Nitheesh NH

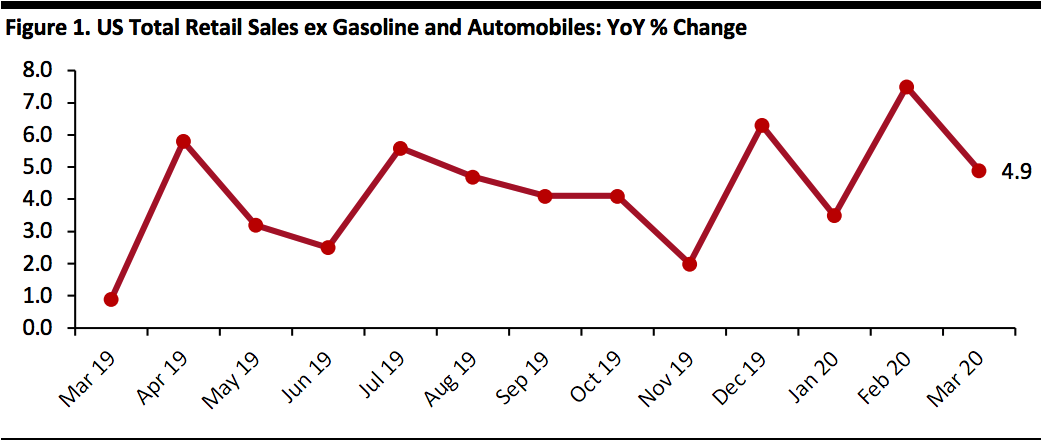

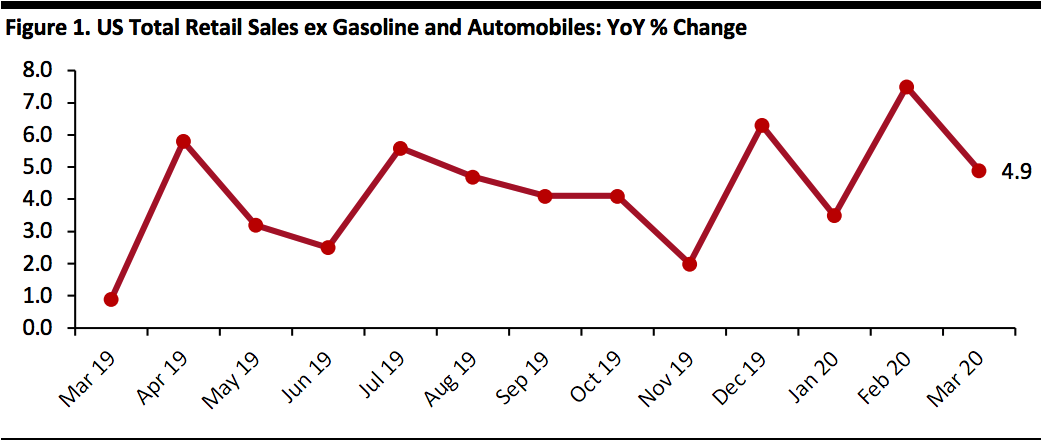

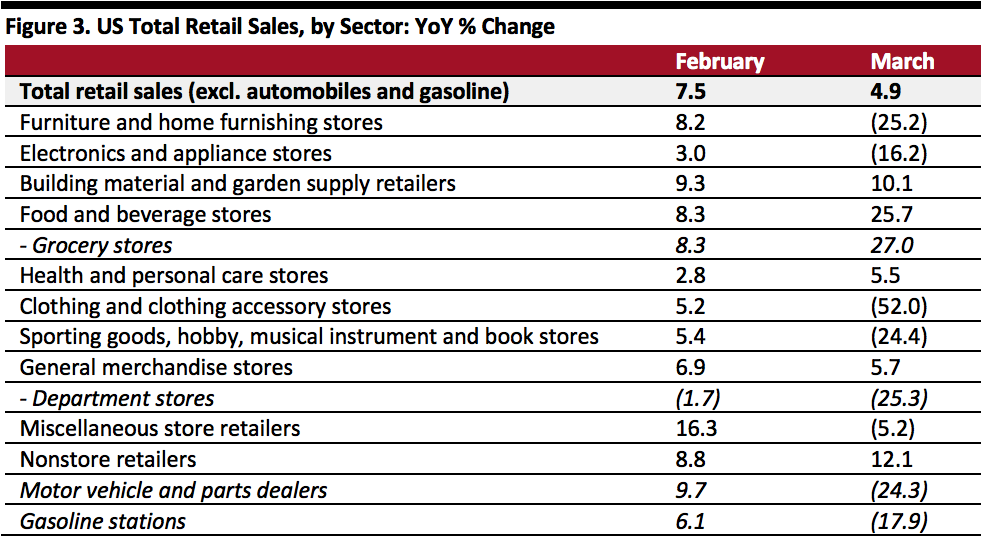

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. Perhaps surprisingly, this metric remained positive in March at 4.9%, albeit slower than February’s 7.5% rate. However, this total figure reveals a deep divide in performance by sector, as we detail later.

In the US, store closures began in the week of March 8–14 and peaked in the week of March 15–21. We expect the retail shutdown to last two to three months, with three months as our base case—which means that we anticipate a full-month shutdown in April for the first time this year. Coupled with lower levels of grocery stockpiling after an initial surge, we expect this to result in a year-over-year decline in total retail sales of around one-third in April.

[caption id="attachment_107855" align="aligncenter" width="580"] Data is not seasonally adjusted

Data is not seasonally adjusted

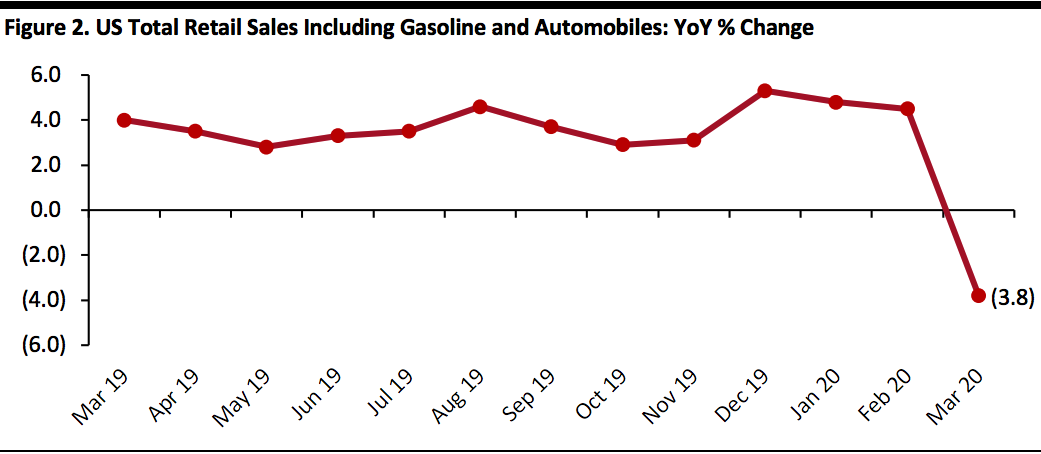

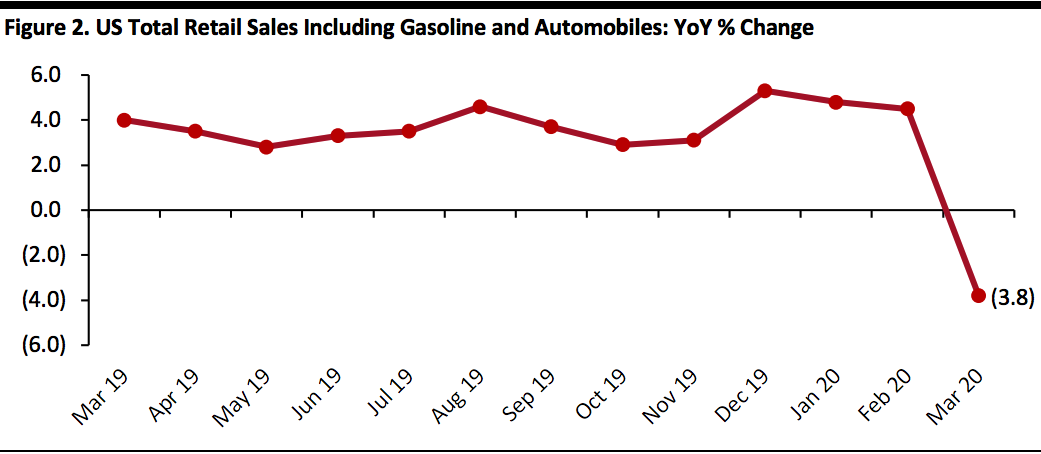

Source: US Census Bureau/Coresight Research[/caption] Retail Sales Decline Month Over Month The Census Bureau’s core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure declined 3.8% year over year in March versus February’s 4.5% growth. On a month-over-month basis and seasonally adjusted, retail sales declined 6.2% in March. [caption id="attachment_107856" align="aligncenter" width="580"] Data is seasonally adjusted

Data is seasonally adjusted

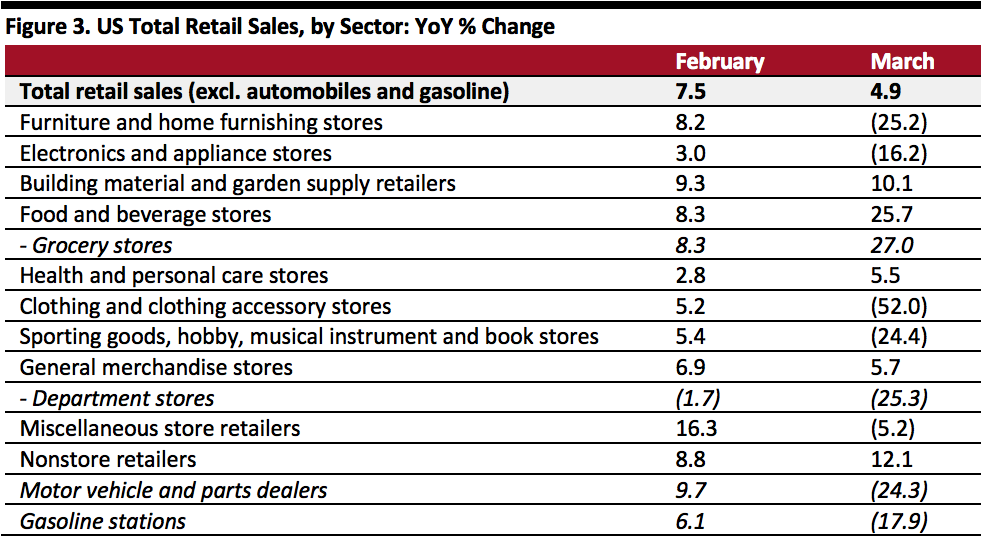

Source: US Census Bureau[/caption] Retail Sales Growth by Sector Most sectors witnessed deeply negative sales growth in March, including furniture and home-furnishing stores, clothing stores, electronics and appliance stores and sporting goods stores, as consumers adjusted to stay-at-home orders and social distancing policies related to the coronavirus. As we recently estimated from our weekly survey findings, apparel is taking the biggest hit. Clothing-store sales nosedived 52.0% in March after reporting 5.2% growth in February. Sales at department stores (a subset of general-merchandise stores and weighted toward apparel) plunged 25.3% in March after February’s 1.7% slide. Sales at grocery stores jumped 27.0%, slightly above the overall food sector’s 25.7% growth, supported by panic buying and stockpiling of food and household essentials as well as the transfer of spending from food service to retail. Health and personal care stores continued to see sales increase, up 5.5% year over year in March, accelerating from February’s 2.8% increase. This total figure will almost certainly mask a polarization between essential retailers such as pharmacies and discretionary retailers such as beauty stores—which will have shuttered stores in the second half of March. Both sporting goods and electronics stores witnessed steep declines in their sales in March after reporting single-digit sales growth in February. Alongside grocery, online-only retailers contributed to the increase in total retail sales: Nonstore retailers, which include e-commerce firms, saw sales growth accelerate to 12.1% in March from 8.8% in February. Gasoline-station sales growth slowed to 6.2% in February. [caption id="attachment_107857" align="aligncenter" width="580"] Data is not seasonally adjusted

Data is not seasonally adjusted

Source: US Census Bureau/Coresight Research[/caption]

Data is not seasonally adjusted

Data is not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Retail Sales Decline Month Over Month The Census Bureau’s core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure declined 3.8% year over year in March versus February’s 4.5% growth. On a month-over-month basis and seasonally adjusted, retail sales declined 6.2% in March. [caption id="attachment_107856" align="aligncenter" width="580"]

Data is seasonally adjusted

Data is seasonally adjustedSource: US Census Bureau[/caption] Retail Sales Growth by Sector Most sectors witnessed deeply negative sales growth in March, including furniture and home-furnishing stores, clothing stores, electronics and appliance stores and sporting goods stores, as consumers adjusted to stay-at-home orders and social distancing policies related to the coronavirus. As we recently estimated from our weekly survey findings, apparel is taking the biggest hit. Clothing-store sales nosedived 52.0% in March after reporting 5.2% growth in February. Sales at department stores (a subset of general-merchandise stores and weighted toward apparel) plunged 25.3% in March after February’s 1.7% slide. Sales at grocery stores jumped 27.0%, slightly above the overall food sector’s 25.7% growth, supported by panic buying and stockpiling of food and household essentials as well as the transfer of spending from food service to retail. Health and personal care stores continued to see sales increase, up 5.5% year over year in March, accelerating from February’s 2.8% increase. This total figure will almost certainly mask a polarization between essential retailers such as pharmacies and discretionary retailers such as beauty stores—which will have shuttered stores in the second half of March. Both sporting goods and electronics stores witnessed steep declines in their sales in March after reporting single-digit sales growth in February. Alongside grocery, online-only retailers contributed to the increase in total retail sales: Nonstore retailers, which include e-commerce firms, saw sales growth accelerate to 12.1% in March from 8.8% in February. Gasoline-station sales growth slowed to 6.2% in February. [caption id="attachment_107857" align="aligncenter" width="580"]

Data is not seasonally adjusted

Data is not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption]