DIpil Das

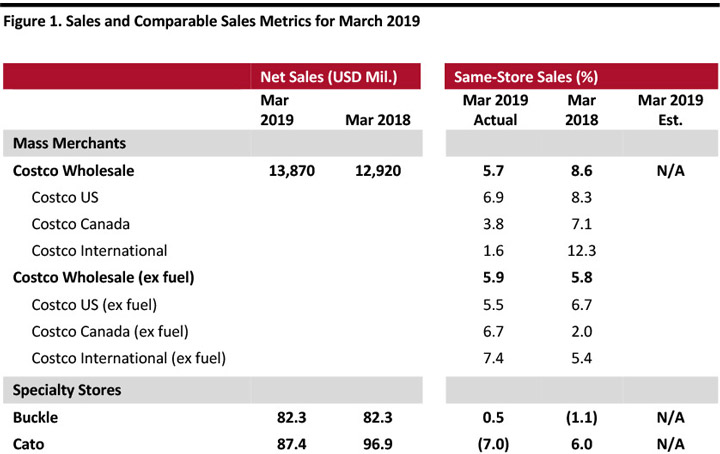

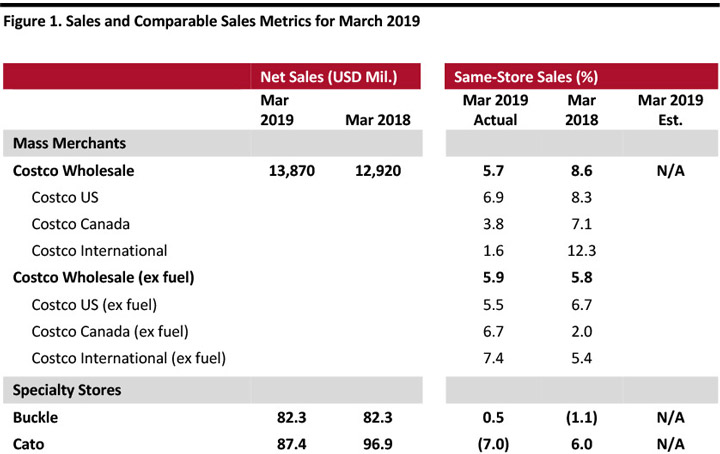

[caption id="attachment_83870" align="alignnone" width="720"] Source: Company reports/StreetAccount[/caption]

Costco’s March Comps Accelerate Driven by Strong Traffic

Source: Company reports/StreetAccount[/caption]

Costco’s March Comps Accelerate Driven by Strong Traffic

Source: Company reports/StreetAccount[/caption]

Costco’s March Comps Accelerate Driven by Strong Traffic

Source: Company reports/StreetAccount[/caption]

Costco’s March Comps Accelerate Driven by Strong Traffic

- Costco’s March same-store sales grew 5.7% year over year, faster than the 3.5% growth in February. The company had one extra shopping day in the month of March versus last year, due to the calendar shift of Easter, which positively impacted the company.

- Costco’s e-commerce comparable sales were up 20.6% in March, slower than February’s 24.2% growth.

- In March, comparable traffic at Costco was up 3.8% in the US and 4.2% worldwide, including the benefit from the extra day.

- The retailer’s strongest results in the US were in the Midwest, Northeast and San Diego. In terms of international performance, strong results were seen in Spain, Mexico and Taiwan.

- Foreign currency fluctuations negatively impacted the company’s comps. Canada was hurt by about 380 basis points, while international comp sales were negatively impacted by approximately 590 basis points.

- Cannibalization negatively impacted the US by about 60 basis points, Canada by 100 basis points and other international segments by approximately 50 basis points. Overall, the company was negatively impacted by 60 basis points.

- Revenue recognition standard ASC 606 had a positive impact of approximately 150 basis points for the US and 120 basis points for the total company.

- In the merchandise segment, excluding the impact of forex, comps for food and sundries were positive mid-single digits; departments that showed strongest results were candy, sundries and frozen foods. Hardlines posted comps in positive mid-single digits; the departments with strong performance were automotive, seasonal, health and beauty, and majors. Softlines were up mid-to-high single digits, the departments that showed strong performance were home furnishings, apparel and domestics.

- Fresh food comparable sales were up mid-single digits, with deli and produce being better-performing departments. In the ancillary businesses, hearing aids, gasoline and optical had the best comp sales increases.

- Gasoline price deflation had a very slight negative impact on the total comps. The overall average selling price fell 0.4% year over year at $2.80 per gallon this year compared to $2.81 a year earlier.

- Buckle’s comparable sales increased 0.5% year over year in March, compared to a 6.8% decline in February. Net sales stood flat year over year, compared to a 7.2% decline in February.

- By business segment, total sales in men’s were up marginally year over year. The men’s segment accounted for approximately 50.5% of total sales in March 2019. Price points were down by about 2.5% for March in the men’s segment.

- Total sales in the women’s segment fell 2.0% year over year. The women’s segment accounted for 49.5% of total monthly sales in March 2019. Price points were down about 5.0% in the women’s business.

- By product type, accessories sales fell 0.5% year over year in March and accounted for 8.0% of total sales. Footwear sales grew 12.5% year over year and represented 7.5% of total sales. Average accessory price points were down by about 6.5% and average footwear price points were flat in March.

- In the current month, units per transaction grew 4.0% and the average transaction value increased by about 0.5%.

- Cato’s sales fell 9.8% year over year to $87.4 million, compared to a 12.0% decline in February. Comparable sales fell 7.0% year over year in March, compared to a 10% decline in February.

- As of April 6, 2019, the company operated 1,306 stores in 31 states, down from 1,351 stores in 33 states as of April 7, 2018. In March, Cato closed two stores.