Nitheesh NH

Introduction

Alibaba Group is a market leader in China for online shopping, entertainment and food delivery services. The company is no longer just an e-commerce giant, but also a technology company that provides solutions to businesses and consumers. In this report, we provide an overview of Alibaba Group and discuss its New Retail strategy, including how the company is empowering consumers, merchants and retailers.Overview of Alibaba Group

Alibaba Group Holding Limited was founded in 1999 and is headquartered in Hangzhou, China. Through its subsidiaries, the company provides online and mobile commerce businesses in China and internationally. It operates in four segments: Core Commerce, including marketplaces such as Taobao and Tmall; Cloud Computing, namely Alibaba Cloud; Digital Media and Entertainment; and Innovation Initiatives and Others. Alibaba has three main growth strategies: driving user growth and engagement; empowering businesses to facilitate digital transformation and improve operational efficiency; and continuing to innovate. Alibaba’s mission is “to make it easy to do business anywhere.” According to John O’Loghlen, the company’s Director of Business Development for Australia and New Zealand, Alibaba’s vision is to build an operating infrastructure that will allow businesses to expand globally and to serve 2 billion consumers by 2036. To help achieve this, Alibaba is implementing its New Retail strategy, building an ecosystem of digital services that can be tapped into by consumers, sellers, service providers and content providers.Alibaba’s New Retail Strategy

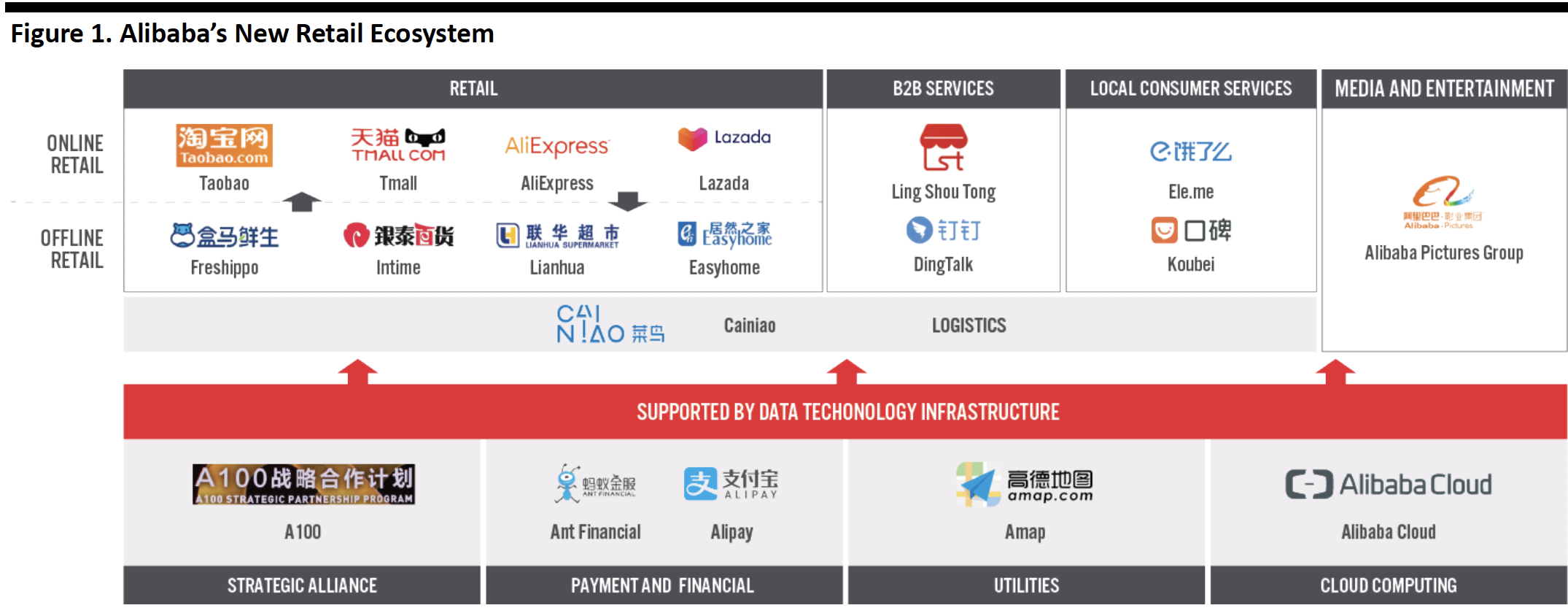

“New Retail” was coined by Alibaba’s founder Jack Ma in 2016, and refers to a model that integrates online retail, offline retail and logistics across a single value chain, powered by data and technology. The aim is to upgrade and transform production and sales operations and improve customer experience. The New Retail concept centers around enabling consumers to reach the right product at the right time and place, by using data and technology coupled with consumer insights. Alibaba Aims To Empower Merchants and Consumers through New Retail New Retail is intended to allow businesses to succeed in the digital era, according to O’Loghlen. This involves helping traditional retailers to restructure and enhance the way they operate, which can touch everything from customer experience to inventory management and retail spaces. At the same time, Alibaba is able to capture real-time data on digital consumer behaviour that can help merchants to quickly respond to changing demand. Through New Retail, Alibaba is also undergoing restructuring as it strives to remain at the forefront of innovation in e-commerce and broadens its identity as an e-commerce company into big data, physical infrastructure and mobile payment. Alibaba is essentially a technology/platform provider for businesses. This makes it unlike other companies such as Amazon that are both B2B service providers and business-to-consumer (B2C) retailers. In the past, we have seen Alibaba actively helping online and offline retailers, local service providers and merchants to digitalize their businesses, empowering them with data technology and enabling them to create value from data insights through the New Retail strategy. We will discuss this in more detail in the following sections. [caption id="attachment_99128" align="aligncenter" width="700"] Source: Alibaba/Coresight Research[/caption]

Source: Alibaba/Coresight Research[/caption]

Online Retail

Alibaba is probably best known for its online marketplaces. Alibaba.com is the company’s wholesale (B2B) marketplace, but Alibaba offers a number of sites on which consumers can shop. Through the New Retail strategy, these online platforms extend further than simply enabling retailers to sell and consumers to buy, by offering tools to empower retailers to sell better and consumers to make better purchasing decisions. Taobao Taobao is Alibaba’s consumer-to-consumer online marketplace, on which merchants are primarily individuals and small businesses. According to , a Beijing-based data analytics service provider, Taobao Marketplace has a large and growing social community and was China’s largest mobile commerce destination in terms of gross merchandise volume for the 12 months ended March 31, 2019. In May 2019, Taobao launched a multi-label store called Taostyle in the Hangzhou Kerry Centre shopping mall to bring into offline retail the independent clothing brands that sell via its online platform. The store rotates inventory and refreshes the featured brands at least twice per month. Taostyle features in-store technology to assist shoppers, such as including QR codes on clothing tags that can be scanned to gain access to detailed product information and customer reviews. The store also allows consumers to place orders online in addition to buying in store. The Taostyle clothing store represents the extension of online retail into physical stores for small- to medium-sized brands that may not otherwise have the resources to build an offline presence. The regular rotation of brands offers newness for consumers, which should drive repeat visits to the store. [caption id="attachment_99076" align="aligncenter" width="700"] Taostyle store

Taostyle storeSource: Alizila[/caption] In the grocery sector, Taobao launched a one-hour delivery service called Taoxianda in March 2018. Customers can access Taoxianda on the Taobao app to order products from retailers such as Auchan, LOTUS and RT-Mart, which are delivered within one hour within a 5-kilometer radius. Taoxianda currently provides solutions for 23 brands in 278 cities and has digitalized more than 800 stores. [caption id="attachment_99077" align="aligncenter" width="700"]

Taoxianda

TaoxiandaSource: Coresight Research[/caption] Taoxianda manifests Alibaba’s New Retail strategy in a number of ways:

- It helps traditional retailers to create their own online Taoxianda stores, thus increasing their online sales penetration by more than 25%.

- It helps to digitalize product inventory and store layout to improve turnover and efficiency.

- It leverages data gathered online as well as location-based technology to provide personalized and localized product recommendations.

- It integrates online and offline marketing channels across all customer touch points before and after the transaction, as well as providing delivery capacity to improve the overall shopping experience.

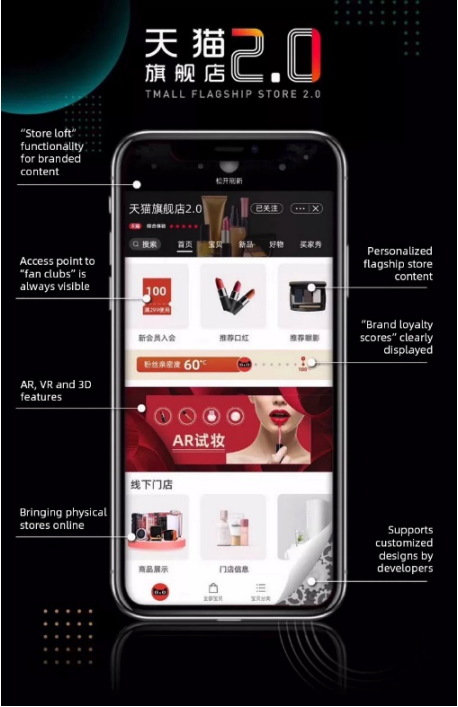

Tmall Flagship Store 2.0

Tmall Flagship Store 2.0Source: Alizila[/caption] Also in July 2019, Alibaba’s customer experience business unit reported that its service operating system is open to merchants, and launched an upgraded version of its Fulfillment by Tmall 2.0 (FBT) service platform. Merchants that integrate their operations with the FBT gain access to a range of tools. For example, they are able to use visual data maps to identify sales spikes, as well as set up early-warning alerts and active service systems to recognise and resolve supply chain issues more quickly. AliExpress AliExpress, which was launched in 2010, is a global retail marketplace for Chinese products. China-based companies or individuals that sell on the platform are each issued a unique store number. There is no minimum order requirement, and customers can pay safely using the AliExpress buyer protection service. The marketplace can be accessed in multiple languages, including Arabic, Japanese, Portuguese and Russian. In August 2019, AliExpress opened its first brick-and-mortar store, which an omnichannel concept that combines online shopping with the experience of physical retail. The store is located in the Xanadú shopping center in Madrid, Spain, and sells products that are in high demand on AliExpress Plaza, which ships items in three to seven days. : the entrance, which contains the best-selling products; an area where customers can fly drones; and an area that features an augmented reality mirror. The latter allows shoppers to “try on” different clothing items, as the mirror scans the customer and displays apparel overlaid on the rendering of their body. [caption id="attachment_99079" align="aligncenter" width="700"]

AliExpress offline store in Spain

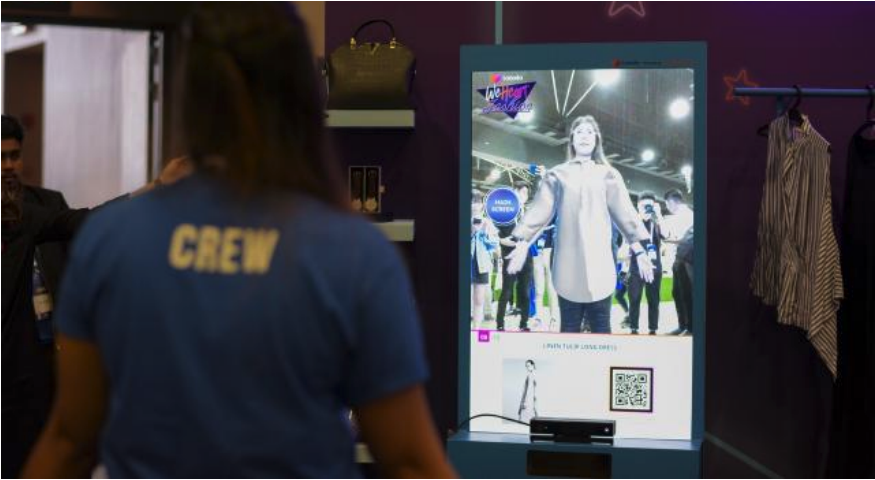

AliExpress offline store in SpainSource: Alizila[/caption] The new store was launched to enable online brands “to break barriers with the consumer” by providing them with a physical retail touchpoint, according to the Xanadú shopping center’s management team. Shoppers at the store are also able to make purchases online through AliExpress. Lazada Lazada Group is an international e-commerce company that is headquartered in Singapore. Its business model is to sell products to customers from its own warehouse inventory. The company was founded by Rocket Internet in 2012, but Alibaba Group bought a controlling stake in Lazada in April 2016 to support its international expansion plans. By August 2018, Lazada became the largest e-commerce operator in Southeast Asia, based on average monthly website traffic. Currently, Lazada has operations in Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam. In October 2019, at its Wecommerce annual flagship seller summit, Lazada Malaysia showcased future retail concepts that offer new ways for sellers to engage with customers through integrated offline and online capabilities. The event attendees were offered the opportunity to preview Lazada’s new Fashion Mirror, which uses augmented reality technology to allow consumers to experiment with clothing and accessories. According to the company, this also reduces retail costs as it reduces the amount of space required to stock inventory, among other things. [caption id="attachment_99080" align="aligncenter" width="700"]

Lazada showcased augmented reality technology at Wecommerce 2019.

Lazada showcased augmented reality technology at Wecommerce 2019.Source: Alizila[/caption] Lazada Malaysia also showcased a mixed reality booth, which brings to life the company’s plan to marry offline and online retail. By wearing a set of goggles, the customer is able to navigate virtually through a physical store and browse products for sale using augmented reality.

Offline Retail

In addition to online retail, Alibaba is also investing in the offline space through its New Retail strategy, which extends across multiple industry sectors. Grocery: Freshippo Freshippo, formerly known as Hema, is a fresh-grocery store that serves three purposes at once: a supermarket, a fulfillment center and a restaurant. , whilst at the same time enabling customers to shop for groceries and dine in store. As of September 2019, there are 175 Freshippo stores in 22 cities within China, according to the brand’s President, Hou Yi. Shopping at Freshippo is a smartphone-powered experience. Once customers download the Freshippo app, they can shop via the Internet or in offline Freshippo stores and pay through Alipay. Orders placed in the app are delivered to customers within 30 minutes within three kilometers of the store. In store, customers are able to scan QR codes for product information, and fresh food is prepared by chefs on site. In terms of manifesting New Retail, Freshippo leverages data and smart logistics technology to enable customers to buy online and receive home deliveries, to drive online customers to its offline restaurants and to provide fulfillment logistics for e-commerce orders. [caption id="attachment_99081" align="aligncenter" width="700"] Freshippo stores feature QR codes to give customers access to product information.

Freshippo stores feature QR codes to give customers access to product information.Source: Alizila[/caption] Department Store: Intime Alibaba acquired department store chain Intime for around $2.6 billion in 2017, and has since utilized its technology and infrastructure to digitalize Intime’s operations in different areas, from membership to payments to logistics. Intime launched a mobile app that allows customers to access product information by scanning items in the department store and offers a touchpoint for further engagement after they leave. Real-time consumer data is supplied by Alibaba, which enables Intime to make use of statistics as well as set up augmented reality interfaces for its customers. Alibaba has helped to transform Intime from a traditional brick-and-mortar operator to a technology-driven innovator. This led to an increase in foot traffic in 2018’s 6.18 shopping festival for Intime, according to the company. [caption id="attachment_99082" align="aligncenter" width="700"]

Alibaba has introduced various technologies to Intime stores.

Alibaba has introduced various technologies to Intime stores.Source: Alizila[/caption] Supermarket: Lianhua In mid-2017, Alibaba acquired an 18% stake in the Lianhua supermarket chain, which is owned by the Bailian Group. This move was an extension to the partnership that Alibaba established with the Bailian Group in February that year with the aims of delivering a better shopping experience and enhancing overall business efficiency. The two companies are working to achieve these goals by sharing consumer data and integrating offline stores, merchandise, membership programs, logistics and payment tools. Since its investment in Lianhua, Alibaba has been leveraging its data capabilities to drive sales for the supermarket chain, which had been struggling to grow revenues. [caption id="attachment_99083" align="aligncenter" width="700"]

Lianhua Supermarket

Lianhua SupermarketSource: Alizila[/caption] Home Furnishings: Easyhome Alibaba announced in February 2018 that it would pay around RMB5.45 billion ($867 million) for a 15% stake in Beijing Easyhome Furnishing, China’s second-largest home-improvement supplies and furniture chain. Alibaba has stated that, through combining the strengths of the world’s largest e-commerce platform with the rich offline sources of Easyhome, the tie-up will provide both online and offline customers with a comprehensive home-improvement solution. [caption id="attachment_99084" align="aligncenter" width="700"]

Alibaba’s partnership with Easyhome

Alibaba’s partnership with EasyhomeSource: Alizila[/caption] Alibaba’s New Retail solutions helped Chinese home-furnishings retailer Easyhome digitalize its first store in October 2018, covering operations from customer targeting and profiling to manufacturing, delivery and installation. In Easyhome stores that have implemented such technologies, shoppers can scan each item’s QR code with their smartphones to access product information, and then make purchases easily and quickly through Alibaba’s mobile payment service Alipay. The stores also feature large display screens on the walls, enabling customers to see their desired furniture and décor in a virtual home setting. According to William Chen, who heads the Home Times project at Alibaba’s Cloud Retail division, Alibaba possesses the hardware and know-how to build New Retail-driven stores, and is working with partners that have access to offline channels and expertise in operating physical stores.

Strategic Alliances

Alibaba announced the launch of “A100” in January 2019, a strategic partnership program built on the Alibaba Operating System that offers companies a holistic one-stop solution to accelerate their digital transformation. Creation of the Alibaba Operating System forms part of the company’s progression from an e-commerce provider to an integrated global technology company. New Retail is a key interface through which businesses can tap into the Alibaba Operating System. The A100 programme covers 11 different operational areas, encompassing sales, logistics, supply chain optimization, payments, marketing and a wide range of supporting services powered by cloud-based technologies. According to the company, members of A100 will develop a deep and longstanding working relationship with Alibaba businesses across multiple functions and platforms. For example, Alibaba has helped home-appliance brand Haier (one member of the A100 programme) to digitalize its physical stores. Customers can now read product reviews by scanning QR codes attached to the products in Haier’s stores, providing benefits of the online community experience while also enabling them to see and touch the products. [caption id="attachment_99085" align="aligncenter" width="700"] Alibaba announces its A100 Strategic Partnership Program at the inaugural Alibaba ONE Business Conference.

Alibaba announces its A100 Strategic Partnership Program at the inaugural Alibaba ONE Business Conference.Source: Alizila[/caption]

B2B Services

Ling Shou Tong According to Alibaba, New Retail will allow convenience stores to remain competitive on the market, which is the founding mission of Ling Shou Tong (LST). LST is Alibaba’s New Retail inventory management platform that enables mom-and-pop stores to strengthen their brick-and-mortar presence, optimize product supply and increase sales. LST helps to integrate the inventory management of each store into a central warehousing and logistics system. The analytics platform anticipates customer preferences and informs proprietors of order requirements, including quantities and scheduling. LST realizes Alibaba’s New Retail strategy in the following ways:- It improves distribution efficiency for fast-moving consumer goods (FMCG) brands and their distributors by digitalizing offline distribution data through point-of-sale systems at mom-and-pop stores, enabling greater visibility of data throughout the transaction value chain.

- It enables FMCG brands and their distributors to achieve precise and effective marketing by providing more targeted and accurate marketing recommendations.

- It enables mom-and-pop stores to offer customers a broader selection of FMCG products, as supply and inventory management are optimized.

- It provides recommendations to stores and helps them to analyze sales and expenses, manage promotions and improve the presentation of their products in stores, thus increasing sales potential.

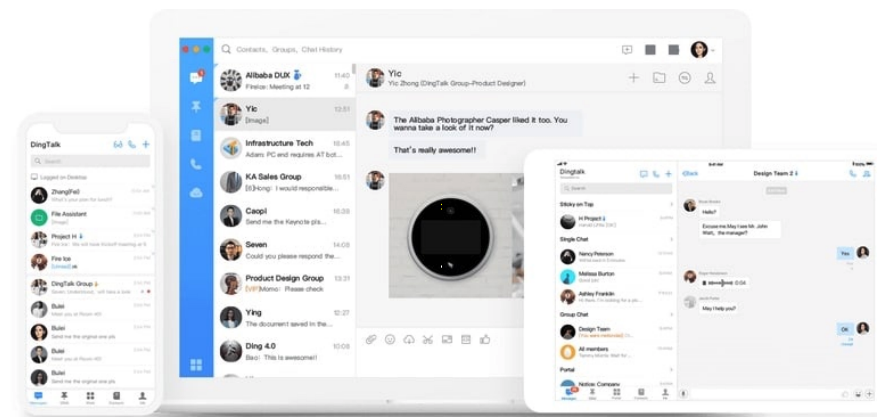

The DingTalk enterprise messaging platform

The DingTalk enterprise messaging platformSource: DingTalk[/caption]

Payment

Alipay is a leading third-party online payment app developed by Ant Financial, an Alibaba-affiliated company since it received a 33% equity interest in September 2019. Founded in 2004, Alipay provides payment and escrow services for transactions on Alibaba platforms. Alipay has since expanded to other verticals such as utility bill payment, online shopping and financial products, including personal loans, insurance and investment funds. Alipay is the primary payment method for Hema and many other Chinese stores. As of September 25, 2019, Alipay has 900 million active users in China and 1.2 billion worldwide, combined with local wallet partners. Merchants can leverage consumer data gathered through Alipay for personalization and targeted marketing. Shoppers can also use Alipay in online and offline stores across 56 markets worldwide. Alipay plays a key role in New Retail for Alibaba through directing traffic from online to offline channels and providing consumer insight through user analytics. Integrated with QR code technology, Alipay has been made available as a payment option at the stores of the Bailian Group and Intime, both of which are strategic partners of Alibaba.,Local Consumer Services

Ele.me Ele.me was originally an on-demand food delivery platform. Alibaba later merged the company with its lifestyle unit Koubei in October 2018 to boost its local services capabilities. According to Daniel Zhang Yong, Executive Chairman and Chief Executive of Alibaba Group Holding, Alibaba hopes that to the move will offer an integrated experience to consumers both online and offline. Ele.me has now become a dedicated local services platform that is able to offer quick delivery. We saw Ele.me manifesting the New Retail strategy in its Starbucks partnership in August 2018, which made Ele.me the coffee giant's exclusive delivery partner in China. [caption id="attachment_99087" align="aligncenter" width="700"] Ele.me staff deliver Starbucks goods.

Ele.me staff deliver Starbucks goods.Source: Alizila[/caption] Koubei Koubei was formed from a joint venture between Alibaba and Ant Financial in 2015 and is integrated with Alipay. Koubei is an online-to-offline entertainment and leisure activities app (similar to Groupon), and has a search engine that provides information on local services such as restaurants, food delivery, movie ticketing, shopping and travelling. Koubei plays an important role in implementing Alibaba’s New Retail strategy as the platform directs online traffic offline, helping to boost offline store sales:

- Consumers are able to search for local merchants using Koubei and then visit the stores to take advantage of promotions.

- Local merchants can use Koubei to create virtual stores where shoppers are able to browse through merchandise, purchase items and receive discounts. Consumers can access the virtual store by scanning the merchant’s QR code.

Happy Lemon’s Koubei smart store

Happy Lemon’s Koubei smart storeSource: Alizila[/caption]

Media and Entertainment

Alibaba Pictures Group In 2014, Alibaba bought Hong Kong film and TV producer ChinaVision Media Group, and renamed it as Alibaba Pictures Group. The integrated cultural corporation has interests in TV, film production, print media and mobile media.In 2016, Alibaba Pictures Group acquired almost 61% of Hangzhou Xingji, which operates the Hangzhou Star Cinema, for ¥39 million ($358,000) from its shareholder Hangzhou Kunwei. The deal represents the corporation’s move to expand its reach via investments in cinemas and movie production to sate the growing appetite of Chinese audiences for entertainment and movies. Alibaba aims to build an integrated, online-to-offline entertainment platform for the industry by combining its e-commerce capabilities with the traditionally offline entertainment and cinema circuit, encouraging consumers to purchase movie tickets on their smartphones before heading to the cinema.Utilities

Location services provider AutoNavi was stablished in 2001 and acquired by Alibaba in 2014. The brand’s mobile app, known as Amap, provides navigational and real-time traffic information. Powered by big data and cloud technologies, Amap captures users’ driving patterns in real time and collaborates with police and transport offices to capture information about traffic accidents. [caption id="attachment_99089" align="aligncenter" width="700"] Amap is a navigational and traffic information mobile app.

Amap is a navigational and traffic information mobile app.Source: Amap[/caption] Alibaba rolled out its New Retail City initiative in April 2018, and Beijing joined soon after. It was reported the following month that roughly 5,000 traditional shops were expected to go online in the city as part of the initiative. Alibaba would share geographical information with the Beijing Commission of Commerce, and Beijing residents would then be able to find nearby vegetable markets, convenience stores and nursing rooms, as well as snack bars and restaurants, at any time via the Amap app. According to Liu Zhenfei, President of Amap, the service will “utilize its innovation capacities of developing Internet products to serve users out and about and provide data for businesses, becoming a professional living map” for Beijing residents.

Cloud Computing

Alibaba Cloud, also known as Aliyun, was founded in 2009 as a private cloud to serve Alibaba’s e-commerce businesses. It now offers a comprehensive suite of cloud services to customers worldwide: elastic computing; database, storage and network virtualization services; large-scale computing; security, management and application services; big data analytics; a machine learning platform; and IoT (Internet of Things) services. Alibaba Cloud has a key role to play in New Retail by being at the forefront of digitization and providing solutions through Alibaba’s retail business. Over the years, Alibaba Cloud has improved the performance of artificial intelligence and big data-based intelligence and promotion engines, helping Alibaba’s platforms provide more accurate recommendations to retailers and merchants. Alibaba Cloud’s infrastructure also helps to integrate e-commerce and offline channels—handling web traffic, orders and payments—during the Singles’ Day event each year.Logistics

Founded in 2013, Cainiao is a logistics data platform that drives efficiency by connecting e-commerce companies with logistics companies to provide fulfillment on a large scale. Cainiao’s platform spans delivery, warehouse, pick-up, and rural and cross-border logistics. Its goal is to be able to deliver anywhere in China within 24 hours and anywhere in the world within 72 hours. [caption id="attachment_99090" align="aligncenter" width="700"] A Cainiao warehouse

A Cainiao warehouseSource: Alizila[/caption] Cainiao manifests Alibaba’s New Retail strategy by using data insights and technology to digitalize the entire logistics process and empower logistics partners, thereby improving efficiency across the logistics value chain. The platform uses AI to help merchants to predict regional demand for certain products and speed up parcel deliveries by determining the fastest and most cost-effective delivery routes.