DIpil Das

What’s the Story?

The beauty and personal care (BPC) industry was one of India’s fastest-growing consumer markets until the pandemic in 2020. Sales declined in the first quarter of 2020 due to decreased consumer demand—prompted by staying at home, physical distancing and mask-wearing—and store closures: According to a May 2020 report by management consulting firm McKinsey, prestige brands saw 55% and 75% year-over-year declines in global cosmetics and fragrance sales, respectively. However, many brands regained momentum by the last quarter of 2020 and through 2021, and although India experienced a second wave of Covid-19 cases between April and June 2021, we expect the BPC industry to continue its rebound in 2022. The following factors are driving the industry’s growth: the popularity of do-it-yourself (DIY) online cosmetics tutorials; the growing consumer preference for natural and sustainable beauty products; the rise of direct-to-consumer (DTC) online beauty brands; social media and beauty influencers; and favorable demographic changes. In this report, we assess the growth of the BPC industry, the drivers of growth, innovative players in the industry, and trends to watch in 2022.Market Performance and Outlook

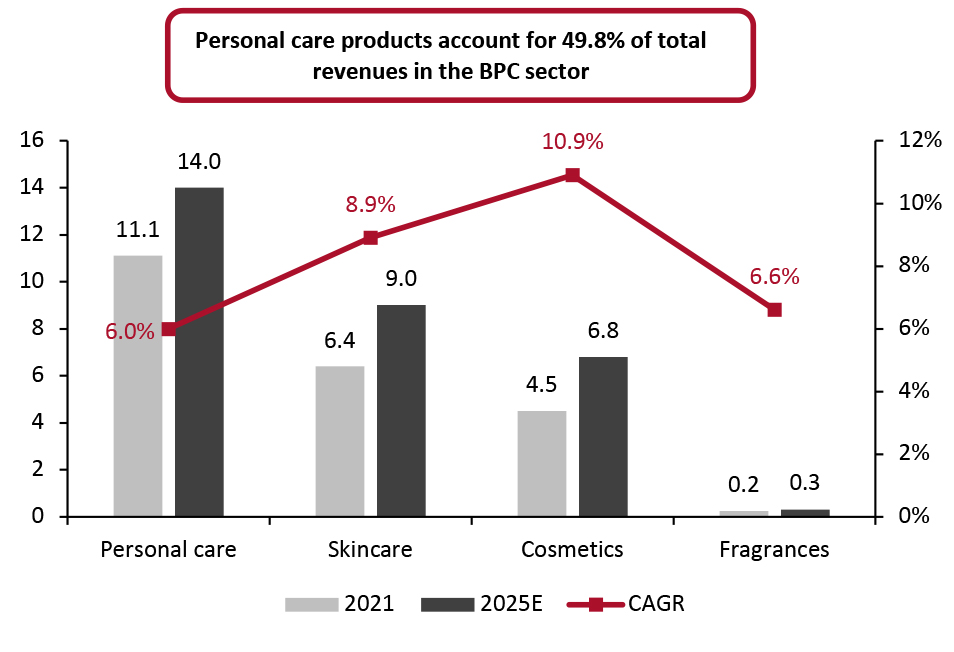

BPC Industry Growth Projections The BPC industry in India comprises four main categories: personal care, skincare, cosmetics and fragrances. The Indian BPC market was at $22.3 billion in 2021 and will reach $30.1 billion by 2025, growing at a CAGR of 7.8%, according to Statista. Personal care accounts for 49.8% of total sales in the Indian BPC market. The personal care segment is valued at $11.1 billion in 2021 and will reach $14.0 billion by 2025, growing at a CAGR of 6.0%. Skincare and cosmetics currently account for $6.4 billion and $4.5 billion, respectively. The skincare segment is projected to grow at a CAGR of 8.9% to $9.0 billion by 2025, while cosmetics sales will increase at a 10.9% CAGR in the same period. The fragrance segment occupies a small fraction of India’s overall BPC market, accounting for just $238 million in 2021. The segment is expected to grow at a CAGR of 6.6% and reach $313 million by 2025.Figure 1. Indian Beauty and Personal Care Revenue by Segment 2021–2025E (Left Axis; USD Bil.) and Revenue Growth (Right Axis; CAGR%) [caption id="attachment_139094" align="aligncenter" width="700"]

Data are at current exchange rates, as of October 2021

Data are at current exchange rates, as of October 2021 Source: Statista [/caption] Average revenue per capita in the Indian BPC market was $16.03 in 2021, and will increase to $20.83 by 2025, according to Statista.

Market Drivers

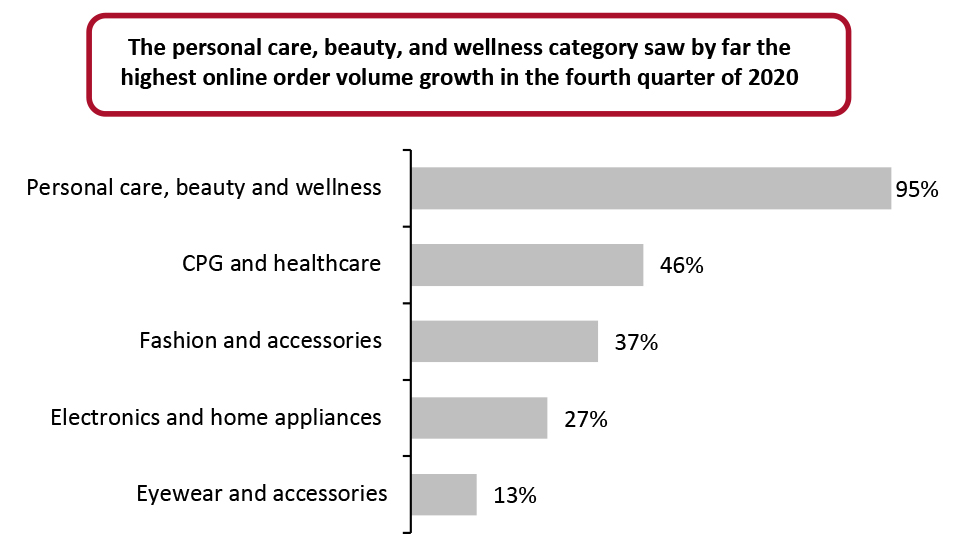

Favorable Demographics and Increased Consumer Spending on Beauty India has the world’s largest youth population (defined as those aged 15–34), according to estimates by India’s Ministry of Statistics and Programme Implementation. According to the EY analysis of World Bank Population Projections and Estimates data for 2020, millennials and Gen Zers comprised 51% of India’s 1.3 billion billion population. The 15–34 age group will comprise 32.3% of the country’s population by 2030, against 22.3% in China and 27.6% in the US. This large youth population presents opportunities for the BPC category. Rising urbanization coupled with the growing income of the Indian middle class is also fueling demand for beauty products. Consumer spending on beauty is likely to increase in the coming years: Mumbai-based financial services firm Avendus Capital, in its October 2020 report, estimated that the wallet share of the beauty and personal care category in India will reach 1.2% by 2025, up from 1.0% in 2020. Rise in Online Beauty Shoppers, Growth in E-Commerce and DTC Beauty Brands The nationwide lockdown of March–May 2020 during the first wave of the pandemic led to a surge in e-commerce, with consumers shifting to online channels for their essential and non-essential category purchases. According to a report by cloud-based e-commerce solutions provider Unicommerce in association with global management consulting firm Kearney, the last quarter of 2020 saw e-commerce order volume grow by 36% year over year, much of which was driven by the personal care, beauty, and wellness segment. The order volume of the personal care, beauty, and wellness segment grew by 95% in the final quarter of 2020 compared to the same period in 2019.Figure 2. Selected Categories: Indian E-Commerce YoY Order Volume Growth Oct–Dec 2020, % [caption id="attachment_139095" align="aligncenter" width="700"]

Source: Kearney/Unicommerce[/caption]

The report also states that brand websites reported 94% year-over-year volume growth in the fourth quarter of 2020.

A faster take-to-market, better control over brand communications, direct interaction with consumers and a rise in digital payment adoption have prompted many Indian brands to move toward DTC. There are over 80 DTC brands in India’s beauty and personal care segment, including well-known names such as Nykaa, Mamaearth, Plum, MyGlamm, Sugar Cosmetics, WoW, Beardo and Bombay Shaving Company.

DTC beauty brands also receive increased funding from venture capitalists. According to a March 2021 report by business research and intelligence firm Praxis Global Alliance (PGA) Labs and Knowledge Capital, investors pumped $1.4 billion into Indian DTC brands between 2014 and 2020, some 54% of which was into the beauty and fashion segment. Avendus’ October 2020 DTC report estimates the number of online beauty shoppers in India will reach 135 million by 2025.

Increased Adoption of Do-It-Yourself (DIY) Content Augmented by Social Media Influencers

With salons and spas closed during the pandemic, consumers turned to online alternatives, and increasingly switched to DIY beauty treatments. Influencers and Bollywood celebrities also supported this trend through social media videos of DIY self-care techniques, showcasing beauty hacks catering to skin and hair categories using ingredients that are common in Indian kitchens, such as coffee powder and amlas (also known as Indian gooseberries).

Companies are also engaging with shoppers by offering online product tutorials, virtual consultations and digital content that promotes DIY among them.

Nature's Tattva, a Delhi-based DIY beauty brand, is an example of a brand capitalizing on this trend: it provides raw materials with simple DIY tutorials, enabling consumers to make their own cosmetics suited to their skin and hair type. Similarly, L’Oréal India is engaging with its online users to help them color their hair at home.

These pandemic-driven habits appear to be persisting among consumers. Even as salons have started to re-open, lingering concerns prompt many consumers to forego their regular services and go for treatments that they can complete at home. As new variants continue to emerge, we expect the DIY content offered by companies, celebrities and social media influencers to become increasingly popular, and drive demand for beauty products as consumers learn to master the services they previously went to a professional for.

Pandemic-Accelerated Demand for Clean and Sustainable Products

The clean beauty movement has become more important than ever since the start of the pandemic. Globally, the clean beauty market is growing rapidly and is expected to reach over $54 billion by 2027, according to Statista, reflecting the shift of clean beauty from a niche to a mainstream concern, driven by consumers’ pandemic-related focus on health and wellness. Mamaearth's founder Varun Alagh, for instance, claims the brand is now significantly ahead of its pre-pandemic revenues, which grew by three–four times during 2021.

Clean beauty brands as a whole are also improving their formulation and pigmentation to offer better results—meaning consumers no longer have to choose between effective and clean products. Products from clean and sustainable brands in India, including Vanity Wagon, Sublime Life, Plum, Mamaearth, Kiro and Lotus Botanicals, are primarily priced in the mass to the mass-premium range, and 80%–90% of sales currently come from Metros and Tier 1 cities.

Tier 2 and Tier 3+ Cities to Further BPC Growth

Growing consciousness of grooming trends among the rural youth population, and their desire to mirror urban lifestyles, has led to growth in demand for BPC products in lower-tier markets. Additionally, various economic and financial factors such as the shift to e-commerce, higher disposable income, increased Internet and smartphone penetration—allowing rural consumers to view beauty-related social media content—and digital payment adoption have improved access to beauty and personal care among Tier 2 and 3 consumers, fueling the growth of this industry. Online marketplace Paytm Mall, for example, reported a 50% jump in sales of trimmers, epilators, face scrubbers and other personal grooming products from Tier 2 and 3 cities in May 2020.

These smaller Indian cities are increasingly accounting for a significant volume of online sales across categories. A Unicommerce report from October 2020 revealed that Tier 2+ cities account for 66% of online consumer demand in India, and this share will rise further in the coming years.

Underlining this trend, French premium beauty brand Sephora has announced plans to open another 75 stores in India, and intends to focus on Tier 2 and 3 cities in this expansion. Online beauty retailer Purplle claims to have witnessed an 80% increase in sales compared to pre-pandemic times, the bulk of which it attributes to Tier 2 and 3 markets. To meet growing demand from Tier 2 and 3 cities, Purplle has also set up fulfillment centers in Kolkata and Guwahati.

Source: Kearney/Unicommerce[/caption]

The report also states that brand websites reported 94% year-over-year volume growth in the fourth quarter of 2020.

A faster take-to-market, better control over brand communications, direct interaction with consumers and a rise in digital payment adoption have prompted many Indian brands to move toward DTC. There are over 80 DTC brands in India’s beauty and personal care segment, including well-known names such as Nykaa, Mamaearth, Plum, MyGlamm, Sugar Cosmetics, WoW, Beardo and Bombay Shaving Company.

DTC beauty brands also receive increased funding from venture capitalists. According to a March 2021 report by business research and intelligence firm Praxis Global Alliance (PGA) Labs and Knowledge Capital, investors pumped $1.4 billion into Indian DTC brands between 2014 and 2020, some 54% of which was into the beauty and fashion segment. Avendus’ October 2020 DTC report estimates the number of online beauty shoppers in India will reach 135 million by 2025.

Increased Adoption of Do-It-Yourself (DIY) Content Augmented by Social Media Influencers

With salons and spas closed during the pandemic, consumers turned to online alternatives, and increasingly switched to DIY beauty treatments. Influencers and Bollywood celebrities also supported this trend through social media videos of DIY self-care techniques, showcasing beauty hacks catering to skin and hair categories using ingredients that are common in Indian kitchens, such as coffee powder and amlas (also known as Indian gooseberries).

Companies are also engaging with shoppers by offering online product tutorials, virtual consultations and digital content that promotes DIY among them.

Nature's Tattva, a Delhi-based DIY beauty brand, is an example of a brand capitalizing on this trend: it provides raw materials with simple DIY tutorials, enabling consumers to make their own cosmetics suited to their skin and hair type. Similarly, L’Oréal India is engaging with its online users to help them color their hair at home.

These pandemic-driven habits appear to be persisting among consumers. Even as salons have started to re-open, lingering concerns prompt many consumers to forego their regular services and go for treatments that they can complete at home. As new variants continue to emerge, we expect the DIY content offered by companies, celebrities and social media influencers to become increasingly popular, and drive demand for beauty products as consumers learn to master the services they previously went to a professional for.

Pandemic-Accelerated Demand for Clean and Sustainable Products

The clean beauty movement has become more important than ever since the start of the pandemic. Globally, the clean beauty market is growing rapidly and is expected to reach over $54 billion by 2027, according to Statista, reflecting the shift of clean beauty from a niche to a mainstream concern, driven by consumers’ pandemic-related focus on health and wellness. Mamaearth's founder Varun Alagh, for instance, claims the brand is now significantly ahead of its pre-pandemic revenues, which grew by three–four times during 2021.

Clean beauty brands as a whole are also improving their formulation and pigmentation to offer better results—meaning consumers no longer have to choose between effective and clean products. Products from clean and sustainable brands in India, including Vanity Wagon, Sublime Life, Plum, Mamaearth, Kiro and Lotus Botanicals, are primarily priced in the mass to the mass-premium range, and 80%–90% of sales currently come from Metros and Tier 1 cities.

Tier 2 and Tier 3+ Cities to Further BPC Growth

Growing consciousness of grooming trends among the rural youth population, and their desire to mirror urban lifestyles, has led to growth in demand for BPC products in lower-tier markets. Additionally, various economic and financial factors such as the shift to e-commerce, higher disposable income, increased Internet and smartphone penetration—allowing rural consumers to view beauty-related social media content—and digital payment adoption have improved access to beauty and personal care among Tier 2 and 3 consumers, fueling the growth of this industry. Online marketplace Paytm Mall, for example, reported a 50% jump in sales of trimmers, epilators, face scrubbers and other personal grooming products from Tier 2 and 3 cities in May 2020.

These smaller Indian cities are increasingly accounting for a significant volume of online sales across categories. A Unicommerce report from October 2020 revealed that Tier 2+ cities account for 66% of online consumer demand in India, and this share will rise further in the coming years.

Underlining this trend, French premium beauty brand Sephora has announced plans to open another 75 stores in India, and intends to focus on Tier 2 and 3 cities in this expansion. Online beauty retailer Purplle claims to have witnessed an 80% increase in sales compared to pre-pandemic times, the bulk of which it attributes to Tier 2 and 3 markets. To meet growing demand from Tier 2 and 3 cities, Purplle has also set up fulfillment centers in Kolkata and Guwahati.

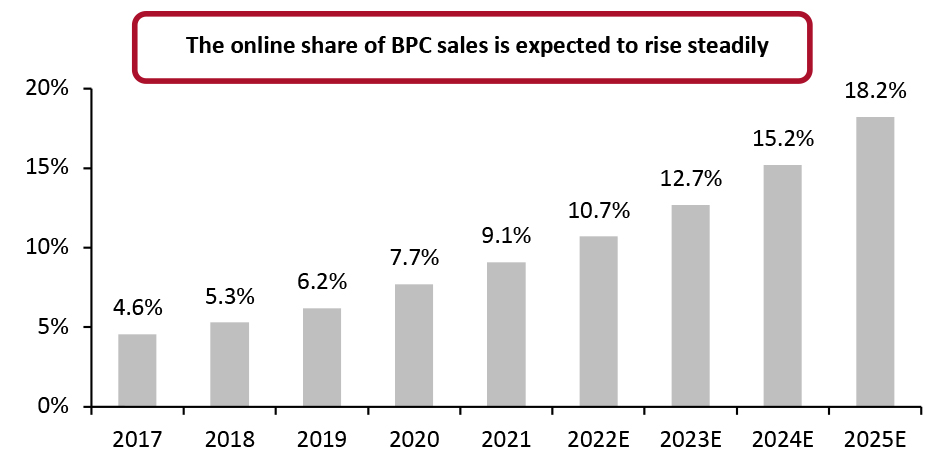

Online Market

The pandemic-led consumer shift to e-commerce has resulted in a rise in online sales of beauty products, particularly DIY, self-care, personal care and hygiene products. This surge in BPC e-commerce, as consumers spend more time online on product discovery, advice and inspiration, has led to the proliferation of DTC beauty brands. According to Statista estimates, the online revenue share of the BPC industry will continue to increase, reaching 18.2% by 2025.Figure 3. Online Revenue Share of Indian BPC Industry, 2017–2025E [caption id="attachment_139096" align="aligncenter" width="699"]

Source: Statista[/caption]

Indian consumers, especially Gen Zers, rely on social media platforms for watching beauty tutorials and buying beauty and personal care products online, a trend that has been amplified by an increase in Internet penetration and smartphone adoption. The online BPC industry is thus emerging as one of the most profitable playgrounds for consumer goods, and DTC beauty brands are focusing on this e-commerce surge for their growth and expansion.

DTC beauty brands such as Mamaearth, Plum and Sugar Cosmetics have attracted huge investments for their online and offline expansion. Below, we examine some of the prominent DTC online BPC brands in India.

Mamaearth, founded in 2015 by husband and wife Varun and Ghazal Alagh, is Asia’s first personal care brand with Made Safe-certified toxin-free products for mothers and children. Mamaearth offers over 80 natural, toxin-free products in over 500 cities in India, both through its own website and major e-commerce platforms including Amazon and Flipkart. The brand also has an offline presence in over 2,000 multi-brand stores across 40 cities in India. The company has raised $110.8 million in funding over seven rounds. Its latest funding round, in December 2021, raised $37.5 million in a Venture round led by Sequoia Capital India.

Plum, a vegan beauty brand that offers skincare, cosmetics, body and bath products, mostly targeted at women, was founded in 2014 by Shankar Prasad. The company offers over 80 SKUs, selling its products both through the DTC channel and 6,000 retail outlets in more than 220 cities, in addition to 15 online marketplaces. In November 2020, Plum raised ₹1.1 billion ($14.8 million) in a Series B funding round led by Faering Capital.

Purplle is a digitally native vertical brand (DNVB) selling cosmetics, fragrances, haircare and skincare products. The company provides its users with a highly personalized digital shopping experience, recommending products based on personal preferences, search keywords and purchase behavior. As of March 3, 2021, it sells over 1,000 brands and nearly 50,000 products on its website and app. In November 2021, Purplle raised $60 million from Premji Invest at a valuation of $630 million.

Sugar Cosmetics, a DTC cosmetics brand founded in 2015 by Kaushik Mukherjee and Vineeta Singh, sells its products with an omnichannel approach, focusing on content marketing and through its own app. The company has a presence across modern trade stores and kiosks through 10,000 retail touchpoints. In February 2021, Sugar Cosmetics raised $21 million in a Series C funding round led by Elevation Capital (formerly SAIF Partners), with existing investors A91 Partners and India Quotient, and strategic venture debt from Stride Ventures.

Source: Statista[/caption]

Indian consumers, especially Gen Zers, rely on social media platforms for watching beauty tutorials and buying beauty and personal care products online, a trend that has been amplified by an increase in Internet penetration and smartphone adoption. The online BPC industry is thus emerging as one of the most profitable playgrounds for consumer goods, and DTC beauty brands are focusing on this e-commerce surge for their growth and expansion.

DTC beauty brands such as Mamaearth, Plum and Sugar Cosmetics have attracted huge investments for their online and offline expansion. Below, we examine some of the prominent DTC online BPC brands in India.

Mamaearth, founded in 2015 by husband and wife Varun and Ghazal Alagh, is Asia’s first personal care brand with Made Safe-certified toxin-free products for mothers and children. Mamaearth offers over 80 natural, toxin-free products in over 500 cities in India, both through its own website and major e-commerce platforms including Amazon and Flipkart. The brand also has an offline presence in over 2,000 multi-brand stores across 40 cities in India. The company has raised $110.8 million in funding over seven rounds. Its latest funding round, in December 2021, raised $37.5 million in a Venture round led by Sequoia Capital India.

Plum, a vegan beauty brand that offers skincare, cosmetics, body and bath products, mostly targeted at women, was founded in 2014 by Shankar Prasad. The company offers over 80 SKUs, selling its products both through the DTC channel and 6,000 retail outlets in more than 220 cities, in addition to 15 online marketplaces. In November 2020, Plum raised ₹1.1 billion ($14.8 million) in a Series B funding round led by Faering Capital.

Purplle is a digitally native vertical brand (DNVB) selling cosmetics, fragrances, haircare and skincare products. The company provides its users with a highly personalized digital shopping experience, recommending products based on personal preferences, search keywords and purchase behavior. As of March 3, 2021, it sells over 1,000 brands and nearly 50,000 products on its website and app. In November 2021, Purplle raised $60 million from Premji Invest at a valuation of $630 million.

Sugar Cosmetics, a DTC cosmetics brand founded in 2015 by Kaushik Mukherjee and Vineeta Singh, sells its products with an omnichannel approach, focusing on content marketing and through its own app. The company has a presence across modern trade stores and kiosks through 10,000 retail touchpoints. In February 2021, Sugar Cosmetics raised $21 million in a Series C funding round led by Elevation Capital (formerly SAIF Partners), with existing investors A91 Partners and India Quotient, and strategic venture debt from Stride Ventures.

Competitive Landscape

The BPC industry is one of the fastest-growing consumer product sectors in India. Growing disposable income and strong demand for personal care, hygiene and beauty products are combining to drive the growth of the BPC industry in India. The BPC industry in India comprises the personal care, skincare, haircare, cosmetics and fragrances segments. Large CPG companies and multinational conglomerates dominate the Indian BPC industry—indeed, the industry has substantial opportunities for international players. Colgate-Palmolive India, Hindustan Unilever Limited (HUL), L’Oréal India and Procter & Gamble are the leading international players in the Indian market. In addition, Gillette India, Home Products, Johnson & Johnson (India) and Reckitt Benckiser (India) and have a strong presence in India. Prominent domestic players include Dabur India, Emami, Godrej Consumer Products, Marico and Wipro Consumer Care & Lighting. While Indian brands have a sizeable presence in the mass category, international players dominate the premium category. The prominent sales channels include branded retail outlets, department stores, DTC websites and apps, highly competitive e-commerce marketplaces, grocery retailers, hypermarkets, shopping malls, specialty store chains and supermarkets.. Meanwhile, the proliferation of DTC beauty brands, enhanced consumer convenience, and the growing popularity of digital payments are supporting the growth of the online BPC market. The figure below presents key metrics of selected prominent BPC companies in India (domestic and international), based on their annual reports. The combined revenue generated by these companies was around $7.5 billion in the fiscal year ended March 31, 2020, based on average 2020 exchange rates.Figure 4. Key Metrics of Selected Major Indian BPC Players [wpdatatable id=1605 table_view=regular]

Percentages may not sum to 100 due to rounding Conversions to USD are at average 2020 exchange rates Source: Company reports Dabur India Limited Dabur is an Indian multinational consumer goods company. Dabur is one of the world’s largest ayurvedic and natural healthcare companies, with a portfolio of over 250 herbal and ayurvedic health products across the food, haircare, home, oral care and skincare categories. It has a wide distribution network, covering 6.7 million retail outlets with high penetration in urban and rural markets. It also operates in the specialized beauty retail business, with 111 stores across 39 cities under its brand “NewU.”as of April 2020. The company reported a revenue of ₹87.0 billion ($1.2 billion) in FY20, of which its consumer care and personal care segments contributed around 60%. Hindustan Unilever Limited (HUL) HUL, a subsidiary of UK-based Unilever, is one of India’s largest consumer goods companies. As of 2019, HUL’s product portfolio has 44 brands spanning 14 categories, including foods, haircare, home, personal care and skincare. Its prominent BPC brands include Axe, Clinic Plus, Dove, Glow & Lovely, Lakmé, Lifebuoy, Lux, Pond’s, Sunsilk and Vaseline. The company has about 21,000 employees as of 2021. It reported revenues of ₹387.9 billion ($5.2 billion) in FY20, with the BPC segment contributing 45% of its revenue. The company has recently taken steps to promote inclusivity, renaming its well-known skin-lightening brand Fair & Lovely (“fair” in this context indicating lighter-colored skin) as Glow & Lovely, and launching a campaign against domestic violence on international women’s day.

Retail Innovators

BPC brands increasingly offer personalized beauty, skincare and haircare solutions using data-driven technology to curate their product offerings. Moreover, many innovative BPC brands are also embracing diversity and inclusion. Below, we examine some BPC brands that offer personalization and leverage technology to curate their products and services. Bare Anatomy Bare Anatomy is a beauty tech startup that uses personalization to curate its beauty products. It currently offers shampoos, conditioners, hair oils, hair serums, and hair masks—all personalized to each customer’s unique needs and made fresh to order. Customers must answer a questionnaire related on their hair profile and preferences on the brand’s website. Bare Anatomy deploys advanced technology to analyze the distinct hair profile of every customer to formulate the most effective products for each individual’s specific requirements. The data-driven company offers natural, vegan and cruelty-free products. Kama Ayurveda Kama Ayurveda, a Delhi-based beauty and skincare brand, introduced online beauty consultation for customers with their ayurvedic beauty experts during the pandemic. Customers can schedule appointments with Kama Ayurveda experts in their preferred language and time slots. The company helps address customers’ beauty concerns and customize their beauty routine by offering an in-store-like experience through this initiative. SkinKraft SkinKraft, a personal care and skincare brand based in Hyderabad, uses data analytics to formulate customized solutions for women’s skin problems. Customers visiting the website are asked to complete a “skinID” questionnaire designed by dermatologists. The company uses this information to analyze the customer’s skin requirements and creates a skin profile. A detailed analysis of the profile helps SkinKraft identify problem areas and the ingredients required to manage them. It then recommends a customized skincare regimen, including a cleanser, a moisturizer and a skin issue-specific product to the customer to address the requirement outlined in their skin profile. Super Smelly Super Smelly is a toxin-free personal care brand for adolescents. The brand was launched in 2018 with a mission to offer healthy and toxin-free alternative personal care products to the underserved adolescent market. The company offers a small range of around 18 products, including deodorants, face masks, face washes, hand rubs, moisturizers and lip balms. Super Smelly makes and sends its formulations to Safe Cosmetics Australia for certifications including Made-Safe, 100% toxin-free, vegan and allergen-free. Once it receives these certifications, it sends the formulations to a French laboratory to test them for suitability for its target customers, to ensure the products are effective as well as safe. It also uses International Fragrance Association (IFRA)-compliant fragrances, all of which have been checked for toxicity.Themes We Are Watching

Key themes we will be watching in 2022 include a boom in the men’s grooming market, BPC brands becoming more inclusive, BPC brands offering personalization through data-driven insights, AR-powered tech adoption in beauty, and a post-pandemic revival of demand for salons and spas. Men’s Grooming Will Be a Booming Market The demand for men’s grooming products is rising due to urbanization and new trends toward looking well-groomed. According to Research and Markets, the male grooming market in India was at $643 million in 2018 and will likely grow at a CAGR of 11% to reach $1.2 billion by 2024. Men’s grooming is now expanding into categories that were previously reserved exclusively for women. Male grooming goes beyond shaving to include face masks, face washes, eye creams, make-up, moisturizers and perfumes.- Delhi-based Bombay Shaving Company offers 30 male grooming products across the bath, beard-care, grooming, shaving and skincare categories.

- Skin Elements, in 2017, ventured into the men’s personal hygiene category and offers products with a strong focus on hygiene, odor management, anti-chafing, skincare, and haircare. According to one of its founders, Raghav Sood, the business has been profitable since its inception The company also secured $100,000 in seed funding led by Redcliffe Capital in August 2018.

- The Man Company is an e-commerce platform that offers a subscription-based service for men’s grooming and essentials. It allows customization of products, and customers can set the frequency of their order and revise or cancel the subscription at any time.

- Kolkata-based CPG brand Emami picked up an additional 12% stake for ₹500 million ($6.7 million) in The Man Company in June 2021. The brand now owns a 45.9% stake in the company.

- Leading CPG company Marico fully acquired Ahmedabad-based men’s grooming start-up Beardo in June 2020. With this acquisition, Marico, which already had a 45% stake in Beardo, strengthened its presence in the men’s grooming market.

- Kama Ayurveda offers unisex high-end luxury facial scrubs formulated with rich “Kumkumadi oil and saffron” to exfoliate and brighten skin.

- Delhi-based personal care brand Upakarma Ayurveda’s onion oil and shampoo are gender-neutral. Upakarma Ayurveda co-founder Parag Kaushik has said that onions, rich in Vitamin E, are a vital ingredient and essential nutrient for good hair, irrespective of whether it’s for men or women.

- Mamaearth offers gender-neutral face packs, face washes, hair oils, hair masks, serums and shampoos.

- As discussed above, HUL rebranded its iconic skin-lightening brand “Fair and Lovely” to “Glow and Lovely” as part of its commitment to embrace inclusivity in beauty.

- mCaffeine, India’s first caffeinated personal care brand, launched a campaign titled “Confidence over Color” on International Coffee Day, October 1, 2020. The campaign was intended to resonate with younger Indians’ appetite for “no fairness,” clean and cruelty-free BPC products.

- Personal care brands Bare Anatomy and SkinKraft collect questionnaire answers from their customers and analyze this data to recommend personalized products for them.

- Luxury traditional skincare and cosmetics brand Forest Essentials allows customization of facial creams. The company will arrange for an in-depth consultation with their Ayurvedic experts, after which their R&D team will process the answers to determine a unique blend of clean, active ingredients to formulate the product.

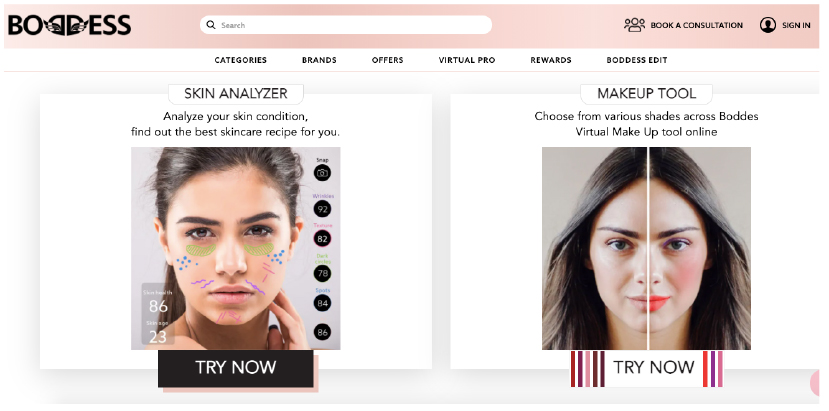

- Indian beauty-tech retailer Boddess launched its AR -powered virtual try-on technology, “The Boddess Virtual Pro,” in March 2020, enabling customers to accurately diagnose their skin condition and try on makeup virtually from the comfort of their homes. Its Skin Analyzer tool assesses skin issues such as blemishes, dark spots, pigmentation, pores and wrinkles and recommends products for each skin type. Its Virtual Make-up tool, meanwhile, allows customers to choose and try on SKUs across all its cosmetic brands. According to its founder and CEO, Ritika Sharma, the company launched this technology to help customers make informed product decisions.

Source: Boddess.com[/caption]

Salons, Spas and At-Home Services Will See a Post-Pandemic Revival

Though self-care and DIY have become popular during the pandemic, salons, spas and at-home services will see a resurgence after health concerns diminish: The popularity of at-home treatments demonstrates continued demand for these services.

Source: Boddess.com[/caption]

Salons, Spas and At-Home Services Will See a Post-Pandemic Revival

Though self-care and DIY have become popular during the pandemic, salons, spas and at-home services will see a resurgence after health concerns diminish: The popularity of at-home treatments demonstrates continued demand for these services.

- Home services startup Urban Company reported a 103% jump in revenue year-over-year to ₹2.2 billion ($28.9 million) in fiscal 2020, majorly contributed by its beauty and wellness vertical. The company said that beauty and wellness accounted for 55% of its fiscal 2020 revenue.

- Bodycraft Spa and Salon offered video consultations on pedicure, manicure, and hair styling to their customers during the May–June 2021 lockdown. They also partnered with delivery apps to deliver beauty products and DIY kits. However, its founder Manjul Gupta strongly believes that it is difficult to offer a spa-like experience at home and expects a strong comeback from their customers.

What We Think

We believe online channels will gain more prominence as brands leverage technology to help their consumers with product discovery, advice and tutorials. With the online sale of BPC products also on the rise, we expect a strong surge in beauty e-commerce and a proliferation of DTC beauty brands. We believe that BPC brands will make use of data analytics and technologies such as AR and virtual try-on to offer personalization, customized solutions and a seamless experience to their consumers. With more brands tapping into beauty products and categories previously reserved exclusively for women, the men’s grooming market will have further growth prospects. We believe BPC brands will increasingly embrace inclusivity and sustainability in their product offerings. Implications for Brands/Retailers- Consumers have turned to DIY beauty treatments in the face of the pandemic. Brands and retailers can leverage this to develop and offer DIY beauty kits to consumers. Salons and spas can look for a retail presence by providing these kits to consumers for sale when they visit.

- Gen-Z consumers are social media-savvy and watch beauty tutorials and content on social media. Brands and retailers should incorporate social media beauty influencers into their marketing strategies to understand consumer needs and better target their products.

- Consumers increasingly expect personalization in beauty, and are willing to spend more for customized products. Brands and retailers offering personalization should integrate consumer data into their research and formulations to craft unique BPC products tailor-made for each customer.

- With increased discretionary spending and a desire to mirror urban lifestyles, Tier 2 and 3 markets will be lucrative for brands and retailers looking for offline expansion.

- As health concerns persist—and can be expected to for some time—AR/VR-powered tech solutions are critical for brands to offer a safe and convenient shopping experience, and they should prioritize rolling out these capabilities.

- The D2C model is seeing wide adoption in India’s BPC market, as brands capitalize on its opportunities for rapid take-to-market and close connection with consumers. The sector is also attracting a lot of funding due to improved business performance. Brands and retailers can look at expanding their DTC arms for better growth prospects.

- Real estate companies can offer commercial spaces to BPC brands looking for offline expansion in Tier 2 and Tier 3 cities.

- AR/VR is becoming a must-have for BPC brands to help customers try on makeup. AR/VR technology vendors should enter into strategic partnerships with BPC brands and offer customized solutions.

- BPC companies leverage data-driven insights to curate tailor-made products to their consumers, providing opportunities for artificial intelligence (AI) and machine learning (ML) technology vendors.