albert Chan

Introduction

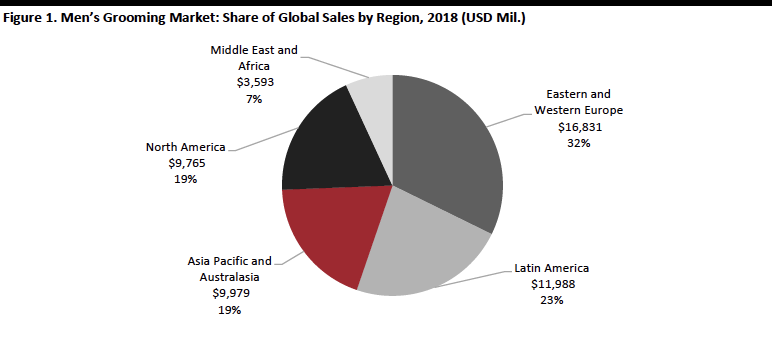

Male beauty is an area ripe with opportunity – including male grooming and especially male makeup as men show increasing interest in skincare, personal care products and even entry-level makeup products. Global sales of men’s grooming products reached $52.2 billion in 2018 and are on track to grow to $63.7 billion by 2023, according to Euromonitor International. Male makeup is an emerging industry category: The category is so nascent that the industry is just beginning to collect quantitative and qualitative data. Previous notions that makeup was only meant for women are being rewritten as makeup for men is becoming more widely accepted in varying degrees throughout the world. Men in Asia Pacific were among the fastest to adopt makeup, with China, Japan and Korea leading the way. The US and European countries have been slower to adopt male makeup, but are starting to gain more traction.Asia Pacific is the Fastest-Growing Region for Men’s Grooming and Makeup

Men’s Makeup is Getting a Makeover – Particularly in South Korea, Japan and China Male makeup is an emerging category, with male consumers worldwide increasingly showing interest in skincare and makeup products. The definitions of masculinity and femininity are being challenged and are changing as men are beginning to wear makeup – and not just for stage performances or on television. Men are dabbling in makeup for everyday use – starting with mild concealers and brow pencils and gradually working toward more advanced makeup such as eyeliner, mascara and lipstick. The industry is so new that there is minimal hard data on its scale (in contrast to the broader grooming industry), but researchers are beginning to collect data on the size of the market. Early signs point to markets in Asia as first movers, with male consumers there showing greater interest in makeup products, compared to their western counteraprts. There are various theories about why men in Asian countries are interested in makeup and skincare. For example, in Korea, the rise of K-pop (especially “boy band” music) has been linked to the rise of male makeup. K-pop boy band members often wear eyeliner, tinted foundation and moisturizers, BB cream and lipstick. The K-pop culture is dramatically influencing male makeup and is helping to normalize it culturally. Additionally, younger generations of males in Korea, Japan, and China are influencing male beauty through their artistic expressions of individuality and creativity, which is increasingly including male makeup. [caption id="attachment_84978" align="aligncenter" width="520"] Innisfree’s Jeju Volcanic Color Clay Mask featuring Kpop group Wanna One

Innisfree’s Jeju Volcanic Color Clay Mask featuring Kpop group Wanna OneSource: Innisfree[/caption] In a March 2019 interview with Jason Chen, General Manager of Tmall Beauty, he referred to a “male beauty era” in which the male beauty market is growing faster than the female beauty market on Tmall in China. Men are getting more sophisticated about their grooming regimes and adding products to their routines to look their best. For example, routines may include serum, face cream and even makeup. Chen said China’s male consumer wants products geared toward men: They don’t want to use women’s beauty products. Chen also highlighted that the male consumer trusts key opinion leaders (KOLs), professionals and celebrities for product recommendations. Lastly, Chen pointed out that China’s male consumer does not take a lot of time to compare products, and makes a decision quickly. Adoption of Men’s Beauty and Grooming Is Growing Fastest in the Asia-Pacific Region Eastern and Western Europe is the largest geographic region in the global men’s grooming market, accounting for 32% of all sales. But, Asia Pacific and Australasia is growing fastest at an estimated 7.0% CAGR to 2022, to be worth $13.0 billion. [caption id="attachment_84979" align="aligncenter" width="772"]

Source: Euromonitor International[/caption]

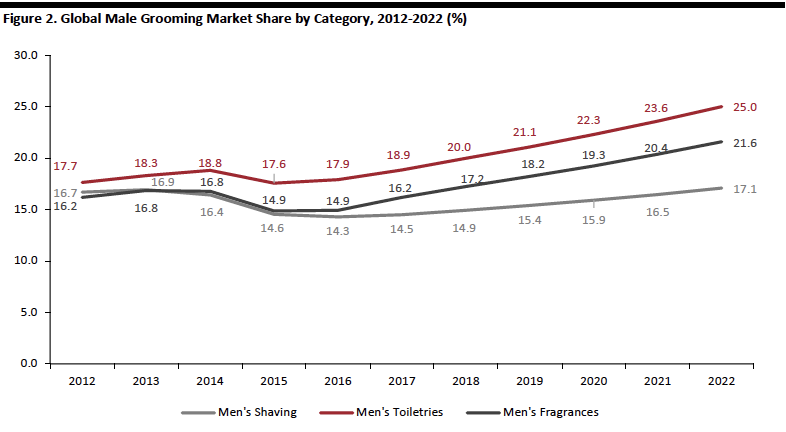

Men’s Toiletries, the Largest Men’s Grooming Category Including Haircare and Skincare, is Expected to Grow The Fastest to 2022

Men’s toiletries is the largest category of male grooming, comprising 38.3% of all retail sales, and it is expected to grow at a compound annual growth rate of 5.8% to 2022. Toiletries includes bath and shower, deodorants, haircare and skincare. This area is growing partly due to men’s interest in skincare and haircare products, and due to new routines and regimes that support toners, masks, moisturizers and even makeup in some cases.

[caption id="attachment_84980" align="aligncenter" width="786"]

Source: Euromonitor International[/caption]

Men’s Toiletries, the Largest Men’s Grooming Category Including Haircare and Skincare, is Expected to Grow The Fastest to 2022

Men’s toiletries is the largest category of male grooming, comprising 38.3% of all retail sales, and it is expected to grow at a compound annual growth rate of 5.8% to 2022. Toiletries includes bath and shower, deodorants, haircare and skincare. This area is growing partly due to men’s interest in skincare and haircare products, and due to new routines and regimes that support toners, masks, moisturizers and even makeup in some cases.

[caption id="attachment_84980" align="aligncenter" width="786"] Source: Euromonitor International[/caption]

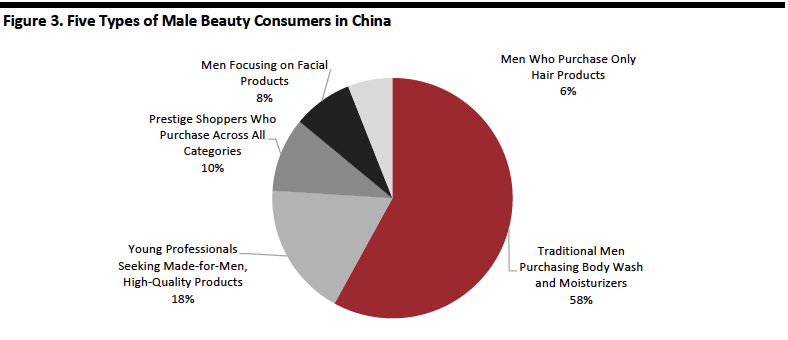

L’Oréal and the Tmall Innovation Center Identified “Five Types” of Male Consumers Shopping for Beauty in China

In 2018, L’Oréal teamed up with Alibaba’s Tmall Innovation Center (TMIC) to uncover insights about China’s male consumer to support L’Oréal’s development of a line of male beauty products for China. L’Oréal says it did not want to take its own products to China as they were, but wanted to target and design products specifically for the local market.

To kick off the project, the team first looked at the male beauty sector in China to determine the target audience. L’Oréal and TMIC crunched data about the male consumer and published a white paper based on the results in September 2018. They found there is no typical male consumer and idenfied general types of male beauty consumers in China, shown below.

[caption id="attachment_84981" align="aligncenter" width="788"]

Source: Euromonitor International[/caption]

L’Oréal and the Tmall Innovation Center Identified “Five Types” of Male Consumers Shopping for Beauty in China

In 2018, L’Oréal teamed up with Alibaba’s Tmall Innovation Center (TMIC) to uncover insights about China’s male consumer to support L’Oréal’s development of a line of male beauty products for China. L’Oréal says it did not want to take its own products to China as they were, but wanted to target and design products specifically for the local market.

To kick off the project, the team first looked at the male beauty sector in China to determine the target audience. L’Oréal and TMIC crunched data about the male consumer and published a white paper based on the results in September 2018. They found there is no typical male consumer and idenfied general types of male beauty consumers in China, shown below.

[caption id="attachment_84981" align="aligncenter" width="788"] Source: L’Oréal and TMIC[/caption]

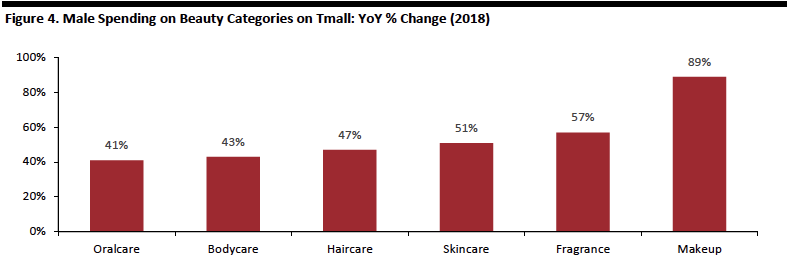

Makeup is the Fastest Growing Category on China’s Tmall for Male Consumers

According to the white paper released by TMIC and L’Oreal China Consumer Intelligence Division in September 2018, total sales of male beauty products in China grew 59% and 54% in fiscal years 2017 and 2018, respectively. The 2018 figure was from a larger base, highlighting the market potential.

As mentioned, the male consumer in China is becoming more interested in daily regimens and routines and are becoming more sophisticated in skincare product usage which may include serums, moisturizers, concealers, foundation, eyeliner, eyebrow pencil and men’s lipstick. For example, the TMIC study found that 62% of men in China between then ages of 15 and 50 use male-specific facial skincare products.

According to Tom Brennan, Group Managing Editor at Alizila, the news hub for Alibaba Group, the definition of male beauty in China is changing. While wearing makeup is traditionally viewed as feminine, men today are increasingly taking care of their appearance and male makeup is viewed by some as a clean and refreshing enhancement to one’s everyday look. Correspondingly, the male consumer in China is spending on makeup, more than any other category on Tmall.

[caption id="attachment_84982" align="aligncenter" width="788"]

Source: L’Oréal and TMIC[/caption]

Makeup is the Fastest Growing Category on China’s Tmall for Male Consumers

According to the white paper released by TMIC and L’Oreal China Consumer Intelligence Division in September 2018, total sales of male beauty products in China grew 59% and 54% in fiscal years 2017 and 2018, respectively. The 2018 figure was from a larger base, highlighting the market potential.

As mentioned, the male consumer in China is becoming more interested in daily regimens and routines and are becoming more sophisticated in skincare product usage which may include serums, moisturizers, concealers, foundation, eyeliner, eyebrow pencil and men’s lipstick. For example, the TMIC study found that 62% of men in China between then ages of 15 and 50 use male-specific facial skincare products.

According to Tom Brennan, Group Managing Editor at Alizila, the news hub for Alibaba Group, the definition of male beauty in China is changing. While wearing makeup is traditionally viewed as feminine, men today are increasingly taking care of their appearance and male makeup is viewed by some as a clean and refreshing enhancement to one’s everyday look. Correspondingly, the male consumer in China is spending on makeup, more than any other category on Tmall.

[caption id="attachment_84982" align="aligncenter" width="788"] Source: Alizila[/caption]

According to the Alizila YouTube video series The Rise of Male Beauty in China, men are shopping across all beauty categories, particularly men’s makeup products that include foundation, concealer, eyebrow pencil and even lipstick.

Male Consumers are Spending More on Male Beauty Products, Presenting an Opportunity for Brands Entering This Market

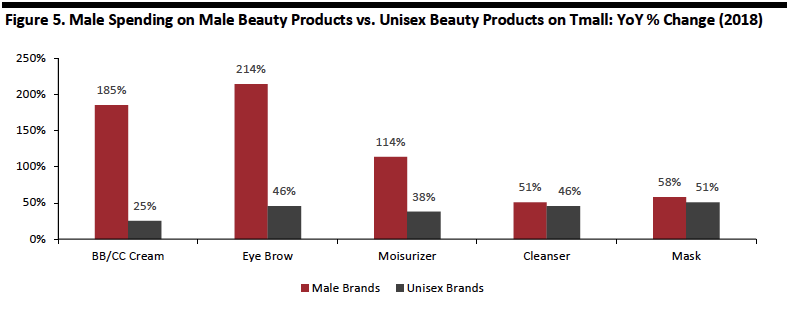

On Tmall in China, male beauty products are growing faster than unisex beauty products. The biggest divergences in growth are in makeup categories such as BB/CC creams and eyebrow makeup — though these are likely to be growing from small bases.

[caption id="attachment_84983" align="aligncenter" width="788"]

Source: Alizila[/caption]

According to the Alizila YouTube video series The Rise of Male Beauty in China, men are shopping across all beauty categories, particularly men’s makeup products that include foundation, concealer, eyebrow pencil and even lipstick.

Male Consumers are Spending More on Male Beauty Products, Presenting an Opportunity for Brands Entering This Market

On Tmall in China, male beauty products are growing faster than unisex beauty products. The biggest divergences in growth are in makeup categories such as BB/CC creams and eyebrow makeup — though these are likely to be growing from small bases.

[caption id="attachment_84983" align="aligncenter" width="788"] Source: Alizila[/caption]

On Tmall, Luxury Male Makeup Brands are Seeing Higher Growth than Premium and Mass Cosmetics

According to Alizila, luxury makeup brands are seeing the highest growth rate by male beauty consumers on Tmall, particularly in the makeup category. Luxury male makeup grew 218% in 2018 over the previous year.

[caption id="attachment_84984" align="aligncenter" width="790"]

Source: Alizila[/caption]

On Tmall, Luxury Male Makeup Brands are Seeing Higher Growth than Premium and Mass Cosmetics

According to Alizila, luxury makeup brands are seeing the highest growth rate by male beauty consumers on Tmall, particularly in the makeup category. Luxury male makeup grew 218% in 2018 over the previous year.

[caption id="attachment_84984" align="aligncenter" width="790"] Source: Alizila[/caption]

There is an Opportunity for Male Makeup Brands in China: Supply is Not Able to Meet Demand

In an interview in April 2019, Jason Chen of Tmall Beauty said Alibaba has found that supply outpaces demand for male beauty. He pointed to a shortage of men’s beauty products in China, which is creating an opportunity for brands and retailers. The previously mentioned L’Oréal and TMIC research study in 2018 also confirmed a lack of choice in male-specific personal care products, particularly skincare.

Source: Alizila[/caption]

There is an Opportunity for Male Makeup Brands in China: Supply is Not Able to Meet Demand

In an interview in April 2019, Jason Chen of Tmall Beauty said Alibaba has found that supply outpaces demand for male beauty. He pointed to a shortage of men’s beauty products in China, which is creating an opportunity for brands and retailers. The previously mentioned L’Oréal and TMIC research study in 2018 also confirmed a lack of choice in male-specific personal care products, particularly skincare.

Male Makeup Growth Slower in US, But Showing Opportunity For Personalized Grooming (Which May Lead To Beauty)

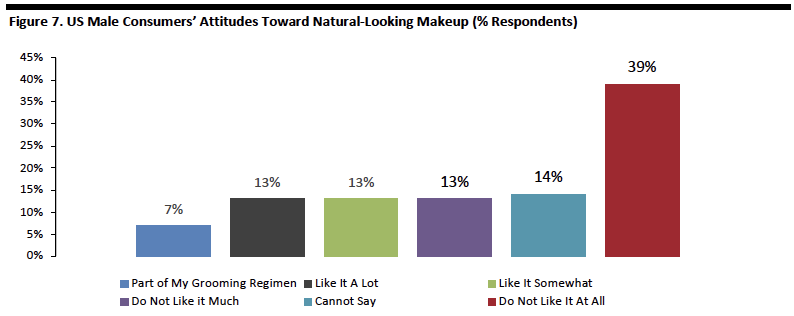

US Males are Embracing Makeup Less Quickly than Asian Counterparts The US male consumer has not embraced makeup as quickly as his Asian counterparts, but the market is showing signs of opportunity. Some 53% of US male consumers do not like male makeup, but a combined 33% of US men like or use natural-looking makeup, according to a 2017 Statista survey. [caption id="attachment_84985" align="aligncenter" width="794"] Base: 1,032 US male respondents, surveyed in June 2017

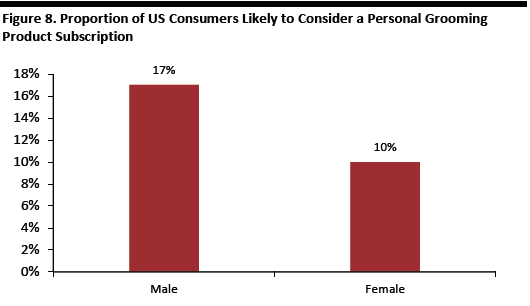

Base: 1,032 US male respondents, surveyed in June 2017Source: Statista[/caption] Brands are Launching Men’s Personalized Grooming Boxes The US male consumer is open to considering a personal grooming subscription – a way for the male consumer to try samples of grooming and beauty products. This could be a way for men to try entry-level male beauty products such as tinted moisturizers, tinted SPF, concealers, or eye-brow pencils, in a “no-risk” format. By having samples in a box, male beauty brands can collaborate to create a gateway to the full beauty product – knowing that the conversion rate for men to try beauty products on their own may be higher. According to a 2017 survey by Worldpay and Socratic Technologies, US men are more likely than US women to consider a personal grooming subscription. [caption id="attachment_84986" align="aligncenter" width="530"]

Base: 895-987 US Internet users, surveyed in January and February 2017

Base: 895-987 US Internet users, surveyed in January and February 2017Source: Worldpay/Socratic Technologies[/caption] Hawthorne, a direct-to-consumer company, has started offering monthly subscription boxes of products personalized based on user surveys. Hawthorne developed an algorithm that can identify the right product based on body chemistry, shower habits, skin type and lifestyle with 95% accuracy. Consumers take a survey, the company recommends personalized products based on the survey results, uses data to predict when the cosnumer will run out and sends auto-refills. [caption id="attachment_84987" align="aligncenter" width="516"]

Source: Hawthorne.co[/caption]

Walgreens collaborated with Birchbox to introduce “BirchboxMan,” which lets consumers personalize their grooming subscription box by selecting grooming preferences and needs so they get the most relevant samples each month. The subscription box ships five samples a month, including haircare, skincare and shaving products. For an extra $10 a month, consumers can join Birchbox Plus, which gets them five grooming samples and a handpicked lifestyle item, such as a tech gadget or accessory (such as hats and socks).

Some examples of the brands and contents of a recent personalized subscription BirchboxMan included:

Source: Hawthorne.co[/caption]

Walgreens collaborated with Birchbox to introduce “BirchboxMan,” which lets consumers personalize their grooming subscription box by selecting grooming preferences and needs so they get the most relevant samples each month. The subscription box ships five samples a month, including haircare, skincare and shaving products. For an extra $10 a month, consumers can join Birchbox Plus, which gets them five grooming samples and a handpicked lifestyle item, such as a tech gadget or accessory (such as hats and socks).

Some examples of the brands and contents of a recent personalized subscription BirchboxMan included:

- Baxter of California, Daily Face Wash

- Duke Cannon, Big Ass Brick of Soap, Jr.

- Kiehl’s, Facial Fuel Moisturizer, SPF 20

- Oars + Alps, Shine Free Lip Balm

- Ursa Major, Fortifying Face Balm

BirchboxMan

BirchboxManSource: Walgreens.com[/caption]

Global Male Makeup Brands

Male Makeup Retailers, Brands, and Marketplaces to Know There have been several brand launches in the male makeup space. We covered Boy de Chanel, Hims and Lab Series, in our November 2018 report on male grooming. Here we highlight FIVEISM x THREE, MMUK and DTRT.- FIVEISM x THREE: Japan-based Pola Orbis launched the makeup brand FIVEISM x THREE in October 2018, cosmetics geared to men. The line includes makeup base, foundation, eyeshadow, eyebrows, lipstick, nail polish and multi-use color sticks. The company is using a new stick format for its foundations as a shape that is easy for men to apply – and very similar to the motion of shaving. The cosmetics are sold at department stores in Tokyo and Osaka and are available online. The concept behind the brand is individuality. The beauty brand is marketed as one “to be free from the confines of gender, age, borders, conventional wisdom and prejudices.”

Source: Fiveism-x-Three.com[/caption]

Source: Fiveism-x-Three.com[/caption]

- MMUK, Men’s Makeup, is a UK-based marketplace offering skincare and cosmetics for men. The company launched an online presence in 2012, and in 2017, opened its first brick-and-mortar store in the UK. The company has its own brand and also sells third-party brands such as Myego, War Paint Makeup for Men, 4V00 Men’s Cosmetics, Recipe for Men, Calvin Klein, Korres, W7, BRTC Homee and House of Formen. The brand’s website reported that according to the grooming blog Ape to Gentleman, 73.6% of men prefer to buy grooming products online. The company sells guyliner, manscara, brow gel, bronzer, tinted moisturizer, BB Creams and a wide range of skincare and cosmetic products.

- DTRT (Do The Right Thing) is a Korea-based men’s makeup and skincare brand that launched in 2013. The brand is sold in the US at Sephora, and includes BB facial creams with SPF 50, toners, facial scrubs, cleansers and lotions.

Source: Sephora.com[/caption]

Source: Sephora.com[/caption]

Key Insights

Male grooming is an area of opportunity: Male products accounted for just 11.3% of the global beauty and personal care market in 2018. Within grooming, male makeup is growing quickly. Many men show increased interest and are becoming more adventurous in trying makeup.- Male makeup is an emerging category. The definitions of masculinity and femininity are being challenged and are changing as men are beginning to wear makeup – and not just for stage performances or television.

- Asia Pacific, which includes Australasia, is one of the fastest-growing major regions for men’s makeup and grooming. The men’s grooming category is expected to grow at a 7.0% CAGR to 2022 – and men in China, Japan and Korea are pioneering the change. In China, men’s daily grooming regimens are becoming more sophisticated and may include serums, moisturizers, concealers, foundation, eyeliner, eyebrow pencil and men’s lipstick. In Korea, male adoption of makeup products has been influenced by K-pop culture and by younger male consumers.

- By category, male consumers in China spent at a higher rate in 2018 compared to 2017 on makeup on Tmall, and spent more on products targeted at men compared to unisex products on Tmall.

- Supply is not able to meet demand for male makeup products in China, according to Jason Chen of Tmall Beauty, creating an opportunity for brands. The Chinese male consumer wants products geared towards him.

- Adoption of male makeup is slower in the US compared to its Eastern counterparts, but the market shows potential: Some 33% of US males say they like or use natural looking makeup.

- Brands are launching men’s personalized grooming boxes. Some 17% of US male consumers are open to considering a personal grooming subscription. This creates an opportunity for male consumers to try samples of grooming and male beauty products “risk free” – and for brands to convert them to regular buyers.