Nitheesh NH

Introduction

In this report, we examine the market size and trajectory of the personal luxury goods market in Asia, major factors impacting the market, the competitive landscape and themes we are watching in 2022 and beyond. This report only covers the personal luxury segment, which includes apparel, accessories, beauty, footwear, jewelry and watches, and excludes experiential luxury categories, such as art, hospitality, travel, vehicles and wines and spirits, as well as the secondhand luxury market.Market Performance and Outlook

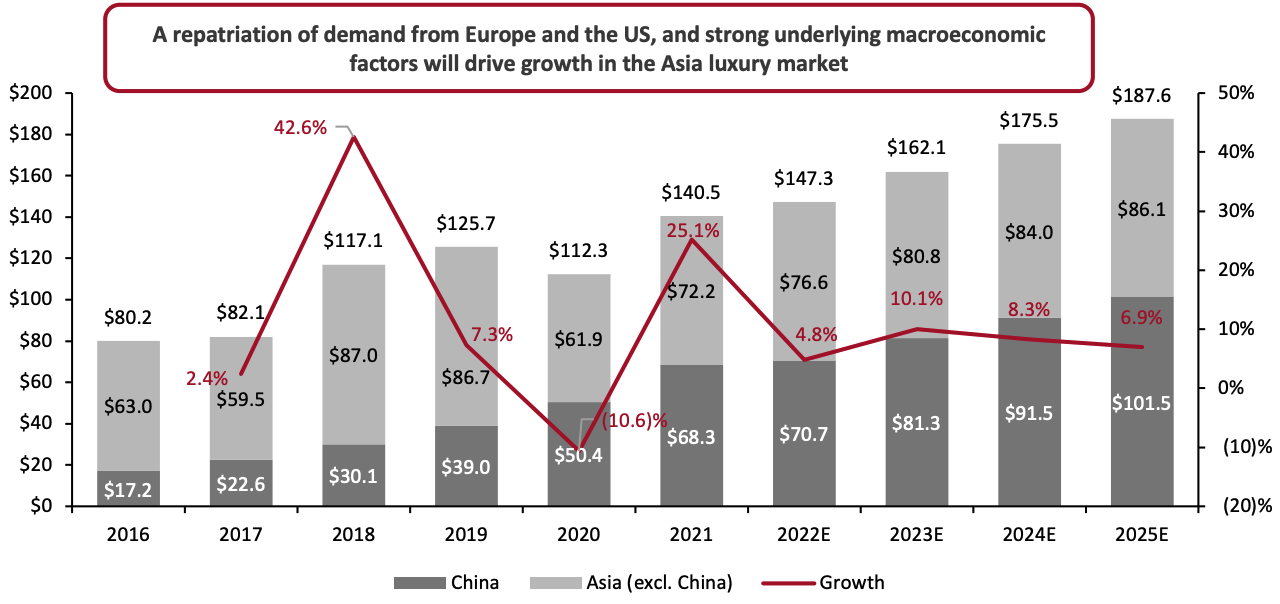

Trajectory to 2025 Remains Strong, Despite 2022 Setbacks Coresight Research estimates the total Asia personal luxury market grew 25.1% year over year to $140.5 billion in 2021, surpassing pre-pandemic levels. The recent growth is locally driven, as international travel has yet to return to pre-pandemic levels. In China specifically, 2021 sales were up 36% year over year to $68.3 billion. The country is the single-largest market in Asia and the second largest in the world.- Through 2022, we expect the Asia luxury market growth to be dampened in the first half by Covid-19 lockdowns in China earlier this year as well as various macroeconomic factors in the region. We expect sales to recover in the second half of the year—providing there are fewer lockdowns and China re-examines its strict zero-tolerance Covid-19 policy—driven by pent-up demand, regional holidays and shopping events and several other underlying factors that we examine later in the report. Therefore, for 2022, we expect the luxury market in China to grow at 3.5% and the rest of Asia at 6.5%, resulting in overall growth of 4.8%.

- Beyond 2022, we expect solid growth, albeit slower than 2021, due to strong comparatives. As Asia’s rising younger and middle-income populations draw luxury spending away from the US, we expect China to displace the US as the single-largest luxury market by 2025.

- With this slowdown and an uncertain macroeconomic environment in Asia, we expect Europe and the US to drive global luxury growth in 2022.

Figure 1. Asia Personal Luxury Goods Market Size (Left Axis; USD Bil.) and YoY Growth (Right Axis; % Change) [caption id="attachment_150529" align="aligncenter" width="700"]

Converted to USD at constant 2020 exchange rates

Converted to USD at constant 2020 exchange ratesSource: Coresight Research[/caption] Resilient Demand for Luxury Goods in Asia In 2021, European luxury companies posted strong sales growth in Asia, with several major groups, including Hermès, Kering, LVMH, Moncler, Prada and Richemont, reporting solid recoveries. In recent quarters, however, they experienced some slowdown in sales due to lockdowns in China.

- LVMH made 42% of its 2021 revenue in Asia. Asia’s share of revenues in the Fashion and Leather Goods category specifically grew to 50% in 2021, up from 42% in 2019.

- Richemont reported a rise in the share of sales from Asia in its fiscal year ended March 31, 2022. The region accounted for 47% of sales, up from 43% two years ago.

- Kering reported strong double-digit growth in its Asia-based reporting segments (Asia Pacific and Japan) in 2021, collectively accounting for 44% of total sales, up from 42% in 2019.

Market Factors

Lockdowns Temporarily Offset Solid Growth Prospects Several factors are impacting the growth of the Asia luxury goods market:- Common Prosperity Policy—China’s “Common Prosperity” policy—meant to narrow the gap between various economic classes by 2050 and increase scrutiny of consumers’ displays of wealth—could hinder some consumers from purchasing luxury goods. However, we think this will only impact those at the top of the economic strata, who are more likely to make conspicuous displays of wealth, and not middle-class, aspirational consumers.

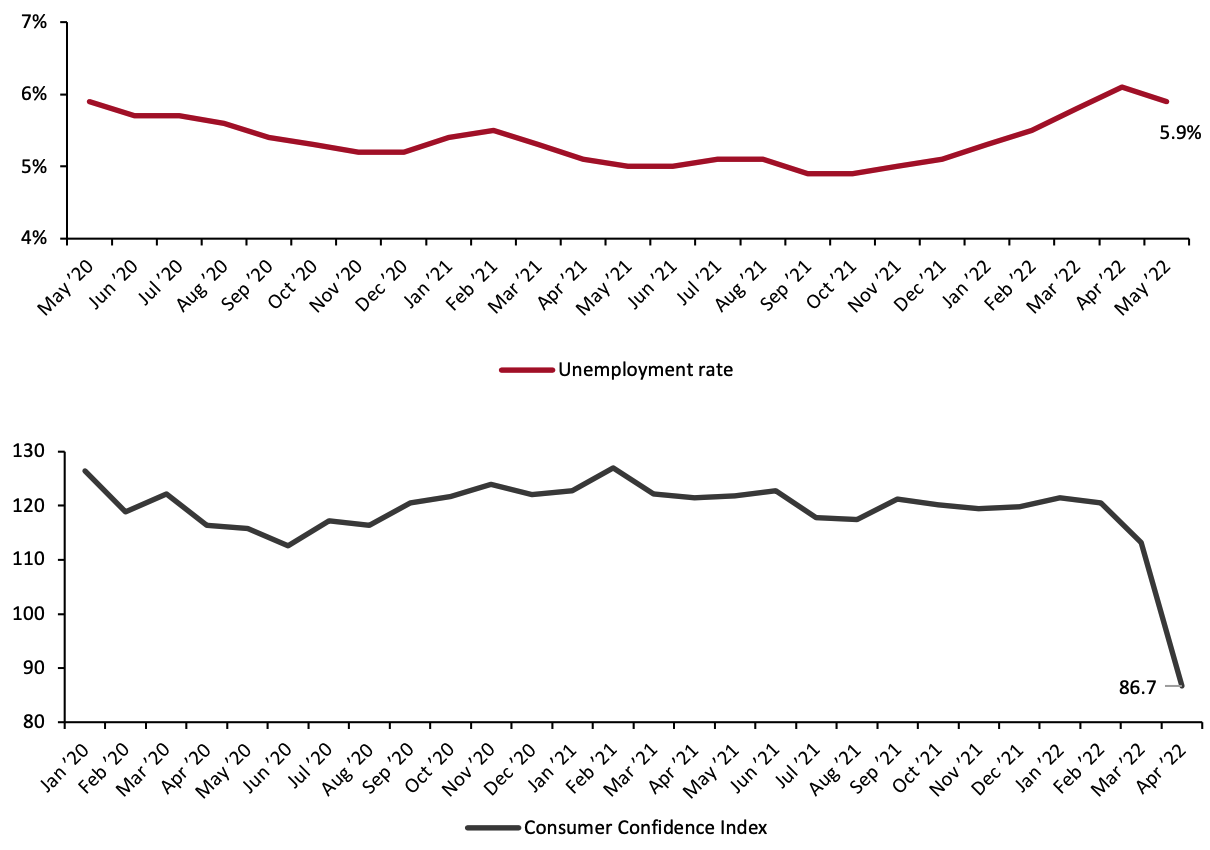

- Lockdowns—The recent Covid-19 lockdowns and China’s strict zero-tolerance policy have temporarily dented sales and resulted in other trickle-down effects, such as rising unemployment and plummeting consumer confidence. In the last several months, the unemployment rate in China has steadily increased, reaching a peak of 6.0% in April before relaxing to 5.9% in May, according to data from the National Bureau of Statistics of China (NBS). Meanwhile, consumer confidence has dropped, with NBS data showing that it plunged to 86.7 points in April 2022—its lowest level since the index’s creation in 1990—meaning consumers will spend more cautiously. Although core luxury consumers are less likely to be affected by the current economic environment, younger and aspirational consumers may take a more prudent approach to luxury consumption in the near term.

Figure 2. China: Unemployment Rate and Consumer Confidence Index [caption id="attachment_150530" align="aligncenter" width="700"]

Source: NBS[/caption]

Source: NBS[/caption]

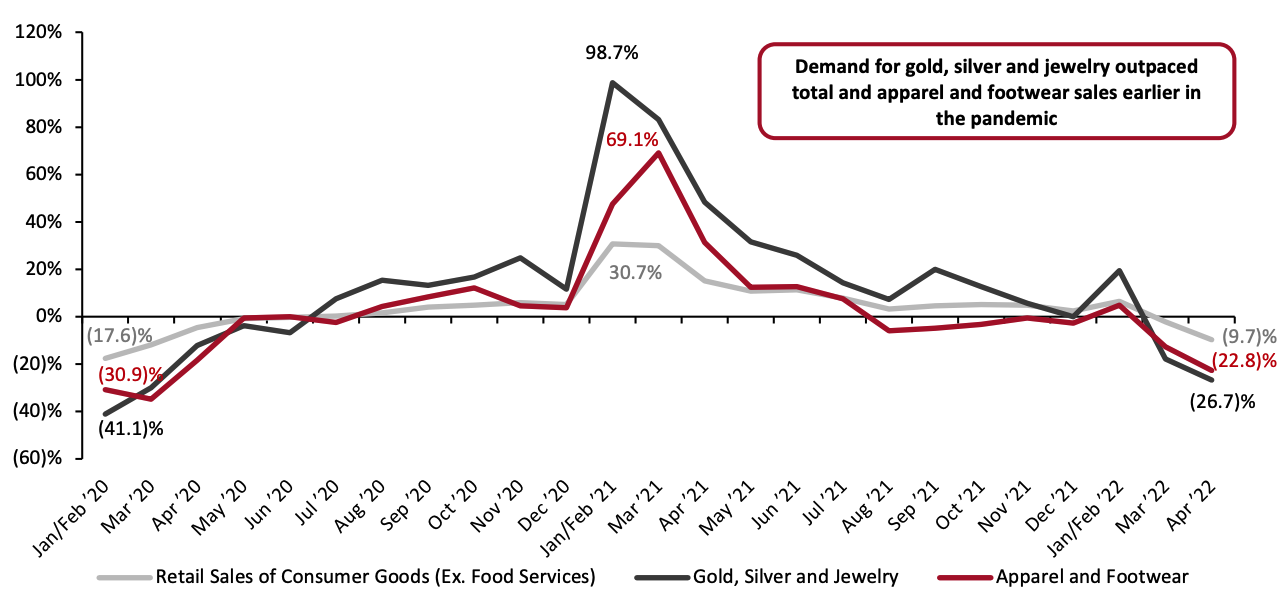

- Demand repatriation—Previously, Asian consumers—a significant share from China—often traveled to Europe, where several major brands are based, for their luxury shopping. Over the last two years, however, with limitations on travel, Asian consumers began shopping for luxury domestically, repatriating demand to the region, and we expect this behavior to continue moving forward. Retail sales data from China indicates that demand for luxury, using retail sales for gold, silver and jewelry as a proxy, has been strong except during periods of strict lockdowns, such as early 2020 and March and April 2022 (see Figure 2 below).

Figure 3. China Retail Sales Growth: Consumer Goods (Ex. Food Services); Gold, Silver and Jewelry; Apparel and Footwear [caption id="attachment_150531" align="aligncenter" width="700"]

Source: NBS[/caption]

Source: NBS[/caption]

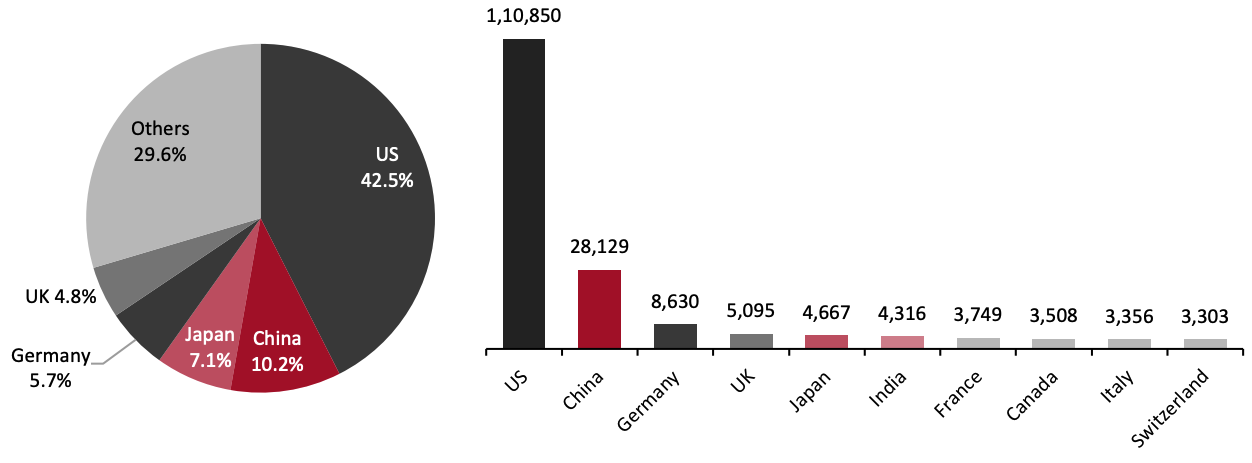

- High share of affluent consumers—According to Credit Suisse’s Global Wealth Databook 2021, as of the end of 2020, China and Japan account for 17.3% of all the world’s high-net-worth individuals (HNWIs)—those with assets exceeding $1 million. Meanwhile, three of the ten countries with the most ultra-high-worth individuals (UHNWIs)—those with assets exceeding $50 million—are in Asia.

Figure 4. 2020: Share of Worldwide HNWIs (Left) and Number of UHNWIs in the Top Ten Countries with the Most UHNWIs (Right) [caption id="attachment_150532" align="aligncenter" width="700"]

Source: Credit Suisse/Coresight Research[/caption]

Source: Credit Suisse/Coresight Research[/caption]

- Return to social events and gatherings—As the threat of Covid-19 recedes across Asia, consumers will increasingly socialize, work in-person, attend gatherings and travel. After wearing casual wear for two years, consumers will desire to update their wardrobes with apparel and footwear suitable for these occasions, driving some sales in Asia.

- Trading up—As consumers worked from home over the last two years, they saved money that may otherwise have been spent on commuting costs, office attire and eating out. We think consumers will begin using these savings on high-quality purchases for themselves.

- Younger luxury consumers—A younger demographic will drive luxury purchases in Asia in the coming years. As of the end of 2020, many major economies in Asia have a low age dependency ratio—the ratio of dependents (under the age of 15 or over the age of 64) to the working-age population—implying a higher proportion of income earners in the future as the population is relatively young. Based on the Fotile Hurun Wealth report published by the Hurun Research Institute in 2020 (the latest available data), we estimate there will be 7.2 million new young, wealthy consumers in China by the end of 2032.

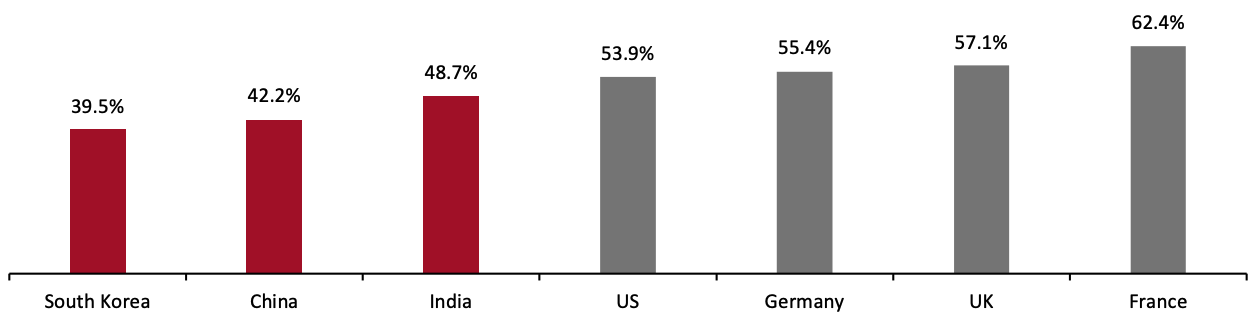

Figure 5. 2020 Age Dependency Ratios from Select Major Global Markets [caption id="attachment_150533" align="aligncenter" width="700"]

Source: World Bank[/caption]

Inflation

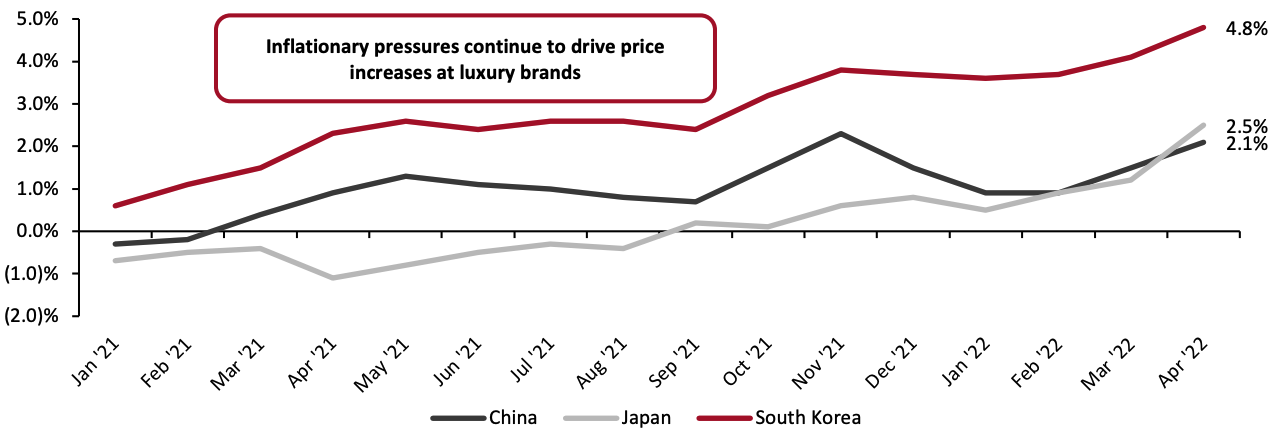

Personal luxury goods cover several product categories; as such, we look at China, Japan and South Korea’s CPIs to understand the degree to which consumer prices have been impacted in these major Asian economies.

In April 2022, the CPI in China rose 2.1%, in Japan it increased by 2.5% and in South Korea it rose by 4.8%. While these CPIs have risen at a slower rate than their Western counterparts, they are still at their highest levels in months.

Source: World Bank[/caption]

Inflation

Personal luxury goods cover several product categories; as such, we look at China, Japan and South Korea’s CPIs to understand the degree to which consumer prices have been impacted in these major Asian economies.

In April 2022, the CPI in China rose 2.1%, in Japan it increased by 2.5% and in South Korea it rose by 4.8%. While these CPIs have risen at a slower rate than their Western counterparts, they are still at their highest levels in months.

- Hong Kong-based jewelry retailer Chow Tai Fook remarked during its November 2021 earnings call that its fixed and variable costs had increased 20%–40% in mainland China, Hong Kong and Macau.

- Several luxury brands have raised prices globally as raw material inflation and supply chain disruptions made it increasingly challenging for them to absorb further costs.

- In South Korea, Chanel increased product prices in 2020 and 2021 and limited customers to one bag of purchases to secure exclusivity. In the ongoing inflationary environment, the brand announced further price increases of 5% in the country in March 2022 in its core handbags and accessories and seasonal ready-to-wear collection. At the same time, it also raised prices in those collections by 2% in Hong Kong, 6% in Europe and 8% in Japan.

Figure 6. CPI in China, Japan and South Korea [caption id="attachment_150534" align="aligncenter" width="700"]

Source: NBS/Statistics Bureau Japan/Statistics Korea[/caption]

Source: NBS/Statistics Bureau Japan/Statistics Korea[/caption]

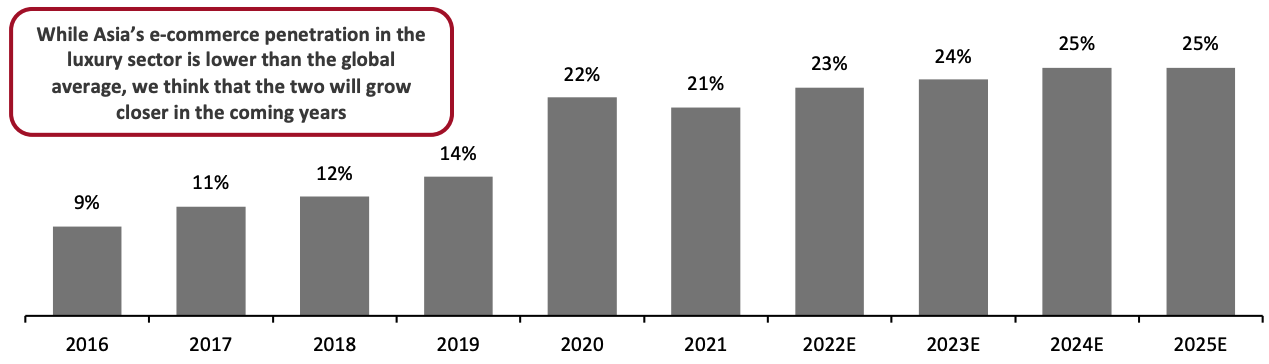

Online Market

E-commerce penetration rates in major Asian markets, such as China, Japan and South Korea, have historically been higher than in under-developed Asian retail markets, such as India. Additionally, the luxury sector overall has been slow to adopt e-commerce; however, the pandemic accelerated digitalization in luxury. Still, we think Asia’s e-commerce penetration in the luxury sector is lower than the global average. Coresight Research estimates that online sales in the global personal luxury market totaled $71.7 billion in 2021, representing 19.9% year-over-year growth and 21.0% of the worldwide market. We expect e-commerce sales to reach $83.7 billion in 2022, growing 16.6% from 2021 and accounting for 23.0% of the global market. We think China’s 2022 lockdowns will lead to higher e-commerce growth in the country compared to other Asian countries. At the same time, the presence of sophisticated e-commerce platforms with dedicated luxury touchpoints in China and other countries, such as Tmall’s Luxury Pavilion and JD.com’s luxury-focused brand pages, make luxury brands more online accessible in the regions these platforms serve, leading to increased e-commerce penetration.Figure 7. Global Luxury E-Commerce Penetration Rate [caption id="attachment_150535" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Competitive Landscape

While LVMH is the undisputed global luxury leader, in 2020, Chow Tai Fook and Richemont surpassed LVMH in terms of revenues in Asia, indicating the strength of demand for jewelry. Then, in 2021, Chow Tai Fook’s growth pushed its revenues close to LVMH’s in the region. During LVMH’s earnings call on January 27, 2022, CEO Bernard Arnault stated that although Chinese consumers could not travel in 2021, they purchased more of the company’s products in that year than they did in 2019. Management reiterated in the company’s first-quarter earnings call in April 2022 that it does not expect Asian tourism to Europe and the US to rebound this year, but they are confident in the strength of local demand in Asia. Chow Tai Fook, Hong Kong-based jewelry retailer, saw strong growth in 2021. It opened over 200 stores and points-of-sale in its latest quarter ended March 31, 2022. Richemont reported strong growth in Asia in its latest fiscal year, although sales were impacted in China due to lockdowns during its fourth fiscal quarter. Once the lockdowns are lifted, it expects a slower recovery compared to the last time China was in lockdown. Still, in the company’s May 2022 earnings call, management stated it expects the Asia Pacific region to post growth in the coming quarters, despite the drag from China. Kering is the second biggest luxury group globally; however, in Asia, it is outranked by Chow Tai Fook and Richemont. On its full-year earnings call in February 2022, Kering management reported that Asia Pacific’s share of its revenues improved on a two-year basis, despite Japan losing share due to restrictions in 2021. In the first quarter of fiscal 2022, its Asia Pacific revenues were impacted by lockdowns in China. Still, in the year ahead, management expects to further increase both its store count and e-commerce penetration in Asia, as its e-commerce penetration in Asia is low compared to the 24% average in the US and Europe.Figure 8. Major Luxury Companies’ Asia Revenue (USD Bil.)* [wpdatatable id=2087]

*The table excludes Rolex as it does not provide a region-wise split of its total revenue **Annual revenue of these companies converted to USD at historical exchange rates from the day of the annual report’s release ***These are consensus estimates Source: Company reports/S&P Capital IQ/Coresight Research

Themes We Are Watching

Counterbalance exposure to China—Even though China is set to become the largest luxury market in the world, we think luxury brands will look to counterbalance their exposure in China—both on the retail and the supply chain side—by expanding in other high-growth markets. Changing approach to brand ambassadors—In the wake of several controversies involving brand ambassadors in Asia, luxury brands are likely to take a more pragmatic approach in choosing who represents them. For instance, controversies surrounding Prada ambassador and actor Zheng Shuang and Louis Vuitton ambassador and pop idol Kris Wu led the brands to quickly drop them as negative media attention intensified. Prada has taken a more measured approach to localizing its promotion in China, hiring several Olympic champions as ambassadors—including table tennis player Ma Long, water polo player Xion Dunhan, marathon athlete Li Zhixuan and basketball player Yang Shuyu. Expanding online and offline networks—As Asian consumers have become more accustomed to shopping for luxury locally, we think luxury brands will expand their physical networks in the region. At its June 2022 Capital Markets Day, Kering announced store network expansion plans for Yves Saint Laurent in Southeast Asia and specifically mentioned growth opportunities in Japan and South Korea. In 2021, several luxury groups opened new stores in Asia to capitalize on local shopping, including Richemont, which opened boutiques in China, Japan and South Korea for its Chloe, Montblanc, Dunhill and Delvaux brands. On the e-commerce front, in January 2022, LVMH expanded its partnership with JD.com. Then, in April 2022, it announced its Bvlgari brand will open a storefront on the Tmall platform. Both platforms allow luxury brands to customize their digital storefronts and tap into the growing, digitally savvy young Chinese consumer base. Luxury brands exploring livestreaming—Previously, luxury brands have been slow to adopt livestreaming in China. However, after Louis Vuitton completed its first shoppable livestream on China’s popular social media site Little Red Book in March 2020, more and more brands and retailers have shown interest in livestreaming for luxury selling. Since then, Coach and Dior, among other brands, have also dipped their toes into the livestreaming pool in China. Despite these forays, livestream selling to a mass audience on a frequent basis remains unlikely in the luxury market, as luxury companies need to maintain exclusivity. Accordingly, in March 2022, Tmall Luxury Pavilion launched a one-to-one livestream shopping service in which professional sales advisors will engage with customers in private sessions. It remains to be seen how luxury brands will further explore this popular sales channel in Asia.Retail Innovators

Balaan, founded in 2015 and based in South Korea, is a luxury fashion platform connected to over 900 fashion houses and boutiques in Europe. According to South Korean newspaper The Korea Economic Daily, the platform’s products are priced about 30% lower than those offered on the platforms of its European competitors, Farfetch and Net-A-Porter. The paper also reported that the startup was in the process of raising $82 million in round C funding in April 2022 and will use the funds to develop its systems further and acquire startups specialized in authenticating luxury goods. It has raised $37 million as of October 2021. HeartDub uses artificial intelligence to digitalize textiles for virtual formats. The software collects data from textile firms and converts that to a virtual textile output. The company claims this method is faster and more economical than creating clothing from scratch. The startup was established in China in 2014 and has since partnered with the China Textile Association to develop a catalog of textiles. Around 80 companies use its software, including Swizz luxury brand Bally, which is owned by Chinese conglomerate Shandong Ruyi. HeartDub’s funding information is unavailable. Ponhu Luxury, based in China and established in 2015, is a luxury resale startup that facilitates the buying and selling of secondhand goods. The platform offers appraisal and valuation, maintenance and repair, recycling, consignment, rental and auctioning of luxury goods. The online platform also operates a store in Beijing, China, to collect, maintain and sell secondhand luxury products. The startup has raised $134.7 million to date.What We Think

The Asia luxury market is set for strong growth in the medium term, led by China, which we think will form the single-largest market by 2025, overtaking the US. Continued local demand as international travel remains below pre-pandemic levels, a growing base of young consumers with rising incomes and an appetite for luxury, and a high share of affluent consumers in key countries will drive this growth. Implications for Brands/Retailers- Brands and retailers should look to localize sales and promotion approaches to the regions of Asia they operate in to drive local demand.

- Companies should look to adopt emerging technologies, such as livestreaming and artificial intelligence, that will customize their products and branding to appeal to Asian markets.

- While China will remain a strong growth market, brands and retailers should explore other Asian markets to reduce dependence on a single market and, thus, vulnerability to disruptions.

- Technology vendors that can help brands and retailers easily localize their customer interfaces, such as websites and apps, will benefit from increased luxury growth in Asia.