Nitheesh NH

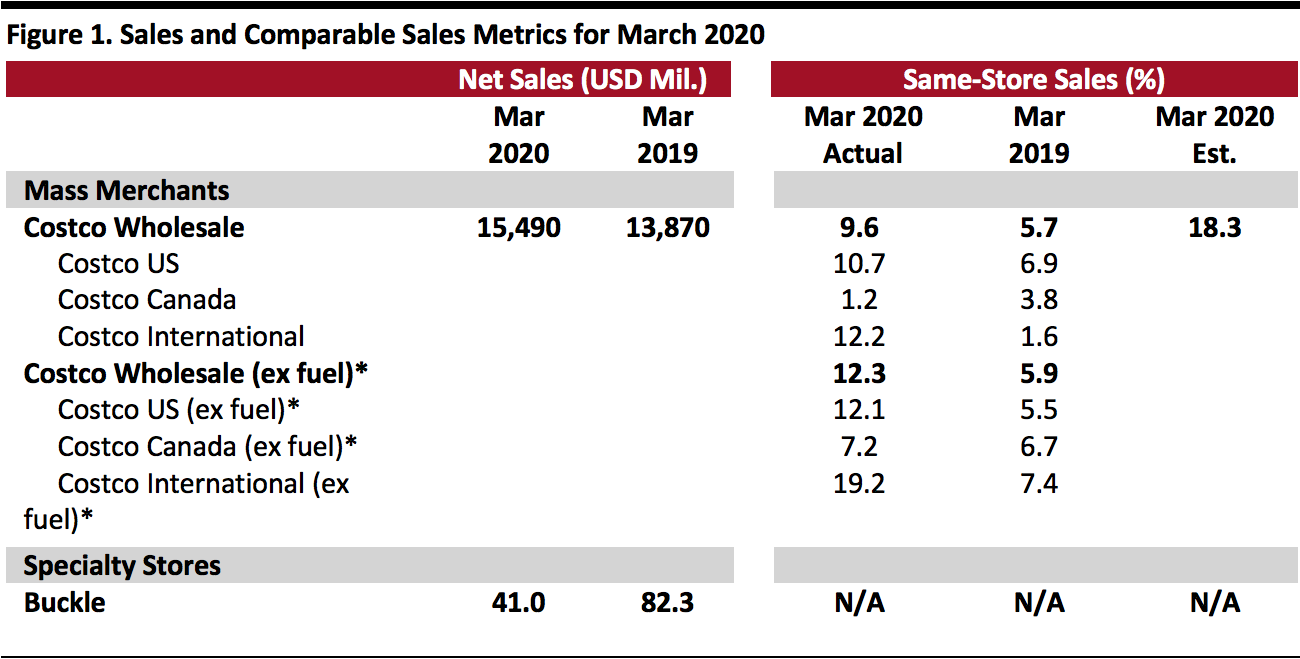

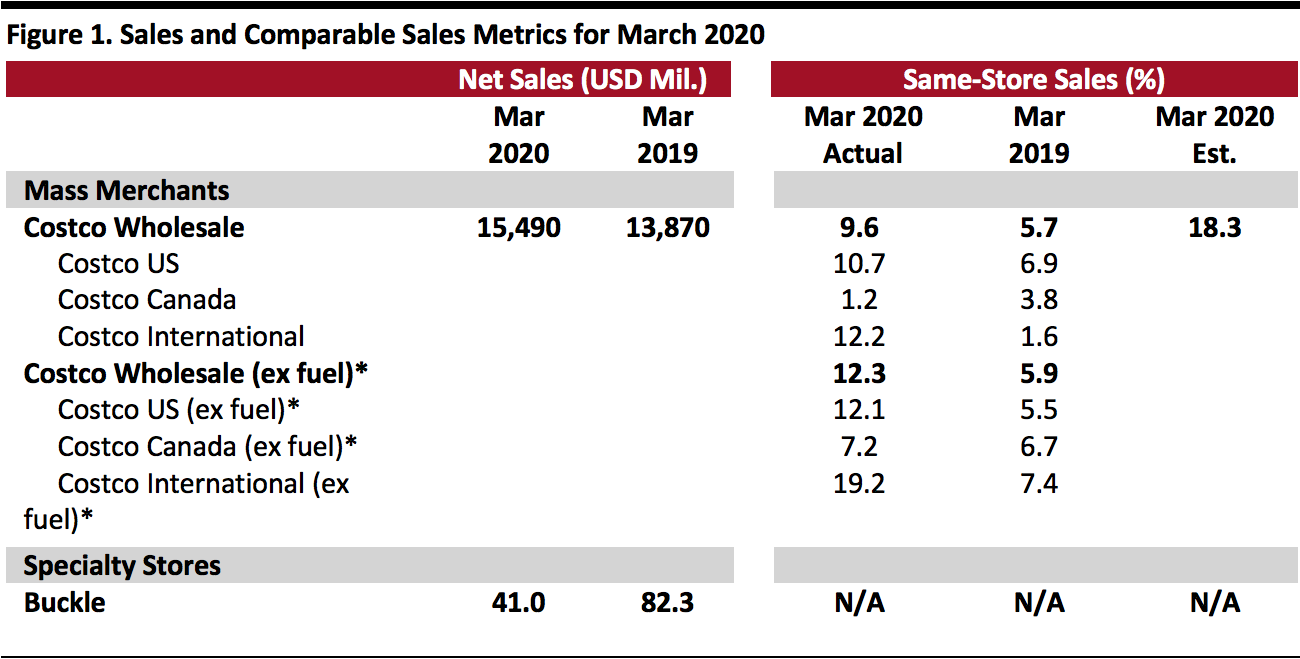

[caption id="attachment_107747" align="aligncenter" width="700"] *Excluding the impact of gasoline price changes

*Excluding the impact of gasoline price changes

Source: Company reports/StreetAccount[/caption]

*Excluding the impact of gasoline price changes

*Excluding the impact of gasoline price changesSource: Company reports/StreetAccount[/caption]

Costco Comp Growth Decelerates, Online Comps Surge

- In March (specifically, the five weeks ended April 5), Costco’s global same-store sales increased by 9.6%, decelerating from February’s 12.1% growth and 870 basis points (bps) below the consensus estimate recorded by StreetAccount, as sales were significantly impacted by the lockdown and uncertainty amidst the coronavirus pandemic.

- Lower gasoline sales were a particular drag on the top line: Excluding the impact of changes in gasoline prices, global comps were up 12.3% in March.

- Costco recorded strong growth in sales and traffic in its warehouses in the first half of March due to panic buying and stockpiling that extended from the last week of February. Midway through the March reporting period, the company made some operational changes, partly in response to government actions. For instance, Costco limited the number of individuals allowed in its warehouses at one time, depending on local requirements.

- Costco’s online comparable sales grew 48.3% in March, compared to February’s 22.6% growth.

- Excluding gasoline price changes, Costco US comps were up 12.1% in March, versus 11.6% in February. In the US, the regions with the strongest results were the Midwest, the Northeast and Texas. Internationally, Costco saw the strongest results in Australia, Taiwan ans the UK.

- Currency fluctuations negatively impacted overall comps by about 140 bps. Canada same-store sales were negatively impacted by around 410 bps by foreign exchange rates, while Costco’s “other international” segment was hurt by about 620 bps.

- Cannibalization from newly opened locations negatively impacted US comps by about 10 bps and the company’s other international segment by 120 bps. Overall, cannibalization negatively impacted comparable sales by 20 bps.

- In the merchandise segment, excluding currency effects, comparable growth for food and sundries was positive, in the mid-30s in percentage terms: Food, frozen foods and sundries departments showed the strongest results. Hardlines posted negative comps in the low, single digits: Tires, sporting goods, and lawn and garden were underperforming departments. Softlines were down, in the mid-20s in percentage terms: Luggage, apparel and jewelry performed worse than other departments.

- Fresh-food comparable sales were up in the mid-20s in percentage terms, with meat and produce performing better than other departments.

- In the ancillary businesses, gas and pharmacy saw the strongest comp sales increases.

- Gasoline price deflation negatively impacted total comps by about 130 bps, with the overall average selling price decreasing to $2.38 per gallon this year from $2.78 last year.

- As of April 5, 2020, the company operates 787 warehouses (547 in the US), versus 770 warehouses (535 in the US) on April 7, 2019.

Buckle’s Net Sales Plunge Due to the Coronavirus Pandemic

- Buckle’s March total net sales for the five-week period ended April 4, 2020 nosedived 50.2% year over year after February’s 6.0% increase.

- Due to the coronavirus outbreak, Buckle announced the closure of all brick-and-mortar stores for an indefinite period beginning March 18, 2020. The company’s online store remains open. Buckle also stated that it plans to only report total sales each month and would not separately report comparable store sales during this time due to the store closures.

- As of April 9, 2020, the company operates 446 stores across 42 states.