Web Developers

Source: Company report

Source: Company report

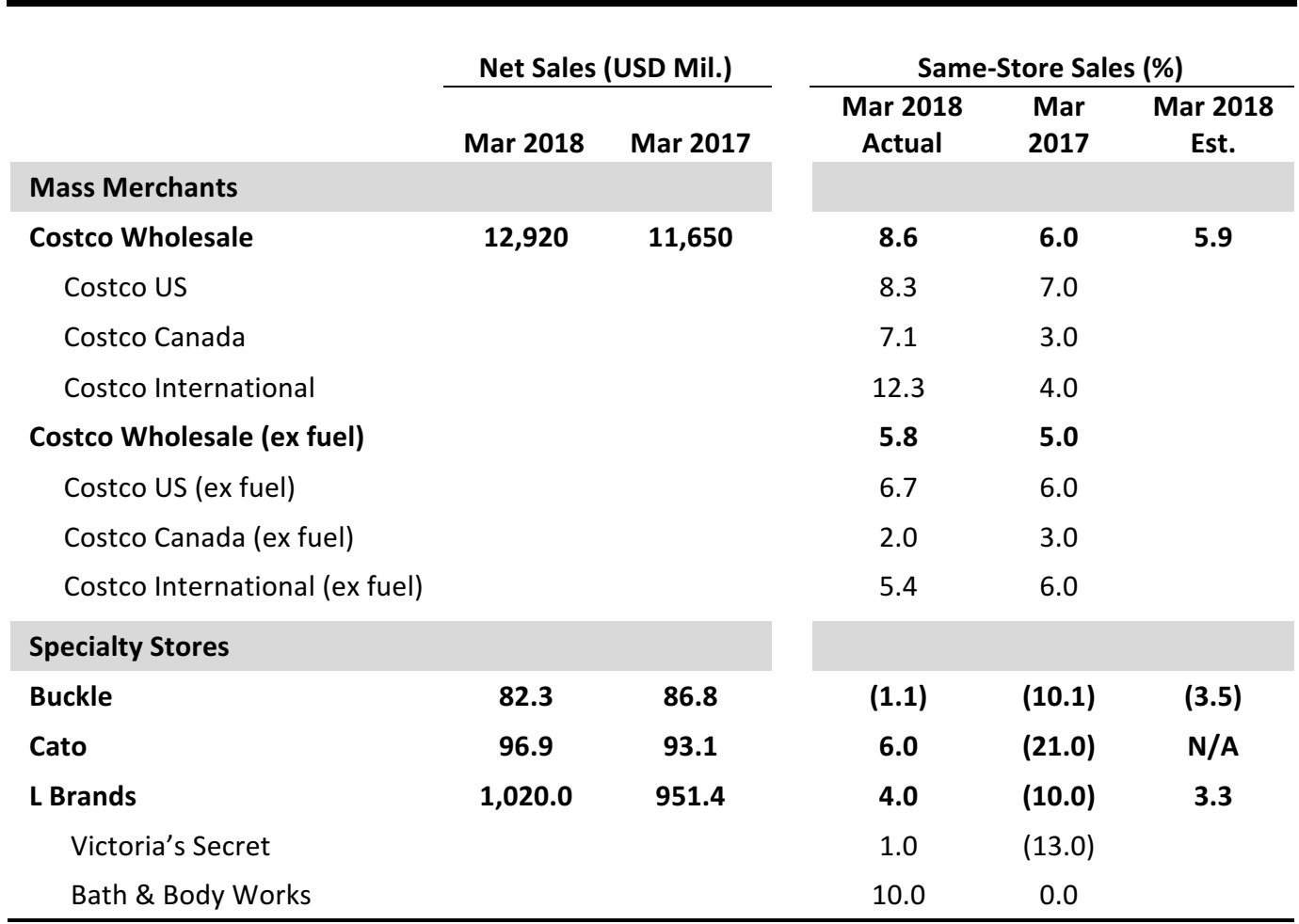

Costco’s US Comps Continued to Beat Expectations, with Hardlines Up by High Single Digits

- Costco’s March same-store sales were up 8.6% year over year, beating the consensus estimate of 5.9%.

- The company reported that the March retail month had one less shopping day compared with the same month last year, negatively impacting monthly sales by 1.0%–1.5%.

- The company’s comp traffic was up 4.3% worldwide and up 4.5% in the US in March, including the negative impact from the Easter holiday shift.

- Costco’s average transaction value was up 4.2%, including gas price inflation and foreign exchange.

- Within the US, the strongest sales regions were the Northeast, Midwest and Southeast. Internationally, Mexico, Japan and the UK were the better-performing countries, in local currencies.

- Cannibalization negatively impacted other international markets by 150 basis points and negatively impacted the US market by 50 basis points.

- Food and sundries comps were up by mid-single digits in March. The departments with the strongest results were tobacco, liquor and deli.

- Hardline comps were up by high single digits year over year. The better-performing categories included majors, hardware and seasonal goods. Sales in the majors category were up more than 30%, led by appliances and tablets.

- Softline comps were up by mid-single digits for the month. Better-performing categories included jewelry, housewares and small appliances. Fresh foods were up by mid-single digits, with bakery and service deli among the better-performing departments.

- Costco’s e-commerce sales were up 33.2% year over year in March.

L Brands Reported Positive Comps Overall and at the Brand Level

- L Brands’ comps were up 4% in March. Victoria’s Secret’s comps were up 1% and Bath & Body Works’ comps were up 10%.

- L Brands’ merchandise margin rate was down versus the same month last year and was below the company’s expectations.

- At Victoria’s Secret, comps were up 1%, with growth in beauty and modest growth in lingerie partially offset by a decline in PINK. The company reported that it is seeing positive PINK comps and improvements in its loungewear business; the decline in PINK was primarily due to swimwear, which the company is in the process of exiting.

- At Bath & Body Works, comps were up 10% in March and the merchandise margin rate was flat year over year.

- The company expects this year’s early Easter to negatively impact April comps by 2–3 percentage points.

Buckle Reported Negative Comps, but Beat Estimates

- Teen retailer Buckle saw an overall comp decrease of 1.1% year over year in March, but comps beat the consensus estimate of (3.5)%.

- Total sales were up 3.0% year over year in the men’s business. Men’s represented 49.5% of total sales versus 47.0% in March last year. Price points were down 2.5%.

- Total sales for the women’s segment were down 6.5%. The women’s segment accounted for 50.5% of total monthly sales versus 53.0% last March. Price points were down 2.0%.

- Accessories and footwear represented 8.0% and 6.5% of sales, respectively. The average accessory price point was up 3.0% and the average footwear price point was up 6.0%.

Cato Expects Late Easter to Impact April Same-Store Sales

- Cato reported March sales of $96.9 million, a 4% increase year over year. Comps were up 6% in the month.

- The company expects April same-store sales to decline by high single digits and for combined March and April same-store sales to decline by low single digits.