Nitheesh NH

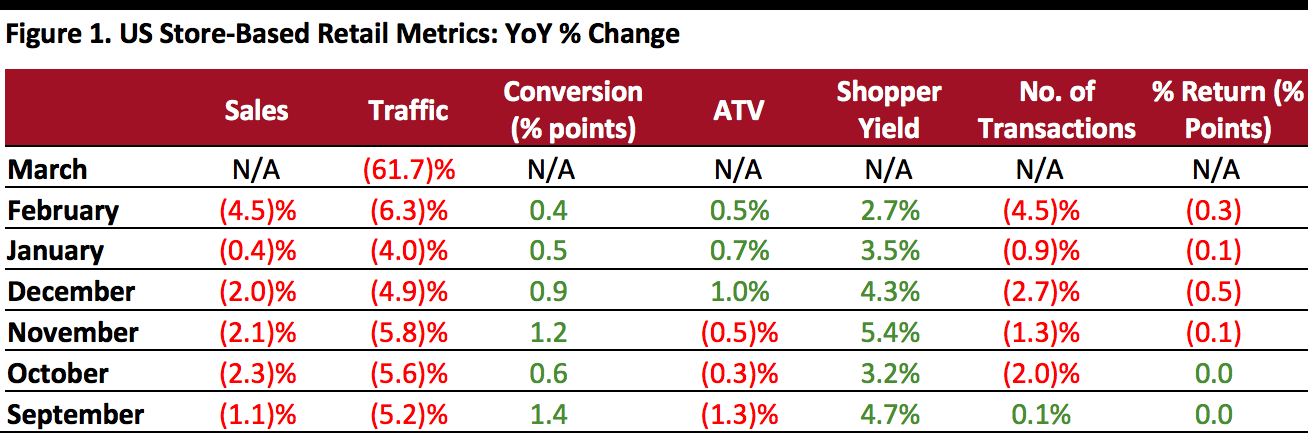

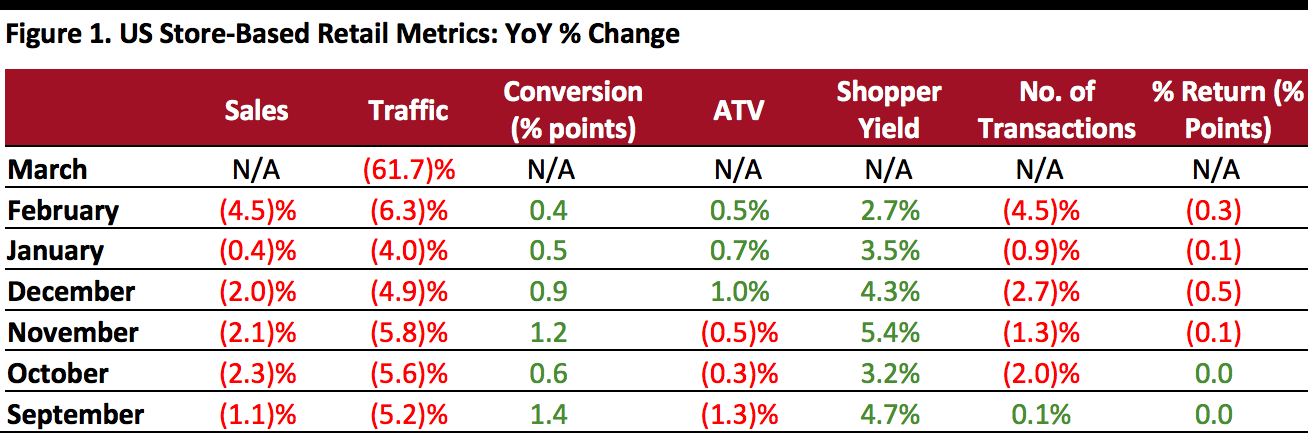

The Coresight Research US Retail Traffic and In-Store Metrics report reviews year-over-year changes in selected store-based metrics. In this month’s report, we review store traffic changes through March, when lockdown measures were implemented across the US. Major retailers began to close stores from the middle of March due to the coronavirus pandemic.

Retail traffic fell sharply, by 61.7%, year over year in March following February’s 6.3% decline.

Weekly data for March tracks the progress of store closures over the five weeks (March 1–April 4, 2020):

ATV = average transaction value, % return = percentage of goods returned to stores

ATV = average transaction value, % return = percentage of goods returned to stores

Source: RetailNext[/caption]

- The first week saw a decline of only 7.1%.

- Declines accelerated to 28.9% in the second week, 76.8% in the third week and 95.2% in the fourth .

- In the fifth week, traffic fell 95.7%, as 97% of retailers had closed stores, according to RetailNext’s CEO Retailer Pulse survey data.

- Other than traffic, RetailNext did not publish the metrics for which it typically provides data.

ATV = average transaction value, % return = percentage of goods returned to stores

ATV = average transaction value, % return = percentage of goods returned to storesSource: RetailNext[/caption]

Apparel was badly hit as consumers reduced shopping for nonessential items.

- The apparel sector experienced the largest traffic decline at 66.6%, followed by the footwear sector with a 65% decline in traffic.

- The home sector posted the lowest decline in traffic at 56.9%. The jewelry sector saw traffic decline at 61.6%.

- The Northeast saw the largest traffic decline at 63.5%, as travel and business restrictions were implemented due to an increase in the number of coronavirus cases.

- The South posted the lowest decline in traffic at 58.9%, as restrictions in most of the Southern states were implemented during the fifth week (beginning of April).

- The Midwest and West saw traffic decline at 60.8% and 61.7% respectively.

- About 72% of retailers think that the coronavirus outbreak will have an impact on their businesses for more than two years, while 24% of the retailers think that this crisis will affect businesses for about one to two years.

- Once they reopen when the crisis has ended, about 50% of retailers expect to have fewer associates than before, 33% of retailers expect to have the same number of store associates and about 17% of retailers have not yet taken a decision on the number of store associates they will require.

- About 80% of retailers have, or plan to implement, new health and safety practices in stores, while 68% of retailers have, or plan to implement, occupancy controls.