.8% in 2015.)

Figure 7 compares e-commerce sales growth between specialty apparel and footwear and overall physical goods. The National Bureau of Statistics of China does not disclose absolute numbers.

Figure 7. Specialty Apparel and Footwear vs. Overall Physical Goods: Growth in Online Retail Sales (YoY; %) [caption id="attachment_140326" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]

Competitive Landscape

China’s apparel and footwear market is highly fragmented, with the top five apparel and footwear brands accounting for just 7.8% of China’s total apparel and footwear sales in 2020. Following the top five, there are hundreds of brands each capturing less than 1% of the total market. As the market is fragmented, there is opportunity for global brands to enter and capitalize on growth.Figure 8. Competitive Landscape of China’s Apparel and Footwear Market by Brand Sales, 2020 [wpdatatable id=1646]

Source: Company reports

Themes We Are Watching

The Rise of New Business Models in E-Commerce We are seeing the rise of new business models in apparel e-commerce, such as the resale model adopted by Idle Fish, the community-based sales model used by Poizon and RED, and mini programs for e-commerce adopted by social media platform WeChat.Figure 9. Comparison of New E-Commerce Models in China [wpdatatable id=1647]

Source: Company reports/36KR Holdings

We expect the e-commerce space to continue to grow in China, with consumers likely retaining pandemic-driven online shopping habits. Accelerated infrastructure and technology improvements will also support momentum. We believe that the e-commerce distribution channel in China presents significant opportunities for retailers to capture share of the apparel and footwear market. Physical Store Innovations The Covid-19 pandemic has significantly impacted the ways in which Chinese consumers engage with physical retail. Apparel and footwear brands and retailers in China are looking to innovations that support engaging and interesting in-store experiences to drive sales. We expect to see a wave of “spectacular retail” investments in physical stores in 2022, following on from experience-rich flagship store launches and technology-driven interactive store enhancements in 2020 and 2021, as detailed in Figure 10.Figure 10. Apparel and Footwear Brands and Retailers: Physical Store Innovations in China

| Brand/ Retailer | Overview | Image |

| Burberry | Burberry opened a concept store in Shenzhen, China in July 2020. Customers can use a WeChat mini app to access features such as store tours, appointment bookings, events and table reservations in Thomas’s Cafe, the in-store café and community space. |  |

| ENG (Chinese fashion retailer) | The retailer opened a store in Shanghai in June 2021, designed to target Gen Z shoppers. This store features holographic projections of sneakers and 24/7 vending machines that sell apparel and sneakers. The second floor of the store is a relaxation area for shoppers to take time out with a book or magazine. |  |

| NIKE | NIKE opened a concept store, named Rise, in Guangzhou, China in July 2020. It uses real-time data on browsing, buying and local events to stock the shop bi-weekly. NIKE is also using its Experience app to give local fans access to weekly sports activities, in-store workshops and events such as basketball games and football matches (which are hosted by NIKE-affiliated Guangzhou-based athletes, experts and influencers). |  |

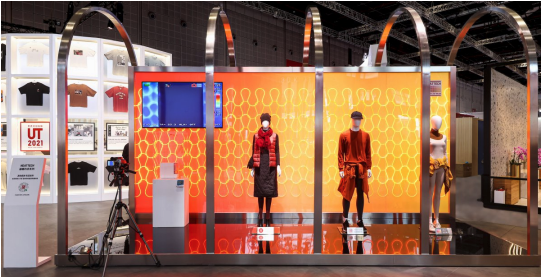

| Uniqlo | In November 2021, Uniqlo opened a flagship store in Beijing. The store features a customization workshop where customers can design their own t-shirts using thousands of specially designed patterns, such as Universal Studios and Disney motifs and Chinese calligraphy. |  |

| Wrangler | In December 2021, Wrangler, a denim brand owned by Kontoor, opened its first standalone store in Chin in Nanjing. The store features neon light displays and stations with detailed information on key products. The store’s assortment is fully localized and showcases Wrangler’s latest collaboration with Chinese apparel brand Sankuanz. |  |

Source: Company reports

Livestreaming Livestreaming is a key avenue for apparel and footwear brands and retailers to connect with consumers. Coresight Research estimates that China’s livestreaming e-commerce market reached $300 billion in 2021, accounting for around 5% of China’s total retail sales of consumer goods, which totaled $6.8 trillion in 2021, according to the National Bureau of Statistics of China.- Click here to read Coresight Research’s extensive coverage of livestreaming.

Figure 12. Livestreaming Initiatives by Selected Apparel and Footwear Brands and Retailers in China [wpdatatable id=1648]

Source: Company reports

Smart Manufacturing Technology plays an important role in China’s apparel and footwear market, especially in the manufacturing process. We are seeing more brands and retailers including Alibaba, Anta and Li-Ning leverage technology to improve product creation efficiency. For example, in September 2020, Alibaba rolled out its Rhino Smart Manufacturing platform designed for merchants working on small-scale fashion production. Key functions of the Rhino Smart Manufacturing platform include:- Customization on demand

- Low minimum order requirements of 100 pieces minimum

- Rapid delivery to the consumer in up to seven days from when the order is placed

Figure 13. Selected List of China’s Smart Manufacturing Technologies

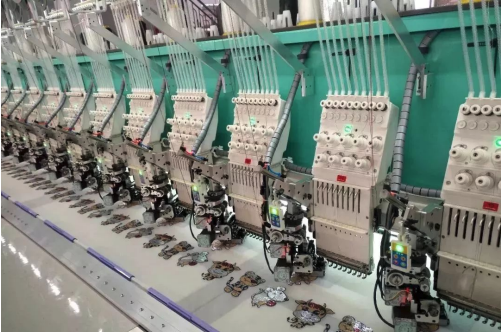

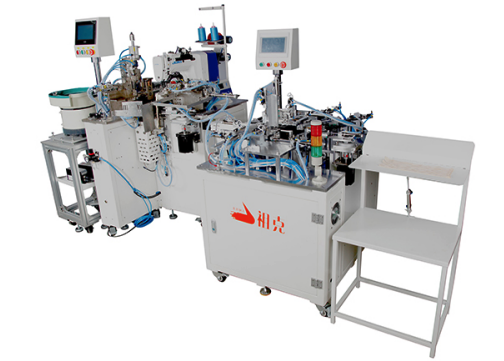

| Company | Technologies | Pictures |

| DAHAO | High-speed closed-loop four sequin embroidery device: The use of closed-loop motor drive can improve embroidery speed to up to 1200 RPM (revolutions per minute), from 850 RPM using existing embroidery devices. The motor can work in a high-temperature environment for long periods of time. |  |

| JOOKE | Intelligent JKC-T-XH8040-SM sewing machine: The machine is used for detailed sewing requirements, offering precision of up to 0.3mm, exceeding 98% of existing technology in the industry. |  |

| SINAJET | Intelligent Vertical Inkjet Cutter Plotter: Released in July 2019, this plotter improves which is higher than 99% of existing offerings in the industry. The machine also digitalizes cutting data and connects directly with intelligent central databases in partner factories. |  |

Source: Company reports

Sustainability We are seeing Chinese consumers pay more attention to the environmental impact of their purchases. For instance, 56% of consumers in China said their buying decisions have been impacted by a company’s or product’s sustainability claims, based on Coresight Research and China Luxury Advisors survey data from March 2021. We expect to see resulting opportunities in sustainable apparel and footwear products, sustainable fabrics and textiles in the near future. Although sustainable apparel and footwear product launches are not yet prevalent in China, we saw an increase in new offerings with a sustainability focus from domestic brands such as Bosideng and ICICLE in 2021. We expect the sustainability trend to boom in China in the next three to five years.Retail Innovators

We discuss three China-based innovators whose products or solutions are disrupting the apparel and footwear market. INA Intelligent Technology (Zhejiang) Co., Ltd Founded in 2004, INA Intelligent Technology (Zhejiang) Co., Ltd. (hereinafter referred to as INA) provides software and hardware integration services for intelligent hanger systems and logistics solutions. With multiple sales channels operating concurrently amid the spike in e-commerce, changes in the way customers buy and try on clothes—plus the demand for free return services and low prices—pose challenges to managing the internal material flow for manufacturers and distributors. INA’s intelligent hanger system helps apparel companies to better manage these logistics. Clothing is put on a hanger according to pre-inputted process codes and automatically sent to the next hanger location according to the corresponding production process route. This significantly reduces handling time. The back-end software of the hanging system also automatically records staff production data. [caption id="attachment_140349" align="aligncenter" width="700"] INA’s intelligent hanger system

INA’s intelligent hanger systemSource: INA[/caption] Rumengnichang Founded in 2015, Rumengnichang is a clothing brand selling Hanfu clothing, a style of traditional Chinese outfits. In recent years, Hanfu has seen an upsurge in popularity in China, particularly among younger consumers, in what is described as a cultural revival of traditional Han Chinese dress. Newly emerged Hanfu brand Rumengnichang is seeing strong digital success among younger shoppers and has 480,000 followers on its official store on Taobao as of January 18, 2022. We believe this brand will continue to play an important part in the growing Hanfu market in China. [caption id="attachment_140348" align="aligncenter" width="700"]

Chinese consumers wearing Rumengnichang’s apparel items

Chinese consumers wearing Rumengnichang’s apparel itemsSource: Rumengnichang[/caption] Ubras Founded in 2016, Ubras is a female lingerie brand, focusing on meeting demand for “comfortable and easy to wear” lingerie. All bras produced by Ubras are one-size-fits-all, which it claims reduces often problematic sizing decisions in the category and improves purchase efficiency. Ubras saw an upsurge in popularity in 2021, particularly among younger consumers. The brand has over 4 million followers on its official store on Taobao as of January 18, 2022. We believe this brand will continue to play an important part in the growing apparel market in China. [caption id="attachment_140350" align="aligncenter" width="700"]

Ubras’ advert for its one-size-fits-all bras

Ubras’ advert for its one-size-fits-all brasSource: Ubras[/caption]

What We Think

Implications for Brands/Retailers- China’s apparel and footwear market recovered fully in 2021 with 17.6% growth. By category, the country’s children’s apparel market will see the fastest growth in the years to come, driven by further liberation of the one-child policy, presenting new opportunities for apparel and footwear brands and retailers.

- We expect apparel and footwear e-commerce penetration to continue to grow over the medium term, as the retention of online shopping habits supports secular channel shifts. At the higher end of the fashion market, reduced travel will continue to redirect some spending from overseas to the domestic market, to the benefit of e-commerce. We expect this online expansion to fuel the growth of new business models in e-commerce.

- China’s apparel and footwear market is highly fragmented, with the top five apparel and footwear brands accounting for just 7.8% of total apparel and footwear sales in 2020. We believe that this equates to significant opportunity for brands to capture greater share of the growing market. We see e-commerce expansion as the principal driver of market-share consolidation in the coming years, due to the inherent scalability of online retail operations improving consumer access to brands.