Nitheesh NH

Introduction

We discuss the Australian grocery sector, presenting our market sizing estimates for 2022 and beyond. We explore notable market factors, e-commerce penetration, the competitive landscape and retail innovators. We also discuss three key themes that we are watching in the sector.Market Performance and Outlook

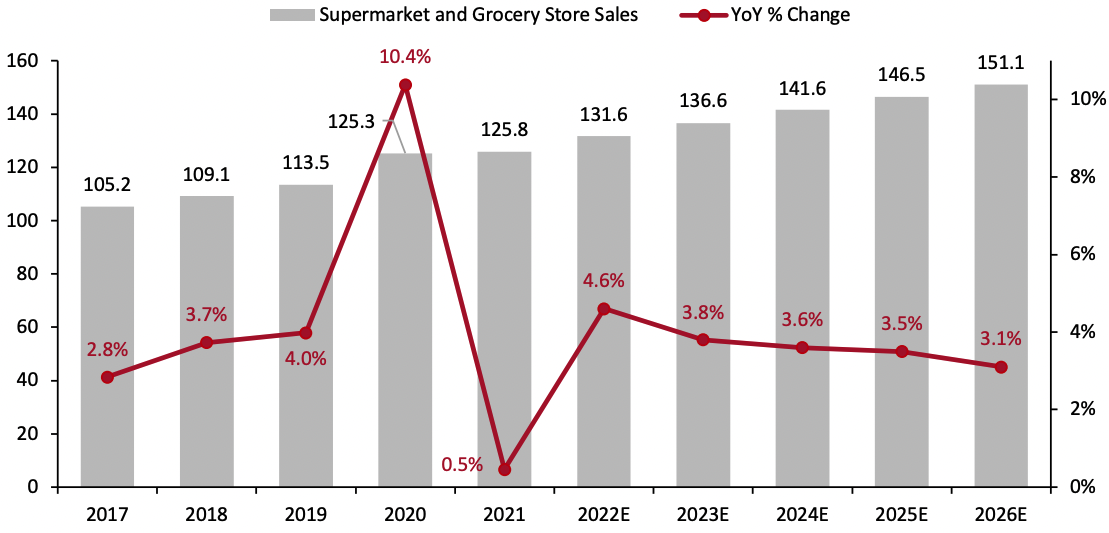

We expect 2022 to bring a growth revival to 4.6% in Australian food retail sales, following moderation to 0.5% in 2021 after the pandemic-driven spike to 10.4% growth in 2020. Australian supermarkets and grocery stores were boosted by the shift to at-home consumption and panic buying earlier amid Covid-19, with sales of A$125.3 billion ($87.9 billion) in 2020 leading to a vastly greater growth increase than any recent year, we calculated using data from ABS. We expect inflation, which surpassed 4% for food and non-alcoholic beverages (see Figure 3) in the most recent quarter, to be a major driver of sector growth in 2022. If it still proves stronger over the year, we see upside potential to our sector estimate for 2022. We expect demand to settle higher than historic levels, given that behavior changes have persisted for more than two years, creating tailwinds for food-at-home demand in the years ahead.Figure 1. Australia Supermarket and Grocery Stores: Total Sales (Left Axis; AUD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_150813" align="aligncenter" width="700"]

Includes goods and service tax

Includes goods and service taxSource: ABS/Coresight Research[/caption]

Market Factors

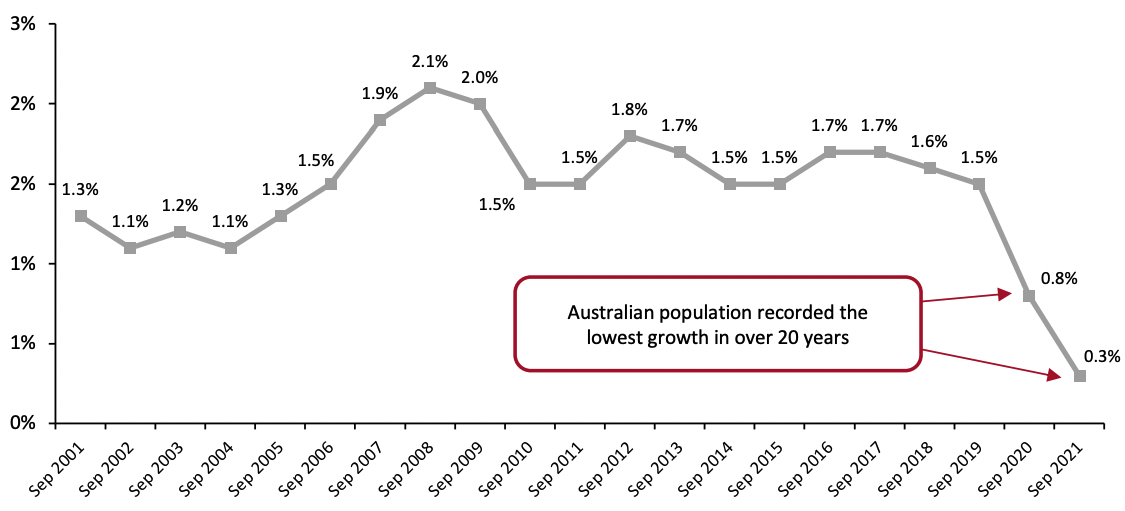

Low Population Growth Australia’s population grew just 0.3% in the year to September 2021, according to ABS, with international border closures resulting in net migration losses for the sixth straight quarter, as shown in Figure 2. Population recovery is set to take several years—The Center for Population forecasts growth will hit 1.4% by 2025. The decline in population growth may have a negative impact on supermarket retailers’ toplines, with some having to consider rationalization of store footprints, particularly if the population per store does not pick up in line with anticipated population growth. However, we believe other forces will partially offset the impact of lower population growth, including more people working and eating at home and a renewed interest in cooking from scratch. Pandemic lockdowns have also driven migration shifts out of major cities. This presents a medium-term headwind to retailers with extensive store footprint in cities, such as Coles, and a tailwind for independent retailers such as Metcash that are largely based in regional towns and suburban areas.Figure 2. Australia Annual Population Growth (YoY % change) [caption id="attachment_150814" align="aligncenter" width="700"]

Source: ABS[/caption]

Inflation

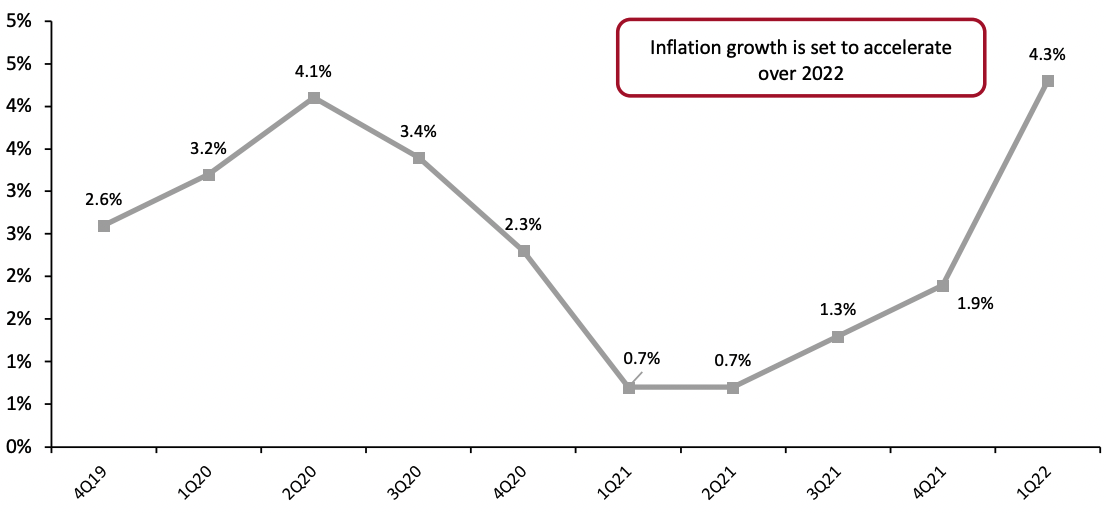

Inflation of food and non-alcoholic beverage prices took off in the March 2022 quarter, growing 4.3% year over year, according to ABS. The recent rise in food prices can be attributed to many factors, including soaring fuel costs, increased freight charges, supply chain disruptions and increased input costs. We expect inflation to stay elevated over the course of 2022 due to continued supply chain headwinds and higher energy prices exacerbated by the war between Russia and Ukraine.

Higher shelf prices will support supermarkets’ revenues in the near term. However, we expect some margin compression as grocers will be reluctant to pass entire cost increases on to consumers, likely doing so in selective product categories to prevent leakage in their consumer bases.

Discount stores that cater to value-conscious shoppers, such as Aldi, will likely benefit from food inflation at the expense of full-price supermarkets as consumers begin to trade down. Rival retailers competing for price-sensitive customer spend must be prepared to fight even harder for share of shoppers, including more intelligent and targeted promotions and loyalty programs.

Source: ABS[/caption]

Inflation

Inflation of food and non-alcoholic beverage prices took off in the March 2022 quarter, growing 4.3% year over year, according to ABS. The recent rise in food prices can be attributed to many factors, including soaring fuel costs, increased freight charges, supply chain disruptions and increased input costs. We expect inflation to stay elevated over the course of 2022 due to continued supply chain headwinds and higher energy prices exacerbated by the war between Russia and Ukraine.

Higher shelf prices will support supermarkets’ revenues in the near term. However, we expect some margin compression as grocers will be reluctant to pass entire cost increases on to consumers, likely doing so in selective product categories to prevent leakage in their consumer bases.

Discount stores that cater to value-conscious shoppers, such as Aldi, will likely benefit from food inflation at the expense of full-price supermarkets as consumers begin to trade down. Rival retailers competing for price-sensitive customer spend must be prepared to fight even harder for share of shoppers, including more intelligent and targeted promotions and loyalty programs.

Figure 3. Food and Non-Alcoholic Beverages Inflation (YoY % change) [caption id="attachment_150815" align="aligncenter" width="700"]

Source: ABS[/caption]

Rise in Consumption of Wellness Products and Organic Foods

The pandemic has contributed to increased consumer interest in health and wellness, motivating shoppers to seek out products marketed as organic, chemical free or health conscious. The market for health-conscious goods and services expanded substantially in 2020, according to the industry association Australian Organic, with 56% of Australian shoppers purchasing organic food in the last year and over 500,000 new shoppers purchasing an organic item.

Nevertheless, the higher prices of organic items represent a challenge for the category since the pandemic and inflationary forces have caused disposable income to fall. As competition among organic private labels develops, however, the gap in unit prices compared to non-organic products will decrease, providing consumers with more options that work for their budgets.

Source: ABS[/caption]

Rise in Consumption of Wellness Products and Organic Foods

The pandemic has contributed to increased consumer interest in health and wellness, motivating shoppers to seek out products marketed as organic, chemical free or health conscious. The market for health-conscious goods and services expanded substantially in 2020, according to the industry association Australian Organic, with 56% of Australian shoppers purchasing organic food in the last year and over 500,000 new shoppers purchasing an organic item.

Nevertheless, the higher prices of organic items represent a challenge for the category since the pandemic and inflationary forces have caused disposable income to fall. As competition among organic private labels develops, however, the gap in unit prices compared to non-organic products will decrease, providing consumers with more options that work for their budgets.

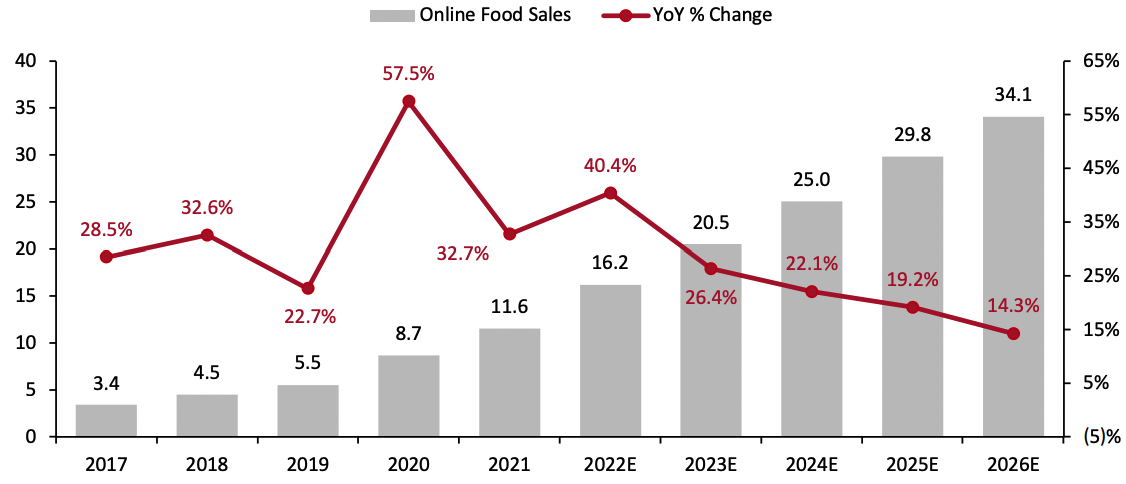

Online Market

Compared to the US and the UK, the Australian grocery market has been slower to move online. The pandemic prompted a significant acceleration in grocery e-commerce, with a huge increase in the volume going through online channels at Coles, Woolworths and other retailers. Online food sales data released by ABS include food retailing, cafes, restaurants and takeaway food services; ABS does not provide a finer split by industry. The data show that online food sales grew to A$8.7 billion ($6.1 billion) in 2020, up 57.5% year over year. Growth slowed to 32.7% in 2021 due to the partial return to on-premise consumption and the hit from consumers returning to shop in stores. In 2022, we expect the market to grow 40.4% driven by inflation offset by fading of pandemic tailwinds for online. Despite expectations of more modest growth in the future, we believe that the pandemic has increased the adoption rate of online food, creating long-term demand at retailers. This bodes well for grocers and restaurants that have invested in initiatives to improve their online capabilities, including fulfillment automation and additional capacity in pickup and delivery.Figure 4. Australia Online Food Sales: Total Sales (Left Axis; AUD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_150816" align="aligncenter" width="700"]

Source: ABS/Coresight Research[/caption]

Source: ABS/Coresight Research[/caption]

Competitive Landscape

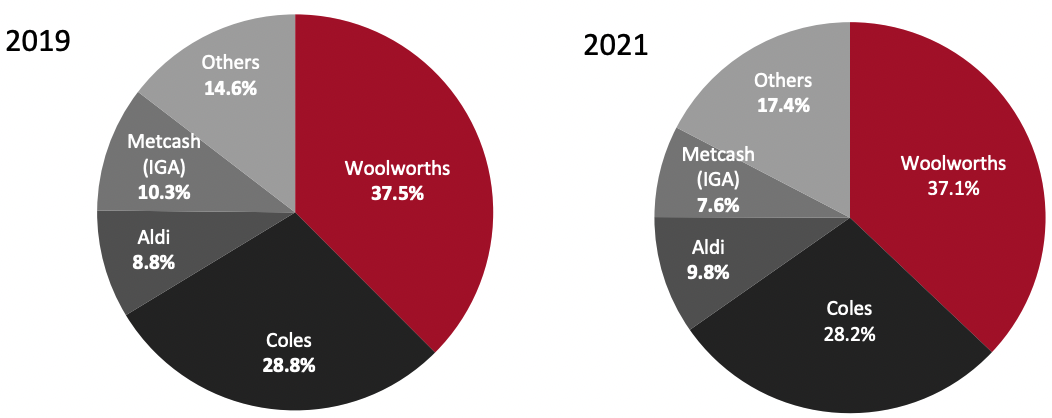

The Australian grocery market is heavily concentrated, with the top four retailers accounting for almost 80% of the market in 2021. Woolworths is the market leader with a share of 37.1%, followed by Coles at 28.2%, Aldi at 9.8% and Metcash at 7.6%, as shown in Figure 5. Woolworths and Coles’ market share marginally declined from 2019 to 2021, primarily due to the growth in popularity of Aldi and Costco. Metcash’s market share declined by 2.7 percentage points in the same period. The company’s Independent Grocers Alliance (IGA) business has been facing challenges over the last few years with increased price competition, Woolworths and Coles rolling out smaller store formats, and growth in online shopping. E-commerce giant Amazon sells pantry items on its local platform in Australia. While there is a latent threat of it introducing its Amazon Fresh service, we expect Amazon to remain a marginal player for the foreseeable future, given the long lead time and difficulty of replicating established supermarket store networks. This is evidenced by Aldi (which entered Australia in 2001) taking nearly two decades to achieve close to a 10% market share. The strong duopoly of Woolworths and Coles has deterred new entrants from the Australian market. The most recent large player to enter the physical grocery space was Costco, which opened its first store in Melbourne in 2009.Figure 5. Australia Grocery Market Share, 2019 and 2021 [caption id="attachment_150818" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Themes We Are Watching

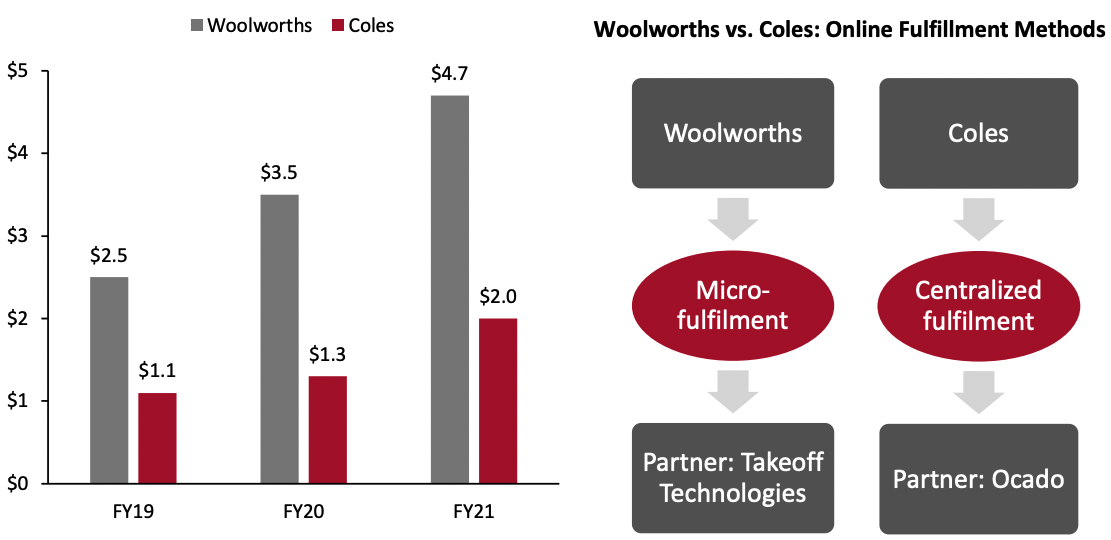

Divergent Routes in Online Grocery Fulfillment from Major Players Australian supermarket giants Woolworths and Coles have taken differing routes to increase their online capabilities. Both companies sought external partnerships to support fulfillment— Coles teamed up with Ocado in March 2019 and Woolworths partnered with Takeoff Technologies in August 2019. The key strategic difference lies in the size and scale of each company’s distribution centers. Takeoff Technologies specializes in store-based micro-fulfillment centers (MFCs), favoring speed of delivery, while Ocado uses centralized customer fulfillment centers (CFCs), which have a larger footprint in order to focus on depth of product range and higher order volumes. The Ocado CFCs will become operational in 2023, while Woolworths’ MFCs are already operational at selected locations. This gives Woolworth a significant head start in acquiring online customers. However, Coles’ extensive product offering and near-perfect order fulfillment should lead to significant customer satisfaction and retention once the system becomes operational.Figure 6. Woolworths and Coles Online Sales, AUD Bil. (Left) and Online Fulfillment Strategy (Right) [caption id="attachment_150819" align="aligncenter" width="700"]

The fiscal year for Woolworths and Coles ends on the last Sunday of June

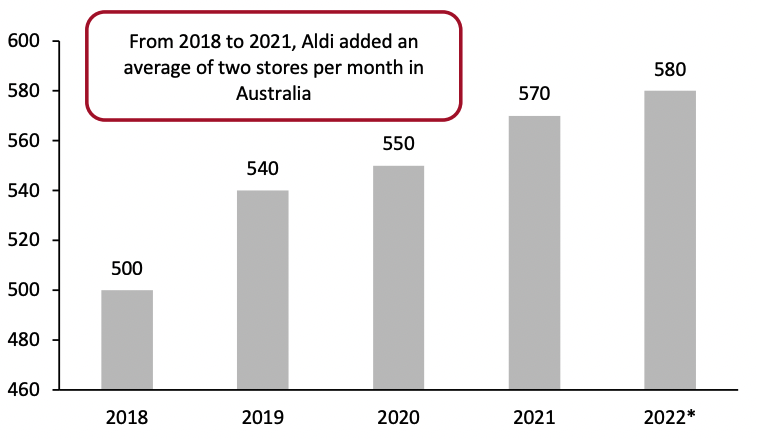

The fiscal year for Woolworths and Coles ends on the last Sunday of JuneSource: Company reports[/caption] Aldi Steps Up Investment in Australia Aldi remains on a strong growth path in Australia, fueled primarily by ambitious store expansion. It opened 20 stores in 2021 and added another 10 in 2022, bringing its total count to 580 stores in the country. Aldi’s existing stores range from 1,000 to 2,000 square meters and are one-third to one-half the size of Woolworths and Coles stores. Aldi carries approximately 1,500 stock keeping units (SKUs), compared with 25,000 SKUs in a traditional full-service grocery store. The company announced in August 2021 that it plans to spend more than A$1.3 billion ($0.9 billion) in Australia over the next few years on technology and distribution centers to support future growth, invest in price and keep up with consumer demand for convenience. In July 2021, Aldi opened an innovative urban store concept named Corner Store in North Sydney. The small-format store layout maximizes efficiency for urban customers, with modern interior design, self-checkouts and extended trading hours. As well as groceries and fresh produce, the store carries a range of ready meals and on-the-go products.

Figure 7. Aldi Australia Store Count [caption id="attachment_150820" align="aligncenter" width="520"]

*As of March 2022

*As of March 2022Source: Company reports[/caption] Proliferation of Instant Grocery Delivery Startups During the pandemic, a new breed of instant grocery delivery startups emerged in the Australian grocery market, including Send (launched March 2021), Voly (launched July 2021) and Milkrun (launched September 2021). The companies are focused on operations in Melbourne and Sydney, with the promise of delivering grocery items within 10–15 minutes without any mark-up in prices. These ultrafast delivery players are vertically integrated, meaning they source their own food products to build a streamlined inventory, store it in their own warehouses (commonly known as dark stores) and rely on their own network of cyclists to get items to local consumers quickly. They typically carry a product assortment of 1,000–3,000 SKUs—much smaller than the 15,000–20,000 found in a typical grocery store. Instant grocery delivery startups in Australia have raised significant financing since their launch. Milkrun raised A$75 million ($52.4 million) in funding in January 2022 after raising A$11 million ($7.7 million) in June 2021. Voly also raised A$18 million ($12.6 million) in December 2021. However, this new market has already seen its first casualty: Send, which was available in 46 suburbs in Sydney and Melbourne, collapsed and entered liquidation in April 2022. The company’s Founder said that international issues had made it harder to raise the necessary capital to scale the business. This underscores the reality that these delivery services are still loss-making and incur heavy cash burn, due to heavy discounting to attract customers— and the high investments required in real estate, marketing and technology. We believe that investments, which have come mainly from venture capital funds, will soon run out, making ultrafast delivery players key acquisition targets and anticipate some consolidation in this space.

Retail Innovators

HIVERY Sydney-based HIVERY provides artificial intelligence (AI) and data science-powered solutions to harness store-level data for category management optimization. HIVERY uses the bottom-up approach to assortment planning and leverages machine learning and data science algorithms to consider consumer preferences and behavior. It generates localized assortments at the store level and helps retailers understand incremental revenue opportunities at each store. This helps retailers optimize assortments to match shopper demand accurately while improving the customer experience. This approach also enhances collaboration between retailers and consumer packaged goods (CPG) companies and helps in improving joint business planning. By developing joint category strategies and tactics in addition to sharing category plans to identify mutual opportunities, users can access a singular view of their shoppers. Shelfie Shelfie is a retail analytics platform based in New South Wales. It helps retailers to track stock on shelves and optimize their in-store execution strategy and product availability levels. It uses cloud-based, complex image processing algorithms to analyze and optimize shelf images to provide real-time stock reporting. The company claims that it helps users to identify sales trends by tracking inventory movements, thereby enabling retailers to optimize merchandising layouts. The technology also alerts the user if products are out of place or missing from the shelves. As such, this solution ensures that out-of-stock items are replenished efficiently, while expired items are pulled off shelves, thereby eliminating operational inefficiencies and providing customers with smooth in-store experiences.What We Think

The pandemic delivered a sales windfall for grocery retailers in 2020. In 2021, as pandemic tailwinds faded, some share of food-away-from-home dollars flowed back to foodservice. Retailers should look to capitalize on pandemic-induced behavior stickiness to sustain the market’s momentum in the years ahead. Implications for Retailers- A sustained step-up in prices due to inflation is likely to drive customers toward value retailers. These retailers are likely to see price rises in line with Woolworths, Coles and independents chains; however, their products are structurally lower-priced, so should benefit from Woolworths and Coles’ shoppers shifting part of their shop to the discount channel. We believe the independents to be less impacted as they have a higher proportion of top-up shops, where shoppers are less price-sensitive and more focused on convenience.

- We believe the aggressive expansion of Aldi will further segment the Australian grocery landscape and increase competitive pressure. This would compel established supermarkets to compete by passing on efficiency gains or cost savings to consumers through price cuts, instead of expanding operating margins and potentially losing share.

- We anticipate the competition to intensify in the online channel, particularly between the Coles-Ocado and Woolworths-Takeoff partnerships. A few of Woolworths’ automated MFCs are already operational, giving it a leg-up in securing more customers and making it difficult for Coles to extract these customers later when its CFCs become operational in 2023. However, we anticipate Coles’ online customers will be increasingly sticky and less likely to switch as its online offering would effectively eliminate out-of-stocks and substitution coupled with high SKU availability.

- Developing an online grocery infrastructure will stay a priority for many industry operators. To improve their online grocery operations, retailers will be investing heavily in supply chain optimization as well as in-store systems, mobile applications and online platforms. Technology vendors must capitalize on the environment and highlight the importance of their solutions for grocery retailers’ pain points.