Nitheesh NH

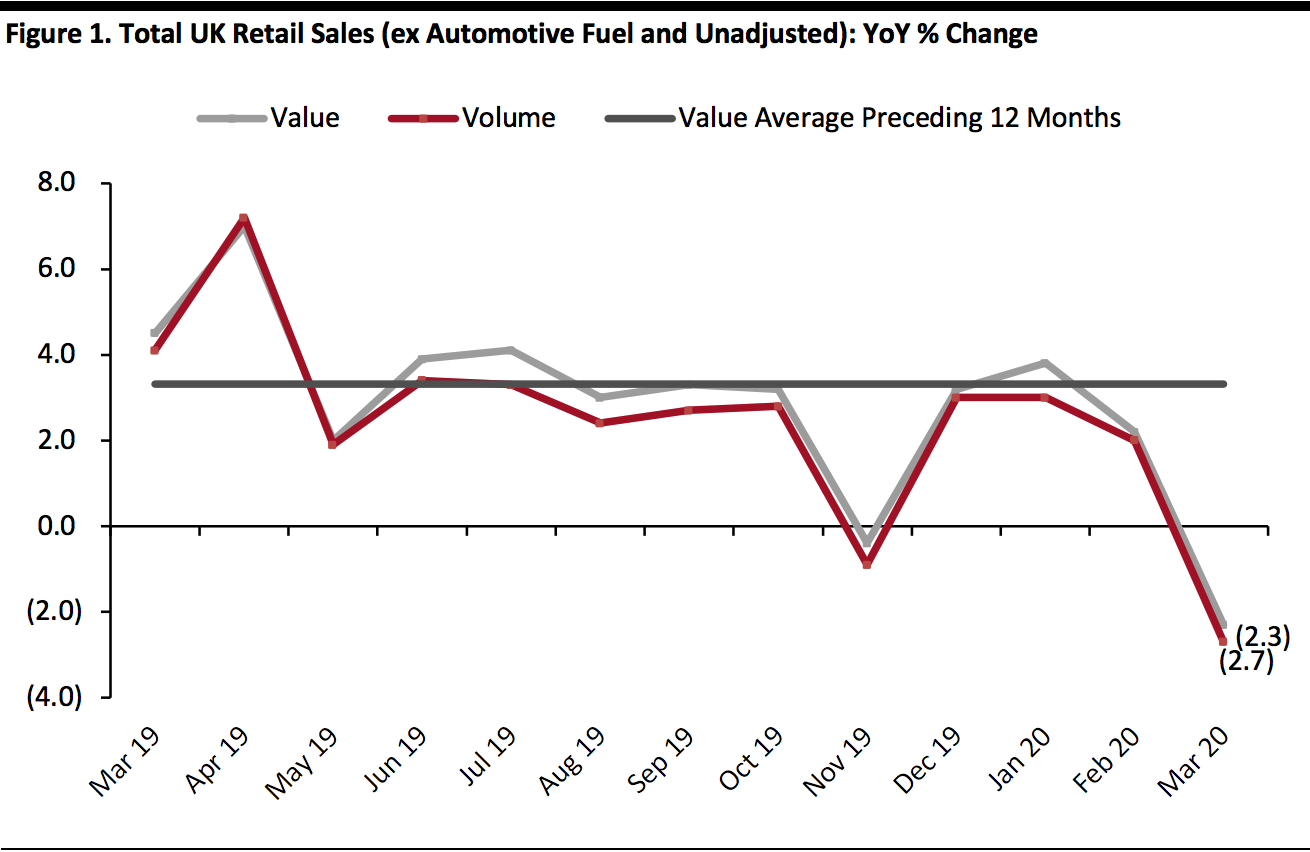

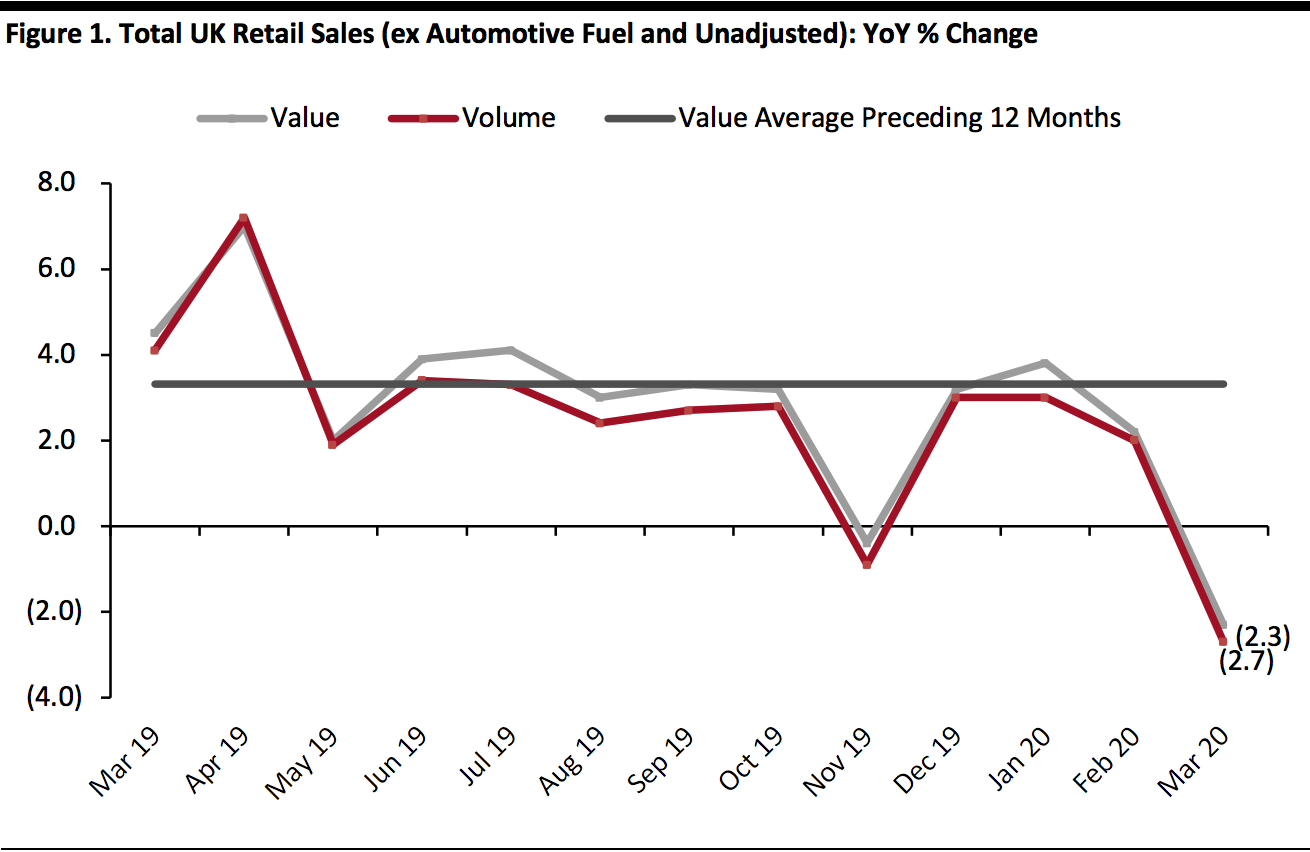

UK retail sales declined by 2.3% in March 2020, but this conceals a sharp contrast between essential and discretionary sectors. As predicted in our February monthly sales report, grocery stores witnessed a double-digit increase in sales in March, as shoppers stockpiled essential items, while sales of nonessential retailers plunged after the government initiated a national lockdown and imposed restrictions on nonessential retail stores from March 23.

With the government extending the lockdown by at least another three weeks as of April 16, and businesses remaining shut or operating at partial capacity, we expect retail sales to take a huge dip of around one-quarter year over year in April. We estimate store-based nonfood retailers will see a total year-over-year sales decline of close to three-quarters in April, with e-commerce accounting for the lion’s share of remaining sales in this sector.

[caption id="attachment_108319" align="aligncenter" width="580"] Data in this report is not seasonally adjusted[/caption]

Retail Sales Growth by Sector

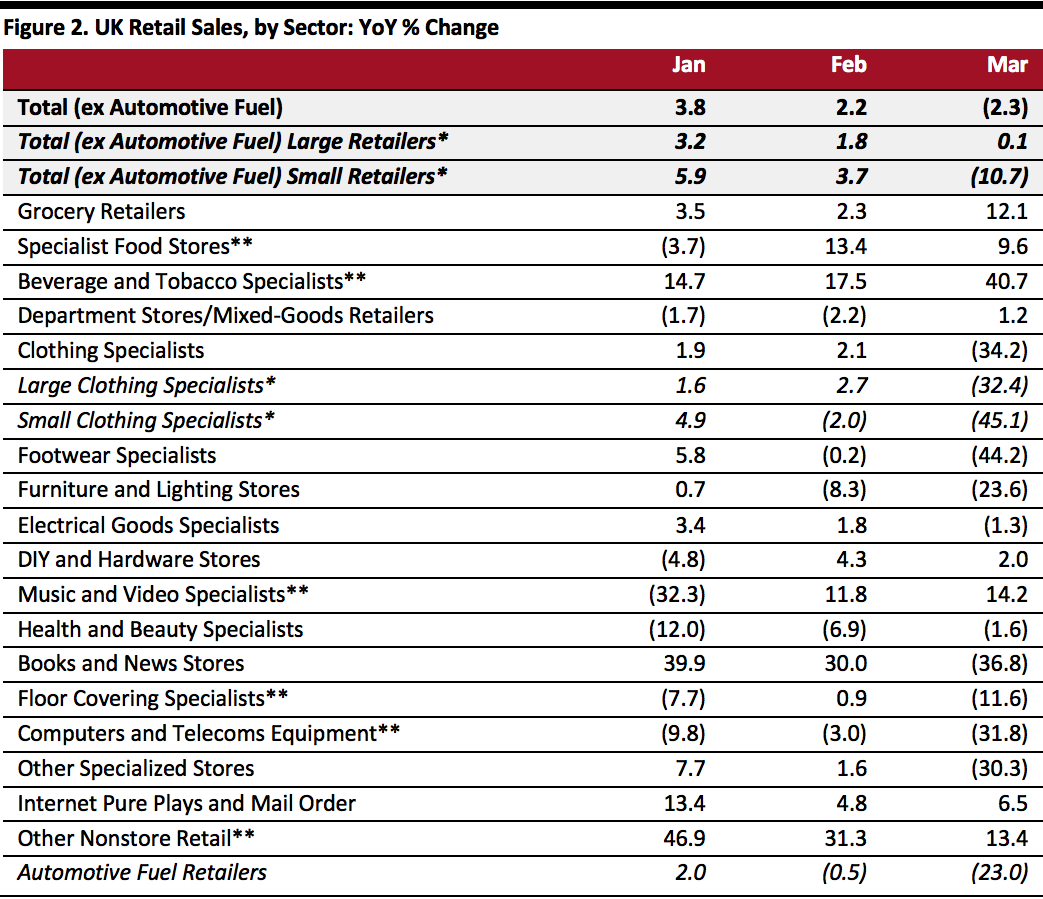

The grocery sector reported strong sales growth of 12.1% in March, with shoppers stocking up on essentials. A 40.7% uplift at alcohol and tobacco stores suggest that Brits stocked up on these products as the lockdown hit. However, most other sectors reported sharp declines in sales, including clothing, footwear, and furniture and lighting, as many businesses had to temporarily close stores and consumers’ appetite for shopping decreased.

Clothing and footwear stores took the biggest hit, with their sales plummeting by 34.2% and 44.2%, respectively. The health and beauty sector saw an improvement, reporting a decline of 1.6% in March, compared to February’s 6.9% slide. These top-line figures are likely to conceal a bifurcation between discretionary beauty stores, which will have been forced to close, and essential healthcare stores such as pharmacies, which remain open.

We continue to see large rises or falls in fragmented sectors for which ONS data has been traditionally volatile—for example, food and drink specialists, music and video stores and computer and telecom specialists.

The ONS recorded shop-price inflation of 0.4% in March, slightly up from 0.2% in February. In March, food-store inflation stood at 1.1%, versus 1.0% in February. Amid declining demand, deflation among nonfood retailers deepened to (0.6)% in March, versus (0.3)% in February.

[caption id="attachment_108320" align="aligncenter" width="580"]

Data in this report is not seasonally adjusted[/caption]

Retail Sales Growth by Sector

The grocery sector reported strong sales growth of 12.1% in March, with shoppers stocking up on essentials. A 40.7% uplift at alcohol and tobacco stores suggest that Brits stocked up on these products as the lockdown hit. However, most other sectors reported sharp declines in sales, including clothing, footwear, and furniture and lighting, as many businesses had to temporarily close stores and consumers’ appetite for shopping decreased.

Clothing and footwear stores took the biggest hit, with their sales plummeting by 34.2% and 44.2%, respectively. The health and beauty sector saw an improvement, reporting a decline of 1.6% in March, compared to February’s 6.9% slide. These top-line figures are likely to conceal a bifurcation between discretionary beauty stores, which will have been forced to close, and essential healthcare stores such as pharmacies, which remain open.

We continue to see large rises or falls in fragmented sectors for which ONS data has been traditionally volatile—for example, food and drink specialists, music and video stores and computer and telecom specialists.

The ONS recorded shop-price inflation of 0.4% in March, slightly up from 0.2% in February. In March, food-store inflation stood at 1.1%, versus 1.0% in February. Amid declining demand, deflation among nonfood retailers deepened to (0.6)% in March, versus (0.3)% in February.

[caption id="attachment_108320" align="aligncenter" width="580"] *A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

**A relatively fragmented sector, in which reported figures have traditionally been volatile

Source: ONS[/caption] Online Retail Sales Growth Total Internet retail sales were up 13.1% year over year in March, versus 5.5% in February. For food retailers, Internet sales were up 19.8% in March, versus 1.1% in February. This growth rate accelerated very sharply in March, as UK shoppers turned in huge numbers to online grocery services. In March, Internet sales were up 17.7% at store-based nonfood retailers, versus 4.2% in February, supported by strong sales of household goods. Online sales were up 8.7% at nonstore retailers.

Data in this report is not seasonally adjusted[/caption]

Retail Sales Growth by Sector

The grocery sector reported strong sales growth of 12.1% in March, with shoppers stocking up on essentials. A 40.7% uplift at alcohol and tobacco stores suggest that Brits stocked up on these products as the lockdown hit. However, most other sectors reported sharp declines in sales, including clothing, footwear, and furniture and lighting, as many businesses had to temporarily close stores and consumers’ appetite for shopping decreased.

Clothing and footwear stores took the biggest hit, with their sales plummeting by 34.2% and 44.2%, respectively. The health and beauty sector saw an improvement, reporting a decline of 1.6% in March, compared to February’s 6.9% slide. These top-line figures are likely to conceal a bifurcation between discretionary beauty stores, which will have been forced to close, and essential healthcare stores such as pharmacies, which remain open.

We continue to see large rises or falls in fragmented sectors for which ONS data has been traditionally volatile—for example, food and drink specialists, music and video stores and computer and telecom specialists.

The ONS recorded shop-price inflation of 0.4% in March, slightly up from 0.2% in February. In March, food-store inflation stood at 1.1%, versus 1.0% in February. Amid declining demand, deflation among nonfood retailers deepened to (0.6)% in March, versus (0.3)% in February.

[caption id="attachment_108320" align="aligncenter" width="580"]

Data in this report is not seasonally adjusted[/caption]

Retail Sales Growth by Sector

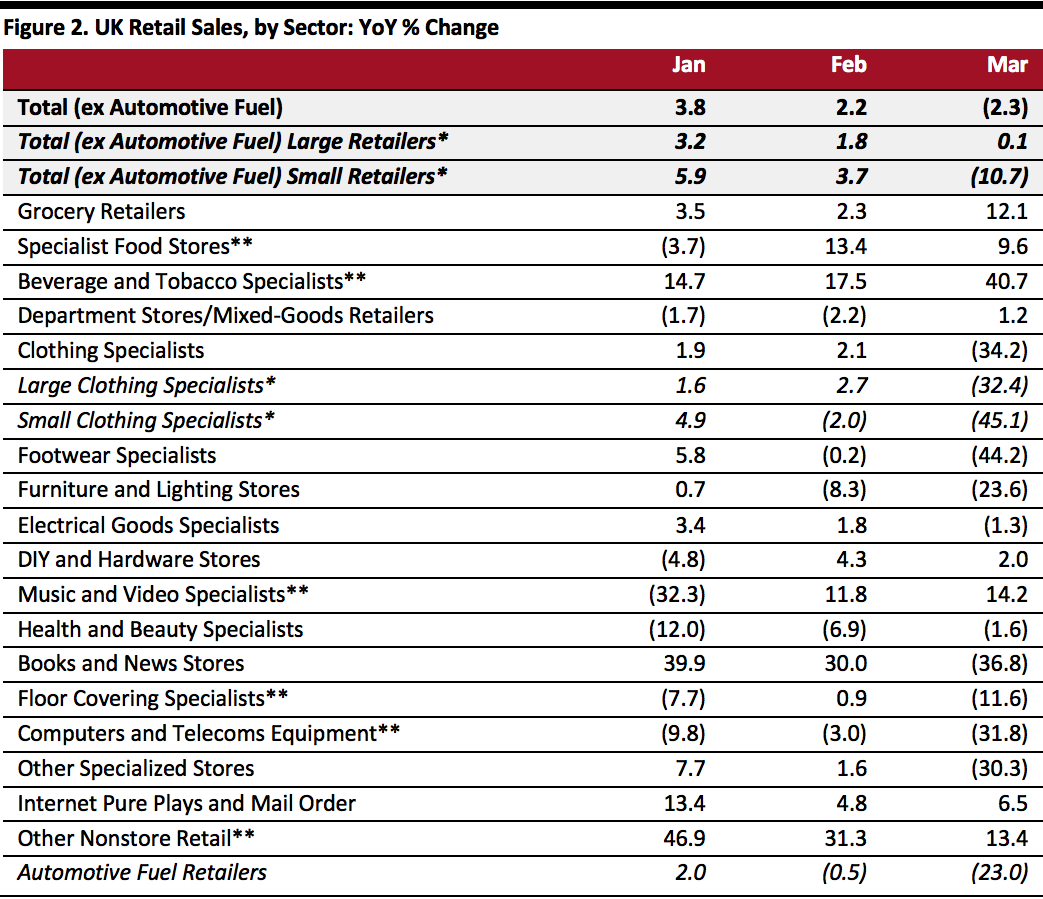

The grocery sector reported strong sales growth of 12.1% in March, with shoppers stocking up on essentials. A 40.7% uplift at alcohol and tobacco stores suggest that Brits stocked up on these products as the lockdown hit. However, most other sectors reported sharp declines in sales, including clothing, footwear, and furniture and lighting, as many businesses had to temporarily close stores and consumers’ appetite for shopping decreased.

Clothing and footwear stores took the biggest hit, with their sales plummeting by 34.2% and 44.2%, respectively. The health and beauty sector saw an improvement, reporting a decline of 1.6% in March, compared to February’s 6.9% slide. These top-line figures are likely to conceal a bifurcation between discretionary beauty stores, which will have been forced to close, and essential healthcare stores such as pharmacies, which remain open.

We continue to see large rises or falls in fragmented sectors for which ONS data has been traditionally volatile—for example, food and drink specialists, music and video stores and computer and telecom specialists.

The ONS recorded shop-price inflation of 0.4% in March, slightly up from 0.2% in February. In March, food-store inflation stood at 1.1%, versus 1.0% in February. Amid declining demand, deflation among nonfood retailers deepened to (0.6)% in March, versus (0.3)% in February.

[caption id="attachment_108320" align="aligncenter" width="580"] *A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers**A relatively fragmented sector, in which reported figures have traditionally been volatile

Source: ONS[/caption] Online Retail Sales Growth Total Internet retail sales were up 13.1% year over year in March, versus 5.5% in February. For food retailers, Internet sales were up 19.8% in March, versus 1.1% in February. This growth rate accelerated very sharply in March, as UK shoppers turned in huge numbers to online grocery services. In March, Internet sales were up 17.7% at store-based nonfood retailers, versus 4.2% in February, supported by strong sales of household goods. Online sales were up 8.7% at nonstore retailers.