Web Developers

Costco’s March Comp Sales Were Affected by Early Easter

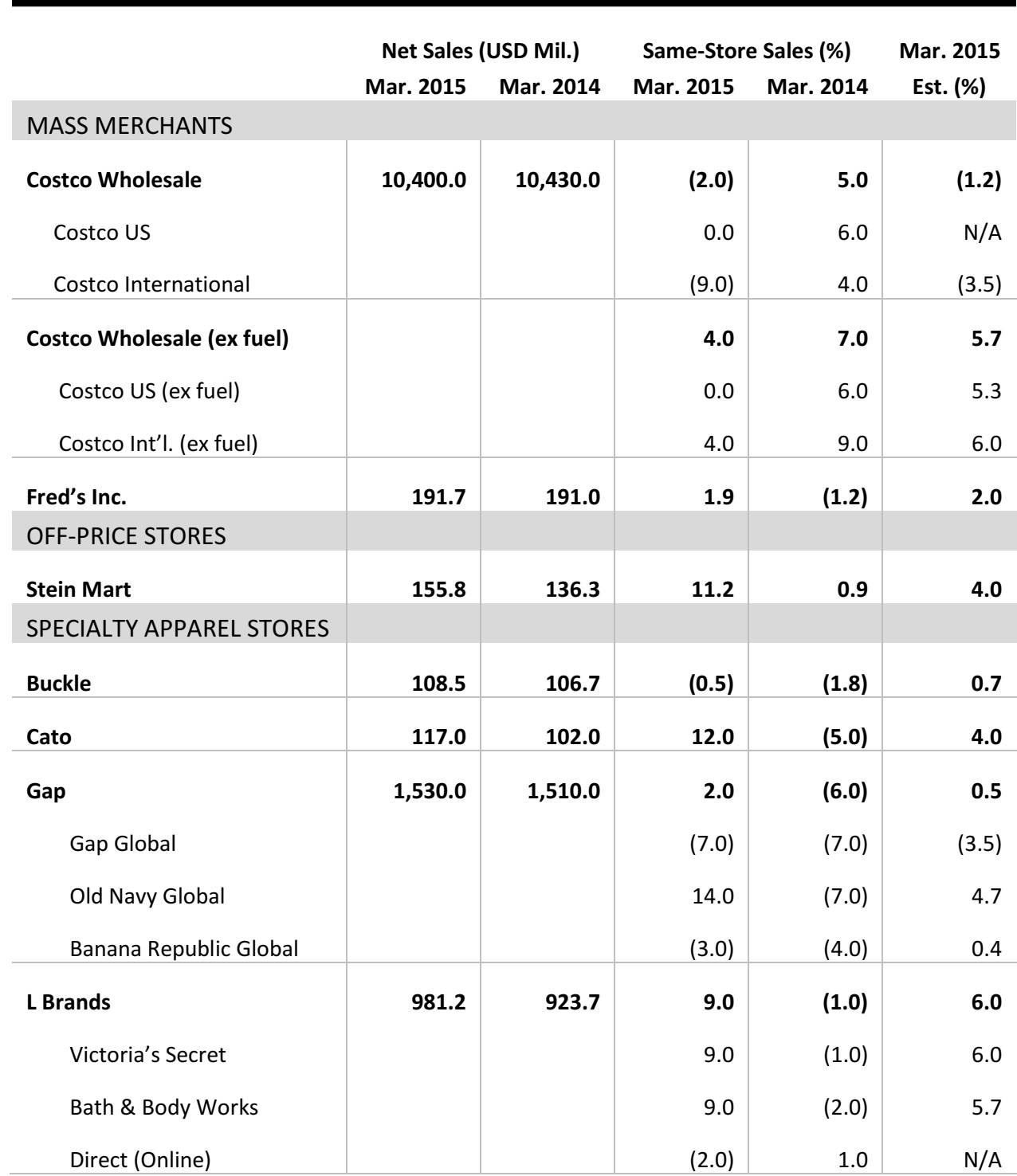

- The five-week period had 34 selling days this year versus 35 selling days last year, reflecting the earlier timing of the Easter holiday this year. The early Easter affected this year’s net and comparable sales by 1%–1.5%.

- Costco’s 2% comparable sales decline was higher than the 1.2% decline that analysts had estimated. When excluding the impact of fuel, comp sales were up 4%.

- Within the US, the strongest sales regions were the Midwest, Southeast and Bay area. On the international side, strong sales were posted in Australia, Mexico and Canada, while sales in Japan were weak.

Value Store Fred’s Inc. Strong Comp Sales in March Were Boosted by Easter Categories

- Fred’s Inc. posted 0.3% total sales growth, to $191.7 million, in March 2015, up from $191 million in March 2014. This moderate increase reflected the closing of 62 stores during 2014. Excluding sales of $8.4 million from stores closed in 2014, total sales increased by 5% for the period.

- The company was pleased that March sales were at the high end of guidance, reflecting a strong Easter assortment in toys, candy and gifts. However, lawn and garden categories were affected by the delayed arrival of spring.

Stein Mart Posted an 11.2% Increase in Comp Sales in March, Beating Estimates of 4%

- Stein Mart benefited from the shift in the peak spring selling period and from pre-Easter sales.

- Most regions showed high single- or double-digit comp sales, while the Northeastern region had mid-single digit growth.

Buckle’s Men’s Categories Posted Strong Comp Results in March

- Buckle’s overall comps were down 0.5%: women’s categories were weak, declining by 3%, while the men’s business was up 8.5%. The total transaction volume grew by 4.5%.

- The women’s section accounted for 57% of total monthly sales versus 60% last year. The men’s categories’ total sales portion increased to 43% from 40% last year.

- Popular men’s categories included casual bottoms, shorts and woven knit shirts. On the women’s side, tops and footwear were strong.

Cato’s March Total and Comp Sales Posted Double-Digit Growth

- Cato’s sales jumped in March, benefiting from the calendar shift of Easter. However, the company expects a negative impact in April sales.

- The company’s year-to-date sales were up 2% year over year.

Old Navy Comp Sales in March Significantly Outperformed Those of Other Gap Brands

- Gap’s March comp sales were up 2%, following a 6% decline last year. Gap benefited from early Easter peak shopping dates, but is expecting weaker April sales due to the calendar shift.

- In addition, West Coast port issues resulted in less merchandize available for sale during the period. Old Navy’s comp sales were up 14%, versus 7% last year, thanks to both parent companies Gap’s focus on Old Navy logistics during the holiday and strong marketing strategies.

L Brands Ended March with 9% Comp Sales, Improved Margins and Low Inventory

- The early Easter helped boost March sales by three to four points. The company expected a five-point decrease due to the calendar shift of the holiday and expects flat April sales.

- Victoria’s Secret’s direct sales business was down 2%, mostly due to a decline in apparel sales.

- Bath & Body Works comps were up 9%, driven strong sales of Hawaii-themed products and the early Easter.

Zumiez 5.5% March Comp Sales Growth Was Driven by Improved Dollar per Transaction Numbers

- The positive Zumiez comps were driven by an increase in dollar per transaction figures, and offset by a decrease in comparable transaction volume. The year-to-date comps were up 6.1% versus last year’s 0.8% decline.

- Men’s apparel, juniors, hard goods and accessories had positive comps, whereas footwear had negative comps.

- While all regions posted positive comps, Europe was particularly strong despite recent unfavorable foreign exchange trends.