Source: Company reports/Bloomberg

4Q15 RESULTS

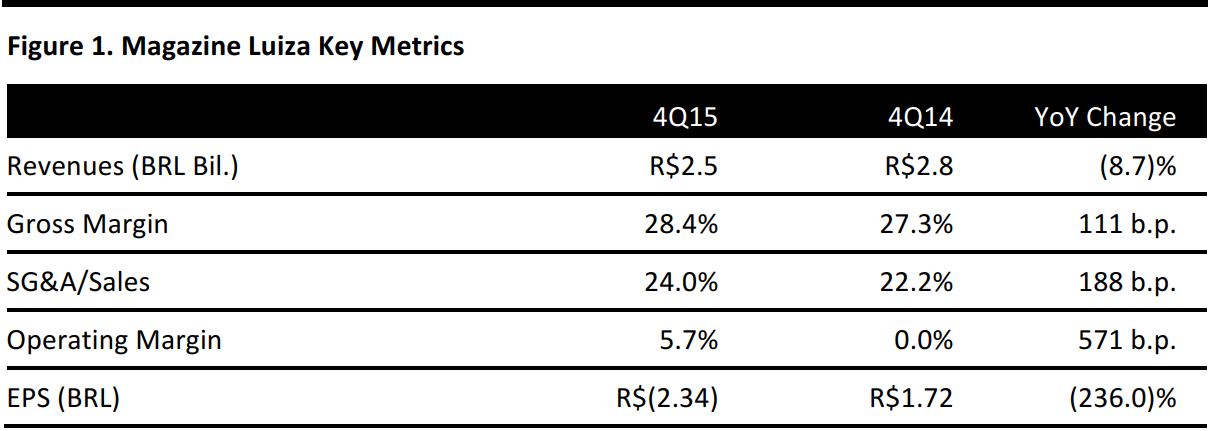

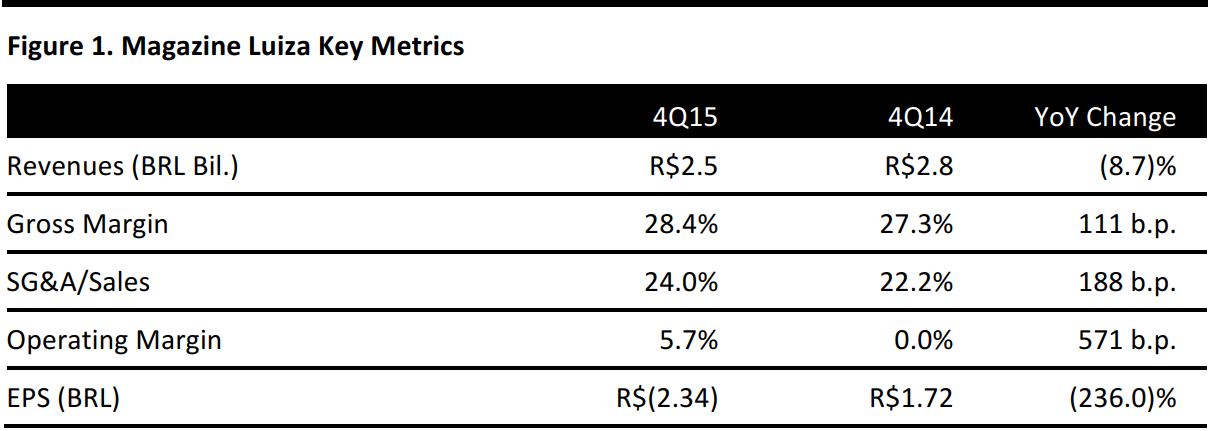

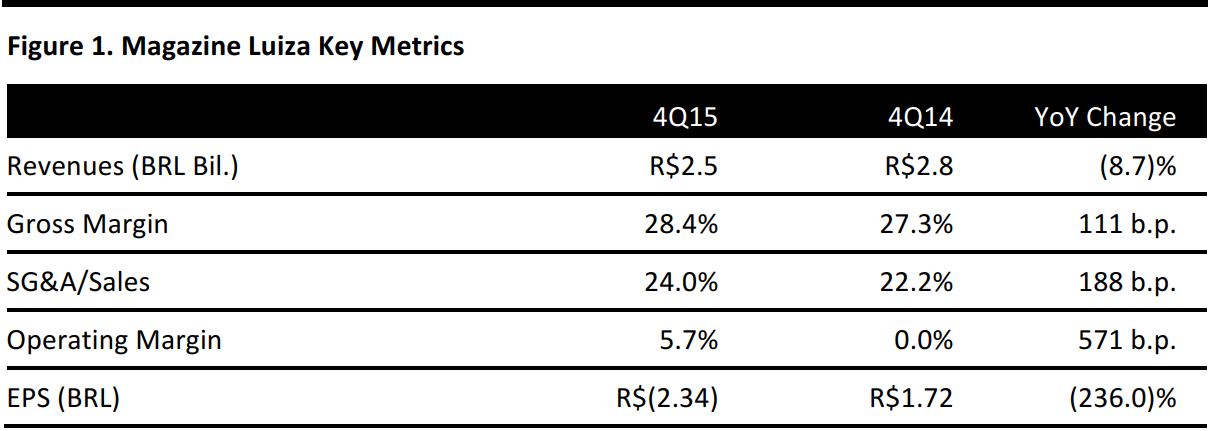

In 4Q15, Magazine Luiza reported a decrease in net revenues of 8.7% from the previous year due to lower merchandise sales and services, which decreased by 8.8% and 7.5%, respectively. Revenues were in line with the consensus estimate of R$2.53 billion. The company’s gross margin increased by 111 basis points due to an improvement in sales mix, charging for shipping and assembly in all stores, and an increase in service revenue.

Comps decreased by 11.6% in 4Q15 due to a 17.6% drop in brick-and-mortar same-store sales. In 4Q14, by contrast, Magazine Luiza reported positive same-store sales growth of 9.4%. The consolidated same-store sales growth decreased by 11.6%. The company reported 19.1% growth in e-commerce sales, helped by the launch of a new mobile app, which had over 1 million downloads. The e-commerce growth helped to offset slumping brick-and-mortar sales.

Bloomberg reported the company’s EPS as R$(2.34) for 4Q15, well below the consensus estimate of R$(0.68). The net loss in 4Q15 totaled R$52.4 million due to lower sales performance, lower dilution of operating expenses and higher interest rates.

2015 RESULTS

Revenues for 2015 were R$9.0 billion, down 8.2% from 2014. General and administrative expenses increased during 2015 due to Brazil’s collective labor wage agreement (enacted in 2015) and an increase in expenses due to high inflation. In 2015, the net loss was R$65.6 million.

Comps decreased by 10.9% year over year due to a tough comparison: in 2014, consolidated same-store sales grew by 17.8%. Magazine Luiza opened 30 new stores in 2015 and closed none.

Bloomberg reported the company’s EPS as R$(2.94) in 2015, well below the consensus estimate of R$(0.23).

OUTLOOK

Magazine Luiza intends to increase e-commerce sales in 2016, and it has implemented its mobile app in all 180 of its brick-and-mortar stores. The company also expects the customer experience to improve after it implements an inventory app for employees.

The company reconfigured its executive board, electing former COO FredericoTrajano as the new CEO for 2016. He replaced Marcelo Silva, who became Vice Chairman of the Board.

The 2016 consensus EPS estimate is R$1.16.