DIpil Das

Introduction

In 2021, the apparel and footwear specialty retail sectors in the US and China saw robust post-crisis recovery, but the UK’s specialty retail sector recovered only partially. This year, we expect those contrasts to partially reverse as the lockdown-impacted Chinese sector lags growth in the UK. In this Market Outlook, we provide our estimates and expectations for the apparel and footwear specialty retail sectors in the US, the UK and China in 2022 and beyond. Furthermore, we explore key growth drivers, competitive landscapes, notable retail innovators in the space, and opportunities arising from three key specialty apparel and footwear trends.Market Performance and Outlook

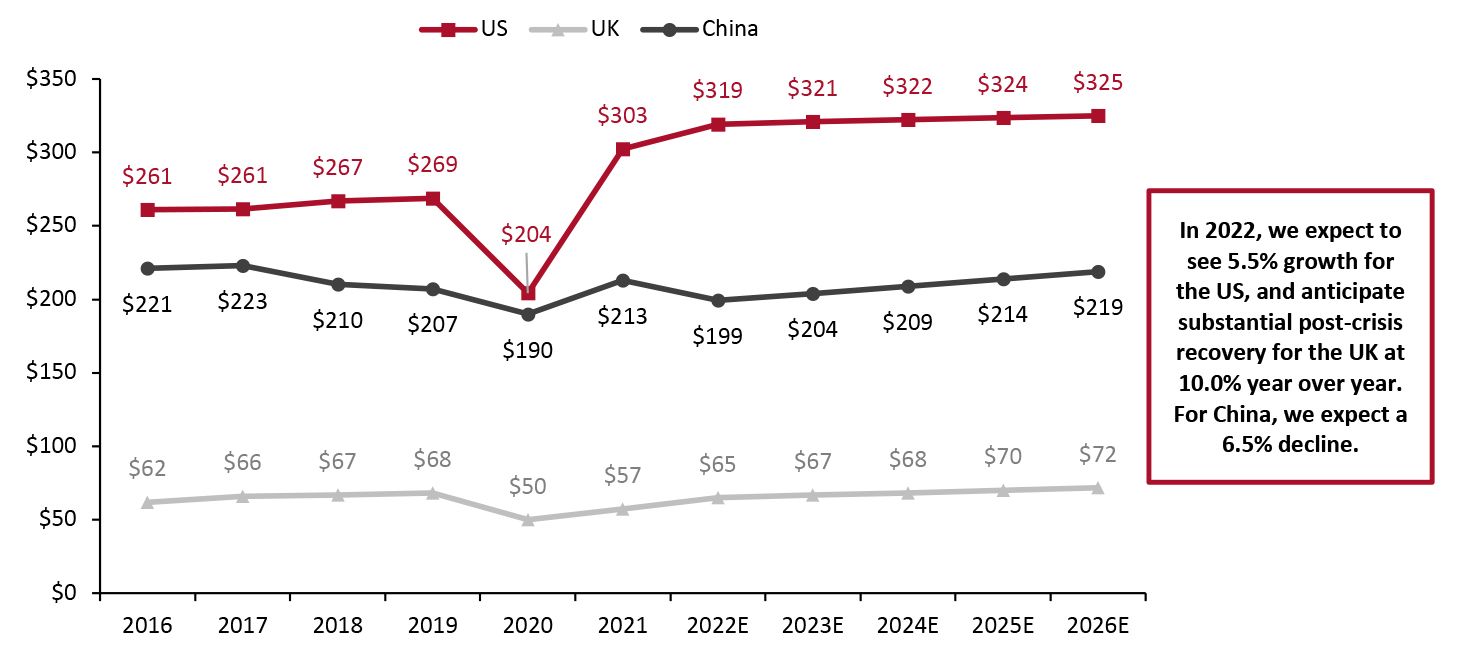

Global Apparel and Footwear Specialty Retail Sector: 2022 and Beyond US: In 2021, US clothing and footwear specialty retail sales increased by 48.1% year over year to approximately $303 billion (excluding sales taxes)—around 12.6% above 2019 levels, we estimate using US Census Bureau data. We identify that this was driven by increased vaccinations, economic recovery, stimulus checks and consumers’ return to more normal ways of living and spending. In 2022, against very strong comparatives, Coresight Research estimates that US specialty retail sales will increase by 5.5% to around $319 billion. Year to date, consumer willingness and strength to purchase from apparel retailers looks solid despite persistent inflation, geopolitical uncertainty and supply chain constraints. In April 2022, the apparel and footwear specialty sector posted sales growth of 11.2% after reporting an 8.2% increase in March 2022. From 2022 to 2026, we expect the US apparel and footwear specialty sector to witness a sales CAGR of 0.4%. UK: In 2021, the UK’s apparel and footwear specialty retail sales improved but did not fully recover from pandemic-driven declines. Apparel and footwear specialty retail sales increased by 14.6% year over year to $57.3 billion (including sales tax and on a constant currency basis) in 2021, but remain 15.8% below 2019 levels, we estimate using Office for National Statistics (ONS) data. We estimate that the sector will see 10.0% growth in 2022, reaching $65 billion, still 4.4% below 2019 levels. The growth will be driven by increased vaccinations, removal of all pandemic-related restrictions and the rise of the fashion resale market (which we discuss further in the market factors section). The UK apparel and footwear specialty sector will grow at a more stabilized rate, at a 2.5% CAGR between 2022 and 2026, we estimate. China: In 2021, total apparel and footwear specialty retail sales increased by 12.1% to $213 billion (excluding sales tax and on a constant currency basis), we estimate using National Bureau of Statistics of China data, with recovery driven by increased vaccination rollout and substantial economic revival seen last year. However, the recent pandemic-related lockdowns in the country are impacting the sector’s sales growth. In April 2022, the apparel and footwear specialty sector posted a steep sales decline of 22.8% after reporting 12.7% decrease in March 2022 and mid-single-digit growth in January and February 2022. Apparel specialty retail sales were hit as China took a zero-tolerance approach to Covid-19 infections, implementing strict restrictions in several cities to fight its latest outbreaks—this includes mandatory lockdowns as well as forced isolations of those who have in contact with infected persons. We estimate that the apparel specialty sector’s sales will decline by 6.5% to about $199 billion in 2022—about 3.9% below 2019 levels, as we anticipate that the strict pandemic-related restrictions will continue to hit apparel specialty retailers in the coming months. As well as hitting demand, this will lead to further supply chain bottlenecks that will pose headwinds for future apparel retail growth. Furthermore, we believe that the recent financial and economic measures remain inadequate to address the complexity of the ongoing problems—for instance, to cushion the slowing economy, on April 18, 2022, China’s central bank announced that it will step up financial support for people, industries and companies affected by the pandemic outbreaks, including lowering interest rates and down payments, and supporting infrastructure by buying local government bonds. From 2023 to 2026, we expect China’s apparel and footwear specialty sector to see a stabilized sales CAGR of 2.4%.Figure 1. US, UK and China: Apparel and Footwear Specialty Retailers’ Sales (USD Bil.) [caption id="attachment_147742" align="aligncenter" width="700"]

Source: US Census Bureau/Bureau of Economic Analysis (BEA)/UK ONS/National Bureau of Statistics of China/Coresight Research[/caption]

Growth Analysis: Specialty Retailers’ Sales Versus Total Consumer Spending on Apparel and Footwear

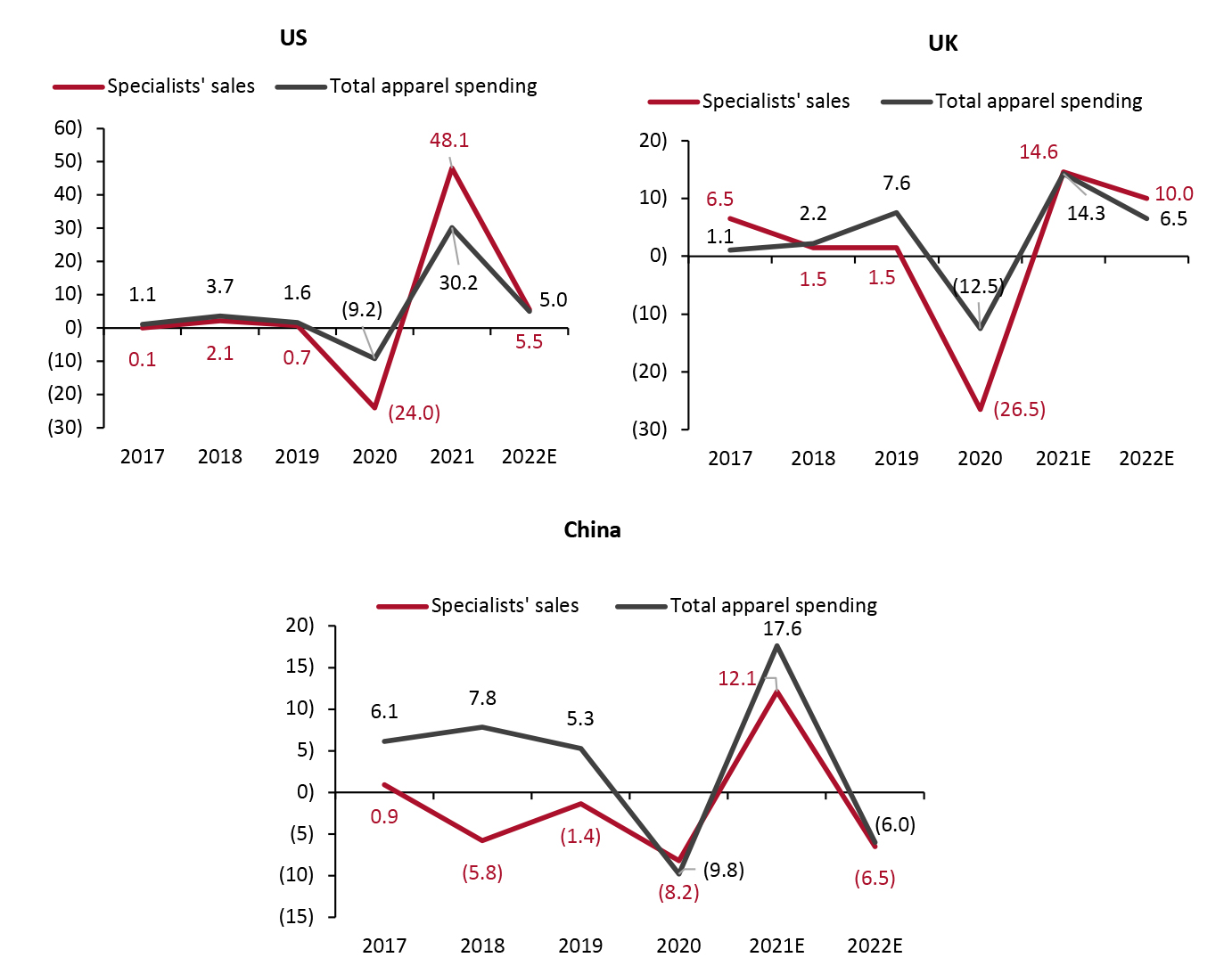

US: In 2021, apparel specialty retail saw higher growth than total apparel and footwear spending growth as shoppers returned to stores and specialty retailers recovered ground lost to rival channels, such as online retailers and mass merchants, in 2020. In 2022, we expect clothing and footwear specialty retail to see growth in the mid-single digits, largely in line with the growth of total apparel and footwear spending.

UK: Like US apparel specialty retailers, we saw UK specialty retailers’ estimated sales recover at a faster rate than total apparel and footwear spending in 2021. In 2022, we expect specialty retailers’ sales growth momentum to continue and outpace the growth of total apparel and footwear spending.

China: Specialty retailers in China underperformed versus total apparel and footwear spending in 2021. In 2022, we estimate that apparel and footwear specialty retail sales growth will continue to under pace total apparel and footwear spending growth in the country as we expect pandemic-related lockdowns and strict restrictions in Chinese cities to have a greater impact on specialty retail sales than those of non-specialty retailers, such as online retailers and mass merchants. For instance, in April 2022, Uniqlo China (owned by Fast Retailing), one of the leading apparel and footwear specialty retailers in China, noted that it expects its revenues and operating profit to drop in fiscal 2022 ending August 2022, owing to pandemic-related lockdowns and restrictions.

Source: US Census Bureau/Bureau of Economic Analysis (BEA)/UK ONS/National Bureau of Statistics of China/Coresight Research[/caption]

Growth Analysis: Specialty Retailers’ Sales Versus Total Consumer Spending on Apparel and Footwear

US: In 2021, apparel specialty retail saw higher growth than total apparel and footwear spending growth as shoppers returned to stores and specialty retailers recovered ground lost to rival channels, such as online retailers and mass merchants, in 2020. In 2022, we expect clothing and footwear specialty retail to see growth in the mid-single digits, largely in line with the growth of total apparel and footwear spending.

UK: Like US apparel specialty retailers, we saw UK specialty retailers’ estimated sales recover at a faster rate than total apparel and footwear spending in 2021. In 2022, we expect specialty retailers’ sales growth momentum to continue and outpace the growth of total apparel and footwear spending.

China: Specialty retailers in China underperformed versus total apparel and footwear spending in 2021. In 2022, we estimate that apparel and footwear specialty retail sales growth will continue to under pace total apparel and footwear spending growth in the country as we expect pandemic-related lockdowns and strict restrictions in Chinese cities to have a greater impact on specialty retail sales than those of non-specialty retailers, such as online retailers and mass merchants. For instance, in April 2022, Uniqlo China (owned by Fast Retailing), one of the leading apparel and footwear specialty retailers in China, noted that it expects its revenues and operating profit to drop in fiscal 2022 ending August 2022, owing to pandemic-related lockdowns and restrictions.

Figure 2. US, UK and China: Apparel and Footwear Specialty Retailers’ Sales Versus Total Apparel and Footwear Consumer Spending (YoY % Change) [caption id="attachment_147743" align="aligncenter" width="700"]

Source: US Census Bureau/BEA/UK ONS/National Bureau of Statistics of China/Coresight Research[/caption]

Source: US Census Bureau/BEA/UK ONS/National Bureau of Statistics of China/Coresight Research[/caption]

Market Factors

Below, in Figure 3, we discuss five key factors that will influence sales in the apparel and footwear specialty sector in 2022 and beyond. Furthermore, we discuss the ongoing inflation in the US, the UK and China apparel and footwear specialty sector in the section below the table.Figure 3. Key Factors Driving Apparel and Footwear Specialty Retailers’ Sales in the US, the UK and China [wpdatatable id=1984 table_view=regular]

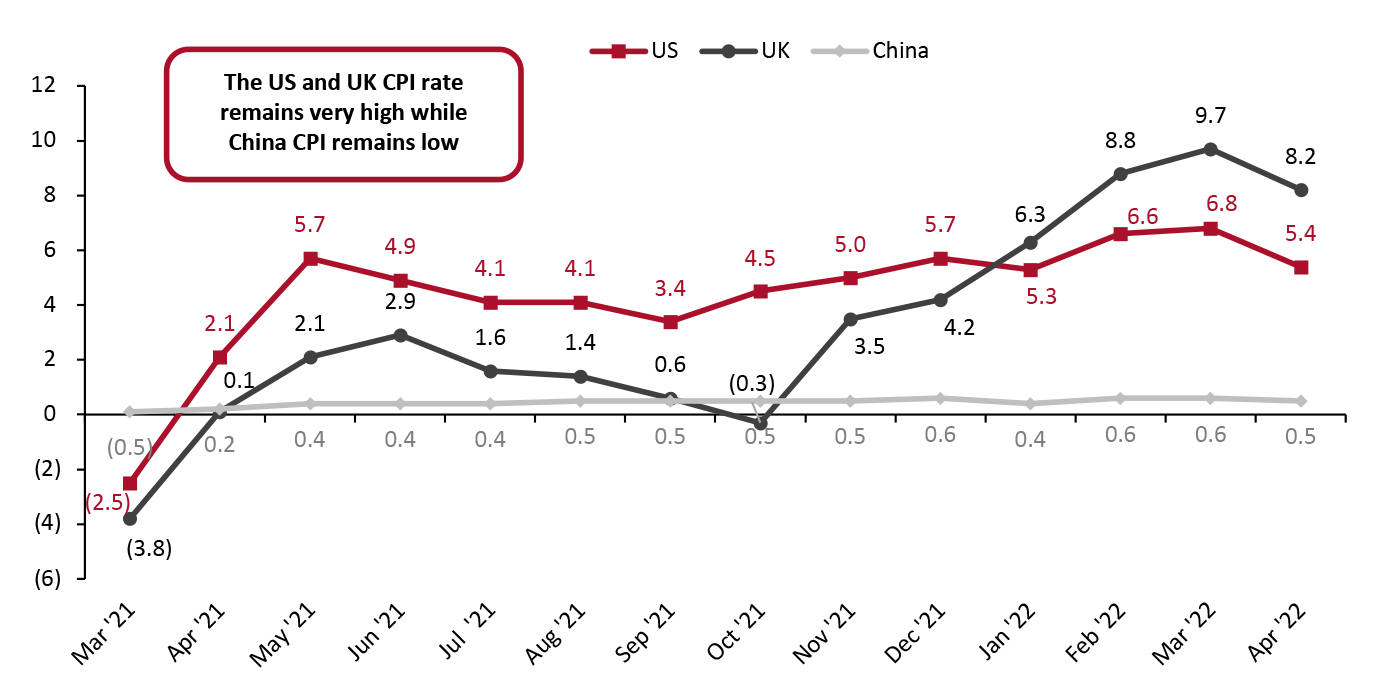

Source: Company reports/IMF/Chain Store Age/UK Office for Budget Responsibility/US Congressional Budget Office/Coresight Research Inflation US: Consumer retail prices for apparel and footwear remained very high, with year-over-year price inflation peaking in March 2022—as the strong apparel and footwear demand from consumers has coincided with constrained supply owing to supply chain challenges. Moreover, retailers had little incentive to offer discounts, equating to indirect inflation in consumer prices. Apparel retail price increases stood at 6.8% in March 2022 and 5.4% in April 2022, marking 13 consecutive months of year-over-year growth, according to the latest data from the Bureau of Labor Statistics. To counter inflation, in March 2022, the Federal Reserve raised the interest rates by 25 basis points (bps) to 0.5%—the first increase since 2018. Furthermore, the Fed increased the interest rates by another 50 bps in May 2022, the largest increase since 2000. Additionally, the Bank has signaled more interest rate increases in 2022. An increase in interest rates could cool down the inflation to a great extent—the slowing of overall inflation will likely lead to the easing of the apparel and footwear prices. Similarly, we expect apparel and footwear import prices to stabilize by the second half of 2022 with some easing in supply chain disruption allowing retailers, shippers and other supply chain stakeholders to clear their backlogs. UK: Consumer retail prices for apparel and footwear in the UK have been growing at a very fast pace since November 2021. In March 2022, apparel and footwear retail prices peaked—surging by 9.7% year over year—before moderating to 8.2% in April, according to the latest data from the UK Office for National Statistics (ONS). The recovery in apparel and footwear demand and supply chain disruptions, as well as Russia-Ukraine War tensions, are impacting the inflation in the country. Despite high inflation, we expect substantial post-crisis recovery for UK apparel and footwear specialty retailers, driven by key growth factors mentioned in Figure 3 above. Furthermore, to counter inflation, the Bank of England raised the key interest rate from 0.1% to 0.25% in December 2021, to 0.5% in February 2022, and then to 0.75% in March 2022. China: Unlike in the US and the UK, consumer retail prices for apparel and footwear in China have been low—with almost flat year-over-year price inflation in all months of 2021 and year-to-date in 2022. This is because the Chinese government regularly intervenes—through fiscal and monetary measures—to bring the economy back to equilibrium (theoretically when demand is equal to supply) and minimize the effect on inflation.

Figure 4. US, UK and China: Clothing and Footwear Consumer Price Index (YoY % Change) [caption id="attachment_147744" align="aligncenter" width="700"]

Source: US Census Bureau/BEA/UK ONS/National Bureau of Statistics of China/Coresight Research[/caption]

Source: US Census Bureau/BEA/UK ONS/National Bureau of Statistics of China/Coresight Research[/caption]

Online Sector Sales

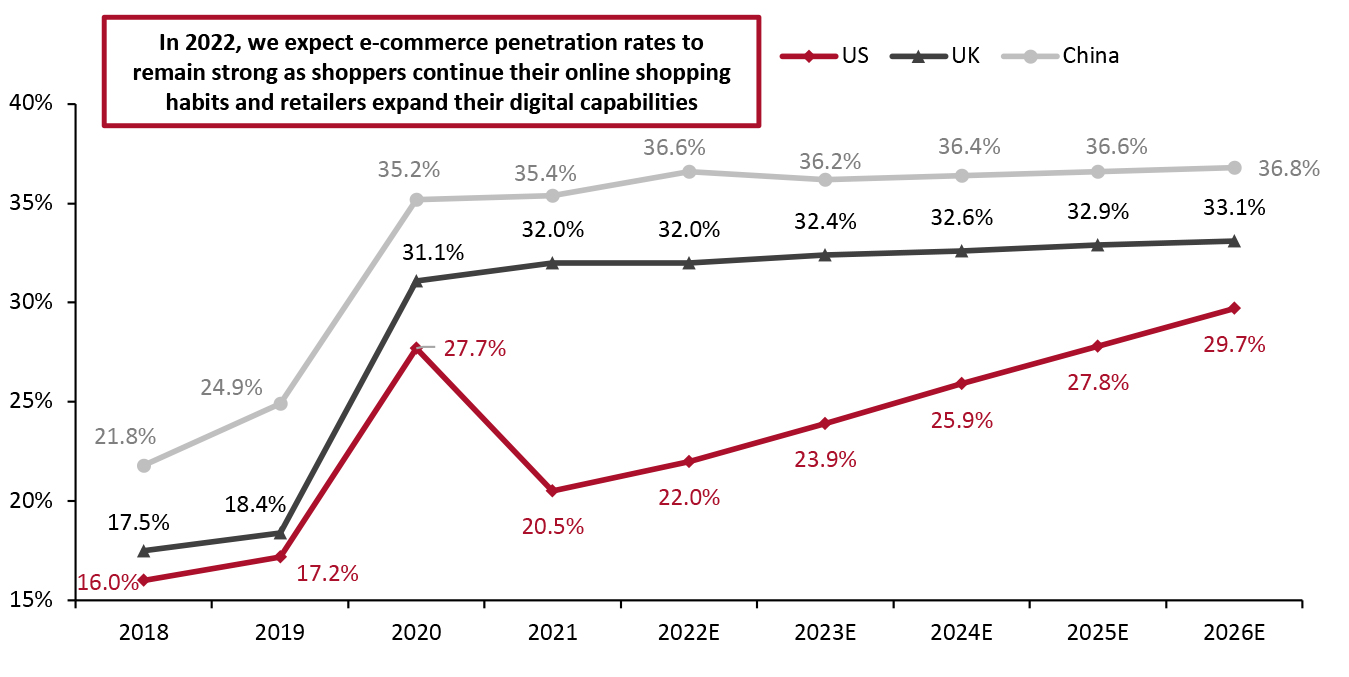

There has been an unprecedented online channel demand surge for apparel and footwear across the globe amid the Covid-19 pandemic. We discuss e-commerce penetration for the US, the UK and China in 2021 and our outlook for 2022 and beyond. US: The e-commerce penetration rate of US apparel and footwear specialty retailers’ sales eased to 20.5% in 2021 from 27.7% in 2020, we estimate using US Census Bureau data. However, we expect the penetration rate to slightly increase to 22.0% in 2022, driven by consumers’ continuing online shopping habits and apparel retailers’ growing capacities on the digital supply side. We believe that major retailers, including American Eagle Outfitters, Gap Inc. and Lululemon Athletica, will continue to exceed the sector average, which will be offset by the performance of less digitally agile retailers. UK: We expect the e-commerce penetration rate of apparel and footwear specialty retailers’ sales to remain flat at 32.0% in 2022, based on our analysis of ONS data. We base this assumption on the ongoing strong preferences of apparel and footwear shoppers toward online shopping and the success of UK-based apparel and footwear e-commerce platforms, such as ASOS and Boohoo—which will likely influence more apparel and footwear specialty retailers to reposition their operations to place greater emphasis on e-commerce sales and fulfillment. While some major retailers, such as Next Plc, substantially exceed the UK sector average for e-commerce penetration, apparel specialty giant Primark has confirmed that it does not intend to operate an online channel despite pandemic-related store closures having cost the retailer an estimated £1.1 billion ($1.5 billion) between early 2020 and early 2021. China: China’s apparel and footwear e-commerce penetration rate slightly accelerated to 35.4% in 2021 from 35.2% in 2020, according to Euromonitor. (The National Bureau of Statistics of China does not provide online retail sales data for apparel and footwear specialty retailers). For 2022, we estimate that the share of e-commerce sales within China’s total apparel and footwear market will increase to 36.6%. We believe that the online apparel and footwear channel will remain solid in 2022 as China is still dealing with new Covid-related lockdowns and restrictions—and a greater (versus prior year) portion of Chinese consumers will likely shop online this year.Figure 5. US, UK and China: E-Commerce Share of Apparel and Footwear Specialty Retailers’ Sales (%) [caption id="attachment_147722" align="aligncenter" width="699"]

For the US and the UK, e-commerce market sizes are represented as a proportion of the apparel and footwear specialty retailers’ sales recorded by the US Census Bureau and the UK ONS, respectively (data post-2021 are Coresight Research estimates). For China, the e-commerce market size is represented as a proportion of the total apparel and footwear market size recorded by Euromonitor as the National Bureau of Statistics of China does not provide absolute numbers for apparel and footwear specialty retailers’ online sales (data post-2021 are Coresight Research estimates).

For the US and the UK, e-commerce market sizes are represented as a proportion of the apparel and footwear specialty retailers’ sales recorded by the US Census Bureau and the UK ONS, respectively (data post-2021 are Coresight Research estimates). For China, the e-commerce market size is represented as a proportion of the total apparel and footwear market size recorded by Euromonitor as the National Bureau of Statistics of China does not provide absolute numbers for apparel and footwear specialty retailers’ online sales (data post-2021 are Coresight Research estimates). Source: Euromonitor International Limited 2022 © All rights reserved/US Census Bureau/ONS/Coresight Research [/caption]

Competitive Landscape

Leading Companies Apparel and footwear specialty retail is one of the most competitive industries across the US, the UK and China, with numerous retailers competing for market share. US: Gap Inc. holds the most dominant position in the US apparel and footwear specialty retail space in terms of revenue, followed by Dick’s Sporting Goods and Academy Sports & Outdoor. Figure 6 lists the leading apparel and footwear specialty retailers, ranked by their latest US revenues. In 2022, we expect to see different growth trajectories among apparel and footwear specialty retailers by segment: retailers that focus on sportswear, athleisure and casual wear—such as Academy Sports & outdoor, Dick’s Sporting Goods and Lululemon—are showing stronger sales growth than retailers that focus on general apparel, such as Gap, American Eagle Outfitters and Urban Outfitters. Nevertheless, within the abovementioned group, American Eagle Outfitters and Gap Inc., are witnessing strong growth in their activewear and intimate apparel offerings and are looking to expand in these categories. UK: Next continues to hold the most dominant position in the UK apparel and footwear market, followed by JD Sports and Primark. Like what is happening in the US, retailers focused on sportswear and athleisure, such as JD Sports, are reporting stronger sales growth than retailers focused on general apparel, such as Primark. International apparel and footwear specialty retailers, including H&M and Inditex, hold strong positions in the UK apparel retail space. China: The China apparel retail market is more fragmented than the US and UK markets. Sportswear and casual apparel retailer Topsports International holds the most dominant position in terms of revenues. Similar to the UK landscape, international retailers, including Fast Retailing, H&M and Inditex, hold a dominant position in the China apparel retail space, as shown in Figure 6.Figure 6. US, UK and China: Leading Apparel and Footwear Specialty Retailers, Ranked by Revenue (USD Bil.) [wpdatatable id=1985 table_view=regular]

Fiscal years differ and have been allocated to the closest calendar years *Primark’s 2021 UK revenues (for the year ended September 18, 2021) and Inditex 2021 UK revenues (for the year ended January 31, 2022) are estimated as these retailers have not yet filed their UK revenues for fiscal 2021 **Inditex (China) revenues are estimated as the company does not provide a revenue breakdown for the Chinese market Source: Company reports/Coresight Research Store Numbers and Changes Below, in Figure 7, we provide store numbers and year-over-year change of leading apparel and footwear retailers across the US, the UK and China. These store data are from third-party location data provider ChainXY, which follows different definitions of apparel and footwear retail sectors in the US, the UK and China, and also includes store numbers of brands, such as Coach and Skechers, and off-pricers, such as Ross Stores, in its analysis; it excludes stores of some leading apparel and footwear specialists, such as Next and Marks & Spencer in the UK. US: Among apparel and footwear specialty retailers, Old Navy, Cato Fashions and American Eagle Outfitters hold the dominant positions in the country in terms of store count as of April 2022, according to recent data from ChainXY, a chain location data provider. While Old Navy and American Eagle Outfitters witnessed a year-over-year increase in net store openings count, Cato Fashion witnessed a decline. Overall, in the top 10 list of clothing stores, we found that off-price apparel specialty retailers, including Ross Stores, T.J. Maxx and Marshalls, and apparel brands such as Claire’s, Coach and Carter’s hold dominant positions—with apparel brands substantially expanding their store locations to grow their DTC channels. Please refer to the Appendix for a full ranking of 50 apparel brands and retailers by store numbers. UK: In terms of the number of stores, the UK apparel and footwear retail sector is dominated by both domestic players such as Primark and AllSaints as well as international players, including Claire’s and H&M. China: As ChainXY provides store count data for only international players comprising American and European apparel brands and retailers, Figure 7 provides information on only US- and UK/Europe-based companies’ Chinese store counts. In terms of physical store count, Adidas holds the most dominant position, followed by Tommy Hilfiger and H&M. Zara also featured in the top 10 list of retailers by the number of stores.

Figure 7. US, UK and China: Major Tracked Apparel and Footwear Retailers, by Number of Stores, as of April 2022 [wpdatatable id=1987 table_view=regular]

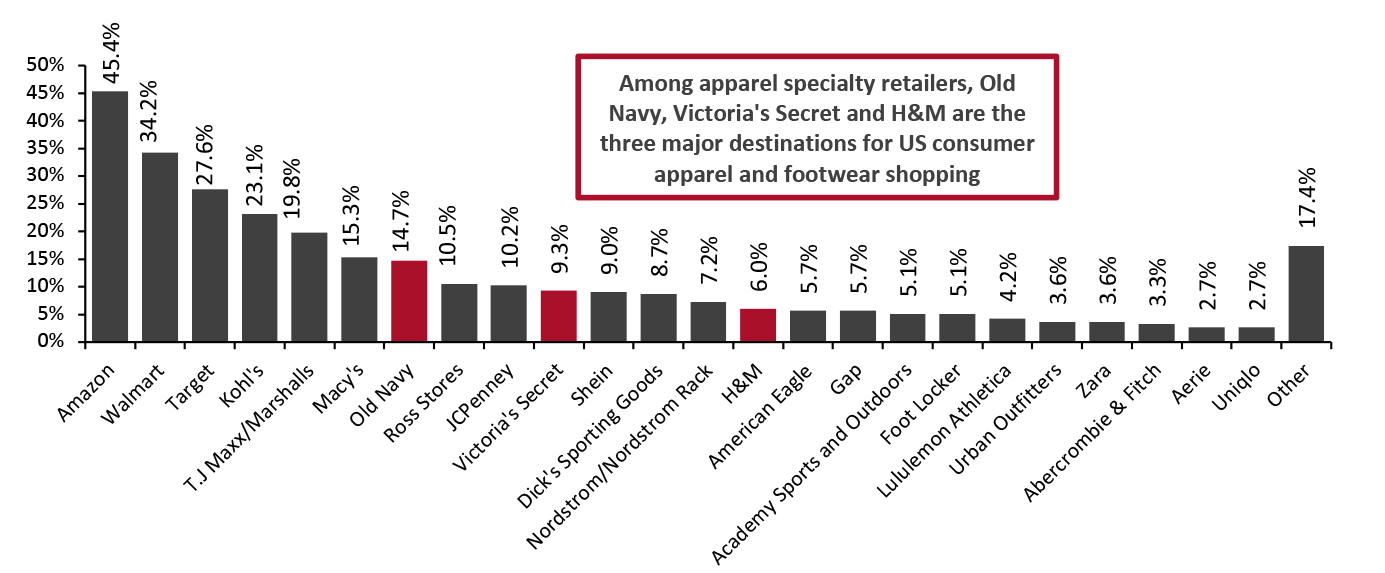

Sector defined by ChainXY; some major retailers may not be tracked/included Source: ChainXY/Coresight Research Where Consumers Are Shopping in the US and What Are They Buying Among the apparel and footwear specialty retailers, Old Navy (14.7%), Victoria’s Secret (9.3%) and Dick’s Sporting Goods (8.7%) are the top three destinations US shoppers bought clothing or apparel accessories from in the past three months ended February 7, 2022, according to Coresight Research survey data. The top three apparel and footwear specialty retailers are followed by H&M (6.0%), American Eagle (5.7%), Gap (5.7%), Academy Sports and Outdoor (5.1%) and Foot Locker (5.1%). However, overall, the results show that compared to apparel and footwear specialty retailers, e-commerce platforms (Amazon), mass merchandisers (Target and Walmart) and department stores (Kohl’s and Macy’s) are the major destinations for apparel shopping, mainly because of the larger product assortments, more convenient services such as buy online, pick up in-store (BOPIS), fast delivery and easy inventory request, according to our analysis.

Figure 8. US Apparel Shoppers: Retailers from Which They Have Purchased Clothing or Apparel Accessories in the Past Three Months (% of Respondents) [caption id="attachment_147723" align="aligncenter" width="701"]

Base: 332 US respondents aged 18+ who purchased clothing or apparel accessories in the past three months ended February 7, 2022

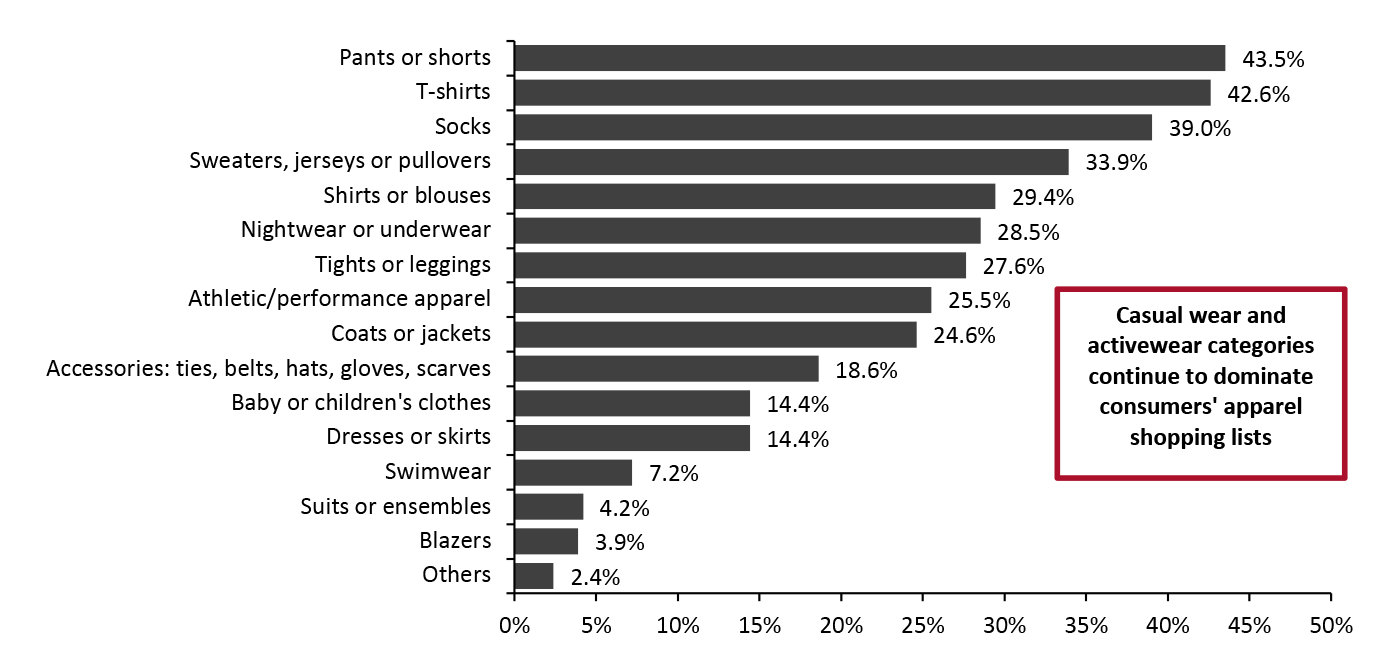

Base: 332 US respondents aged 18+ who purchased clothing or apparel accessories in the past three months ended February 7, 2022 Source: Coresight Research [/caption] By categories, pants or shorts (43.5%), T-shirts (42.6%) and socks (39.0%) are the top three clothing or apparel accessories categories US shoppers bought in the past three months ended February 7, 2022, according to our survey. On the other hand, blazers and suits or ensembles are at the bottom of the list, implying the low demand for dress wear categories, and reinforcing our insights on the continued casualization trend.

Figure 9. Respondents Who Purchased Clothing or Apparel Accessories in the Past Three Months: Categories That Consumers Purchased (%), February 2022 [caption id="attachment_147724" align="aligncenter" width="701"]

Base: 332 US respondents aged 18+ who purchased clothing or apparel accessories in the past three months ended February 7, 2022

Base: 332 US respondents aged 18+ who purchased clothing or apparel accessories in the past three months ended February 7, 2022 Source: Coresight Research [/caption]

Themes We Are Watching

We discuss three key themes that we believe present opportunities in apparel and footwear specialty retail sectors in the US, UK and China. 1. Leveraging Strategic Partnerships We are seeing more apparel retailers and brands collaborate with each other to launch new products, expand their distribution channels, capitalize on the unique strengths of each brand and take advantage of surprising partnerships to generate intrigue. Below, in Figure 10, we provide some of the key recent strategic collaborations that took place across the US, the UK and China.Figure 10. Key Recent Strategic Collaborations in the US, the UK and China [wpdatatable id=1988 table_view=regular]

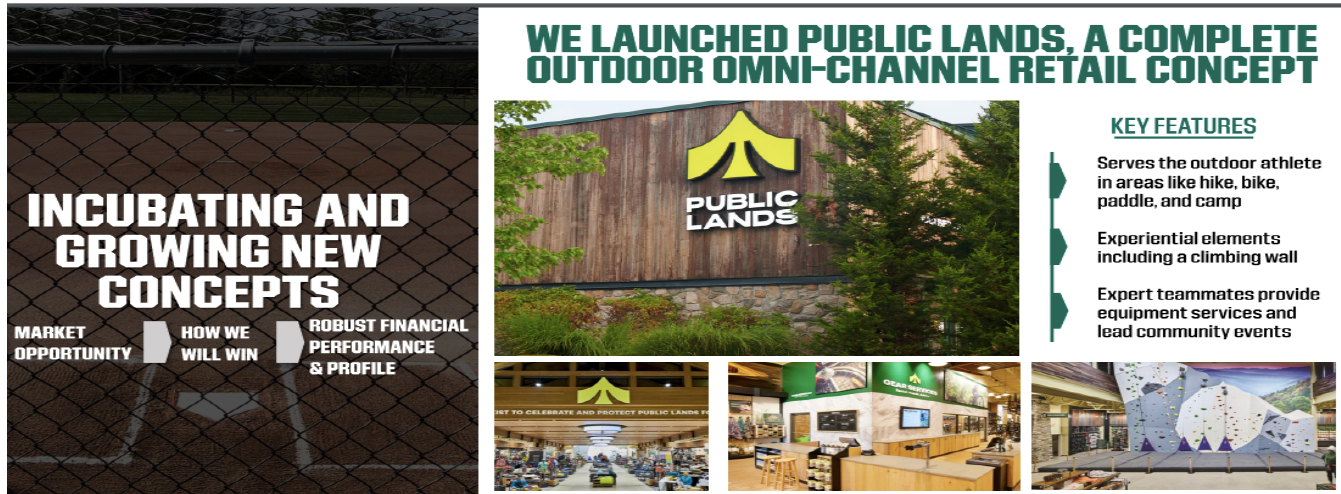

Source: Company reports 2. Physical Store Innovation In 2022 and beyond, we expect to see more apparel and footwear specialty retailers in the US, the UK and China adopt physical store innovation strategies store to drive customer engagement through personalized events and well-designed or theme-focused in-store activities. Below, we provide examples of three recent physical store innovations by apparel and footwear specialty retailers in the US, the UK and China. Dick’s Sporting Goods: Dick’s Sporting Goods announced the opening of its second Public Lands store and second Golf Galaxy Performance Center in Columbus, Ohio, in November 2021. The 60,000 sq. ft. Public Lands store is an outdoor-concept store that features a 30-foot rock wall, an in-store gear repair and rental department and specialized shops dedicated to various outdoor activities. The Golf Galaxy Performance Center offers golfers access to industry-leading TrackMan and BioMech golf technologies, hitting bays, custom fittings, golf lessons from a Class A Certified PGA Professional, and apparel and footwear from top brands. Furthermore, the company plans to open a Dick’s House of Sport store by the end of May 2022. The store will feature an outdoor turf, tech-enabled batting cage for baseball and softball, a running track, hi-tech golf hitting bays and putting green and a 35-foot rock wall, among others. [caption id="attachment_147725" align="aligncenter" width="700"]

Dick’s Sporting Goods launched its second Public Lands store in Columbus, Ohio, in November 2021

Dick’s Sporting Goods launched its second Public Lands store in Columbus, Ohio, in November 2021 Source: Dick’s Sporting Goods [/caption] Similarly, in November 2021, Uniqlo China opened its flagship store in Beijing, China, which features a customization studio that allows shoppers to design their own T-shirts using thousands of specially designed content types, including Chinese-calligraphy-themed patterns as well as Chinese-style Universal Studios and Disney motifs. [caption id="attachment_147726" align="aligncenter" width="701"]

Uniqlo launched its flagship store in Beijing, China, in November 2021

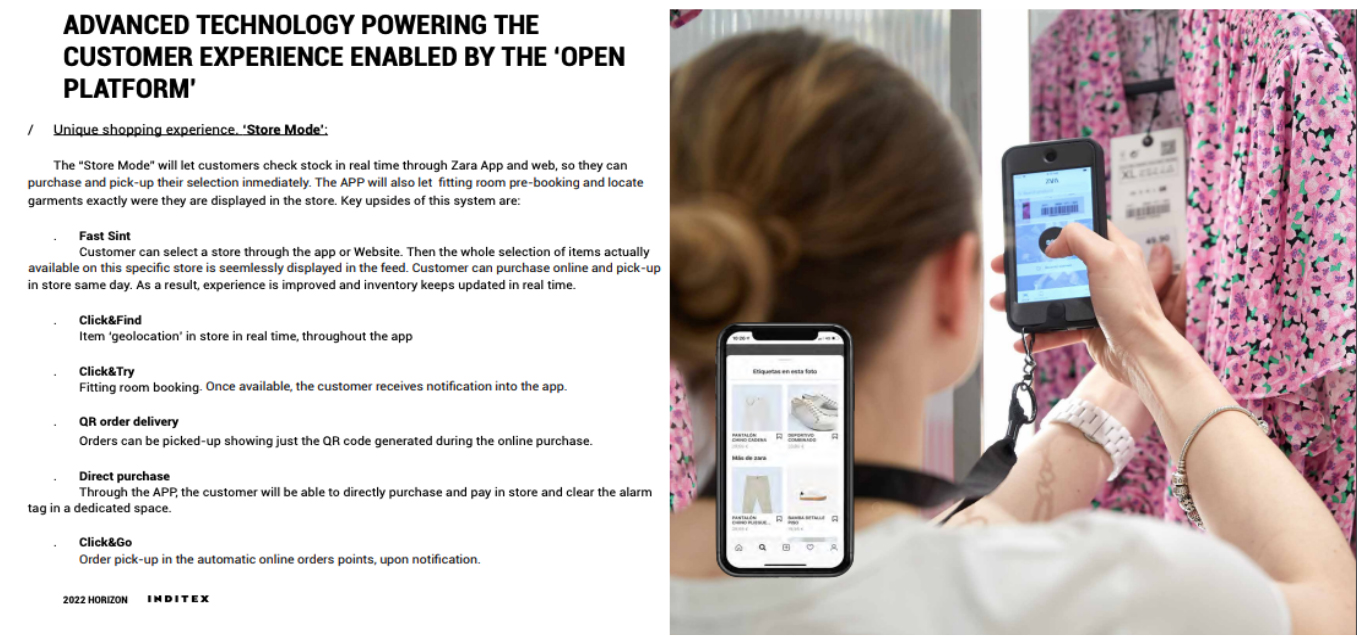

Uniqlo launched its flagship store in Beijing, China, in November 2021 Source: Fast Retailing [/caption] Earlier, in July 2021, Zara (owned by Inditex) launched its Store Mode technology across all UK stores, connecting its physical locations with its website and app. Originally tested in nine London locations, this technology can allow customers to check into any UK store online and view the products or sizes available in specific stores. Then, customers can buy and pick up in-store on the same day. [caption id="attachment_147727" align="aligncenter" width="700"]

Zara’s Store Mode technology-based mobile app

Zara’s Store Mode technology-based mobile app Source: Inditex [/caption] 3. Pricing Strategy, Product Mix and Freight Costs Remain Key Factors Impacting Gross Margins We are closely tracking what impacts the gross margins of global apparel and footwear specialty retailers to examine factors affecting companies’ business performances. Based on the operating results reported by apparel retailers in the most recent quarter, we identify appropriate pricing strategies and a better product or channel mix as positive drivers of gross margins and increasing freight costs as a negative driver of gross margins. Furthermore, we are seeing most apparel retailers using full-price strategies and adjusting product mixes to combat inflation and rising freight costs.

Figure 11. Gross Margin Metrics of Selected Apparel and Footwear Retailers [wpdatatable id=1989 table_view=regular]

Retail Innovators

Technology innovators are emerging as significant enablers of apparel and footwear retailers’ push into e-commerce expansion. Through technological innovations, these startups are helping retailers to lower inventory levels and improve efficiency, agility and resilience across their supply chains. We discuss two innovators and their impact on the apparel and footwear specialty retail sector. 1. Engagement Agents Founded in 2016 and based in Texas, US, Engagement Agents provides a Software-as-a-Service (SaaS) platform to help retailers automate, maximize and monetize their already paid expenses for malls’ and shopping centers’ marketing channels via gross rent, CAM (common area maintenance) fees, merchant association fees, marketing/ad funds and percentage rent, to drive the substantial number of impressions, traffic and sales to the retailers’ stores and online channels. Engagement Agents enables retailers to access real-time statistics and facts about consumer demand, via contact management, content distribution, marketing automation, real-time reporting, workflow optimization and actionable insights—to make better business and marketing decisions. Since its inception, Engagement Agents has helped many retailers to optimize in-store leases, drive store and online traffic and sales growth and generate savings, according to the company. This includes enabling a 1,000 store retailer to achieve in-store lease optimizations of an average of $26 million annually; driving a 29% increase in traffic for a 30-store retailer; bolstering 5% sales growth for a 100-store retailer and generating an average of $150,000 per year savings for a 140-store retailer. Some key Engagements Agents customers include apparel and footwear brand owners Adidas and Levi’s and department store chain Nordstrom. 2. GhostRetail Founded in 2020 and based in Ontario, Canada, GhostRetail creates an in-store experience online for global apparel brands and retailers, including American Eagle Outfitters and Canada Goose, through a one-to-one live video shopping platform. The live video shopping platform aims to increase a brand’s e-commerce conversions by eliminating friction in digital purchases by enabling live one-to-one streaming video with real-time in-person sales consultation, real-time shopper behavior tracking, appointment-based co-shopping, integrated product catalog searches, in-app wallet and checkout, in-app barcode scanning, associate and customer ratings, and branded lounges, among others. GhostRetail creates opportunities for apparel retailers to activate social media influencer communities and extend traditional sales forces as the platform can be used in-store, in small footprint “Ghost” studios in rural areas and at home. [caption id="attachment_147728" align="aligncenter" width="701"] American Eagle brand’s AE Live app, powered by GhostRetail

American Eagle brand’s AE Live app, powered by GhostRetail Source: American Eagle Outfitters [/caption]

What We Think

In the US, Coresight Research estimates that apparel and footwear specialty retailers’ sales will increase by mid-single digits in 2022, following robust post-crisis recovery in 2021, driven by the sustained casualization trend, growing fashion resale market, consistent economic recovery, increasing vaccinations and consumers returning to more normal ways of living. We expect most apparel and footwear specialty retailers to maintain the sales momentum from last year with variation depending on key product segments. However, rising inflation remains a key headwind. Unlike the US, the UK witnessed a slower sales recovery in 2021—and we expect that the apparel and footwear specialty retail market in the UK will grow by low-double-digits year over year in 2022—still 4.4% below the pre-crisis level. We expect to see more stabilized growth from 2023 onward in the UK. In China, we estimate apparel and footwear specialty retailers’ sales will decline by high single digits in 2022, following low-double-digit growth in 2021 as we expect the recent pandemic-related lockdowns and strict restrictions in the country to impact the sector’s sales considerably. While we believe that the recent financial measures, including lowering interest rates, adopted by the Chinese government are steps in the right direction toward lifting the economy, they may not be adequate to completely offset the impacts of ongoing pandemic-related strict restrictions, including lockdowns and mandatory isolations, on the country’s retail sector. Nevertheless, in the first quarter of 2022, China’s GDP remained strong despite the restrictions. Implications for Retailers- We see e-commerce as a significant opportunity for global apparel and footwear specialty retailers to drive sales as we expect many consumers to cement pandemic-driven online shopping habits in 2022 and beyond. However, we believe harnessing the digital consumer while also engaging consumers to bring them to the store will be key.

- We expect to see more strategic partnerships among global retailers and brands in the apparel and footwear retail industry in 2022 and beyond. Strategic collaborations can help retailers to access new technologies and expand into new consumer segments to enhance their market shares.

- We believe apparel and footwear retailers are poised to benefit from physical stores. The future of physical apparel stores will be more personalized, convenient and interesting. Therefore, it is important that apparel brands and retailers make changes to physical stores and attract customers to make purchases through strategies like apparel customization shops, and fun and fascinating in-store activities or events.

- High inflation and supply chain challenges are weighing on the margins of apparel retailers, particularly in the US. To preserve their margins, retailers should devise appropriate pricing strategies, ensure an optimal product and/or channel mix, and look to minimize the logistic costs by evaluating various means of transportation in terms of costs and benefits, and automating distribution centers, among others.

- Mall owners and landlords should utilize opportunities to rent space to retailers—to recover revenues that were lost during the pandemic years of 2020 and 2021. Mall owners and landlords should work with retailers to develop innovative ideas to utilize retail space efficiently and attract customers back to stores.

- Innovators have strong opportunities to partner with apparel and footwear specialty retailers to drive their push into e-commerce expansion. Innovators can also support apparel and footwear retailers in lowering inventory levels and improving efficiency across their supply chains.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved

Appendix: Ranking Apparel and Footwear Retailers by Store Numbers

Appendix: Figure 1. 50 Major Apparel and Footwear Retailers Ranked by US Store Numbers [wpdatatable id=1990 table_view=regular]

Sector defined by ChainXY; some major retailers may not be tracked/included Source: ChainXY/Coresight Research

Appendix: Figure 2. 50 Major Apparel and Footwear Retailers Ranked by UK Store Numbers [wpdatatable id=1991 table_view=regular]

Sector defined by ChainXY; some major retailers may not be tracked/included Source: ChainXY/Coresight Research

Appendix: Figure 3. 50 Major Apparel and Footwear Retailers Ranked by China Store Numbers [wpdatatable id=1992 table_view=regular]

Sector defined by ChainXY; some major retailers may not be tracked/included Source: ChainXY/Coresight Research