DIpil Das

What’s the Story?

The pandemic has been driving changes in the global apparel and footwear industry: Consumer preferences have evolved; business models have shifted; and retailers have been improving their digital capabilities. We see 2021 as a year for trends such as casualization, sustainability and omnichannel business to reach new stages of maturity in the apparel and footwear market. This report provides an update to our Market Outlook from March 2021.Market Performance and Outlook

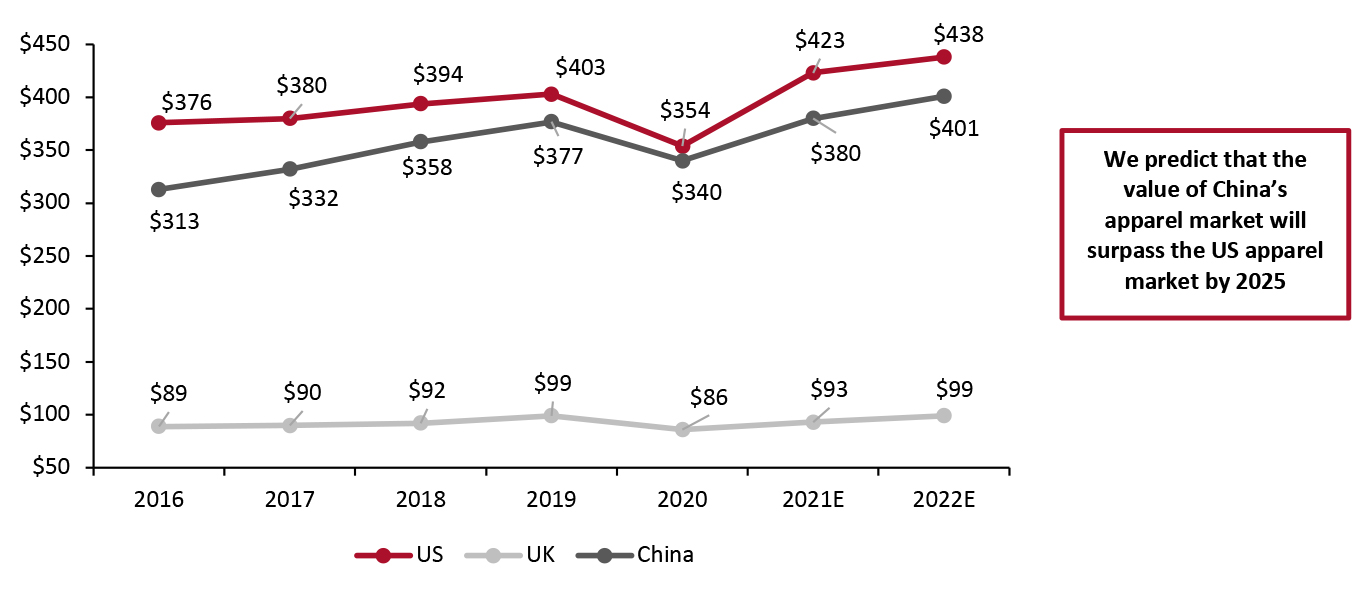

Global Apparel Market Overview The US The US apparel and footwear market totaled $354 billion in 2020—down 12.2% year over year and hitting a record low since 2013, according to the Bureau of Economic Analysis (BEA). This decline was primarily due to the impacts of the global Covid-19 pandemic. We estimate that the market will recover with 19.5% growth in 2021, reaching $423 billion, with the rollout of vaccines and consumers being able to return to more regular ways of living, working and spending. This is a significant increase from our prior estimate of a 7.0% year-over-year increase in 2021, in the context of a very strong recovery for apparel year to date, supported by rounds of stimulus payments. Fueled by those payments to consumers, on a two-year basis, apparel and footwear spending growth averaged 13.3% between January and June 2021; our full-year estimates assume a moderation in the two-year growth rate in the second half. We expect the market to grow with a stabilized low-single-digit percentage rate in 2022 and beyond. The UK The UK apparel and footwear market was worth $86 billion in 2020, down 12.5% year over year. The market has been more severely impacted by the pandemic than the US apparel and footwear market. We estimate that the UK market will grow by 8.1% year over year in 2021 (to $93 billion) and by 6.5% in 2022 (to $99 billion). When the UK apparel market recovers, we expect it to grow at a more stabilized rate of around 2–4% in 2023 and beyond. China The apparel and footwear market in China declined by 9.8% in 2020, totaling approximately $340 billion, according to Euromonitor International. We expect the market to fully recover to a pre-crisis level in 2021, seeing 11.8% growth and totaling $380 billion. We estimate that the market will grow at a more moderate 5.5% in 2022 to reach $401 billion—still behind the estimated value of the US market (see Figure 1). The value of China’s apparel market is likely to surpass the US apparel market by 2025.Figure 1. US, UK and China: Apparel and Footwear Market Value (USD Bil.) [caption id="attachment_130981" align="aligncenter" width="725"]

Coresight Research sourced US and UK apparel consumer spending data to measure the US and UK apparel market. The US personal consumption expenditures are seasonally adjusted at annual rates. The UK household expenditures are not seasonally adjusted. For the China market, we sourced Euromonitor International data for better comparison.

Coresight Research sourced US and UK apparel consumer spending data to measure the US and UK apparel market. The US personal consumption expenditures are seasonally adjusted at annual rates. The UK household expenditures are not seasonally adjusted. For the China market, we sourced Euromonitor International data for better comparison. Source: Euromonitor International Limited 2021 © All rights reserved/UK Office for National Statistics/US BEA/Coresight Research [/caption]

Market Drivers

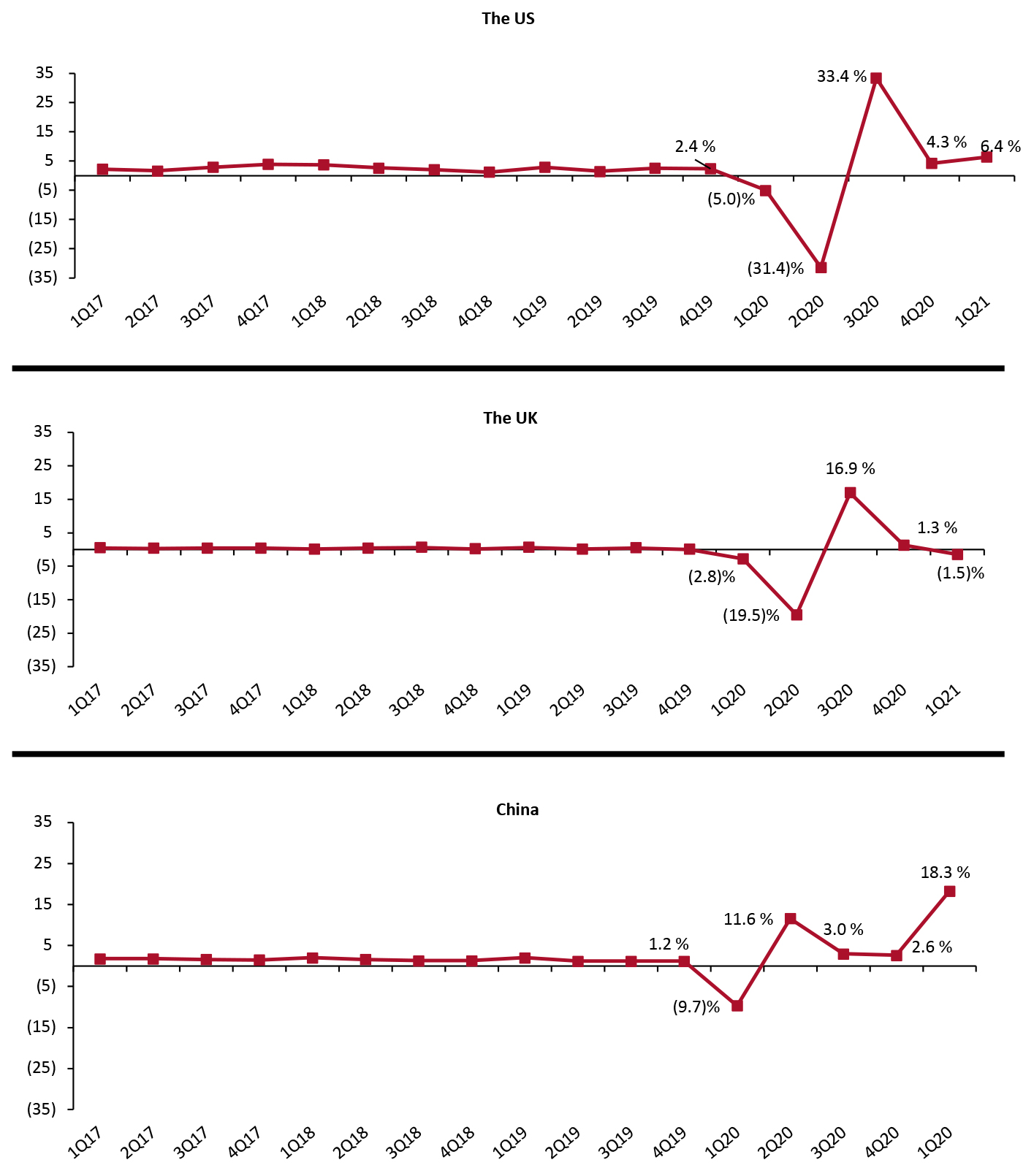

Vaccinations and Consumers’ Return to Normal Behavior While 2020 saw pandemic-led retail shutdowns, 2021 is bringing vaccine rollouts in the US, the UK and China, which offer a path out of the pandemic. In the US, 53.5% of the population have received at least one vaccine and 45.1% of the population are fully vaccinated as of June 21, 2021, according to the Centers for Disease Control and Prevention. The US has also been easing Covid-19 lockdowns and has allowed stores and restaurants to reopen—albeit with policies varying by state. By comparison, approximately 61.8% of the UK population—more than 42 million people—have received at least one dose of a vaccine as of June 21, according to the UK government. The government ended all lockdown restrictions in England on July 19. China’s vaccination drive is falling behind the US and the UK due to consumers’ fears around vaccine safety. As of June 21, 2021, 7.1% of the Chinese population are fully vaccinated. Economic Recovery We saw GDP recover strongly in the US and China in the third and fourth quarters of 2020 and the first quarter of 2021, and we believe that this will continue, driving increases in personal consumer expenditure and fueling the recovery of apparel and footwear markets in 2021. GDP in the UK also recovered quickly in the third and fourth quarters of 2020, but declined slightly in the first quarter of 2021. According to the most recent estimates from the Bureau of Economic Analysis (BEA), the US economy saw 6.4% quarter-over-quarter growth in the first quarter of 2021 (annualized and seasonally adjusted), following an increase of 4.3% and 33.4% in the fourth and third quarter in 2020, respectively. The UK economy grew at a rate of 1.3% from the preceding quarter (annualized and seasonally adjusted) in the fourth quarter of 2020, following an increase of 16.9% in the third quarter, according to data from the UK Office for National Statistics. Although the economy declined by 1.5% in the first quarter of 2021, we believe it was a temporary fallback and the economy will likely recover in the second half of 2021. The high increases in third-quarter 2020 GDP in the US and the UK reflect economic recovery from the declines in the first two quarters of 2020, but the relatively modest or negative fourth-quarter 2020 and first-quarter 2021 growth rates indicate the ongoing impact of the pandemic. The Chinese economy recovered sooner than the US and the UK, and its most severe quarter-over-quarter decline, in the first quarter of 2020, was much less deep. China’s GDP growth of 11.6% in the second quarter of 2020 was followed by 3.0% and 2.6% increases in the third and fourth quarters respectively, according to the National Bureau of Statistics of China. China’s GDP growth surged to 18.3% in the first quarter of 2021, showing strong economic recovery.Figure 2. GDP: Change from Preceding Quarter (Annualized; %) [caption id="attachment_130982" align="aligncenter" width="725"]

Source: US BEA (top)/UK Office for National Statistics (middle)/National Bureau of Statistics of China (bottom)[/caption]

Source: US BEA (top)/UK Office for National Statistics (middle)/National Bureau of Statistics of China (bottom)[/caption]

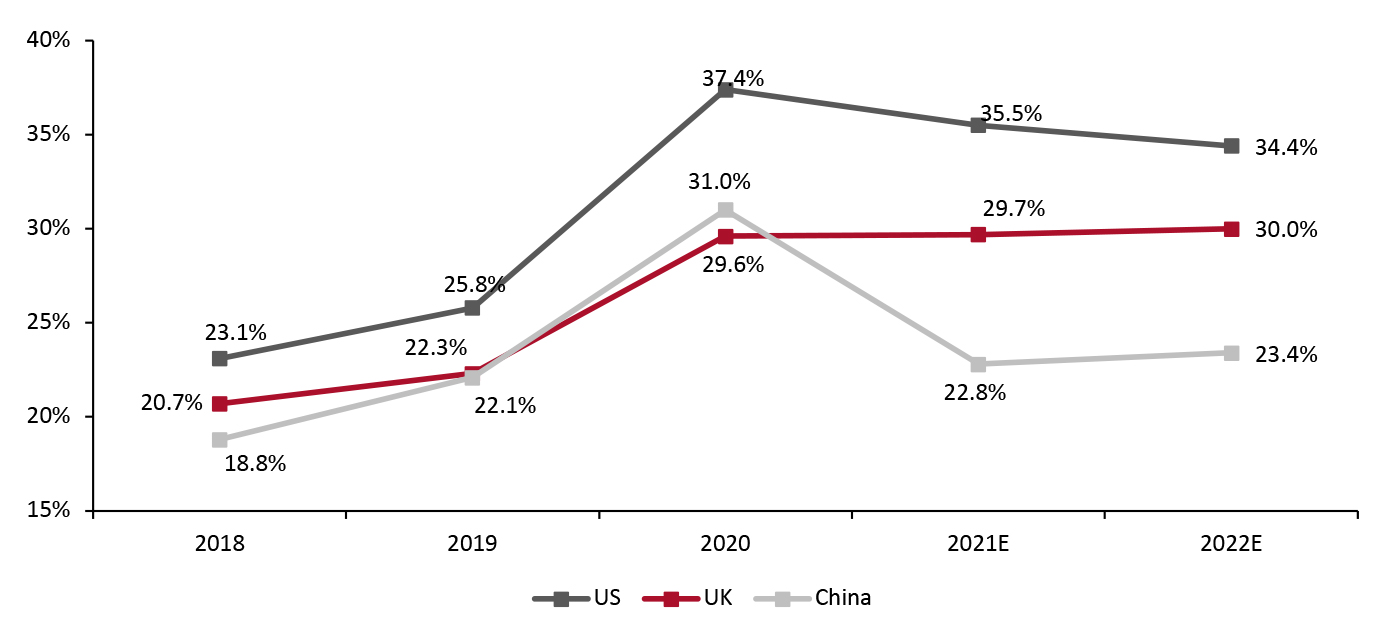

Online Market

Coresight Research estimates that the US online apparel market grew to account for 37.4% of the country’s total apparel and footwear sales in 2020, versus just over one-quarter in 2019. On the assumption that shoppers return to stores in 2021 and into 2022, albeit not at the levels seen before the crisis, we expect the penetration rate of apparel and footwear e-commerce to ease in each of those years. We currently model a leveling-off in terms of e-commerce share in 2021 and 2022 (see Figure 3), although this outlook is highly tentative. We estimate that the penetration rate of e-commerce in the UK apparel and footwear market will slightly increase to 29.7% and 30.0% in 2021 and 2022, respectively, from a 29.6% share in 2020. The China apparel online channel grew to account for 31% of total apparel and footwear sales in 2020, versus 22.1% in 2019, according to Euromonitor. The penetration rate of China apparel and footwear e-commerce will decline to 22.8% and 23.4% in 2021 and 2020 as a large portion of Chinese consumers still retain the habit of shopping in-store and are likely to return to stores for shopping after the pandemic.Figure 3. US, UK and China: E-Commerce Penetration Rate in the Apparel and Footwear Market (% of Total Apparel and Footwear Sales) [caption id="attachment_130983" align="aligncenter" width="725"]

Note: All UK and China e-commerce data, and US e-commerce data prior to 2020, are sourced from Euromonitor (US data for 2020 and thereafter are Coresight Research estimates). For comparability, e-commerce market sizes are represented as proportions of the total apparel and footwear market sizes recorded by Euromonitor (US market size adjusted by Coresight Research for 2020 and thereafter). For the UK and US, these base market sizes differ from the consumer spending figures cited earlier in this report, which are from different source.

Note: All UK and China e-commerce data, and US e-commerce data prior to 2020, are sourced from Euromonitor (US data for 2020 and thereafter are Coresight Research estimates). For comparability, e-commerce market sizes are represented as proportions of the total apparel and footwear market sizes recorded by Euromonitor (US market size adjusted by Coresight Research for 2020 and thereafter). For the UK and US, these base market sizes differ from the consumer spending figures cited earlier in this report, which are from different source. Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research [/caption]

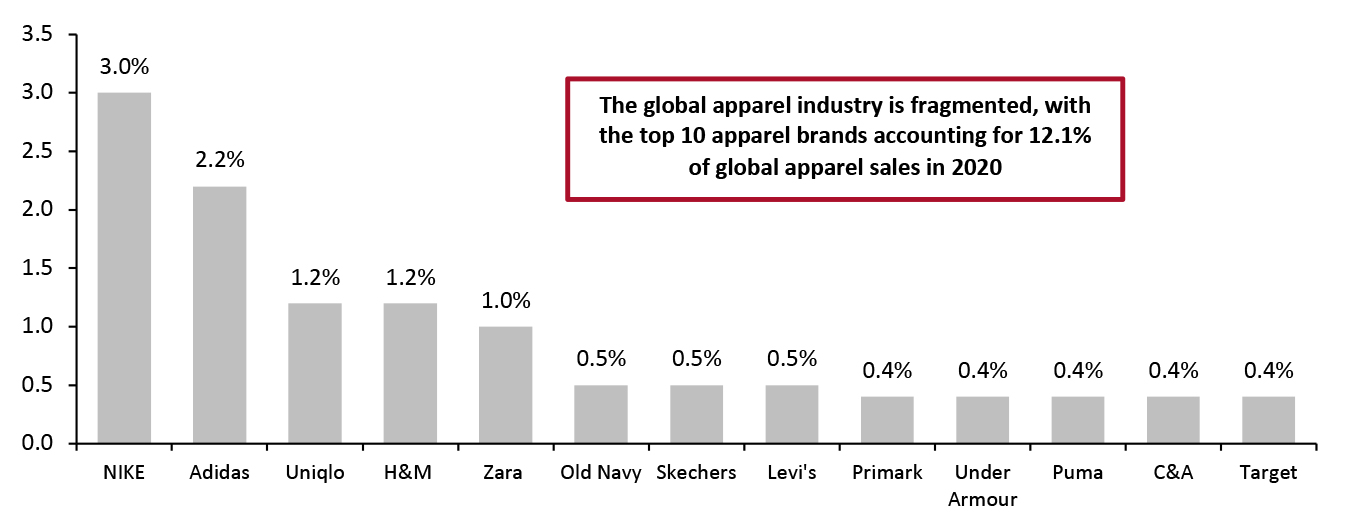

Competitive Landscape

The global apparel industry is fragmented, with the top 10 apparel brands accounting for 12.1% of global apparel sales in 2020, according to data from Euromonitor International. Even NIKE, which sells in 170 countries worldwide, holds just 3% of the global apparel market. Adidas has a 2.2% share, followed by Uniqlo (1.2%), H&M (1.2%) and Zara (1.0%).Figure 4. Top 10 Global Apparel and Footwear Brands: Market Share, 2020 (%) [caption id="attachment_130984" align="aligncenter" width="724"]

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

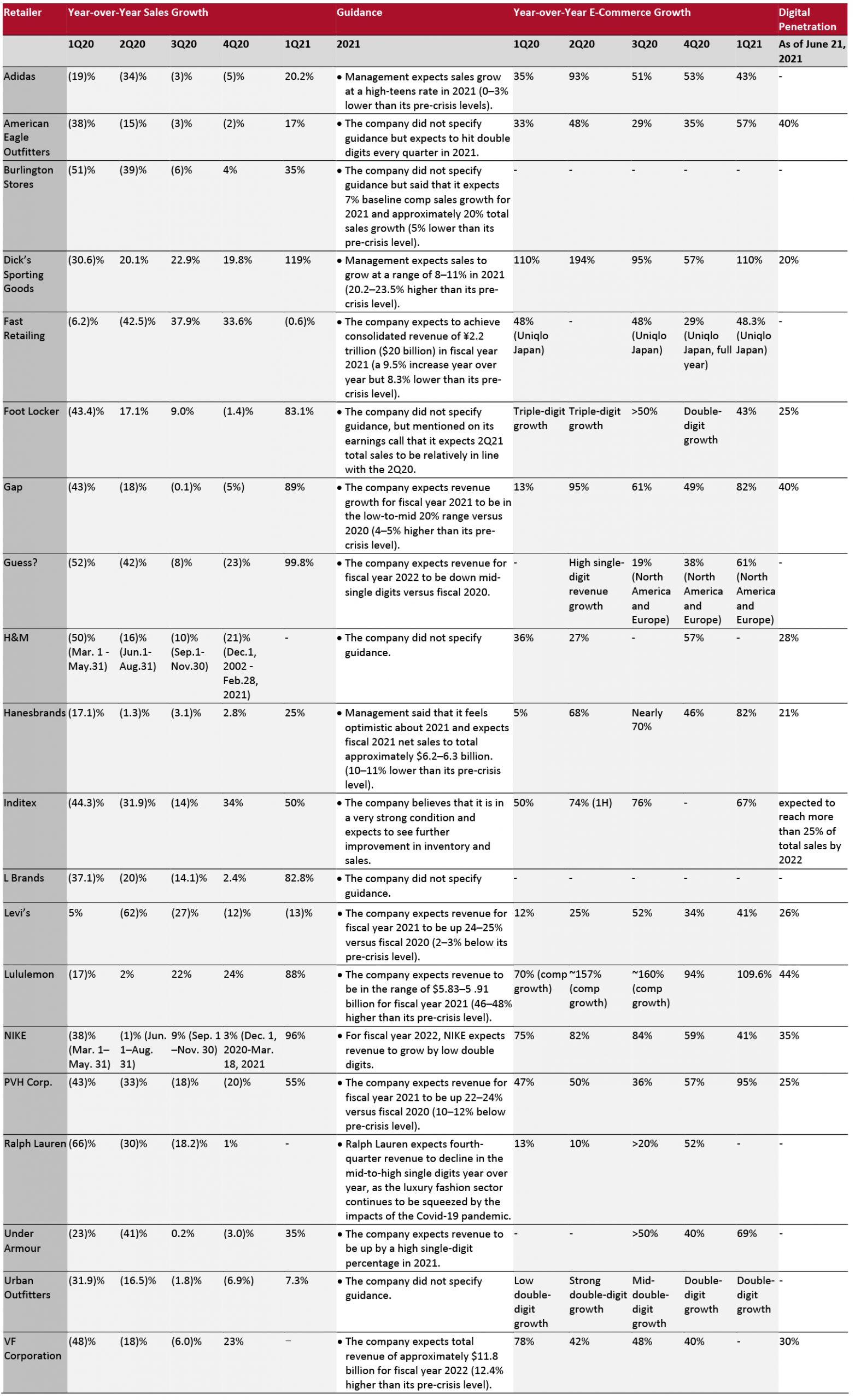

Last year was an underperforming year for many apparel retailers. Among 20 selected apparel brands and retailers in the Coresight 100 (our focus list of the largest and most influential companies in the global retail ecosystem), 35% saw year-over-year declines in revenues in all four three quarters of 2020, impacted by the pandemic. Furthermore, 40% saw year-over-year declines in at least two quarters of 2020.

We saw different trajectories of recovery in the apparel and footwear market, by sector. For example, retailers that focus on activewear have shown signs of earlier recovery: Dick’s Sporting Goods, Foot Locker, Lululemon and NIKE saw their negative year-over-year growth at the start of 2020 turn positive in the second or third quarter of 2020.

Specialty retailers including American Eagle Outfitters, Burlington Stores, Gap and L Brands, along with other retailers and brands in the general apparel sector (such as Fast Retailing, Guess, H&M and Inditex) have also shown signs of recovery, with sequential improvement in year-over-year revenue growth in the first three quarters of 2020, but at a slower pace than activewear retailers. Some 50% of the 20 selected apparel brands and retailers saw slower year-over-year growth in the fourth quarter of 2020, mainly because of store closures during the typically busy holiday season.

Of the apparel companies under our coverage that reported e-commerce penetration figures, 75% have achieved digital sales penetration of at least 25%, according to recent earnings releases—and all companies aim to increase this penetration within the next three years to respond to consumer demand. We expect to see apparel retailers make more efforts to entice online shoppers in 2021.

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

Last year was an underperforming year for many apparel retailers. Among 20 selected apparel brands and retailers in the Coresight 100 (our focus list of the largest and most influential companies in the global retail ecosystem), 35% saw year-over-year declines in revenues in all four three quarters of 2020, impacted by the pandemic. Furthermore, 40% saw year-over-year declines in at least two quarters of 2020.

We saw different trajectories of recovery in the apparel and footwear market, by sector. For example, retailers that focus on activewear have shown signs of earlier recovery: Dick’s Sporting Goods, Foot Locker, Lululemon and NIKE saw their negative year-over-year growth at the start of 2020 turn positive in the second or third quarter of 2020.

Specialty retailers including American Eagle Outfitters, Burlington Stores, Gap and L Brands, along with other retailers and brands in the general apparel sector (such as Fast Retailing, Guess, H&M and Inditex) have also shown signs of recovery, with sequential improvement in year-over-year revenue growth in the first three quarters of 2020, but at a slower pace than activewear retailers. Some 50% of the 20 selected apparel brands and retailers saw slower year-over-year growth in the fourth quarter of 2020, mainly because of store closures during the typically busy holiday season.

Of the apparel companies under our coverage that reported e-commerce penetration figures, 75% have achieved digital sales penetration of at least 25%, according to recent earnings releases—and all companies aim to increase this penetration within the next three years to respond to consumer demand. We expect to see apparel retailers make more efforts to entice online shoppers in 2021.

Figure 5. Selected Coresight 100 Apparel and Footwear Brands and Retailers: Sales Growth, E-Commerce Growth and Digital Penetration (%) [caption id="attachment_130985" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US Retail Innovators

We discuss two US-based innovators whose solutions can benefit the apparel and footwear market. CreateMe Founded in 2018 and based in New York, CreateMe is an on-demand apparel customization platform that enables apparel brands to design new products using 3D design technology and create products based on customized textiles and materials suggestions. Using 3D design technologies to develop innovative products can confer a powerful competitive advantage for apparel brands and retailers. In 2021, 3D product design will continue to evolve, allowing apparel manufacturers to visualize concepts quickly and make any number of changes before fabric is produced. Apparel retailers that have already adopted 3D design include NIKE, PVH Corp, Under Armour and Xcel Brands. Revionics Founded in 2002 and based on the West Coast, Revionics is an analytics company that offers retailers and brands lifecycle price, promotion and markdown optimization solutions. Revionics’ predictive science supports replenished merchandise and category management processes, and it can forecast markdowns that could improve profit margins. In 2020, apparel retailers faced a highly competitive environment in which players offered attractive pricing via multiple sales channels to appeal to consumers. Pricing also reflects strategic objectives. For example, a retailer could price a new product competitively during its launch to encourage shoppers to try it, then raise prices once demand is established. In 2021, we expect retailers to formulate more effective pricing strategies through collaborating with analytics companies rather than simply offering markdowns. We expect artificial intelligence to become more important in price optimization and to be complemented by new technologies that will enhance consumer analytics capabilities for retailers.Themes We Are Watching

From Wholesale to DTC Due to the pandemic, many apparel retailers and brands—including Kontoor Brands, Levi’s and Under Armour—saw margins through wholesale channels (such as department stores and specialty stores) drop in 2020, while margins at DTC (direct-to-consumer) channels, such as the brand’s own websites and stores, achieved gains. Retailers are therefore adjusting their channel mix to skew more toward DTC business, and we expect this shift to continue in 2021 as more apparel brands and retailers reduce their exposure to wholesale.- Kontoor Brands is optimizing its distribution strategy by enhancing the quality of its wholesale business through the exit of select underperforming channels, markets and points of distribution. It is also increasingly working with retailers such as Amazon, Kohl's and Walmart.

- Under Armour plans to reduce its wholesale footprint in 2021 and beyond. It expects to reduce overall North American wholesale distribution points by 2—3,000, to reach 10,000 doors.

- Kontoor Brands is optimizing its distribution strategy by enhancing the quality of wholesale business through the exit of select underperforming channels, markets and points of distribution and increasingly working with retailers including Walmart, Amazon and Kohl's.

- Denim brand Wrangler and sustainable footwear company Twisted X announced an agreement on December 11, 2020 to create a Wrangler footwear collection with a focus on sustainability.

- Adidas outlined its 2021 sustainability goals on December 28, 2020, which include producing 17 million pairs of shoes with recycled plastic waste.

- NIKE launched the NIKE Air Force 1 Low sneakers at the beginning of 2021, which feature recycled wool and synthetic leather. The company also released sustainable basketball sneakers on February 3, 2021.

- High-end apparel brand Alice + Olivia launched its first casual collection on November 19, 2020.

- Athleta, the activewear division of Gap Inc., launched its first sleepwear collection on January 6, 2021, which includes T-shirts, camisoles, shorts, joggers, nightgowns and sleep rompers.

- On December 30, 2020, Marks & Spencer announced plans to expand its womenswear activewear brand Goodmove to include kidswear and menswear, as the retailer plans to focus more on casualwear in 2021.

- Thom Browne, an American fashion brand, launched its first activewear range on November 26, 2020.

- Re-examine the sourcing mix. A number of major apparel retailers, including Abercrombie & Fitch, Fast Retailing and Lululemon, have reduced their sourcing or manufacturing exposure to China in 2019 and 2020. For US companies, import taxes will be higher in 2021, as the tariff exclusions that had shielded many businesses from former President Trump’s trade war expired on January 5. We expect to see more onshoring or nearshoring of apparel production to build a more flexible supply chain.

- Invest in modern technologies. For example, NIKE plans to scale its RFID (radio-frequency identification) capabilities across its stores in Europe, the Middle East and Africa in 2021 to enable better on-time product allocation and replenishment, and the company plans to test consumer-facing RFID capabilities such as self-checkout in Korea.

- Upgrade fulfillment model. UK retailer ASOS is upgrading its fulfillment model to enable its global warehouse network to fulfill any order from any warehouse in 2021. The new model will allow US orders to be fulfilled from the US (Atlanta), the UK or Germany, depending on where items are in stock, which will increase the inventory turnover rate, prevent delayed shipment and better meet consumer demand.

What We Think

Implications for Brands/Retailers- The global pandemic has severely impacted the apparel and footwear markets in the US, the UK and China, and we expect to see different rates of recovery in 2021 and beyond. For the US, we estimate that apparel and footwear sales will grow by 19.5% in 2021, supported by stimulus payments. We do not expect the UK market to fully recover to a pre-crisis level until 2022. We expect the China market to fully recover to a pre-crisis level in 2021, but with a slower growth rate than the US market.

- The cumulative effects of the pandemic have put pressure on US apparel and footwear brands and retailers, as demonstrated by sequential year-over-year revenue declines in 2020. However, we see e-commerce as a great opportunity for apparel retailers to adjust product and service offerings and drive sales. In 2021, we expect consumers to retain online shopping habits, although some spending will be directed back to physical stores. We recommend that brands and retailers continue to offer convenient product discovery, shopping and delivery options to increase customer loyalty.

- In 2021, we believe more apparel brands and retailers will reduce their exposure to wholesale channels, and DTC business models will become more popular.

- As the world gradually emerges from the Covid-19 crisis, we expect both US and global apparel brands and retailers to look for modern technologies and alternative strategies to lower inventory levels and improve the efficiency, agility and resilience of the supply chain, which presents more opportunities for innovators to partner with retailers.