1) Companies Are Hiring Chief Algorithm Officers (CAOs) to Raise Their Apparel IQ

Data is king. Companies are hiring Chief Algorithm Officers (CAOs) today to be faster, to understand data and to make better products and decisions. In a panel session titled “Connecting Your Sourcing Dots in the Americas,” Mike Todaro, Managing Director, American Apparel Producers’ Network (AAPN), said that “data” and “connectivity” are two things that can transform businesses today. Data can improve time, cost and the customer experience, and many organizations are neglecting to tap into this valuable asset. For example, Amazon looks at every piece of data to understand its customers, and is continually analyzing customer behavior to target customers and determine the markets it will enter. The information and the data that is available from sourcing trends, factories and at companies’ fingertips is limitless today, and is only going to expand.

2) At Hugo Boss, Smart Factories Are the Company’s “Digital Twin” and Are Transforming Fashion Production

Linking the entire supply chain through smart factories and digitalization of manufacturing is a game changer for fashion because this is what is linking the entire chain.

In a panel session titled “The Future Is Here,” Joachim Hensch, Managing Director, Hugo Boss, Textile Industries, discussed his company’s journey to become a smart factory, noting that smart factories are not just a mindset that you can buy off the shelf. There is no one way to become a smart factory.

He described how Hugo Boss began its journey to become a smart factory. In 2015, the company set up what he referred to as a “digital twin,” the premise of the smart factory. He compared the concept to humans—we each have a digital twin on Facebook and LinkedIn. The smart factory is the same concept of establishing a presence, only in a different format.

Hugo Boss set targets for itself in terms of this digital twin: to connect, collect, analyze and predict what will happen at each step of its smart factory journey.

Hensch described how the company’s digital transformation continued in 2016, with automation, then move to artificial intelligence (AI) and, eventually, how the company will manufacture goods in what it calls “Suits 2020,” which describes how it thinks about its entire manufacturing process under a smart factory. At Hugo Boss, robots are currently running in conjunction with regular operators in its factories called “COBRAs.”

Hensch said that the smart factory has also changed how Hugo Boss thinks about space in 3D space planning. For example, when one thinks about planning, they usually think about humans. A smart factory, on the other hand, allows one to think about space differently, in 3D. In this regard, Hugo Boss is utilizing hanging spaces for garments, as well as for trims and storage. In the future, Hugo Boss is thinking about using drones for micro-deliveries within the factory as part of 3D space planning.

Source: Hugo Boss

3) Connectivity—Through Relationships in the Supply Chain—Provides Speed

In a panel session titled “Connecting Your Sourcing Dots in the Americas,” Lloyd Parks, President, Dominance Apparel, discussed the importance of understanding where products are sourced and the costs to produce a final product. Parks emphasized that it is critical to physically go into the areas where a company wants to source and to build relationships. For example, if a product lead time needs to be shortened, it is more likely to happen with a strong network of suppliers with which a company has built a trusted working relationship.

Mike Todaro, MD, AAPN, added that “business relationships give you speed, and there is no speed until there is trust.” He shared that he and fellow panelists, collectively knew “every sewing machine in the Americas in their combined rolodexes, and where they were sourcing.” He said, “If you’re not fast, you’re useless.” Having a trusted, connected network can provide a competitive advantage in terms of speed.

4) Transparency into all Elements of the Supply Chain—Using Consumer-Facing Apps—Is the Future of Fashion

In a panel session titled “Visual Trust: Transparency Is the Key to Fashion’s Future,” Katherine Stein, Director Business Development – Softlines, SGS North America, and Chris Morrison, CEO, Transparency-One, presented the case that consumers today are environmentally conscious and want to understand where their products are sourced, how they are made and that they are environmentally sound.

Morrison defined transparency as “knowing all of the elements in the supply chain,” and visual trust as “knowing the supply chain, down to the source.” Ethical sourcing, is increasingly becoming more in demand, with consumers wanting to know about the source of product components and where the companies are buying them. For example, according to the American Apparel & Footwear Association, 60% of consumers what to know if their clothes, textiles and home products are responsibly produced. A Nielsen study reported that 91% of consumers would be more loyal to a company that supports a social or environmental issue. Furthermore, Marketing Week reported that sustainable brands can grow up to 50% faster than other businesses.

Transparency-One has created a platform working with suppliers, manufacturers and retailers to trace products through every tier of the supply chain. Morrison discussed three main challenges: 1) how complicated mapping the supply chain is; 2) convincing suppliers to join the platform; and 3) sharing information with consumers.

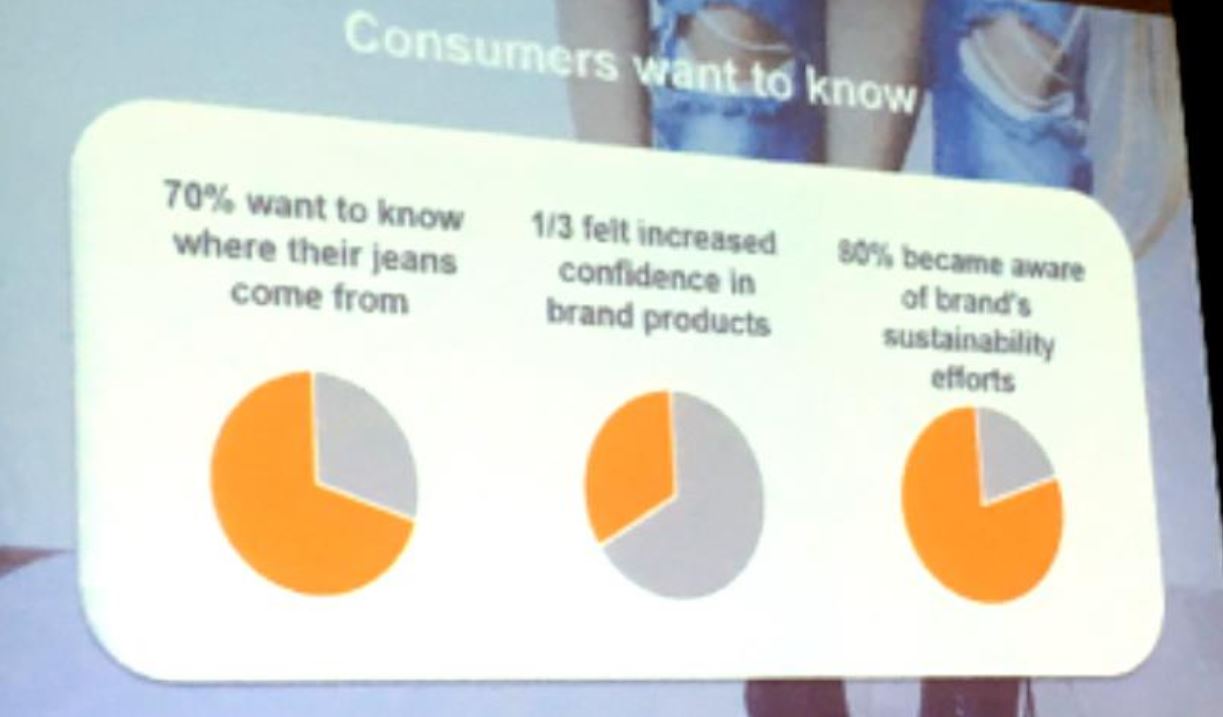

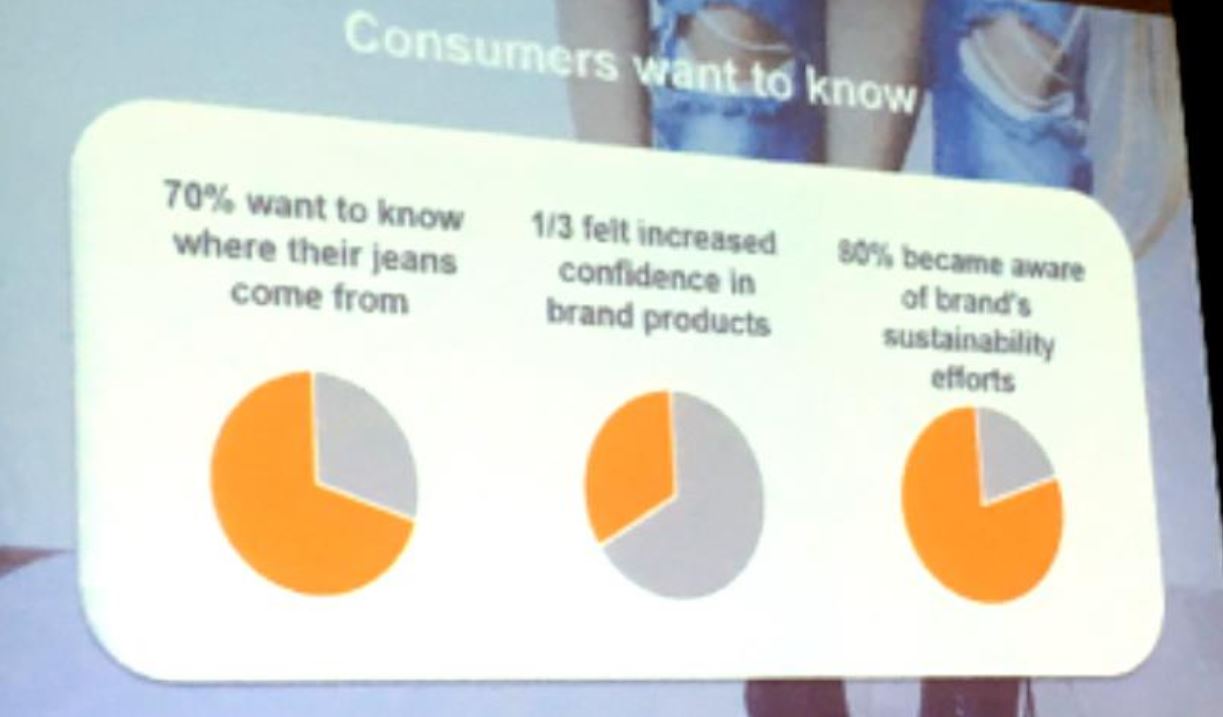

Transparency-One performed a case study with a major fashion retailer to map a denim jean supply chain. The denim company shared its sourcing data with consumers via an augmented-reality application. The consumer findings from this study showed that 70% of consumers want to know where their jeans come from, 33% felt increased confidence in brand confidence and 80% became aware of the brand’s sustainability efforts.

Source: Transparency-One

5) In Women’s Footwear, Price and Value Are Driving Consumers’ Buying Decisions; Brand Is Most Important for Athletic Shoes

In a panel session titled “Reframe, Reset, Retail,” Jocelyn Thornton, Senior Vice President, Creative Services, The Doneger Group, shared takeaways from the trend forecasting firm’s women’s footwear preferences survey.

The Doneger Group surveyed 300 women to determine what shoes women buy, where they buy them and what they look for when buying shoes. Key takeaways from the survey included that price and value are important for consumers, with 37% of women looking at price when shopping for shoes, 35% at function and only 9% at brand.

However, in response to the question “when is brand important?” 49% of respondents said athletic wear, 28% comfort and casual, and 9% said brand is important when buying cold-weather boots.

What would make a customer spend more on a pair of shoes? Some 44% reported quality material, 30% ultimate function and 10% personalization or customization.

Concerning the footwear trend that was most exciting, according to the Doneger survey, 66% reported comfortable and trend-right, 18% athleisure and 8% dressy.

Finally, in response to, “What motivates you to buy new shows?” 31% of respondents reported replacing the basics, 23% seasonal changes and 21% promotions.