DIpil Das

What’s the Story?

While apparel speciality sectors worldwide were hit hard by the pandemic in 2020, we expect to see post-crisis recoveries in 2021. We provide our outlooks for the apparel and footwear specialty retail sectors in the US, the UK and China in 2021 and beyond. We also explore key growth drivers, competitive landscapes, notable retail innovators in the space, and opportunities arising from four key specialty apparel and footwear trends. Our recent apparel and footwear market outlook report covers overall consumer spending on apparel and footwear and considers the competitive landscape of apparel brand owners.Market Performance and Outlook

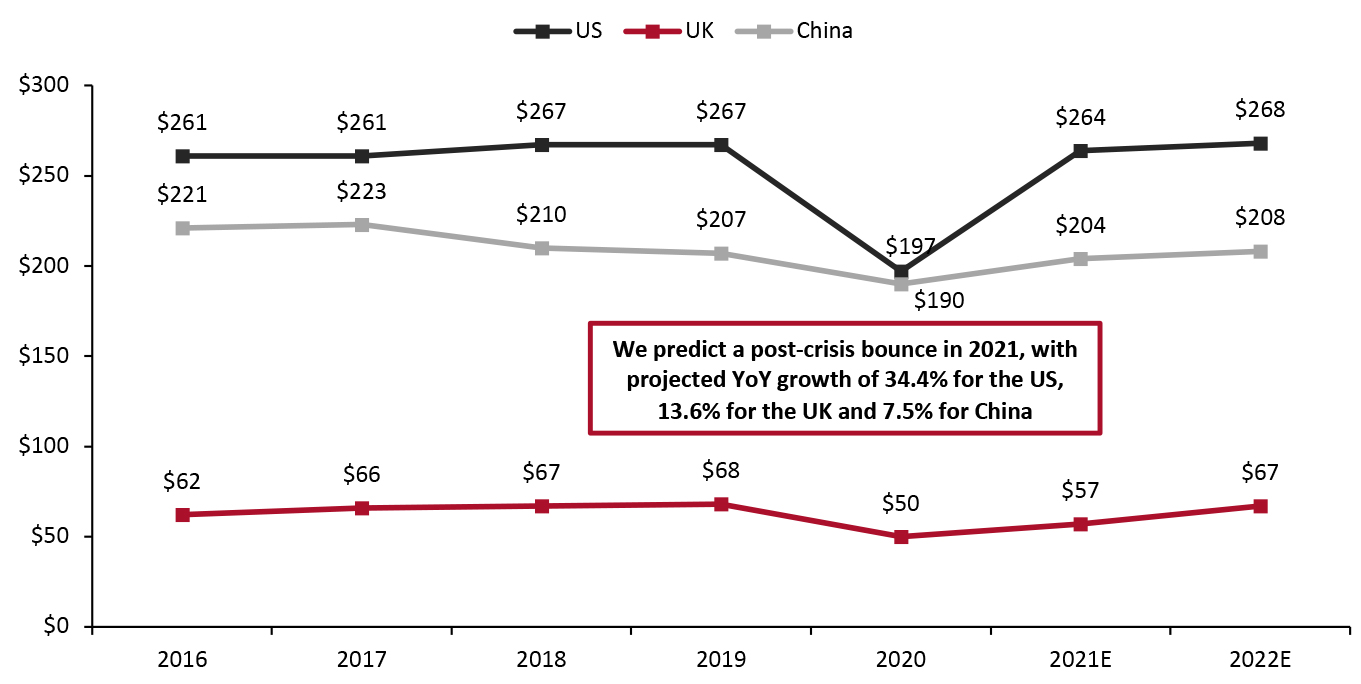

Global Specialty Apparel Sector: 2020 and Beyond US: In 2020, US clothing and footwear specialists’ sales dropped by 26.4% to approximately $197 billion (excluding sales taxes), according to the US Census Bureau, driven by deep declines through lockdowns and a sluggish recovery. In 2021, Coresight Research estimates that US specialists’ sales will increase by 34.4% to around $264 billion, only 1.1% below 2019 levels. Sales growth in 2021 will be driven by increased vaccinations, economic recovery, stimulus checks and consumers’ return to more normal ways of living and spending, particularly from the second half of the year. In 2022, we expect the US apparel and footwear specialty sector to see more stabilized growth of 1.5%. UK: Apparel and footwear specialists’ sales declined by 26.3% to $50.1 billion (including sales tax and on a constant currency basis) in 2020, according to the Office for National Statistics. We estimate that the sector will see 13.6% growth in 2021, reaching $57 billion, but remain 16.3% below 2019 levels. While the first quarter of 2021 saw UK apparel and footwear specialists’ sales decline by over 40% due to coronavirus lockdowns, we expect to see strong pent-up demand for apparel and footwear in the second quarter of 2021. We anticipate that this will be driven by increased vaccinations and easing of pandemic-related restrictions, which we discuss further in the market drivers section). In 2022, we expect the sector to recover to an approximate pre-crisis level, with estimated growth in apparel and footwear specialists’ sales of 18.5%, reaching $67 billion. We anticipate that most of the recovery will be in the first half of 2022. From the end of 2022 onward, we expect the UK apparel and footwear specialty sector to grow at a more stabilized rate. China: In 2020, total apparel and footwear specialists’ sales declined by 8.5% to $190 billion (excluding sales tax and on a constant currency basis), according to the National Bureau of Statistics of China. We forecast that the specialty apparel sector will recover to an approximate pre-crisis level by the end of 2021, with 7.5% growth in 2021—reaching $204 billion. We expect the majority of recovery to be in the second half of the year as the vaccination rollout increases in China, which has so far been slower than in the US and the UK. In 2022, we expect the sector to see more stabilized growth of 2.1%.Figure 1. US, UK and China: Apparel and Footwear Specialists’ Sales (USD Bil.) [caption id="attachment_127656" align="aligncenter" width="725"]

Source: US Census Bureau/UK Office for National Statistics/National Bureau of Statistics of China/Coresight Research[/caption]

Growth Analysis: Specialists’ Sales Versus Total Consumer Spending on Apparel and Footwear

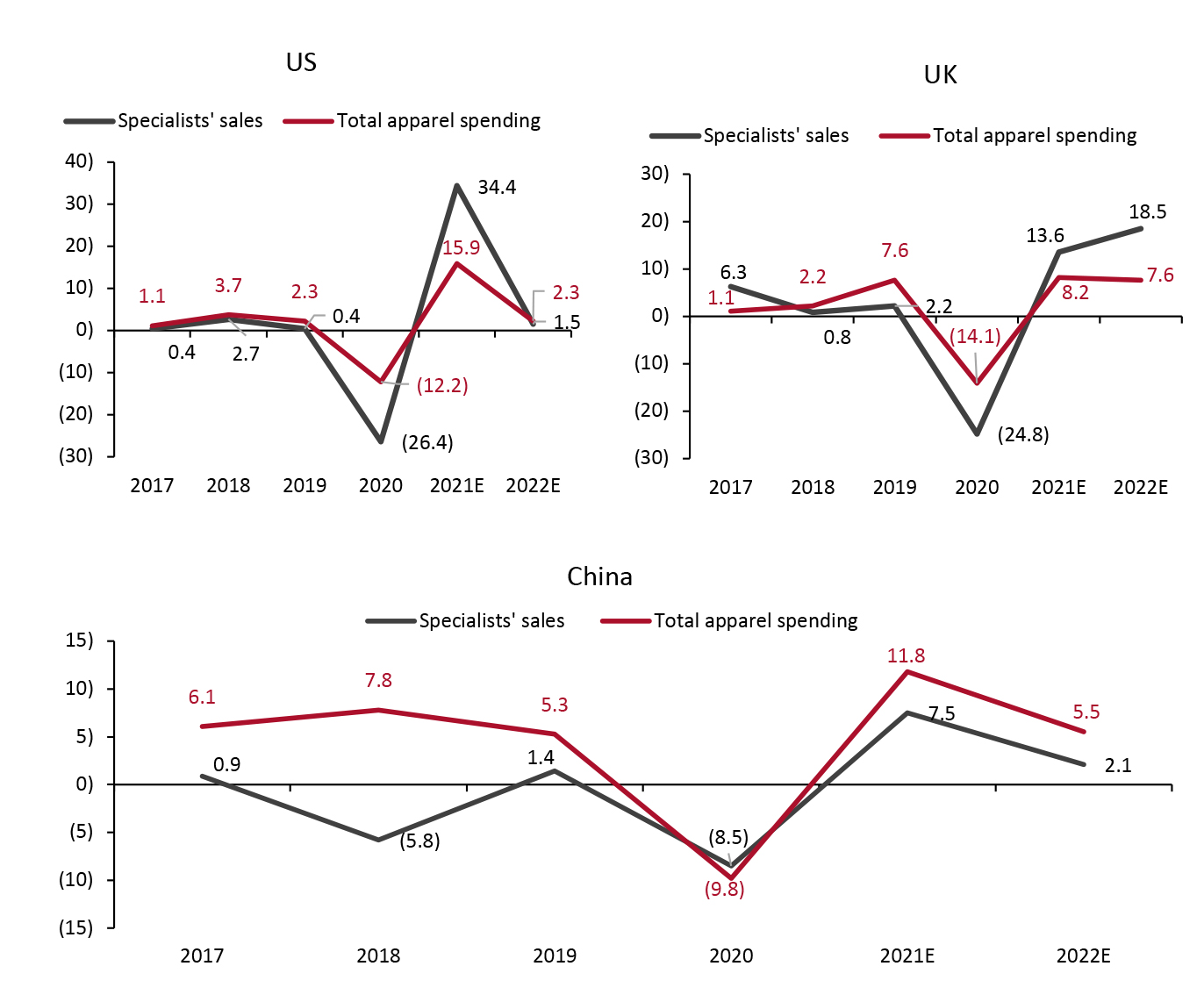

US: Clothing and footwear specialty retailers underperformed versus apparel and footwear spending in 2020, with many non-specialist retailers able to stay open amid Covid-19-related store closures. Coresight Research estimates that specialists will see substantially higher growth than total apparel and footwear spending growth in 2021 as shoppers return to stores and specialty retailers recover the majority of the ground lost to rival channels in 2020, such as online retailers and mass merchants. However, in 2022, we expect clothing and footwear specialists to see more stabilized growth, which will slightly underpace the growth of total apparel and footwear spending.

UK: Like US apparel specialists, UK specialty retailers also underperformed versus total apparel and footwear spending in 2020. We expect specialists’ sales to recover at a faster rate versus total apparel and footwear spending in 2021. Furthermore, we expect specialists’ sales growth momentum to continue in 2022 and substantially outpace the growth of total apparel and footwear spending.

China: Specialty retailers in China outperformed versus total apparel and footwear spending in 2020. Coresight Research estimates that clothing and footwear specialists’ sales growth will underpace the total clothing and footwear spending growth in the country in 2021 and 2022.

Source: US Census Bureau/UK Office for National Statistics/National Bureau of Statistics of China/Coresight Research[/caption]

Growth Analysis: Specialists’ Sales Versus Total Consumer Spending on Apparel and Footwear

US: Clothing and footwear specialty retailers underperformed versus apparel and footwear spending in 2020, with many non-specialist retailers able to stay open amid Covid-19-related store closures. Coresight Research estimates that specialists will see substantially higher growth than total apparel and footwear spending growth in 2021 as shoppers return to stores and specialty retailers recover the majority of the ground lost to rival channels in 2020, such as online retailers and mass merchants. However, in 2022, we expect clothing and footwear specialists to see more stabilized growth, which will slightly underpace the growth of total apparel and footwear spending.

UK: Like US apparel specialists, UK specialty retailers also underperformed versus total apparel and footwear spending in 2020. We expect specialists’ sales to recover at a faster rate versus total apparel and footwear spending in 2021. Furthermore, we expect specialists’ sales growth momentum to continue in 2022 and substantially outpace the growth of total apparel and footwear spending.

China: Specialty retailers in China outperformed versus total apparel and footwear spending in 2020. Coresight Research estimates that clothing and footwear specialists’ sales growth will underpace the total clothing and footwear spending growth in the country in 2021 and 2022.

Figure 2. US, UK and China: Apparel and Footwear Specialists’ Sales Versus Total Apparel and Footwear Consumer Spending (YoY % Change) [caption id="attachment_127662" align="aligncenter" width="725"]

Source: US Census Bureau/Bureau of Economic Analysis/UK Office for National Statistics/ National Bureau of Statistics of China/Coresight Research[/caption]

Source: US Census Bureau/Bureau of Economic Analysis/UK Office for National Statistics/ National Bureau of Statistics of China/Coresight Research[/caption]

Online Sector Sales

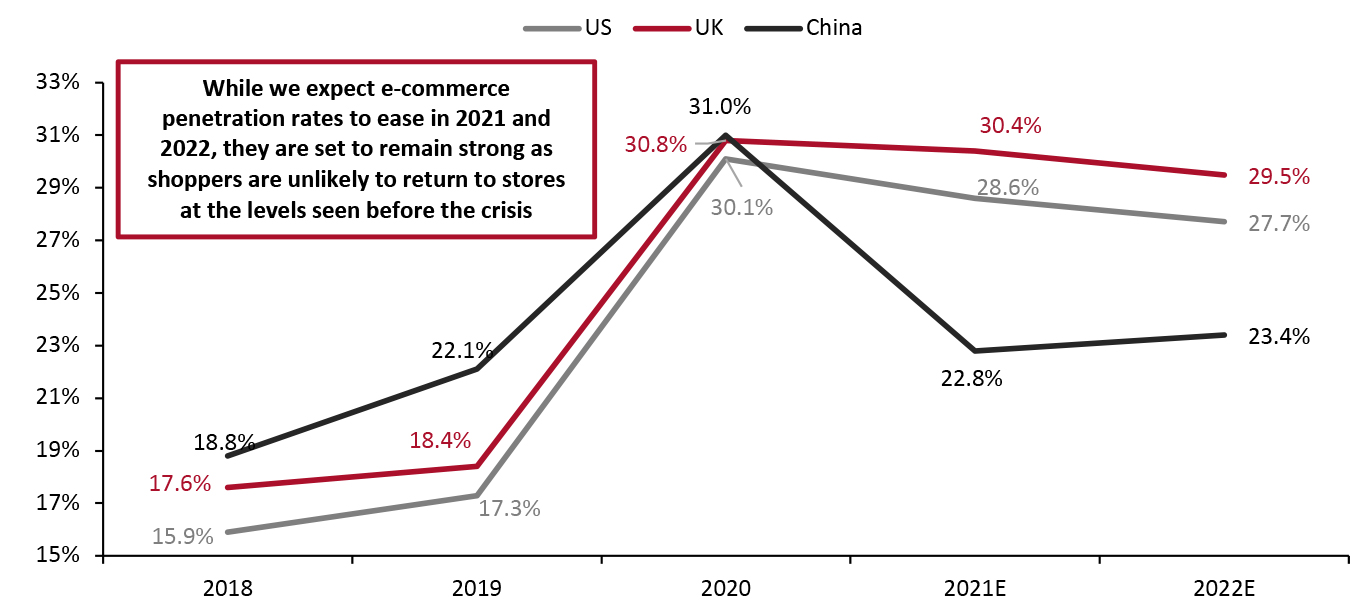

There has been an unprecedented online channel demand surge for apparel and footwear across the globe amid the Covid-19 pandemic. While the 2020 shift to online is now consolidating in 2021, we expect many apparel consumers to retain the habit of online shopping even after the crisis. We discuss e-commerce penetration growth for the US, the UK and China in 2020 and our outlook for 2021 and beyond. US: The e-commerce penetration rate of US apparel and footwear specialists’ sales grew to 30.1% in 2020, versus just 17.3% in 2019, according to the US Census Bureau. We expect the penetration rate to ease in 2021 and 2022, but remain strong on the assumption that shoppers will not return to stores at the levels seen before the crisis. Major retailers including American Eagle Outfitters, Gap Inc. and Urban Outfitters, exceed the sector average, which is offset by the performance of less digitally agile retailers. We explore this further in Figure 6. UK: We expect the e-commerce penetration rate of apparel and footwear specialists’ sales to slightly decrease to 30.4% and 29.5% in 2021 and 2022, respectively, from a 30.8% share in 2020, according to the UK Office for National Statistics. Although the e-commerce penetration rate among apparel and footwear specialists is set to slightly ease, we expect it to remain higher than pre-crisis levels. We base this assumption on the shift in apparel and footwear shopper preferences toward online shopping and the success of UK-based apparel and footwear e-commerce platforms, such as ASOS and Boohoo, which will likely force specialty retailers to reposition their operations to place more emphasis on e-commerce sales and fulfillment. While some major retailers, such as Next Plc, substantially exceed the UK sector average for e-commerce penetration, apparel specialist giant Primark has confirmed that it does not intend to operate an online channel despite pandemic-related store closures having cost the retailer an expected £1.1 billion ($1.5 billion) in 2020 and 2021. China: The overall e-commerce penetration rate in China’s total apparel and footwear market reached 31.0% in 2020, according to Euromonitor. (The National Bureau of Statistics of China does not provide online retail sales data for apparel and footwear specialist retailers). We believe that many Chinese consumers are likely to return to their pre-crisis physical store shopping habits. This is in line with Euromonitor’s forecasted decline in the share of e-commerce sales within China’s total apparel and footwear market to 22.8% in 2021, reaching 23.4% in 2022. While this is well below 2020 levels, the anticipated e-commerce penetration rate marks a slight increase from 2019—indicating continued opportunities e-commerce opportunities despite easing in the channel.Figure 3. US, UK and China: E-Commerce Share of Apparel and Footwear Specialists’ Sales (%) [caption id="attachment_127658" align="aligncenter" width="725"]

For the US and the UK, e-commerce market sizes are represented as a proportion of the apparel and footwear specialists’ sales recorded by the US Census Bureau and the UK Office for National Statistics, respectively (data for 2021 and 2022 are Coresight Research estimates). For China, the e-commerce market size is represented as a proportion of the total apparel and footwear market size recorded by Euromonitor as the National Bureau of Statistics of China does not provide absolute numbers for apparel and footwear specialists’ online sales.

For the US and the UK, e-commerce market sizes are represented as a proportion of the apparel and footwear specialists’ sales recorded by the US Census Bureau and the UK Office for National Statistics, respectively (data for 2021 and 2022 are Coresight Research estimates). For China, the e-commerce market size is represented as a proportion of the total apparel and footwear market size recorded by Euromonitor as the National Bureau of Statistics of China does not provide absolute numbers for apparel and footwear specialists’ online sales. Source: Euromonitor International Limited 2021 © All rights reserved/US Census Bureau/Office for National Statistics/Coresight Research [/caption]

Market Drivers

We expect sales in the specialty apparel and footwear sectors in the US, the UK and China to be driven by four key factors in 2021 and beyond, as detailed in Figure 4.Figure 4. Key Growth Drivers for Apparel and Footwear Specialists’ Sales in the US, the UK and China [wpdatatable id=978 table_view=regular]

Source: US Congressional Budget Office/UK Office for Budget Responsibility/IMF/ThredUP/H&M/Coresight Research

Competitive Landscape

Apparel specialty retail is one of the most competitive industries across the US, the UK and China, with numerous retailers competing for market share. We provide extensive coverage of the key players under our Coresight 100 focus retailers list. US: The top 10 apparel and footwear retailer specialists accounted for 41.7% of total apparel and footwear specialists’ retail sales in 2020. Off-price apparel specialists, including Burlington Stores, Ross Stores and TJX held dominant positions in the country. International apparel giant H&M was also part of the top 10 apparel specialty retailers in the US by sales in 2020. We provide extensive insight into these retailers under our Coresight 100 coverage. UK: In 2020, the top 10 apparel and footwear specialty retailers accounted for 60.6% of total sector sales. The UK apparel and footwear retail sector is dominated by both domestic players, such as Primark and Next, as well as international players, including H&M and Inditex. China: The China apparel retail market is more fragmented than the US and UK markets, with the top 10 apparel and footwear specialty retailers accounting for a 21.1% share of total consumer spending in 2020. International retailers, including Fast Retailing, H&M and Inditex, hold a dominant position in the China apparel retail space, as shown in Figure 5.Figure 5. US, UK and China: Top 10 Apparel and Footwear Specialty Retailers, Share of Sector Sales in 2020 (%) [wpdatatable id=980 table_view=regular]

*Mark & Spencer (M&S) is not included in the UK list because Euromonitor classifies M&S as a department store. **Arcadia Group went bankrupt and sold its HIIT, Miss Selfridge, Topman and Topshop brands to ASOS in February 2021 and the intellectual property rights, digital assets and e-commerce rights of its Burton, Dorothy Perkins and Wallis brands to Boohoo. ***Edinburgh Woollen Mill went into administration and was sold to a consortium of international investors in January 2021. ****Clarks Footwear went into administration and sold its majority stake to Hong Kong-based private equity firm Lionrock Capital in November 2020. Source: Euromonitor International Limited 2021 © All rights reserved Apparel and Footwear Specialty Retailers: Latest Quarterly Growth and Outlook Reports We present recent quarter growth numbers of major publicly listed apparel and footwear retailers and summarize key commentary on their future outlook.

Figure 6. Selected Leading Apparel and Footwear Specialty Retailers in the US, the UK and China: Quarterly Sales Growth, E-Commerce Growth, Online Penetration (%) and Key Commentary [wpdatatable id=982 table_view=regular]

Source: Company reports/Coresight Research

Retail Innovators

Technology innovators are emerging as a significant enabler to apparel and footwear retailers’ push into e-commerce expansion. Through technological innovations, these startups are helping retailers to lower inventory levels and improve efficiency, agility and resilience across their supply chains. We discuss three innovators and their impact on the apparel and footwear specialist market. 1. HeartDub Founded in 2011 and based in Beijing, HeartDub innovates in digitalized fabric and textile technology in the clothing industry. Its artificial intelligence (AI)-driven “physics-engine” collects data on physical fabrics and analyzes structural elements, including colors, designs and patterns, to create “virtual fabrics to be worn by virtual models.” The digital clothing try-on tool is programmed so that the virtual model makes realistic movements, demonstrating how clothes would look on a human body in real life. The innovation reduces the cost of designing and developing fabrics compared to traditional methods—which typically involves making physical samples and getting approval before closing a contract. The software can thus optimize transactions between apparel manufacturers and specialty retailers. HeartDub’s solution can cut development production costs by 50% while shortening sample delivery time by 90%, according to CEO Huang Jingshi. The company plans to use its technology to connect more players across the supply chain through online clothing design, virtual try-on functions, digital runway shows, and virtual character creation for games and films, contributing to the digitalization of the apparel industry. More than eight companies currently use HeartDub services, including France-based fashion company SMCP Group and Chinese textile giant Shandong Ruyi, which owns UK-based luxury fashion brand Aquascutum. 2. Newmine Founded in 2011 and based in Massachusetts, US, Newmine’s Chief Returns Officer, an AI-powered platform, enables retailers to holistically view returns data and provides analysis and prescriptive actions across the value chain. The Chief Returns Officer platform uses anomaly detection and natural language processing to identify the root cause of returns—generating corrective actions that retailers can take to reduce future returns and empower teams in different departments to collaborate seamlessly. This technology offering aims to improve retailers’ bottom lines by minimizing product returns, which are a significant cost driver across retail—and particularly for apparel and footwear specialists. In January 2021, Newmine launched KeepScore, a success benchmark that enables retailers to quickly identify their most profitable products, suppliers and customers by understanding which products customers chronically return and which they keep. 3. Nexite Founded in 2017 and based in Israel, Nexite collects and provides real-time in-store data to retailers, helping them to identify which of their products generate the most engagement and the highest conversion rates. Furthermore, Nexite provides data-driven store arrangement insights, thus enabling retailers to manage their omnichannel businesses effectively—which will be crucial for apparel and footwear specialists looking to compete with e-commerce platforms. Nexite is also working to develop in-home smart closets that can recommend apparel outfits, new purchases and resale options by leveraging the same tags and technology that Nexite uses with its retail partners. Currently, Nexite is conducting a pilot test with a global brand in Tel-Aviv, Israel. According to the company, it also has three upcoming projects set to take place in the US and Europe with some of the world’s largest fashion companies. [caption id="attachment_127659" align="aligncenter" width="725"] Source: Nexite[/caption]

Source: Nexite[/caption]

Themes We Are Watching

We discuss four key themes that we believe present opportunities in specialty apparel and footwear retail. 1. Demand for Activewear, Athleisure and Intimates Amid the pandemic, we have seen strong demand for activewear and athleisure. We expect to see different recovery trajectories among apparel and footwear specialists by segment—for instance, retailers that focus on activewear and athleisure, such as Bosideng International, DICK’s Sporting Goods, Foot Locker and Lululemon are showing stronger signs of recovery and growth than retailers that mostly focus on general apparel, such as American Eagle Outfitters, Gap Inc., Fast Retailing, H&M and Inditex. Nevertheless, within the above mentioned group, American Eagle Outfitters and Gap Inc., are witnessing strong growth in their activewear and intimate apparel offerings and are looking to expand in these categories, which we discuss below:- American Eagle Outfitters’ intimates apparel brand Aerie posted a 25% increase in sales in its fourth quarter, ended January 31, 2021, which marked 25 consecutive quarters of double-digit growth for the brand. The company aims to double its Aerie banner revenue to $2 billion by 2023. In July 2020, American Eagle Outfitters launched its new activewear brand “OFFLINE,” with plans to open 30 OFFLINE stores in 2021. American Eagle Outfitters anticipates strong growth in this category.

- Gap Inc.’s activewear brand Athleta reported a double-digit increase in sales in its fourth quarter, ended January 31, 2021. The company continues to expand the banner, with the goal of doubling Athleta sales to $2 billion in 2023 from $1 billion in 2019. This equates to 20.0% of the company's total revenues, up from 12.5% in 2019.

- American Eagle Outfitters: On January 21, 2021, the company set out its goal of being carbon neutral in its company-owned facilities by 2030. Moreover, by 2023, American Eagle Outfitters plans to reduce its water use per pair of jeans by 30% and achieve 100% sustainable cotton sourcing. We see this as a positive move for the company in engaging with today’s fashion shopper.

- H&M: In December 2020, H&M Foundation, in partnership with The Hong Research Institute of Textiles and Apparel, announced plans to invest $100 million over five years in the Planet First program, an initiative that works toward finding sustainable solutions for the fashion industry. Moreover, in November 2020, H&M reached a multi-year partnership with Swedish textile recycling company Renewcell to supply H&M with thousands of tons of circulose fibers made from unusable textile waste. This comprises part of the company’s 2030 goal that aims at improving sustainability in its material sourcing.

- Inditex: In February 2021, Inditex partnered with Asia-based bank DBS to provide finance to over 2,000 Indian organic cotton farmers in the retailer’s supply chain to bolster sustainable farming practices.

- Next Plc: On March 4, 2021, Next joined the US Cotton Trust Protocol as part of its goal to source 100% of its main raw materials from sustainable and responsible sources by 2025. The US Cotton Trust Protocol will provide Next with verified data on the practices used on US cotton farms in six important areas of sustainability: energy use, water use, greenhouse emissions, land use efficiency, soil carbon and soil loss.

- ASOS: The company acquired HIIT, Miss Selfridge, Topman and Topshop brands from UK-based apparel and footwear company Arcadia Group for £265 million ($362 million) in February 2021.

- Boohoo: In February 2021, Boohoo acquired the intellectual property rights, digital assets and e-commerce rights of Arcadia Group brands Burton, Dorothy Perkins and Wallis out of administration for £25.2 million ($35.2 million). Boohoo expects the acquisition to grow the company’s market share across a broader demographic, such as in menswear. The acquired brands had over 2 million active customers in 2020. Earlier in January 2021, Boohoo acquired UK-based department store Debenhams from the latter’s administrators for £55 million ($75.4 million). The deal included the department store’s brand assets, e-commerce operations, intellectual property, and own-label beauty and fashion products.

- JD Sports: In February 2021, UK-based sportswear retailer JD Sports entered into an agreement to acquire US-based athletic apparel and footwear retailer DLTR for £355 million ($495 million). This followed JD Sports’ acquisition of US-based footwear retailer Shoe Palace for £240 million ($325 million) in December 2021.

- Next Plc: On March 10, 2021, Next entered into an agreement to acquire a 25% indirect stake in UK-based apparel retailer Reiss Limited through the purchase of shares from existing shareholders. In its fiscal year ended February 1, 2020, Reiss achieved a turnover of £227 million ($300 million), an increase of 22% from fiscal 2019. Reiss currently operates in 14 countries through 79 stores, 104 concessions, and via wholesale and franchises. In the company’s fiscal 2021 earnings conference call held on April 1, 2021, CEO Simon Wolfson stated that Next is more interested in acquiring minority stakes in a number of independently run businesses than acquiring fewer businesses outright. This strategy will help management to focus on Next operations and reduce the risk of getting sucked into the day-to-day management of acquired businesses.

- Sportswear and casual clothing company American Giant witnessed traffic growth of 68%, with monthly visits at 394,000.

- Department store Neighborhood Goods saw traffic growth of 64%, with monthly visits at 35,000.

- Men’s apparel company Original Stitch saw traffic growth of 117%, with monthly traffic at 48,000.

- Outdoor apparel company Parks Project witnessed a traffic rise of 86%, with monthly traffic at 375,000.

- Fashion and lifestyle brand Rowing Blazers saw 127% traffic growth, with monthly visits at 204,000.

- Themed party apparel company Shinesty reported 55% traffic growth, with monthly visits at 416,000.

- Holiday-themed apparel company Tipsy Elves saw traffic growth of 337%, with average monthly visits at 57,000.

- Men’s apparel company Untuckit saw a traffic increase of 47%, with monthly traffic at 610,000.

What We Think

While many apparel and footwear specialty retailers across the US, the UK and China underperformed in 2020, we expect to see a solid recovery in 2021 and beyond—albeit with varying rates across regions and retailers, depending on their key product segments. In the US, Coresight Research estimates that specialists’ sales will increase by 34.4% in 2021, weighted toward the second half of the year, and return to a near pre-crisis level in 2022. For the UK, we expect specialists’ sales to witness a 13.6% increase in 2021 and recover to an approximate pre-crisis level by 2022. Unlike the US and the UK, China is witnessing a much faster recovery—we forecast that the apparel and footwear market will fully recover to a pre-crisis level in 2021, with 7.5% growth for the year, and we expect to see more stabilized growth from 2022 onward in the country. Implications for Retailers- We see e-commerce as a significant opportunity for apparel and footwear retailers to drive sales as we expect a large number of consumers to cement pandemic-driven online shopping habits in 2021 and beyond. We recommend that retailers enhance their digital capabilities, such as with new distribution centers and expanded ship from store capabilities.

- Apparel and footwear specialty retailers should continue to take proactive steps toward sustainability in order to win consumer trust and attract investors and employees in a dynamic retail landscape.

- We expect to see substantial M&A activity in the global apparel and footwear retail industry in 2021 and beyond. Acquisitions present opportunities for apparel and footwear giants to acquire new technologies and expand into new consumer segments to enhance their market shares. For struggling apparel and footwear retailers, M&A activity presents an opportunity to fix what is not working, for instance, long-term strategies could address the core retail business misdirection that led to the initial collapse. Although retailers lose control over their operations, there is upside potential for substantial synergy.

- Innovators have strong opportunities to partner with apparel and footwear specialty retailers to drive the push into e-commerce expansion. Innovators can also support apparel and footwear retailers in lowering inventory levels and improving efficiency, agility and resilience across their supply chains.

- Apparel and footwear retailers may look to acquire innovators with the goal of generating substantial synergy in their new retail models, as exemplified by Lululemon’s acquisition of US livestreaming service provider MIRROR.

Source for all Euromonitor data: Euromonitor International Limited 2021 © All rights reserved